Theme 3B - Market failure

1/18

Earn XP

Description and Tags

Rest of causes of market failure

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

19 Terms

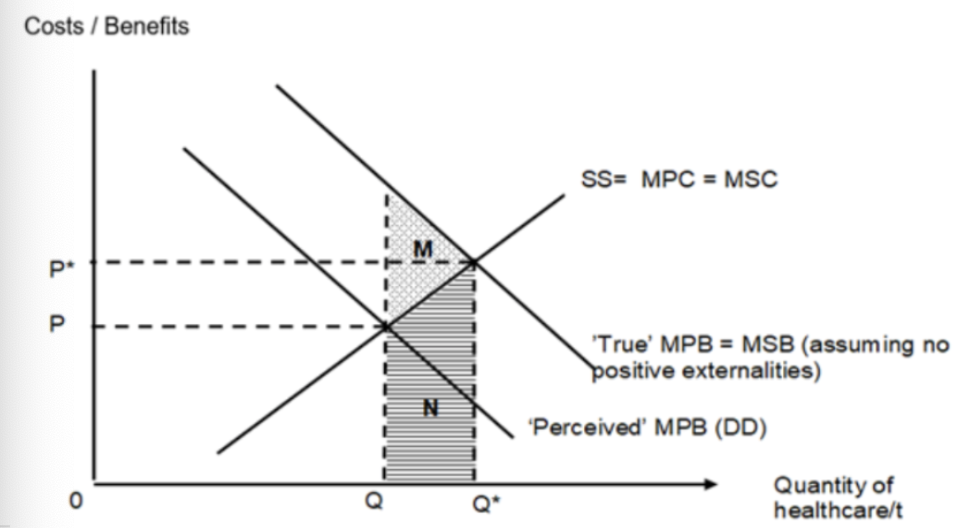

Explain how underestimation of true private benefit (consumer ignorance) causes welfare loss

Describe problem |

|

Explain market outcome |

|

Explain socially optimal outcome |

|

Explain welfare loss and allocative inefficiency |

|

Draw the graph of how underestimation of true private benefit (consumer ignorance) causes welfare loss

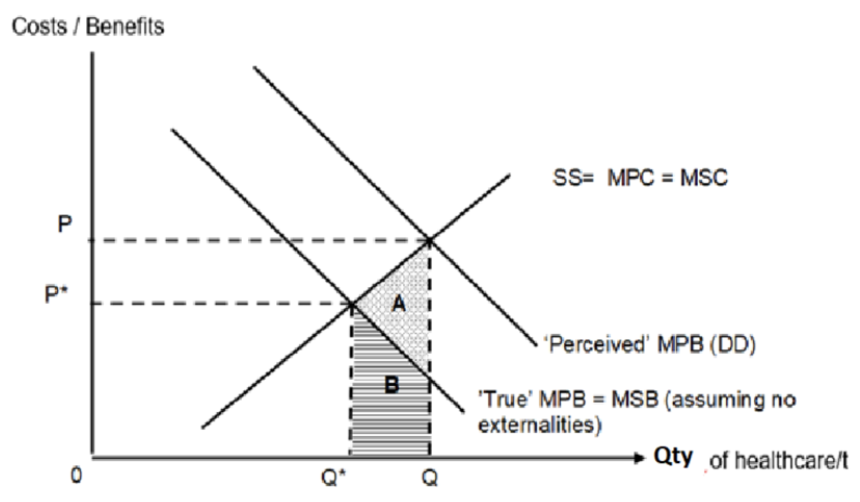

Explain how overestimation of true private benefit (consumer ignorance) causes welfare loss

Describe problem |

|

Explain market outcome |

|

Explain socially optimal outcome |

|

Explain welfare loss and allocative inefficiency |

|

Draw the graph of how overestimation of true private benefit (consumer ignorance) causes welfare loss

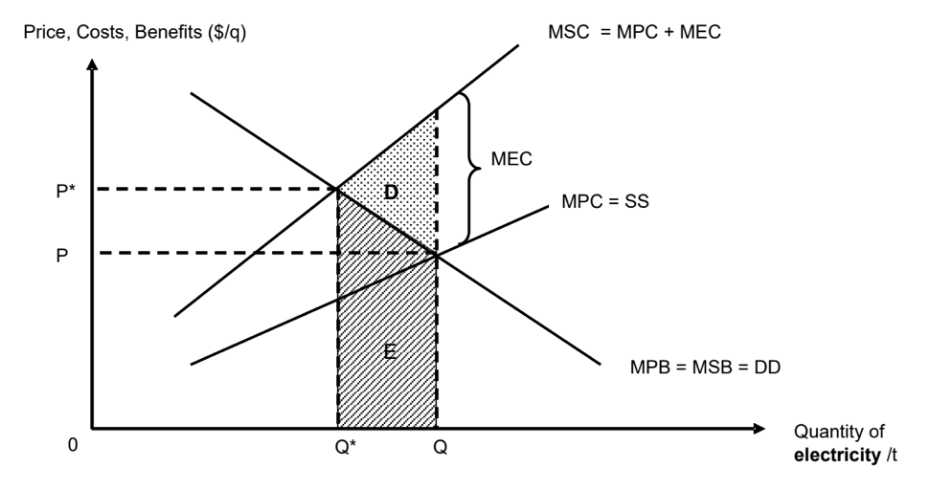

Describe asymmetric information

Occurs when one side of the market – either buyers or sellers, has better information than the other

This results in distortion of incentives and inefficient market outcomes -> problems of adverse selection, moral hazard, or supplier-induced demand -> market failure -> can lead to full market collapse, if no action is taken to correct them

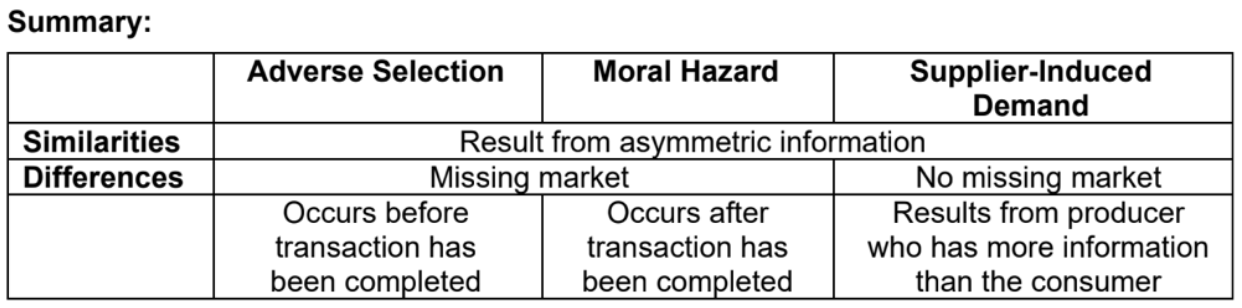

Describe how AI leads to adverse selection

Situation in asymmetric information between consumers and producers results in an unfavourable selection of products / buyers participating in a market, which leads to a missing market for a segment of other buyers / sellers, who do not get to buy or sell the good even though it is beneficial for them to do so

Occurs BEFORE the transaction has been completed

Describe AI of Uninformed sellers and knowledgeable buyers and its effects

AI leads to adverse selection

A person who buys a health insurance policy knows much more about his / her risks and needs for insurance than the insurance firm knows before the transaction

The insurance firm must pick from a pool of customers who the firm has no information on, in deciding to whom to sell the insurance to and at what price

High-cost customers -> high medical expenses (fall ill frequently)

Company assumes 50-50 high and low cost -> charge average cost of providing insurance coverage

Price would be higher than what low-cost customers are willing to pay -> drop out of the insurance market

Price is lower than what high-cost customers are prepared to pay -> join the market

Effects:

As more high-cost customers buy insurance

Average cost of insurance companies rises and the average price that insurance companies charge consequently rises

More low-cost customers drop out of the market -> the market will increasingly be dominated by high-cost customers

Only high-cost customers are left in the insurance market

Market for insurance for low-income customers disappears -> missing market

Low-cost consumers cannot buy the good and producers cannot sell the good to low-cost consumers

Since the low-cost customers are driven out of the market by high-cost customers due to asymmetric information, the potential net benefit to society from having some low- cost customers insured is lost and society’s welfare is not maximised

Hence, adverse selection leads to allocative inefficiency

Describe moral hazard

Situation in which economic agents take greater risks / act less carefully than they normally would because the resulting costs will not be borne by them (does not bear full consequences of its actions)

Occurs after transaction has been completed

Give an example of moral hazard using the insurance market

Example (insurance market) | Cause people to take greater risks because they know part of the costs of undesirable outcomes of taking risks will be borne by the insurance companies -> drive insurer's cost -> service will no longer be provided since there is insufficient incentive (profits) to offer it for sale -> missing market |

Cause (principal-agent problem) |

|

Impact | Lack of trust between potential buyers and sellers for a product -> mutually advantageous trade might not take place -> no market for it -> market failure as the potential net benefit to society from having these goods and services traded is lost and society’s welfare is not maximised -> allocative inefficiency |

Describe supplied-induced demand using doctors and patients

Arises when a producer has more information than a consumer -> consumers end up buying more goods/services than what is optimal for them

Profit-motivated doctors may lead patients to believe that certain non-essential healthcare services or tests are required

This causes the consumers’ perceived MPB to be higher than the true MPB

Since consumers’ demand is based on their perceived MPB of the service, consumers consume until perceived MPB = MPC, at Qe

If consumers had full information on true MPB, they will consume until true MPB = MPC at Q*e

Q > Q* (overconsumption)

This results in welfare loss of area A because for each of the units between Q* and Q, the MSB (True MPB) is lower than the MSC and a net loss is incurred by society from consuming those units

Draw graph of supplied-induced demand using doctors and patients

Compare adverse selection, moral hazard and supplier-induced demand

Define factor immobility

(Def.): refers to the inability or/and unwillingness (barriers) of factors of production to move between different industries of locations

Compare occupational and geographical immobility

Occupational immobility | Geographical immobility | |

Definition | Refers to the inability or/and unwillingness of factors of production to move between occupations or industries | Refers to the inability or/and unwillingness of factors of production to move between geographical areas |

Causes |

|

|

Explain how factor immobility leads to market failure

DD may change -> FOP unwilling or unable to move to expanding sectors that needs more FOP -> FI leads to unemployment -> wastage of resources -> economy producing at a point inside the PPC -> productivity inefficient -> allocative inefficient

Eg. Aging population -> increase demand for healthcare and decrease demand for primary education:

Decrease in derived demand for primary school teachers -> teachers retrenched -> these people with job-specific skills probably do not have the relevant skills to take up jobs available in the healthcare industry and will remain unemployed (resources ‘wasted’) (this is structural unemployment)

Healthcare industry not able to get the desired amount of labour needed to increase quantity supplied to meet the rise in demand -> cannot produce at the socially optimal level of healthcare services -> welfare loss

Describe market dominance

Imperfectly competitive firms that possess market power will produce at a level of output lower than the socially optimal level (underproduction) -> welfare loss to society -> allocative inefficiency

Describe public goods

Good that is non-excludable, non-rivalrous and non-rejectable

Eg. National defence, street lighting, flood control systems

Non-excludability: it is impossible or very costly to prevent someone who has not paid from consuming the good

Non-rivalry: consumption of the good by one person does not diminish the availability of the good for another person -> consumption of the good by more people does not incur any additional costs (marginal cost of providing for an additional user is zero,this does NOT mean MC of producing the good is zero)

Non-rejectability: inability of consumers to refuse the consumption of a good once it has been produced

Explain how public goods lead to market failure

Since public goods are by nature non-excludable, it is impossible or impractical for producers to exclude those who have not paid from consuming the flood protection

Since consumers can be free riders, they would not be willing to pay for the good and hence there is no effective demand

With no demand, producers will be unable to sell their good at any positive price level and thus will not be able to earn revenue to cover the cost of production

At zero price, no profit-motivated private producers would be willing and able to supply the flood protection

When left to the free market, there will be no production of coastal protection infrastructure and total market failure occurs

The potential net benefit to society from having some level of coastal protection infrastructure produced and consumed is lost

State policies to address occupational and geographical immobility

|

|

Occupational Geographical