EDEXCEL A-LEVEL BUSINESS FORMULAS

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

% mark up

(Difference in price/original cost) X 100

% change

((New value - old value)/old value) X 100

Price elasticity of demand (PED)

% change in quantity demanded/% change in price

Income elasticity of demand (YED)

% change in quantity demanded/% change in income

net cash flow

cash inflows - cash outflows

opening balance

cash balance at the start of the month

closing balance

opening balance + net cash flow

cumulative flow

sum of all closing balances

sales revenue

selling price X quantity sold

total variable costs

variable cost per unit X quantity sold

total costs

fixed costs + variable costs

profit

total revenue - total costs

break even output

fixed costs/contribution per unit

contribution per unit

selling price per item - variable cost per item

total contribution

contribution per unit X quantity sold

margin of safety

actual output - break even ouput

budget variance

budget amount - actual amount

gross profit

sales revenue - cost of sales

gross profit margin

(gross profit/revenue) X 100

operating (net) profit

gross profit - (fixed costs+variable costs)

operating profit margin

(operating profit/revenue) X 100

net capital employed

non-current liabilities + equity

current ratio

current assets/current liabilities

acid test (quick ratio)

(current assets - stock)/current liabilities

capital intensity

capital goods/fixed costs X 100

labour productivity

Total output/number of employees

labour turnover

number of employees leaving/total number of employees X 100

average cost per unit

total production costs/total output

actual output/maximum possible output X 100

capacity utilisation

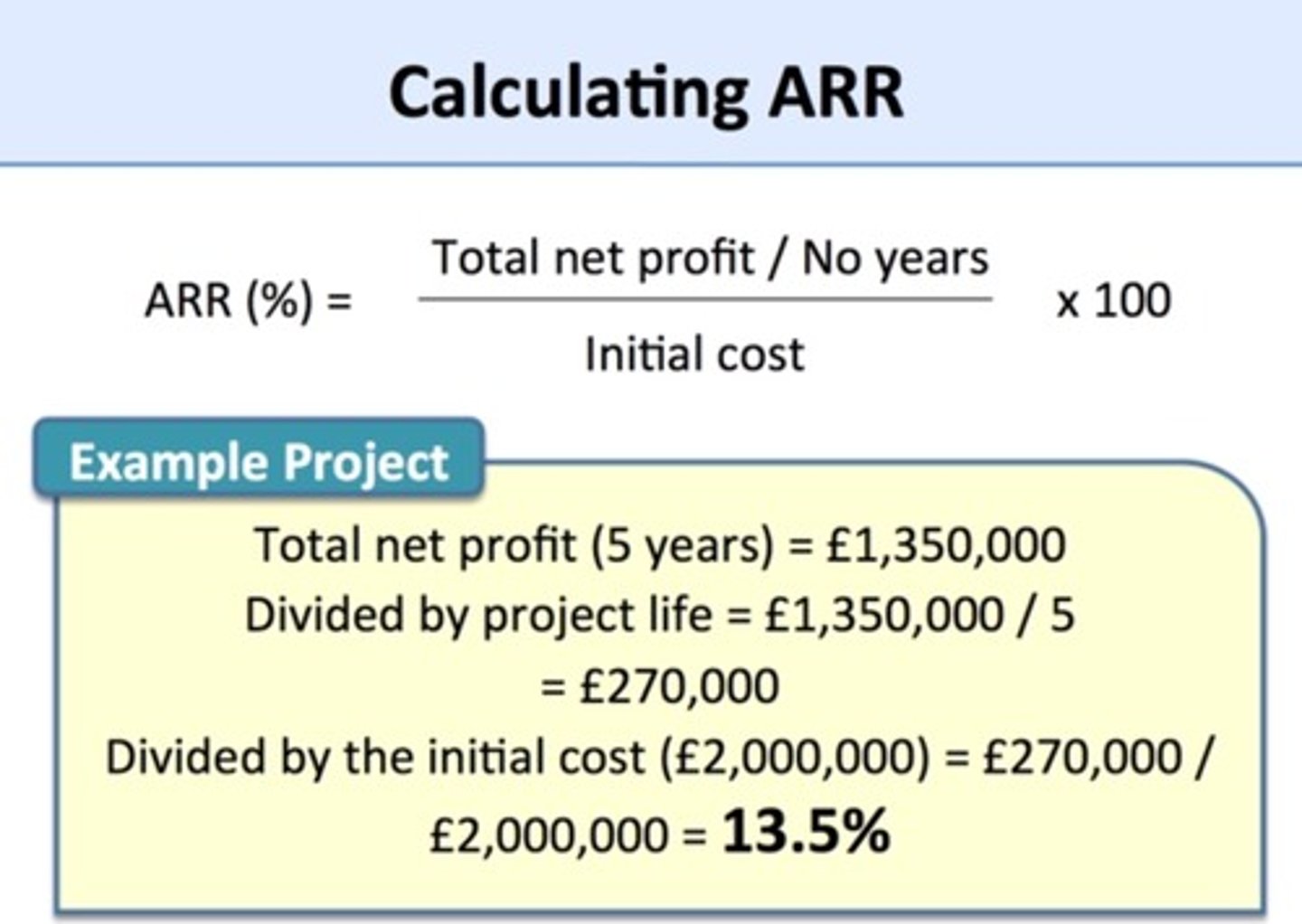

Average Rate of Return

Gearing Ratio

Non-Current Liabilities / Capital employed

x 100

Return on Capital Employed

Operating Profit / Capital Employed

x100

Rate of Absenteeism

(Number of day absent on a day)/ (Total number of staff employed)

x100