Prosperity Portfolio

1/86

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

87 Terms

Sentiment

The emotions, plans, or though processes that lead up to the buying or selling of a security.

Price Action

The literal and numeral movement of a stock. The larger the number, the more powerful.

Candlesticks

A visual representation of price action and sentiment.

Red and Black

Name the 2 colors that represent Down days.

Green and White

Name the 2 colors that represent Up days.

buying

A white candle is always a candle.

White candle

Created when the stock closed higher than it opened.

buying

The bigger the white candle, the more that took place during the day.

open

The BOTTOM of the candle is the price.

close

The TOP of the candle body is the price.

bullish

White candles indicate what kind of trend?

support

White candles mean the most when found at a strong price.

9:30 am EST

What time does the stock market open? (format: X:XX am EST)

4:00 pm EST

What time does the stock market close? (format X:XX pm EST)

Upper wick

The high of the trading price point for the stock during the Trading Day.

Lower wick

The low of the trading price point for the stock during the Trading Day.

one day

On the Daily view, 1 candle represents …

one week

On the Weekly view, 1 candle represents …

one month

On the monthly view, 1 candle represents …

shadows or tails

Wicks are commonly referred to as or .

buying

Lower wicks always represent pressure.

buying

The longer the lower wick, the stronger the _ pressure

selling

Upper wicks always represent pressure.

selling

The longer the upper wick, the stronger the _ pressure.

shaved bottom candle

A white/bullish candle with NO lower wick.

shaved bottom candle

Indicates strong buying pressure because the exact second the candle opened, it got bought higher.

Shaved top candle

A black/bearish candle with no upper wick.

shaved top candle

Indicates strong selling pressure because the exact second the candle opened, it got sold lower.

patient

Be when you see a candle with both long upper and lower wicks. It has intense buying and selling pressure.

black

A candle is always a selling candle

black candle

Created because the stock closed lower than the open.

bear candle

The bigger this candle is, the more selling that took place during the day.

close

The bottom of the candle body is the _

open

The top of the candle body is the

bear candles

These types of candles mean the most when found at a strong resistance price.

Doji candle

When a candle has the same open and closing price, what is this called?

Doji candles

These candles mean the most when found at support or resistance prices.

doji candles

These candles generally precede a reversal/change in price, especially when found at an all time high or low.

doji candle

You can identify this candle when there is no actual candle body.

doji candles

These candles show confusion and indecision among buyers and sellers.

hammer candle

A bullish candle. Best found in a nice uptrend, above all of the moving averages.

buying

The longer the lower wick (in terms of a hammer candle), the stronger the pressure.

Hammer candle

A candle with a lower wick that is 2 times the size of the candle body.

selling

Upper shadows/wicks indicate _ pressure.

upper

It is preferred that hammers have small __ wicks.

support; above; higher

When you spot a hammer candle at , make sure that the next candle closes to ensure that buyers have enough momentum to continue price action _.

selling

The bigger the upper wick, the more _ pressure.

bullish

With hammer candles, IF you see the stock go up the next day, above the high, then you will become _.

Hammer-ish candle

A candle that has the shape, design, and sentiment of a hammer, but the body is black.

Inverted hammer

An upside down hammer that forms at a support.

Shooting star candle

An inverted hammer that forms at a resistance.

Shooting star candle

A long upper wick, small perfectly square candle body with a shaved bottom found at a good resistance.

buying

White candle shows _ pressure

next day

How long do you have to wait for a shooting star's signal?

High wave candle

A type of doji candle with a huge upper and lower wick.

high wave candle

A type of doji candle with a huge upper and lower wick that shows massive indecision between buyers and sellers.

2 to 3 days

How many days should you wait to see which direction a stock moves following a high wave candle?

Engulfing pattern

When the following candle is larger than the previous smaller candle's range.

engulfing pattern

When the price of the stock moves stronger in both directions than its previous candle - showing us that there might have been a sudden shift in supply and demand.

Larger

Which candle takes on the stronger, more indicative direction in the case of an engulfing pattern? The smaller candle or the larger candle?

support; close

If you find a bullish engulfing pattern at a good __, wait for a __ before going bullish.

Bullish engulfing pattern

When a white candle is larger than the previous black candle's range, taking on a stronger, more indicative direction.

Bearish engulfing pattern

When a black candle is larger than the previous white candle's range, taking on a stronger, more indicative direction.

bottom; top; top; bottom

For a bull candle, the Open Price is at the and the Close Price is at the of the candle. Whereas for a bear candle, the Open Price is at the , and the Close Price is at the _.

bullish; above; below

List the 3 things that must occur for a pattern to be considered the perfect bearish engulfing pattern: 1) The 1st candle should be _______. 2) The open of the 2nd bearish candle must be _____ the high of the 1st bullish candle. 3) The close of the bearish candle must be ______ the low of the 1st bull candle.

resistance; low; high; bearish

If the bearish engulfing pattern is found at a good __, and the pattern is text book, enter with a close below the _, and place the stop above the __ of the _ candle.

selling

The more bearish candles that form, the more pressure is building.

low

In the event of a bearish engulfing pattern, enter your trade (likely a sell or a put) below the _ of the bearish candle.

Retest Gap

Bull candle gapping up. Depends on what the 3rd candle is.

bullish; bearish

For a Retest Gap, if the 3rd candle is bullish (white), go . If the 3rd candle is bearish (black), go __.

STO a put

What action should you perform when you want to get paid to purchase a stock at a low price?

STO a call

What action should you perform when you already own at least 100 shares in a stock, and you want to get paid to sell it at a higher price.

more

You get paid _ on puts if you wait longer (set the exp date farther away)

50

If you can capture ___% within a week of call or puts' expiration date - SELL TO CLOSE!

Bull Gap n Go

A bear candle gapping up into a bull candle; moves quickly; BE BULLISH (BUY)

sell; decrease

When a BULL candle gaps up, people will . Expect a _ in stock prices.

Bear shat pattern

When a bear candle gaps up into another bear candle.

STO puts

When an old support (floor) becomes a new ceiling, you should …

bullish; high

When the first BEAR candle closes above the 10 EMA, you should go above the _ of that candle.

bear; high

When the 1st ______ candle closes above the 10 EMA, you should buy. Get in above the _____ of the bear wick.

bearish

You should go _______ when you see the 1st BULL candle closing BELOW the 10 EMA.

Evening Star Reversal Pattern

A pattern where the first day’s candle is white followed by two black candles. On the 2nd day, there should be a gap up and a black candle forms. On the 3rd day, the stock should gap down again forming a black candle.

below; low

If the 3rd candle closes ______ the _____ of the first bullish white candle in the Evening Star Reversal Pattern, it is considered an intensely strong pattern.

Evening Star Reversal Pattern

What type of pattern is shown here?

Evening Star Reversal Pattern

What type of pattern is shown here?

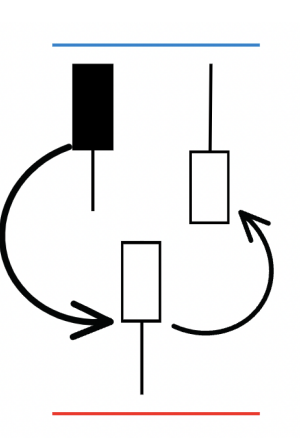

Morning Star Reversal Pattern

A pattern where the 1st day candle should be black (bearish) followed by two white candles (bullish). `

Morning star reversal pattern

What type of pattern is shown here?