Economic performance

1/57

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

58 Terms

How is short run growth displayed on a PPF?

What usually causes this?

Movement from a point inside the PPF to a point on the PPF, it brings ideal resources into production.

Usually caused by demand side changes in an economy (an outward shift in aggregate demand), can also be caused by the supply side- an inward shift in the SRAS.

How is long run economics growth displayed?

What are the causes?

An outward movement in an economy’s PPF symbolising an increase in the economy’s productive potential. An outward shift in the LRAS.

an increases in the quality or the quantity of the factors of production.

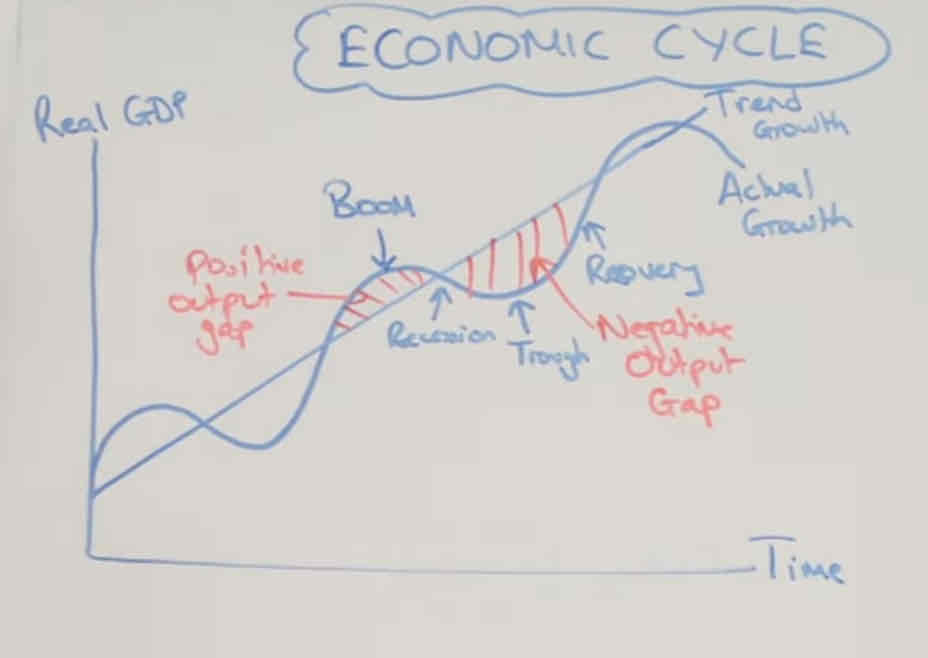

What’s an economic cycle and what does the graph look like?

Upswings (positive output gaps) and downswings (negative output gaps) in an economies aggregate economic activity taking place over 4 to 12 years.

What are changes in the economic cycle caused by?

Fluctuations in aggregate demand (pessimism), supply side factors, the role of speculative bubbles, political business cycle theory, outside shocks hitting the economy, changes in inventories, the Marxist explanation, multiplier/ accelerator in action, climatic cycles.

What is trend growth?

The rate at which output can grow, on a sustained bases, without upward or downward pressure on inflation.

What are the costs of economic growth?

The use of finite resources, pollution and environmental degradation, can destroy local cultures and communities, can widen inequalities in the distribution of wealth, urbanisation, rapid growth in population.

What are benefits of economic growth?

Increases living standards and welfare, may lead to people who strive to improve the environment, increases the length of people lives.

What are characteristics of a Boom?

Growth is increasing faster than trend, positive output gap, high profits, low unemployment, high business and consumer confidence, higher tax revenue, more imports (decelerating BoP deficits), high inflation.

What are characteristics of a recession/trough?

Declining AD, negative output gap, high unemployment, low business and consumer confidence (lower consumer spending and investment), high unemployement, smaller BoP deficit (due to low demand for imports), Discount and de-stocking, loose policy, fall in house prices and construction.

What are characteristics of a downturn?

Decreasing economics growth (although there’s still a positive output gap), decreasing inflation, increasing unemployment, BoP deficit is improving.

What are characteristics of a recovery?

Increasing economics growth, decreasing unemployment, increasing inflation, BoP deficit is worsening, rising consumer and business confidence, higher investment, increasing construction, increasing house prices.

What are demand side shocks? What are examples?

Shocks to aggregate demand. Examples: a sudden increase in interest rates, a sudden cut in government spending, a sudden strengthening of the exchange rate, a sudden housing market crash, a sudden financial market crash, higher tax

What are supply side shocks? What are examples?

Shocks on the supply side. Shocks that affect LRAS e.g natural disasters and wars. Shocks to SRAS e.g a sudden increase in price of raw materials, a sudden increase in wages, a sudden increasing gin business taxes like VAT, sudden wreaking of the exchange rate.

What’s the definition of unemployment?

Those of working age who are willing and able to work (in the next two weeks),actively seeking (looked in the last four weeks) work but do not have a job.

How do you calculate the unemployment rate?

Unemployment rate= (number of people unemployed/ number of people economically active) x 100

What are the two main measures of unemployment?

Labour force survey- Surverys 40,000 households every year. Weaknesses: sampling errors, cost, doesn’t account for discouraged workers, doesn’t account for inactive groups, doesn’t account for the underemployed, doesn’t tell us about disparities.

Claimant count- counts those who are claiming job seekers/ unemployment benefits. Weaknesses: difficult to compare between countries, not everyone will claim, not everyone can claim, could be subject to fraud.

What is voluntary unemployment?

When workers choose to remain unemployed and refuse job offers at current market wage rates.

What is involuntary unemployment?

When workers are willing to work at current market wage rates but there are no jobs available.

What is frictional unemployment?

that is usually short term and occurs when a worker switches between jobs (the time in which economic agents are searching for and waiting to start a new job) due to geographical and occupational immobilities. AD/AS diagram, an increase in frictional unemployment reduces the pool of labour, workers wages increase and the SRAS curve shift inwards (lower employment → lower production)

What are examples of geographical immobilities of labour?

Local friends and family, the price of and difficulties of moving and ignorance about job vacancies in other areas.

What are examples of occupational immobilities of labour?

Difficulties in training for jobs which require new skills and the effects of restrictive practices- discrimination and the need for unnecessary qualifications.

How can the government reduce frictional and structural unemployment?

Improving the geographical and occupational mobility of labour, reducing workers search periods between jobs and by introducing supply side policies.

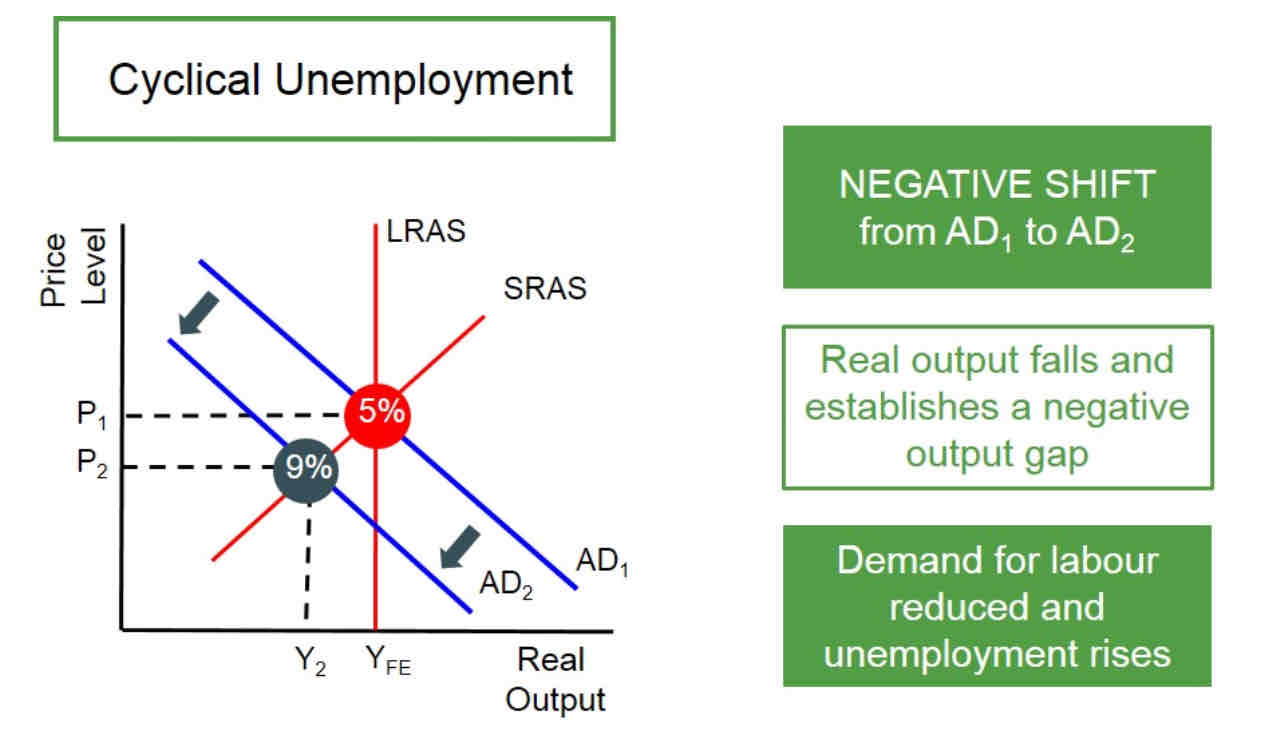

What’s cyclical unemployment?

Cyclical employment (demand deficient unemployment or Keynesian unemployment) is unemployment caused by a lack of aggregate demand in the economy, occurring when an economy goes into a recession or depression, due to firms generating lower revenue (thus needing to cut costs) and there being a lower quantity demanded. This is disequilibrium unemployment.

(Need to go over Keynesian)

What is Structural unemployment?

Results from the immobility of labour due to a long term change in the structure of an industry e.g demand for a good, new products, competitions, technology and changing skill requirements. This can result from an occupational immobility of factors (skills mismatch) or a regional immobility of factors (workers unable or unwilling to physically move). This can be caused by technological advancements, loss of comparative (price) advantage or modernisation (a need for new skills). This is equilibrium unemployment.

What could governments do to reduce structural unemployment?

Training programmes.

What are real wages?

The purchasing power of the nominal wage

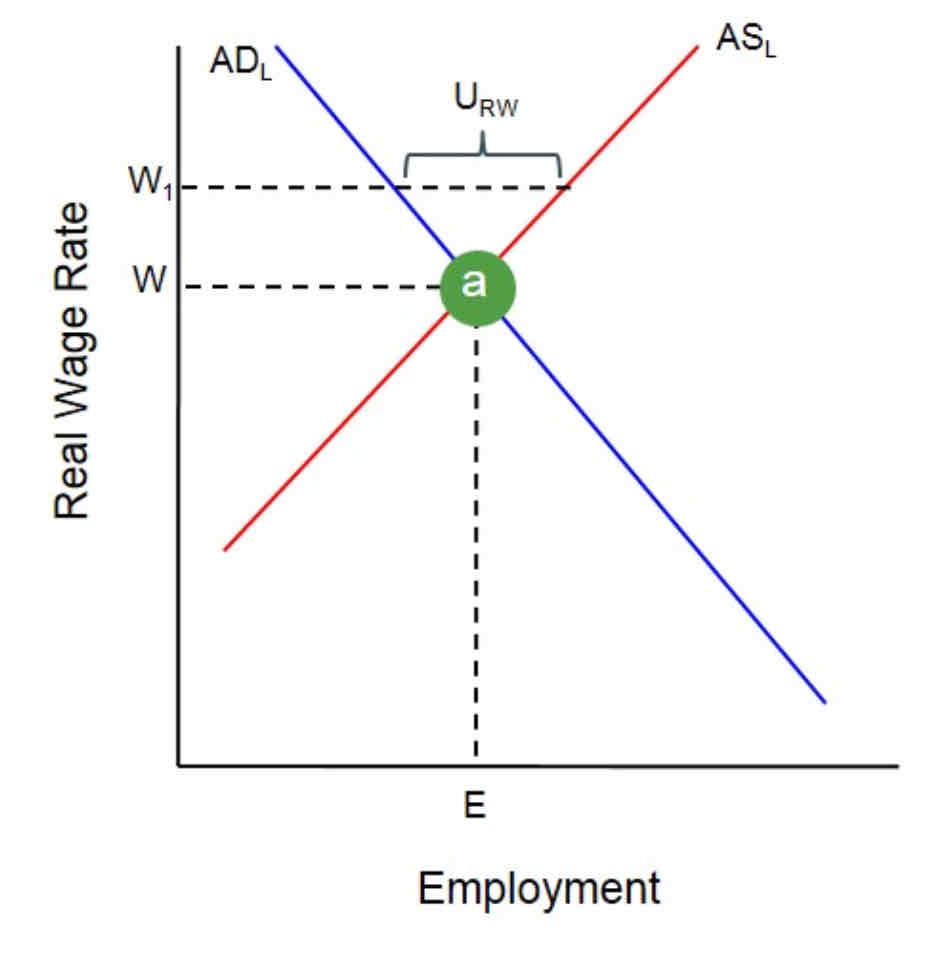

What is real-wage theory of unemployment?

Occurs when wages are forced above equilibrium in a labour market creating excess supply of labour. Could be caused by an increase in minimum wage or trade union. This is disequilibrium unemployment.

What this the natural rate of unemployment?

The rate of unemployment when the aggregante labour market is in equilibrium. Frictional and structural unemployment makes up equilibrium unemployment, this is known as the natural level of unemployment.

What is seasonal unemployment?

Demand for goods and therefore workers fluctuates at different times of the year (seasons) due to factors such as the weather.

What’s the trend growth rate?

The rate at which output can sustainably grow without putting upward or downward pressure on inflation. It reflects the annual average percentage increase in the productive capacity of the economy.

How could the government reduce unemployment by reducing the search periods?

Greater restrictions on job seekers allowance e.g having to go to a centre to claim.

How could the government reduce unemployment by improving the occupational mobility of labour?

Provide retraining schemes, provide information about jobs

How could the government reduce unemployment by improving the geographical mobility of labour?

Making it easier for people (especially families) to move house e.g by subsiding removal costs.

What supply side policies can governments implement to reduce unemployment?

What are the consequences of unemployment?

The economy isn’t growing as quickly as it can due to wasted human capital, higher crime rates (higher costs), reduces an economy’s international competitiveness (using labour-intensive methods rather than investing), higher taxes (JSA), lower tax revenue for the government, the longer somebody is unemployed, the less likely they are to be employed. Individual consequences: low standards of living for the individual increased stress, health risks, poorer diet, increase risks of marital break-up and social exclusion.

What are consequences of unemployment?

Lost output (inside PPF) (constrains growth, lower standards of living)

deterioration of government finances (higher spending on JSA and benefits, costs incurred due to social issues e.g spending due to crime, health care, and lower tax revenue (income, cooperation and VAT) this causes budget deficits and national debt to rise causes an opportunity cost.

Social costs (higher poverty, higher crime rates, health issues, marital break down).

Costs to other countries.

Lost income

Hysteresis (the longer someone is employed, the more likely they are to remain unemployed e.g deskilling, this reduces AD and may causes them to leave the labour force, reducing LRAS)

What are benefits of unemployment?

Greater pool of labour force firms-higher productivity

Low inflation, no pressure on wages to rise

Improve current account position (fewer imports)

Time for workers to find suitable jobs (no pressure)

What are evaluation points for unemployment

All of your friends have

What’s inflation?

An increase in the average level of prices in an economy in a given time period. A persistent or continuous rise in the average price level of an economy.

What’s demand-pull inflation?

A rising price level caused by an increase in aggregate demand (rightward shift).

What’s cost push inflation?

A rising price level caused by an increase in the costs of production (shown by a rightward shift of the SRAS curve).

What do deflationary policies do?

They use fiscal or monetary policies to reduce aggregate demand in order to remove excess demand.

What is disinflation?

When the rate of inflation falls but remains positive.

What is reinflation And reflationary policies?

Reinflation is an increase in economics activity and output And reflationary policies simulate aggregate demand.

What do monetarist economists believe?

They argue that a prior increase in the money supply is the cause of inflation as it increases AD.

What is monetarism?

Narrowest sense- inflation is caused by an increase in the money supply. Wider sense - pro-free markets economic theories and policies.

What is the Fisher equation?

Money supply x the velocity of money circulation = price level x quantity of output

What do monetarists argue regarding the Fisher equation?

V is constant (or stable) so when M increases, it spent on goods and services and if Q is unable to increase, P is pulled up by excess demand.

What do Keynesian economists believe regarding the Fisher equation?

When M increases, it may be partially absorbed by a slow down in V (most of it is not spent on consumer goods and services).

What do inflation expectations do/mean?

If people believe that inflation will be high in the future, they will act in an inflationary way now causing future high inflation (e.g workers demand higher wages and increase spending and producers increase prices) If people expect the inflation rate to fall, they will behave in a way that causes low inflation.

What are rational inflation expectations?

Rational inflation expectations is when economics agents predict inflation by using all available information. They understand that unemployment cannot sustainably fall below the natural rate of unemployment so predict that an increase in AD will increase inflation.

What are adaptive inflation expectations?

When people will believe that the future inflation will be like inflation was in the immediate past.

What is inflation targeting?

Since 1997, the BOE have been in charge of inflation, the inflation target is 2%, people are then more likely to expect it to be 2%. However, if BOE fails to achieve this, their credibility decrease, making it harder to reach the target.

What are the benefits of inflation?

Associated with growing markets, healthy profits, reduces chance of deflation and business optimism.It is necessary to make labour markets function effectively (allows some real wages to fall (to reduce unemployment) but doesn’t significantly reduce labour in them as real wages aren’t falling, only nominal.

What are disadvantages of inflation?

Distributional effects, distortion of normal economic behaviour, breakdown in the functions of money, reduced international competitiveness, shoe leather and menu costs.

What’s fiscal drag?

Where increases in nominal income ‘drag’ people into paying higher amounts of income tax even if their real income is unchanged. This is more likely to occur if tax bands are not updated in line with inflation (2021-22 and 2022-23).

What is good (benign) deflation?

A decrease in the averaged price level due to improvements in the economy’s supply side, which reduces business costs of production (SRAS and LRAS shift outwards/rightwards), increasing output and employment.

What is bad (malign) deflation?

A fall in the average price level due to a decrease in aggregate demand (inward shift), consumers continue to delay spending anticipating lower prices, further contributing to this (downward spiral, negative multiplier effect and possibly a credit crunch).