Looks like no one added any tags here yet for you.

When does market failure occur?

when there is an inefficient allocation of resources

some potentially valuable resources are being wasted

resources are being allocated inefficiently and consumers are less well of than they could be

How can monopolies take advantage of market power?

when consumers have no alternatives to buying from a monopoly, the supplier can choose the price to charge an quantity to sell

the profit maximising monopolist will set sales where MR=MC → can involve abnormal profits

quantity sold will therefore be lower than in a competitive market to keep supply down and prices up

source of market failure as resources are not allocated efficiently

What effect does market power have on consumers?

if firms abuse market power, they are able to distort resource allocation whilst increasing their own profits at the expense of consumers → takes more of consumers real incomes→ reduces consumer spending power→ decreases standard of living

What does having market power involve?

the ability of a producer to exert some level of control over a market → may include:

setting prices

restricting output

influencing other producers

creating barriers to entry and influencing supplies

What is a cartel?

any agreement within a group of businesses to restrict competition by for example raising prices and agreeing to not compete with each other.

How might businesses go about the fact that cartels are illegal?

they may take place in secret (covert)

What issues may cartel members agree on?

prices

output levels

market sharing

discounts and credit terms

preferential supply

bid rigging

How might cartels agree on price to reduce competition?

prices may be fixed at a higher level than a competitive market would otherwise reach

How might cartels agree on output levels to reduce competition?

can restrict the level of supply→ upward pressure on prices

e.g. De Beers (monopoly for diamonds) withheld diamonds from the market to force prices up

How might cartels agree on market sharing to reduce competition?

could involve dividing up the market so each member of the cartel has their own share where others do not intrude or compete

How might cartels agree on discount or credit terms market sharing to reduce competition?

can be fixed to disadvantage customers or suppliers

How can cartel members use preferential supply to limit competition?

means restricting the number of customers and outlets they will supply to → makes the product more exclusive and forces up prices

How can cartel members use big rigging to limit competition?

Bid rigging is a form of collusion where competitors coordinate their bids to manipulate the outcome of a competitive bidding process. Instead of genuinely competing, they agree on who will win the contract, often leading to higher prices and less competition.

When do firms have a strong incentive to collude?

when competition is laready limited -. e.g. in an oligopoly

oil example of a cartel

A famous example of a cartel is OPEC, which fixed their output of oil. This was possible since they controlled over 70% of the supply of oil in the world. This reduces uncertainty for firms, which would otherwise exist without a cartel.

What is collusion?

agreement between two inidivudlas or busiesses however does not have to be a formal agreement

What is explicit collusion?

involves tow or more businesses discussing their plans and agreeing to follow a joint strategy

differs from a cartel since it does not have to entail a formal agreemnt

What is tacit agreement/collusion?

competing firms may not actually communicate in any way

they keep their prices at the same level

they avoid price cutting but without actually meeting

What are restrictive practices?

includes any action that a business may use to limit competition

examples of restrictive practices

tying together or bundling products → e.g. Microsoft including its browser with its operating system → made it difficult for rival browsers to compete

What is monopsony power?

exists where a major purchaser has market power over smaller suppliers which can be dominated by the buyer

this buying power means that a monopsony can exploit their bargaining power with a supplier to negotiate prices

reduced cost of purchasing inputs increases their profit margins → can translate into monopoly power if the buyers can translate this into competitive advantage

monospony power exists in both product and labour markets

opposite of monopoly power where the seller has power of the buyers

example of industries with monposony power

supermarkets have power of small farmers

large supermarkets will often buy the entire crop of a farm

farm then produces a single product to suit the buyer and after this the buyer has a powerful position on future contract negotiations

Amazon’s buying power in the retail book market

can get a better price that other smaller booksellers

What is a natural monopoly?

exists when it is considered to be the most efficient form of market structure

e.g. national grid and rail networm

because infrastructure and capital costs are so high → dominated by fixed costs

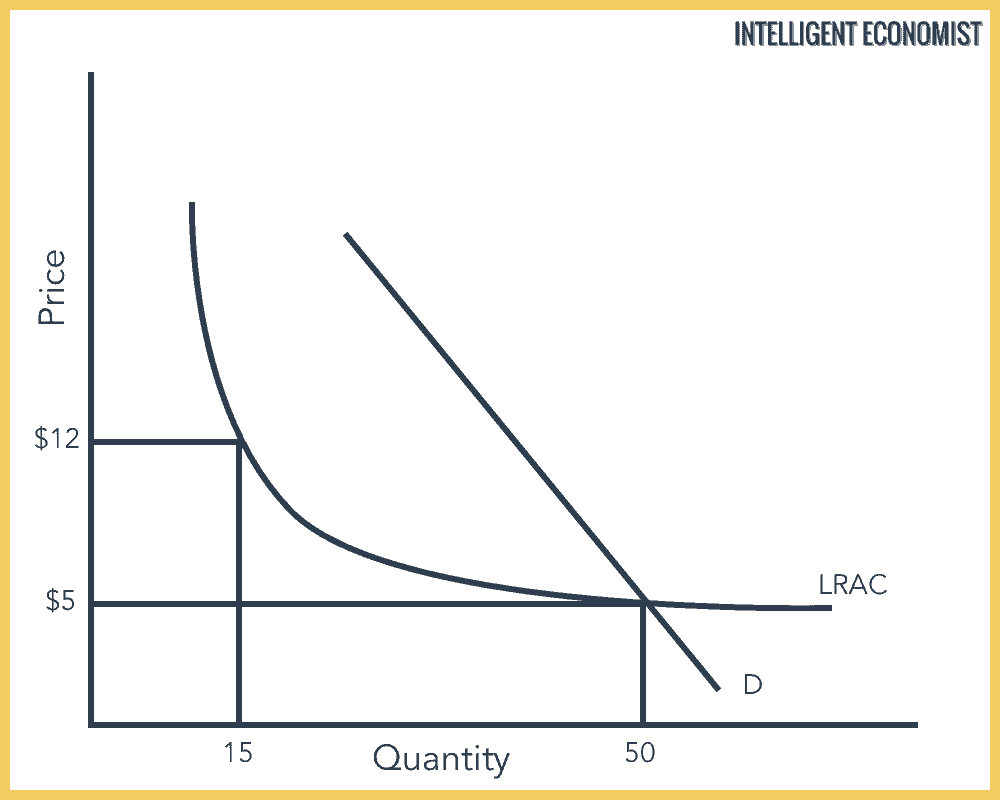

draw a graph of a natural monopoly

evaluation of natural monopolies (prospect of increased prices for consumers)

could mean that high prices are passed onto consumers:

there is a low level competition → no pressure to be efficient → danger of high prices being passed onto consumers

lack of innovation and investment for improvements

natural monopolists may also wish to put prices up if they are driven by profit maximisation

this is because natural monopolies are usually PED inelastic as they are necessities → TR will increase

How can there be monopsony power in the labour market?

monopsony employers can pay below the free market wages because workers have nowhere else to find employment

How can there be monopoly power in the labour market?

a trade union or professional body can restrict the supply of labour to a particular industry / profession

e.g. using qualifications

they can negotiate working conditions or force pay above the free market wage levels, resulting in higher wages → passed onto consumers

Implications of market failure for consumers

anti-competitive and restrictive practices will restrict copetition and raise prices

consumers disposable income is reduced → standard of living compromised

consumers dont receive the same range of choice due to lack of innovation that a competitive market would usually have

Implications of market failure for businesses

POSITIVE :

able to grow powerful and reap economies of scale to gain competitive advantage - however this depends on if they want to pass these lower prics onto consumers

NEGATIVE :

if businesses do not face strong domestic comp they lack efficiency

weakens their competitiveness in international markets

Implications of market failure for governments

government always has a responsibility to the public interest

govt will want to achieve economic growth throughout innovation and investment however this is not achievable with lots of market failure

governments may need to think about how to control or regulate market failure

How can competition be promoted? (3)

preventing anti-competitive practices

controlling mergers and takeovers

privatisation

How can competition be promoted through preventing anti-competitive practices?

the CMA is the main competition regulator in the UK

key aims is to promote competition and ensure markets are effecient as they can be

may restrictive practices can be prevented - e.g. market sharing, price fixing

Why can preventing restrictive practices be difficult?

illegal, covert cartel activity can be difficult to find evidence for

a whistle-blower in this situation is useful→ whistleblowers or the first firm to confess often escape punishment, which gives firms an incentive to cooperate with the authorities and can spark a race to confess

examples of sanctions of restrictive activity

European Commission fined Microsoft $497 for not giving users choice over which browser they use

the EC is also investigating google for abusing its dominant position in the internet search market

How can competition be promoted through controlling takeovers and mergers?

M&As can remove one competitor from the market which therefore creates monopoly power

the CMA investigates merges or takeovers which create a market share of 25% or more, or a business with a turnover of more than £70 million per year

examples of controls on M&As

In 2015, poundland launched a takeover of 99p stores

However the CMA expressed concerns that the deal could reduce competition in more than 90 places

However the takeover was accepted in the end because it was found that the takeover would not significantly reduce competition

In 2016, Hutchison agreed to buy the UK O2 phone operation from telefonica for £10.3 billion

CMA expressed concerns about this merger since they wanted ‘the mobile telecoms sector to be competitive so that consumers can enjoy innovative mobile services at fair prices and high network quality’

what is the EU Commissions advice on controlling M&As?

if a community wide impact was identified or when two firms together had a turnover of above 250 million Euros

history + reasons for privatisation

began in 1980s under Thatcher → she argued that public sector businesses had a lack of profit incentive due to lack fo competition

led to lack of efficiency and low quality

since govt has more of a social objective while businesses have the objective of profit maximisation

e.g. British Aerospace, gas, steel, water, electricity, coal railways, Jaguar, BT were all privatised

How can privatisation help promote competition?

businesses became more efficient and have the incentive to innovate due to competition

improvements in productive efficiency

Free market economists will argue that the private sector gives firms incentives to operate efficiently, which increases economic welfare. This is because firms operating on the free market have a profit incentive, which firms which are nationalised do not.

firms also have to produces the goods and services consumers wantm→ increases allocative efficiency and might mean goods and services are of a higher quality.

Competition might also result in lower prices. However, firms which profit maximise in a competitive market might compromise on quality.

main regulatory bodies in the UK for natural monopolies

Ofgem (gas and electriity)

Ofwat (water)

Ofcom (communications)

ORR (rail and road)

Why would natural monopolies need regulation?

since these infrastructures mean that they have no direct competition so regulation is necessary to ensure that they dont abuse their market power by attempting to raise prices and overcharge consumers

What is regulatory capture?

when thre regulator ends up being influenced by the industry’s POV and are persuaded to treat firms generously at the expense of consumers

examples of regulatory bodies in action

2016 : Ofwat wanted water companies to reduce real prices by5% by 2020 and to improve their leak fixing performance

their rising water prices previously brought increased profit for the firm and took a large chunk of household income

How can consumers be exploited by firms?

inappropriate labelling can be misleading

pricing strategies can obscure the true cost of the product

price fixing means that consumers can be left unable to buy the product from a competitio at a lower price

they can be offerd poor quality products

How are consumers protected by regulation?

regulation aims to ensure that companies do not exploit their monopoly power by charging excessive prices

What does the Competition and Markets Authority (CMA) do? (5)

investigates mergers which could restict competition

conducts market studies and investigations in markets where competition may be weak and consumer problems could develop

investigates where there may be breaches of UK/EU prohiitions in relation to anti- comp behaviour

brings criminal proceedins against indidivudlas who form business cartels

enforces consuemr protection legislation to ensure consumers always have choice

examples of CMA investigations

2014 - CMA accounced an investigation into Pork Farms aquisition of Kerry Foods

CMA said the merger between the two firms had created a lessening of competition

2016 - CMA found that 5 London model agencies had colluded on setting prices for modelling services

fined £1.5 billion

What is the impact of EU competition policy?

the EU competition Directorate works with the CMA and other national competition authorities to control cross border practices that restrict competition

How does the European Commission regulate competition?

larger companies that do bsuiness outside the EU cannot merge without prior approval from the EC

EU has wide ranging powers and can impose large firms → e.g fine on Intel of £948 million

in the EU, a market share of 38% is treated as unnacceptabke market power, in uk it is 25%

What are the rules for businesses in the EU?

businesses:

may not fix prcies or divide markets among themselves

may not use a dominant position in a market to squeeze out smaller competitiors

not allowed to merge if that would give them control over a market

What is the trade off about employee protection?

cost cutting for firms may mean short cuts on health and ssafety and condititons whereas employees will advocate against this→ trade off between emplyees and employers

however many employers may believe that good working condittions will generate benefits from better motivation→ productivity

How is employee proection regulated in the UK?

The Health and Safety Act 1974→ improved working conditions and has provided compensation for where negligence has caused accidents

was brought in by Harold Wilson who had a good relationship with the trade unions

UK figure of work accidents is 1/34th of USAs → effective

minimum wages → national living wage reduces exploitation and poverty and create incentives to work

What is the problem with legislation to ensure employee proection?

a new govt can easily come in and remove that law by bringing in new laws that supercede them

what are the benefit of regulation?

• Without regulation, markets will be less efficient and show signs of market failure.

• Regulation helps to remove market imperfections and correct market failure.

• Competition creates a more robust and innovative economy, fostering economic growth by increasing efficiency.

• Regulation protects both consumers and employees.

• Businesses that are hurt by unfair competition can complain to the CMA, which will investigate.

• Regulation can benefit suppliers in a supply chain where monopsony buyers have market power and can force prices down.

• Better working conditions can help to raise productivity.

• Having strict rules for all businesses levels the playing field. Socially responsible businesses may face competition from others that cut costs by paying very low wages and having very poor working conditions. Regulation for all means no business has a competitive advantage based on dubious labour market practices.

How is the generation of competition through regulation beneficial?

As the market becomes more competitive businesses must strive against each other to make sales to consumers. This makes them efficient. → The community benefits from lower prices, greater choice, innovative products, improved reliability and better quality products and service. →. The economy benefits as resources are used more efficiently as businesses strive to succeed. Productivity increases and businesses become more competitive internationally boosting exports and growth

What are the costs of regulation?

• Imposing a regulatory framework will mean that government expenditure is necessary to create and run the regulatory bodies. This has an opportunity cost to the taxpayer.

• Implementing the legislation via the legal system can be costly for governments.

• Regulation by whatever means will impose compliance costs on businesses. → HOWEVER this is only a short term costs, and is probably cheaper than costs of punishments such as lawsuits and litigation

• For some businesses this may reduce profitability; they are forced to reduce prices or abandon mergers.

• This may reduce their ability to invest and grow in the future, to the detriment of the economy.

• Complying with consumer protection legislation such as health and safety may cause costs to be passed on to the consumer.

• Businesses tend to dislike regulation; it is likely to reduce profitability, especially if disregarding the regulations leads to fines or imprisonment.

• These costs must be weighed against the benefits of not allowing businesses to thrive by behaviour that puts others at a disadvantage.