Managerial Economics: Theory of Production and Surplus

1/90

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

91 Terms

Production Function

Relationship between inputs and outputs over time.

Total Product (TP)

Total output of goods or services produced.

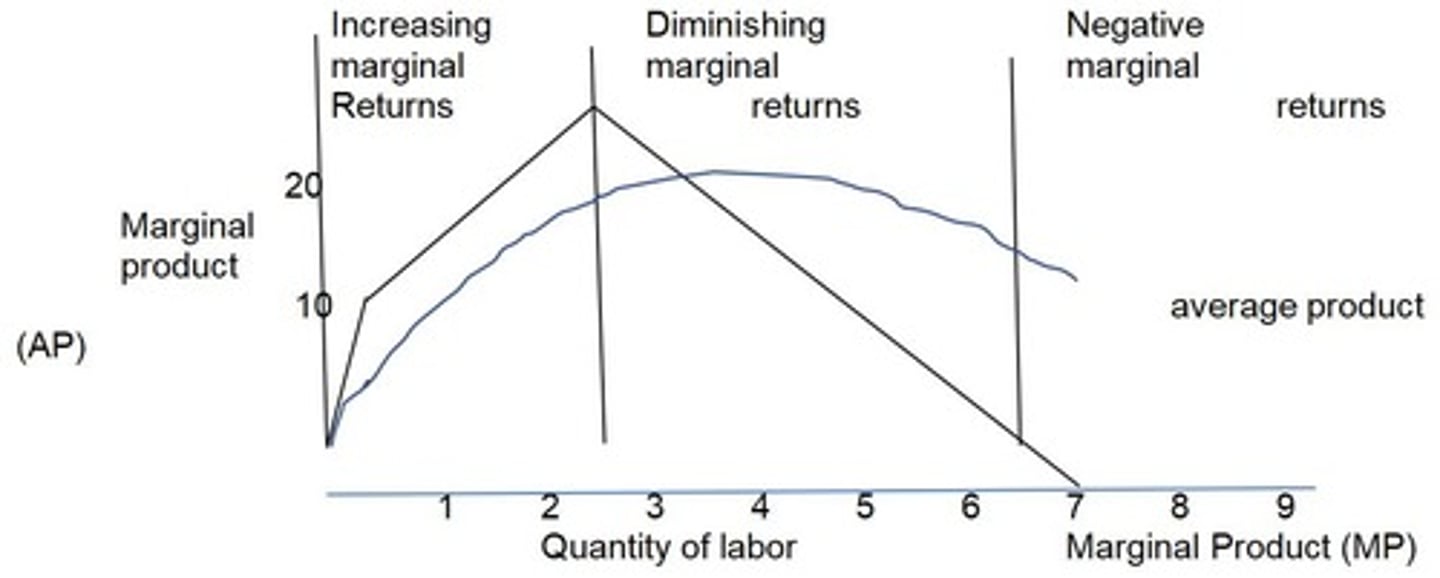

Marginal Product (MP)

Additional output from one more unit of input.

Average Product (AP)

Output per unit of labor employed.

Law of Diminishing Returns

Decreasing additional output with increased input.

Stage of Increasing Returns

Output increases more than proportional to input.

Stage of Decreasing Returns

Additional input yields less additional output.

Stage of Negative Returns

Total product declines after peak output.

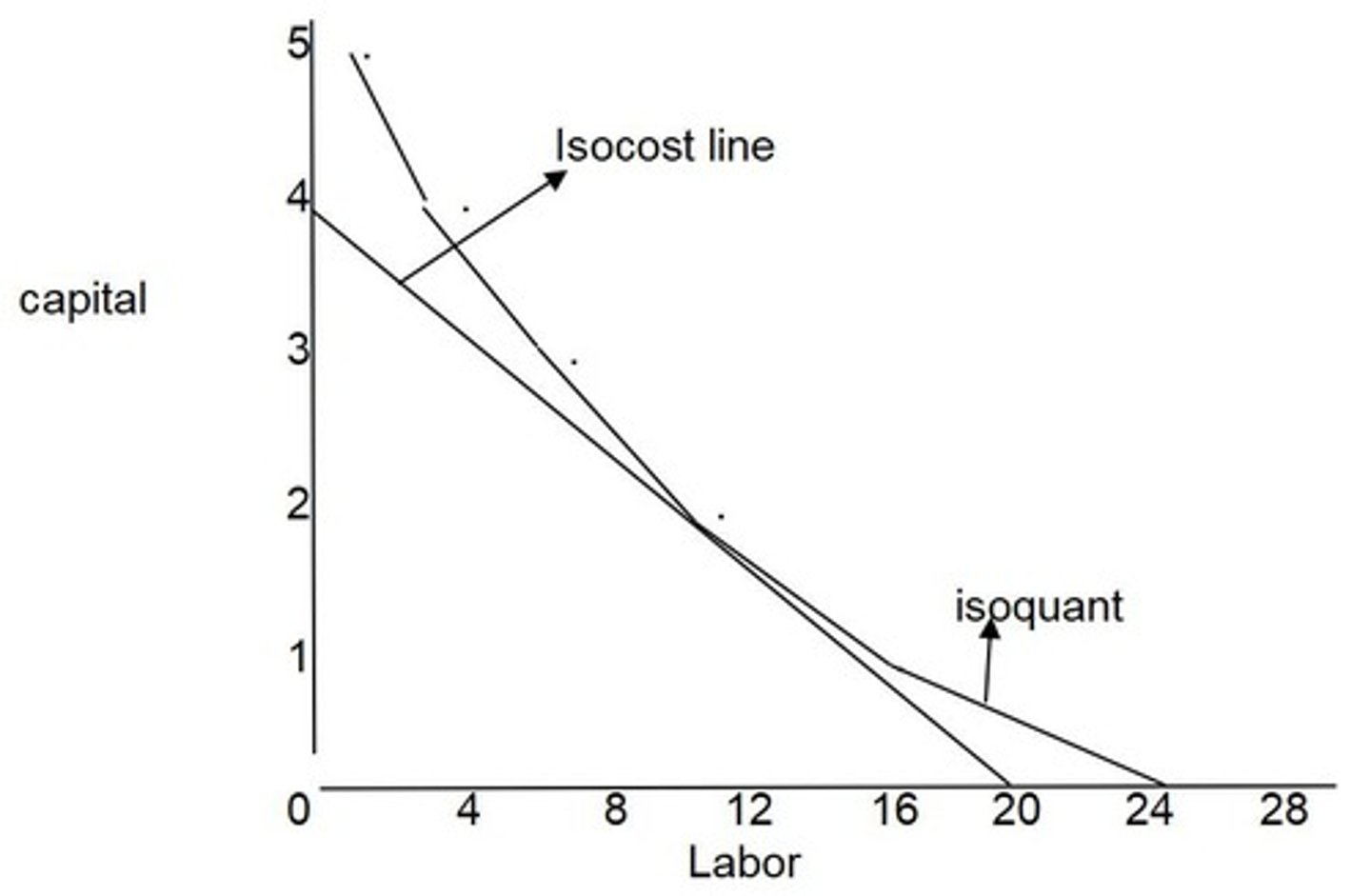

Isoquant

Graph showing input combinations for same output.

Isocost Line

Graph of input combinations for a given cost.

Breakeven Quantity

Quantity with zero profit or loss.

Input Substitution

Replacing one input with another in production.

Convex Isoquant

Increasing second factor needed for first factor decrease.

Labor Cost

Expense incurred for employing labor in production.

Capital Cost

Expense incurred for using capital in production.

Production Process

Method of transforming inputs into outputs.

Variable Input

Input that can change in quantity during production.

Fixed Input

Input that remains constant regardless of output.

Graphical Representation

Visual depiction of economic relationships and data.

Optimal Combination of Inputs

Best mix of inputs for desired output level.

Cost Minimization

Achieving desired output at the lowest cost.

Production Stages

Different phases of output response to input changes.

Input Costs

Expenses associated with acquiring production resources.

Isoquant

Graphical representation of input combinations yielding output.

Indifference Curve

Shows consumer preferences between two goods.

Buyer-Seller Relationship

Interaction where buyer values product and seller values cost.

Investment Decision

Evaluating current costs against future gains.

Discounting

Calculating present value of future cash flows.

Present Value Formula

PV = FV/(1+i) for cash flow valuation.

Future Value Formula

FV = PV x (1+i) for future cash estimation.

Interest Rate (i)

Percentage used in discounting and compounding calculations.

Transaction Surplus

Gains from exchange between buyer and seller.

Buyer Surplus

Difference between buyer's value and agreed price.

Seller Surplus

Difference between agreed price and seller's value.

Total Surplus

Sum of buyer surplus and seller surplus.

Law of Demand

Higher prices lead to lower quantity demanded.

Demand Curve

Graph showing quantity demanded at various prices.

Demand Schedule

Table correlating price and quantity demanded.

Breakeven Analysis

Determining profitability through breakeven quantity.

Breakeven Quantity Formula

Q = F/(P-MC) for cost analysis.

Diminishing Marginal Utility

Satisfaction decreases with each additional unit consumed.

Compounding

Calculating future value based on present investments.

Rule of 72

Estimate years to double money at given interest.

Net Present Value (NPV)

Investment profitability measure comparing future cash flow.

Wealth Creation

Result of voluntary transactions between parties.

Trade-off

Balancing current costs against future benefits.

Marginal Analysis

Evaluating benefits and costs of additional output.

Marginal Revenue (MR)

Additional income from selling one more unit.

Marginal Cost (MC)

Cost of producing one additional unit.

Consumer Surplus

Difference between total value and expenses.

Optimum Price

Price maximizing profit for producers.

Price Elasticity of Demand

Responsiveness of quantity demanded to price changes.

Elasticity Coefficient

Ratio of percentage change in quantity to price.

Total Value

Sum of all marginal values for units consumed.

Marginal Utility

Additional satisfaction from consuming one more unit.

Consumer Behavior

Decision-making process based on marginal value.

Profit Calculation

Profit equals revenue minus total costs.

Revenue

Total income generated from sales.

Price Reduction Impact

Lower prices increase units sold but reduce revenue.

Sliced Kutsinta Example

Illustrates consumer choices based on marginal values.

Zero Surplus

Total value equals expenses; no consumer benefit.

Price Increase Effect

Higher prices decrease units sold but increase profit.

Demand Curve

Graph showing relationship between price and quantity demanded.

Utility Maximization

Consumers aim to maximize satisfaction per dollar spent.

Profit Maximization

Producers aim to maximize profit through pricing.

Quantity Demanded

Number of units consumers are willing to buy.

Consumer Decision-Making

Based on comparing marginal value and price.

Price Change Analysis

Evaluating effects of price changes on demand.

Marginal Cost

Additional cost of producing one more unit.

Marginal Revenue

Additional revenue from selling one more unit.

Profit Maximization

Occurs when MR equals MC.

Price Elasticity of Demand

Sensitivity of demand to price changes.

Elastic Demand

Coefficient greater than 1; demand highly responsive.

Inelastic Demand

Coefficient less than 1; demand less responsive.

Unitary Demand

Coefficient equals 1; proportional response to price.

Cross Elasticity of Demand

Sensitivity of demand for one product to another's price.

Complementary Goods

Negative cross elasticity indicates goods are complementary.

Substitutes

Positive cross elasticity indicates goods are substitutes.

Income Elasticity of Demand

Responsiveness of demand to changes in income.

Normal Goods

Positive income elasticity; demand increases with income.

Inferior Goods

Negative income elasticity; demand decreases with income.

Price Elasticity of Supply

Sensitivity of supply to price changes.

Elastic Supply

Coefficient greater than 1; supply highly responsive.

Inelastic Supply

Coefficient less than 1; supply less responsive.

Unitary Supply

Coefficient equals 1; proportional response to price.

Market Period

Immediate time after price change; no supply adjustment.

Short Run Supply

Time too short to change plant capacity.

Long Run Supply

Time sufficient for firms to adjust capacity.

Price Elasticity of Supply Coefficient

es = % change in quantity supplied / % change in price.

Cross Elasticity Formula

Exy = (Qx1 - Qx2) / (Qx1 + Qx2) / (Py1 - Py2) / (Py1 + Py2).

Ed Formula

ed = (change in quantity demanded) / (original quantity + new quantity) / 2.