ACYFARP11: Current Liabilities, Provisions & Contingencies

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

Which of the following is not considered a characteristic of a liability?

a. Present obligation

b. Arises from past event

c. Results in an outflow of resources

d. Liquidating is reasonably expected to require use of existing resources classified as current assets

D

Which of the following should be included as current liabilities?

a. Trade notes payable

b. Short-term zero-interest bearing note payable

c. Unearned revenue

d. All of these are included in current liabilities

D

Which of the following is a noncurrent liability?

a. Income tax payable

b. One-year magazine subscription received in advance

c. Unearned interest income related to noninterest bearing long-term note receivable

d. Estimated warranty liability

C

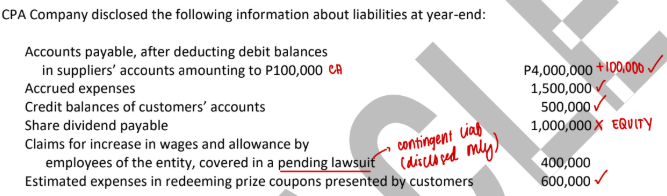

What total amount should be presented as current liabilities at year-end?

a. P6,700,000

b. P6,600,000

c. P7,100,000

d. P7,700,000

A

BSA Company disclosed the following liability account balances on December 31, 2025:

Accounts payable P1,900,000

Bonds payable 3,400,000

Premium on bonds payable 200,000

Deferred tax liability 400,000

Dividends payable 500,000

Income tax payable 900,000

Note payable, due January 31, 2026 600,000

On December 31, 2025, what total amount should be reported as current liabilities?

a. P7,100,000

b. P4,300,000

c. P3,900,000

d. P4,100,000

C

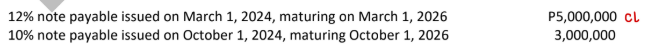

DEF Company reported the following liability balances on December 31, 2025:

The 2025 financial statements were issued on March 31, 2026.

On January 31, 2026, the entire P5,000,000 balance of the 12% note payable was refinanced through issuance of a long-term obligation payable lump sum. Under the loan agreement for the 10% note payable, the entity has the discretion to refinance the obligation for at least twelve months after December 31, 2025.

What amount of the notes payable should be classified as current on December 31, 2025?

a. P8,000,000

b. P5,000,000

c. P3,000,000

d. P0

B

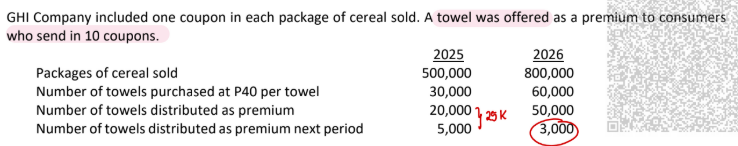

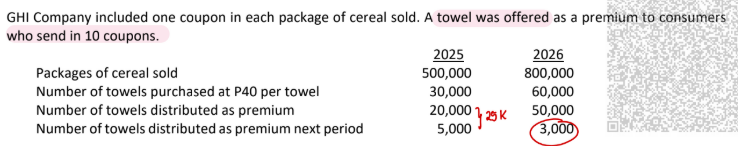

What is the premium expense for 2025?

a. P1,000,000

b. P1,200,000

c. P600,000

d. P500,000

A

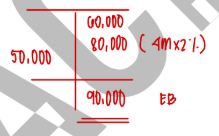

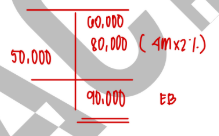

What is the premium liability on December 31, 2026?

a. P320,000

b. P400,000

c. P120,000

d. P520,000

C

XYZ Company estimated annual warranty expenses at 2% of annual net sales. The net sales for the current year amounted to P4,000,000. At the beginning of current year, the warranty liability was P60,000 and the warranty payments during the current year totaled P50,000.

What is the warranty expense for the current year?

a. P70,000

b. P50,000

c. P80,000

d. P60,000

C

XYZ Company estimated annual warranty expenses at 2% of annual net sales. The net sales for the current year amounted to P4,000,000. At the beginning of current year, the warranty liability was P60,000 and the warranty payments during the current year totaled P50,000.

What is the warranty liability at year-end?

a. P10,000

b. P70,000

c. P80,000

d. P90,000

D

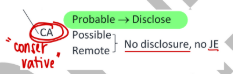

A provision is

a. An event which is not recognized because it is not probable or cannot be measured reliably

b. An event which is probable and measurable

c. An event which is probable, possible or remote and measurable

d. An event which is probable but not measurable

B

Which of the following statements is incorrect concerning a contingent liability?

a. A contingent liability is not recognized in the financial statements

b. A contingent liability is disclosed only

c. If the contingent liability is remote, no disclosure is required

d. A contingent liability is both probable and measurable

D

Which of the following statements is incorrect concerning a contingent asset?

a. A contingent asset is not recognized in the financial statements because this may result to recognition of income that may never be realized

b. When the realization of income is virtually certain, the related asset is no longer contingent asset and its recognition is appropriate

c. A contingent asset is only disclosed when the occurrence of the future event is possible or remote

d. The related gain arising from the contingent asset is recognized usually when it is realized

C

December 31, 2025, ABC Company was a defendant in a pending lawsuit. In the opinion of the entity’s attorney, it is probable that ABC will have to pay P500,000 and it is reasonably possible that ABC will have to pay P600,000 as a result of this lawsuit.

What amount should be reported in the 2025 financial statements?

a. An accrued liability of P500,000 only

b. An accrued liability of P500,000 and disclosure of a contingent liability of P100,000

c. An accrued liability of P600,000 only

d. No information about this liability

B

On November 5, 2025, AB Company was in an accident with an auto-driven by XY Company . The entity received notice on January 12, 2026 of a lawsuit for P700,000 damages for personal injuries suffered by Company Y.

The entity’s counsel believed it is probable that XY will be awarded an estimated lawsuit amount in the range between P200,000 and P500,000. The possible outcomes are equally likely. The accounting year ends on December 31 and the 2025 financial statements were issued on March 31, 2026.

What amount of provision should be accrued on December 31, 2025?

a. P0

b. P200,000

c. P500,000

d. P350,000

D

During 2025, Company X filed suit against Company Y seeking damages for patent infringement. On December 31, 2025, the legal counsel believed that it was probable that Company X would be successful against Company Y for an estimated amount of P1,500,000. On March 31, 2026, Company X was awarded P1,000,000 and received full payment thereof. The financial statements were issued March 1, 2026.

In Company X’s 2025 financial statements, how should this award be reported?

a. As a receivable and revenue of P1,000,000.

b. As a receivable and deferred revenue of P1,000,000.

c. As a disclosure of a contingent asset of P1,000,000.

d. As a disclosure of a contingent asset of P1,500,000.

D