Empirical Marketing - Week 2

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

What are the 5 sources of customer dynamics?

Discrete life events

Typical lifecycle

Learning effect

Product lifecycle

Constantly changing environment context

What is the level and rate of change of discrete life events?

Individual level

Immediate change

Examples: a first time parent often changes their preferences for cars, vacations and restaurants.

What is the level and rate of change of typical lifecycle or maturation as people age?

Individual level

Slow change

Examples: as people age, they become more focused on risk reduction, less willing to change, and more focused on comfort and health.

What is the level and rate of change of product learning effects?

Individual level

Medium change

Examples: customers might learn, after using a product for a time, that there are certain specialized or high-tech features they would like.

What is the level and rate of change of product lifecycle?

Product market level

Medium change

Examples: during early stages, consumers may purchase more new features, in later periods, they may get more price sensitive.

What is the level and rate of change of changes in economy, government, industry or culture?

Environmental level

Slow to immediate change

Examples: as the culture around “health food” changes, consumer preferences in response to dietary concerns (calories, sodium, carbohydrates,…) also change.

What are discrete life events?

Events that have immediate impacts on many aspects of customers’ purchase decisions. Example: graduation, new job, marriage

Even small habits (eating more, watching more TV) can have an impact on their brand preferences.

What is aging effect?

Changes in a person’s motivation, ability, preferences, and consumption choices as they grow older.

What is customer learning effect?

The process where users of a particular product or service become more familiar with the product, and thus are more likely to repurchase the same product in the future.

What is product lifecycle?

In early stages, consumers buy multiple new features, in later periods they are more price sensitive.

After a new product is launched, most of its sales are trial purchases so marketers often offer free samples. As the products begin to take off, with a faster growth rate, firms likely to drop their free sample offers and focus more on customers’ retention.

What is the second marketing principle?

MP#2: all customers change, and an effective marketing strategy must manage customer dynamics

What is the evolution of approaches for managing customer dynamics?

Lifecycle approach: uses generic stages of growth and their position in the lifecycle to determine customer preferences and associated strategies.

Dynamic customer segmentation: segments a firm’s existing customers based on expected migration patterns.

Customer lifetime value: captures the contribution of each customer according to his or her expected migration path over the entire lifetime with the firm.

What are the inputs to the customer dynamics framework?

Firm’s existing customer portfolio

Data linking past customer responses with specific marketing programs and the programs’ cost.

The qualitative and quantitative information from lost customer analysis (cause of defection, where they go, effective recovery strategies)

What is the process for managing customer dynamics?

Lifecycle approach

Dynamic segmentation

AER model and lost customer approach

Customer lifetime value (CLV)

Choice, factor, cluster models

What are the outputs of the customer dynamics framework?

A description of the firm’s customer personas and expected migrations to understand how they change, including:

Critical life event triggers

The products and services they buy at different points in their lifecycle migration. When they stop buying it and why

How they feel at different stages in their lifecycle

The CLV of customer in each persona

AER positioning statements: how to best position the firm in each persona/AER stage.

AER strategies: what marketing strategies work best for each persona/AER stage.

What are the lifecycle approaches?

Customer lifecycle: capture how individuals typically change as they age and reach common milestones.

Product lifecycle: products go through four typical stages in society: introduction, growth, maturity, and decline.

Industry lifecycle: comprises of 5 stages

Early establishment of its range and boundaries.

An innovation stage to set a “dominant design”.

The shakeout stage, marked by economies of scale, such as that smaller players get forced out.

Maturity, when firms focus on market share and cash flows

The decline stage when sales decay for the industry as a whole.

What is customer dynamic segmentation approach (AER model)?

Evaluates existing customer’s behaviors/needs to understand temporal differences:

Customers are “temporally” similar in each stage (assumption)

Matches marketing action domains (acquisition is often a self-contained marketing domain)

Dynamic based segmentation is sometimes called Acquisition-Expansion-Retention (AER model) because it captures customers entering the firm’s portfolio and expanding over time:

Acquisition stage: begins with first contact, before the first purchase occurs

Expansion stage: upsell or cross-sell to expand engagement with existing customers

Retention stage: deals with customers who may migrate away in pursuit of “greener pastures”

What is lost customer analysis informs AER strategies?

Identify the cause of customer churn & work backward to ensure other customers don’t leave for the same reason. 3 steps process:

Set regular intervals for contacting lost customers to identify the cause of churn (choice models) and potential recovery strategies.

If the lost customer is not in the firm’s main target segment, firms could:

Change acquisition criteria

Evaluate an expansion to address of customer.

If the lost customer is in the firm’s target market, firms should:

Fix the problem

Implement retention strategies to build brands and relations

What is RFM analysis for segmentation?

Direct marketers for years have been using 3 readily available customer behaviors:

Recency: time elapsed since last purchase

Frequency: purchases in last period

Monetary: purchases in last period

These RFM variables put customers in rank-ordered groups, based on their value in the past year (not by modeling but by rank-order sorting).

Using the profits generated from a test mailing to a few customers from each group, direct marketers then mail the catalog only to the groups with an acceptable return in investment.

Customer lifetime value (CLV) is a key analysis tool for making AER decisions, what is it?

CLV approach: evaluates a firm’s profit as the sum of each customer’s lifetime discounted cash flows.

Approach captures “true”contribution of each customer at any stage by accounting for:

Customer heterogeneity and dynamic effects (individual level, uses transition expectations, and discounts future profits)

Tradeoffs among AER strategies (e.g., how acquisition may affect retention)

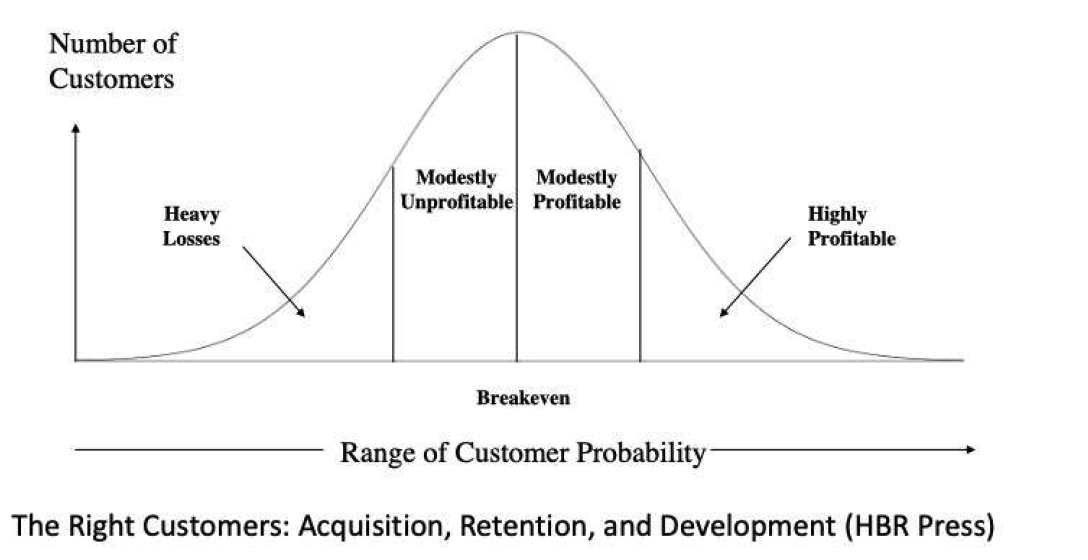

CLV also accounts for varying profits across customers, what is “Beyond 80/20 rule” and CLV analysis?

Beyond 80/20 rule: firms earn 150% of their profits from 30% of their customers

CLV analysis: captures these differences among existing customers and identify “best customers”

How does CLV accounts for the time varying profits of your customers?

Annual earnings typically increase over a customer’s life due to cross/up-selling

Some customers are more costly to acquire or retain (lowering prices, high service levels)

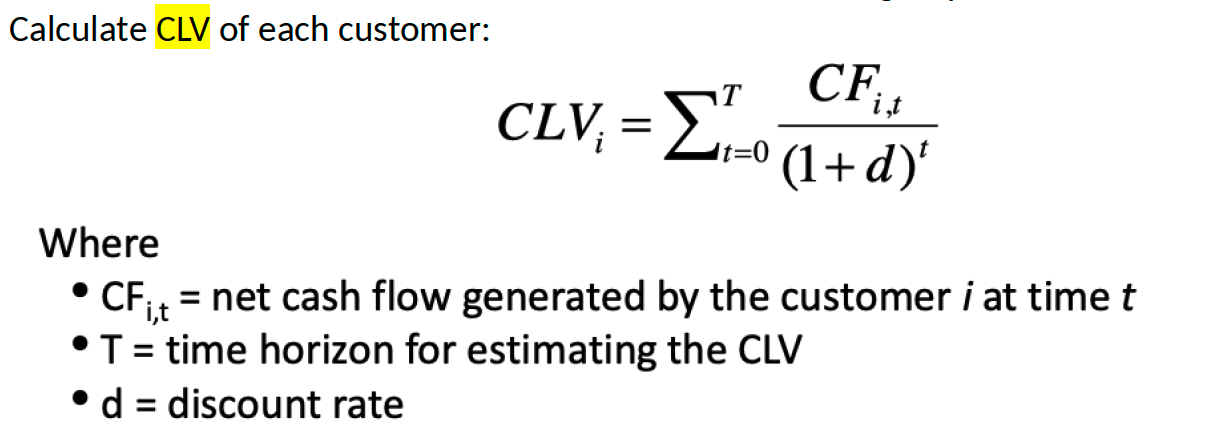

What is the CLV for each customer?

Need cash flow (sales - costs) for individual customers or group of customers

CLV is the value added by an individual customer, to the company

CLV approach is a form of customer-centric accounting where firm’s value is the sum of all its customers’ CLV

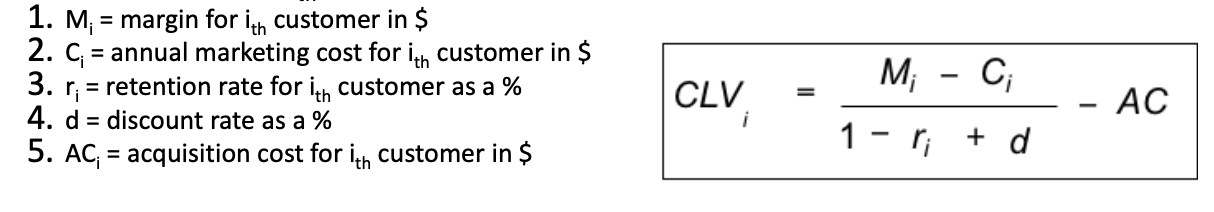

What is the formula for simplified customer lifetime value analysis?

What are the generalizations on AER strategies from CLV analysis?

AER strategy that maximizes CLV maximizes neither the acquisition rate nor retention rate.

Investments in customer acquisition and retention have diminishing marginal returns.

Under spending in acquisition and retention is more detrimental and results in smaller CLV than overspending.

A suboptimal allocation of retention expenditures will have a larger detrimental impact on long-term customer profitability than suboptimal acquisition expenditures.

What is customer referral value (CRV)?

Lifetime value of customer bringing the firm another customer

Highest CLV customers do not always generate the highest CRV

“Advocates” real value is higher than a CLV would predict so you need to protect these customers (3x more in 1 study)

Identifying advocated: protect, enable, expand