econ final

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

The Great Misery refers to the period of time in the U.S. between

November 1973 and June 1983 when the value of the Misery Index was 12.5 or higher for 116 straight months.

Observing “life expectancy at birth” globally (i.e., for the world as a whole), between 1770 and 1950 this measure ________________ and then between 1950 and 2021 this measure ________________.

increased from 28.5 years to 46.5 years;

Ilan Moschidae – a well-connected, unscrupulous businessman – owns Nikola Motors, a company that produces electric cars. He has exploited his political connections in order to get legislators in his state to give Nikola Motors an interest free loan to build a new factory. This appears to be an example of

Crony Capitalism.

Qihong was born in China. Throughout his entire life he has excelled academically. After earning a Master’s degree from the China University of Mining and Technology in Beijing, he came to the United States to pursue a PhD. Upon completion of his PhD he was hired by a prestigious research university in Oklahoma, where he works to this day. This story provides an illustration of

the Brain Drain

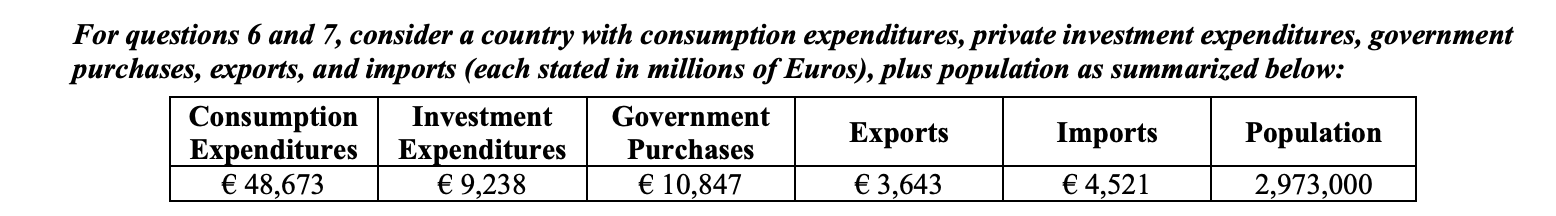

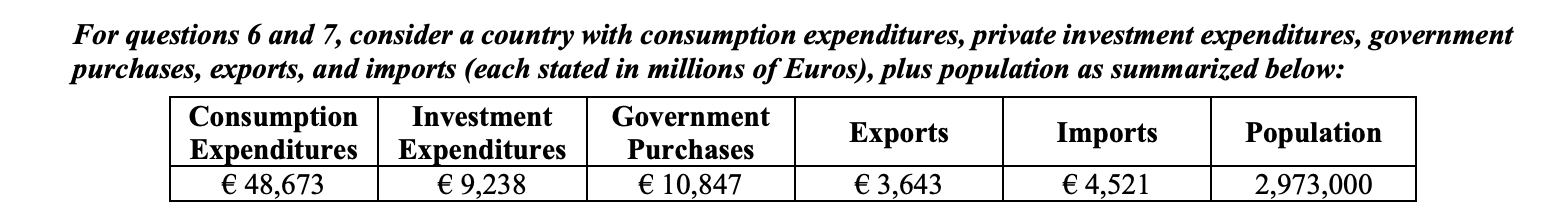

Net Exports for this country are equal to ________.

€ – 878 million (i.e., negative 878 million Euros)

For this country, Per Capita Gross Domestic Product is approximately equal to ________.

€ 22,832.16

Consider a country in which there are 132.9 million people with jobs, 10.4 million people without jobs who are looking for one, and 62.7 million people without jobs who are not looking for one. The unemployment rate of this country is roughly ______.

7.3%

In the Expanded Circular Flow Diagram, government collects taxes from

domestic households and domestic firms (but no foreign entities).

Between 1923 and 2023 the value of Real GDP Per Capita in the U.S.

increased from $8,772 to $66,755 (i.e., became roughly 7.6 times larger)

In 2022 there were approximately _________ deaths from malaria worldwide, with _________ occurring in Africa.

608,000; over 95%.

Capital Flight refers to

the tendency for wealthy people in poor countries to invest their financial resources abroad instead of at home.

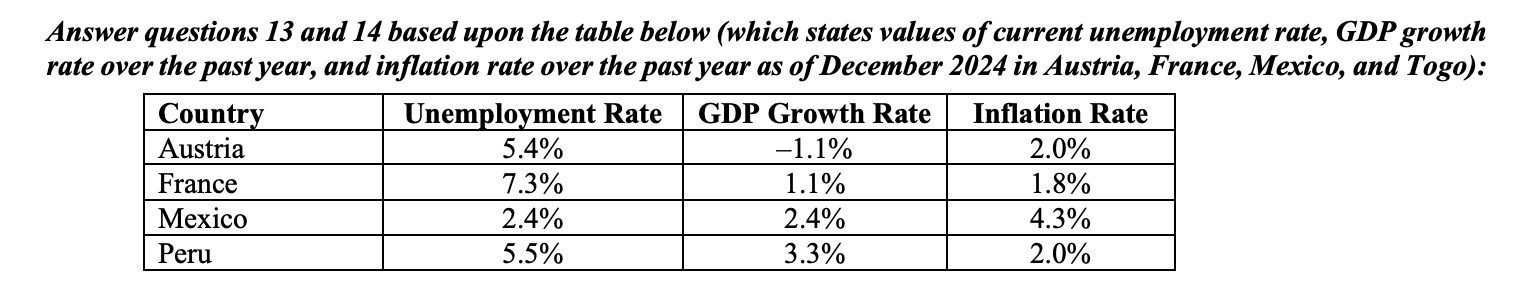

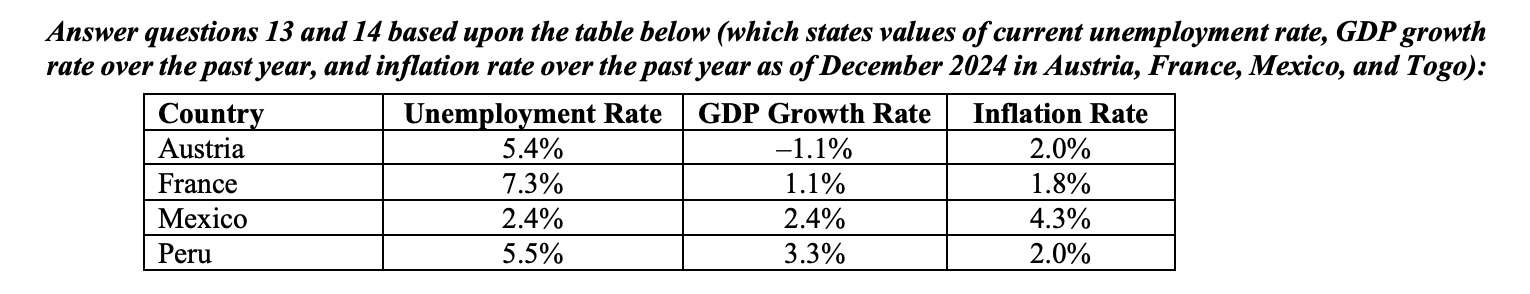

Based upon these figures, of these four countries the value of the Misery Index was largest in

france

If these values remained constant indefinitely, the GDP of __________ would double in approximately 30 years.

mexico

____________ is illustrated by an outward shift of the Production Possibilities Frontier over time.

Economic Growth

During our discussion in lecture of government failure resulting from costs of complying with government bureaucracy it was noted that in recent decades people in ____________ have been burdened with “a complex, irrational, almost incomprehensible system of controls and licenses” under which “everything needed (government) approval and a stamp,” known as the “Permit Raj.”

india

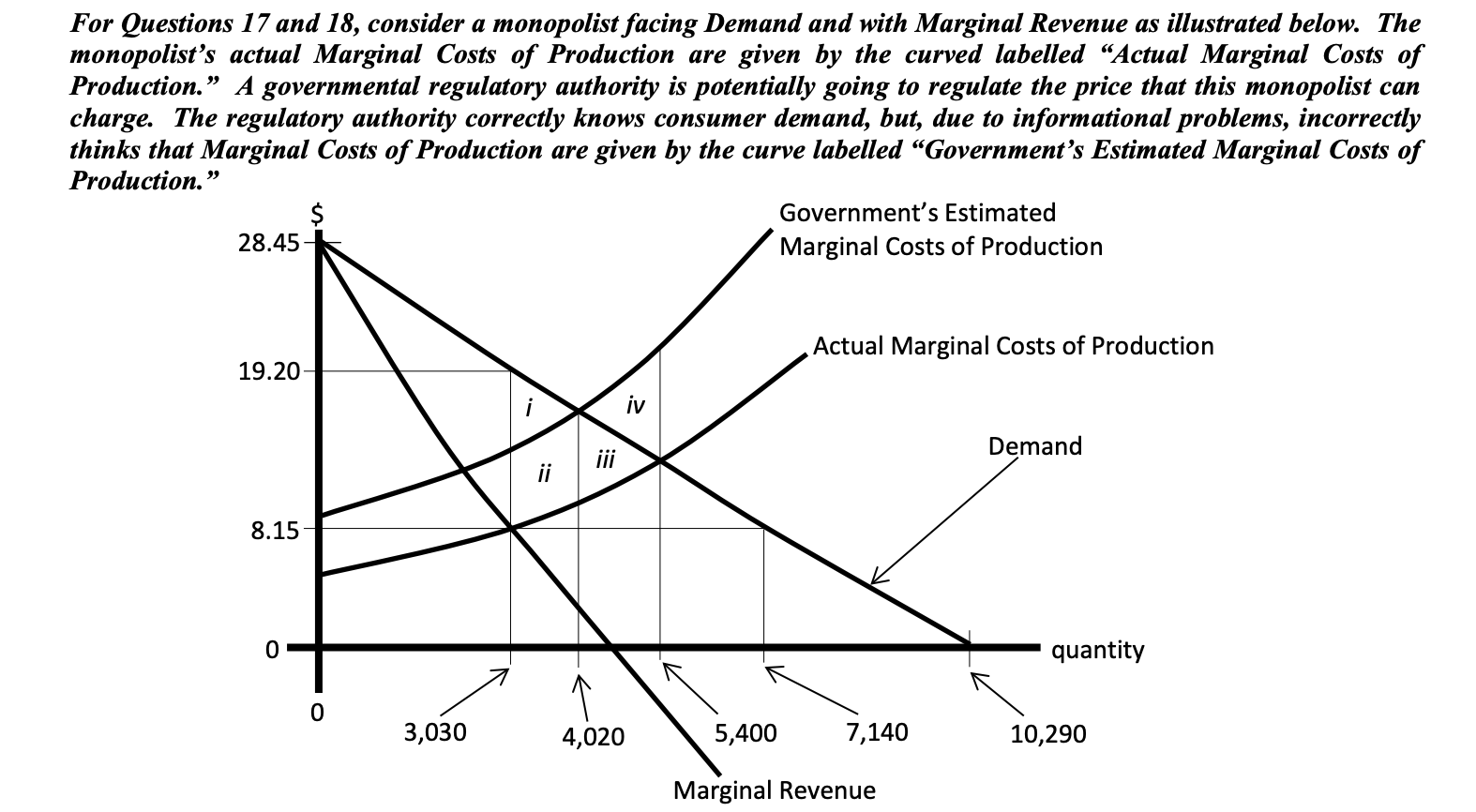

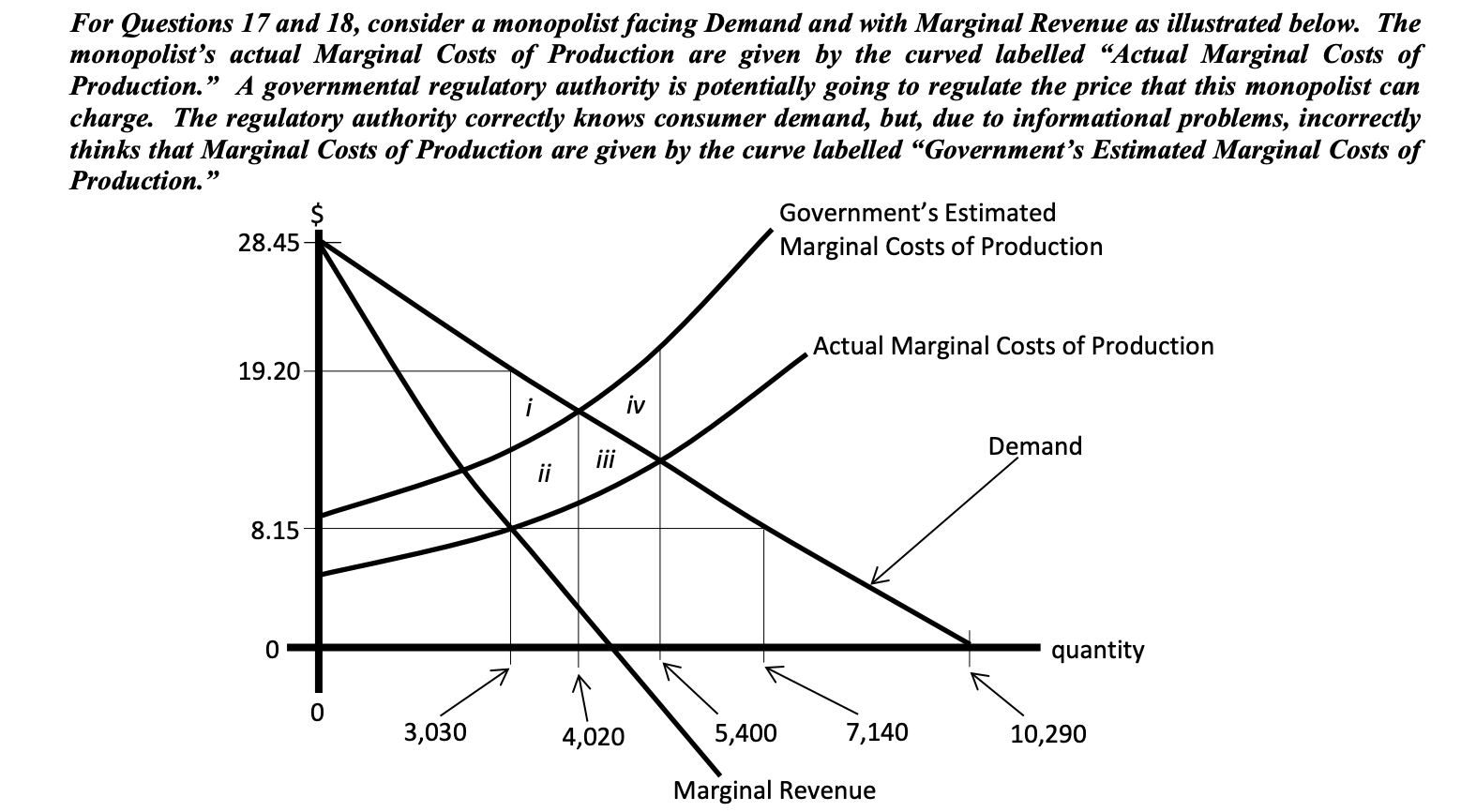

Based upon “Actual Marginal Costs of Production,” the efficient quantity is ____________, but an unregulated profit-maximizing monopolist would produce ____________.

5,400 units; 3,030 units.

Suppose that the government regulates the monopolist by setting the price it is allowed to charge and requiring that it serve all customers who want to purchase the good at this set/regulated price. When the government sets what it believes to be the ideal price to get the efficient quantity traded based upon “Government’s Estimated Marginal Costs of Production,” the resulting Deadweight Loss will be equal to _

area iii.

19. Which of the following is NOT part of the “Coasian Solution” to the problem of externalities?

Prevent individuals from compensating others if they infringe upon the property rights of others.

Which of the following is a good example of a “Club Good”?

A Sirius/XM Satellite Radio broadcast.

“Decision makers having inaccurate information” can

possibly lead to either Market Failure or Government Failure.

The “Incidence of a Tax” refers to

who bears the burden of the tax in terms of decreased welfare.

The efficient level (i.e., Social Surplus maximizing level) of provision of this public good is ______________.

Low Provision

Suppose that this five-person society decides to try to choose the level of provision of the public good by “voting.” For whatever level of public good is provided, the total costs would be split equally between the five million people (e.g., if they were to choose Low Provision, then mandatory taxes of $40 would be imposed on each of the five million people). Given a choice between two different levels, suppose a person will vote for the level which gives them (individually) a larger surplus. Considering a series of pair-wise votes over the various levels, there

is a Condorcet Paradox, since “Zero” defeats “Low,” “Medium” defeats “Zero,” and “Low” defeats “Medium.”

Between 1820 and 1929 the mean value of Government Spending as a Percentage of GDP in the U.S. was 6.78%. Between 1930 and 2024, the mean value of this measure was ________.

33.00%

The __________________ argument in favor of redistribution is based upon a claim that the socially best income distribution maximizes the well-being of the worst-off member of society.

Rawlsian Justice

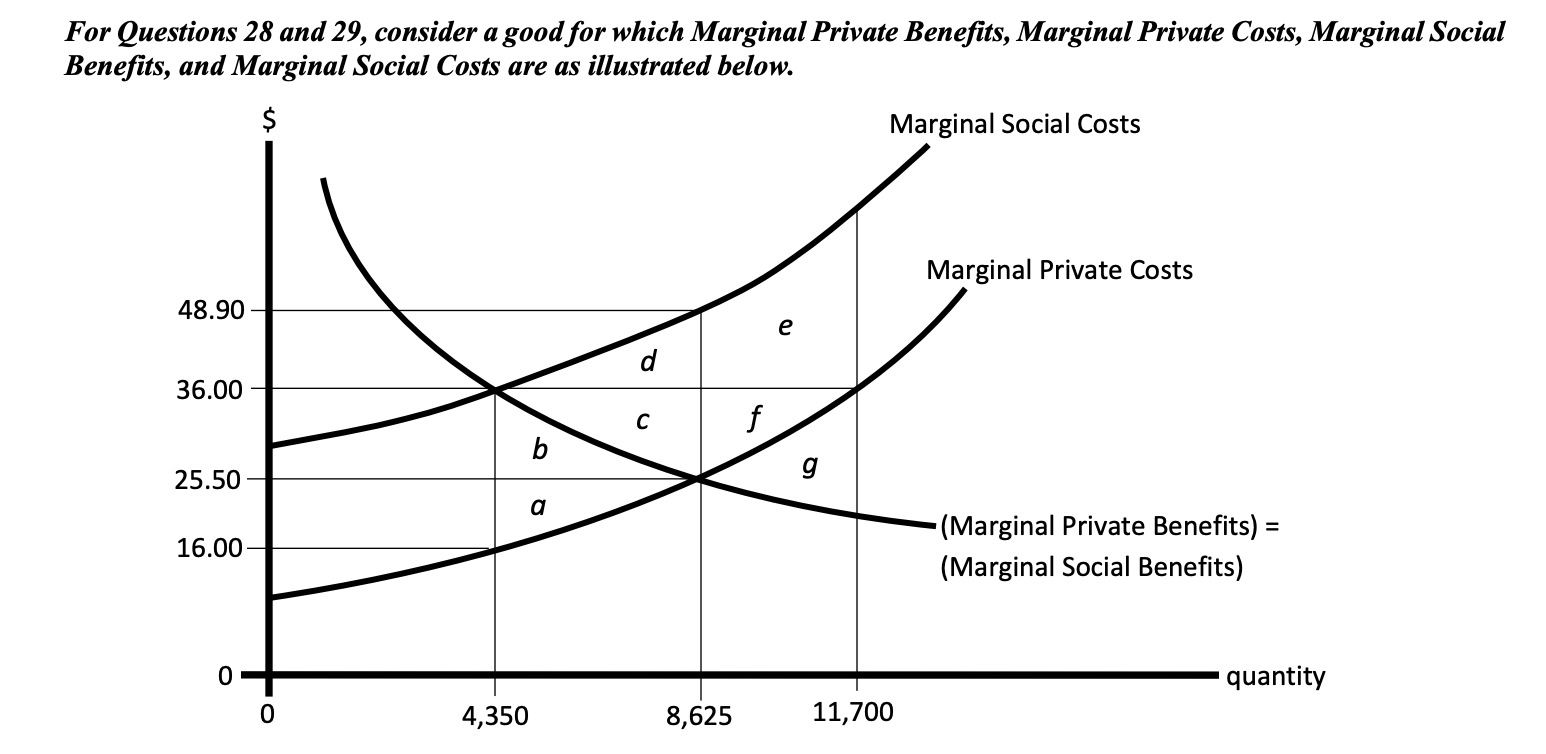

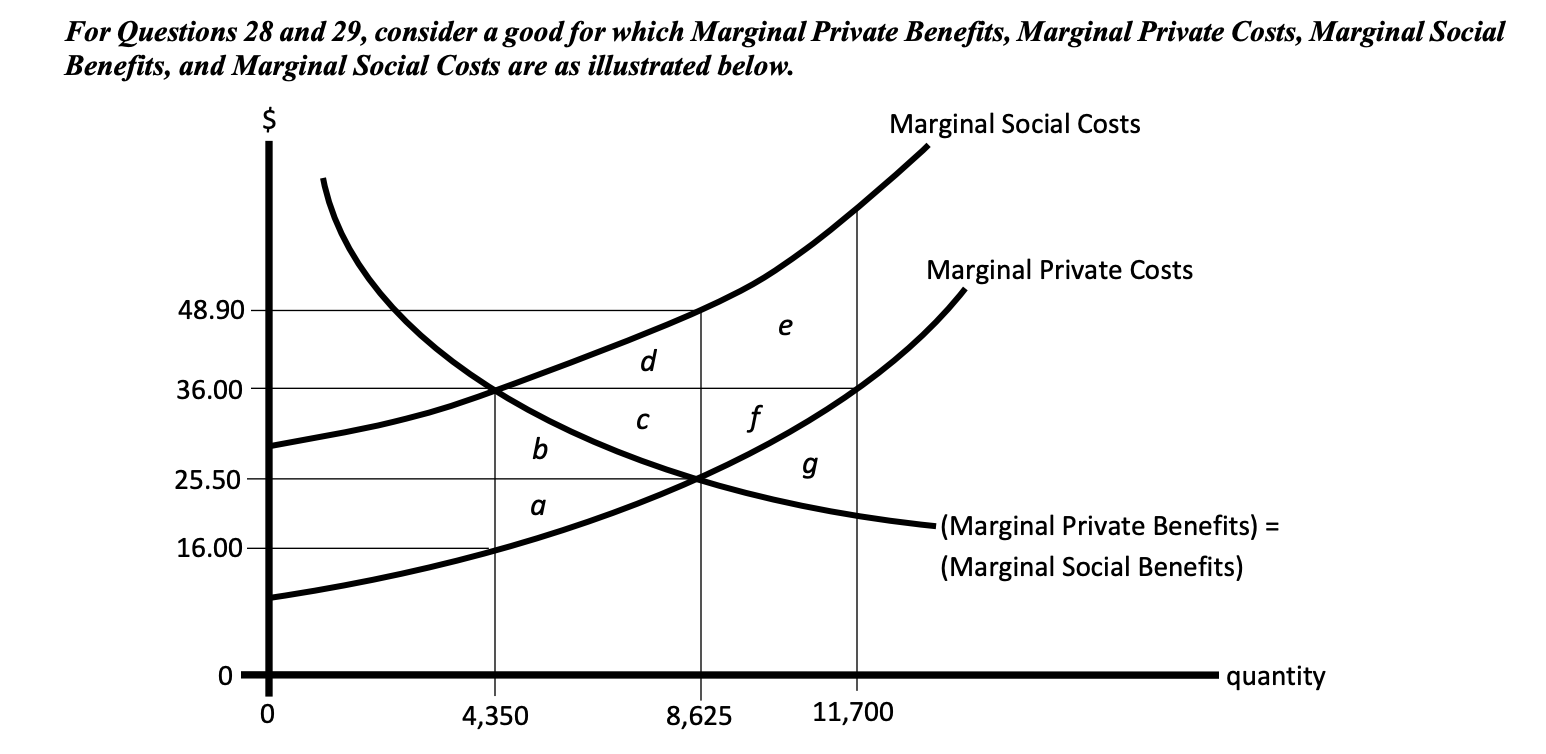

At the “free market outcome” there would be a Deadweight-Loss equal to

B. “areas c+d.”

The “Distribution Function of Government” refers to

. government policies aimed at altering the final levels of consumption of goods/services across consumers/households, usually with the intention of realizing a “fairer” apportionment of consumption/income/wealth.

Suppose a per unit tax of $20.00 were imposed on buyers in this market. With this tax in place

Deadweight Loss is zero due to the efficient level of trade being realized.

Consider the market for Good X. At the market equilibrium (with no tax imposed), 32,000 units are traded at a price of $15.75 per unit. Assume that this is the efficient quantity of trade. If a per unit tax of $1 is imposed on sellers, the government collects tax revenue of $29,500 and Deadweight Loss is equal to $1,225. If this $1 per unit tax were imposed on buyers instead of sellers, then

the tax revenue of the government would be exactly $29,500 and the Deadweight Loss would be exactly $1,225.

Consider the following two statements. Statement 1: “Some households with low income have a large amount of wealth while others have a small amount of wealth.” Statement 2: “No households with a high income have a small amount of wealth.”

Statement 1 is true, but Statement 2 is false.

Which of the following statements about a Lorenz Curve is NOT true?

“A Lorenz Curve must lie above the 45-degree line.”

Suppose that the nine representatives can potentially engage in logrolling by agreeing to “trade votes.” In practice, they will consider doing this by “packaging different proposals together” and having a single up-or-down vote on the package of proposals. Which of the following statements is accurate?

“If ‘Proposals I, II, & III’ are voted on as a package, they will collectively be approved. This outcome increases Total Social Surplus relative to voting on the three proposals separately.”