Exam 2 Ec202

1/45

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

46 Terms

Unemployment

Results in loss of income and production

structural unemployment

Changes in industry are present such as technology, geography and skill of workers

frictional unemployment

temporaty unemployment from normal job transitions

cyc;ical unemployment

due to recessions

unemployment rate

unemployed workers / # of workers in labor force

participation rate

labor force / working age population

consumer price index

used to measure price changes over time

( Cost of basket (current) / cost of basket (base year) ) times 100

calculation to measure CPI

food and drink, transportation, healthcare, clothing, recreation, education, housing

goods and services included in the CPI basket

Inflation

Rise in prices and decrease in value of currency

Phillips curve

The belief that there is an inverse relationship between unemployment and inflation

disruption of credit markets, decrease in asset value, poorest get poorer

Results of inflation

Nominal Interest Rates

Price of money now vs price in the future

Real interest rates

price of goods and services now vs in the future

deflation

falling prices that delay consumer spending

growth in supply

increase in population, employment and labor hours

real GDP

GDP adjusted for inflation

nominal GDP

GDP not adjusted for inflation

nominal GDP / real GDP x 100

GDP deflator

nominal GDP / GDP deflator x 100

real GDP

y = AK ^ a N ^ 1-a

Cobb-douglas production function

The key to long run growth

Total Factor Productivity

Constant Returns to scale

if K and N change, the output changes at the same rate

diminishing returns to scale

If one input changes, the output gains get smaller and smaller as the scale increases

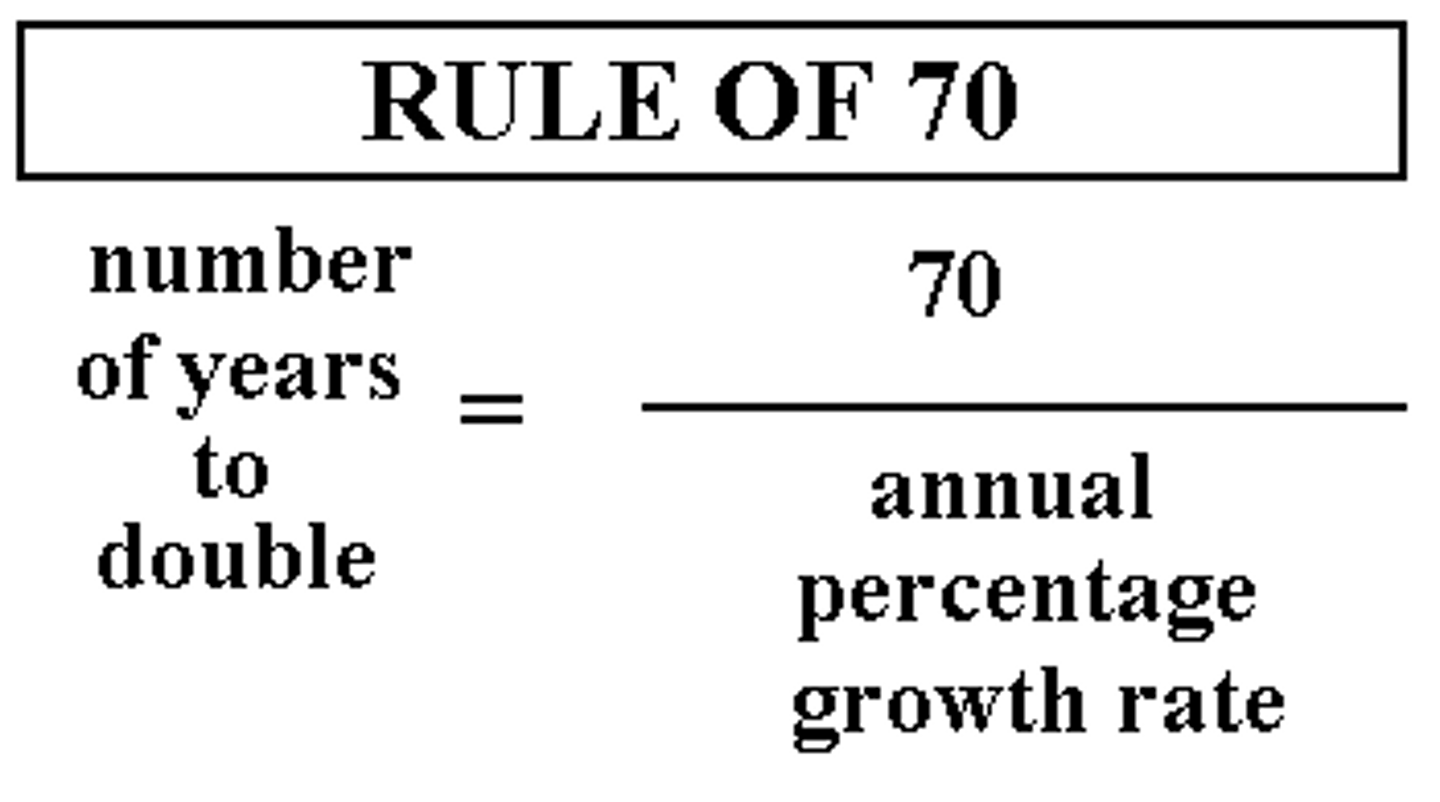

# of years it takes for a variable to double

the rule of 70

(y(t+1) -y(t))/ y(t)

Function to find Real GDP (yt+1 = future period) yt = earlier period

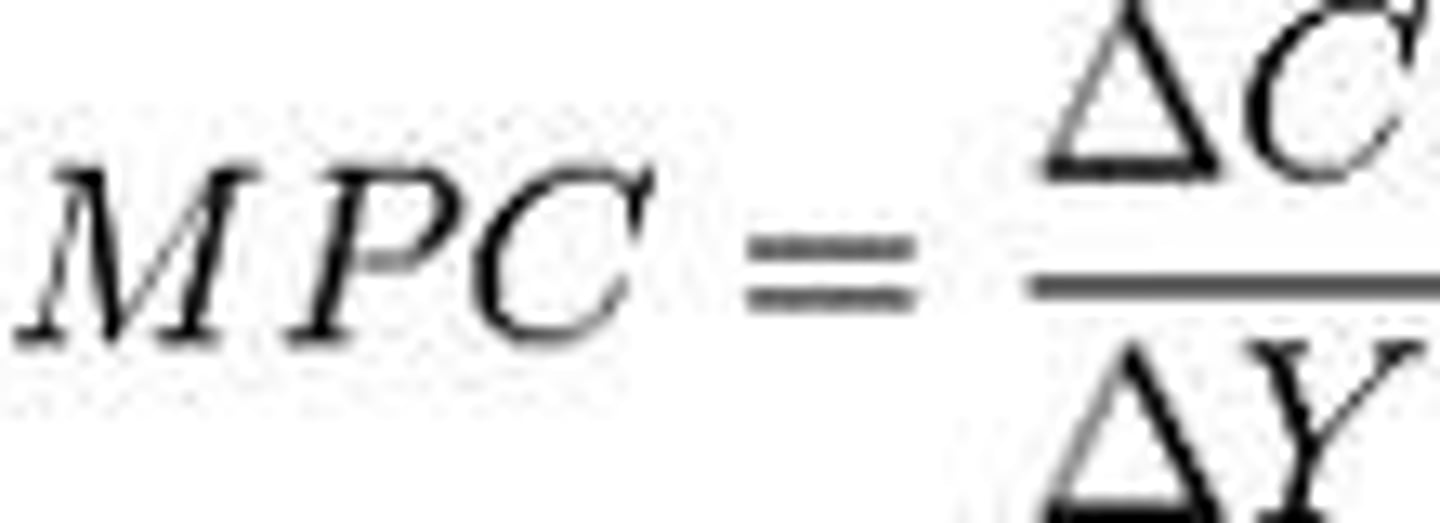

Marginal Propensity to Consume (MPC)

Change in consumption / disposable income

disposable income

GDP per capital - net taxes

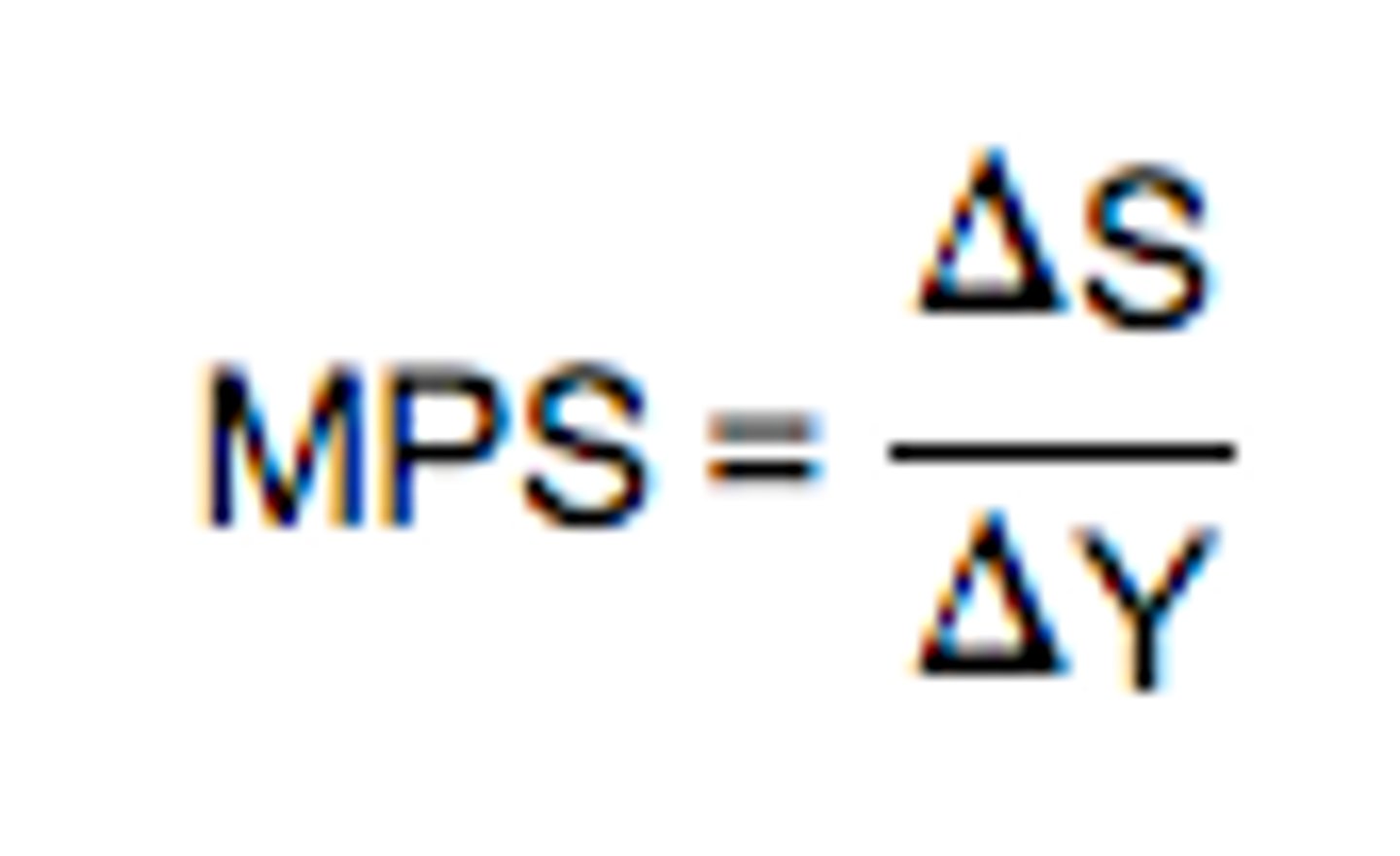

marginal propensity to save

change in money saved / disposable income

Y

real GDP

C

consumption

I

investment

G

Government spending

X

exports

m

imports

Y = C + I + G + (X - M)

Aggregate Expenditure Sum

John Maynard Keynes

Economist who shared ideas about aggregate supply and demand

aggregate supply

total output of goods at different price levels (relationship between supply and price)

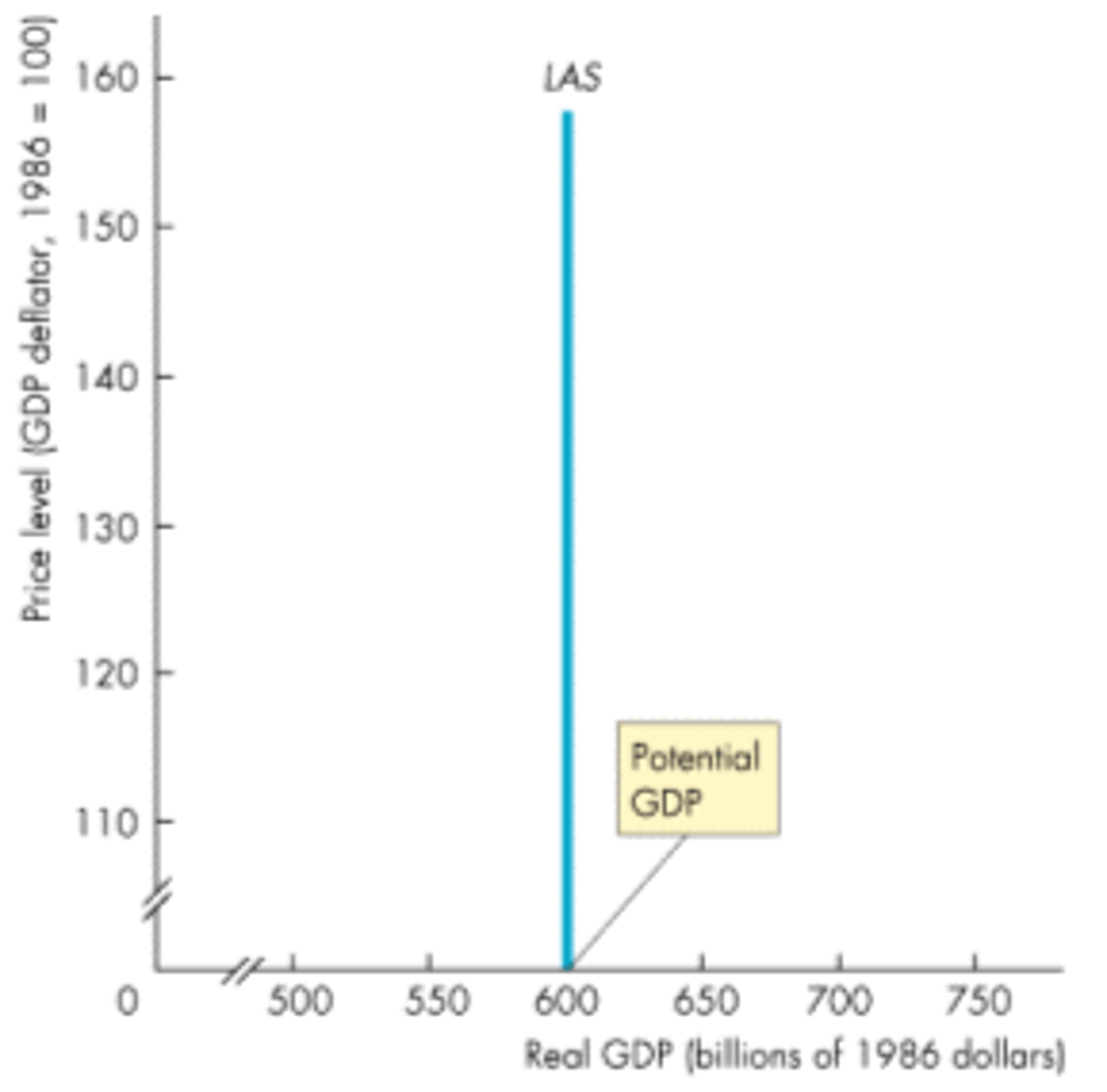

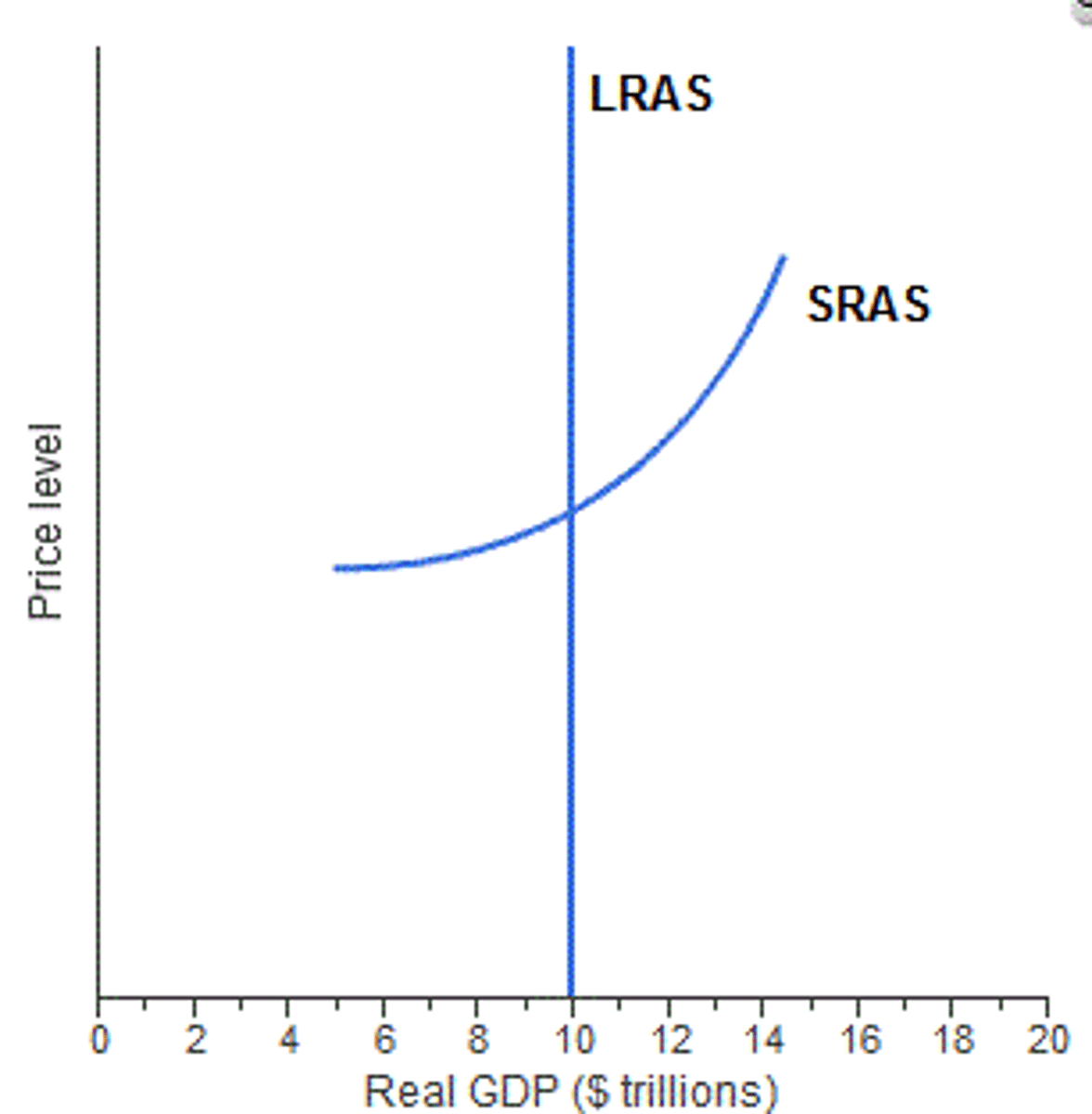

Long Run aggregate supply

the relationship between the quantity of real GDP supplied and the price level when the money wage rate changes in step with the price level to maintain full employment

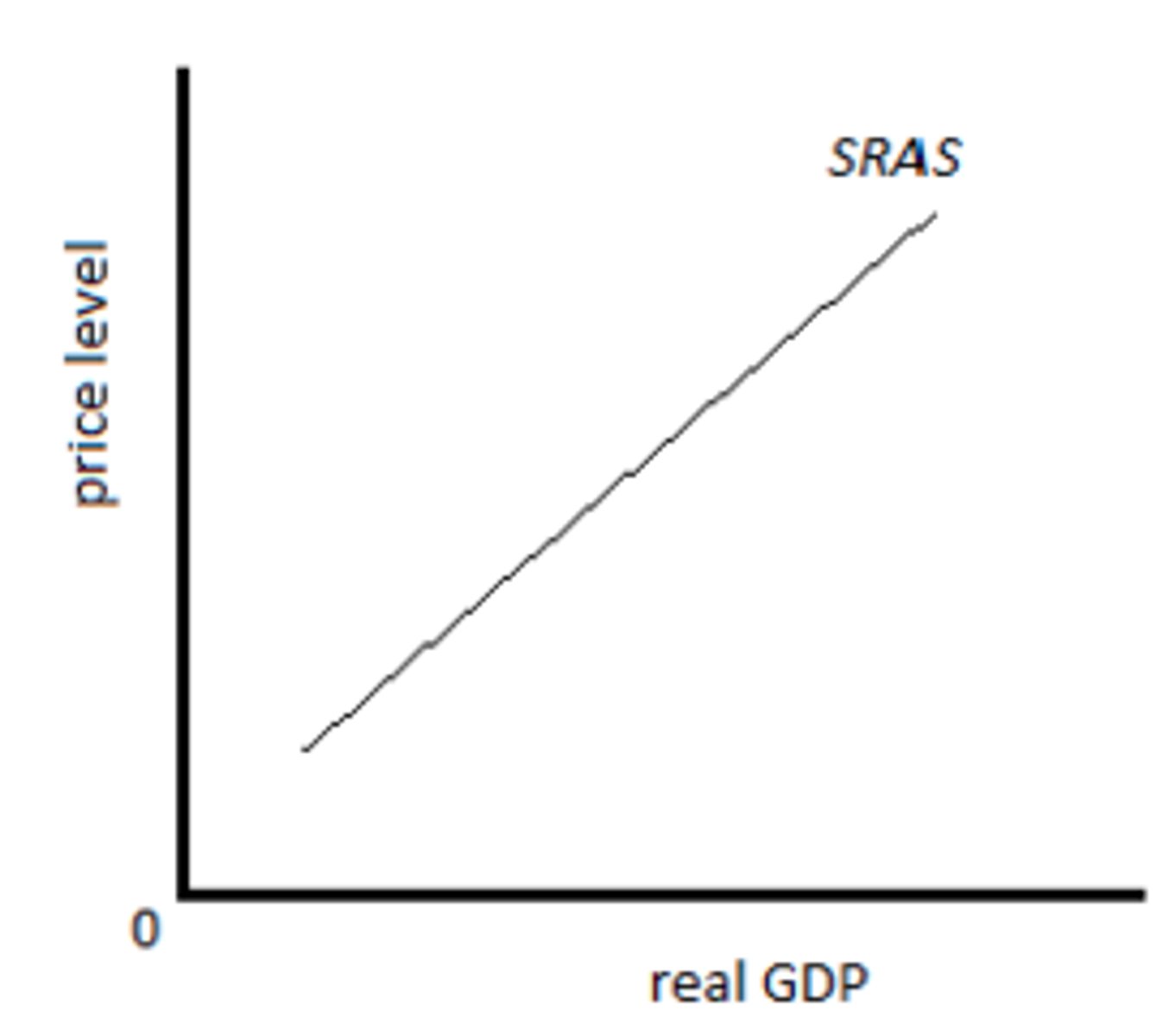

short run aggregate supply

The relationship between the quantity of real GDP supplied and the price level when the money wage rate, the prices of other resources, and potential GDP remain constant.

Long Run equilibrium

occurs when real GDP = Nominal GDP

Increased of aggregate demand

Caused by increases in spending by the government and consumers

short run equilibrium

When aggregate demand equals short run aggregate supply

potential GDP

GDP of a country when the employment rate is 100%

recession

GDP is less than its potential

when GDP is above potential GDP

Recession could be incoming