deez nuts

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

70 Terms

Strategy

The set of goal-directed and integrated acitons a firm takes to gain and sustain competitive advantage

Strategic Management

Combines analysis, strategy formulation, and implementation in the quest for competitive advantage

Mastery of strategic management enables you to:

View a firm in its entirety (i.e., at the “30,000-foot level”)

Think like a general manager (i.e., see the “Big Picture”)

Position your organization for superior performance

A good strategy is based on three elements

An accurate diagnosis of the competitive challenge

Analysis of the firm’s external and internal environments

A guiding policy to address the competitive challenge

Formulation of corporate, business, and functional strategies

A set of coherent actions that reflect the firm’s guiding policy

Implementation of the strategy

Competitive Advantage

Superior performance compared to other competitors in the same industry or the industry average

Sustainable competitive advantage

Achieved by firms that outperform their competitiors or the industry average over a prolonged period

“Holy Grail” of successful strategy

Competitive Disadvantage

When a firm underperforms its rivals or the industry average

As with competitive advantage, it is relative

Competitive Parity

Two or more firms that performa at the same level

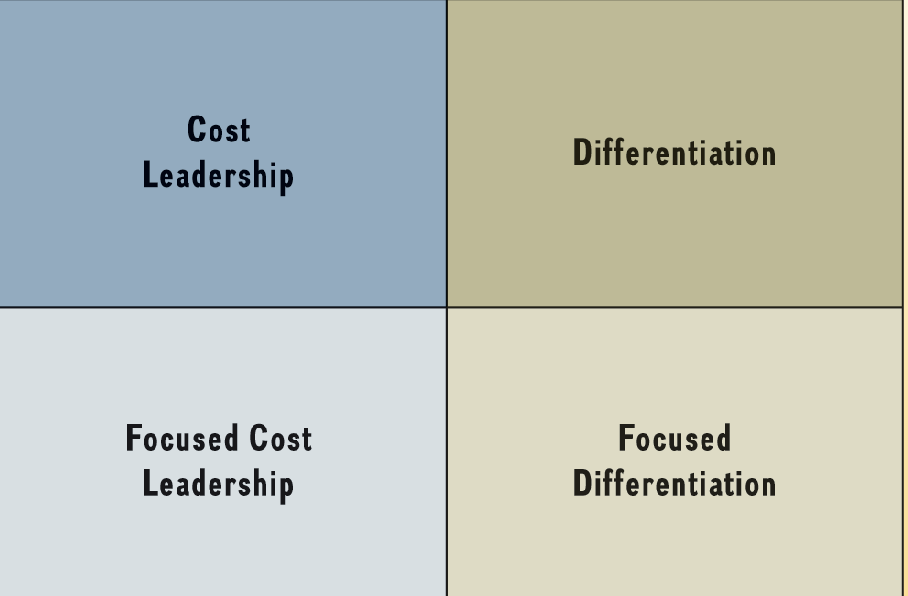

Generic business strategies

Differentation Strategy: Provide goods or services that consumers value more higly than those of its competitors (Nordstrom)

Cost Leadership Strategy: Provide goods or services that are similar to those of competitors, but at the lower prices (Walmart)

Blue Ocean: A strategy that combines both differentiation and cost-leadership activities (Trader Joe’s)

A firm offers a differentiated product/service at low cost

Uses value innovation to reconcile trade-offs

Blue Oceans represent:

• Untapped market space

• Creation of additional demand

• Opportunities for highly profitable growth

Strategic Positioning

A unique position within an industry that allows the firm to provide value to customers while controlling costs

Stakeholder

Organizations, groups, and individuals that:

Can affect or be affected by a firm’s actions

ahve a vested claim or interest in the performance or survival of the firm

Internal Stakeholders

Stockholders, employees (including executives, managers, and workers), and board members

External Stakeholder

Customer, supplier, alliance partners, creditors, unions, communities, media, and governments

Shareholders v. stakeholders

Stakeholder strategy

Integrative approach to managing a diverse set of stakeholders

goal is to gain and sustain competitive advantage

Stakeholder strategy

Gain and sustain competitive advantage

Benefits performance

Reveal important

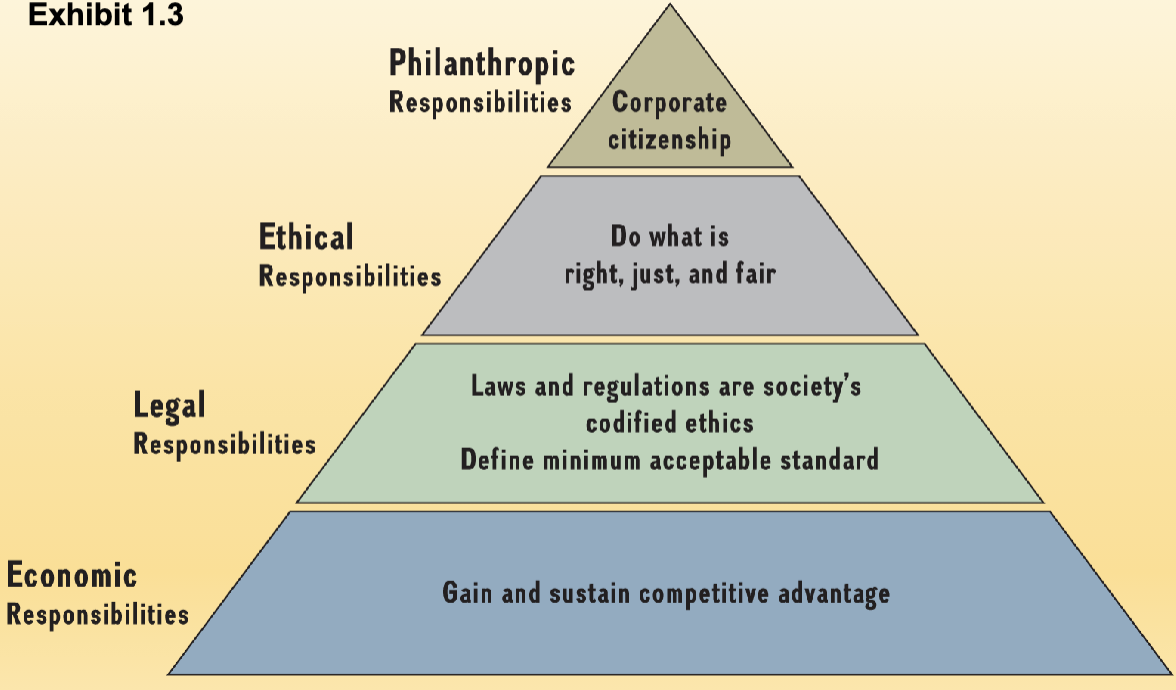

Pyramid of Corporate Social responsibility

AFI Stands for…

Analysis, Formulation, Implementation

Strategic leadership

Use power and influence to implement strategy and reach goals

Formal authority

ceo (position)

Informal authority

Get people to do things (persuasion)

Function of innate abilities and learning

Strategic leaders Mainly do

Face-to-face meetings

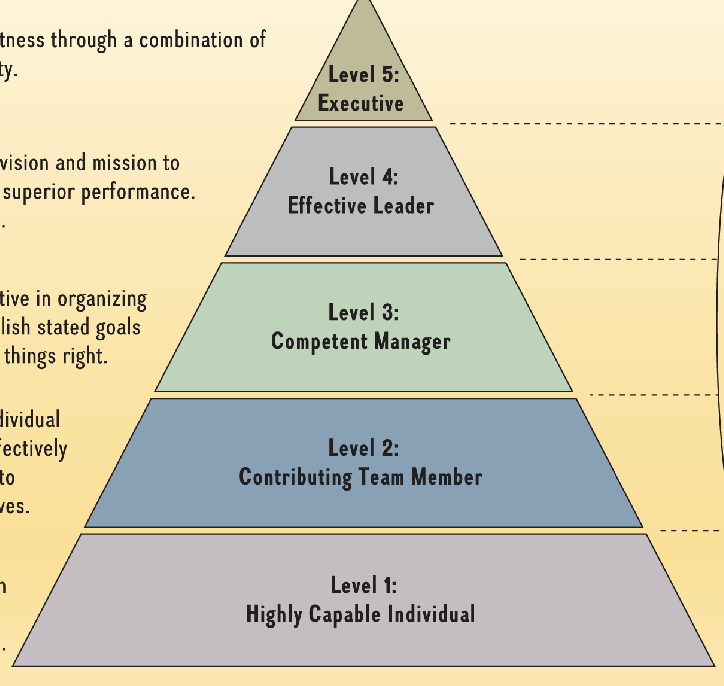

Level-5 Leadership pyramid

Strategy Process

Where and how to compete

1. Corporate (where)

industry, markets, and geography

2. Business (how)

cost leadership, differentiation, or value innovation

3. Functional (how to implement)

different strategies require different activities

Vision, mission, values

Vision: What do we want to accomplish

Expressed as a statement

uses the infinitive form of a verb (to be, to create)

forward thinking and inspiring

Mission: How do we accomplish our goal

how the vision is accomplished

Values: What commitments do we make?

What safeguards do we put in place?

how do we act both legally and ethically as we pursue our vision and mission?

Vision and competitive advantage

strongest when customer oriented

internal stakeholders help define

org. structure align

Product oriented vision statements

Define a business in terms of a good or service provided

Focus on improving exisitng products and services

Force managers to take a more myopic view

Customer oriented vision statements

solutions to customer needs

allow companies to adapt to changing enviroments

Problem solving for the customer

Mission: Strategic commitments

Credible actions that back up the vision and mission statements

costly

long term

difficult to reverse

Three approaches to strategic management

Top down

formal, data, top down, military

Scenario planning

Formal top down, probability of things happening, develop strategic responses

asks what if questions

Planned emergence

Beings with strategic plan, but less formal

Black Swan event

High impact and highly improbable

Strategic initiatives

Activity that firm pursues

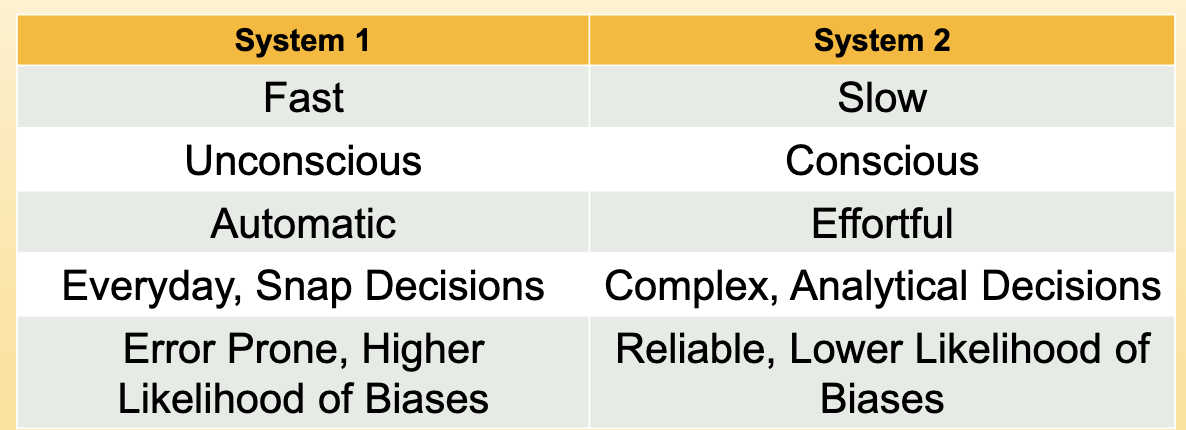

Two decision making modes

Cognitive biases

Group think

Confirmation bais

Illusion of control

Devil’s Advocacy

Challenge with alternative viewpoints

General Enviroment

Hard to predict and difficult to control

Industry enviroment

Strategic leaders have some control over

Scanning and Monitoring

Scanning:

predicts environmental changes to come

detects changes already under way

Monitoring:

tracks evolution of environmental trends

Competitive Intelligence

Identifies rivals’ strengths and weaknesses

PESTLE Framework

Political

Government bodies, social movements can exert to influence firm

Economic

money, exchange rates, interest rates, relatively stabel economies with strong growth potential

Sociocultural

Society cultures, norms, and values

Technological

new knowledge

Legal

Laws enacted

Environmental

Industry and Industry analysis

Industry:

Group of incumbents

same set of suppliers and buyers

Analysis:

Identify and industry’s profit potential

Derive implications

5 Forces model

Strengths and weaknesses

Competitive advantage

Threat of new entrants:

Entry barriers

bargaining power of suppliers:

powerful if only a few firms dominate the industry

suppliers sell to several industries

bargain power of buyers

force price down

bargain for higher quality

play competitors against each other

threat of substitute

same needs in different way

competition

balanced competitors

slow growth

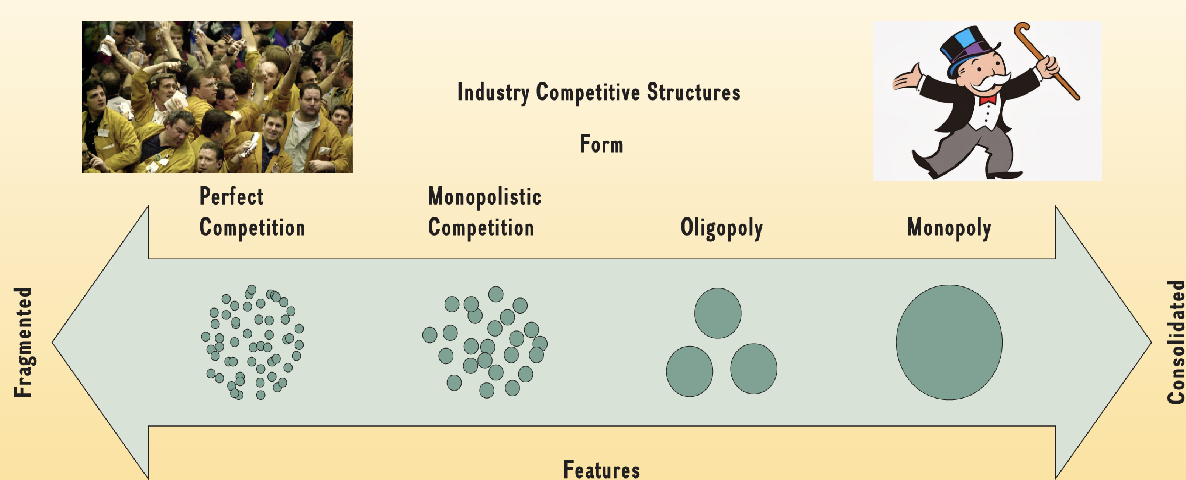

Competitive industry structrue

Number and size of competitors

Core competencies

Unique strengths embedded deep within a firm

allow the firm to differentiate from rivals

expressed through structures, processes, and routines

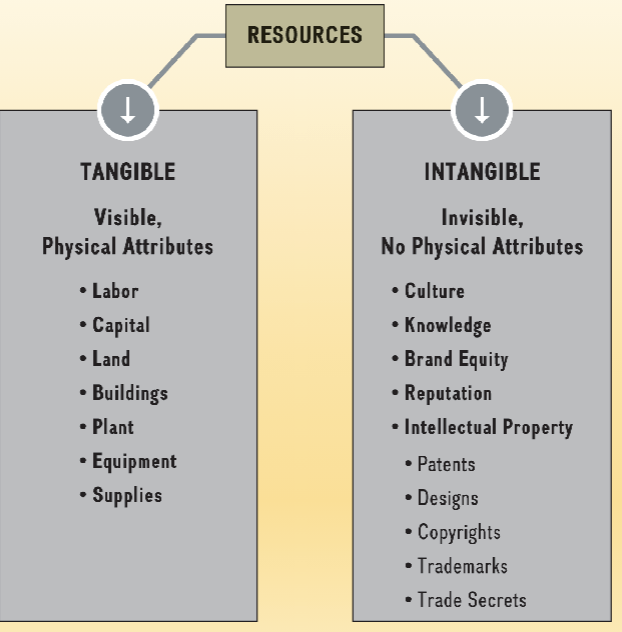

Resources: Tangible and Intangible

bundled to create organizational capabilities

Capabilities are the source of a firm’s core competencies

Resource-based view of the firm

An internal analysis of a company

an external analysis of the industry and its competitive environment

Can leave to competitive advantage if they are valuable, rare, and hard to duplicate

Critical assumptions of the RBV

Resource Heterogeneity

Resource Immobility

VRIO

Valuable - in formulating and implementing strategies

Rare - or uncommon; difficult to exploit

Inimitable - or diffiuclt/expensive to copy

Organized - to capture the value of the resource

Preventing Imitation

Physical uniqueness: impossible to duplicate

Path dependency: hard to duplicate bc of all that has happened along the path

Causal ambiguity: impossible to explain

Social complexity: result from social engineering

Core Rigidity

former core competency that has turned into a liability

turns a resource from an asset to a liability

Value Chain

Transforming inputs into outputs

Through primary and support activities

each activity adds incremental value

each activity also adds incremental costs

Value-chain analysis

looks at the sequential process of value-creating activities within a firm

Value is the amount buyers are willing to pay

The value received (by the firm) must exceed the costs of production

Primary activities

Firm activities add value directly

inbound logistics: receiving, storing and distributing inputs

Operations: transforming inputs

Outbound logistics: collecting storing and distribuing product to the buyer

Marketing and sales: purchases of products adn services by buyers and how to get buyers to make those purchases

Service: to enchance or maintain the value

support activities

add value indirectly

Procurement: purchase inputs

Tech devlopemtn

HR

General Adminsitraiton

Outsourcing

cannot create value in either a value chain activitiy or a support function

fe organizations possess the resources and capablitites required to achieve competitive superiority

Accounting Profitability

Assesses firm performance

compares and benchmarks firm performace to competitors and industry average

Limitations of accounting data

backward-looking

focuses mainly on tangible assets

Shareholder value creation: definitions

shareholders

own shares of stock, are legal owners of public companies

Risk capital

money provided for an equity share

cannot be recovered if firm goes bankrupt

Total return to shareholders

Stock price appreciation + dividends

Market Capitalization:

Dollar value of total shares outstanding

number of outstanding shares x share price

Limitations of shareholder value creation

Volatile stock prices

Macroeconomic factors affect stock prices

Stock prices can reflect the mood of investors

Economic value creation

What we pay and what customers will pay for

Opportunity costs

Best forgone alternative

Balanced Scorecard

helps managers achieve strategic objectives

uses internal and external performance metrics

Balances both financial and strategic goals

Pros and cons

Triple Bottom Line

Profits: economic dimension

People: social Dimension

Planet: Ecological Dimension

Business-level Strategy

Goal directed actions to achieve competitive advantage in a single product market

How should we compete?

Who: which customer segments?

What: custoemrs needs will we satisfy

Why: do we want to satisfy them?

How: will we satisfy our customers’ needs?

Strategic position

Strategic profile based on value creationa nd cost in a specific product market

Valuable and unique position, which:

meets customer needs

maximizes product value

lowest possible product cost

Focused business strategies

narrower competitive scope

Focused differentiation: mont blanc pens

Focused cost leadership: BIC pens

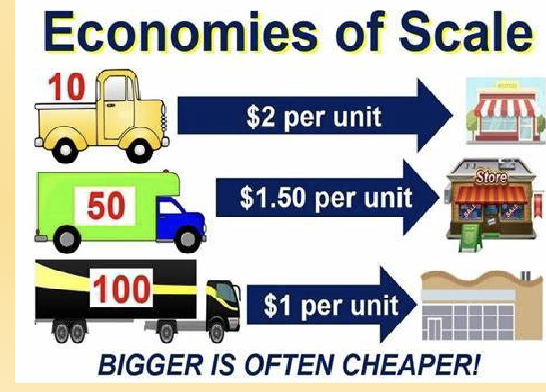

Economies of Scale (size)

Decreases in cost per unit

Achieved as output increases

spreads fixed costs over a larger output

Economies of Scope (range)

savings that come form producitng two or more outputs at less cost

Shares the same resources or technology

Perceived value

three drivers

Product Features

Customer Service

Complements

Drivers that keep costs low

Cost of input factors

raw materials, capital, labor, and it services

Economies of scale:

decreases in cost per unti as output increases

learning-curve effects

less time ot product output with experience

Diseconomies of scale

firm is too big

complexitites of too much coordination

Learning curve

Less time to produce output with experience