Phillips Curve

1/3

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

4 Terms

Phillips Curve

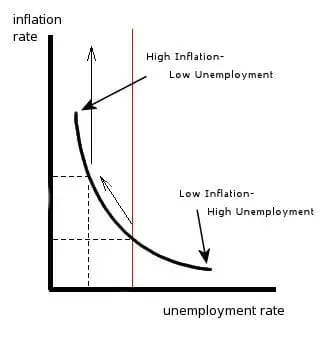

shows the relationship between inflation and unemployment

In the short run, there’s a downwards sloping relationship in other words, a negative

In long run there’s no relationship between inflation and employment so it is vertical

Phillips inflationary gap

short run phillips curve

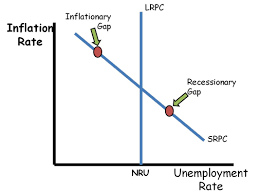

The SRPC is a downward sloping curve which shows the inverse relationship between the inflation rate and unemployment in the short-run. Generally, as unemployment increases, the inflation rate decreases, and as unemployment decreases, the inflation rate increases. In many ways, the SRPC curve can be thought of as a mirror image of the SRAS curve. As the AD shifts, moving the point of intersection on the SRAS, there is a mirrored movement along the SRPC (see illustration). Demand shock inflationary gaps cause movement up the SRPC and demand shock recessionary gaps cause movement down the SRPC.

Long run phillips curve

In the long run, there is no relationship between the unemployment rate and the inflation rate. In fact, regardless of the inflation rate, the economy will find its way to the Natural Rate of Unemployment (NRU). As a result, the LRPC is a vertical curve at the NRU (4.8% in the US according to the Federal Reserve). Since the Natural Rate of unemployment (full employment) is structural unemployment plus frictional unemployment, anything that will change structural unemployment or frictional unemployment will shift the LRPC. A higher NRU shifts the LRPC right, and a lower NRU shifts the LRPC left.

At the intersection of the long-run and short-run Phillips curve, the expected inflation rate is found. The actual inflation rate can be higher or lower (depending on where the economy is on short-run Phillips curve). Where there is an inflationary gap, the actual inflation rate will be higher than expected. When there is a recessionary gap, the inflation rate will be lower than expected.