Chapter 13: IAS 7 Statement of cash flows

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

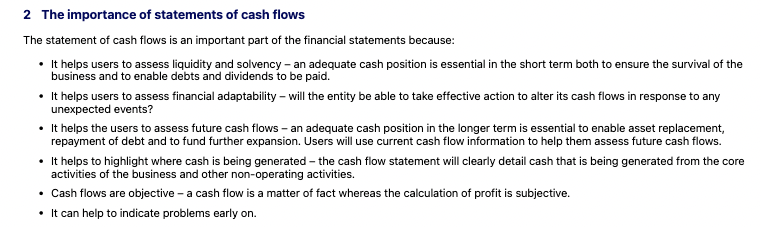

How does the statement of cash flows help assess liquidity and solvency?

How does the statement of cash flows help assess financial adaptability?

How does the cash flow statement help users assess future cash flows?

What does the cash flow statement highlight about cash generation?

Why are cash flows considered objective?

How can a cash flow statement help spot problems early?

Q: How can a cash flow statement help spot problems early?

A: By revealing cash shortages or unusual cash flow patterns before they impact financial health.

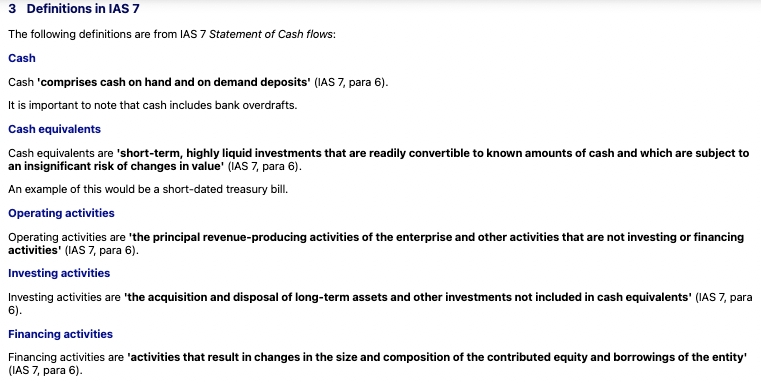

What is the definition of cash under IAS 7?

What are cash equivalents under IAS 7?

What are operating activities according to IAS 7?

What are investing activities according to IAS 7?

What are financing activities according to IAS 7?

What are the main sections of a statement of cash flows under IAS 7?

List typical adjustments to profit before tax when calculating operating cash flows.

What working capital changes are included in operating activities?

What items are included under cash flows from investing activities?

What items are included under cash flows from financing activities?

How is the net increase/decrease in cash and cash equivalents calculated?

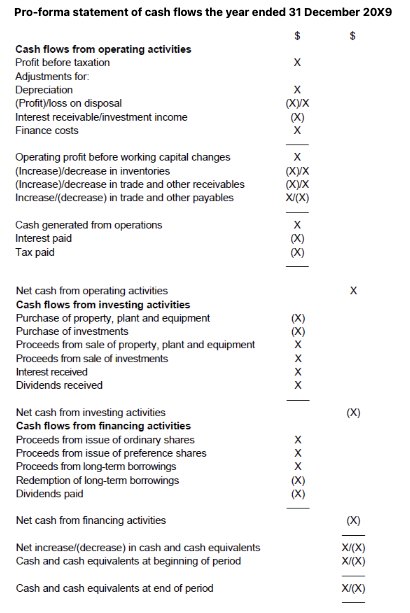

Q: What are the main sections of a statement of cash flows under IAS 7?

A:

Cash flows from operating activities

Cash flows from investing activities

Cash flows from financing activities

Q: List typical adjustments to profit before tax when calculating operating cash flows.

A:

Depreciation

(Profit)/loss on disposal

Interest receivable/investment income

Finance costs

Q: What working capital changes are included in operating activities?

A:

(Increase)/decrease in inventories

(Increase)/decrease in trade and other receivables

Increase/(decrease) in trade and other payables

Q: What items are included under cash flows from investing activities?

A:

Purchase of PPE or investments (outflows)

Proceeds from sale of PPE or investments (inflows)

Interest received

Dividends received

Q: What items are included under cash flows from financing activities?

A:

Proceeds from issuing shares or borrowings

Redemption of borrowings

Dividends paid

Q: How is the net increase/decrease in cash and cash equivalents calculated?

A:

Net cash from operating + investing + financing activities = Net change in cash and cash equivalents

What are the two methods of calculating cash generated from operations?

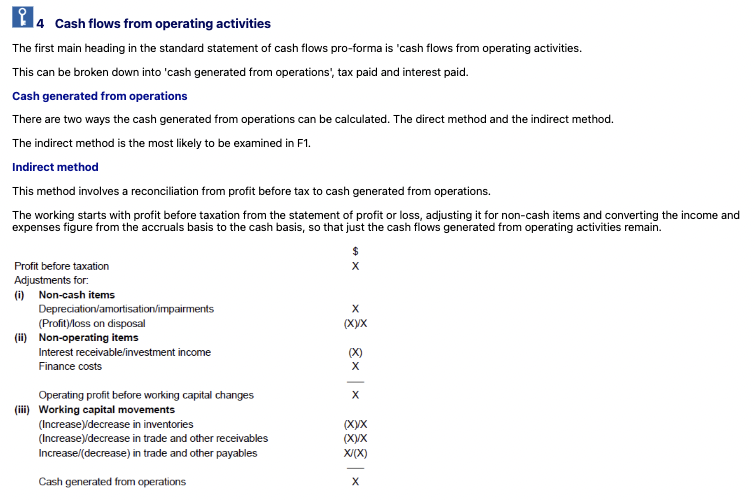

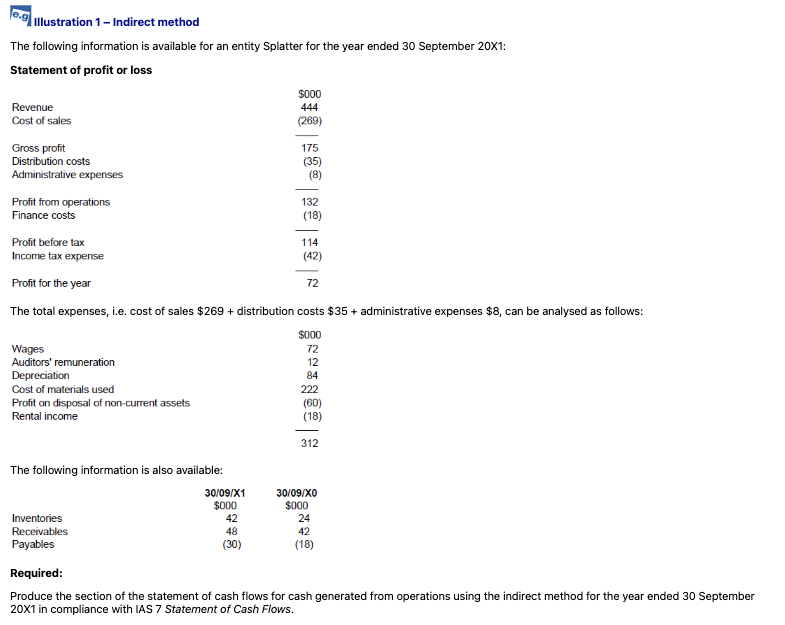

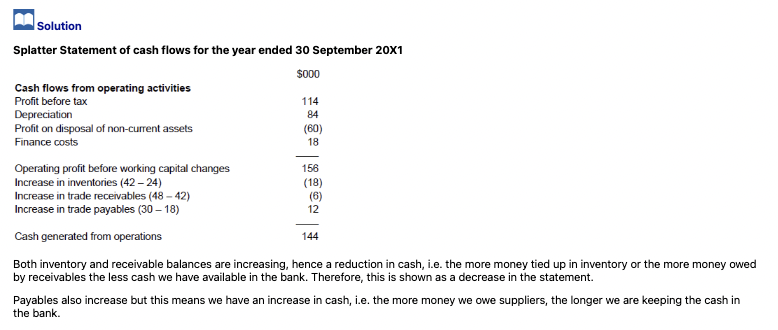

How does the indirect method calculate cash generated from operations?

What working capital adjustments are made under the indirect method?

Why is depreciation added back to profit in the indirect method?

How is profit/loss on disposal treated in the indirect method?

Why is investment income/interest received deducted in the indirect method?

How are finance costs treated in the indirect method?

What’s the cash flow effect of a change in receivables?

What’s the cash flow effect of a change in inventory?

What’s the cash flow effect of a change in payables?

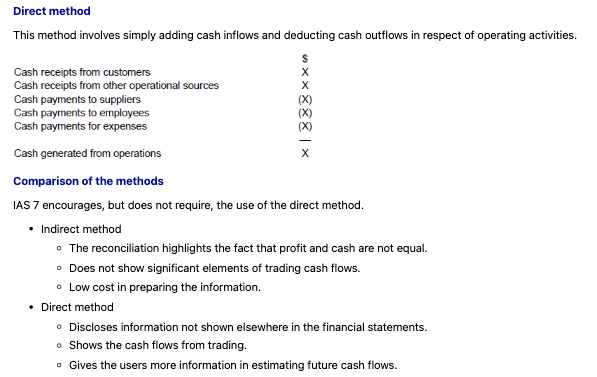

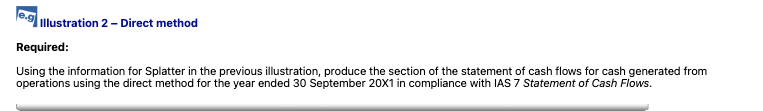

What is the direct method of calculating cash from operations?

What are the advantages of the indirect method for cash flows?

What are the advantages of the direct method for cash flows?

What does IAS 7 say about the direct method?

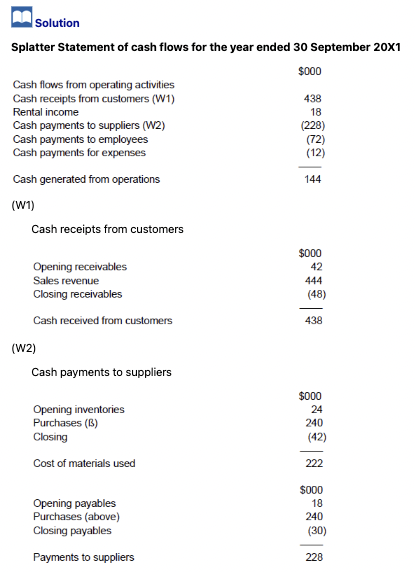

What other items are considered cash flows from operating activities under IAS 7?

How is interest paid calculated using the T-account method?

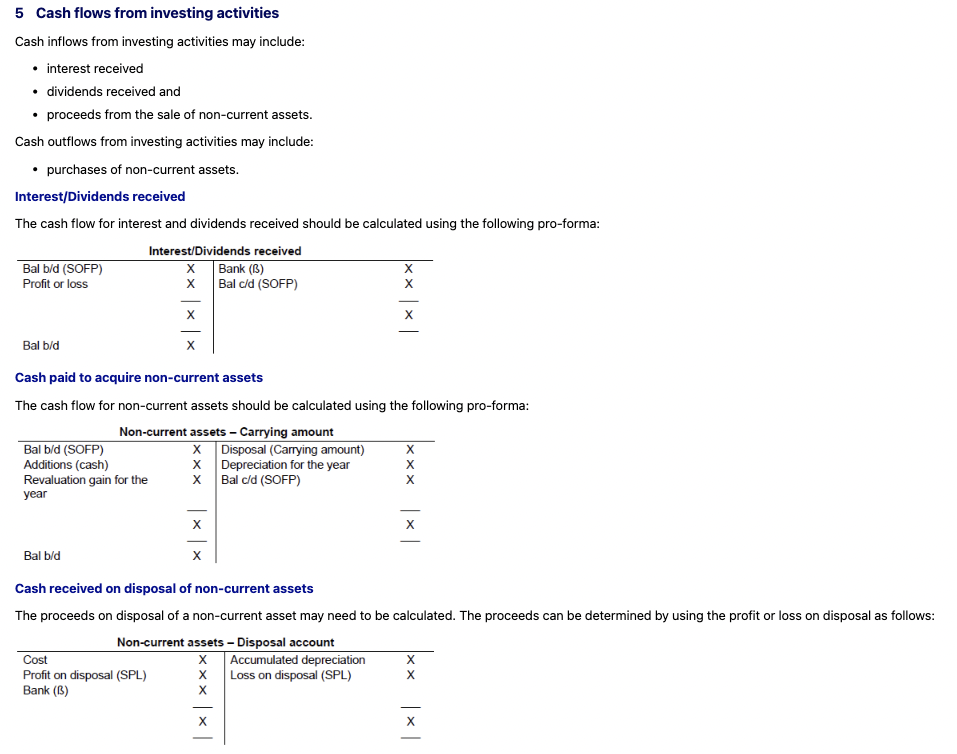

What are typical cash inflows and outflows from investing activities under IAS 7?

How is the cash received for interest/dividends calculated using the T-account?

How is the cash paid to acquire non-current assets calculated using the T-account?

How is cash received on disposal of non-current assets calculated?

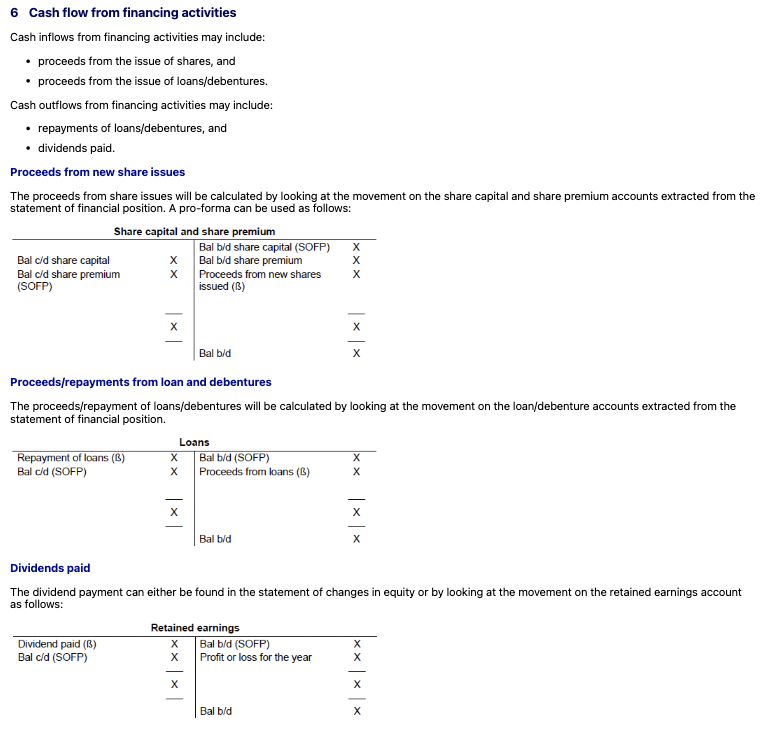

What are common cash inflows and outflows from financing activities under IAS 7?

How is cash received from new share issues calculated using T-accounts?

How is cash received or repaid for loans/debentures calculated?

How can the amount of dividends paid be determined?

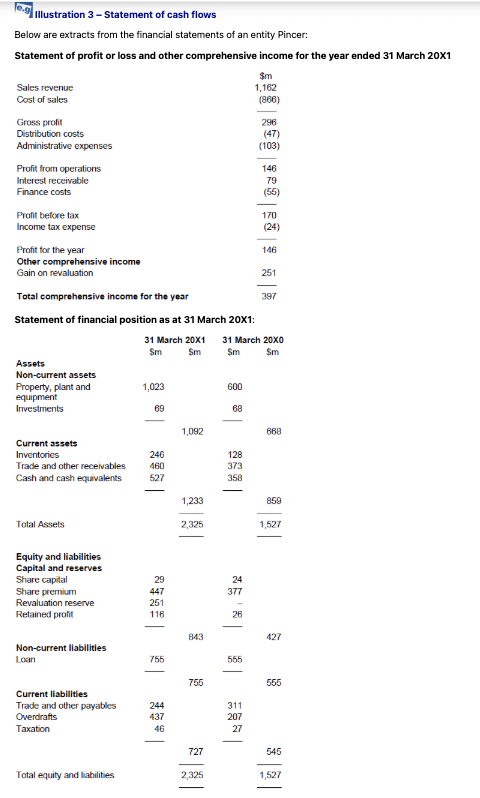

Additional information

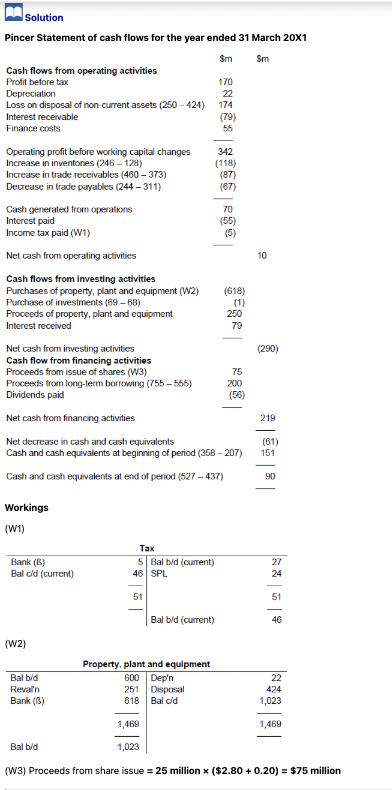

Profit from operations includes depreciation on the property, plant and equipment of $22 million. The revaluation reserve relates wholly to property, plant and equipment.

During the year ended 31 March 20X1, plant and machinery costing $1,464 million, which had a carrying amount of $424 million, was sold for $250 million.

During the year ended 31 March 20X1, 25 million 20c shares were issued at a premium of $2.80.

Dividends paid during the year were $56 million.

Required

Produce a statement of cash flows for Pincer for the year ended 31 March 20X1 in compliance with IAS 7 Statement of Cash Flows using the indirect method.