IB Economics SL/HL Unit 3 (Macroeconomics)

1/89

Earn XP

Description and Tags

All macroeconomics terms, formulas, and diagrams for IB Economics. Includes both SL and HL (HL = Italics). 2022~2029 syllabus. Imported from econinja.net.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

90 Terms

National Income

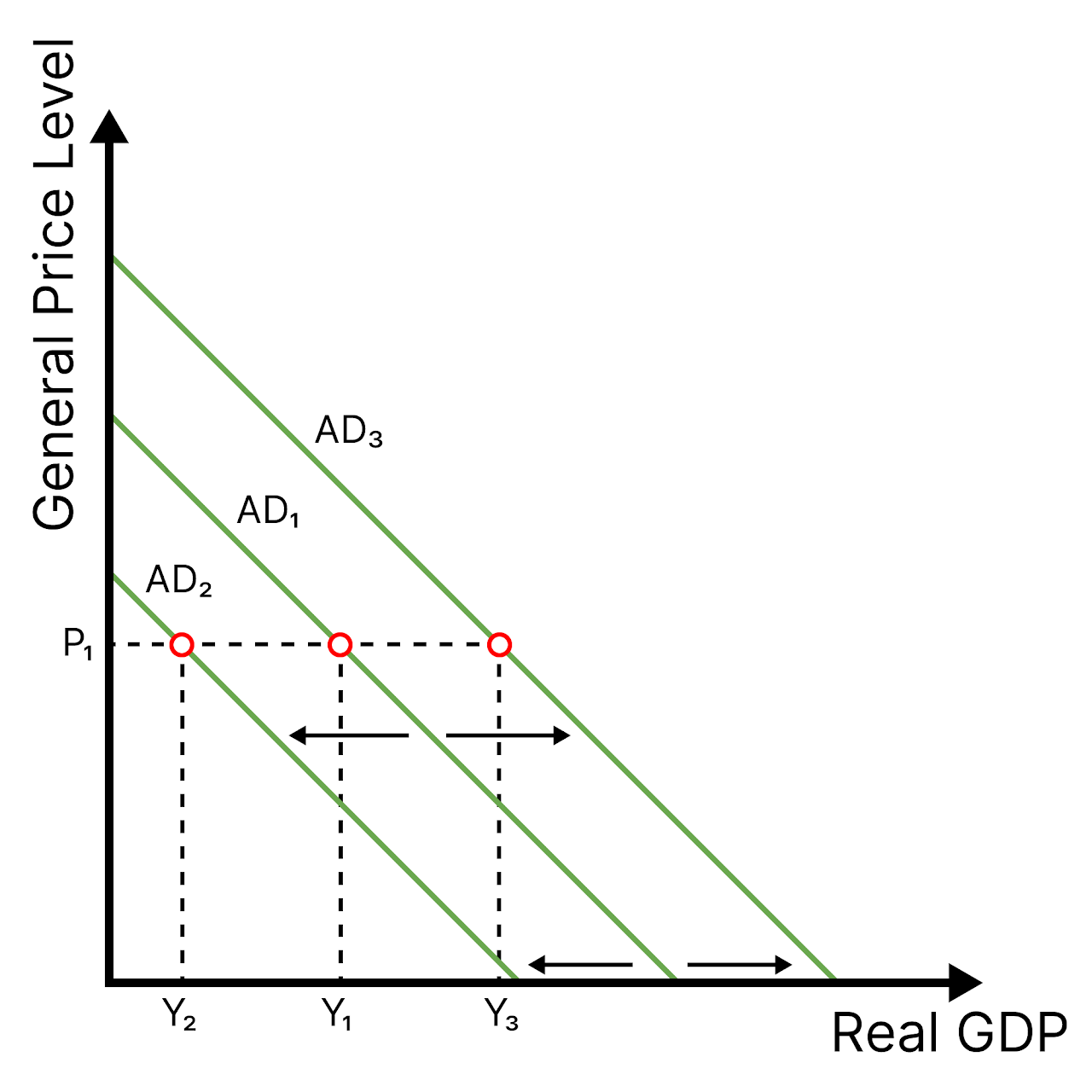

Aggregate Demand

Government/National Debt

Debt Servicing Costs

Credit Rating

Marginal Tax Rate

Monetary Policy

Money Supply

The total amount of money circulating in an economy.

Money Creation

Open Market Operations

Minimum Reserve Requirements

Minimum Lending Rate

Quantitative Easing

Money Demand

Fiscal Policy

Keynesian Multiplier

Crowding Out

Automatic Stabilizers

Supply-Side Policies

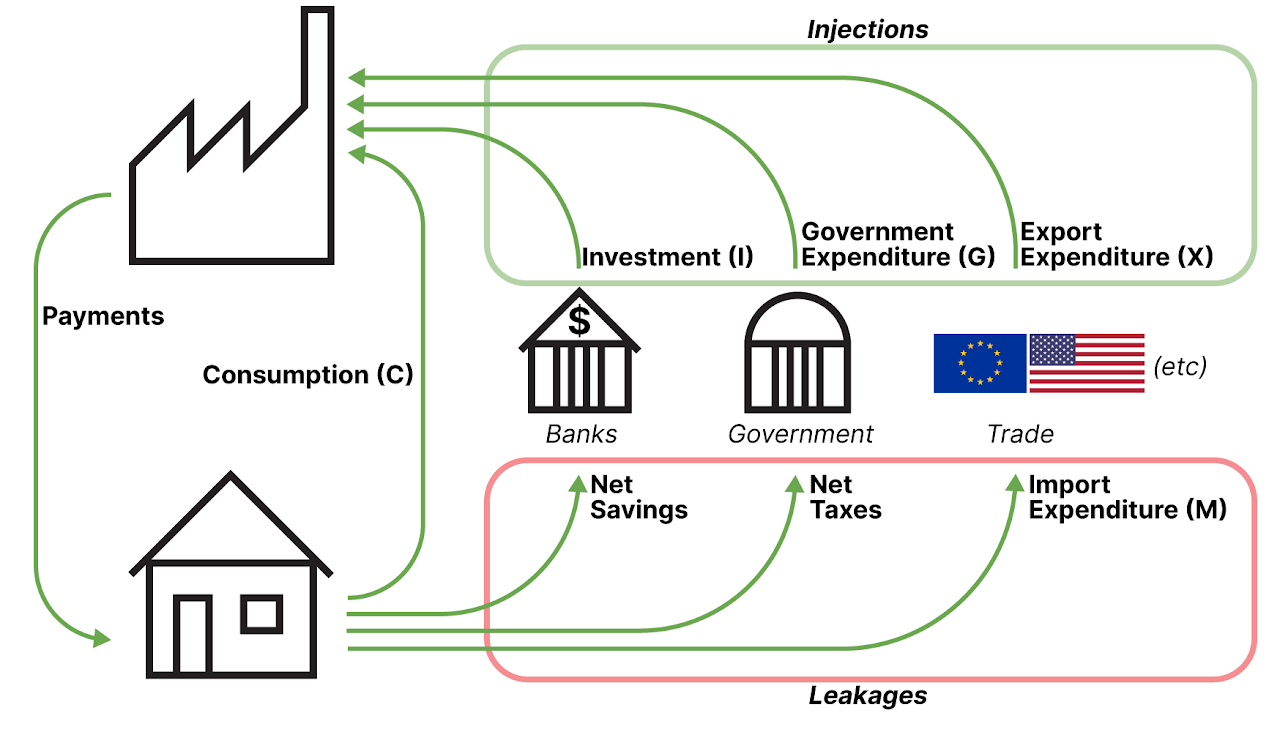

The circular flow of income model

Shows the interactions between decision makers, leakages, and injections

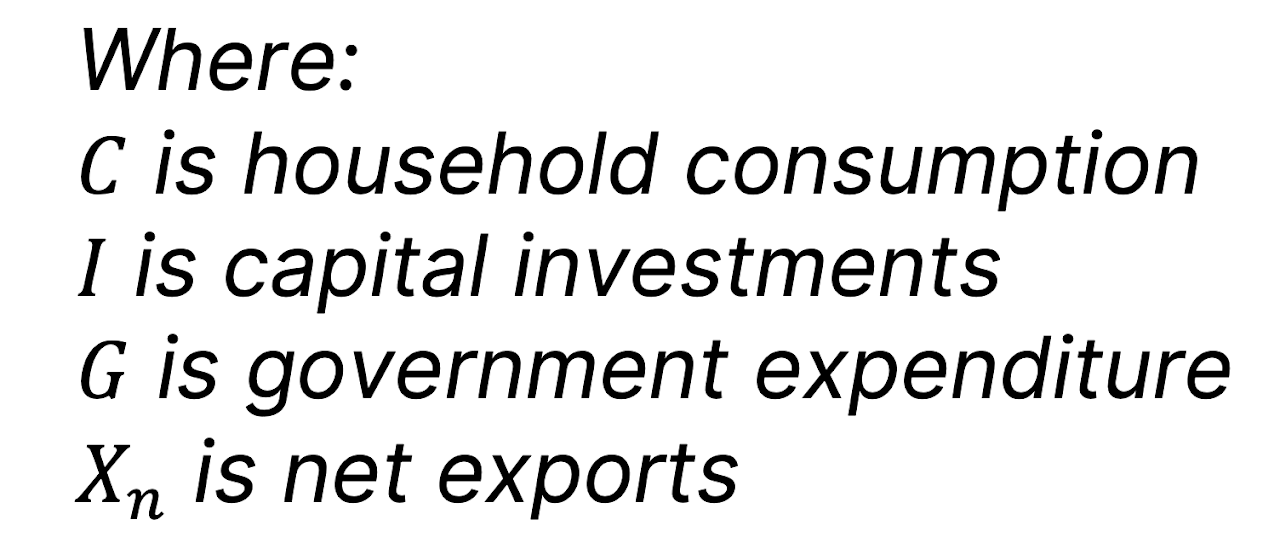

GDP =

= C+I+G+Xn

GNI =

= GDP + Net Income from abroad

Real GDP =

= GDP/Deflator

Real GNI =

= GNI/Deflator

Real GDP Per Capita =

= Real GDP/Population

Real GNI Per Capita =

= Real GNI/Population

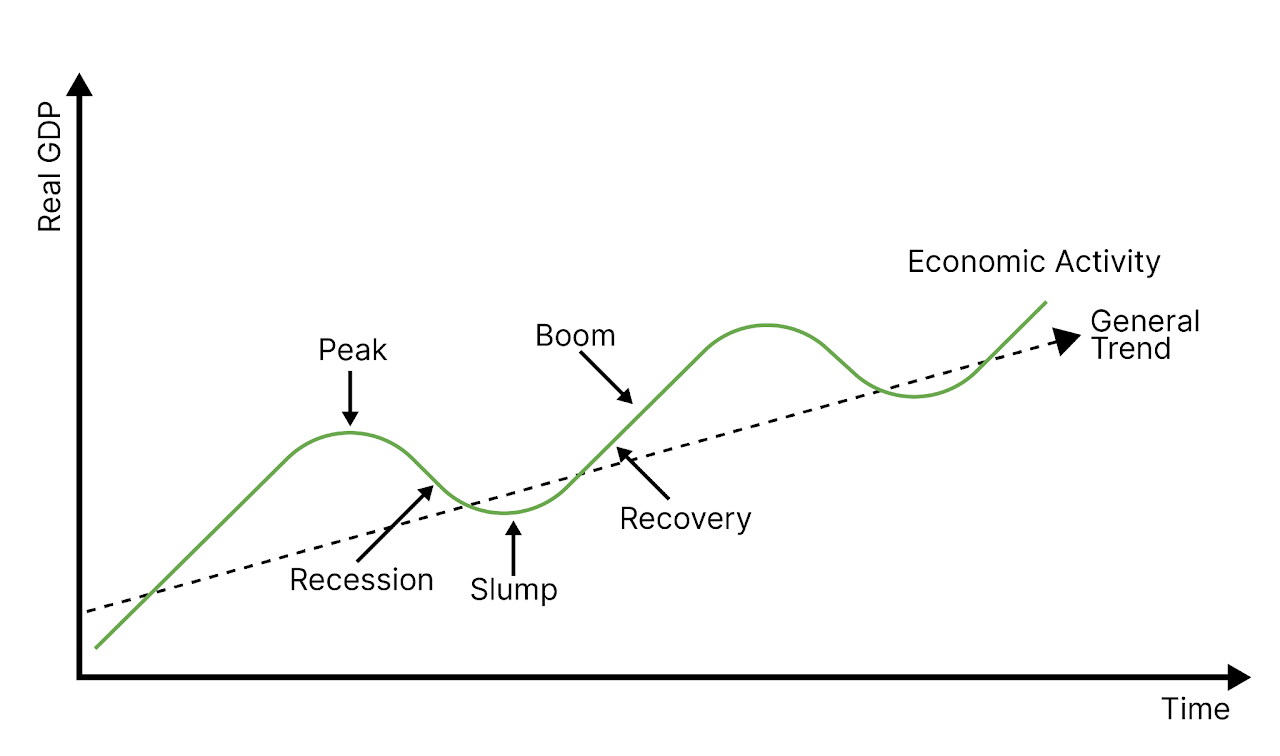

The business cycle

Shows short-term fluctuations and the long-term growth trend.

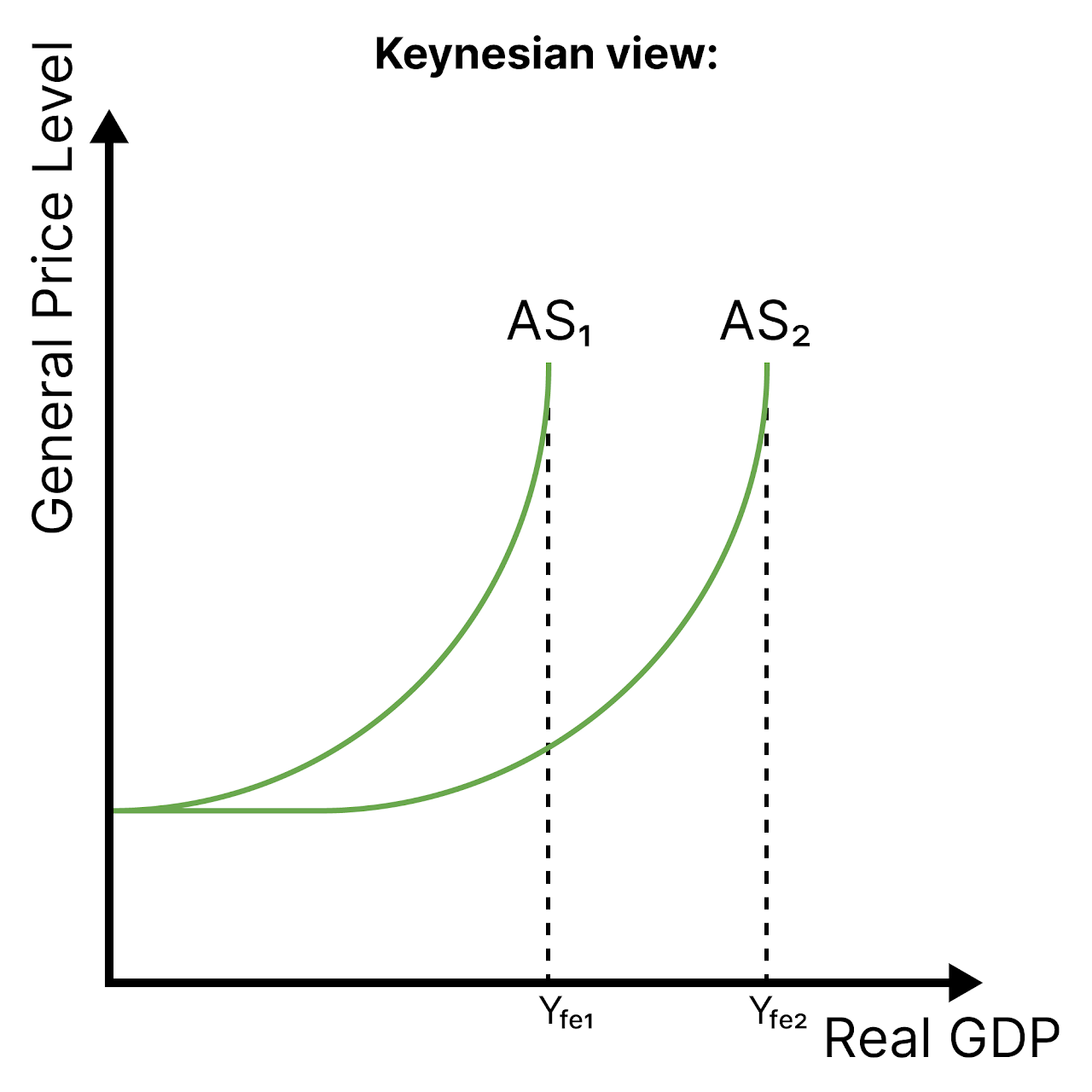

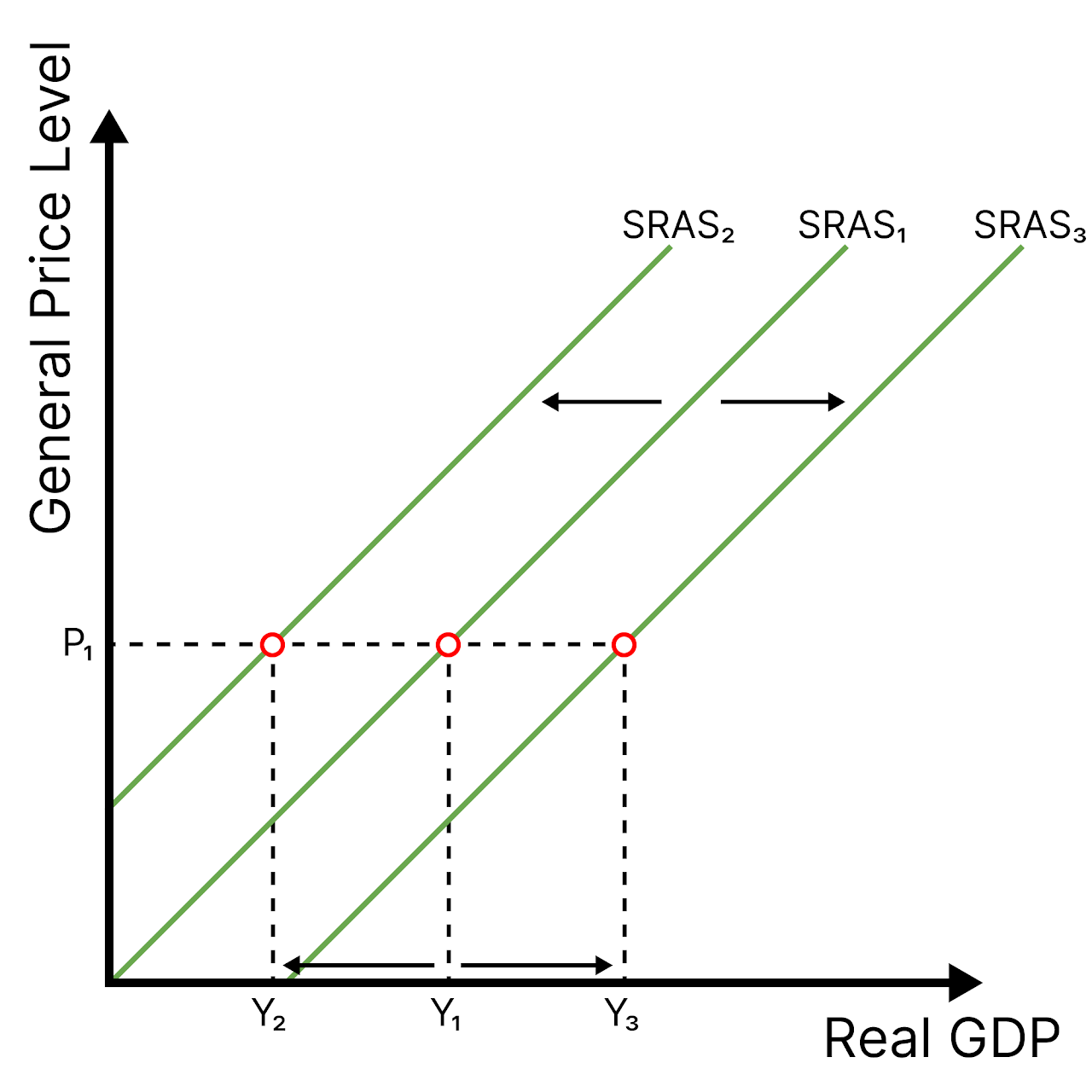

SRAS

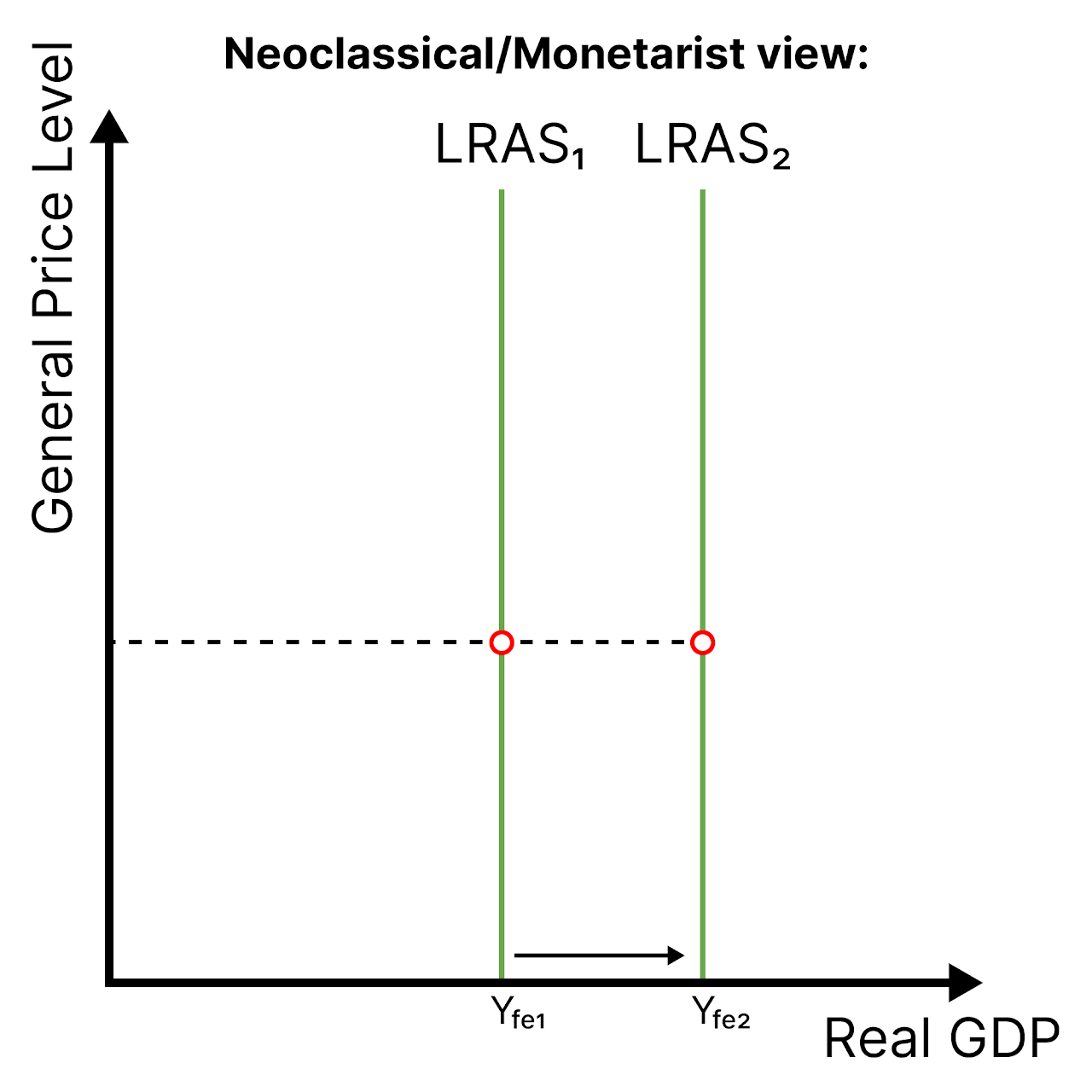

LRAS

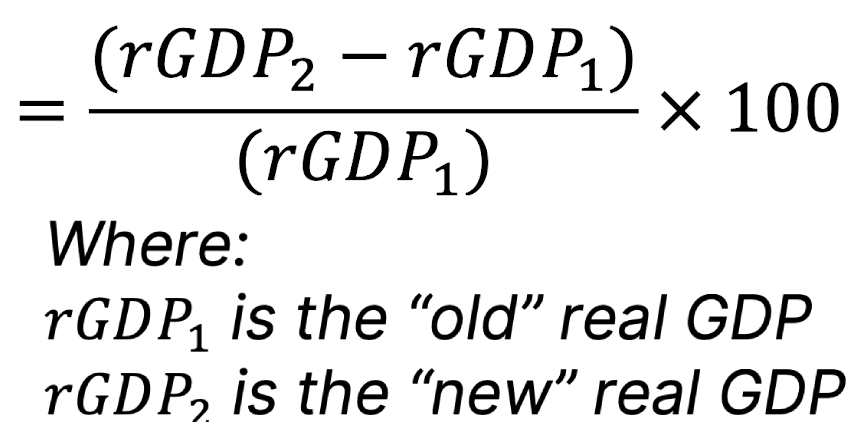

Growth (%) =

Unemployment (%) =

= 100(Unemployed people/Labor Force)

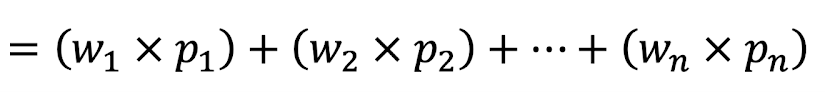

Weighted Price Index =

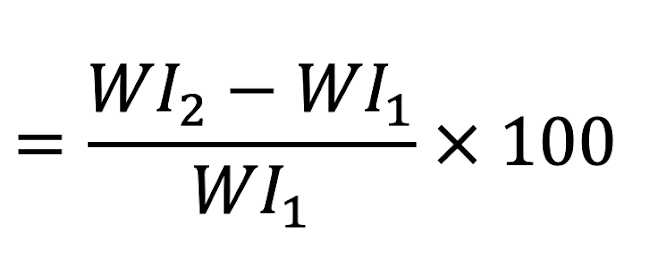

Inflation Rate (%) =

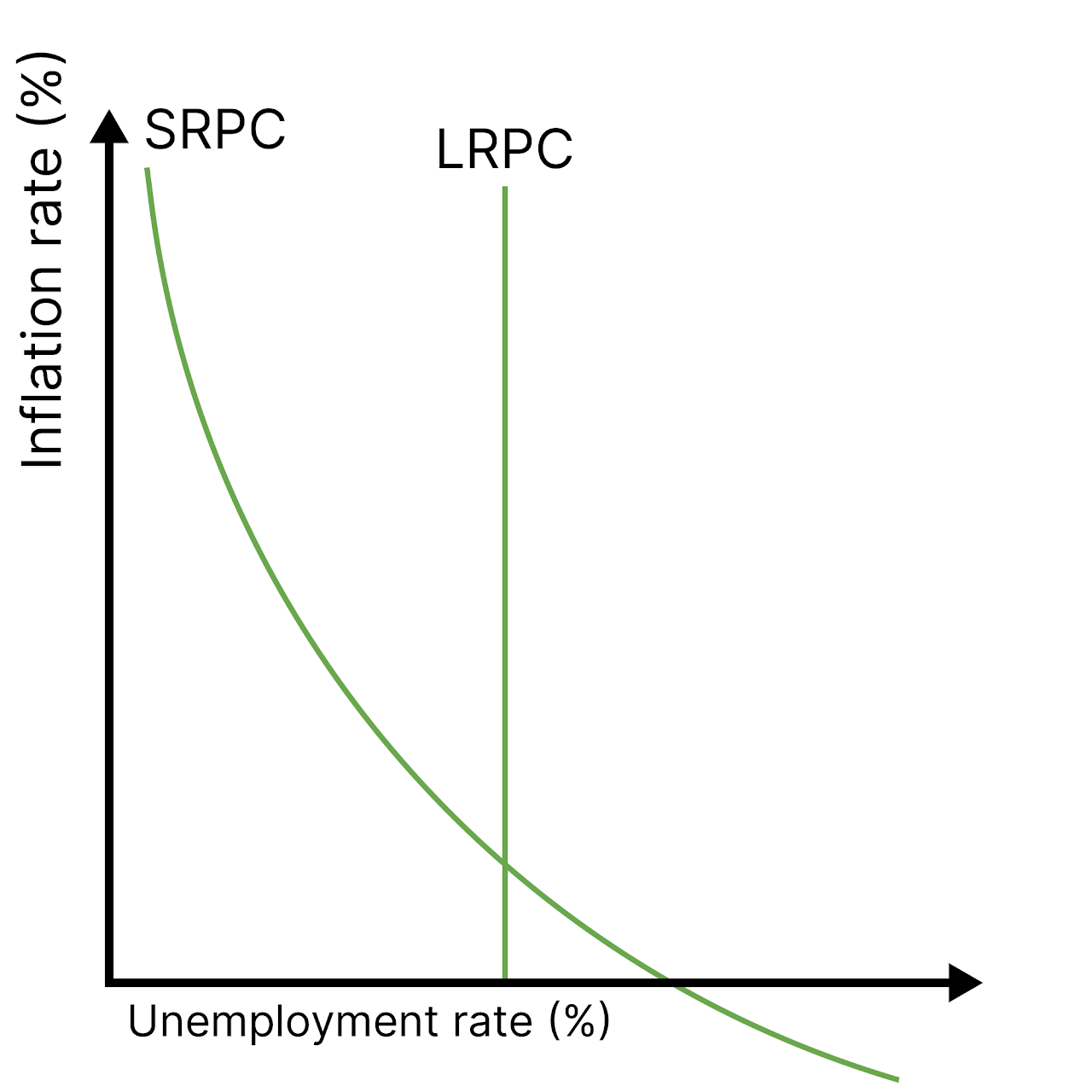

Phillips Curve

Shows the short-run and long-run relationship between inflation and unemployment.

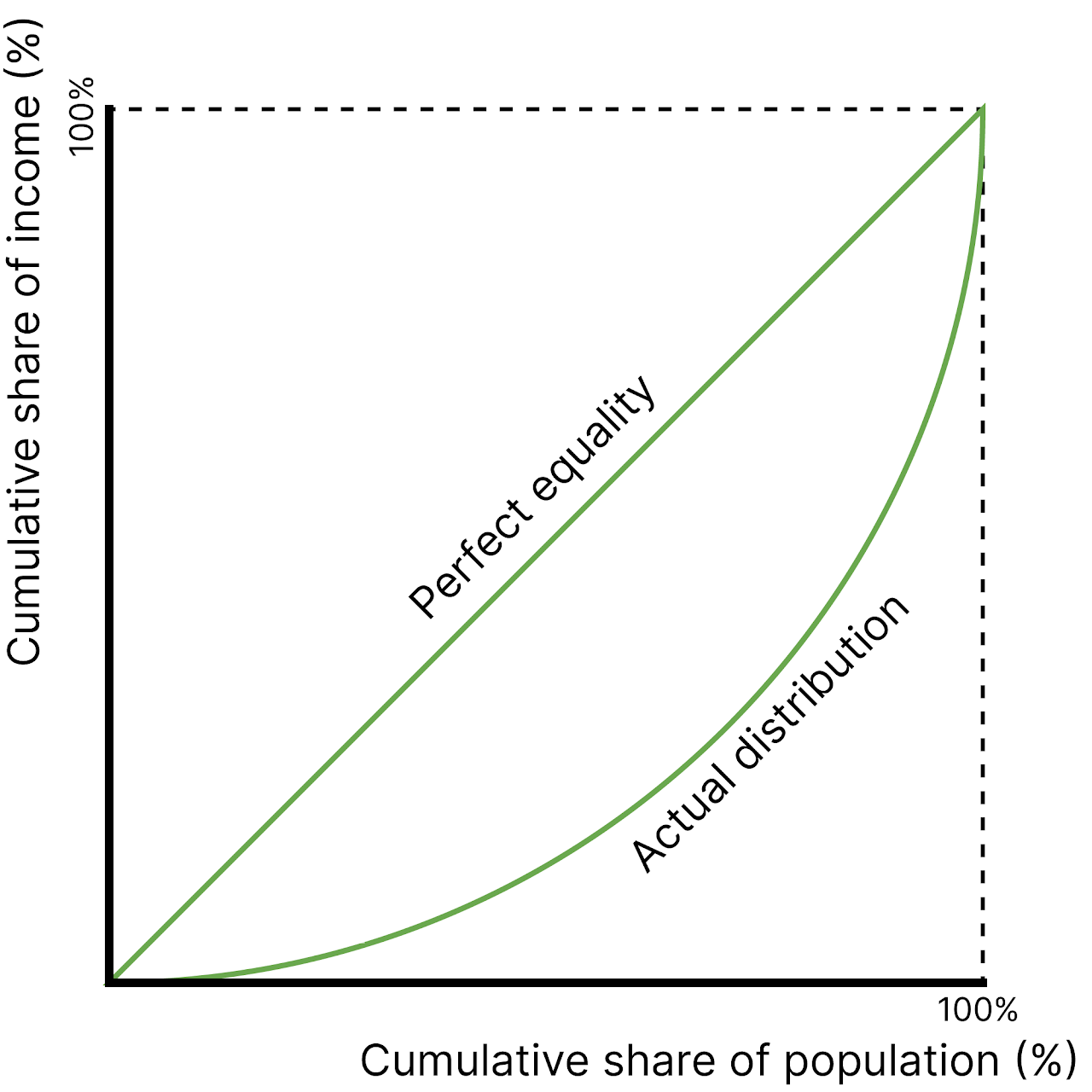

Lorenz Curve

Shows the distribution of income and possible changes in the distribution of income.

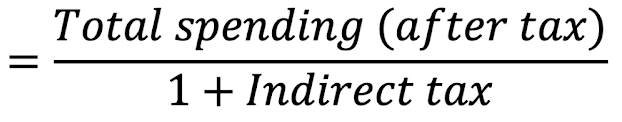

Pre Tax Item Cost =

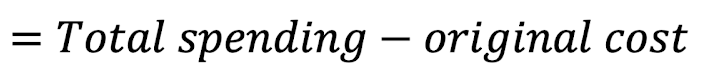

Indirect Tax Paid =

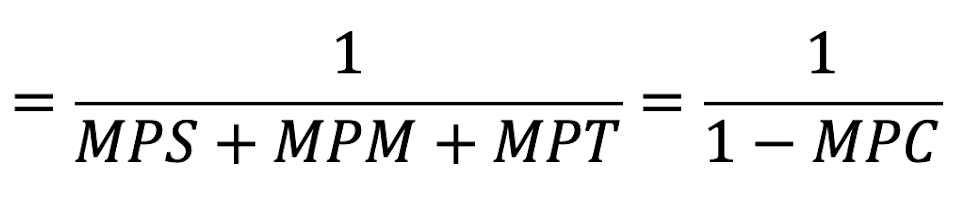

Keynsian Multiplier =

Where:

MPS is the marginal propensity to save (for each $ you earn, how much will you save)

MPM is the marginal propensity to import (for each $ you earn, how much goes to imports)

MPT is the marginal propensity to tax (for each $ you earn, how much goes to tax)

MPC is the marginal propensity to consume (for each $ you earn, how much do you spend)

Actual Effect =

The effect on GDP of a change in an injection in investment, government spending or exports, using the Keynesian multiplier