Theme 3

1/61

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

62 Terms

What are the reasons for planned growth?

To increase profits

To achieve economies of scale

Increase market share

Increase profitability

Increased market power over customers and suppliers

What are the 2 types of economies of scale?

Internal - economies within a business such as managerial, purchasing and technical economies

External - economies that occur in the industry e.g. improved infrastructure

What are some problems linked to growth?

Diseconomies of scale (average costs rising)

Overtrading

Why do diseconomies of scale occur?

Poor communication

Poor employee motivation (alienation)

Poor management

Organic growth

When a firm grows from within, using its own resources

Inorganic growth

When a firm grows from merging or acquiring another company

Advantages for organic growth

More control

Minimises risk

Gives staff opportunities to advance = better motivation

Disadvantages for organic growth

Slow growth

Limited by internal resources

Harder to respond to competition

What is a merger?

When 2 firms of a similar size agree to join forces permanently creating a new company

What is a takeover?

One firm buys the majority of shares in another

What is vertical integration?

When one firm takes over/merges with another in a stage of production in the same industry

What is horizontal integration?

When a firm buys out another in the same industry (e.g. a competitor)

What is conglomerate integration?

When one firm buys out another with no clear connection to industry

Why do businesses remain to stay small?

Product differentiation or USPs

Flexibility

Maintain customer service level

Forward vertical integration

Buying out a customer

Backward vertical integration

Buying out a supplier

Mission statement

Brief statement that summaries the aims, purpose and core values of a business

Ansoff’s Matrix

A tool used to help a business decide how to grow. The 4 strategies are:

Market penetration

Market development

Product development

Diversification

Market penetration

An existing product within a market

Help to improve economies of scale

Strengthens existing

Limited ceiling for sales

Product development

New product in your existing market

Meets evolving customer needs

Expands product portfolio

Product may fail

Market development

New market using an existing product

Increases economies of scale

Boosts revenue and brand image

Market may reject the product

Diversification

New product in a new market

New revenue streams

Potential synergies - links to industries

High risks

High costs

Distinctive capabilities

Businesses can gain competitive advantage by 3 ways:

Architecture - strong relationships and networks of trust

Reputation - strong brand images build over time through quality and customer loyalty

Innovation - developing new ideas to gain an advantage

Porter’s 5 forces

Help businesses evaluate the attractiveness and potential profitability of an industry

Industry rivals

Threat of new entrants

Buying power

Supplier power

Threat of substitutes

Threat of new entrants

Measures the ease of how easily new competitors can enter the market and disrupt existing businesses - depends on the barriers of entry

Threat of substitutes

The risk of customers switching to alternative products or services that meet the same need - not in direct competition but serve the same customer needs

Buyer power

Influence customers have over prices and business decisions based on demand

Supplier power

Control suppliers have over pricing, quality and availability of key resources - businesses can consider backwards vertical integration

Industry rivals

The level of competition among existing markets in the industry

Corporate culture

The shared values, beliefs and behaviours that shape how employees interact and work within a business

Strong culture

When employees align with the company’s values creating a unified workforce

Weak culture

When employees do not share the company’s values, leading to a lack of cohesion and higher employee turnover rates

How corporate culture is formed

Leadership style

Type of ownership e.g. plcs or sole traders

Type of product

Recruitment policies

Power culture

Centralised, with one person or a small group of people making key decisions shaping the culture

Quick decison making with clear direction from the leader

Lack of employee involvement decreases motivation

Employees may become reliant on the leader

Role culture

Structured and hierarchical system where employees have clear roles and responsibilities based on their job title

Efficient in large complex businesses by improving department coordination

Allows employees to specialise in their roles

More rules and procedures = slower decision making which can hinder innovation

Task culture

Employees are allocated projects or tasks, emphasising teamwork and problem solving in a flexible structure

Higher motivation as expertise is valued

More innovation

Lacks clear authority

Person culture

When an organisation prioritises individuals over the company, employees work indepently

Lots of freedom = greater motivation

Hard to implement in large businesses

Lack of direction

Shareholder approach

Prioritises maximising profits and returns for shareholders, often focusing on short term performance

Can be seen as unethical

Lacks long-term sustainability

Stakeholder

Individuals who have interest in, or are affected by a business’ activities and decisions

Stakeholder approach

Considers the interest of all stakeholders rather than focusing solely on profit

Consultation with stakeholders

Long term gain

Stakeholder objectives

Consumer - best quality products at the cheapest price

Employees - increased wages and development

Suppliers - shorter payable days and higher payments

Ethics

Businesses making decisions that priotise doing the morally right thing rather than maximising profits

Corporate social responsibility (CSR)

Benefits a business’ stakeholders, by addressing social and environmental concerns in operations and decision making

An active choice, not ethics

Quantitative sales forecasting

Estimating future sales figures based on past trends and patterns

Purpose of moving averages

Help to smooth out fluctuations in data to identify trends more clearly

Extrapolation

The process of using past data to predict sales, extending the trend line on a graph

Limitations of quantitative sales forecasting

Assumes past trends will be the same as the future

The further into the future, the harder it is to predict

Start ups cant use it

Payback period

How long it takes for an investment to recover its initial cost

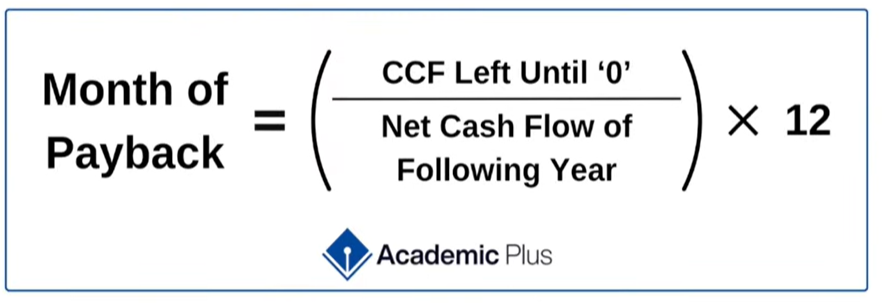

Month of payback formula

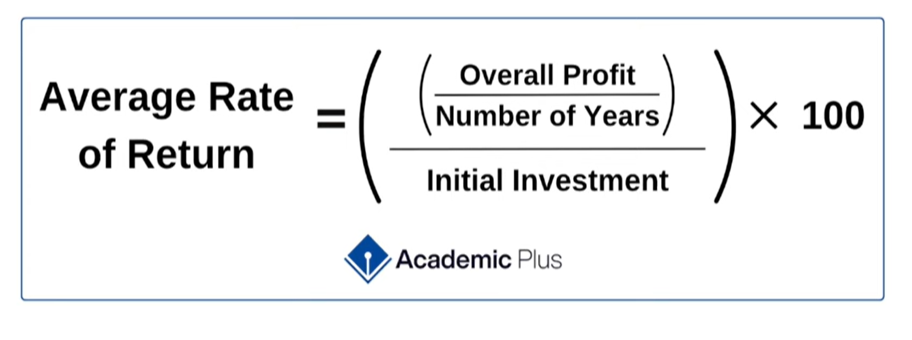

Average rate of return formula (ARR)

Net present value (NPV)

Financial metric that evaluates the value of the investment against interest rates and time

Limitation of decision trees

They rely on estimated probabilities which can be inaccurate, and their reliability depends on the accuracy of data used

Critical path analysis (CPA)

A network diagram that shows how activities within a project can be done simultaneously and which can be done consecutively

EST

Earliest start time for an activity to be started

LFT

Latest finish time a task can be completed before it delays the activity

SWOT analysis

Strengths

Weaknesses

Opportunities

Threats

Internal

External

Opportunities

External factors that a business can exploit for growth such as emerging markets and changing trends

PESTLE analysis

Strategic tool used to assess external factors that can impact a business’ performance and decision making:

Political

Economic

Social

Technological

Legal

Environmental

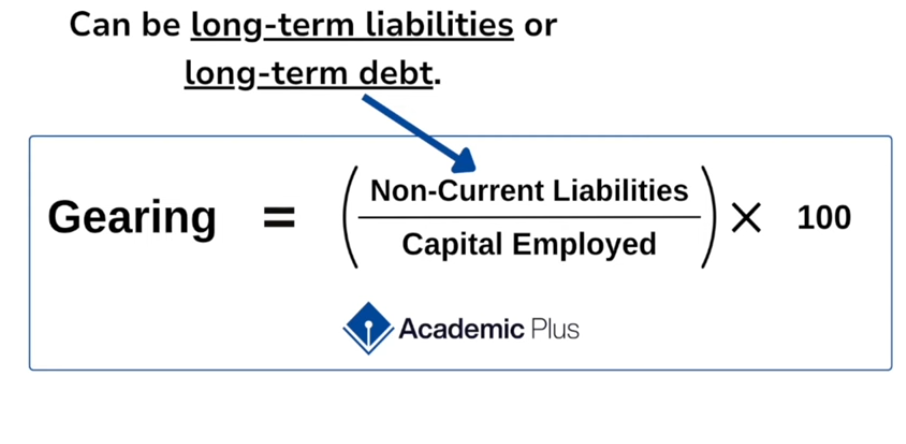

Gearing

Measures how reloiant a business is on borrowing money

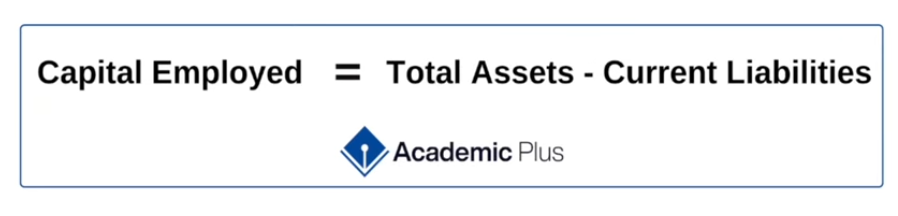

Capital employed

Long term investments made in a business to support its operations and growth

High gearing

Over 50%

Increased interest rates

Poor cash flow

Likelihood of insolvency

Low gearing

Under 25%

Limited growth potential as avoiding risks