Macroeconomics - Inflation & Types of Inflation

1/24

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

25 Terms

Inflation: Definition

a sustained increase in the average price level (APL) of an economy over time

Stable inflation is associated with growth (2-3%)

Unstable rates of inflation cause uncertainty in the economy and affect spending decisions

↑AD → ↑profits and incomes → ↑jobs → ↓unemployment

Disinflation: Definition

a slowdown in the rate of inflation, slower inflation

Prices are still increasing, but more slowly

Ex: from 4% to 2% inflation but NOT DEFLATION

Deflation: Definition

negative inflation rate; a decrease in the average price level

Often associated with recession and falling demand

Why do we LIKE inflation?

✅ Pros:

↑AD → ↑profits and incomes → ↑jobs → ↓unemployment

Why do we DISLIKE inflation?

❌ Cons:

↓Real income falls

Value increases: ↑inflation → ↑prices

↓What income gets you

Workers get demotivated over time by fall in real income 😔

Prices can fluctuate

↓Purchasing power when incomes stay fixed

↓Real income falls

For lower income people, they must spend all they have and can’t save

For middle income people, they can save a little bit but inflation causes them to save less

For higher income people, inflation is not a huge issue at 2%-4%

High and Unstable Inflation: Harmful Effect

Reduces real income: When wages don't keep up with inflation, purchasing power falls.

Uncertainty: Discourages investment due to unpredictable future costs.

Income redistribution effects: Hurts fixed-income earners and savers.

Wage pressure and strikes: Workers may demand higher wages to maintain living standards.

Potential inflationary spiral: Higher wages → higher costs → higher prices → demand for more wages.

Why do workers hate inflation?

Inflation causes…

Disincentive: workers become less productive, may protest

Discontent: unions potentially strike to raise wages

INFLATIONARY SPIRAL!

Real Interest Rate:

High inflation reduces real returns on savings.

Investors may shift to real assets (property, gold, inflation-indexed bonds).

Savings during Inflation: Effect on Economic Groups

Effect of savings due to inflation:

Low-income people: few savings, more trade-offs

Middle-income people: they have savings and can maintain their lifestyle to a point

High-income people: have a cushion and can weather the storm, more assets so asset values ↑

Inflation acts as a regressive tax, disproportionately hurting the poor

Consumer Price Index (CPI): Definition

weighted basket of typical goods and services that are bought in the economy by the typical family, used to measure changes in inflation

Measures the average change in price of a "basket" of goods and services consumed by a typical household.

Consumer Price Index (CPI): Limitations

Representative bias: Not all households have the same consumption patterns.

little information on how individuals are affected (disregards different cultures, income brackets, ages, parts of the country)

Static basket: Basket may not reflect changes in preferences or new goods.

Quality adjustments: goods and services improve in quality over time → prices of certain goods may fall. A reduction in inflation may be due to improvements in quality, but it may be misinterpreted as a bad thing or that economic activity is slowing down when it’s not

CPI may overstate inflation if it doesn’t account for quality improvements.

Does not reflect income distribution: Effects of inflation vary across income levels.

Causes of Inflation: Types

Demand-Pull Inflation = increase in aggregate demand

Cost-Push Inflation = higher costs of production

Monetary Inflation = sustained increase in the amount of money available to the economy

Inflationary Spiral = inflation compounds

(Price-Wage Inflationary Spiral)

Hyperinflation = Demand-Pull → Cost-Push Inflation spirals

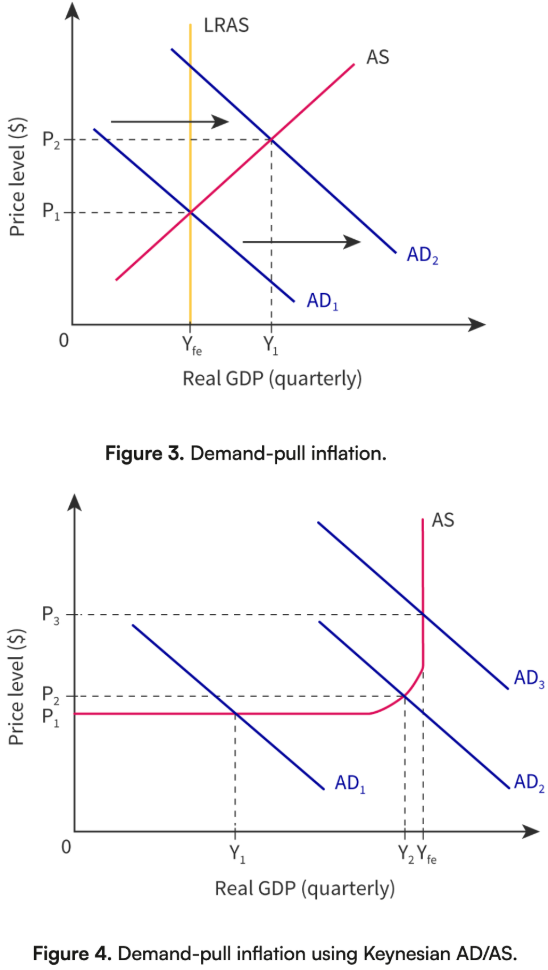

Demand-Pull Inflation: Definition

occurs when aggregate demand exceeds the economy’s productive capacity

Key features:

Driven by increases in C, I, G, or (X - M).

Likely when the economy is near or at full employment.

Supported by Keynesian and Neoclassical views:

Keynesian: Prices may not rise until full capacity is reached.

Neoclassical: Any AD increase raises prices; no permanent output gain.

Demand-Pull Inflation: Graph

Demand-Pull Inflation: Solutions 🦊

🔹 Demand-Pull Inflation

Main Issue: Excessive aggregate demand

Solutions:

Contractionary fiscal policy (reduce government spending, raise taxes)

Contractionary monetary policy (raise interest rates, reduce money supply)

Strengthen exchange rate to reduce net exports

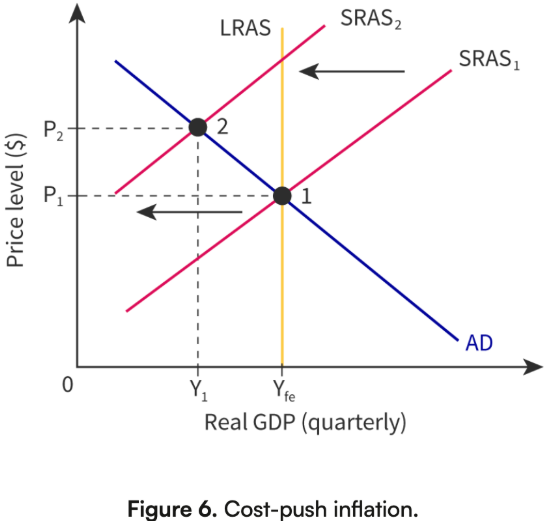

Cost-Push Inflation: Definition

Caused by increases in the cost of production that shift the short-run aggregate supply (SRAS) curve leftward

Sources:

Rising wages

Higher raw material prices (e.g., oil)

Currency depreciation (imported inflation)

Supply shocks (natural disasters, wars)

Increased regulation or taxes on firms

Cost-Push Inflation: Graph

Cost-Push Inflation: Solutions 🦊

🔹 Cost-Push Inflation

Main Issue: Rising production costs

Solutions:

Market-based supply-side policies (e.g., deregulation, reduce minimum wage, reduce production taxes)

Encourage technological innovation to boost productivity

Reduce import tariffs or secure cheaper import sources (to lower costs)

NOTE: Demand-side policies may worsen unemployment

Monetary Inflation: Definition

results from excessive growth in the money supply beyond the economy's ability to produce goods/services

Key concept:

"Too much money chasing too few goods."

Expansionary monetary policy (e.g., QE, OMO, deficit financing) increases AD, possibly triggering inflation.

Monetary Inflation: Solutions 🦊

🔹 Monetary Inflation

Main Issue: Excess money supply

Solutions:

Tight monetary policy (increase interest rates, sell government bonds, reduce QE)

Improve central bank independence to reduce political pressure for excessive money printing

Currency reform in extreme cases

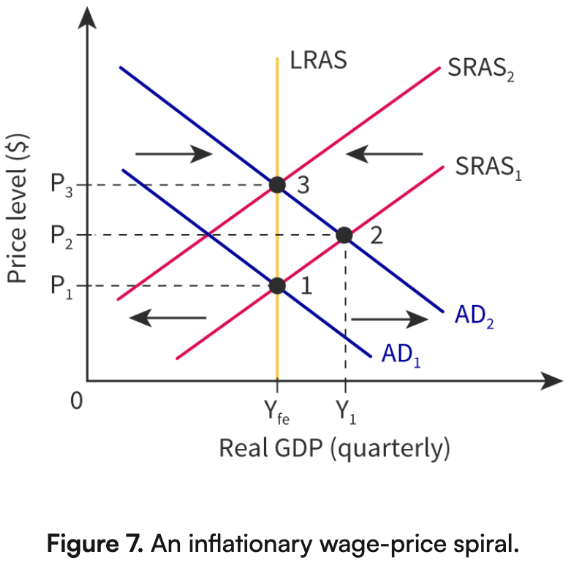

Inflationary Spiral (Price-Wage): Definition

occurs when inflation expectations lead to continuous wage and price increases:

Higher AD causes prices to rise.

Workers demand higher wages.

Higher wages increase costs for firms.

Firms raise prices again.

Cycle repeats, leading to embedded inflation.

Inflationary Spiral (Price-Wage): Graph

Inflationary Spiral (Price-Wage): Solutions 🦊

🔹 Inflationary Spiral

Main Issue: Self-reinforcing wage-price increases due to expectations

Higher AD causes prices to rise.

Workers demand higher wages.

Higher wages increase costs for firms.

Firms raise prices again.

Cycle repeats, leading to inflationary spiral.

Solutions:

Pre-emptive contractionary monetary policy to manage expectations

Implement income policies or wage guidelines

Maintain credibility of central bank to anchor inflation expectations

Short-term wage freezes or public sector wage restraint (controversial)

Hyperinflation: Definition and Impact

Definition: Extremely rapid and out-of-control inflation, often >50% per month

Causes:

Money illusion from higher inflation: higher wages and higher inflation

Demand-pull → cost-push inflation spirals into hyperinflation

Persistent demand-pull + cost-push effects

Massive money supply growth

Collapse of trust in currency

Effects:

Money loses value rapidly

Savings and pensions are wiped out

Shift to barter or foreign currency

Solutions:

Currency reform (currency swap)

Stabilization via tight monetary and fiscal policy

Restoring central bank credibility

External support (e.g., IMF loans)

Hyperinflation: Solutions 🦊

Problem: Demand Pull → solve using Contractionary Demand-Side policies

Milton Friedman Monetarist

Currency swap: replaced inflated currency with new second currency to raise faith

Hyperinflation is too difficult to solve, but inflation rates of ~8% is manageable and can be used for policies

Quantitative Easing (QE)

Introduction of new money into the money supply of an economy

Usually used to kickstart aggregate demand when the economy is stagnant

However, this can be done by government implementing government spending projects with new money or by buying back bonds and putting new money onto the market