Microeconomics Midterm I

1/93

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

94 Terms

Gross domestic product (GDP)

Measures the total goods and services produced in the economy at market prices in a given period

Limited measure of economic development

Per-capita GDP

Related measure of living standards, simply given by GDP divided by population

Limited but helpful indicator of living standards

Growth rates

Measures the change of levels of GDP and per-capita GDP in growth

Issues of GDP

Price changes over time

The range of products and services available can vary greatly at different moments in time

Comparing different nations (prices vary considerably from country to country)

Purchasing power parity (PPP) units

Calculates per-capita GDP by correcting price differences from countries to countries

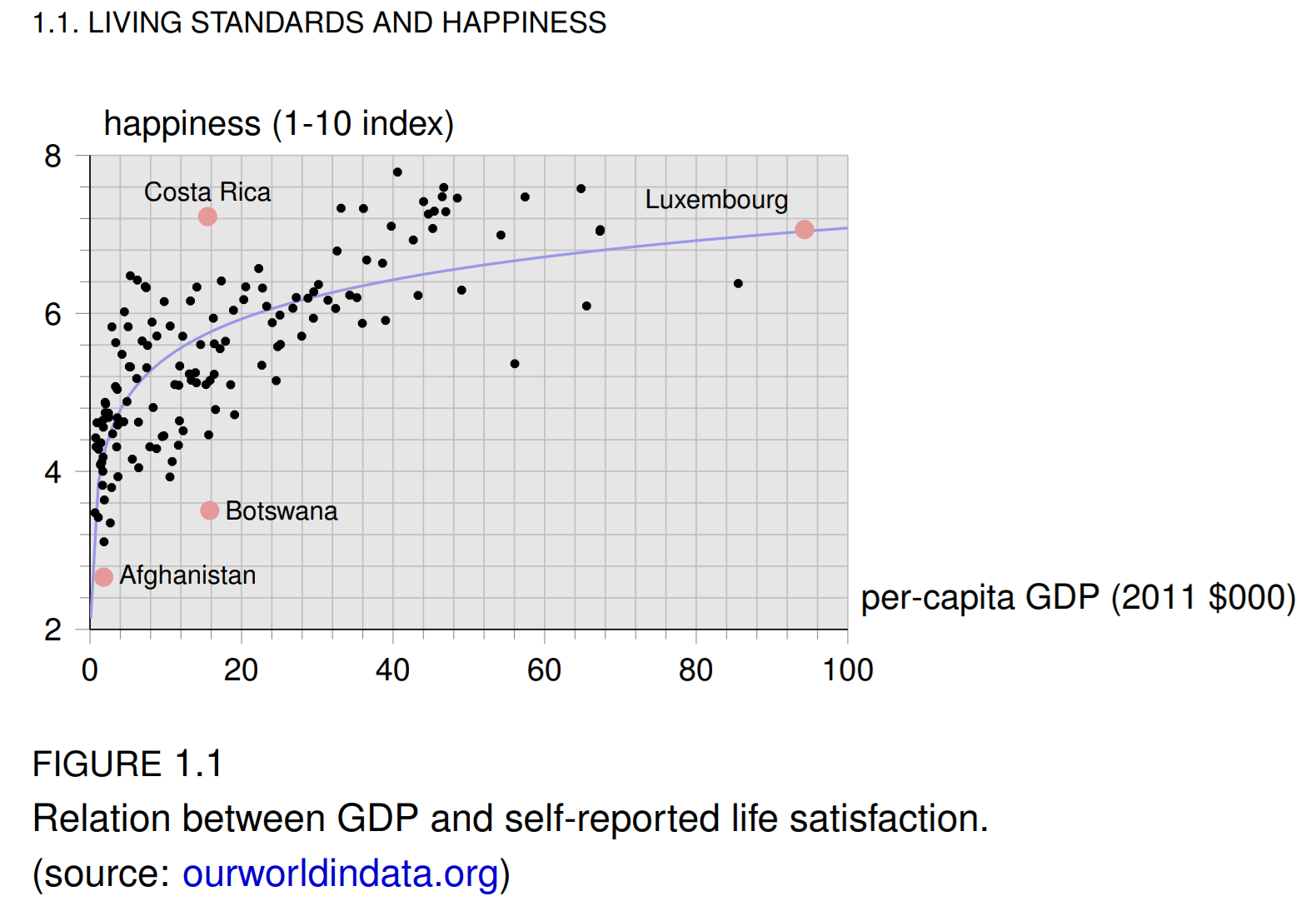

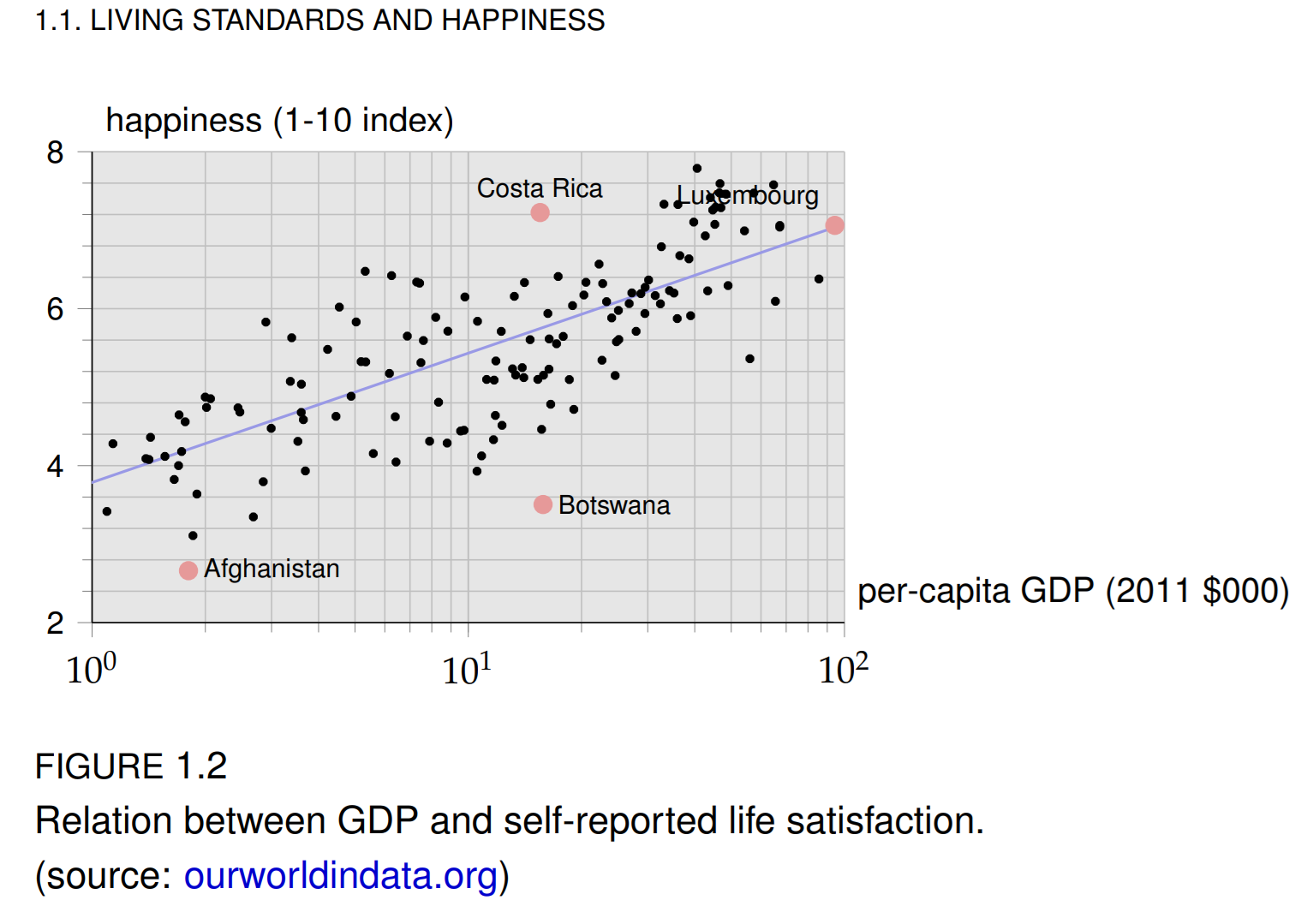

Correlation between GDP and Happiness

There’s a correlation between GDP and happiness, no causality. There could be a third variable.

Happiness report considers a list of factors including: social support, life expectancy, freedom to make life choices, generosity, perception of corruption

Logarithmic graph

Each equidistant tick corresponds to multiplying the variable by X number

10^0 = 1, 10^1 = 2

The original GDP–happiness curve is concave because increases in GDP have a big effect on happiness at low GDP levels but a small effect at high GDP levels.

Taking the log of GDP “compresses” large GDP values, so the curve straightens out. In log terms, a 10% rise in GDP raises happiness by about the same amount, whether a country is poor or rich.

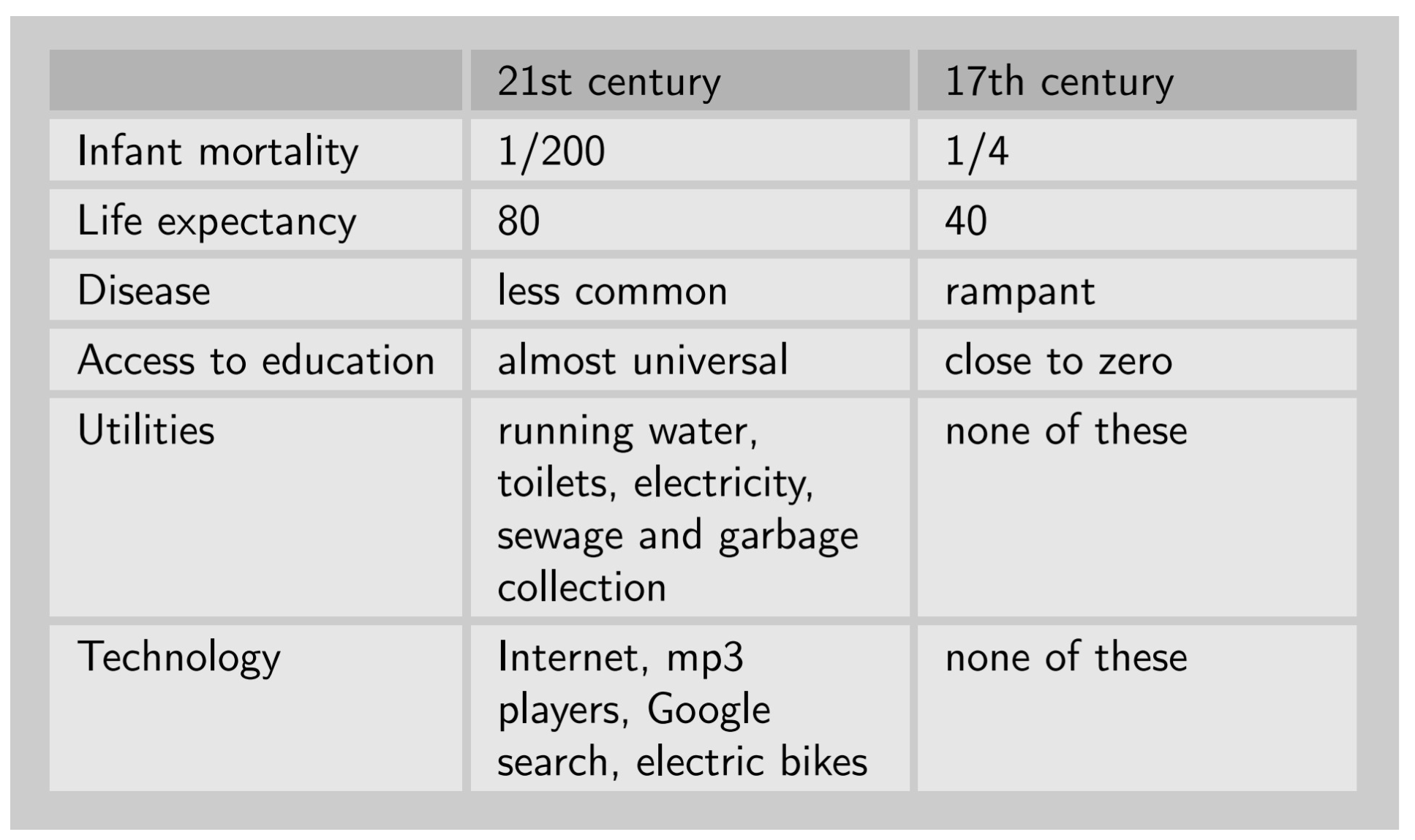

History’s hockey stick

A relatively constant per-capita level (near-zero growth) suddenly turning into a high-growth pattern

Capitalist revolution

Extraordinary pace of economic growth experienced by the countries that first adapted the capitalist system of economic organization

Capitalism

An economic system of private property, markets, and firms

AKA: Market-based economies/Market economies

Why it works (in theory):

Competition, division of labor and gains from specialization, markets and value creation, globalization, innovation (process and product)

Varieties of capitalism:

Property

Most-present day advanced economies may be characterized by mixed economies

Government role (health, education, innovation system)

Limits of capitalism:

Inequality

Discrimination

Climate change: many correlations, strong case for causality

Industrial Revolution

Took place in the late 18th century and early 19th century. A rapid transition from manual labor to mechanized production, from agriculture to manufacturing, rapid population growth

Led to the creation of firms and the distinction between capitalist and workers

The emergence of capitalism was associated with extremely rapid improvements in production technologies and gains in production efficiency

James Watt patents his steam engine, Adam Smith publishes The Wealth of Nations

Competition between firms incentivizes them to innovate

Division of labor (specialization)

Scales economies: worker specializing in one task only incurs the set up cost once

Learning by doing: doing the best method

Globalization

When Scotland and France trade, the market for French wine makers increases

Leads to a greater market size

Innovation

Process innovation: producing the same product or service in a new or more improved way

Product innovation: producing new products or services

The capitalist system improves living standards in various ways

a) market exchange creates value (both parties are better off

b) markets allow for specialization, which in turn leads to greater efficiency

c) the profit incentive leads leads individuals and firms to engage in product and process innovation

Varieties of capitalism

China is a state-owned enterprises play an important role, considerably more than the U.S. In France, eminent domain laws are more favorable to public projects than in the U.S.

Mixed economies

A system combining free markets with state intervention (as well as private firms with public enterprises)

Inequality

The take-off of capitalism affected different countries at different times

Intra-country inequality: ex) in 1960, the top 1% in the US earned about 10% of total income, and continues to increase

Discrimination: Gender/racial discrimination

Women are paid less of about 20% than men (one reason is due to selection as women choose jobs that pay less on average)

White-Americans earn about 30% more than Black Americans (influenced by education levels, access to college)

Environment

Level of CO2 emissions (Along with CO2 atmospheric concentration and temperature) are increasing and economic activities (transportation, travel, manufacturing) had an influence

Cargo ships steam across the ocean

Sustainable development/sustainable economy

1) The right incentives for individuals and firms to engage in cost-reduction and quality improvement innovation, as well as efficient production

2) A stable society, in particular one that is just.

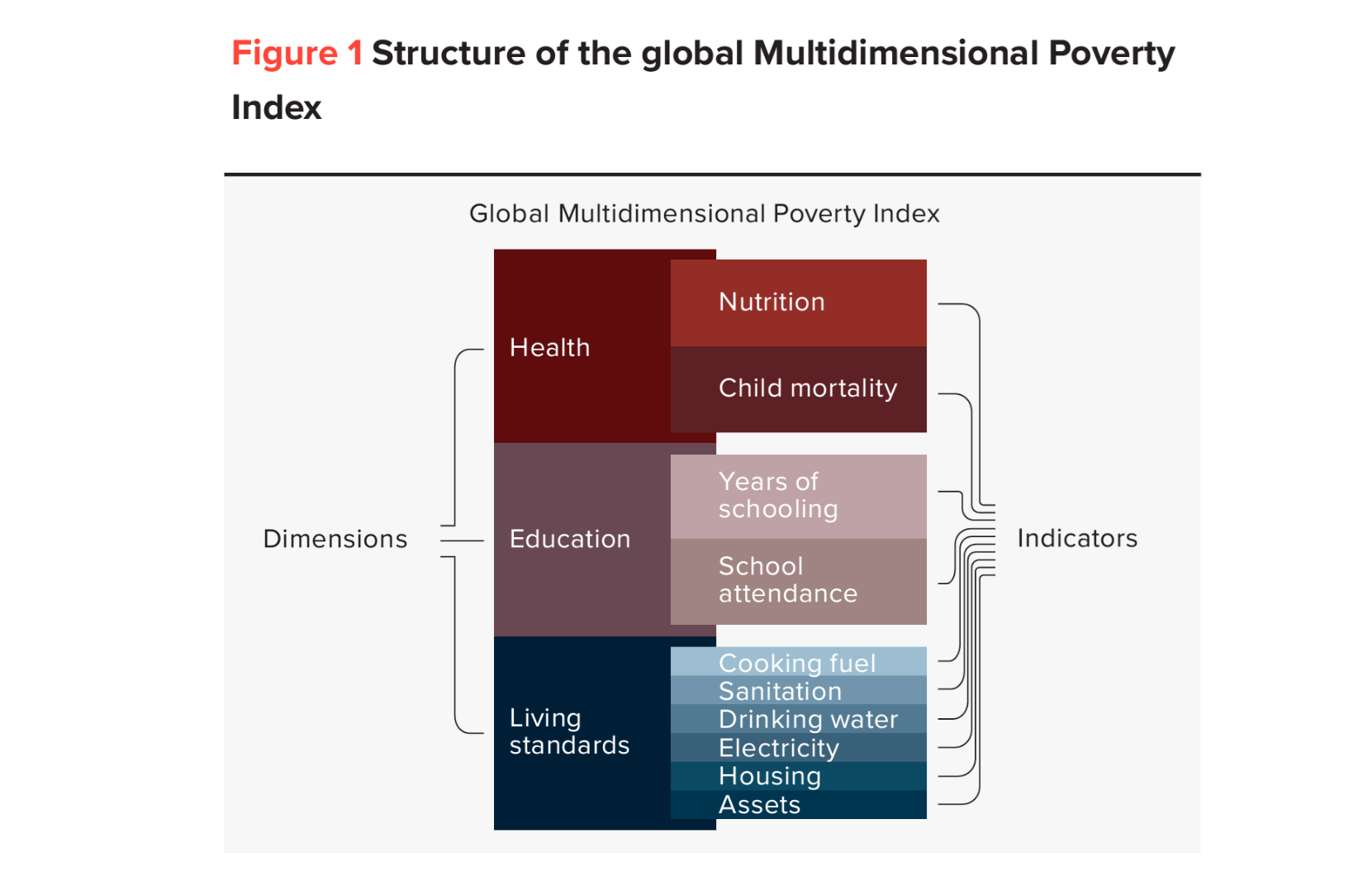

3) A stable biophysical environment and resource base sustainable development goals: by 2030

Sustainable development goals

By 2030:

No Poverty

Zero Hunger

Good Health and Well-being

Quality Education

Gender Equality

Clean Water and Sanitation

Affordable and Clean Energy

Decent Work and Economic Growth

Industry, Innovation, and Infrastructure

Reduced Inequality

Sustainable Cities and Communities

Responsible Consumption and Production

Climate Action

Life Below Water

Life On Land

Peace, Justice, and Strong Institutions

Partnerships for the Goals

Social responsibility

Improving human well-being and community health by ensuring fair, equitable, and inclusive practices

Requires an increasing engagement by individuals and the government

Comparing women in Asia vs Europe/America, there is a significant lower population due to selective abortion and female infanticide

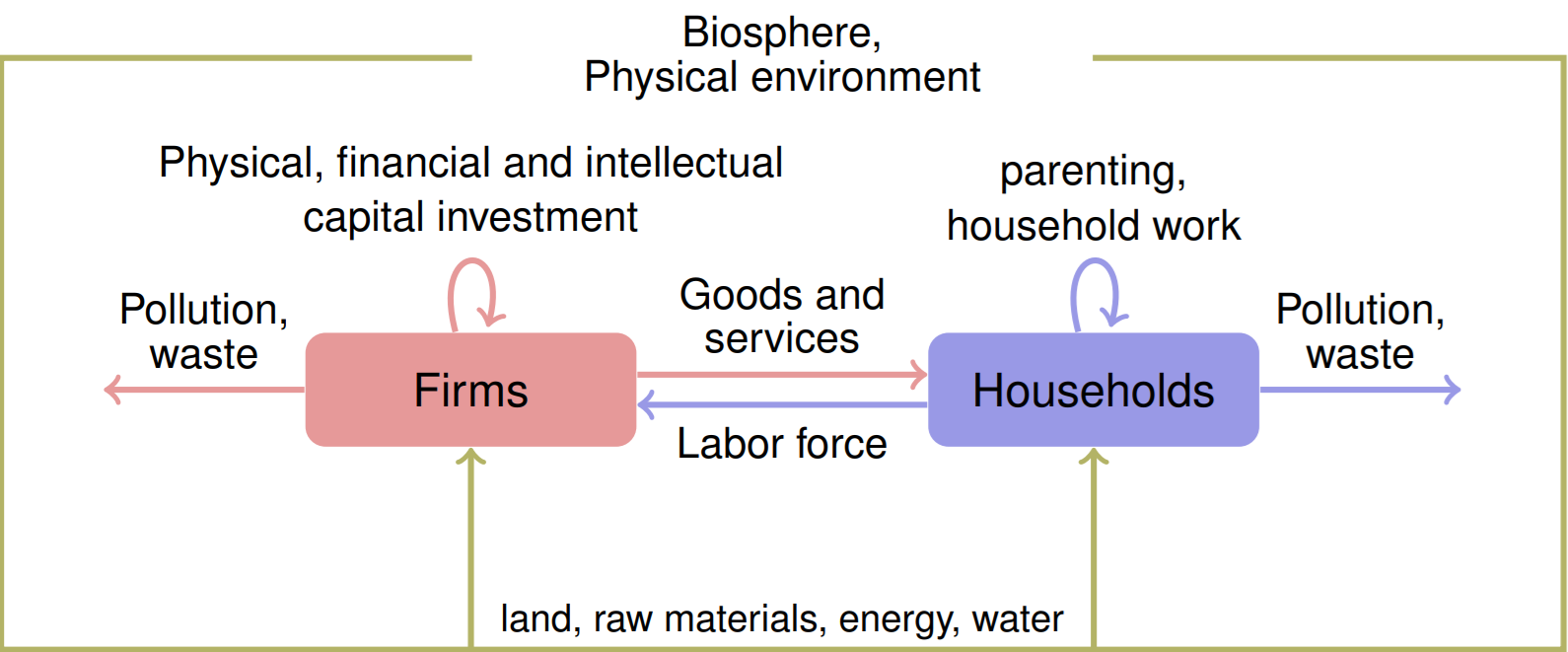

Sustainable resource use

Economic activity in the context of a specific planet/environment

Model of the economy

Corporate social responsibility

A company’s sense of responsibility towards the community and the environment, both ecological and social, in which it operates

Value of life

An economic value used to quantify the benefit of avoiding a fatality

Invisible hand

Individual self-interest, through competition in a free market, can naturally benefit society as a whole

Behind the GDP numbers

*415M people in India exited poverty

Brief history of economy

Era 1: Self-sufficient, family-based production

Various economies around the world characterized by self-sufficient, family-based production

Growing own food, making own clothes

Era 2: Market economy with family-based production

Families produced surpluses of food and other products

Exchange their surpluses in markets, typically local

Era 3: Industrial revolution

First took place in Britain (18th-19th centures)

The first “hockey stick”

Culture of growth, progress, cumulative innovation

The rise of engineers, mechanization of textile in industry

James Hargreave’s spinning jenny

James Watt’s steam engine

Emergence of physical capital and factories

Creation of firms and the distinction between capitalists and workers

First problems: the condition of labor in the 19th century

Economic model

Description of an economic situation by means of words, diagrams, and mathematical expressions

Like maps, provide a simplified depiction of reality, focusing on the most relevant elements and how they relate to each other

Post hoc fallacy

“After this, therefore because of this.” Logical error where someone assumes that because one event happened after another, the first event must have caused the second

Counterfactuals

A “what if” scenario, what would have happened if things were different

Identifying assumption

We can assume x causes y (causation)

The assumption that allows us to identify the causal effect of the price decrease

Sample selection effects/selection bias

When a study’s sample’s not representative of the overall target population

Ceteris paribus principle

“All other things equal” where conditions remain the same

Suppose we want to see how the price of apples affects the quantity people buy.

Ceteris paribus, we assume all other factors (income, price of oranges, tastes, etc.) stay the same.

Then we can isolate the effect of price alone.

Positive analysis

Statements about what is. Cause and effect.

Facts

Ex: if price increases, demand decreases

Normative analysis

Statements about what ought to be/should be.

Opinion-based

Ex: the government should raise minimum wage to stop poverty

Homo economicus

Portrays humans as agents who are consistently rational and self-interested, specifically agents who act with the purpose of optimally pursuing their ends

Behavioral economics

Studies the effects of psychological factors on behavior of individuals and institutions

Sociology

Deals with the patterns of social relationships, social interaction and culture that surround everyday life

Conspicuous consumption

Consumer spending on luxury goods and services to publicly display economic power rather than enjoying them for their intrinsic value → social status

Positional goods: A refinement on the concept of conspicuous consumption

Statistical discrimination

Ex: car insurance rates, different average payments in demographics

Taste discrimination

Ex: minority groups are hired less, there is a distaste

Institutional discrimination

The idea that different treatment by race is also perpetrated by organizations or even codified into law

Extractive economic institutions

Which destroy incentives, discourage innovation, and sap the talent of their citizens

Lack of property rights, absence of rule of law, etc

Copyright protection

Goes a long way toward incentivizing an author to create, but extending copyright protection beyond the author’s death does not seem to provide any additional gain

Immigration quotas

Especially when applied to skilled immigrants, produce, significant harm to the economy

Limits green card visas

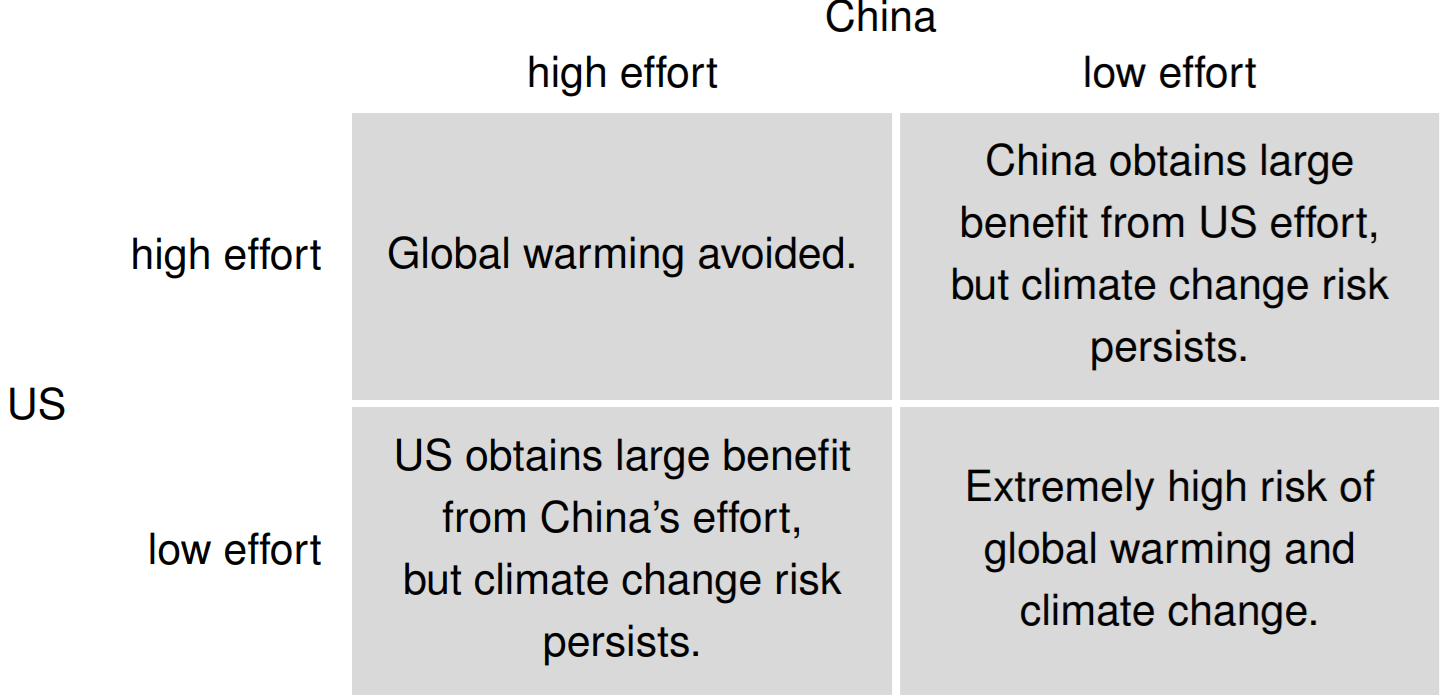

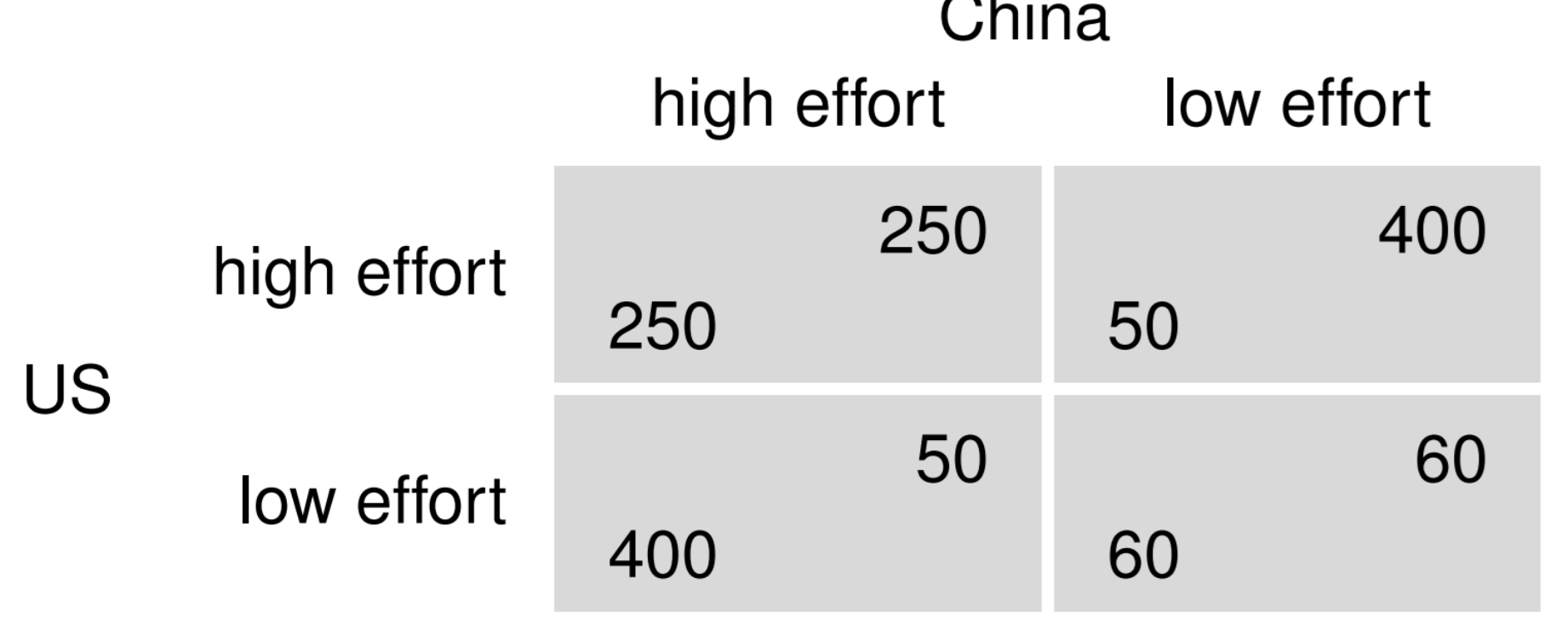

Game theory

How people make decisions when the outcome not only depends on what they do, but also what others do.

High effort + high effort: Since both players are putting in the same effort, nobody is ahead. They’re both splitting the burden equally, so the outcome is equal, but not maximized because nobody is free-riding off of someone.

Ex: you and your roommate clean the room equally, but both end up tired

Low effort + high effort: Since one player (player A) is not putting in enough effort while the other (player B) pays a great cost, player A gets to freeload and enjoy benefits while player B suffers from hard work.

Ex: you clean the entire room by yourself which you ended up tired while your roommate enjoys benefits

Low effort + low effort: Since both players lack, neither is receiving the benefits

Ex: neither you or your roommate cleaned the room, neither is benefiting

Social dilemma

A situation where individuals, acting in their own self-interest, make choices that lead to a collectively worse outcome than if they had cooperated

Dominant strategy

A plan of action for a player that yields the highest possible payoffs regardless of what the other player(s) do in the game

Prisoner’s dilemma

Each player chooses the dominant strategy but the resulting outcome in the worst for both players

Choice

We mean how consumers, workers, and firms make choices (we must choose between alternative uses of scarce resources, such as time and money)

Markets

We mean the interaction between buyers and sellers who transact products or services

Consumer surplus and producer surplus = total surplus in the market (the market is working well if total market surplus is maximized)

Public policy

We mean how the government impose constraints on consumers, firms, and markets to address system failures

Merger policy: Whether firms A and B should merge

Carbon taxation: Taxing activities that generate greenhouse gases

Welfare transfers: food stamps

Physics envy

Economics as purely positive analysis

When economists try to make their models as precise and “scientific” as physics, even though human behavior is more unpredictable.

Confirmation Bias

Definition: The tendency to notice or give more weight to evidence that supports one’s theories, while ignoring or dismissing evidence that contradicts them.

Selection Bias

Definition: When the data used in a study is not representative of the population being studied.

Constant discount rate vs. Present bias (Myopic)

Constant discount rate:

Standard economic assumption

People value the future less than the present at a constant, proportional rate and time-consistent

If you prefer $100 today over $110 tomorrow, you will still prefer $100 in 10 days over $110 in 11 days in the same proportion.

Myopic/Present bias:

Short-term choices: People overvalue immediate rewards. Ex: you’re offered $50 today but $100 in 1 year, you would choose the $50 for today

Long-term choices: However, if the two choices are both long-term, then the person is more willing to choose the larger reward with greater patience. Ex: you’re offered $90 in 10 years but $100 in 11 years, you would choose the $100 in 11 years because the difference of 1 year doesn’t feel big because both are in the future.

Madonna concert example

Her concert was planned for 84 concerts, the question is, should she do more, lower, or exactly 84?

Benefit: Ticket sales, merch, publicity, etc

Cost: Rental, staff, time, etc

If benefit > cost, do 85th

Vice versa

Cost-benefit approach

Making decisions by comparing extra benefits with the costs

If benefits > costs, do it, if not, vice versa

Sunk cost

Costs that have already been incurred and cannot be recovered, no matter what you do in the future.

Ex: Airbus spent money developing the Beluga airplane. That money is already spent. Whether they charge a high price, low price, or stop production, that money is gone.

Explicit costs: Out-of-pocket, monetary payments.

Example: Paying for raw materials, employee wages, or market research.

Sunk costs are explicit if the company actually spent money—like Airbus paying for research.

Opportunity cost

Refers to something that needs to be given up in order to obtain a certain good x

Implicit costs: Non-monetary opportunity costs—what you give up by using your own resources.

Example: If the CEO spends 1,000 hours managing a project, the implicit cost is what else they could have done with that time (like consulting for another company).

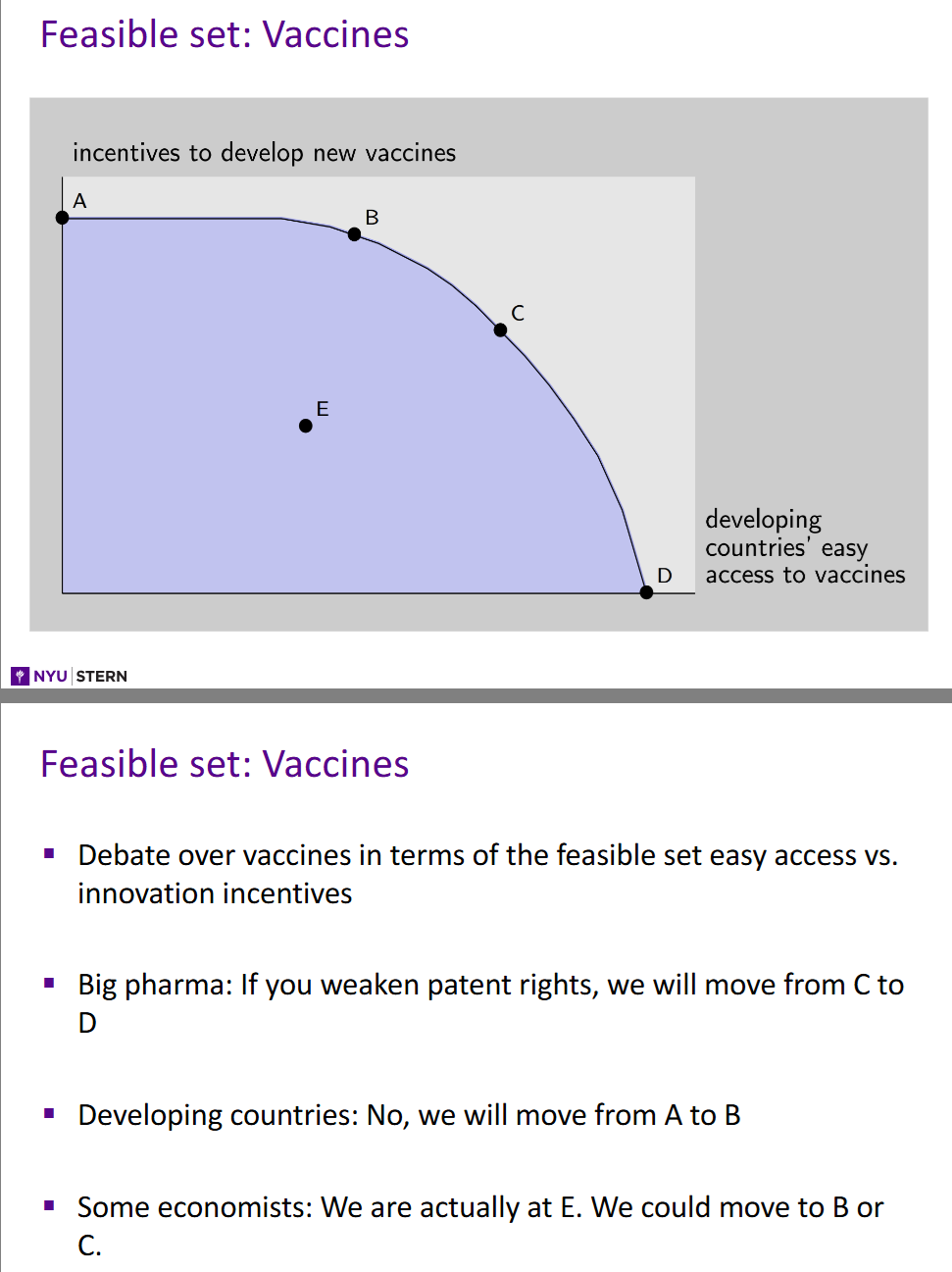

Feasible set

Simply the set of outcomes that are attainable

There’s a trade-off if we increase access, there are less incentives

Decreasing marginal benefit

As you consume more of something, the extra benefit you get from each new unit tends to shrink

First cup of coffee wakes you up, second cup helps a bit

Decreasing marginal utility

Same idea as decreasing marginal benefit but for consumers, the satisfaction you get from consuming is utility

First cup of coffee has the highest utility, second has less

Total utility

The overall satisfaction or benefit from consuming a total quantity of a good

Total utility from one cup = happiness/energy from one cup

Total utility from two cups = happiness/energy of both cups

Laws of decreasing/diminishing marginal returns

When producing something, if you keep adding more of one input (like workers) while holding everything else fixed (like kitchen size) the extra output from each new input will shrink

Increases in staff, increases more tables served, however, contribution of an additional worker would decrease

1st cook → 10 plates/hr

2nd cook → 18 plates/hr instead of 20 because they might bump into each other

Zero-sum game

My gain is your loss

*Economic transaction, on the other hand, involves values for both parties

Comparative advantage

Economic agents should specializes on the activities in which they’re relatively better at

Incentives vs. Anti-incentives

Incentives: Something that motivates a person to act in a certain way linked to rewards

Anti-incentives: A policy or action that unexpectedly encourages the opposite behavior from what was intended.

Ex: Parents were consistently bringing their kids to the daycare late. The daycare imposed an anti-incentive (fine) hoping to discourage lateness. However, this led to the opposite result of increasing lateness.

Before fine: “I should not be late because it’s rude and unfair to the daycare”

After fine: “I can pay $5 and it’s fine to be late.”

The moral cost is replaced by a monetary cost. The fine replaced the moral/social incentive with a monetary transaction, removing the guilt of being late.

Marginal benefit vs. Marginal cost

Marginal benefit: The additional benefit or satisfaction you get from consuming one more unit of a good or service

Marginal cost: The additional cost incurred you get from consuming one more unit of a good or service.

Opportunity cost

A money manager has been working for 5 years. She is considering to start a business or stay.

Revenues and costs:

Market research: $5,000

Fees: $140,000

Miscellaneous: $12,000

Rent: $36,000

Other expenses: $18,000

Wages $24,000

Sunk cost: $5,000

Do not take into account because you can’t get it back

Revenue: $140,000 + $12,000 = $150,000

Explicit costs: $36,000 + $18,000 + $24,000 = $78,000

Implicit costs: $56,000 + $4,000 = $60,000

She expects to tie up $80,000 in personal savings in working capital to start the new business.

Annual income is $56,000 (implicit costs) and expected annual stock of 5% (implicit costs) = $4,000. So should she start her business?

However, her boss tells her she is due for a raise from her current position is now $80,000.

Her implicit costs increase, so her economic profit became negative, don’t start the business

Market value

The transaction monetary amount

Value in use

The benefit received from using a good

Paradox of value

The two values are not necessarily related

Market value of diamonds is higher than water but the value in use of water is higher

Revealed preference

Based on your actions (your data) we can infer your preference

Lena buys TV subscription of $40/monthly but does not buy $60/monthly, we can infer Lena’s willing to pay $40 maximum

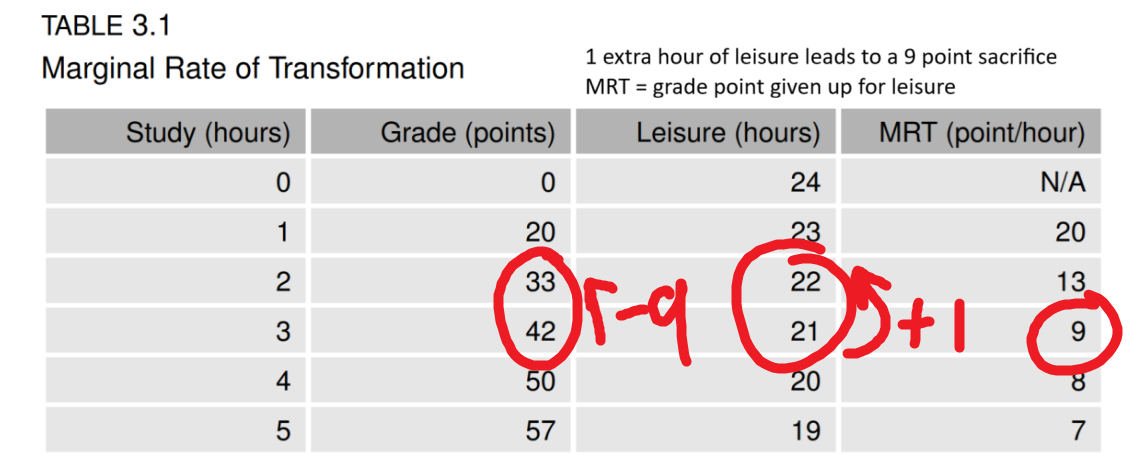

Marginal rate of transformation (MRT)

Given by the absolute value of the slope of the BUDGET LINE (the straight line that touches the outer edge of the feasible set)

Indicates how much you HAVE TO give up Y to obtain an ADDITIONAL unit of x (opportunity cost of x in terms of y)

Alexei needs to give up his grade (Y) for an additional hour of leisure (X)

Having to/need to give up

Utility

A concept that describes a person’s preferences

Ex) Leisure (15) and grades (84), would Alexei have a lower utility or a higher if he instead had 18 leisure and 84 grade?

A higher one because he is benefiting from having more goods

Completeness

An agent’s preferences are complete if, for any two options A and B, the agent can say either:

A } B

B } A

A ~ B

They can’t say “I have no idea”

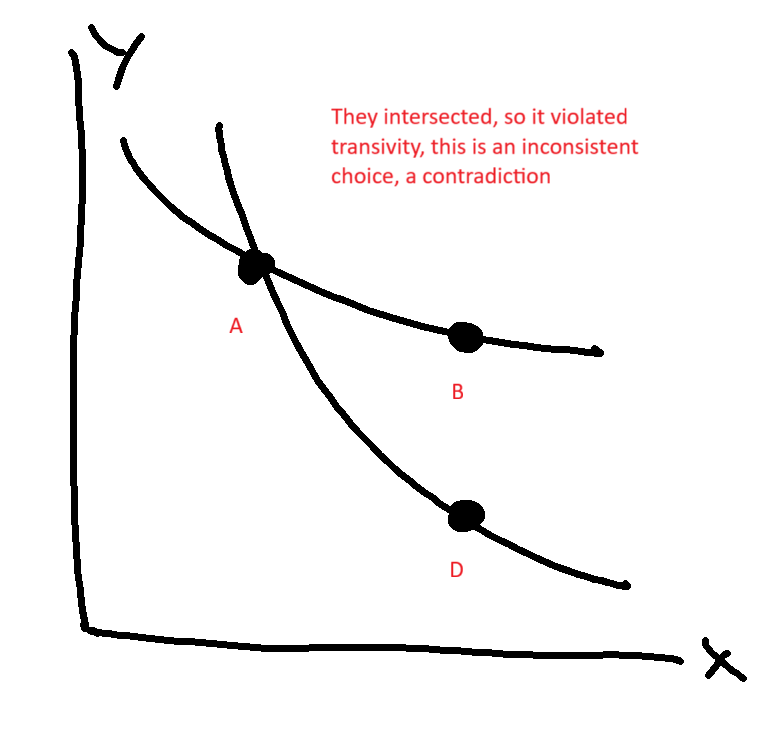

Transivity

Preferences are rational if whenever an agent prefers A } B and B } C, the agent also prefers A } C

Ex: A ~ B and A ~ D, but since A is on both graphs, it implies that A ~ B ~ D. However, B has more than D because of monotonicity.

Indifference curves never cross (if that were the case, we would have a violation of transitivity)

Monotonicity

The more of a good is always better

Bundles that are farther from the origin (more of at least one good and no less of the other) are preferred

So, monotonicity implies higher indifference curves = higher utility

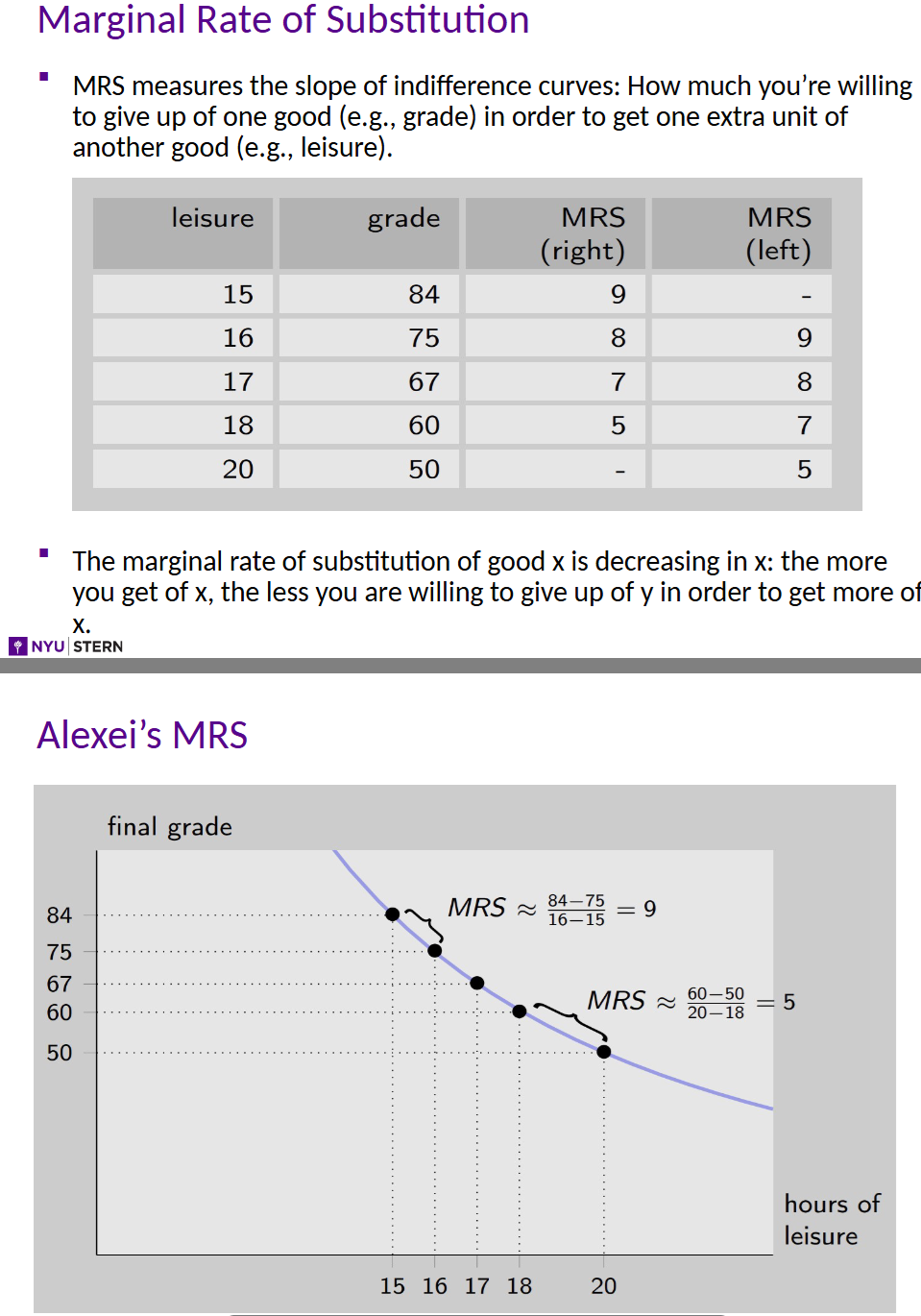

Marginal rate of substitution (MRS)

Represents the absolute value of the slope of the indifference curve

Indicates how much you ARE WILLING TO give up Y to obtain an additional unit of X while keeping your utility constant

Alexei is willing to give up some of his grade (Y) for an additional hour of leisure (X) without changing his overall satisfaction

Willingness to give up

Law of decreasing/diminishing marginal rate of substitution

MRS decreases when you obtain more of x

When x increases, you’re willing to give up less of y for an additional unit of x

Ex: when leisure (x) increases, leisure (x) becomes less valuable, so you’re less willing to give up grades (y) for it

Implies convexity of the indifference curves

MRSxy denotes the absolute value of the slope

Perfect substitutes

Two goods can be swapped at a constant rate

The indifference curve would be straight

MRS is constant

Law of decreasing MRS does NOT APPLY

Perfect complements

Two goods must be used together

The Indifference curve is L-shaped → extreme convexity

MRS is either 0 or infinity

Law of decreasing MRS does NOT APPLY

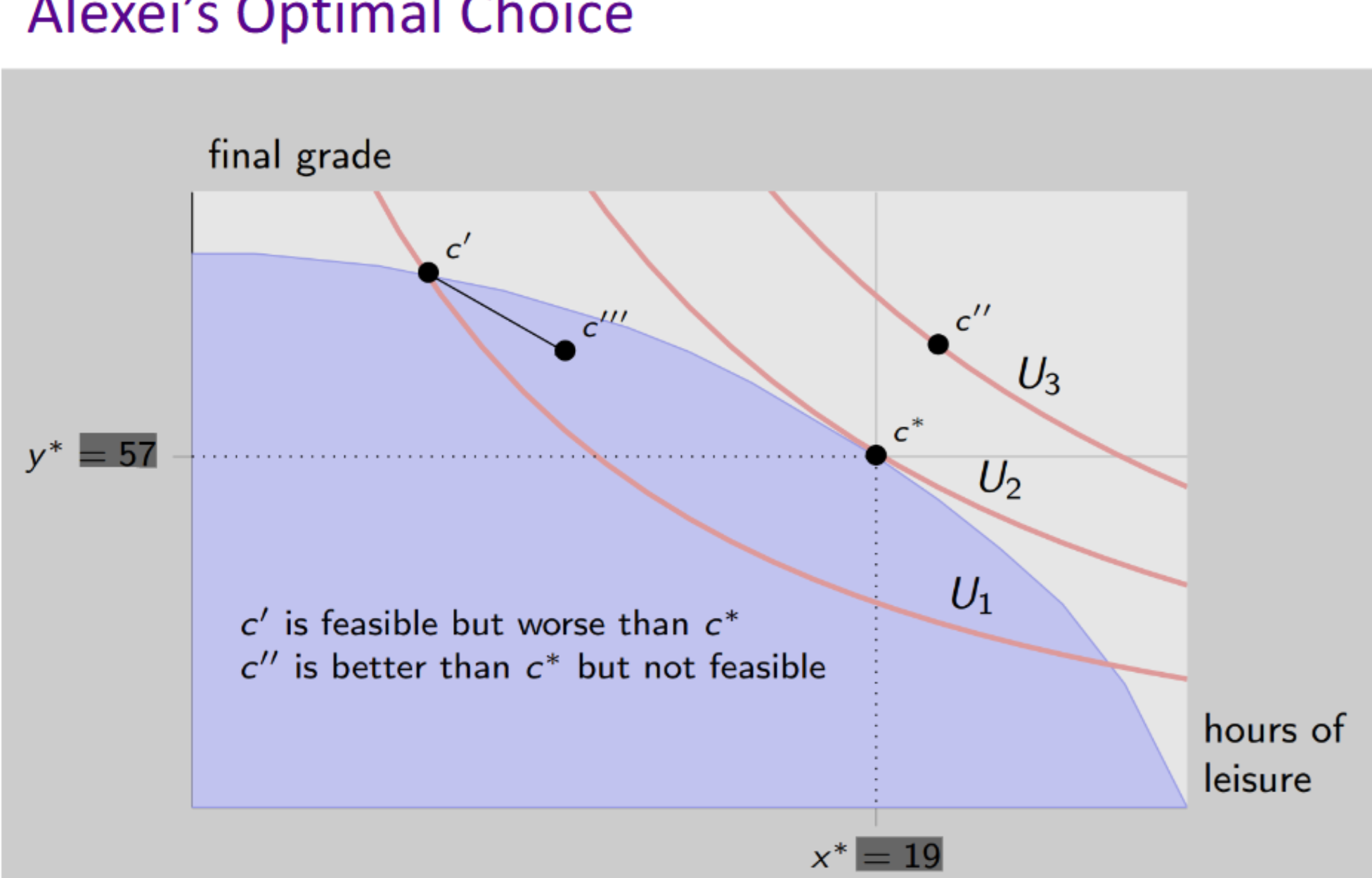

Alexei’s optimal choice

Alexei’s feasible set: combinations of grade and leisure that he can attain

Alexei’s preferences: combinations of grade and leisure that he prefers with respect to other combinations

Graph one:

C’ is feasible because it’s on the border but worse off than C*

C’’ is better off than C* but not feasible because it’s not attainable

C’ is lower utility than C’’ U1 { U2

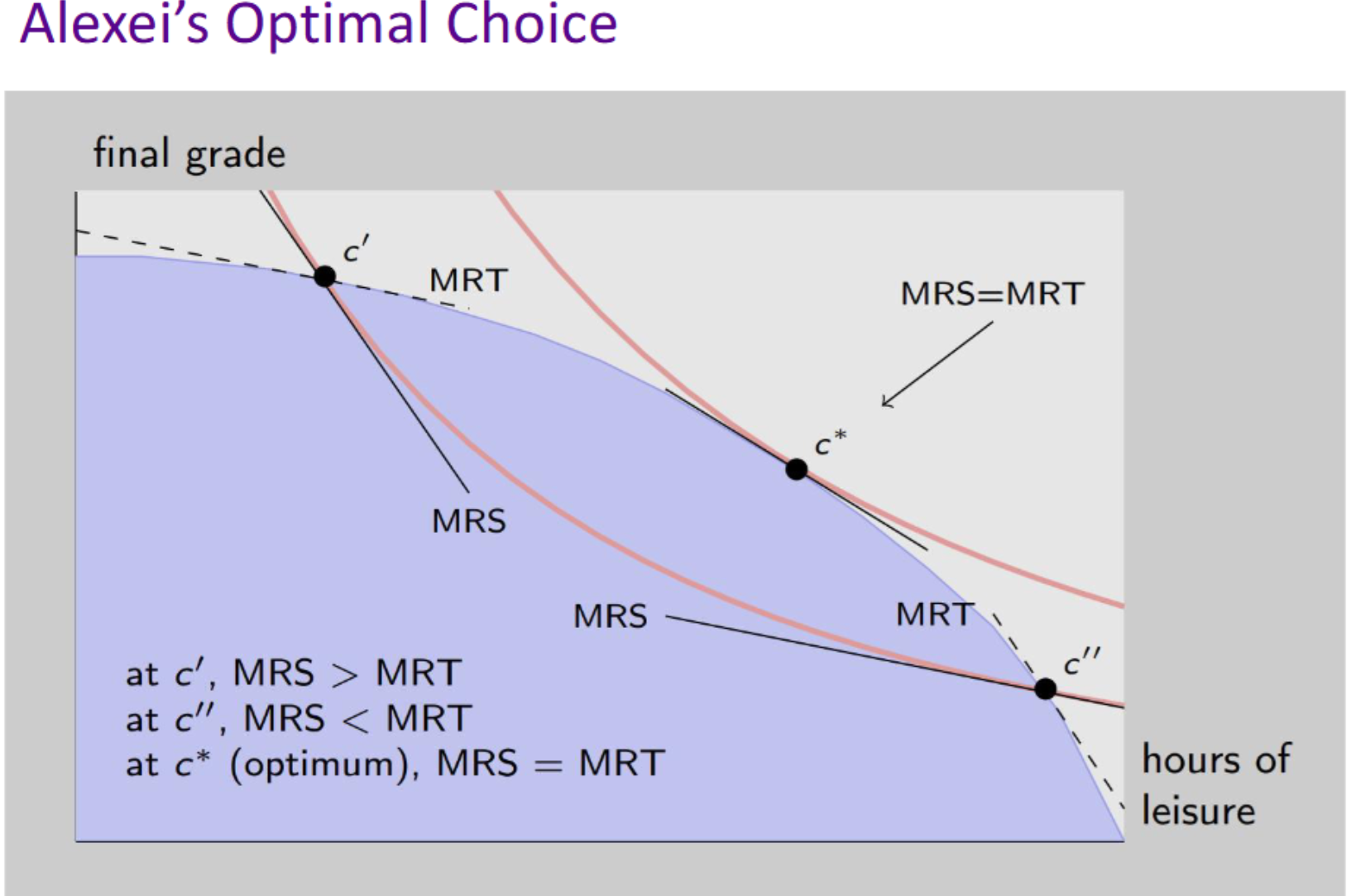

Graph two:

At C’, Alexei is willing to give up more than he needs b/c MRS > MRT

At C’’, Alexei is giving up more he’s willing to b/c MRT > MRS

At C*, there’s an optimum/optimal choice b/c MRT = MRS

Constrained optimization

Finding the optimal resource allocation in a world where resources are scarce

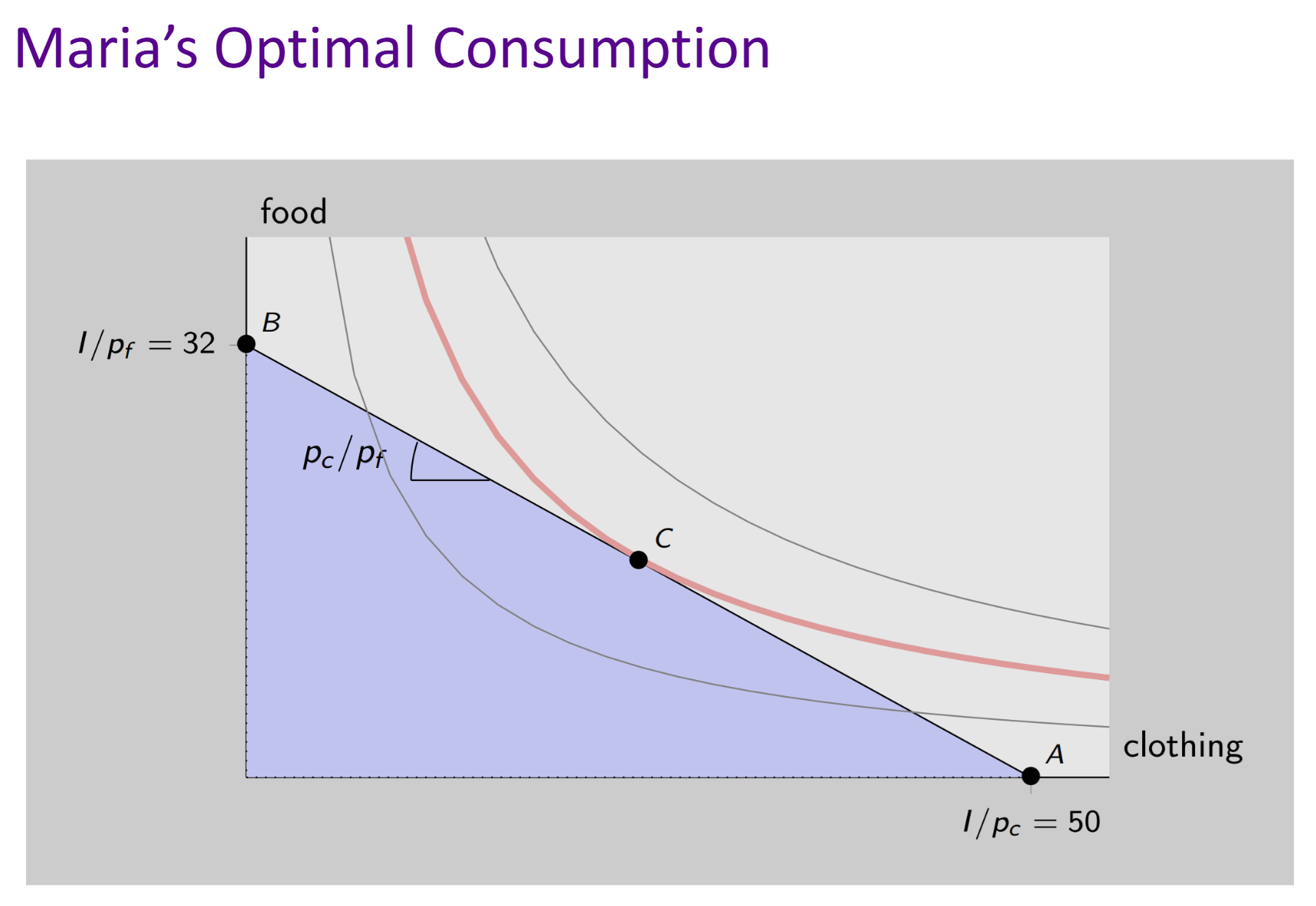

Consumption

Maria has an income of 56

Price of food = 1.75

Price of clothing = 1.12

Suppose Maria were to spend all of her income on clothing. Then she could afford 56/1.12 = 50 units of clothing. Alternatively, she could spend all of her income on food. Then she could afford 56/1.75 = 32 units of food. However, if Maria is to spend all of her income on clothing and food then the following equality holds: px X + py Y = I

The slope of the budget line, in absolute value is given by y2-y1 / x2-x1

MRS = pc/pf, instead of saying y/x, we can x/y because MRS is given by the definition of giving up y for x

Slope = ratio of clothing to food (pc/pf)

At bundle c*: MRS = MRT

Slope of the indifference curve (MRS) = slope of the budget line (MRT)

Maria should choose consumption levels of food and clothing such that the marginal rate of substitution of clothing for food (how much food she’s willing to give up for an extra unit of clothing) is exactly equal to the ratio (price of clothing divided by price of food)

*Optimal consumption mix corresponds to the equality of the MRS and the price ratio*

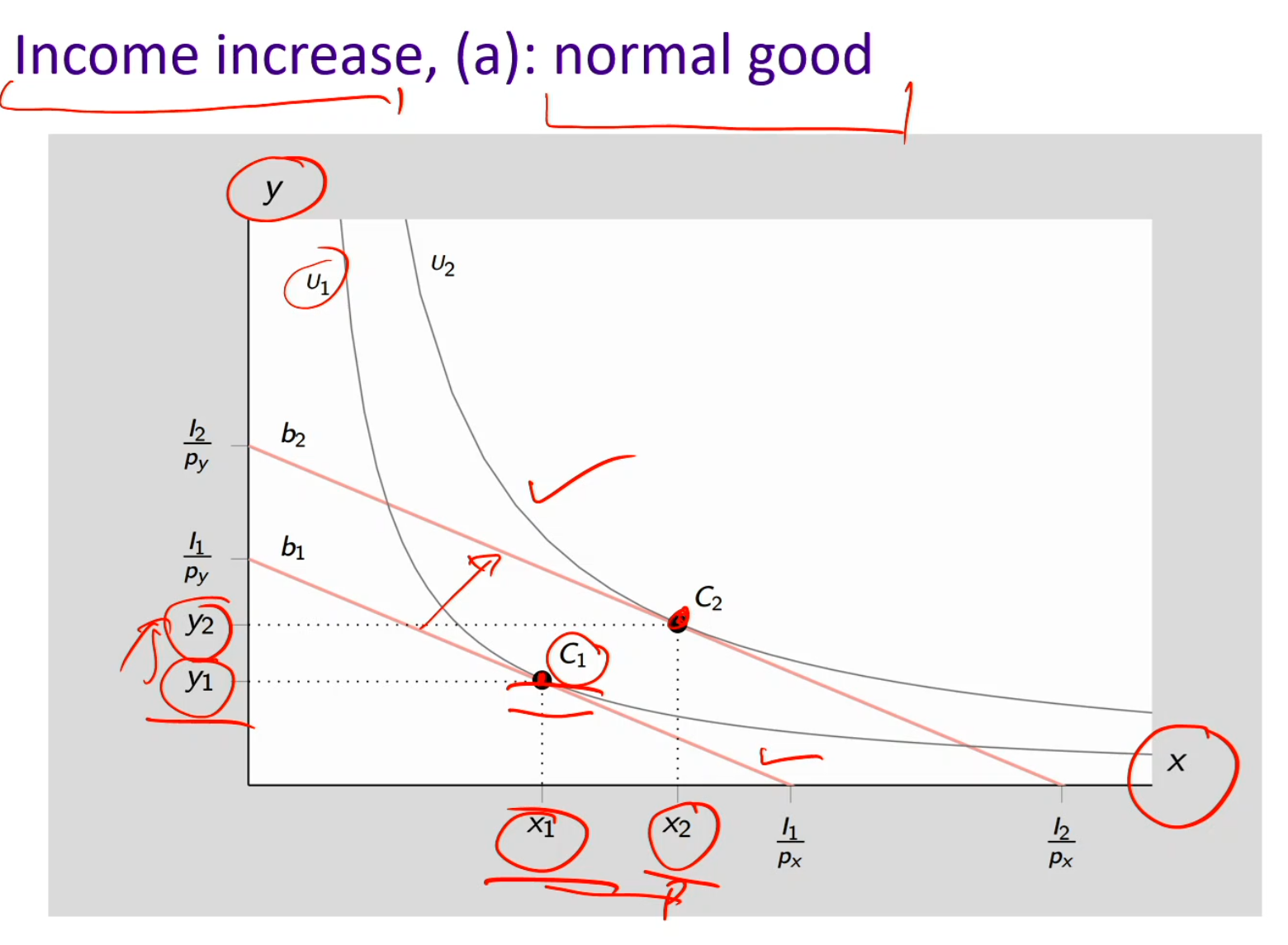

Normal good

Normal good consumption increases when income increases, vice versa

Ex: clothing, electronics, brand-name, cars, etc

As people become more wealthier, they tend to buy more of these goods

Ex: Income increases and normal good increases

The budget line shifts outward (income ↑)

The slope does not change as it shifts parallel, because prices stay the same

X1 shifts to X2, Y1 shifts to Y2

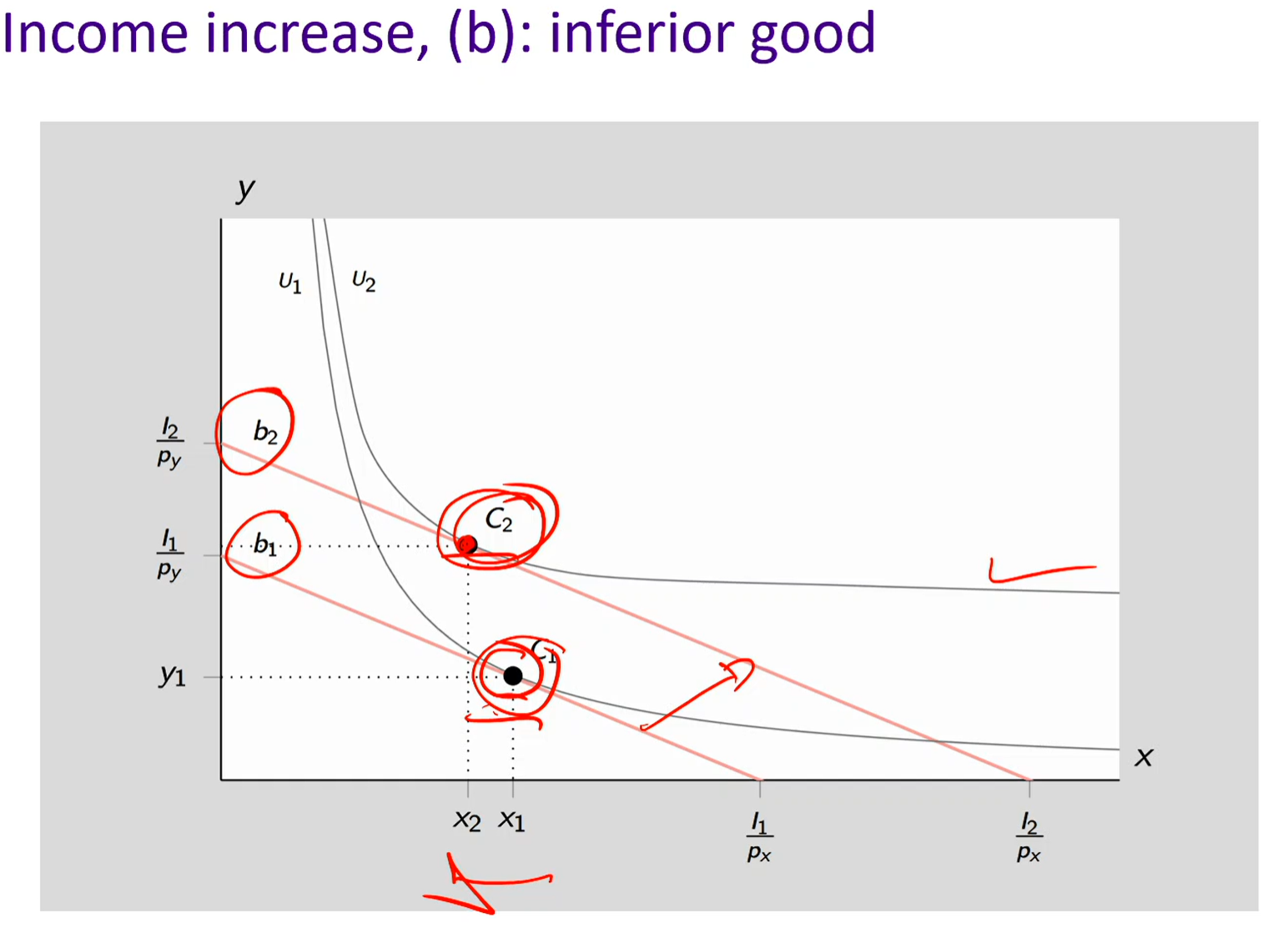

Inferior goods

Inferior good consumption decreases when income increases, vice versa

Ex: generic food products, fast food, instant noodles, etc

Consumers buy less of these goods as they become wealthier

Ex: Income increases and consumption decreases

The budget line experiences a parallel shift (also upwards/rightwards).

However, x is consumed less since X2 is to the left of X1

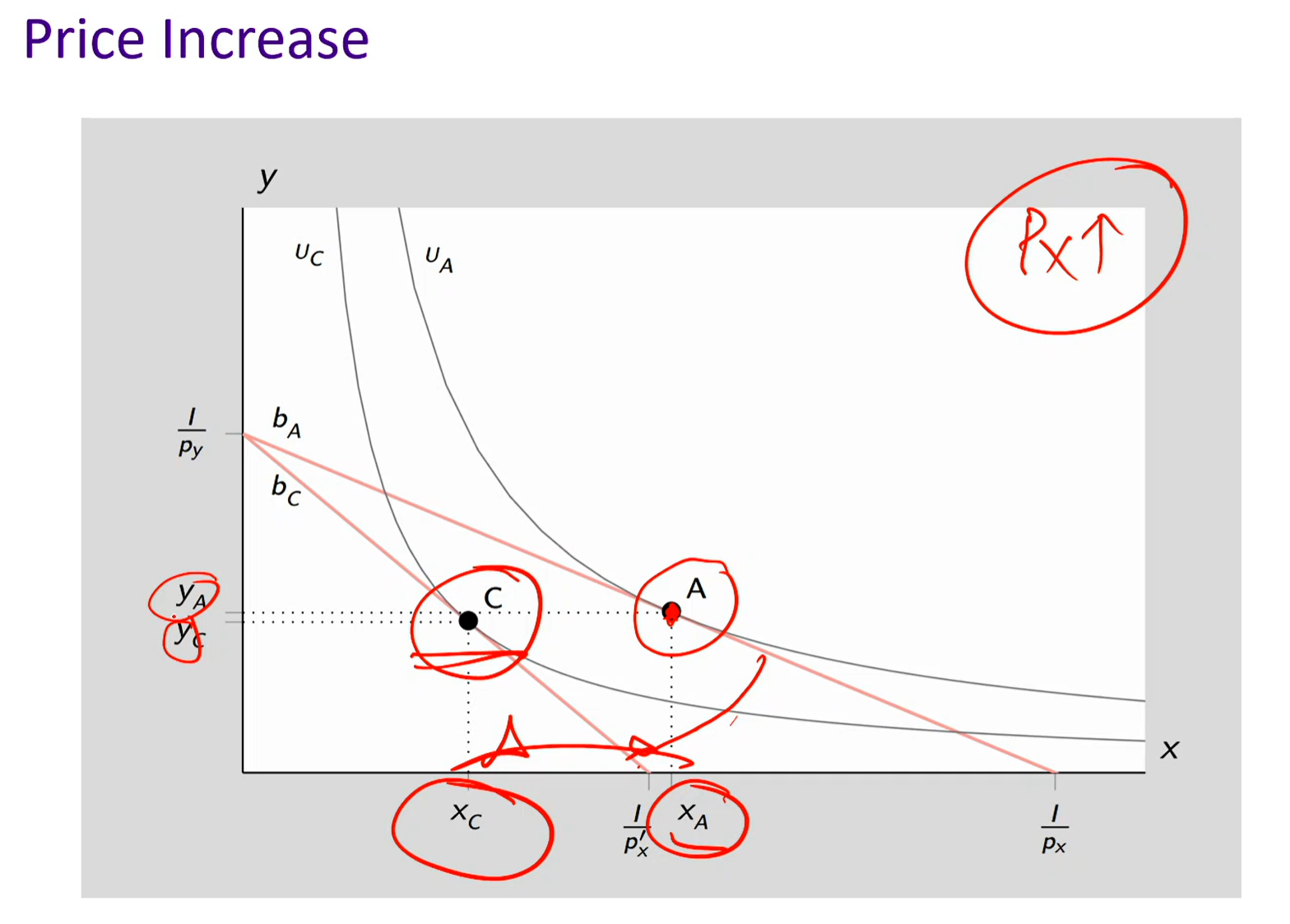

Price changes

Price increases

As price increases, the budget line rotates inward

Purchasing power decreases as price increases because you’re able to afford less good x now, thus, less satisfied and worse-off

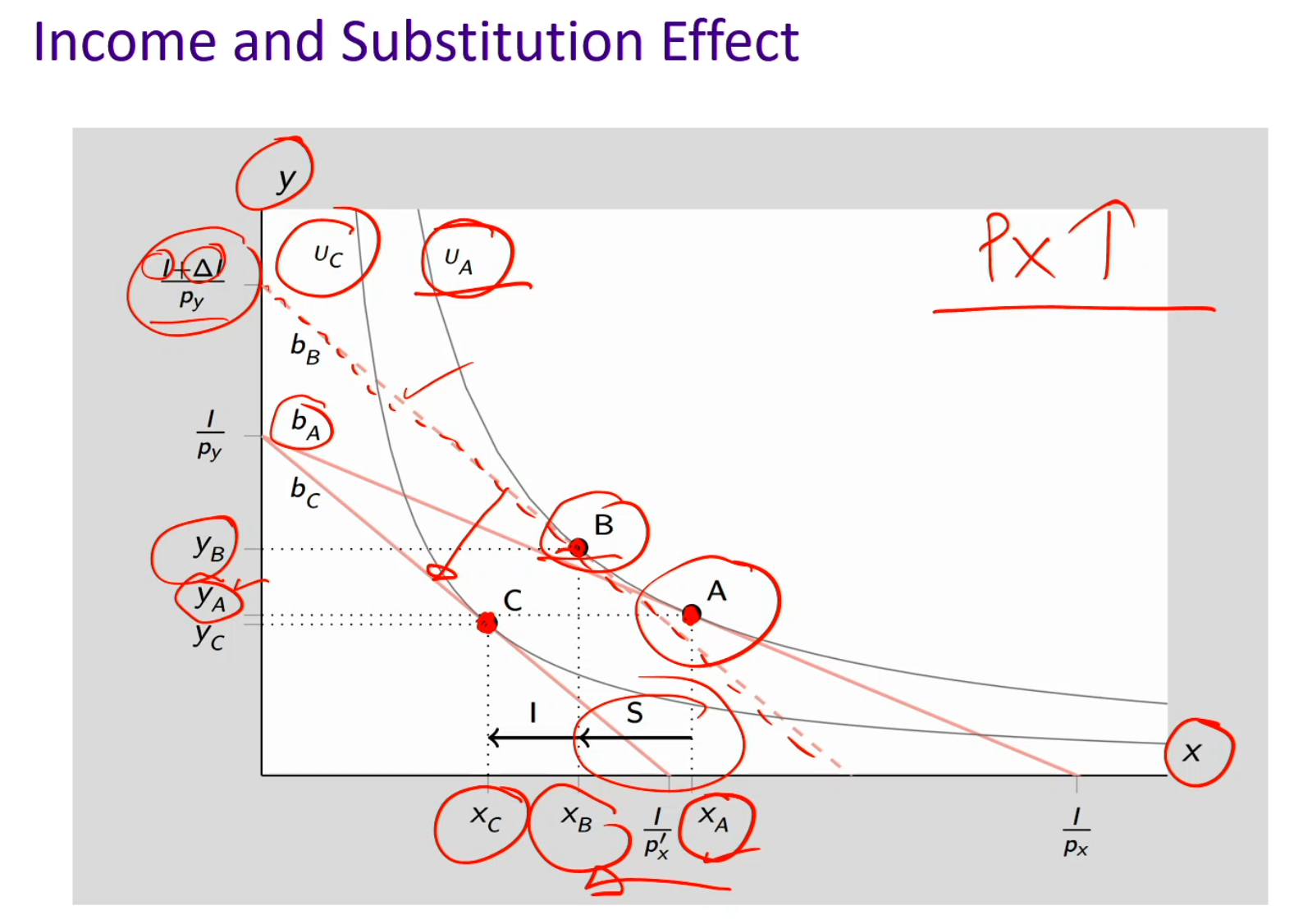

Substitution effect and income effect

We are given Px increasing:

The budget line rotates inward because you can now afford LESS of good x for the same income

Substitution effect:

Since price increased for good x, we must substitute away from x to the relatively cheaper good y

Hypothetically, someone gives you just enough extra money so you can stay just as happy as before so you’re stuck on the same indifference curve (same happiness/utility level)

Always on the same indifference curve and your happiness/utility hasn’t changed

So bundle A shifts to bundle B

Income effect:

Purchasing power decreases

You were at bundle B (same happiness level as bundle A). Now take away the extra imaginary money. So bundle B shifts down to a lower indifference curve at bundle C (less happiness)

Consumption decreases, b/c of the decrease in purchasing power, your real income decreases. Thus, this is a normal good b/c you consume less as your income decreases

Moves you to a different indifference curve because of the change in your real income

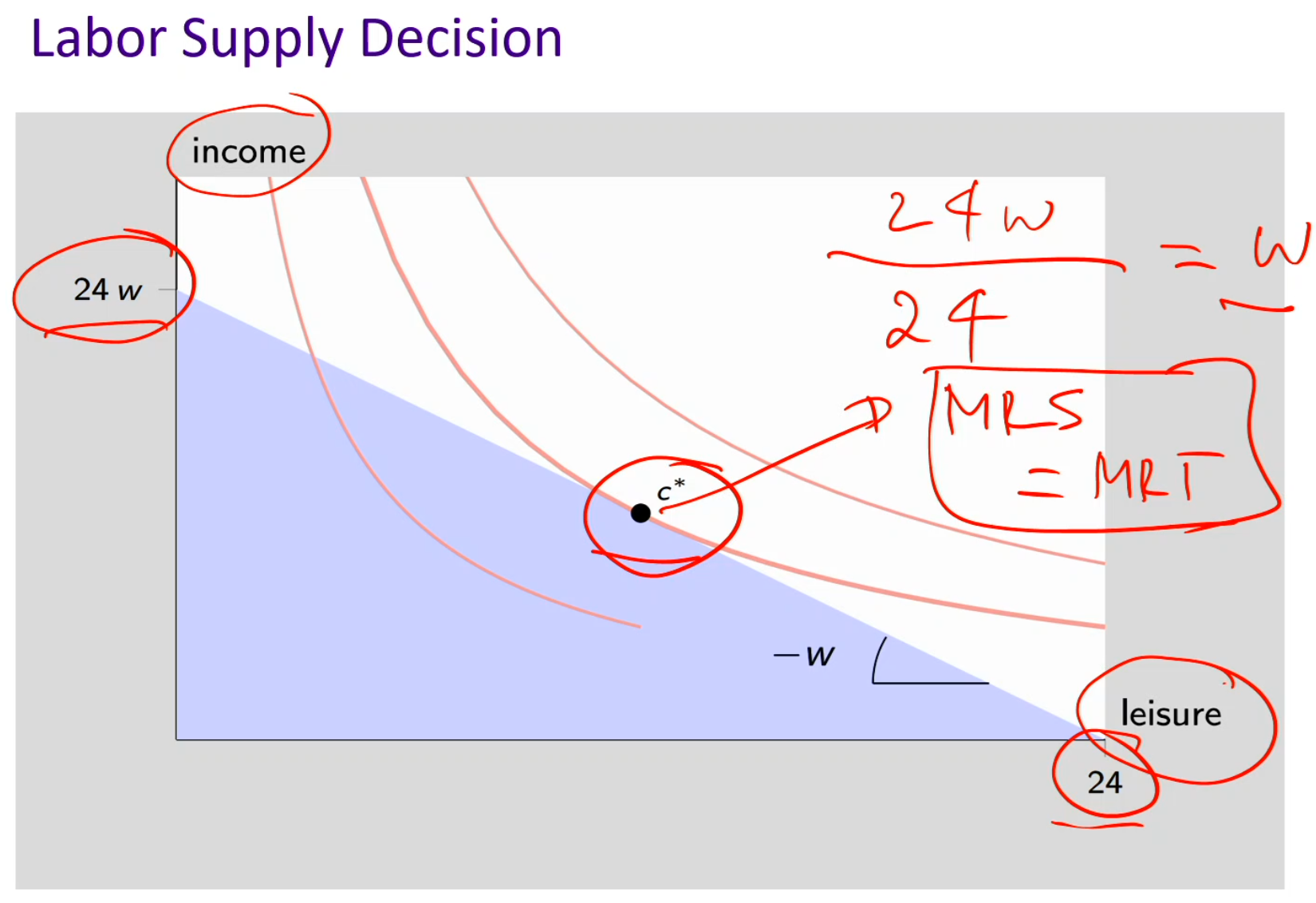

Labor supply

Ana must decide how to balance two goods

Income (which she can spend on stuff)

Leisure time (when she cab enjoy stuff)

Will make assumption Ana can work any # hours she wants and earn w per hour

In some jobs, you have some flexibility regarding hours of work (Uber driver, etc)

In many jobs, # hours is fixed (law firm, government office, etc) but if have different job offers with different hours, choosing a job offer amounts to choosing # hours

At C*, MRT (slope of the budget line) = MRS (slope of the indifference curve)

General rule MRT = MRS becomes MRS = w

There’s an optimal bundle

Absolute value of the slope = 24w/24 = w

Price of income: = 1, it costs her $1 to gain an additional $1

Income (y-axis) is already measured in dollars, so its “price” is just $1 per $1

There’s no hidden opportunity cost attached to income itself — it’s just money

Price of leisure: = w, the opportunity cost (doesn’t have an explicit price but an implicit cost)

If she sat on her couch all day, she’s giving up wages

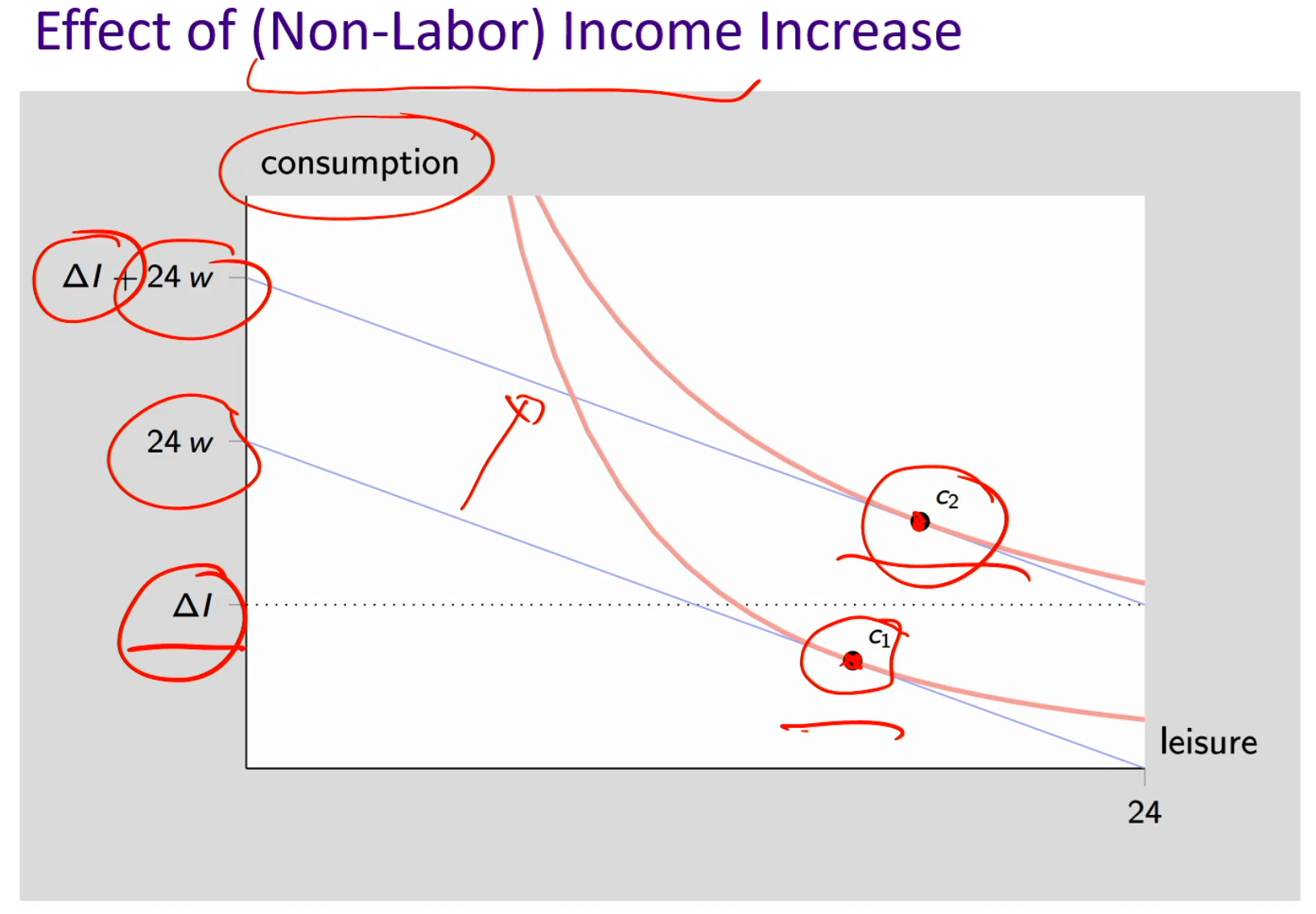

Effect of (non-labor) income increase

Non-labor income: It’s money you get without working

Ex: inheritance, trust fund, social security, etc

it does not depend on how many hours you work

At C1, non-labor income increases. The budget line shifts outward (from ΔI to ΔI + 24 w).

C1 jumps to C2 (a higher indifference curve with a different bundle, better-off)

Since you’re getting free money, you now have more leisure (richer people would prefer to work less and have more leisure). Therefore, leisure is a normal good here as income increases, you consume more.

Δ represents non-labor income

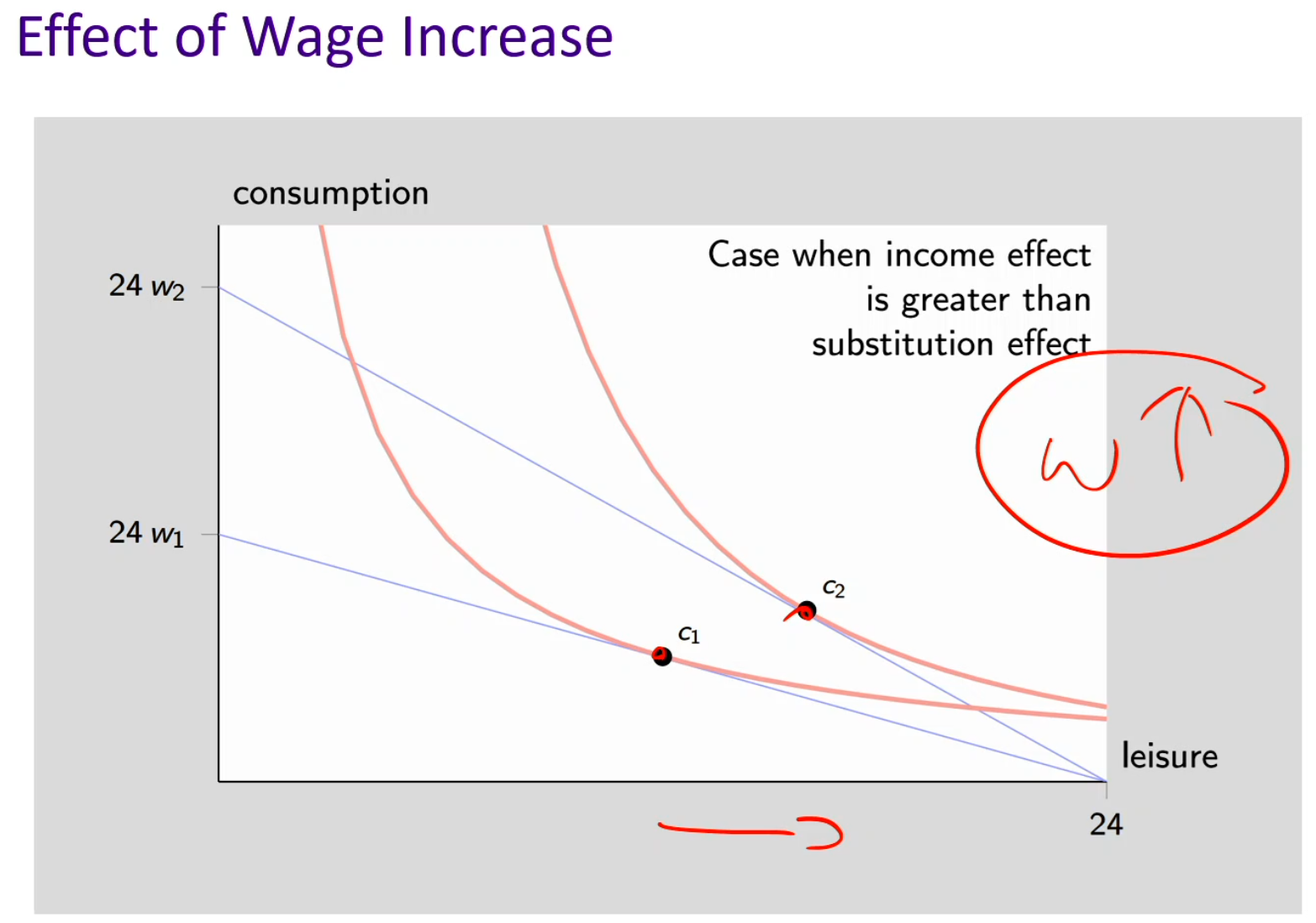

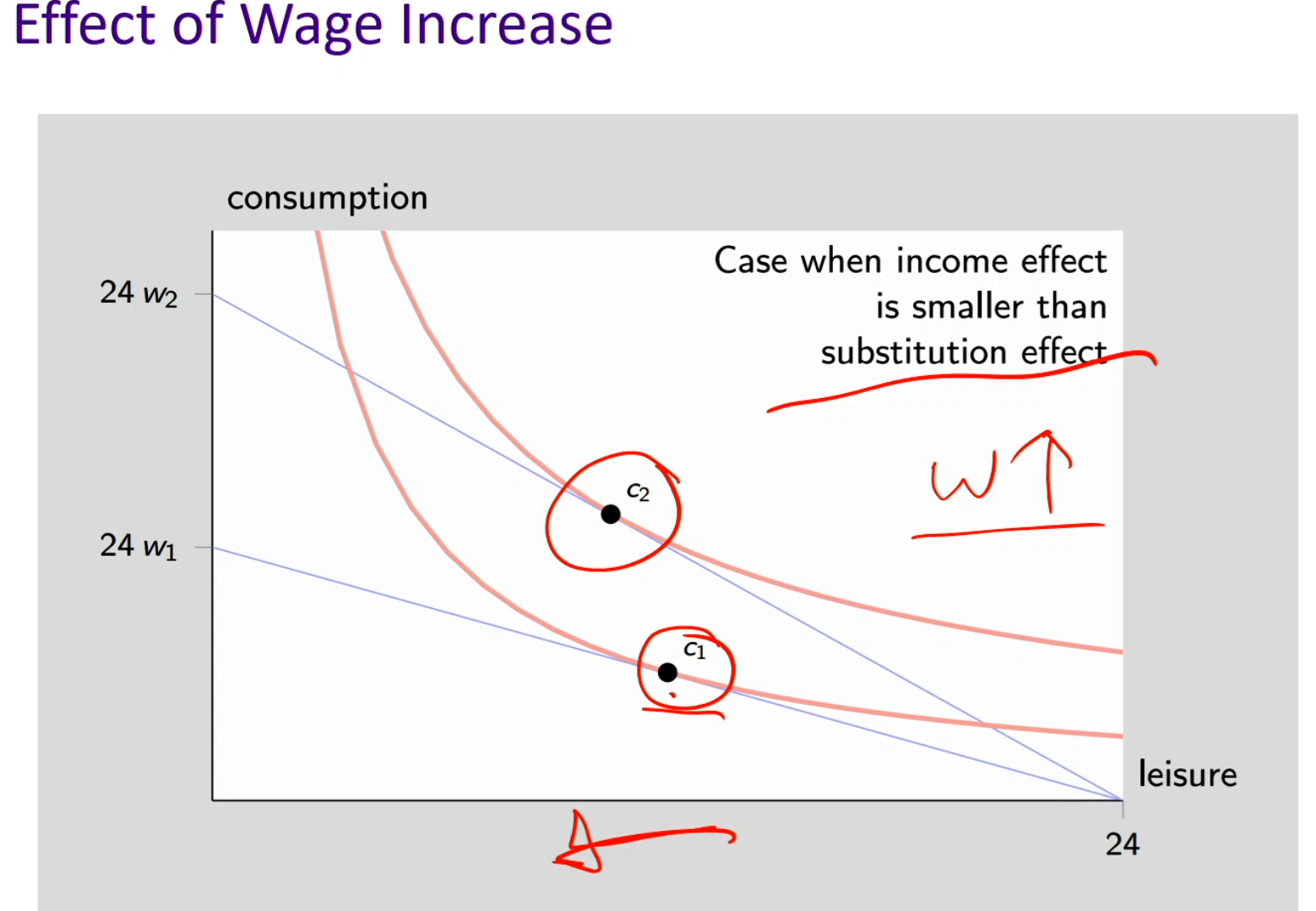

Effect of wage increase (substitution effect > income effect)

Always start with the prompt: (substitution effect > income effect)

Since substitution effect overpowers, we have to look at the problem in that perspective first. We would think leisure has gotten more expensive so we swap out leisure for labor supply, thus leisure would to the left, decreasing.

Substitution effect:

When the price of good x increased, we substitute that good x for good y that’s relatively cheaper. Therefore, for a price increase, the substitution effect always makes you consume less of the now more expensive good x. This makes the substitution effect always negative.

Only goes in one direction (if price increases, you consume less so you shift to the left. But if the price decreases, you consume more of good x so you shift to the right)

When wages increase, you would have less leisure because you work more (opportunity cost of leisure goes up). So you substitute leisure into labor.

Income effect:

Depends on normal good or inferior good, goes in either directions

As wages increases, you can afford more of everything, including leisure. So you supply less labor. Therefore, this becomes a normal good.

At C1, when wages increases, we shift to the upward budget line to C2. Since wages increases, our leisure hours decreased while our labor supply increased.

Substitution effect: Since we’re now working more, our leisure (good x) has decreased. Thus, leisure is now more valuable, more expensive. So, we substitute leisure time for the relatively cheaper good, work hours.

Income effect: This is a normal good because real income increased, so purchasing power increased. Therefore, we can afford more of leisure.

Total effect: substitution effect is greater than the income effect because as wages increased, we’re supplying more labor, decreasing leisure.

Effect of wage increase (income effect > substitution effect)

Always start with the prompt: (income effect > substitution effect)

Since income effect overpowers, we have to look at the problem in that perspective first. We would think leisure has gotten more attainable because our purchasing power (real income) increased. So we leisure would shift to the right, increasing.