Corporate Finance Ch4

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

market cap(italization)

number of outstanding shares * closing price

Earnings per share

net income after taxes, interest, etc. / #of shares held by investors

dividend yield

dividend / stock price

ETF

exchange traded funds— a whole portfolio of stocks, not just one. S&P 500,Dow Jones

book value of equity

assets - liabilities

going-concern value

created when a collection of assets is organized into a healthy operating business

shortcomings of book value as a tool to measure market value

does not account for inflation

exclude intangible assets— IP

ignores going-concern value

liquidation value

what investors get when company fails and assets are sold.

2 approaches to valuing stocks

valuation by comparables (compare P/E and P/B)

forecast and then discountthe dividends or future cash flows

P/E

price to earnings ratio

P/B

Price to book ratio

how to estimate stock price with EPS and P/E

EPS * P/E

enterprise value

equity market cap + debt — the value of the firm to all debt and equity holders

EBIT vs. EBITDA

earnings before interest tax

earnings before interest depreciation amortization

how to estimate stock price using enterprise value

enterprise value - debt = market cap equity

then divide by outstanding shares

PV of a stock, known as dividend discount model

PV (price) = discounted cash flows ofall future dividends

reimann sum div / (1+r)^t

where t = infinity because stocks have no maturity

r = demanded rate of return

cost of equity

the r that investors demand of thestock.

expected return

expected returns = (Dividends + Price Sold - Price at investment) / price at investment

estimate todays P0 stock price based on forecast for one year

(dividend+price can sell) / (1+r)

risk class

all stocks of equivalent risk are priced to offer the same expected return

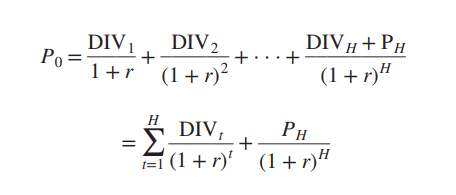

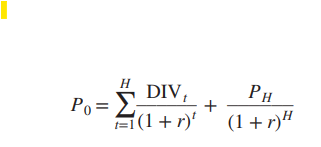

Find P0 using future prices and dividends until time H

if H goes to infinity, then remove the PH/(1+r)^H part of equation— it is 0

constant growth of dividends DCF model (growing perpetuity)

P0= DIV1 / (r-g)

dividend yield

DIV1/P0

plowback ratio

1- DIV/EPS

1-payout ratio

amount reinvested

ROE

EPS/book equity per share

Dividend Growth rate using plowback ratio and ROE

g=plowback ratio * ROE

plowback = 1- DIV/EPS

P0 DCF model with 2+ stages of growth

When to use perpetual growth formula vs. DCF with 2+ growth rates

if growth exceeds economy growth, it is not sustainable probably. that indicates growth will change and you should use DCF

or, if ROE appears to be increasing forever. it will not— it will reach a stable long term level

growth stocks

bought for capital gains, not dividends. longer term

income stocks

for shorter term and dividends

PVGO

net present value of growth opportunities

NPV of all investments the company is expected to make in the future

growth stocks have positive PVGO

how can we think of stock prices

value of average earnings under a no-growth policy + PVGO

P0 = EPS1/r + PVGO

Present Value of level stream of earnings

EPS1/r

PVGO

NPV1 / r-g

valuation based on free cash flows

wider picture, only concerned with what is available to be paid out to shareholders, not how its actually divided. FCF = earnings - new investment

FCF PV H

PV= reimann sum (FCFt)/(r+r)^t + PVh / (1+r)^h

remember, PVh is just price at time h

can estimate with P/E and P/B. then discount back when you plug into equation

does faster growth require increased investment?

yes. this reduces Free cash flow.

can ROA continue above the discount rate forever?

no,at some point you will be maintaining your profits, no longer growing.

at PV horizon, should PVGO = 0?

yes. PV horizon = earnings horizon + 1 /r