Global Economics

1/11

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

12 Terms

international trade benefits

lower prices

grater choice

increased competition

a source of foreign exchange

advantage types

Absolute advantage

can produce more goods/services than other countries

due to: resources, technology, workforce

Comparative advantage

can produce the same amount of output at a lower opportunity cost

limits:

ignores transport costs

overlooks externalities

overspecialization: vulnerability to shocks-dependency

Tariffs and quotas, effects on different sectors

tax imposed on goods and services-a way to support domestic firms

effect on:

Consumers: prices go up-less consumer choice

Producers: face less competition-sell more-better off

Market: less total trade-efficiency and welfare fall

Governments: short term benefit, other countries might complain, start a trade war

Quotas:

limits how much of a good/service can be imported

same effects except governments do not generate tax revenue

administrative barriers

measures that restrict trade, but can protect national interests

ex. licensing requirements, complex documents

Free trade vs protectionism

For trade protection

national security

protect domestic jobs

prevent unfair competition

preserve cultural identity

For free trade

lower price for consumers, more choice

greater efficiency: focus on comparative advantage

international cooperation

economic integration types

-countries cooperating to reduce trade barriers

preferential trade agreement

deal between countries giving them special access for trading

bilateral=2 countries, multilateral=2+

Trading blocs

groups of countries joining together to reduce trade barriers

no tariffs, free trade areas (FTA)

Monetary union

group of countries sharing a common currency ex. EU union

single central bank

exchange rate types

-shows how much one currency is worth compared to another

Floating exchange rate: value of currency changes based on supply and demand in the forex market

appreciates: value increases compared to other countries

depreciates: value decreases compared to other countries

factors:

foreign demand: foreign D🔼=D🔼-USD will appreciate

domestic demand: domestic D🔼=S🔼-USD will depreciate

Fixed: currency kept at set value by buying, selling currencies

Devaluation: deliberately lowering the value

exports are cheaper and more competitive-reduces trade barriers

Revaluation: increasing the value of a currency

to control inflation, reduce trade surplus

reflects strong economic performance

Managed: central bank intervenes to influence the exchange rate-no specific target, but range

Overvalued currencies: value above equilibrium in the long run

imported goods are cheaper than what they should be-exports become expensive

Undervalued currencies: below equilibrium in the long run

imported goods more expensive than should be-exports become cheaper

balance of payments credit vs debit

-a record of the value of all transactions between a country and the rest of the world

+Credit item: payments received from foreign consumers, firms

-Debit: payments given to foreign consumers, firms

what BOP consists of

Current account

trade goods

trade in service

income

current transfers (transfer of money with no goods/services)

Capital account

non-financial, asset transfers

(natural resources, intangible assets)

Financial account

direct investment (property, land)

portfolio investment (bonds, stocks, shares, bonds)

reserve assets (government reserves)

account surplus, account deficit and how to fix it

surplus: credit>debit

deficit: credit<debit

how to fix deficit:

reducing imports-boost exports

supply side policies

improve a country’s competitiveness

marshall lerner condition

states a currency depreciation will improve the trade balance only if PED exports+PED imports>1

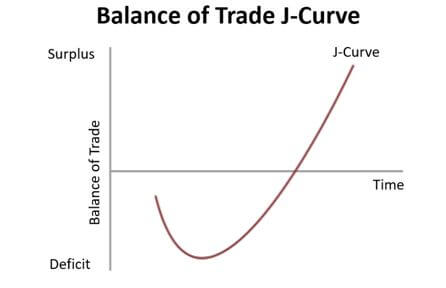

the J curve effect

when a country devaluates its currency balance gets worse before it gets better

why:

short run: more money going out than coming in-country spends more than it earns = trade deficit gets worse

long run: Other countries start buying more exports because they’re cheaper,

exports go up-the country earns more and spends less = trade balance improves