Acquisition Method

1/15

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

Acquisition method: How is tangible and intangible assets & liability measured

at fair value as of the date of acquisition; any internal asset that was not previously identified needs to be identify by the acquirer as well

Acquisition method: How is contingent liability defined & measured

1) obligation from the past 2)expect costs to occurs but not yet. IFRS includes continent liabilities if their fair value can be reliably measured; US GAAP includes only those that are probable and can be reasonably estimated

SPV, if substance of relationship indictaes control by sponser, IFRS requries which method?

consolidation

what method for business combination for IFRS & Gapp

acquisition method

How is direct cost of business combonation treated

Direct costs of the business combination, such as professional and legal fees, valuation experts, and consultants, are expensed as incurred.

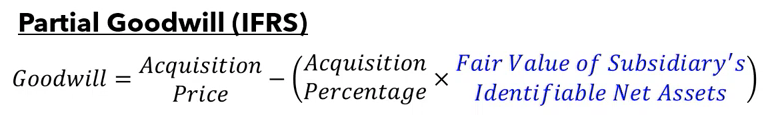

Partial goodwill fomula

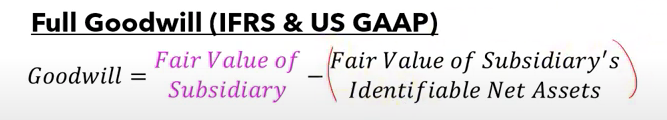

IFRS and Gapp good will option

IFRS allows full or partial good will, Gapp only allows full goodwill

Full goodwill formula

where is non controlling interest (minority interest)

separate component in equity in consolidated balance sheet

Acquisition method VS Equity Method impact on net income

net income is the same

both IFRS and Gapp requires impairment to be recognized on the

income statment

when spv is created, does it improve financial ratios

no, because consolidation is used, no changes to the ration

does spv reduce borrowing cost

yes,SPE is bankruptcy remote, and the lenders will have a direct claim on the receivables, thus allowing the SPE to borrow at preferred rates.

if a bond maybe sold before maturating, which of below can not be used 1)FVPL 2)FVOCI 3)Amortized cost

cant not use amortized cost

Acquisition, difference between calculating income earned and investment value

Dividend. 1) income earned is %*investee NI - %amortization 2) same as above but also - dividend