Money, EBC & Economic Performance

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

Real and Financial wealth

An asset (stock variable) is anything with a monetary value, that can be owned (or controlled), and that can generate future revenues.

In practice, the features of an asset are:

It must be owned/ controlled (by a person, a group, etc.)

It has a monetary value

It does not depreciate over time (store of value).

Real assets

A tangible or physical asset that has intrinsic value due to its substance and properties. It is used to produce goods and services or to provide utility directly (vintage chair, house, Ferrari car, etc.)

Financial assets

A claim on future income or on the real assets of another economic unit. It has no intrinsic value by itself but represents a right to receive cash flows or other financial benefits (cash, money In bank account, share of stock, bond, etc.).

Liabilities

A liability (stock variable) is a legally binding obligation arising from a past transaction or event, that requires a future outflow of economic resources (typically payment of cash, transfer of assets, or provision of services) from one economic agent to another.

In practice, a liability is the present obligation of an entity to transfer economic resources due to past events.

In practice, the features of a liability are:

It arises from past transactions (e.g., borrowing, receiving goods/ services without payment).

It results in a probable future economic sacrifice.

It can be contractually enforceable or implied by law or custom.

Typical classification of liabilities:

1. By Time Horizon:

Short-term (Current) Liabilities: Obligations due within one year or the operating cycle.

Long-term (Non-current) Liabilities: Obligations due after more than one year.

2. By Institutional Sector:

Household liabilities (e.g., mortgages, credit card debt).

Firm liabilities (e.g., loans, bonds issued).

Government liabilities (e.g., public debt, pensions).

Bank liabilities (e.g., deposits, interbank borrowing).

3. By contingency:

Actual Liabilities: Existing obligations.

Contingent Liabilities: Possible obligations that depend on future events (e.g., loan guarantees, lawsuits).

Wealth (a stock variable) is the net value of all assets owned by an individual (firm, or nation) after subtracting all liabilities.

Wealth = Total Assets - Total Liabilities

Real Wealth

Comprised of physical, tangible assets.

Provides direct utility or contributes to production.

Examples: Real estate, factories, land, machinery, commodities.

Financial Wealth

Comprised of financial claims or contracts.

Represents a claim on real assets or future income.

Typically corresponds to someone else's liability.

Examples: Bonds, stocks, bank deposits, mutual fund shares.

Being Money

Money (a stock variable) is any asset that is universally accepted as a means of payment for goods and services and for the repayment of debts.

To function as money, an asset must perform three key roles:

Medium of Exchange

Used to facilitate transactions.

Eliminates the inefficiencies of barter (no double coincidence of wants required).

Unit of Account

Provides a common measure for valuing goods and services.

Allows for consistent pricing and economic calculation.

Store of Value

Retains purchasing power over time (though possibly imperfectly, due to inflation).

Allows agents to transfer wealth into the future.

Note: An asset must perform all three functions to be considered money.

Many assets are stores of value (e.g., land, stocks), but only money is the dominant medium of exchange.

Commodity

Commodity money is money that has intrinsic value-that is, the item used as money has value even if it were not used as money.

The value comes from the material it is made of, which is typically a commodity that is widely desired or useful.

Examples:

Gold coins - used in ancient Rome and many other civilizations

Silver bars or coins - common in medieval Europe

Salt - used as money in ancient Africa and parts of the Roman Empire

Shells (e.g., cowrie shells) - used as money in parts of Africa, Asia, and Oceania

Fiat

Fiat money has no intrinsic value and is not backed by a physical commodity.

Its value comes entirely from government decree (or "fiat") and the public's confidence in its value.

Examples:

U.S. dollar (USD) - modern U.S. currency is fiat money

Euro (EUR) - legal tender in the eurozone

Japanese yen (JPY)

British pound (GBP) (in its current form)

Any modern paper currency not backed by or silver

Producing money has real costs, which vary significantly by denomination.

While coins may not be cost-effective, high-denomination banknotes are very efficient in terms of production cost.

High-denomination banknotes are more 'fiat' than low denominations and coins.

Being Money in Checking Account

As of today, euros deposited in a checkable deposit (also called a demand deposit) are €s in a bank account that you can withdraw on demand or transfer to make payments, usually using:

A check

A debit card

Or electronic transfer (transferencia)

These deposits are immediately spendable-you can use them to pay for goods and services directly.

For this reason, €s in a checking account can be considered money...at least in Spain!

Being Money in Saving Account

As of today, euros deposited in a savings deposit (also called a demand deposit) are €s in a bank account that you MUST withdraw before you can make payments (or you MUST transfer them into a checkable account).

Restriction in the number of conversions to/from cash

Hence, these deposits are not immediately spendable-you can't use them to pay for goods and services directly.

For this reason, €s in a savings account can't be considered money! Or at least nos'as much' as cash!

Being Money in Money Market Fund

A money market fund (MMF) is a type of mutual fund that invests in short-term, high-quality, and low-risk debt instruments such as Treasury bills, commercial paper, certificates of deposit, and repurchase agreements. Restriction in the number of conversions.

It is designed to offer investors:

High liquidity

Capital preservation

A return in the form of interest income

While not guaranteed, money market funds aim to maintain a stable net asset value (typically $1 per share in the U.S.) and allow investors to withdraw funds quickly, making them a close substitute for cash or bank saving deposits.

Being Money - Debit Cards

Don't confuse the bus with the people that take it!

A debit card itself IS NOT money, but it is a tool that gives access to money.

A debit card is a payment instrument, like a check or a mobile app.

Money is what the card gives you access to-namely, the funds in your bank account (usually a demand deposit)

Being Money - Credit Cards

A credit card is not money. => it is a tool for borrowing money, not transferring existing money. (moving money)

When you use a credit card, you're not using your own money.

You're making a short-term loan from the card issuer (usually a bank or financial institution).

You promise to repay that money later-possibly with interest.

So you're creating debt, not spending money you already own

Credit cards are not money-they are a mechanism for accessing short-term credit, which is a deferred payment.

Being Money - Cryptocurrencies

Are cryptocurrencies money?

It depends on the definition of money and how widely crypto fulfills the key functions of money.

Economists define money by three core functions:

i.Medium of exchange - Used to buy and sell g&s

ii.Unit of account - Provides a standard measure of value

iii.Store of value - Maintains value over time

• Cryptocurrencies fail to be a unit of account and, often, to be a widely accepted medium of exchange. For these reasons they are not money in the 'Definitional sense.

Liquidity of an asset

The degree (time, costs, etc.) to which an asset can be quickly and reliably converted into a means of payment (money) with minimal loss.

Key elements:

"Quickly": The conversion occurs over a short time horizon.

"Reliably": The asset can be sold under normal market conditions.

"Minimal loss of value": The asset can be sold at its fair market price.

In practice:

i. Cash is perfectly liquid.

ii. Checking deposits (CD) are almost as liquid as cash, but not entirely.

iii. Saving deposits (SD) are less liquid than CD.

iv. Money market funds (MMF) are almost as liquid as SD.

v. Marketable securities(e.g. TBills) are less liquid than MMF/SA.

vi. Corporate bonds are less liquid than TBills.

vii. Corporate stocks are less liquid than corporate bonds.

viii. Real estate, art, etc. are less liquid than corporate stocks.

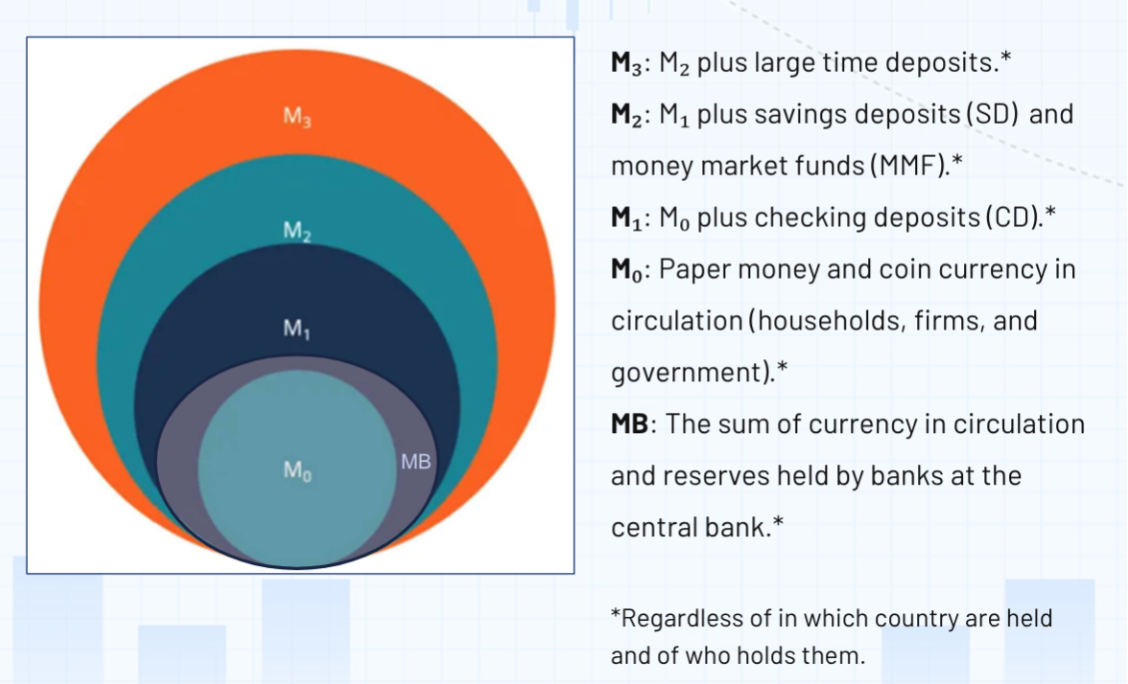

Measuring Money Aggregates

Accurate measurement is important because:

Changes in the money supply are thought to have rather immediate effects on short-term interest rates (e.g., the rate on the marginal lending facility, which offers overnight credit to banks from the Eurosystem), intermediate-run effects on key macro variables such as real GDP, and long-run effects on other key macro variables such as the inflation rateMonetary policy refers to the efforts of central banks (such as the

ECB and Fed) to control key macro variables through the management of the money supply and (short-term) interest rates, including fixing the ECB refi rate (see later).The ECB has some ability to manipulate and control the money supply through open-market operations, i.e., sales and purchases of government T-Bills and bonds to and from the private sector.

Monetary aggregates are categories of money supply, ranked by liquidity, used to measure the total amount of money in an economy.

Purpose:

Help central banks analyze and control money supply

Assist in macroeconomic analysis (inflation, interest rates, output)

Hierarchy of Liquidity:

• From most liquid (used for transactions) to least liquid (used as store of value)

M0

Also known as Currency or Cash

It includes all bills and coins in circulation (banknotes and coins held by households, firms, and governments...regardless of country of pertinence)

Issued by: The Central Bank

It is the most liquid asset as it is ready to be spent to purchase goods and services and to start/settle debts.

The Monetary Base (MB)

Also known as High-Powered Money, Central-Bank Money, or Base Money

It includes:

Currency in circulation (banknotes and coins held by households, firms and governments...regardless of country of pertinence)

Reserves held by commercial banks at the central bank

Issued by: The Central Bank

Used as a foundation for broader money creation via the banking system and is Important for understanding monetary policy transmission.

M1

Highly liquid forms of money, directly usable for transactions. Also known as

Narrow moneyComponents:

All currency in circulation (MO)

Checkable deposits (demand deposits, CD)

Other checkable posits

Use in Policy: Often used to track short-term changes in liquidity and spending

M2

Less liquid forms of money, not directly usable for transactions (but very close to, in modern economies). Also known as 'intermediate money'

Components:

All M1

Saving deposits (saving accounts, SD)

Money-Market Mutual Funds (MMF)

Use in Policy: Often used to track medium/long-term changes in liquidity.

=> M2 only affected by CB

=> M2 and inflation are related to each other (not caused)

=> M2 and Real GDP related as well

Where are the Euros ?

Euro banknotes are held outside the euro area by various countries and regions, each with distinct arrangements and purposes:

Formal Agreements with the EU. Monaco, San Marino, Vatican City, and Andorra: These European microstates have formal agreements with the European Union allowing them to use the euro as their official currency and granting them rights to issue their own euro coins.

Unilateral Adopters: Kosovo and Montenegro: These countries have adopted the euro unilaterally without formal agreements with the EU. They use the euro as their de facto currency to maintain monetary stability and facilitate trade, despite not being part of the euro area or having official issuance rights.

Currencies Pegged to the Euro: Several countries peg their currencies to the euro to stabilize their economies and facilitate trade relations. Example:

Bosnia and Herzegovina: The convertible mark is pegged to the euro.

Bulgaria: The lev is pegged to the euro as part of its commitment under the Exchange Rate Mechanism I| (ERM Il).

CFA Franc Zones: A group of 14 African countries use the CFA franc, which is pegged to the euro, facilitating economic stability and cooperation with European markets.

Purpose of holding Euros

Transaction Purposes: In countries like Kosovo and Montenegro, the euro is used for daily transactions, providing a stable medium of exchange and reducing transaction costs in trade with euro area countries.

Store of Value: In regions with less stable local currencies or higher inflation rates, holding euros serves as a safeguard against currency depreciation, preserving wealth.

Economic Stability: Pegging local currencies to the euro helps maintain economic stability, control inflation, and foster investor confidence by linking to a stable and internationally recognized currency.

The history of the ECB

1992 - Maastricht Treaty: Established the legal basis for the Economic and Monetary Union (EMU) and the future ECB.

June 1, 1998 - ECB officially founded in Frankfurt, replacing the European Monetary Institute.

January 1, 1999 - Euro introduced as an accounting currency; ECB assumes full control over euro area monetary policy.

2002 - Euro banknotes and coins enter circulation across 12 EU countries.

2008-2012 - Global Financial Crisis & Eurozone Debt Crisis: ECB intervenes with non-standard measures (e.g., LTROs, SMP).

2015 - Launch of Quantitative Easing (Asset Purchase Programme) to combat low inflation and stimulate growth.

2020 - Pandemic Emergency Purchase Programme (PEPP) initiated in response to

COVID-19 shock.2021-2022 - Strategy Review: ECB revises inflation target to symmetric 2% over the medium term.

2022-present - Tightening cycle begins, ending the era of negative rates in response to post-pandemic inflation.

ECB's responsibilities and final goals:

Define and implement euro area monetary policy

Sustain low inflation and real economic growth

Ensure smooth operation of payment systems (with daily flows exceeding €1.5 trillion)

Supervise significant number of the euro area banks under the Single

Supervisory Mechanism (SSM) (covering ~80% of banks)

ECB's primary responsibility and final goal: Price stability

Mandated by Article 127 of the Treaty on the Functioning of the EU (TFEU).

Target: Maintain inflation at 2% over the medium term.

Rationale: Stable prices preserve purchasing power, reduce uncertainty, and support sustainable growth.

The ECB uses the HICP (Harmonized Consumer Prices Index)

as the inflation measure.

The ECB’s Governing Council

The Governing Council is the main decision-making body of the ECB and meet every (approx.) 6 weeks. It consists of the six members of the Executive Board, plus the governors of the national central banks of the euro area countries. It decides over:

Currency issuance (the issuance of MO)

Adjust leading interest rates (MRO, DF, and MLF rates)

Asset Purchase Programmes (OMO) Initiation, continuation, scaling, or termination of asset purchases/sales

Longer-term refinancing operations (LTROs, TLTROs)

Emergency liquidity assistance (ELA) for banks

Reserve Requirements: Minimum reserve ratios for commercial banks

Forward Guidance: Communication of expected

future policy stance to influence market expectationsRisk Management: Analysis of collateral eligibility

& salvation

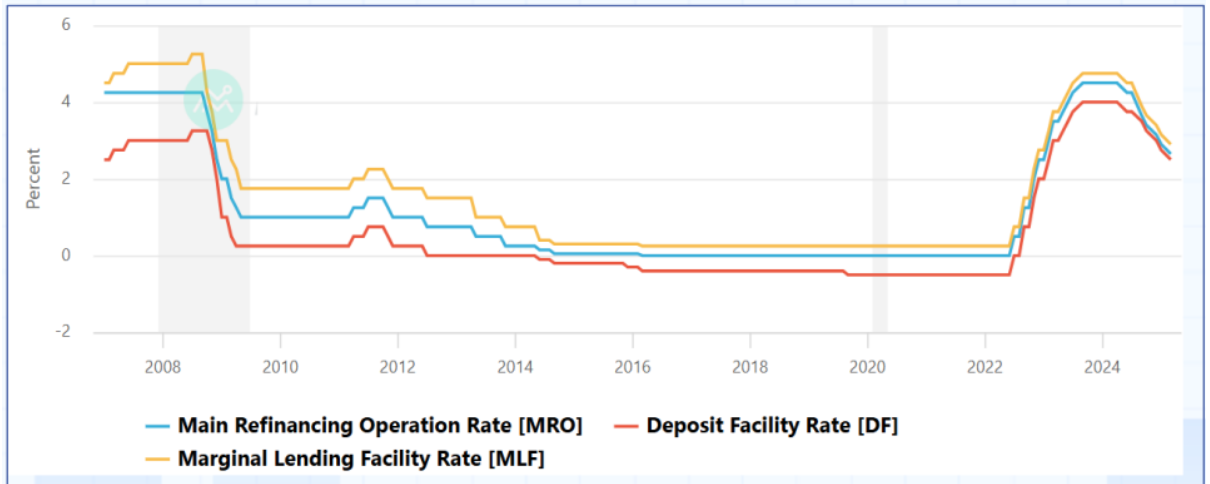

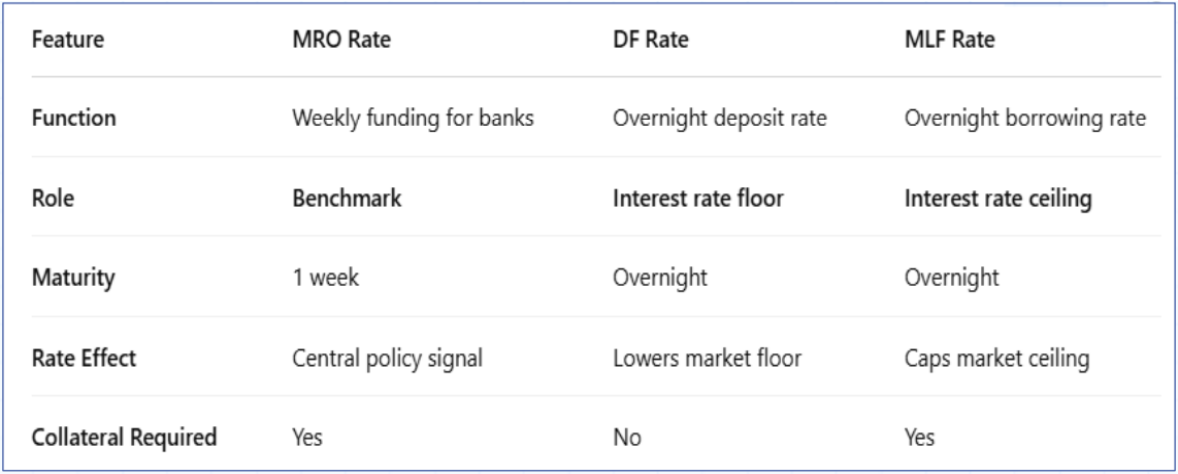

Leading interest rates

The ECB determines the following leading interest rates in the Euro area.

Main Refinancing Operations (MRO) rate

Deposit Facility (DF) rate

Marginal Lending Facility (MLF) rate

This ultimately affects the Eonia/ESTR rate and Euribor rate.

Main Refinancing Operations (MRO) rate

It is the yearly interest rate at which banks and financial institutions borrow money from the ECB for one week against collateral.

Purpose: It's the benchmark policy rate that steers short-term money market rates (e.g., EONIA/ESTR).

Economic Role: Indicates the ECB's monetary policy stance.

If the MRO rate increases → tightening

If the MRO rate decreases → easing

Marginal Lending Facility (MLF) rate

The interest rate banks pay for overnight borrowing from the ECB,

above the MRO rate.Acts as a ceiling for overnight interest rates in the interbank market.

Use Case: Emergency liquidity needs, typically used as a last resort.

Collateral: Loans must be secured with eligible assets.

Deposit Facility (DF) rate

The interest rate banks receive for overnight deposits at the ECB.

Serves as a floor for overnight market rates.

Banks with excess liquidity may use this facility instead of lending in the interbank market.

Economic role:

When the DF rate is negative, it discourages banks from hoarding reserves.

Encourages lending and investment instead.

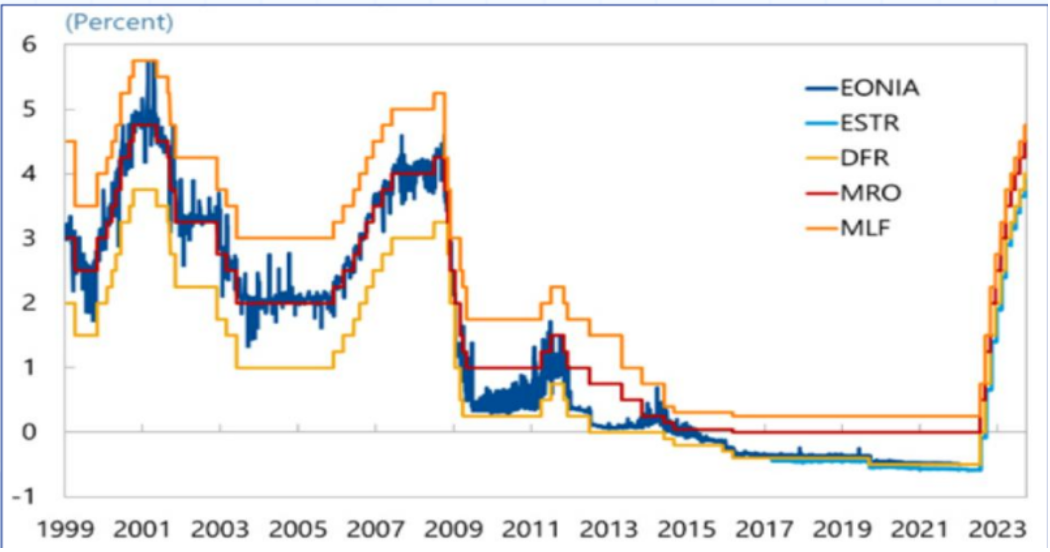

The MRO, DF, and MLF rates are usually adjusted together and in the same direction to create a corridor within which equilibrium rates (such as the

Eonia/ €STR) are 'forced to' fluctuate.

Core interbank interest rates

Eonia/ €STR rate, and Euribor

€STR stands for Euro Short-Term Rate.

It is the benchmark overnight interest rate for the euro

everyday basis it reflects the average interest rate at which banks borrow unsecured overnight funds from other institutions

Based on actual one-to-one transactions (~30 billion euros daily), mainly from comm. banks, money market funds, insurance companies, and pension funds.

€STR is just the overnight EURIBOR. But Euribor has a number of of other maturities.

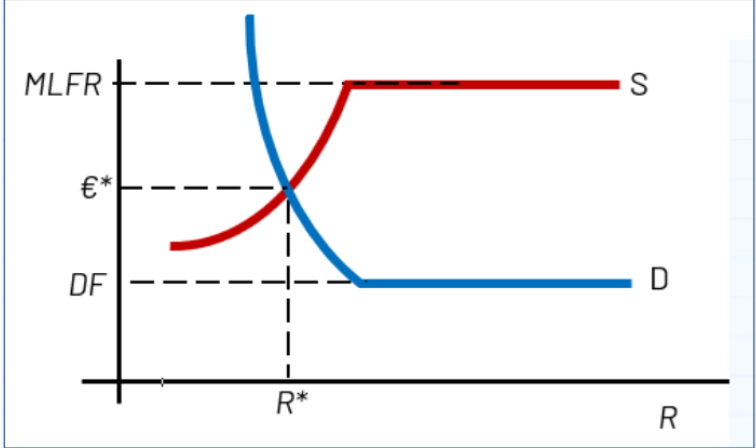

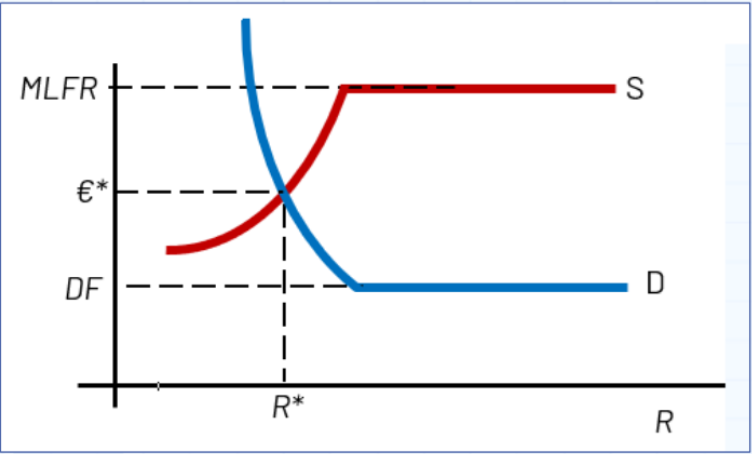

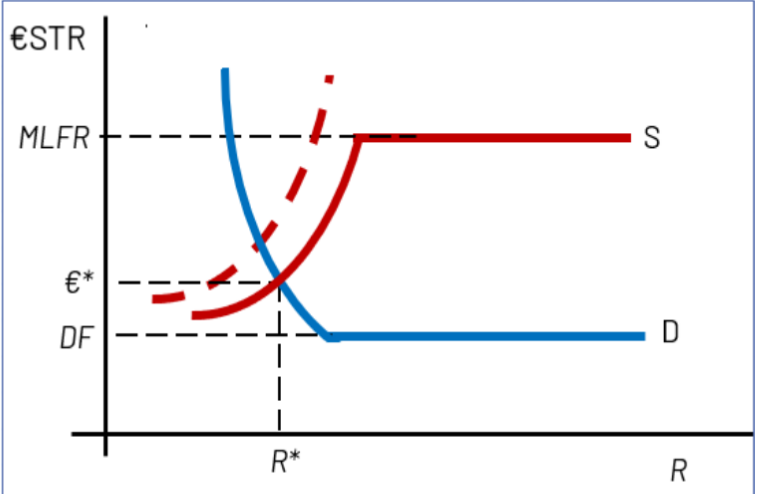

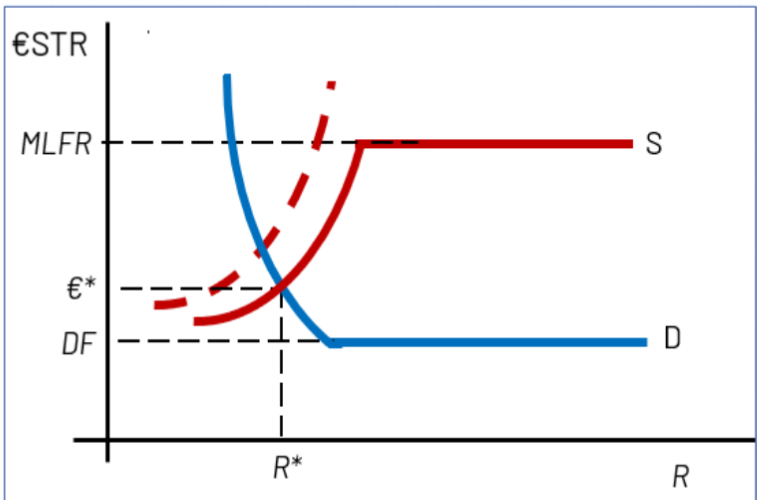

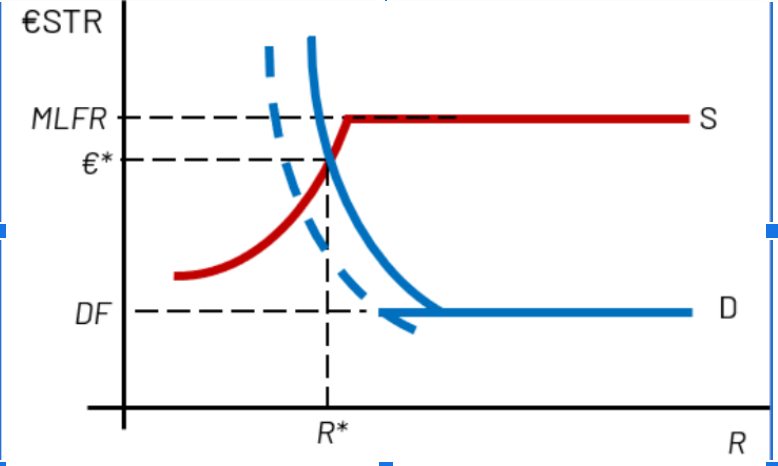

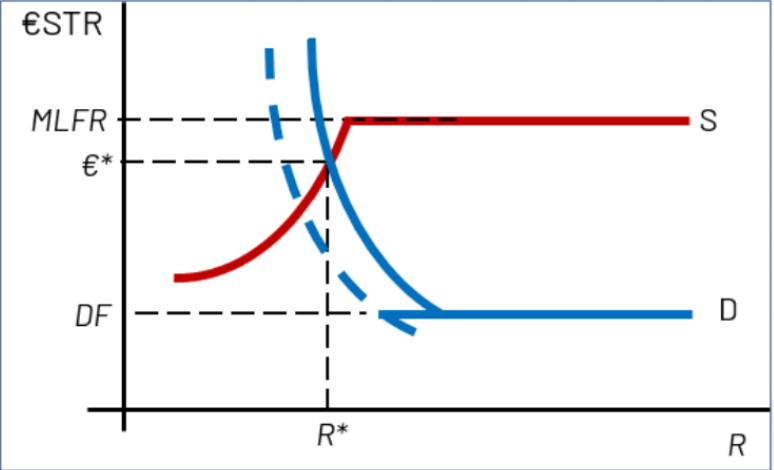

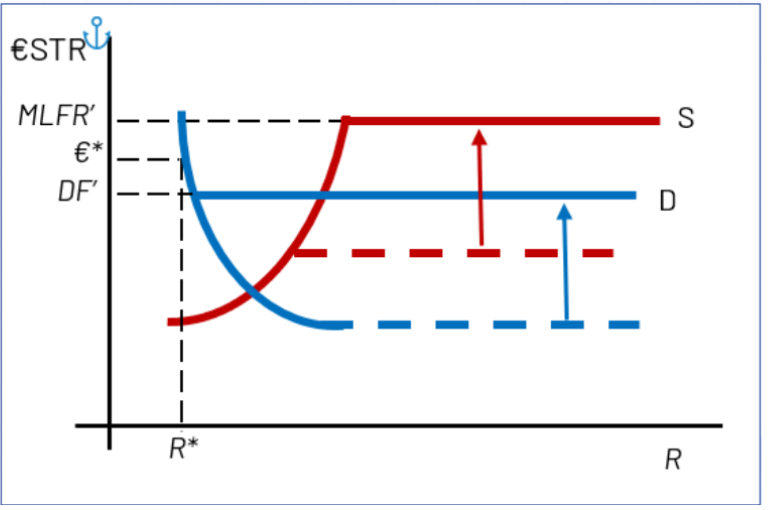

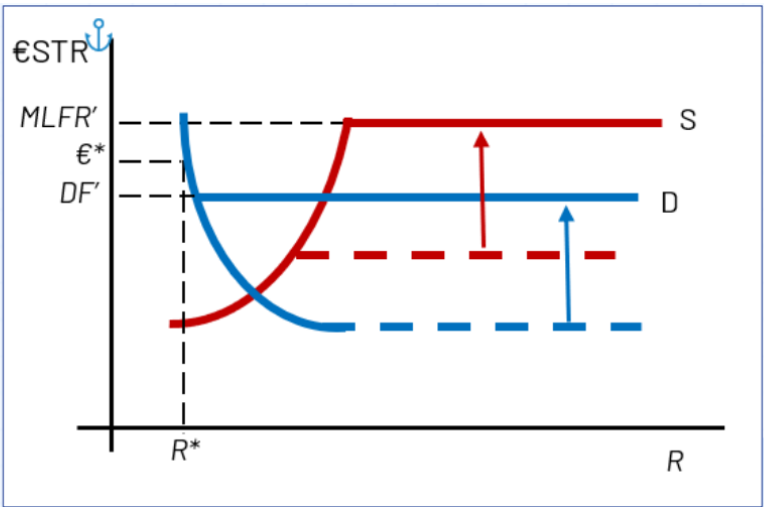

The market for reserves and the €STR

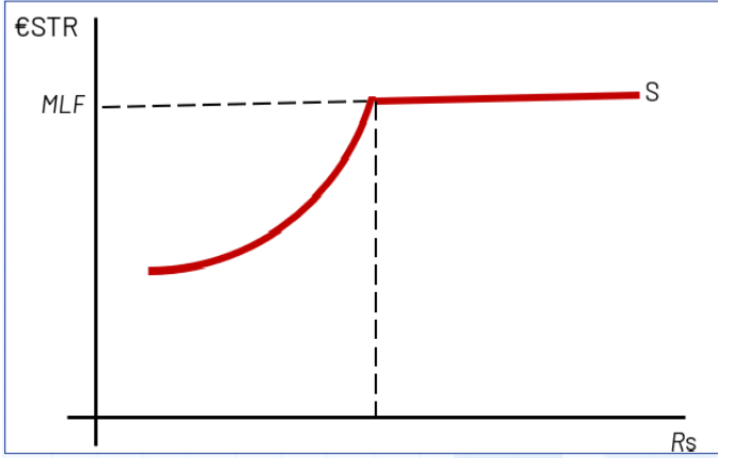

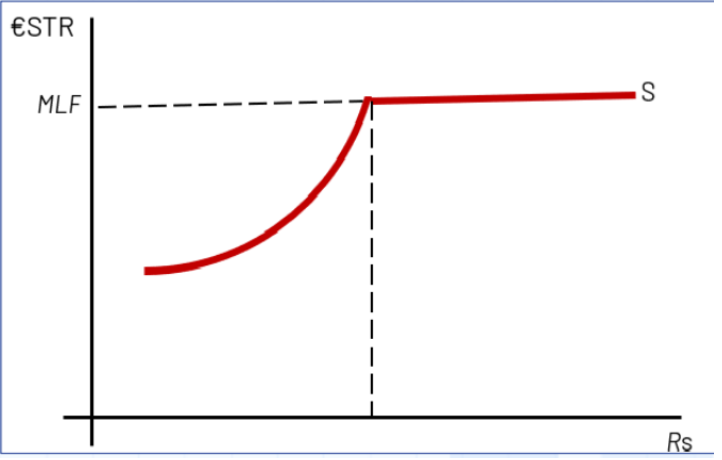

The corner supply curve of reserves (by banks):

The supply curve is upward sloping in the €STR, and then becomes horizontal (infinitely elastic) at the MLF rate.

That's because if the €STR rate ever exceeded the MLF rate, banks thirst for ECB loans would be infinite because an arbitrage opportunity would exist borrow at MLF and relend at the higher €STR rate (money machine) => cannot happen

Below the MLF rate, the reserve supply curve is increasing, based on the particular need (changing every day) of reserves that commercial banks do experience.

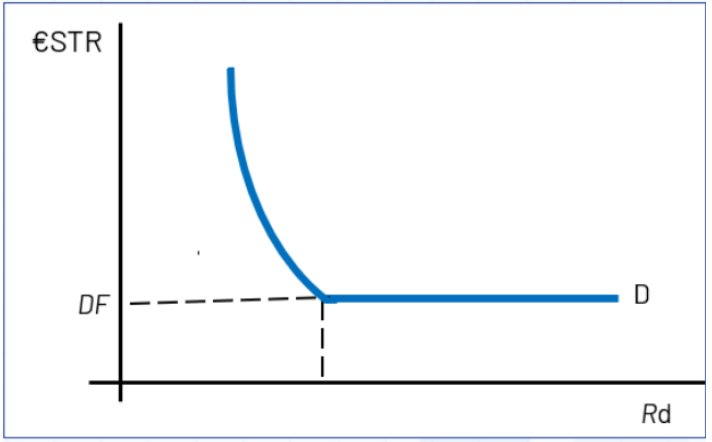

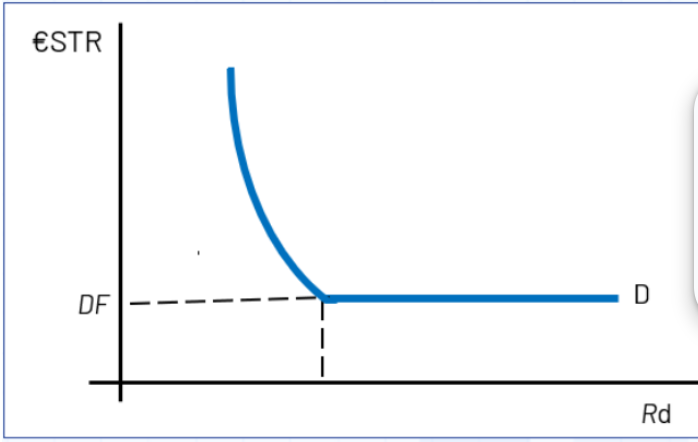

The corner demand curve for reserves (banks):

As the €STR rate paid decreases, the quantity demanded for reserves increases. In practice, as reserves get cheaper, banks will want more of them because the opportunity cost of that added liquidity is lower.

The demand curve is horizontal (infinitely elastic) at the DF rate.

That's because, if the €STR rate ever gets below the DF rate, banks' supply of deposits to the ECB would be infinite because an arbitrage opportunity would exist and persist: borrow by paying the low ESTR rate and deposit by earning the high rate (money machine)

The equilibrium in the market for reserves (banks):

The market-clearing interest rate (€STR*) lies between DF and MLFR, depending on reserve conditions.

This is typically where €STR settles in normal liquidity conditions.

This stylized framework shows how the ECB's corridor system (DF-MLFR) anchors the overnight rate, ensuring stability and effective transmission of monetary policy.

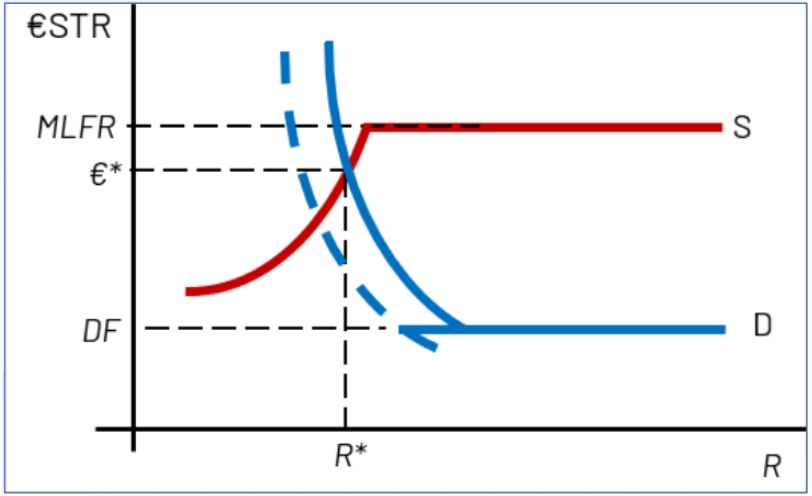

The ECB increases the bank’s reserve requirement

The ECB suddenly increases the percentage of checkable deposits that banks must hold as reserves from 5% to 10%.

Banks must hold more reserves relative to their deposits.

Demand for reserves increases, shifting the demand curve to the right.

This pushes €STR upward, toward the MLF rate, potentially hitting the MLF rate

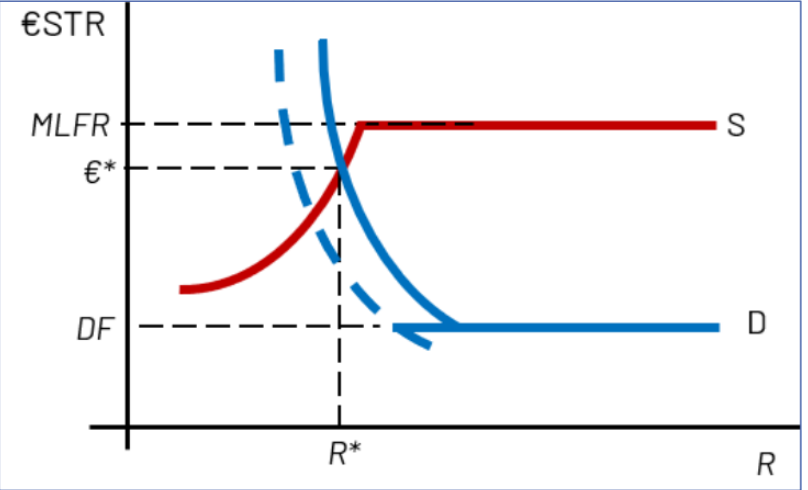

The ECB purchase Tbills in secondary markets

The ECB makes deposits of new money in people's checkable deposits.

This injects liquidity into the banking system.

Supply of reserves increases, shifting the supply curve to the right.

Result: €STR falls, approaching (and possibly hitting) the DF rate.

A financial crisis generates a bank panic

Households fear bank failures and rush to withdraw deposits. Banks lose funding rapidly → scramble for liquidity.

Demand for reserves spikes, shifting demand curve rightward.

€STR jumps, possibly reaching the MLF rate. Interbank markets may freeze and the ECB may deploy emergency liquidity assistance (ELA)

The ECB increases both DF and the MLF rates

The entire interest rate corridor shifts up.

New corridor: higher DF (floor) and MLF (ceiling).

€STR increases accordingly, anchoring overnight rates at a higher level). Shortage of reserves. Unclear what €STR will prevail (no equil)

intro to sequences in geometric progression

Any triplet (n, a, b), with n € N, and a, b € R uniquely and completely identifies a geometric progression. We label G(n, a, b),

In case → co, the geometric progression called geometric series.

Identify the geometric progression G(6,2,3)