ib econ- 3.6: fiscal policy

1/10

Earn XP

Description and Tags

credits https://www.econinja.net/macroeconomics/3-6-fiscal-policy/goals-and-tools-of-fiscal-policy

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

11 Terms

what is fiscal policy?

the use of taxation and government expenditure to influence the level of economic activity in order to achieve macroeconomic objectives

what are examples of government revenues?

direct and indirect taxation: income, inheritance, sales, carbon

sale of goods and services from state owned enterprises: most governments own some companies, which provide revenue

sale of governmental assets: by selling state run businesses like the postal service the government makes money - this can only happen once per business though

what are some examples of government expenditures?

current expenditures: spending on goods and services within the current year, such as healthcare and education

capital expenditures: long term investments by the government (e.g. a new airport)

transfer payments: payments sent to people without any return (e.g. unemployment benefits)

what are the goals of fiscal policy?

low and stable inflation

low unemployment

promote a stable economic environment for long term growth

reduce business cycle fluctuations

ensure an equitable distribution of income

ensure an external balance

what is expansionary fiscal policy?

the use of increased government spending and/or reduced taxes to stimulate economic activity and achieve macroeconomic objectives. used when trying to close recessionary/deflationary/negative output gaps

what are the two methods of expansionary fiscal policy?

cut taxes: means people and businesses will take home more money, incentivising more consumption/investment

increase gov. spending: since G is a part of measuring rGDP (C+I+G+(X-M)), an increase in G will increase economic activity

what is contractionary fiscal policy?

the use of decreased government spending and/or increased taxes to reduce the level of economic activity and achieve macroeconomic objectives. used when the government wants to close inflationary gaps.

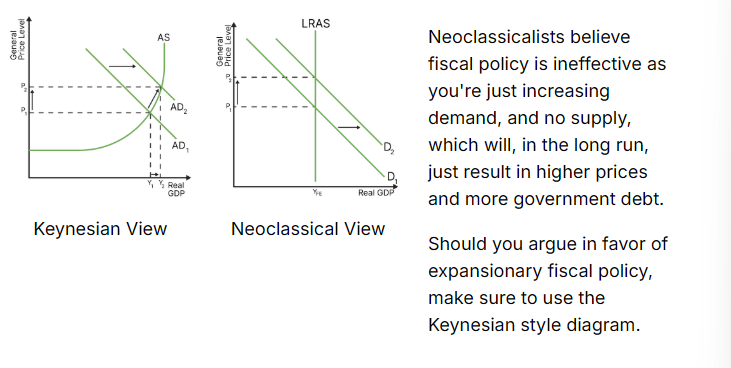

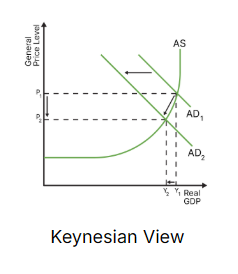

draw the diagram for expansionary fiscal policy (neoclassical and keynesian)

draw the diagram for contractionary fiscal policy

what are the strengths of fiscal policy?

it can target specific economic sectors

gov. spending is effective in recessions (boosts confidence easily)

what are the weaknesses of fiscal policy?

political pressure: it is dependent on the government, and requires political support

time lags: bureaucracy and injection of money take time

increases government debt (not sustainable in the long run)