BSDA Tilburg University IBA 2025

1/124

Earn XP

Description and Tags

Kut vak

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

125 Terms

Three Modes of strategy formation

Planning Mode: A structured, analytical approach where strategies are developed in advance

Adaptive Mode: Strategies emerge from negotiations and incremental decisions

Entrepreneurial Mode: Strategy is shaped by a strong leader’s vision, involving high-risk decisions

Mintzberg’s 5 Ps

Plan

Ploy

Pattern

Position

Perspective

The Competitive Five Forces (Porter)

Threat of new entrants

Bargaining power of suppliers

Bargaining power of buyers

Threat of substitutes

Rivalry among existing competitors

Threat of New Entrants

New players bring new capacity and competition, putting pressure on prices and proftiability

Barriers to entry (economies of scale, customer switching costs) determine how easily new entrants can challenge incumbents

Bargaining power of suppliers

Suppliers with strong leverage can demand higher prices or reduce quality.

This happens when suppliers are concentrated, their products are unique, or switching costs for buyers are high.

Bargaining power of buyers

Powerful customers can force prices down, demand higher quality, or negotiate better terms.

Buyers gain power when they purchase in bulk, have access to multiple suppliers, or face low switching costs

Threat of substitutes

Alternative products or services can reduce industry profitability by offering a better price-performance trade-off.

Examples include digital music replacing CDs or online streaming replacing cable TV.

Rivalry among existing competitors

Intense competition among existing firms can drive down profits, especially in industries with many competitors, slow growth, and high fixed costs.

Non-price competition (e.g., product differentiation, service quality) can reduce the negative impact of rivalry.

Strategy (Porter)

It’s about making trade-offs and choosing a unique position in the market; it’s about deliberately choosing to be different

Elements of a successful strategy

Consistent and long-term goals

Formulated based on analysis

Effectively exploit resources

Rules of thumb (heuristics)

Helpful in strategic management as they provide time-pressed professionals with a simple way of dealing with a complex world

Sometimes they lead to severe and systematic errors in decison-making

Intuitive Thinking

Automatic

Unconscious

Quick

Implicit

Emotional

Effortless

Reflective Thinking

Controlled

Conscious

Slow

Explicit

Logical

Effortful

Strategic Decisions

Direction (What?)

Long-term

Company-wide; holistic

Political

Novel/Rare

Allocate/Commit Resources

Ambiguous

Operational Decisions

Efficiency (How?)

Short-term

Subarea; Partial

Technical

Routine/Precedents to follow

Utilize resources

Definite/Clear

Six Principles describe te essentials of strategy for company practice

Strategy is about gaining, sustaining, and renewing competitive advantage to ensure superior performance

Strategy is about creating a dynamic fit between the company and its environment

Strategy is about being different and choosing what to do and what not to do

Strategy pursues the achievement of a desired long-term aspiration; it is a means to an end.

Strategy is consistency in behavior, whether intended or not intended

Strategy is the symphony that results from multiple areas and strategic themes in an organization

Ways to measure a company’s performance

Economic value

Accounting performance (Profitability)

Economic performance and shareholder value

Corporate sustainability performance

Key Stakeholders

Organizational stakeholders

Stockholders

Managers

Employees

Economic stakeholders

Customers

Competitors

Creditors

Social stakeholders

Nonprofits/NGOs

Communities

Governments/Regulators

Competitors

Various elements need to be considered for gaining insights about how different direct and indirect competitors may impact a firm’s performance

Size, growth, and profitability

Image and positioning

Objectives and commitment

Strengths and weaknesses

Relevance of market share

1% increase of market share leads to 0.13% increase in financial performance

1% increase of customer-related assets (e.g., customer satisfaction) leads to 0.72% increase in financial performance

1% increase of brand-related assets (e.g., brand image, brand awareness) leads to 0.33% increase in financial performance

7-S Model

Hard Factors:

Structure

Strategy

Systems

Soft Factors:

Shared Values

Style

Staff

Skills

Stages of a Market Research Project

Problem definition

Project Design

Selection and design of relevant data collection and analysis methods

Data collection

Establish the target population, source of data and sampling procedure

Analysis and interpretation

Process the data to generate valuable information via statistical inference and visualization

Decisions and actions

Use the information to develop actionable recommendations

Possible uses of secondary data

Providing information at a sufficient level of detail and quality for solving a problem

Source for new ideas that can be investigated further with primary data

Support for the problem definition and formulation of hypotheses

Possible limitations of secondary data

Data is incomplete because it was generally collected for a different purpose

No control over the process of data collection

Data is too old

Types of primary data collection

Questioning & Qualitative

In-depth / expert interview

Focus group discussion

Questioning & Quantitative

Interactive methods:

Personal Interview

Telephone Interview

Anonymous methods

Postal survey

Online survey

Advantages In-dept / expert interview

Greater willingness to discuss sensitive topics by excluding others

No pressure by other people

Sufficient time for every respondent

No counterproductive influencing of one’s opinion by other people

Advantages Focus group discussion

Stimulation of the activity through group dynamics

Creative interaction between participants

Generation of a large quantity of information in a short time

Cost advantages compared with individual interviews

Limitations Qualitative data

No representative character

No objective measurement since statements must always be interpreted by the interviewer

Aggregation of opinions is difficult

Limited options for efficient, computer-based processing

Scale

A discrete or continuous space onto which objects are located according to the measurement rules

Measurement

Rules for assigning symbols to objects such that these either numerically represent the amount of a characteristic or define whether the object falls into a certain category

Nominal Scale type

Categorization of objects (gender, marital status)

Metrics: Percentages, Mode

Methods/Tests: Chi-square test (contingency analysis)

Ordinal Scale type

Ranking of objects in an order (preference ranking of brands)

Metrics: Median, rank-order correlation

Methods: Ordered regression, conjoint analysis

Interval Scale type

Assignment of objects to categories, whereby increments between consecutive categories are identical (temperature scale, satisfaction scale)

Metrics: Mean, variance, correlation, including Ordinal and Nominal metrics

Methods: T-test, ANOVA, regression, factor analysis

Ratio Scale type

Assignment of numerical values to objects, whereby a natural zero point exists (weight, age, sales, price)

Metrics: Geometric means, coefficient of variation, including all other metrics

Methods: All

Measurement and behavioral responses

Context Matters

Contrast effect: An unconscious bias that happens when two things are judged in comparison to one another, instead of being assessed individually

Scales that provide cues: Ranges: 0-1, 1-2, 2-3, more than 3 (indicates that more than 3 is an extreme)

Language use: Native language vs Foreign language

Selected error sources of questioning

Error sources of questioning

Over reporting: respondents state a more positive attitude than they actually have

Interviewer bias: When the expectations or opinions of the interviewer interfere with the judgment of the interviewee

Bias because of question order: First answer choices may be seen as more important than later ones

Halo-effect: One question and its answer may influence the answers of other questions

The tendency to mark the middle position in rating scales

Non-anonymity: Increases inhibition, making respondents less likely to answer truthfully, especially on sensitive or socially undesirable topics, because they fear judgment or consequences

Validity

Scale actually measures what it is intended to measure

Face validity

Convergence validity

Predictive validity

Discriminant validity

Face validity

Intuitively understandable meaning of the scale

Convergence validity

Measurement values from two alternative scales for measuring the same construct correlate with each other

Predictive validity

How well a measurement or scale can forecast a future outcome that it should theoretically be able to predict. (brand strength and market share)

Discriminant validity

Scale does not correlate with another scale that is intended to measure another construct

Reliability

Scale measures the true value precisely, i.e., without inaccuracies

Reliability over time: Stability of measurement values in repeated measurements

Reliability across indicators: High intercorrelation between various indicators of a multi-item scale

Generalizability

Scale can be used for measurement in different settings

Sampling

By performing an analysis of the elements in a population, we may draw conclusions about the entire population

Decisions within the sampling process

Define the population

Determine the sampling frame

Select the sampling procedure

Determine the sample size

Define the population

Be precise

Understand the market

Select the appropriate sampling unit

Do not be too restrictive

Probability sampling

Random selection of persons. Probability of including each person in the sample is known. Samples remain representative of the population

Simple Random Sampling

Systematic Random Sampling

Cluster Sampling

Stratified Sampling

Non-probability sampling

Selection of people based on a non-random process. Fast and cost-effective execution

Snowball sampling

Quota sampling

Convenience sampling

Simple random sampling

Randomized selection of respondents by random generator, drawing from a bowl or other methods

Reasons for use: Relevant groups are sufficiently large and equally easy to reach

Systematic random sampling

Pick every unit in a process that can be considered random (e.g. every 10th visitor to a store)

Reasons for use: Simple to implement and takes advantage of randomness in the environment

Cluster sampling

You divide a population into clusters, such as districts or schools, and then randomly select some of these clusters as your sample

Reasons for use: Groups have a representative composition. Interviewing individual groups yields cost advantages

Stratified sampling

Probability sampling of various groups within the population (e.g. diabetes type 1 versus 2)

Proportional sampling: Proportions of the groups in the sample correspond to those in the population

Disproportional sampling: Intentional over-/under-weighting of groups in the sample

Reasons for use: Over-weighting is required for small groups in order to obtain informative results within the groups when they are particularly relevant for the study.

Snowball sampling

After completion of the interview, the respondent is asked to name other people within a small, specialized population

Reasons for use: Population is small and difficult to reach

Quota sampling

Non-probability sampling. Intentional selection of respondents so that quotas for specific criteria (e.g. gender, age, income) that correspond to the population are met

Reasons for use: Few criteria for representativeness are relevant

Convenience sampling

Non-probability sampling. Selection of respondents who can be reached quickly and at low cost (e.g. students, colleagues)

Reasons for use: Small samples are sufficient for the purpose of the study. Used for pretesting of questionnaires

Findings low-quality giveaways Stäbler

Low-quality giveaways led to negative brand attitudes

Familiar brands were not protected from this negative effect

Personalizing giveaways with the recipient’s name reduced the negative impact of low-quality items

High-quality, personalized giveaways had the most positive effect on brand perception

Scanner Data

It enables timely analysis of sales linked to strategic actions like promotions and couponing, but it has limitations such as lacking psychographic data and causal clarity, and often excludes small retailers.

Statistical data editing

Process of checking observed data, and, when necessary, correcting them

Essential tasks:

Error localization: Determine which values are erroneous

Correction: Correct missing and erroneous data in the best possible way

Consistency: Adjust values such that all edits become satisfied

Why does the data need to be edited

Interview errors: Incorrect instructions for the respondents

Omissions: Respondents not answering a part of the questionnaire

Ambiguity: An unclear response

Inconsistencies: Sometimes two responses can be logically inconsistent

Lack of cooperation: A respondent might check the same response in a long list of questions

Ineligible respondent: An inappropriate respondent (i.e., underage) may be included in the sample

Data coding

The main purpose is to transform the data into a form suitable for analysis

Data matching

The task of identifying, matching, and merging records that correspond to the same entities from several databases or even within one database

Data imputation

Process of estimating missing data and filling these values in into the data set

Data adjusting

Process to enhance the quality of the data for the data analysis. Weighting, variable respecification, and scale transformation

Weighting

Procedure by which each observation in the database is assigned a number according to some pre-specified rule

For example, weighting is used to make the sample data more representative

Variable respectification

Procedure in which the existing data are modified to create new variables, or in which a large number of variables are reduced into fewer variables

For example, six categories are summarized in four categories

Scale transformation

Procedure to adjust the scale to ensure comparability with other scales

For example, some respondents (e.g. from different cultures) may consistently use the lower end of a rating scale, whereas others may consistently use the upper end. These differences can be corrected for

Two main ways we can use text data

Language Reflects: Text reflects intentions, actions, relationships, context, and more

Language Affects: Text affects perceptions, firm outcomes, and more

How to identify causal relationships

Evidence for a strong association (correlation) between two variables

Changing of the cause variable precedes changing of the result variable

Evidence that no rival explanation exists for the observed association of the variables

Experiments establish the best conditions that make it possible to determine causal relationships

Experimental Design

Experimental group: Test subjects who are exposed to the experimental stimulus

Control group: Test subjects who are not exposed to the experimental stimulus

Randomizing: Random assignment of test subjects to experimental / control groups

Matching: Test subjects in experimental and control groups share specific criteria

Stimulus: Variation of a variable that should trigger a behavioral reaction in people

Laboratory Experiment

Performance of the experiment in an artificial environment.

Test subjects are aware of the experiment

Higher internal validity because stimuli can be more effectively manipulated and external factors betters controlled

Lower external validity

Field experiment

Performance of the experiment in a natural environment

Test subjects are not aware that they are part of an experiment

Higher external validity because test subjects are acting under real conditions

More difficult to control extraneous factors

Testing Methods Dependent = Non-Metric, Independent = Non-Metric

Contingency analysis, Logistic regression (e.g., chi-squared test)

Testing Methods Dependent = Non-Metric, Independent = Metric

Logistic Regression (e.g., chi-squared test)

Testing Methods Dependent = Metric, Independent = Non-Metric

Variance Analysis, regression analysis with dummy variables (e.g., F-test and t-tests)

Testing Methods Dependent = Metric, Independent = Metric

Regression analysis (e.g., F-test and t-tests)

One group / sample statistical tests

Nominal —> Frequency distribution = Chi-square test

Metric —> Mean = T-test

Metric —> Variance = Chi-square test

Two-groups / samples statistical tests

In tests on two or more groups, it should be noted whether the variances of the groups are identical and whether the groups/samples are independent of each other

Ordinal —> Median = Mann-Whitney U-Test

Metric —> Mean = T-test

Metric —> Variance = F-test

More than two groups / samples statistical tests

In tests on two or more groups, it should be noted whether the variances of the groups are identical and whether the groups/samples are independent of each other

Metric —> Mean = F-test (ANOVA)

alpha error

The lower the value, the more confident one can be that a specific effect actually exists

Power (1-beta)

The higher the value, the higher the probability that one will correctly detect a real effect. If your study has low power, there’s a high chance you'll miss a real effect even though there is one

Type I error

False positive

Reject a true null hypothesis

Probability is alpha

Type II error

False negative

Accept a false null hypothesis

Probability is beta

Considered a smaller problem

Factors influencing the alpha error

Size of the effect: The larger the measured effect, the lower the probability of error

Dispersion of the measurement values: The greater the dispersion of measurement values, the greater the probability of error

Sample size: The larger the sample, the lower the probability of error. Every effect becomes significant with a sufficiently large sample

Chi-Square test

The chi-square statistic compares the observed values to the expected values. This test statistic is used to determine whether the difference between the observed and expected values is statistically significant

R Squared

Indicates how well the model explains the variance of a dependent variable

There are no rules to how high it must be

It offers no information on how well the model performs outside of the sample

It is the most important goodness-of-fit statistic

No multicollnearity

Multiple regression assumes that the independent variables are not highly correlated with each other. This assumption could be tested using Variance Inflation Factor values (VIF < 10)

Homoscedasticity

This indicates that the variance of error terms are similar across the values of the independent variables (opposite of heteroskedasticity). A plot of standardized residuals versus predicted values could be observed

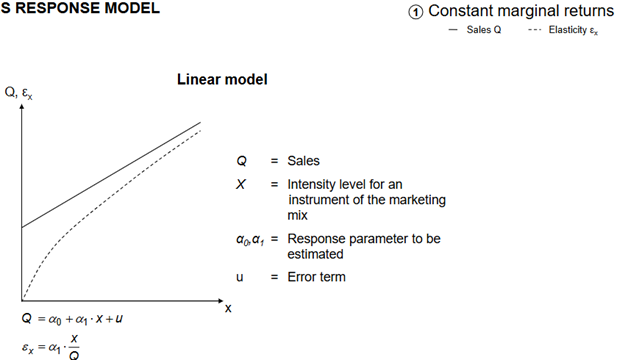

Sales Response Model

Tries to model a sales response as a function of business activities

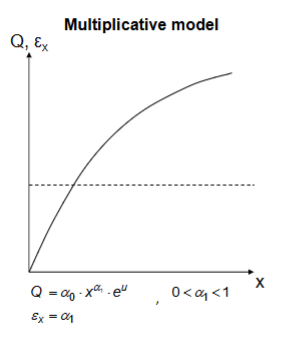

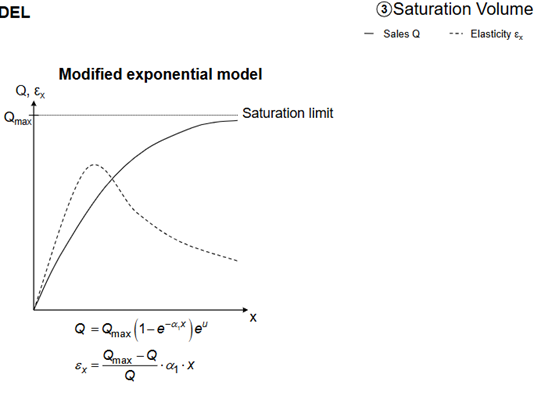

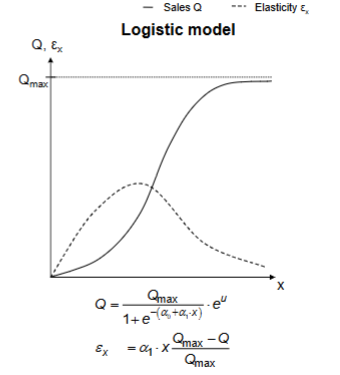

Types of Sales Response Models

Constant marginal returns

Linear Model

Decreasing marginal returns

Multiplicative model

Semi-logarithmic model

Saturation Volume

Modified Exponential Model

S-shaped

Log-reciprocal model

Logistic model

Market Share Models

Multiplicative Interaction model (MCI)

Multinominal Logit Model (MNL)

Elasticity

A universal concept with which the influence of various variables can be compared with others

Linear Sales Reponse Model

What it is

Sales increase at a constant rate with advertising or marketing spend

When to use

Use for simple modeling when data is limited or when a first approximation is acceptable

Advantages

Can be estimated easily

Simple and easy to understand

Disadvantages

Constant returns to scale is not realistic

Assumption that sales can be infinitely increased is not realistic

The Multiplicative Model

What it is

Sales response is modeled using a power function (X^β), reflecting decreasing marginal returns

When to use

Use when increasing advertising has progressively smaller effects

Advantages

Diminishing marginal returns are more realistic than constant

In the multiplicative model, the elasticity can be derived directly from the power exponent of the predictor (constant elasticity)

Disadvantages

No saturation level

Semi-logarithmic Model

What it is

Decreasing marginal returns

A logarithmic transformation is applied to the input variable (e.g., ln(X))

When to use

Use when small increases in input have a large initial impact, but taper off

Advantages

Diminishing marginal returns more realistic

Easy linearization with the help of a logarithm

Disadvantages

No saturation level

If X is close to 0 (and you thus take the natural logarithm of a very small number), sales would go to minus infinity, which is impossible

Modified Exponential Model

What it is

Sales increase with advertising but approach a saturation point over time

When to use

Use when consumer responsiveness declines as spending increases (e.g., mature markets)

Advantages

Saturation level corresponds to realistic consumer behavior

Super Saturation

It occurs when sales even decline as a consequence of excessive business or marketing effort. People get annoyed

Log-reciprocal Model

What it is

Sales response follows an S-curve: no impact at low levels, rapid rise in middle, saturation at high levels

When to Use

Use when a minimum advertising threshold is needed to generate any response

Advantages

Accounts for the phenomenon that advertising needs to be raised above a certain level to have an impact (Threshold Effect)

Logistic Model

What it is

Models the probability of a certain event (e.g., purchase) occurring in an S-shaped pattern

When to use

Use when the outcome is binary or probabilistic (purchase vs. no purchase, adopt vs. not adopt)

Advantages

Accounts for the phenomenon that advertising needs to be raised above a certain level to have an impact (Threshold Effect)

Disadvantages

Outcome variable in logistic model can only be predicted in the form of a probability (e.g., purchase probability, adoption probability)

Event studies

Analyze the financial impact of corporate decisions and events like new product launches and partnerships by examining abnormal stock price changes following an event

Challenges and limitations of event studies (Sorescu, Warren & Ertekin)

Leakage: Information about an event may be known before an official announcement, affecting results

Confounding events: Other news or announcements may occur at the same time, making it hard to isolate the effect of one event

Diverse methodologies: Differences in study design, asset pricing models, and statistical tests can lead to inconsistent findings

Typical events used in event studies

New market entry

M&A

Hostile takeover

Layoffs

External shocks (1st lockdown)