Global economics

1/121

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

122 Terms

Gains from international trade (7)

Lower prices — consumers can import the goods they want from the country that can make them the cheapest; doesn’t necessarily have to buy the good domestically

Greater choice — consumers can choose from goods that are made all over the world, not just in their own country

Differences in resources — firms may now have access to resources which cannot be found domestically

Economies of scale — producers can sell to a larger market which allows them to grow and to further exploit economies of scale to produce more efficiently

Increased competition — free trade opens up the world market to a large number of firms that will compete. Competition will lead to more diverse products, more quality and lower prices

More efficient allocation of resources — resources can now be used in the country that can make most efficient use of them

Source of foreign exchange — countries can use free trade to get foreign currency or make dispose of domestic currency (foreign countries can pay for goods they import in their own currency)

Absolute advantage

when a country can produce a good using fewer resources than another country

Comparative advantage

when a country can produce goods at a lower opportunity cost than another country

Limitations of the theory of comparative advantage (7)

Perfect knowledge is assumed

No transport costs

Only two economies producing two goods, while in reality there are a lot of economies producing a lot of goods

It is assumed that costs of production do not change and that the returns to scale are constant, while in reality this won’t be the case.

It is assumed that the goods that are being traded are completely identical, while in reality differentiation within goods is possible.

It is assumed that factors of production remain in the country, while in reality factors of production can travel between countries.

It is assumed that there is perfect free trade among countries, while in reality trade barriers exist.

Other administrative barriers to trade protectionism (2)

Requiring a lot of paperwork before a good can be imported (“red tape”

Setting high health and safety standards the products have to comply to in order to be imported

Arguments for protectionism (7)

Domestic jobs are protected because domestic consumers are more dependent on domestic production.

Protection can reduce dependence on international trade and can this way protect national security.

Infant industries can freely develop when they do not face competition from foreign established producers.

Maintenance of health, safety and environmental standards

Foreign producers can use the market of other countries to dump excess production at extremely low prices. Protectionism protects domestic producers for this kind of unfair competition.

Protectionism limits imports, this way a balance of payments deficit can be overcome

The government can profit out of tariff revenues.

Arguments against protectionism

It raises prices because its limits free trade.

Import is limited, which limits the diversity of goods being supplied on the domestic market, limiting consumer choice.

Competition diminishes, which reduces the positive effects of competition such as improved quality and diversification of products.

Foreign countries may retaliate with trade barriers of their own, harming the exporting companies of the domestic country (trade wars).

Resources may not be used in the country that can make most efficient use of them: misallocation of resources

Because governments can earn major sums of money by using tariffs there is great potential for corruption, especially in less developed countries.

Domestic companies may focus more on the domestic market due to the barriers, thereby reducing their export competitiveness.

Increased cost of imported factors of production, because tariffs and quota may also apply to these

Advantages of monetary union (5)

Elimination of exchange rate uncertainty and fluctuations, increasing investment into the union

A common currency is more stable against speculation

Lower perceived currency risk increases business confidence in member countries

Elimination of transaction costs between member countries that now use the same currency

Price transparency across member countries, as all prices are now expressed in the common currency

Disadvantages of monetary union (4)

The power to set interest rates and monetary policy is transferred from the member states to a common central bank

Irresponsible spending or debt accumulation by some member countries could hurt the entire union

Individual countries cannot influence their exchange rate to boost the competitiveness of their exports or lower the price of their imports

Initial costs of converting the individual currencies into one currency are extremely large

6 degrees of economic integration

Preferential trade agreement — gives countries access to certain products from certain countries by reducing tariffs/by other agreements related to trade

Free trade areas — countries are able to trade freely among themselves but can also trade with countries outside

Customs union — same as free trade areas, as well as adopting any common external barriers against any country outside of the union

Common market — a customs union with common policies on product regulation and free movement of goods, services, capital and labour

Monetary union — common market with common currency and common central bank

Complete economic integration — countries have no control of economic policy, full monetary union with complete harmonisation of fiscal policy

Advantages of economic integration

Lower transaction costs

Certainty

Price comparison

Trade creation (see later)

Transparency

Helps attract foreign direct investment due to larger market

Disadvantages of economic integration

Loss of economic sovereignty

Interest rate might not fit the situation of all countries involved

Asymmetrical shocks affect different countries within the union differently

Economic integration

The unification of economic policies between different states through the partial or full abolition of tariff and non-tariff restrictions on trade taking place among them prior to their integration.

Trade diversion

Before entry into the customs union, the country imported from country x without barriers. With entry into the union, tariffs are imposed on country x (non-member) and the product is therefore imported from member countries at higher price instead of from country x.

Trade creation

With the entry of the country into the customs union, countries can regain comparative advantage which was hindered by previous trade barriers. Now this country can trade more by exploiting this advantage and producing more of the good.

WTO objective

Increase international trade by lowering trade barriers and provide a forum for negotiations

Functions of the WTO (6)

Administer Wto trade agreements that the Wto has set up between countries.

Be a forum for trade negotiations and facilitate in setting up trade deals.

Handle trade disputes among member states.

Monitor national trade policies.

Provide technical assistance and training for developing countries.

Cooperate with other international organisations in order to increase trade

Factors that limit the effectiveness of the WTO (3)

Some economies, especially the USA and the EU are said to have too much power in the Wto and its trade negotiations

Trade rules that are unfair toward developing countries and fail to protect their “infant industries”

Growing number of trade deals are negotiated outside of the WTO

Exchange rate

Value of 1 currency expressed in terms of another currency

Freely floating exchange rate regime

Value of the exchange rate is determined solely by the demand for and supply of that currency

Depreciations

A decrease in the freely floating exchange rate due to market shocks

Appreciations

An increase in the freely floating exchange rate due to market shocks

Factors that influence supply of and demand for a currency (5)

Foreign demand for exports: when foreign demand for exports increases, demand for the currency will increase because foreign nations will need to buy the exports in the domestic currency.

Domestic demand for imports: when domestic demand for import increases, the supply of the domestic currency increases because domestic consumers will need to buy the import in the foreign currency. They will need to exchange the domestic currency for the foreign currencies.

Domestic interest rates relative to foreign interest rates: when the domestic interest rate increases relative to the foreign interest rates, foreign investors will bring their money into the domestic country. They can only deposit money of the domestic currency on the domestic country’s banks, so demand for domestic currency (in order to exchange their foreign currencies) will increase.

Investment from overseas in domestic firms: when foreign investors invest more in domestic firms the demand for domestic currency will increase, because these investments must be made in the domestic currency.

Speculation: investors may spread rumors about the future development of exchange rates and speculate on future value. Anything can happen to the value of the currency, depending on the content of the rumors.

What happens if the domestic currency appreciates?

Domestic products will be more expensive to buy for foreign nations so exports will decrease.

This will result in decreased employment, because people producing goods for exports will be needed less, and less economic growth.

Foreign products will be cheaper to buy for the domestic nations so imports will increase.

This will result in less inflation due to decrease in price of imports.

Because exports decrease and imports increase the current account balance (X−M) decreases.

Fixed exchange rate regime

In which the value of the currency is pegged to the value of another currency

Revaluation

The rise in value of the currency caused by the government

Devaluation

A decrease in value caused by the government

Managed exchange rate regime

When the exchange rate is freely floating but there is periodic government intervention to influence the value of the exchange rate — i.e. there is a bandwidth within which the value of the currency can freely float, but if the currency goes outside this bandwidth, the government will intervene

How does the government influence demand for and supply for of a currency?

1. Using reserves of money (the central bank has in them in the vaults) to buy or sell foreign currencies:

Selling foreign currencies in exchange for domestic currency decreases the supply of and increases the demand for domestic currency.

The opposite is true for buying foreign currency in exchange for domestic currency.

2. Changing interest rates:

If a government were to increase the domestic interest rate this would draw (the money of) foreign investors to the country and they would have to exchange their foreign currency for domestic currency. This increases demand for domestic currency and decreases supply of domestic currency.

The opposite is true for a decrease in interest rates

Overvalued currency

Keeping the value of the exchange rate artificially high through periodical government intervention in the foreign exchange market

Benefits of overvalued currency (3)

Downward pressure on inflation, as imported final goods are cheap

Increased purchasing power on imported materials and goods

Forces domestic producers to improve their efficiency in order to compete in the world market with a relatively higher selling price

Possible drawbacks of overvalued currency (2)

Damage to export industries

Damage to domestic industries as domestic consumers switch to consuming imports

Undervalued currency benefits (3)

Exports appear more competitive in the world market

Increased employment in export industries

Increased employment in domestic industries

Possible benefits of undervalued currency (3)

Exports appear more competitive in the world market

Increased employment in export industries

Increased employment in domestic industries

Possible drawbacks of undervalued currency (2)

Imports become expensive

The increased price of imported materials may spur cost-push inflation

Advantages of fixed exchange rates (3)

Reduced uncertainty for all economic stakeholders in the country

Government has the pressure to keep inflation as low as possible, because rising price levels cannot be “eased” by an overvalued currency

Reduced speculation in foreign exchange markets (in theory)

Advantages of floating exchange rates (3)

Interest rate may be adjusted more freely in monetary policy

The exchange rate should adjust itself in order to keep the current account balanced

No need to keep high reserves of foreign currencies

Disadvantages of fixed exchange rates (3)

The exchange rate is maintained by the manipulation of interest rates, which causes uncertainty upon the national economy

The country must maintain high levels of reserves of foreign currency

Setting the fixed level of an exchange rate is highly complicated

Disadvantages of floating exchange rates (3)

Uncertainty on international markets

Floating rates are prone to speculation and world events, and do not necessarily adjust to eliminate current account deficits.

A floating rate may worsen existing levels of inflation

Balance of payments

record of all money entering the country (credit, +) and leaving the country (debit, −). It consists of different sub-accounts

Financial accounts

The inflows from investments from abroad (credit) against investment to abroad (debit). These investments can be placed into three categories:

Direct investment: purchase of long-term assets (such as buildings or factories).

Portfolio investment: purchases of stocks and bonds.

Reserve assets: purchases of reserves of gold and foreign currencies.

Capital account

Miscellaneous income (credit) or expenses (debit) that can’t be placed in any other category.

Capital transfers: miscellaneous (e.g. death duties, debt forgiveness).

Transactions in non-produced non-financial assets: purchases of intangible assets (trademarks, patents, rights etc.)

Current account

Inflows of trade and income (credit) against outflows (debit)

Balance of trade in goods: exports of goods minus import of goods.

Balance of trade in services: exports of services minus import of services.

Income: earnings from investment leaving (−) and entering (+) the country.

Current transfers: net payments to governments without retribution (e.g. gifts, aid etc.).

Note that the financial account and capital account add up to the current account

current account = financial account + capital account + net errors and omissions

Relationship between the current account and the exchange rate

A current account deficit causes a downward pressure on the exchange rate, because the supply of the currency (imports) exceeds demand (exports). In a freely floating exchange rate system, the value of the currency should fall, boosting the competitiveness of exports. This is a problem in a fixed exchange rate regime, although in the short run deficits may be covered by gains in the financial and capital accounts. Downward pressure implies that the value of the currency has been set too high. In the long-run, the currency may have to be devalued. A current account surplus causes upward pressure on the exchange rate. In a freely floating regime, the currency appreciates. In a fixed regime, this implies that the value of the currency has been set too low. In the long-run, the currency may have to be revalued.

Consequences of current account deficits and surpluses (3)

Downward pressure on the domestic currency exchange rate: more imports than exports lead to relatively more supply than demand for the domestic currency.

Increase in indebtedness: to finance the net outflow of money the country must borrow money, resulting in more indebtedness and higher interest rates. this can result in declining international credit ratings

More foreign ownership of domestic assets: a current account deficit can be financed with a financial account surplus, meaning the net ownership of foreign countries of domestic country’s assets will increase.

Strategies to tackle a persistent current account deficit

Expenditure switching methods: making sure people buy more domestic products instead of foreign goods so import is reduced. This can be achieved by using protectionist measures.

Expenditure reducing methods: making sure people spend less in general which will also reduce imports. This can be achieved by using contractionary fiscal or monetary policy.

Supply side policies: boosting supply and therefore exports. This can be achieved using supply side policies

J-curve stages

x: starting point, the currency will depreciate from this point because there’s a current account deficit.

y: prices have fallen but it takes time for consumers to act on this due to delays in communication and long term contracts.

z: consumers start to act on new prices, the deficit disappears rapidly

Marshall-Lerner condition

The Marshall-Lerner condition is an economic concept stating that a depreciation of a country's currency will improve its trade balance if the sum of the price elasticities of exports and imports is greater than 1.

Demand for exports and imports are often inelastic, meaning a price change (due to the depreciation of the currency) doesn’t affect them that much

If exchange rates increase, the current account…

Decreases

If the export competitiveness decreases, then the current account deficit…

Increases

If employment decreases in the export sector, then the current account deficit…

Increases

If domestic consumption decreases, then the current account deficit…

Increases

If inflationary pressure decreases, the current account deficit…

Increases

Economic growth

Increase in GDP

Economic development

Improvement in living standards, including wealth and quality of life

Economic growth is NOT equal to economic development

Growth must be inclusive

Sources of economic growth (4)

Increases the quantity or quality of factors of production. As the quantity of, say land, is difficult to increase, most economies focus on improving the quality. Better planning, the use of fertilizers, or improved technology are all factors that may improve the quantity of land and therefore lead to increases in potential growth.

Increases in the quantity or quality of human capital. Policies that increase population growth or encourage new immigration will increase the pool of human capital in the long term. Improving the quality of education and investing in public health care will boost the quality of human capital.

Increases in the quantity or quality of physical capital. Increases in the number of factories, machines, shops, offices, and motor vehicles. Investments in higher education, research and development and access to foreign expertise improve the quality of physical capital.

Improving the institutional framework. Improving national institutions such as the banking system, the educational system, the legal system, as well as public infrastructure are understood as a prerequisite for meaningful economic growth. Investments in national institutions include promoting political stability and building good international relationships

Capital widening

Extra capital is used with an increased pool of labor. Total production will rise, but productivity is unlikely to change, as the ratio of capital per worker remains unchanged.

Capital deepening

Exists when there is an increase in the amount of capital per worker. Usually leads to improvements in labor productivity and total production. Capital deepening often means that the level of technology has improved

Sources of economic development (4)

Reducing widespread poverty improves welfare.

Raising living standards improves welfare.

Reducing income inequalities this increases overall welfare.

Increasing employment opportunities which may increase incomes and therefore welfare

Common characteristics of developing economies (8)

Low standards of living: The vast majority of a developing country’s population tend to experience low incomes, high inequality, and insufficient education. Other indicators of low living standards include extremely poor housing, high infant mortality rates, high levels of malnutrition, and low standards of health and sanitation.

High levels of poverty

Low levels of productivity: Measured by output per capita, low productivity is mainly caused by inadequate education and the lack of access to correct technologies in production.

High rates of population growth, spurring dependency burdens: The crude birth rate is calculated as the annual number of live births per 1000 of the population. In developing countries, crude birth rates are on average more than double than the rates in developed countries

High and increasing levels of unemployment and underemployment. Developing countries are characterized by high levels of unemployment, typically between 10 and 20%. However, the figures omit the part of the population that have given up the search for a job and are no longer featured in the statistics. Additionally, hidden unemployment such as an informal job on a family farm is not included in the unemployment figure. The issue of underemployment in developing countries is massive. Many individuals who would like to get a full-time job get to work only part-time with precariously low wages and, often, dangerous and unsanitary conditions.

Dependence on the primary and agricultural sector. Many developing countries are heavily dependent on the exports of one or two primary commodities, making their economies extremely vulnerable to price volatilities and natural catastrophes that might ruin the crops. These circumstances, out of control for the country itself, make it highly difficult to plan effectively for the future.

Prevalence of imperfect, informal markets and limited information. The recent decades have revealed a neoliberal trend, where market-oriented growth is promoted to developing economies by international organisations such as the IMF and World Bank. However, this approach is possibly problematic, as developing countries often lack the necessary factors that facilitate free markets to function efficiently. The lack of adequate infrastructure, a stable financial system, and a developed legal system all act as barriers to efficient allocation of resources.

Dependence and vulnerability in international relations. In almost all cases, developing countries are dominated by developed countries. They are dependent on them for trade, access to technology, aid, and investment. For these reasons, developing countries are vulnerable in global trade and often harmed by the decisions made by developed countries

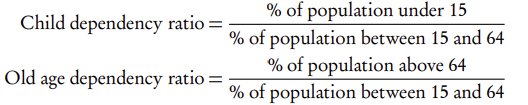

Child dependency ratio

A high crude birth rate raises the child dependency ratio, as adults in the working population have to support more and more children. Supporting large families causes pressure upon the working members of the family, and may cause them to carry out precarious work to make ends meet.

However, developed countries tend to have a much higher old age dependency ratio than developing countries. This means that developed countries have a high number of population over the age of 64 that need to be supported by the working population.

Sustainable development goals

a set of universal goals that meet the urgent environmental, political, and economic challenges facing the world. Although the goals may seem as overly broad to be achievable, they are paired with more specific targets.

Relationship between sustainability and poverty (4)

Poor people rely heavily on the environment for fool, fuel, sanitation, and shelter

Poor people suffer from low levels of agricultural productivity and crop yields on common-pool, marginal lands

Poor people are far more vulnerable to floods and other environmental catastrophes as a result of climate change

Poor people are the least likely to afford the costs of mitigating the climate crisis

Single indicators

Solitary measures that we use to evaluate development, divided into economic, health, education and institutional indicators

Purchasing power parity (PPP)

The exchange rate that equates the purchasing power of currencies in different countries. The PPP is constructed by comparing the prices of an identical product or a service, such as the Big Mac, in different countries

Life expectancy at birth

The average number of years a person may expect to live from the time that they are born

Developed: high

Developing: low

Infant mortality rate

A measure of the number of deaths of babies under the age of one year per 1000 births in a given year

Developed: low

Developing: high

Expected years of schooling

The number of years a child of school entrance age is expected to spend at school

Developed: high

Developing: low

Mean years of schooling

The average number of completed years of education of a population

Developed: high

Developing: low

Institutional measures (3)

Economic and social inequality indicators such as wealth distribution, income inequality, asset ownership and access to credit

Energy indicators like access to electricity or the share of energy bills on the household budget

Environmental indicators including municipal waste (kgs per capita), level of greenhouse gas emissions and oil spill data

Composite indicators

combines a number of single indicators with weighting. This provides us with a single figure that measures multiple dimensions of economic development.

HDI (Human development index)

The best example is the Human Development Index (HDI), a number between 0 and 1 comprised of:

Long and healthy life; measured by life expectancy.

Education; measured by literacy rate and school enrolment.

Standard of living; measured by GDP per capita at PPP

Economically developed countries have a very high HDI (> 0.900). Economically developing countries have a medium (0.500–0.799) or low (< 0.500) HDI. Because HDI takes into account more than just GDP/GNI per capita, a country’s GNP ranking may differ from its HDI ranking

Limitations of the HDI (3)

Does not show difference between rural and urban populations

Does not account for differences between men and women

Does not indicate differences between different ethnic, religious, or social groups within the country

Gender Inequality Index (GII)

The GII is an inequality index that measures gender inequality in three aspects of human development to better expose disparities in the achievements between women and men. The GII measures:

Reproductive health, measured by maternal mortality ratio and adolescent birth rates

Political representation, measured by proportion of parliamentary seats occupied by females and proportion of females and males aged over 25 that have received secondary education

Economic status, measured by labor market participation rate of female and male populations 15 years and older

Inequality adjusted Human Development Index (IHDI)

This indicator is an HDI that takes also into account the cost of inequality. Each of the three components of HDI; life expectancy, education, and the ability to meet basic needs, is toned down by its level of inequality. The difference between the HDI and the IHDI value then measures the cost to human development owing to inequality.

Happy Planet Index (HPI)

Measures sustainable wellbeing through a combination of four elements: wellbeing (satisfaction), life expectancy, inequality of outcomes, and ecological footprint.

The Multidimensional Poverty Index (MPI)

The MPI measures the deprivations experienced by the poor in the population in three key areas that are the same as in the HDI.

Health, measured by nutrition and child mortality

Education, measured by years of schooling and school attendance rates

The ability to meet basic needs, expressed by access to cooking fuel, sanitation, drinking water, and electricity, as well as the level of housing and the ownership of assets.

The Inclusive Development Index (IDI)

The World Economic Forum’s project that constructs an annual assessment of the economic performance of 103 countries in eleven different dimensions. Based on the evaluation, countries are divided into ‘Advanced economies’ and ‘Emerging economies’ for comparison

Contributions and barriers to development (9)

Education and health — better education can lead to a more productive workforce

The use of appropriate technology — Using technology that fits the skills of the people may lead to higher employment levels

Access to credit and micro credit — Small loans can give people the chance to start a business, which increases income and business productivity

The empowerment of women — Emancipation of women can mean higher employment of women or more educated women contributing to development

Income distribution — More equitable income distribution could lead to less conflict, rebellion and wars, which is good for growth and stability

Capital flight — The movement of large amounts of money out of the country as a response to political or economic instability can spur hyperinflation or a sharp depreciation of the domestic currency

Indebtness — The repayment of debt by the local government means that the money cannot be spent on other areas of the economy, hindering development

Landlocked countries — Landlocked countries trade less and have slower growth rates than coastal countries. Transport costs add to the cost of exports

Tropical climates and endemic diseases — A tropical climate tends to slow down development in two key areas; agriculture and health. The prevalence of disease is considerably higher in the tropical zone, affecting the quality of human resources

Import substitution

Producing goods yourself instead importing them

Advantages of import substitution (3)

Protects jobs

Protects local culture

Less dependence on foreign nations

Disadvantages of import substitution (3)

Doesn’t benefit from comparative advantages

Higher prices

Danger of retaliation

Export promotion

Focussing on exporting goods and using the revenues from this export to boost aggregate demand

Advantages of export promotion (3)

More efficiency

Increased variety/quality

Quick growth

Disadvantages of export promotion (3)

Strategy for growth, not development

Inequality

Might not be possible in developing countries

Trade liberalisation

More free trade

Advantages of trade liberalisation (3)

Lower prices

Increased variety / quality

Increased efficiency

Disadvantages of trade liberalisation (2)

May cut jobs in some sectors

Increases dependence

Help of the WTO

International organisation which regulates international trade

Advantages with help of the WTO (2)

Can help set up trade deals

All free trade arguments

Disadvantage with Help of the WTO

Gives multinationals a chance to exploit cheap labour in developing countries

Bilateral and regional preferential trade

Trade agreements between countries in a certain region

Advantages of bilateral and regional preferential trade (3)

Lower prices

Increased variety / quality

Increased efficiency

Disadvantages of bilateral and regional preferential trade (2)

May cut jobs in some sectors

Increases dependence

Diversification

To move from the production and export of primary commodities and to replace these with production and export of manufactured goods

Advantage of diversification

Protection from volatile changes in primary product

Disadvantage of diversification

Developing countries often don’t have the sophisticated workforce for this

Barriers to development (4)

Overspecialisation on a narrow range of products

Too much dependence on the export of a small set of goods

If market of these goods collapses, the country faces economic catastrophe

Price volatility of primary products

Developing countries are dependent on the export of primary products therefore volatility can hurt the economy

Inability to access international markets

Developing countries often cannot access markets of developed countries due to protectionist measures, leading to less exports, limiting growth and development potential

Long term changes in terms of trade

TOT (terms of trade) is low in developing countries, long term low TOT leads to inability to buy imports, resource overuse and inability to finance debt

Foreign direct investment

Long term investments by multinational corporations (MNCs) in foreign countries by either building new plants or expanding existing ones.

Why would companies want to invest in developing countries? (3)

Developing countries can often provide factors of production at a very low cost (e.g. low wages). This makes it possible to produce goods at a low price.

Developing countries often have a favourable fiscal (tax) climate, allowing companies to produce while paying little to no taxes.

Developing countries often have a regulatory framework that makes it easy to bring made profits to the country of origin of the MNC (profit repatriation)