11 economic performance

1/84

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

85 Terms

short run economic growth

an increase in the production of goods and services that occurs without an economy acquiring additional FOP

productivity increase

cost reductions (SRAS)

AD increasing

long run economic growth

an increase ion an economies productive capacity from better quality or quantities of FOP

economic growth an living standards

living standards will increase as long as the population does not increase at a faster rate than the rate of growth

supply side growth

causes by changes in LRAS or SRAS

costs falling, productivity increasing, better FOP

demand side growth

improvements in C + I + G + (X - M)

demand side growth will be inflationary if supply does not increase, unless the economy is operating below full capacity

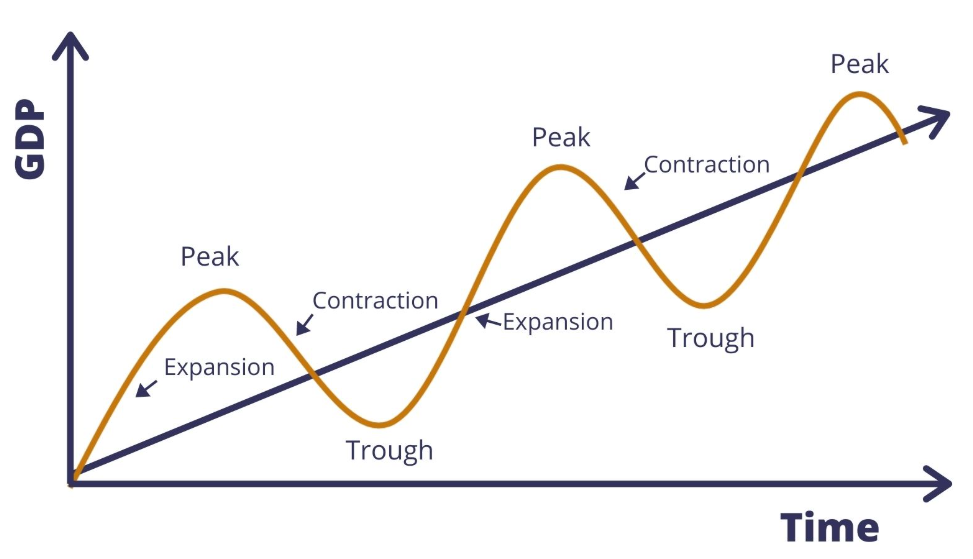

economic cycle

boom

recession

slump

recovery

characteristics of a recovery

output and employment begin to increase

consumption increases - multiplier

firms begin to utilise space capacity

business confidence increases - accelerator

rise in consumer spending due to confidence

inflation creeps up

characteristics of arecession

increases FOP costs from boom eat into profits - less investment - AD falls

income and output falls as firms cant employee as many workers

business and consumer confidence falls

spare capacity rises

inflationary pressure falls - negative multiplier

less imports

firms search for new markets aboard

characteristics of a boom

high levels of business and consumer confidence

high levels of demand

increase level of production

high investment

skilled workers become scarce - wages increase - costs increase

goods and services become scarce - inflation - high IR - PP is lower, UK goods not as competitive, wage price spiral

high imports

skills shortages

characteristics of a slump

disposable income is low

main objective of firms is to survive

large gov budget deficit

high unemployment

deflation

reduced demand

low price of capital aids recovery

goods become more competitive internationally

output gap

the difference between actual output and potential output of an economy in GDP

positive output gap - when actual output exceeds potential output

negative output gap when actual output is below potential output

factors moving an economy from one stage to another

replacement investment and technology advancements

economic shock

optimisation - animal spirits - accelerator

government policy

IR change

asset bubbles burst

credit crunch

strong multiplier

stock pilling

herding - factors that can change the economic cycle

where individuals in a market mimic the actions of a larger group, often leading to trends in investment behaviour increasing AD

asset bubble bursting - factors that can change the economic cycle

occurs when the prices of assets rise rapidly and then suddenly decline, often leading to significant economic downturns

stock pilling - factors that can change the economic cycle

the practice of holding large quantities of inventory to meet anticipated demand - stops firms investing and reduces AD

negative equity - factors that can change the economic cycle

a situation where the value of an asset falls below the amount owed on it - house prices fall but mortgage stays the same

political cycle - factors that can change the economic cycle

a change in government may increase or decrease government spending

replacement investment - factors that can change the economic cycle

investment to replace worn-out or obsolete capital goods, thereby maintaining the productive capacity of an economy - bank loan taken out

economic performance of other countries - factors that can change the economic cycle

if other countries the UK exports to are doing well, they are likely to purchase more exports and so AD rises - could happen in reverse

credit crunch - factors that can change the economic cycle

banks stop lending as they have less loanable funds available - could be a result of overlanding to poorer households who cant pa it back

animal spirits - factors that can change the economic cycle

optimisation about how the economy will preform in the future can increase investment via the accelerator and also have a strong multiplier effect - increase in AD

changes in technology - factors that can change the economic cycle

firms will invest to keep up with other firms - increasing AD and AS as costs of production fall and capacity increases

interest rates - factors that can change the economic cycle

higher rates generally dampen spending, while lower rates can stimulate economic activity as there is a lower opportunity cost to saving and borrowing is cheaper, encouraging consumer and business loans

economic shocks - factors that can change the economic cycle

unexpected events that can disrupt economic stability, affecting aggregate demand and supply

advantages of economic growth

increase SOL

increased employment

lower absolute poverty

increased tax revenue

multiplier

accelerator

larger business profits - investment - spending on CSR

high business and consumer confidence

disadvantages of economic growth

inflation - macro conflict

increase imports - worsen BOP

increased prices on exports - worsens BOP and current account - macro conflict

environmental concerns

increased inequality

increased relative poverty

factors that limit economic growth

infrastructure

dependence on exports

vulnerability to shocks

low levels of savings to invest

declining / ageing population

inflation

unemployment

people who are able, available and willing to work but cant find a job despite searching for work

underemployment

when individuals are working in jobs that do not fully utilize their skills or education

unemployment rate

unemployed individuals / total labour force X 100

voluntary unemployment

workers choose to remain unemployed and refuse job offers at the current market wage, they are not attempting to relocate or retrain to make themselves employable

involuntary unbemployment

when individuals are willing and able to work at the current market wage but there are no jobs on offer - recession

structural unemployment

results from the decline/changes in industries in an economy

cyclical unemployment

occurs due to fluctuations in the business cycle, particularly during recessions, when overall demand for goods and services decreases, leading to job losses

frictional

unemployment occurs when individuals are temporarily between jobs, often due to voluntary transitions in employment

casual unemployment

refers to temporary unemployment that occurs when individuals are not consistently employed, often due to seasonal or contract work

demand deficient unemployment

arising from a decrease in AD

technological unemployment

caused by an introduction of labour saving technology

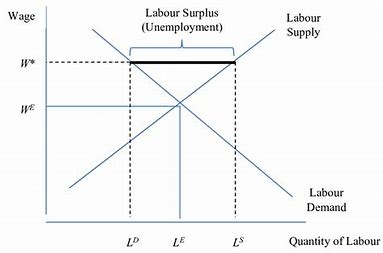

classical unemployment

occurs when wages are set above the market equilibrium, leading to a surplus of labour

seasonal unemployment

occurs when people are unemployed at certain times of the year due to seasonal variations in demand for certain jobs

causes of unemployment

demand side factors

lack of AD firms dont need labour (derived demand)

supply side factors

imperfections in the labour market

geographical immobility of labour

refers to the inability or unwillingness of workers to move to different locations for employment, often due to factors like housing costs, family ties, or lack of information

occupational immobility of labour

refers to the inability or unwillingness of workers to change occupations or professions, often due to a lack of transferable skills, experience, or education

natural rate of unemployment

classical def - unemployment when LRAS and AD are in equilibrium

Keynesian def - unemployment at YFE

NRU includes

people who are frictionally unemployed

people who are structurally unemployed

disaffected workers

benefit lifestylists - unemployment trap

determinants of NRU

availability of job information - how quickly the unemployed find a job

level pf benefits - generous may increase unemployment

cost of living in different regions

skills and education

savings/wealth

hysteresis

if workers are unemployed for a long time they may become de-skilled and less employable, leading to a permanent increase in the natural rate of unemployment

where a variable doesn’t return to its original state

consequences of unemployment on inidivduals

fall in living standards

social costs

less financial security

can become deskilled

consequences of unemployment on the economy

reduced consumption

reduced investment

reduced consumer and business confidence

lower tax revenue - worsens budget deficit

hysterisis

advantages of unemployment

falling rate of inflation - no wage price spiral

easier for businesses to recruit - better quality of labour - better productivity - LRAS right

may lead to increased competition for jobs, encouraging businesses to innovate

sunrise and sunset indistries

sunrise industry - developing

sunset industry - declining

the replacement ratio

measures the amount of money a person would get in employment compared to unemployment

disposable income out of work / disposable income in work

unemployment trap

where a person is better off financially from not working due to government benefits or support than by taking a job, leading to disincentives for seeking employment

poverty trap

when someone stays in a lower paid job as they are not better off gaining a promotion

positive impacts of globalisation on employment

Job Creation in Emerging Markets

developing countries have benefited from increased FDI, leading to the growth of manufacturing and service sectors

Example: Countries like India and Vietnam have seen growth in IT and manufacturing jobs due to outsourcing

Access to Global Job Markets

workers can now apply for remote jobs in other countries, increasing employment opportunities

Skill Development and Technological Transfer

Exposure to international companies has increased skill levels, especially in countries integrated into global supply chains

Entrepreneurial Opportunities

Global markets give entrepreneurs access to new customers, suppliers, and partners, encouraging job creation

negative impacts of globalisation on employment

Job Losses in Developed Countries

Offshoring and outsourcing have led to the decline of manufacturing jobs in some developed economies, like the U.S. and parts of Europe.

Wage Pressure and Job Insecurity

Increased competition can suppress wages and lead to more precarious employment, including temporary or gig jobs.

Widening Inequality

Benefits of globalisation are often unevenly distributed, leading to income inequality between high-skilled and low-skilled workers.

Exploitation of Labor

In some developing countries, globalisation has led to poor working conditions, low wages, and child labor, especially in informal or unregulated sectors.

factors that determine real wage unemployment

mismatch between wage levels and market equilibrium

strength and influence of trade unions

existence of minimum wage laws above equilibrium wage

efficiency wage policies by employers

inflexible labor market institutions or regulations

low labor mobility (geographic or occupational)

high unemployment benefits reducing incentive to accept lower wages

weak demand for labor in specific sectors

labor productivity not matching wage expectations

technological change reducing demand for certain job roles

real wage unemployment

unemployment that occurs when real wages are set above the market equilibrium, leading to a surplus of labour supply due to factors like trade union influence, minimum wage laws, and inflexible labour market regulations.

inflation

a sustained increase in the general price level

measuring inflation

retail price index - average price of basket of goods that reflects consumer buying habits

consumer price index

core inflation rate

the rate of inflation excluding volatile items such as food and energy prices, providing a clearer view of the underlying inflation trend

limitations of measuring inflation

different people experience different rates of inflation

CPI doesn’t include housing costs

doesn’t take quality of goods into account'

lad in data collection

problems with inflation

international competitiveness - less demand for exports - worsens current deficit

negative effect on investment

reduced living standards

reduction in value of savings

fiscal drag - people dragged into next tax bracket while real incomes remain the same

hyperinflation

costs of production increase for businesses

labour may be substituted for capital

advantages of inflation

workers moral increase due to pay rise even if its just the money illusion - real income stays the same

decrease in the real value of debt

increase in tax revenue through fiscal drag

increase in business profits depending on costs

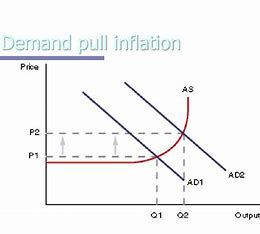

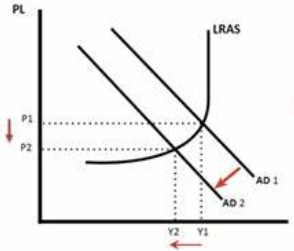

demand pull inflation

inflation occurs as AD shifts right (C + I + G + (X - M)

greater pressure on existing FOP to produce more output as firms try to satisfy demand - closer to YFE - resources become scarcer - FOP increase in price

lower IR

quantitative easing

depreciation of ER

increase in government spending

tax cuts

confidence

exports

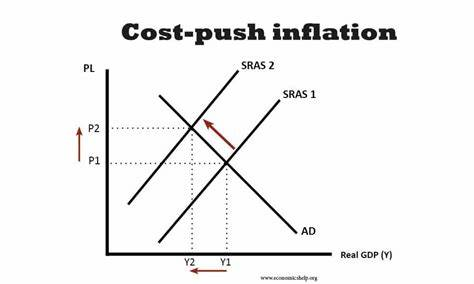

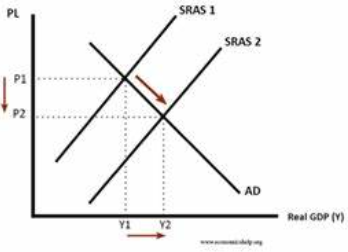

cost push inflation

SRAS shift left due to an increase in costs of production which get passed onto consumers as higher prices

rising wages

high raw material prices

interest rates increase

exchange rate weakens - imports more expensive

wage price spiral

increase in AD - demand pull inflation

price level rises as there is a profit incentive

workers demand higher wages as their incomes are being eroded

firms put prices up to maintain margins after an increase in wage costs - cost push inflation

workers demand higher wages - wage price spiral

quantity theory of money

increases in the money supple will lead to an increase in the PL

M x V = P x T(Q)

expenditure = output

M = money supply

V velocity of circulation - how many times money is used in a year

Increasing money supply leads to higher price levels. p = price level

T(Q) = transactions , real GDP - output of foods available

V and T are fixed so there is a direct relationship between the growth of the money supply and inflation

disinflation

prices are increasing but at a slower rate

deflation

sustained decrease in the general price level, real value of money increases

malevolent (malign) deflation

bad deflation

caused by a decrease in AD

benign deflation

good deflation

caused by a decrease in costs or production or an increase in productivity so SRAS moves right

disadvantages of deflation

gives consumers the expectation that prices will fall further so they hold off on spending

further fall in AD

firms may have to reduce prices - less investment

value of debt increases

value of savings rise which encourages people to save more consumption falls

firms dont give pay rises, lowers motivation and productivity

falling asset prices cause a further decrease in AD

if cause by lack of demand, confidence falls

advantages of deflation

cost of living falls while wages remain the same as Keynesian said they are sticky downwards - higher PP

income inequality falls

MPC increases long run growth

exports increase as they are more price competitive

wage settlements

if people, expect prices to rise - employees and trade unions will bargain for higher wages

causes the wage price spiral

adaptive expectations

theory that suggests firms and households use past information as an indicator for the future

rational expectations

theory where individuals use all available information to forecast future economic variables, leading to more accurate predictions than adaptive expectations

positive output gap effect on inflation and unemployment

Inflationary Pressure

High demand pushes up prices.

Firms raise wages to attract scarce labour, leading to demand-pull and cost-push inflation.

Low Unemployment

Firms hire more workers to meet increased demand.

Unemployment falls below the natural rate (may cause labour shortages)

negative output gap effect on inflation and unemployment

Deflationary/Disinflationary Pressure

Weak demand keeps prices low.

Firms may freeze or cut wages

High Unemployment

Reduced production means fewer jobs.

Unemployment rises above the natural rate due to slack in the economy

how can changes incommodity prices effect inflation

higher input costs

wage price spiral

when input costs fall there is less pressure on prices, leading to lower inflation

stagflation

high unemployment, and high inflation occurring simultaneously

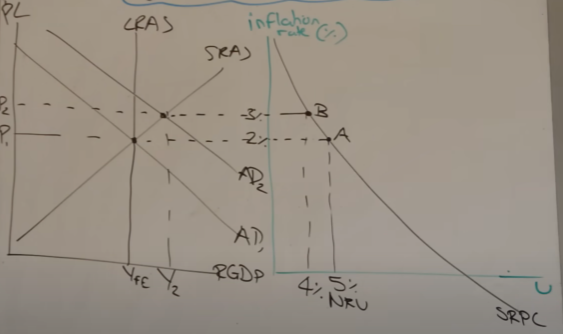

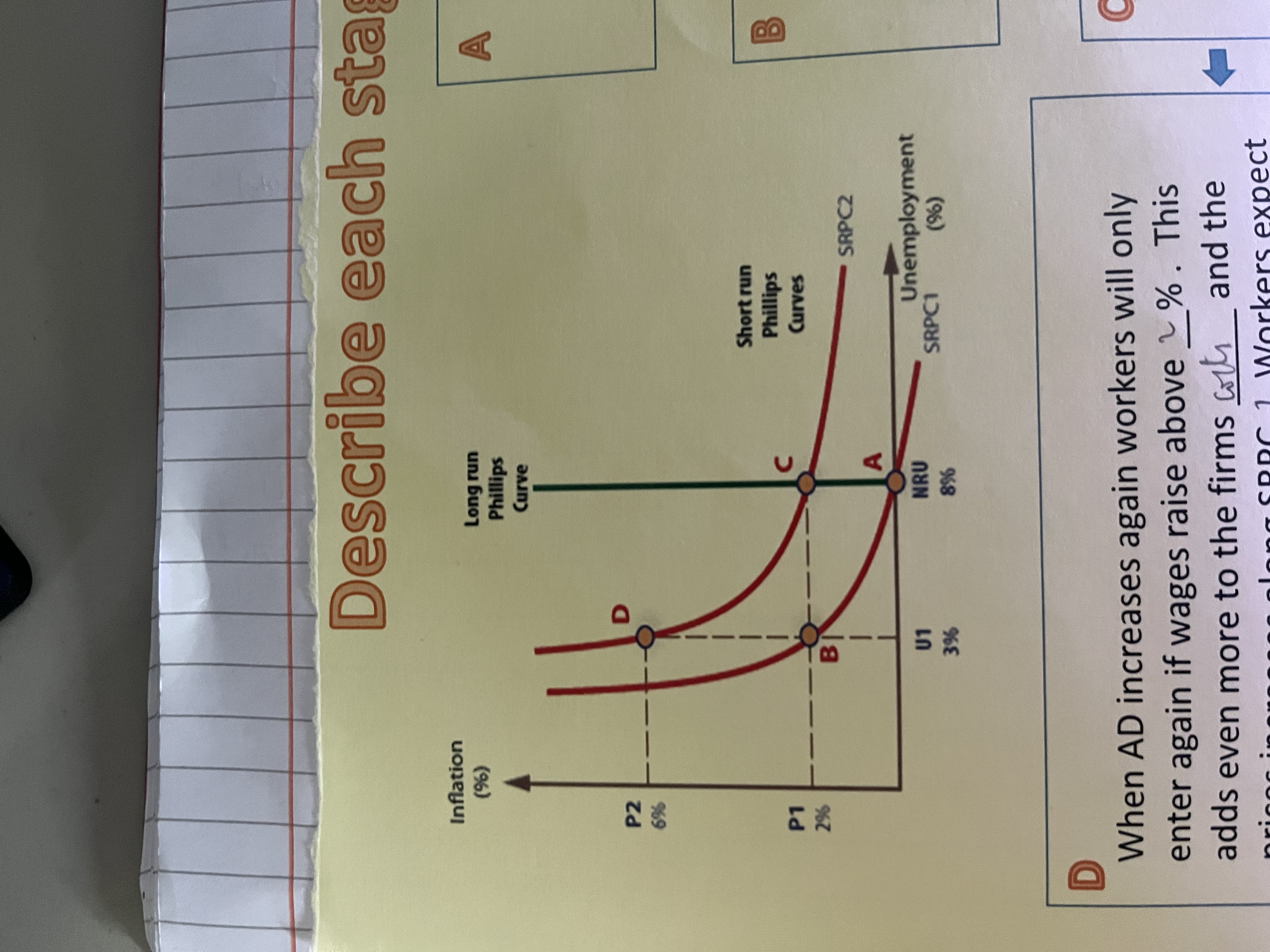

short run Phillips curve

as unemployment falls, inflation increases

when unemployment is low, workers are scare meaning they have ore bargaining power to increase wages - cost push inflation

more income generates more consumption, increasing demand - demand pull inflation

macro conflict - if you want low unemployment you have to sacrifice the low inflation objective

long run Phillips curve

A = unemployment is at NRU with 0% inflation, some workers are voluntarily unemployed

B = an increase in AD reduces unemployment

firms have to increase wages to attract new workers

worker face a money illusion

firms increase prices so inflation increase to 2%

C = workers realise they are no better off

workers leave the labour market

unemployment returns to 8% (NRU)

however inflation is still ta 2%

D = workers will only enter the labour market again if wages raise above 2%

increases firms costs

prices increase

wages now need to be raised in excess of @% to attract new workers

NAIRU

non-accelerating inflation rate of unemployment, where inflation remains stable, reflecting the lowest level of unemployment an economy can sustain without causing inflation to rise

what can shift the long run Phillips curve

change in NRU

if it falls the curve moves left

if it rise the curve shifts right

what type of unemployment is at the NRU