FT2

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

37 Terms

net present value (NPV)

Landen, Inc. uses several methods to evaluate capital projects. An appropriate decision rule for Landen would be to invest in a project if it has a positive…

Recommend C if the required return is between 0% and 9%.

Two investments, C and D are being evaluated. They are mutually exclusive. Investment C has a higher NPV using any discount rate between zero and 9%, while D has a higher NPV using any discount rate between 9.1% and 15%. Which investment do you recommend the company undertake? The initial investment of both opportunities is the same. Which of the following is the BEST answer?

greater than the cost of capital.

If an investment project has a positive net present value, then the internal rate of return is…

If projects are mutually exclusive, one should always choose the project with the highest IRR

Which of the following statements regarding making investment decisions using net present value (NPV) and internal rate of return (IRR) is least accurate?

The problem cannot be solved because the tax rate is not given.

Assume that a newly introduced project at Top Technology Inc. required an initial investment of $10 million in equipment, which will be depreciated (straight-line to zero) over 10 years. At the end of year 8, management made the decision to sell the equipment for $4 million. What must be the after-tax salvage value of the equipment at the end of year 8?

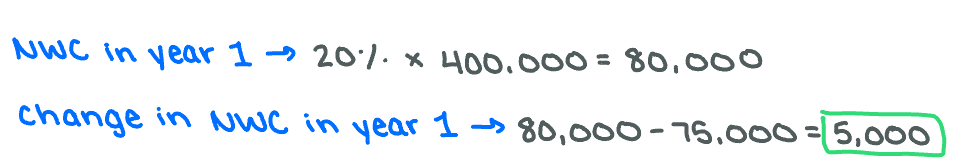

There is a $5,000 increase in NWC.

You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. The project has a 3-year life. You estimate the revenue for the next three years are as follows: $400,000 in year 1, $500,000 in year 2, and $530,000 in year 3. The cash expenses are expected to be $325,000 in year 1, $381,250 in year 2, and $398,125 in year 3. The project requires an initial investment of $165,000, which is depreciated straight-line to zero over the 3-year project life. The actual market value of the initial investment at the end of year 3 is $35,000. Initial net working capital investment is $75,000 (at year 0) and NWC will maintain a level equal to 20% of sales each year thereafter. The tax rate is 34% and the required return on the project is 10%.

Given the $75,000 initial investment in NWC, what change occurs for NWC during year 1?

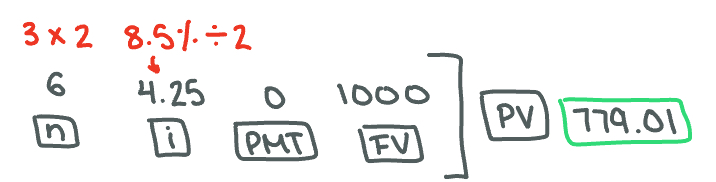

779.01

A zero-coupon bond matures three years from today, has a par value of $1,000 and a yield to maturity of 8.5% (assuming semi-annual compounding). What is the current value of this issue?

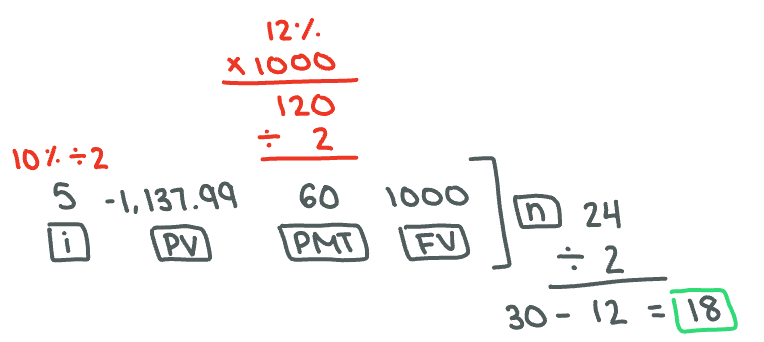

18 years ago

You bought a 30-year bonds many years ago. The bond has a par value of $1,000 and coupon rate of 12%, paid semi-annually. The current price of the bond is $1,137.99 and the yield to maturity is 10%. How many years ago did you buy the bond?

I, Il, and III

If dividends on a common stock are expected to grow at a constant rate forever, and if you are told the most recent dividend paid, the dividend growth rate, and the appropriate discount rate today, you can calculate

I. the price of the stock today

Il. the dividend that is expected to be paid ten years from now

Ill. the expected stock price five years from now

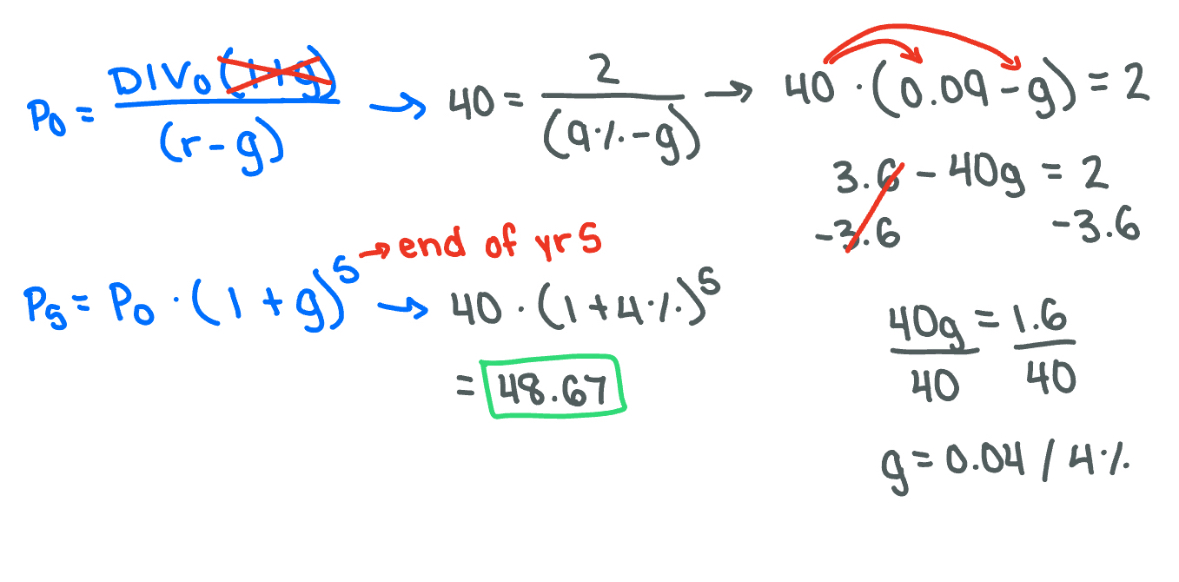

$48.67

Trudeau Technologies common stock currently trades at $40 per share. The stock is expected to pay a year-end dividend, DIV1, of $2 per share. The stock's dividend is expected to grow at a constant rate g, and its required rate of return is 9 percent. What is the expected price of the stock five years from today (that is, P5)? Round to the nearest cent.

the corporation to redeem the bond before the maturity date.

A call provision allows…

10.4%

Calculate the risk premium on stock C given the following information: risk-free rate = 5%, market return = 13%, stock C beta = 1.3.

Investors will buy Datron, pushing up its stock price until its expected return equals the 6% required return.

Analysts worldwide have revised their projections for Datron Corp. They just announced in a press release that they expect return on Datron shares is 8%, and Datron's required return is 6%. This should result in…

0.0

The beta of an investment in U.S. Treasury bills is…

reject profitable, low-risk projects and accept unprofitable, high-risk projects

Assume a firm uses a constant WACC to select investment projects rather than adjusting the projects for risk. If so, the firm will tend to..

Its expected rate of return

Which of the following is most directly affected by the level of systematic risk in a security?

I and IV only

Which of the following are examples of diversifiable risk?

I. An earthquake damages an entire town.

Il. The federal government imposes a $100 fee on all business entities.

IlI. Employment taxes increase nationally.

IV. All toymakers are required to improve their safety standards.

An asset with beta greater than 1

Which of the following assets will an individual investor prefer if she is NOT risk-averse and would like to maximize her expected return?

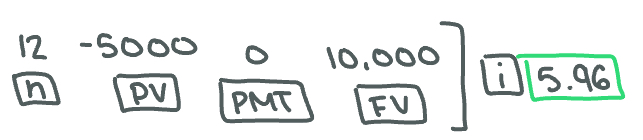

5.95%

Your grandfather placed $5,000 in a trust fund for you. In 12 years the fund will be worth $10,000. What is the rate of return on the trust fund? (round to the nearest one hundredth of 1% and do NOT use Rule of 72)

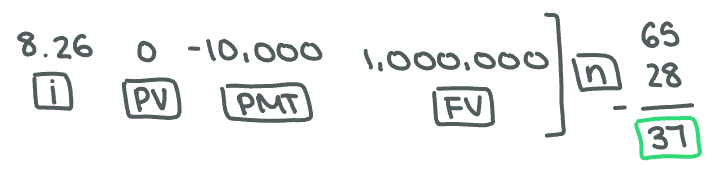

37 years old

Your goal is to have $1 million when you retire at the age of 65. You plan to invest $10,000 every year (at the end of each year) and your financial advisor estimates that your annual rate of return will be 8.28%. At what age should you start to invest for your retirement?

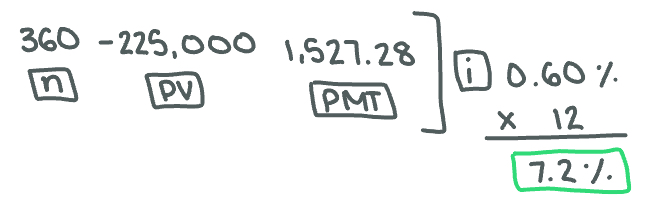

7.20%

Assume that you just bought a house and took out a 30-year (360 months) mortgage loan of $225,000 and must make monthly payments of $1,527.28. Given this information, determine the annual interest rate on your mortgage.

$12,523

The Corner Bar & Grill is in the process of taking a five-year loan of $50,000 at an annual interest rate of 8% with First Community Bank. The loan requires 5 equal payments at the end of each year inclusive of interest and part of the principal. Find the annual loan payment. (Round your answer to the nearest dollar)

If the discount (or interest) rate is positive, the future value of an annuity due will always be less than the future value of an equivalent regular annuity, and the present value of an annuity due will always be less than the present value of an equivalent regular annuity.

Which of the following statements is incorrect (least correct)?

The future value would be greater if the interest rate was higher.

A two-year investment of $3500 is made today at an annual interest rate of 5.75%. Which of the following statements is true?

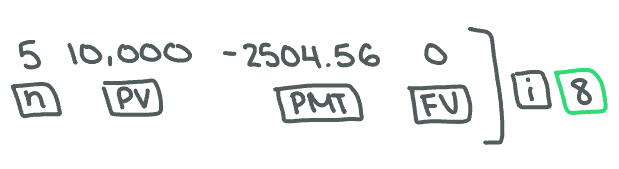

8.00%

South Penn Trucking is financing a new truck with a loan of $10,000 to be repaid in 5 annual end-of-year installments of $2,504.56. What annual interest rate is the company paying? (round to the nearest one hundredth of 1%)

I only

Which of the following calculations ignores the impact of the time value of money?

I. Payback

II. IRR

III. Profitability index

For each $1 of assets owned by the firm it generates $3 in sales.

Which of the following is a correct interpretation of a total asset turnover of 3.0?

769.23

The Canadian government decided to issue a consol (a bond with a never-ending interest payment and no maturity date). The bond will pay $50 in interest each year (at the end of the year), but it will never return the principal. The current discount rate for Canadian government bonds is 6.5%. What should this consol bond sell for in the market? Round your answer to the nearest dollar. (NOTE: do NOT include the dollar sign in your answer).

4.2% + 7% = 11.2%

Shocking Co. is expected to maintain a constant 7 percent growth rate in its dividends, indefinitely. If the company has a dividend yield of 4.2 percent, what is the required return on the power company's stock? Round your answer to the nearest basis point, or hundredth of percent. (NOTE: enter your answer as percent without the percentage sign. For example, for 5.45%, enter 5.45).

None of these are correct

A firm is considering a $5,000 project that will generate an annual cash flow of $1,000 for the next 8 years. The firm has the following financial data:

Market value of debt is $100 million

Market value of equity is $200 million

Cost of equity capital is 15%.

Cost of new debt is 6%.

Tax rate is 33%.

Determine the project's net present value (NPV) and whether or not to accept it.

A decrease in cost of goods sold

Which of the following will increase a firm's times interest earned ratio?

all of the choices are true.

Ratio analysis can be useful for…

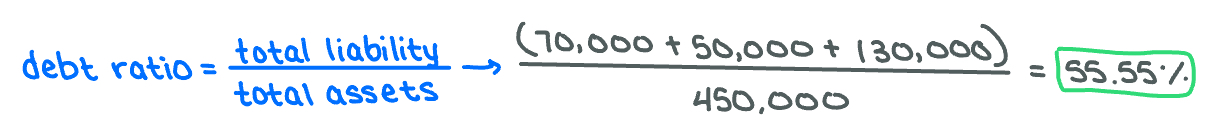

55.6%

Refer to the tables above. The firm's debt ratio is _ (round your answer to the nearest tenth percentage).

Balance sheet

The financial statement that shows what a company owns and what it owes is called the…

Il and Ill only

A ______ can lose, in the extreme case, her entire personal net worth.

I. limited partner

Il. general partner

Ill. sole proprietor

Six of these items

How many of the following balance sheet items are classified as current assets or current liabilities?

Retained earnings

Accounts payable

Plant and equipment

Inventory

Common stock

Short-term notes (maturity <1 year) payable

Wages payable

Accounts receivable

Preferred stock

Marketable securities

Balance sheet

To calculate changes in net working capital from one period to the next, we need which of the following…