ECO 202 Module 4: Economic Efficiency, Government Price Setting, and Taxes

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

surplus

someting that remains above what is used or needed

refers to the benefit that people derive from engaging in market transactions

consumer surplus

the difference between the highest price a consumer is willing to pay for a good or service and the actual price the consumer pays

the area below the demand curve and above market price

related to marginal benefit - the additional benefit to a consumer from consuming one more unit of a good or service

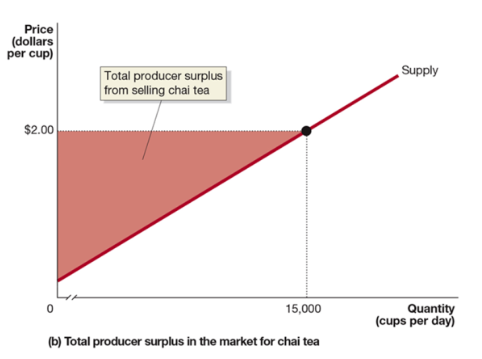

producer surplus

the difference between the lowest price a firm would be willing to accept for a good or service and the price it actually receives

the area above the supply curve and below market price

the lowest price a firm would accept is the marginal cost of producing the good or service

what do consumer and producer surplus measure?

consumer surplus measures the net benefit to consumers from participating in a market rather than the total benefit

consumer surplus in a market is equal to the total benefit received by consumers minus the total amount they must pay to buy the good or service

producer surplus measures the net benefit received by producers from participating in a market

producer surplus in a market is equal to the total amount firms receive from consumers minus the cost of providing the good or service

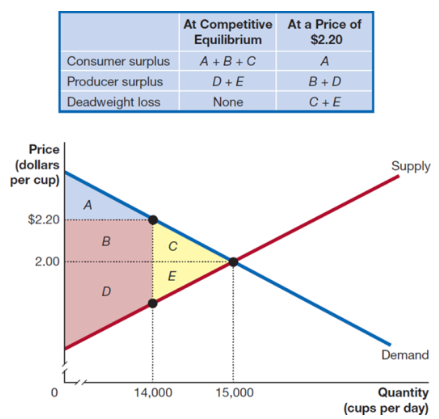

efficiency in competitive markets

1) a market is efficient id all trades take place where the marginal benefit excees the marginal cost, and no other trades take place

2) a market is efficient if it maximizes the sum of consumer surplus and producer surplus (the total net benefit to consumers and firms), known as the economic surplus, which is maximized at competitive equilibrium quantity

deadweight loss

reduction in economic surplus resulting from a market not being in competitive equilibrium, the amount of inefficiency in a market

economic efficiency

market outcome in which the marginal benefit to consumers of the last unit produced is equal to its marginal cost of production and in which the sum of consumer surplus and producer surplus is at maximum

price ceiling

a legally determined maximum price that sellers may charge

ex) rent controls

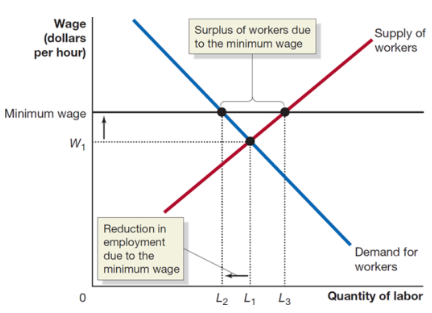

price floor

a legally determined minimum price that sellers may receive

ex) minimum wage

effects of price floor

surplus is transferred from consumers to producers

firms may produce excess products (surplus)

ex) minumum wage raises incomes, but may result in fewer jobs

effects of price ceiling

surplus is transferred from producers to consumers

results in a shortage

ex) rent ceiling, rent decreases, but there is too much demand for the supply of apartments, resulting in a shortage

illegal markets

markets in which buying and selling take place at prices that violate government price regulations

results of government price controls

some people win (renters with lower rents, or landlords who can exploit the shortage of housing to illegally raise rents

some people lose (law-abiding landlords, and renters unable to find apartments

there is a loss of economic efficiency (fewer apartments rented results in deadweight loss)

per-unit taxes

taxes assessed as a particular dollar amount on the sale of a good or service

equilibrium price is $6/pack and 4 billion packs sold/year

a $1/pack tax will shift the supply curve left/up by $1

the price needs to be exactly $1 higher to convince firms to still sell 4 billion packs, because the firms marginal costs effectively increased by $1/unit

new equilibrium price is $6.90 with a quantitty of 37 billion packs/year. consumers pay $6.90 but after paying the $1 tax, producers are left with $5.90

the government will receive tax revenue equal to the green box. some producer and some consumer surplus will become tax revenue and some will become deadweight loss

excess burden

the deadweight loss from a tax

tax efficiency

a tax is efficient if it imposes a small excess burden relative to the tax revenus it raises

tax incidence

the actual division of the burden of a tax betweeen buyers and sellers in a market

does NOT depend on who has the legal obligation to pay for the tax

determined by the relative slopes of the demand and supply curves

a steep demand curve means that buyers do not change how much they want to buy when the price changes, resulting in them taking on much of the burden of the tax

a shallow demand curve means that buyers change how much they buy a lot when the price changes. then they could not be forced to accept as much of the burden of the tax

equilibirum condition

in equilibrium, quantity demanded is equal to quantity supplied. we can use the equilibirum condition to solve for price

ex) Qd = 4,750,000 - 1,000P

Qs = -1,000,000 +1,300P

4,750,000 - 1,000P = -1,000,000 + 1,300P

P = 2,500