Fiscal policy

1/21

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

Fiscal policy

Fiscal policy involves the use of government spending and taxation to fulfil macroeconomic objectives by influencing AD

What can Fiscal policy do and its 3 tools

Fiscal policy can be used to promote long-term economic growth and reduce unemployment

Government spending on physical capital goods

Government spending on human capital formation

Provision of incentives for firms to invest.

Fiscal policy 6 Objectives

Low unemployment

Promoting a stable economic environment for long-term growth

Low and stable inflation

Reducing business cycle fluctuations

Achieving an equitable distribution of income

Trade balance.

Direct & Indirect taxes

Direct taxes are imposed on income (rent, wages, interest, profit)

Indirect taxes are imposed on expenditure

Government revenue streams

Taxes

Operation and sale of public sector businesses. (selling a state owned business is called privatization)

Transfer payments

Transfer payments are payments made by the government without goods or services being received in return, such as welfare payments and donations.

2 types of government expenditure

Current expenditures (short-term) : stuff like wages and supplies for public sector businesses

Capital expenditures (long-term) : Stuff like infra

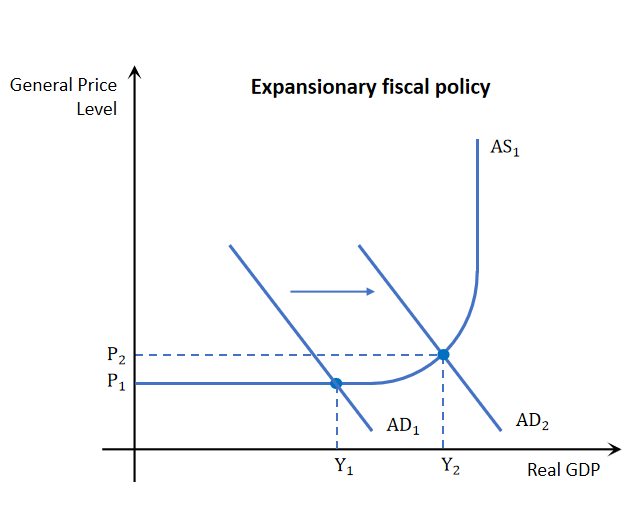

Expansionary fiscal policy affect on AD

Expansionary fiscal policy increases AD. Done using 2 ways

Increase government expenditure increasing G component in GDP

Decrease tax increasing C & I and thus GDP

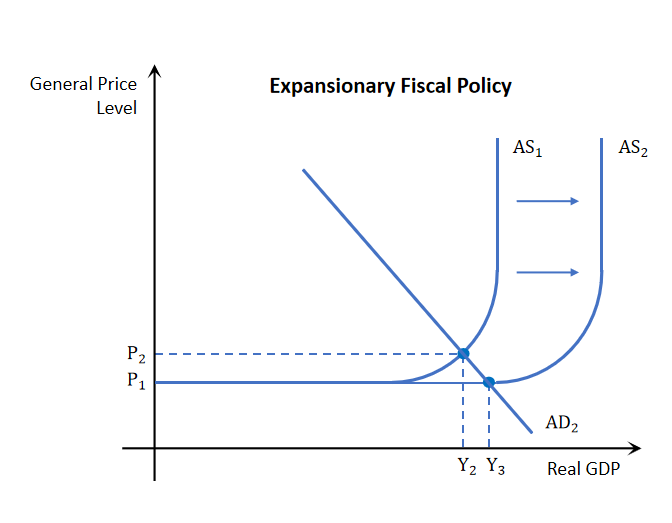

Expansionary fiscal policy affect on AS

AS is only affected on by expansionary fiscal policy, Any government spending which improves the quantity or quality of resources will improve AD and AS. So along with the shift in AD there will also be a shift in AS

this shift allows it so that in the long run national output does increase as usual but price levels will actually go down preventing inflation

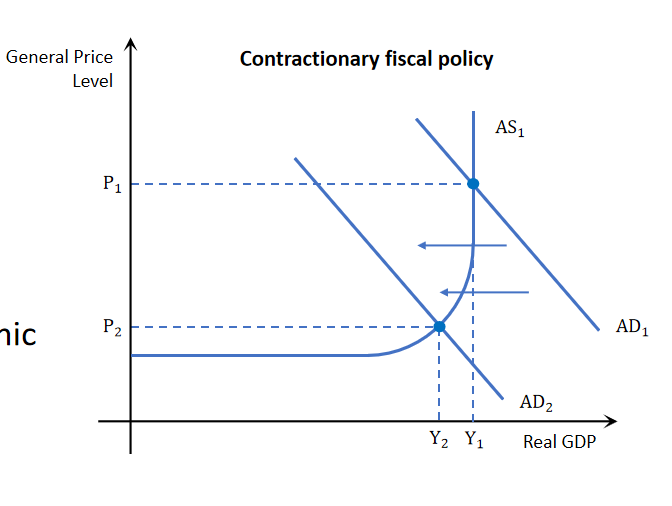

Contractionary fiscal policy

it aims to reduce AD by :

Decreasing government expenditure (↓G)

Increasing direct and indirect taxation (↓C, I)

Issues with high levels of growth

High levels of economic growth can cause:

Undesirably high levels of inflation

Shortages in the labor market.

Keynesian multiplier all Marginal factors

MPT : marginal propensity to tax

MPS : marginal propensity to save

MPC : marginal propensity to consume

MPM : marginal propensity to import

MPM + MPT + MPS + MPC = 1

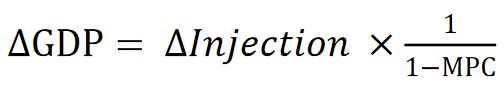

Keynesian Multiplier

This refers to the idea that the spending of one party becomes the income of another party, which then becomes further spending, with the cycle repeating infinitely.

Injection to the circular flow produces a chain reaction of further expenditures, with the effect of increasing AD and real GDP to a value greater than the initial expenditure.

Keynesian multiplier formula

Note as MPM + MPT + MPS + MPC = 1

you can replace the 1/1-MPC with 1/MPM + MPT + MPS

The idea is essentially when government invests money into the economy people spend it, so then that causes more chain reactions that increase GDP and this allows us to quantify that increase

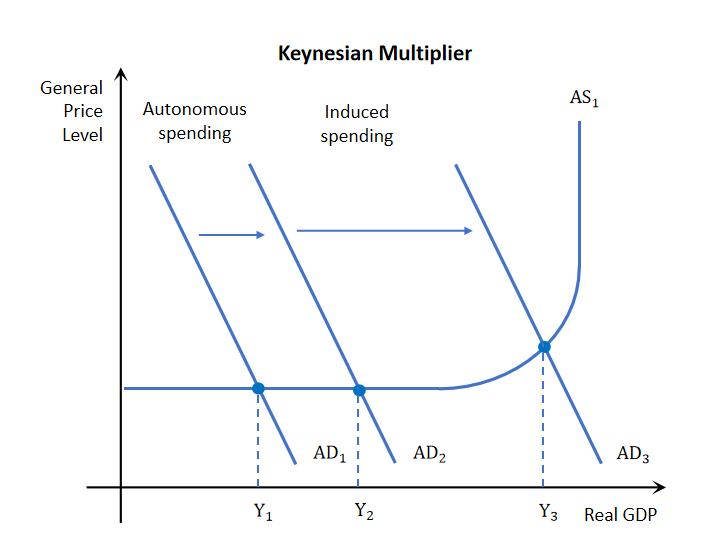

Autonomous spending and Induced spending

Initial injection to the economy is called autonomous spending. the subsequent spending is called induced spending which stimulates AD further

Pros of fiscal policy (2)

Target specific sectors : can be used to correct regional disparities in income and spending habits. like you can cut tax for low income people but increase it for the rich. government spending can be targeted to the sick or unemployed

Stimulates recovery from a deep recession : direct injection of money thanks to multiplier increases AD more then cost of injection. increases confidence which increases GDP which prevents mass unemployment

Cons of Fiscal policy

Political pressure : constraints are there so sometimes contractionary policy isn’t applied when necessary

Time lag

Sustainable Debt : can the government afford to have a budget deficit in both short and long run

3 types of time lag

Recognition lag : takes time to tell whether an economy is in need for government intervention. Sudden shocks cant be immediately dealt with

Administrative lag : Takes time for approval

Effectiveness lag : time lag between the implementation of fiscal policies to seeing the actual effects take place in the economy.

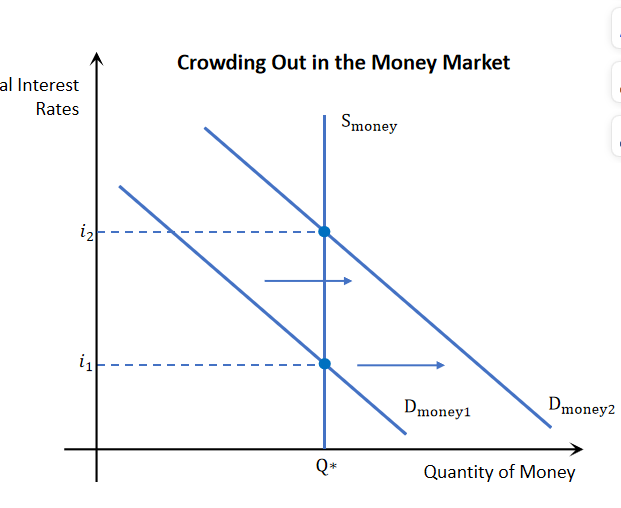

Crowding out

When a government runs a budget deficit, it needs to borrow funds. causes an increase in the demand of money → causes interest rates to increase → makes it harder for private firms to invest → as borrowing funds are more expensive → reduced investment → reduced AD

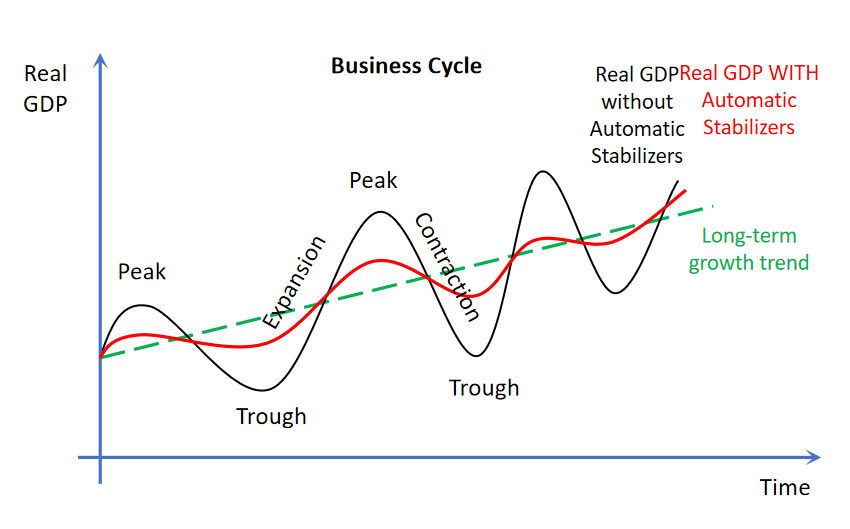

What is an automatic stabilizer

Automatic stabilizers aim to reduce the short-term fluctuations of the business cycle with lower peaks and higher troughs closer towards the long term growth trend.

Progressive tax as a Stabalizer

During expansion

Incomes rise as national output increases (GDP rise) → As incomes rise, households will be taxed a higher proportion of their income. → This prevents the economy from overheating.

During Recession

Incomes fall with national output (GDP) → As incomes fall, households will be taxed a lesser proportion of their income. → This reduces pressure on falling AD and counteracts the economic contraction.

Unemployment benefits as a Stabalizer

During expansion

Some workers may be inclined to stay unemployed to claim unemployment benefits → As a result, national output does not rise too quickly.

During Recession

The distribution of unemployment benefits rise as they are offered to more unemployed workers. → Household consumption will be somewhat maintained, lessening the downward pressure on AD.