Business- Theme 2.1: Raising Finance

0.0(0)

Card Sorting

1/25

Earn XP

Description and Tags

Last updated 5:12 PM on 9/20/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

1

New cards

Long-Term Finance

Sources of money for businesses that are borrowed or invested typically for more than a year. E.g: Bank Loan, Mortgage, Grants, Debentures

2

New cards

Short-Term Finance

Sources of money for businesses that may have to be repaid with immediately or fairly quickly. E.g: Overdraft, Trade Credit.

3

New cards

Internal Finance

Money generated by the business or its current owners

4

New cards

Owner's Capital

Money invested in the business from the owner's personal savings

5

New cards

Sale of Assets

When a business sells off its unwanted or unused assets to raise funds

6

New cards

Retained Profit

Profit which is kept back in the business and used to pay for investment in the business.

7

New cards

Internal Benefits and Negatives

Benefits: -No interest payments

-Business has full control of how to spend

-Saves Space

Negative: -Not very liquid

-High Risk

-May not be enough financed

-Business has full control of how to spend

-Saves Space

Negative: -Not very liquid

-High Risk

-May not be enough financed

8

New cards

Source of finance

A source, either within or outside of a business, from which a business can get access to money. E.g: Friends or Family, Business Angels, Banks and Public.

9

New cards

External Finance

Money raised from sources outside the business (e.g. share issue, leasing, bank loan)

10

New cards

Method of Finance

The process through which a source of finance provides money to a business

11

New cards

Bank Overdraft

Borrowing money from a bank by drawing more money than is actually in a current account. Interest is charged on the amount overdrawn

12

New cards

Trade Credit

The practice of buying goods and services now and paying for them later

13

New cards

Grants

A sum of money given by a certain organization, especially the government, for a certain reason or cause

14

New cards

Crowd Funding

The practice of funding a project or venture by raising small amounts of money through donations from a large pool of people, typically raised via the Internet

15

New cards

Lease

A contract granting use or occupation of property or equipment during a specified time for a specified payment

16

New cards

Bank Loan

Borrowing a sum of money which has to be repaid with interest over a period of time

17

New cards

Mortgage

A loan where property is used as security.

18

New cards

Debentures

Unsecured bonds backed only by the credit worthiness of the bond issuer

19

New cards

Collateral

An asset that might be sold to pay a lender when a loan cannot be repaid

20

New cards

Share Capital

Money introduced into the business through the sale of shares

21

New cards

Venture Capital

Money provided by investors to finance new products and new businesses that have a good chance to be very profitable

22

New cards

Business Plan

A plan for the development of a business, giving details such as the products to be made, resources needed, and forecasts such as costs, revenues and cash flow

23

New cards

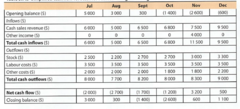

Cash-flow Forecast

The prediction of all expected receipts and expenses of a business over a future time period which shows the expected cash balance at the end of each month

24

New cards

Cash Inflow

Flow of money into business

25

New cards

Cash Outflow

Flow of money out the business

26

New cards

Net Cash flow

The difference between the cash flowing in and the cash flowing out of a business in a given time period