C214 Topic 3: Statement of Cash Flows

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

Which of the following is NOT part of the statement of cash flows?

Cash flows from liquidating activities

3 multiple choice options

The sum of CFO + CFI + CFF is equal to

The change in cash during the period

3 multiple choice options

Which of the following is true with respect to CFO?

An increase in inventory indicates a reduction in CFO.

3 multiple choice options

Free cash flow (FCF) is different from cash flows from operations (CFO) because FCF

represents cash flow after required investment

3 multiple choice options

Balken, Inc. reports the following on its most recent financial statements:

-Change in accounts payable: $50

-Change in notes payable: $100

-Change in long-term debt: $200

-Change in retained earnings: −$120

Net income: $170

What is Balken's CFF for the period?

$10

3 multiple choice options

The statement of cash flows is not useful when assessing the financial health of a firm due to the impact of accrual accounting.

False

1 multiple choice option

Which of the following will decrease CFO?

An increase in accounts receivable and a decrease in accounts payable

3 multiple choice options

Why is depreciation expense a significant source of difference between net income and CFO?

Depreciation expense is non-cash expense on the income statement associated with the acquisition of long-lived assets.

3 multiple choice options

For visualization purposes, it is correct to think of balance sheet accounts relevant to CFI as being on the bottom of the financing side.

False

1 multiple choice option

Increases in operating assets and decreases in operating liabilities will decrease CFO.

True

1 multiple choice option

0 / 1

While looking at XYZ Corp's two most recent balance sheets, you notice inventory decreased by $100,000. The firm has a tax rate of 40%. To calculate cash flow from operations, you will

add $100,000 to CFO

3 multiple choice options

0 / 1

Assuming no asset disposals, CFI is equal to the change in Net PP&E.

False

1 multiple choice option

A firm can sustain negative CFO indefinitely by borrowing, selling equity, or by selling assets.

False

1 multiple choice option

A firm reports the following cash flow data:

CFO = $1,000,000

CFI = −$750,000

CFF = −$100,000

Which of the following is the most reasonable assessment given the data?

The firm is sustainable in its current state.

3 multiple choice options

Increases in operating balance sheet accounts will decrease CFO.

False

1 multiple choice option

Which of the following is done when calculating CFO?

Add an increase in accrued wages.

3 multiple choice options

Which of the following items should NOT be included in the calculation of CFF?

Change in Retained Earnings

3 multiple choice options

When calculating CFO, you generally include the changes in all current assets and current liabilities.

False

1 multiple choice option

Assuming no asset disposals, depreciation expense is equal to

the change in accumulated depreciation

3 multiple choice options

FCFF can sustainably be distributed to the providers of capital.

True

1 multiple choice option

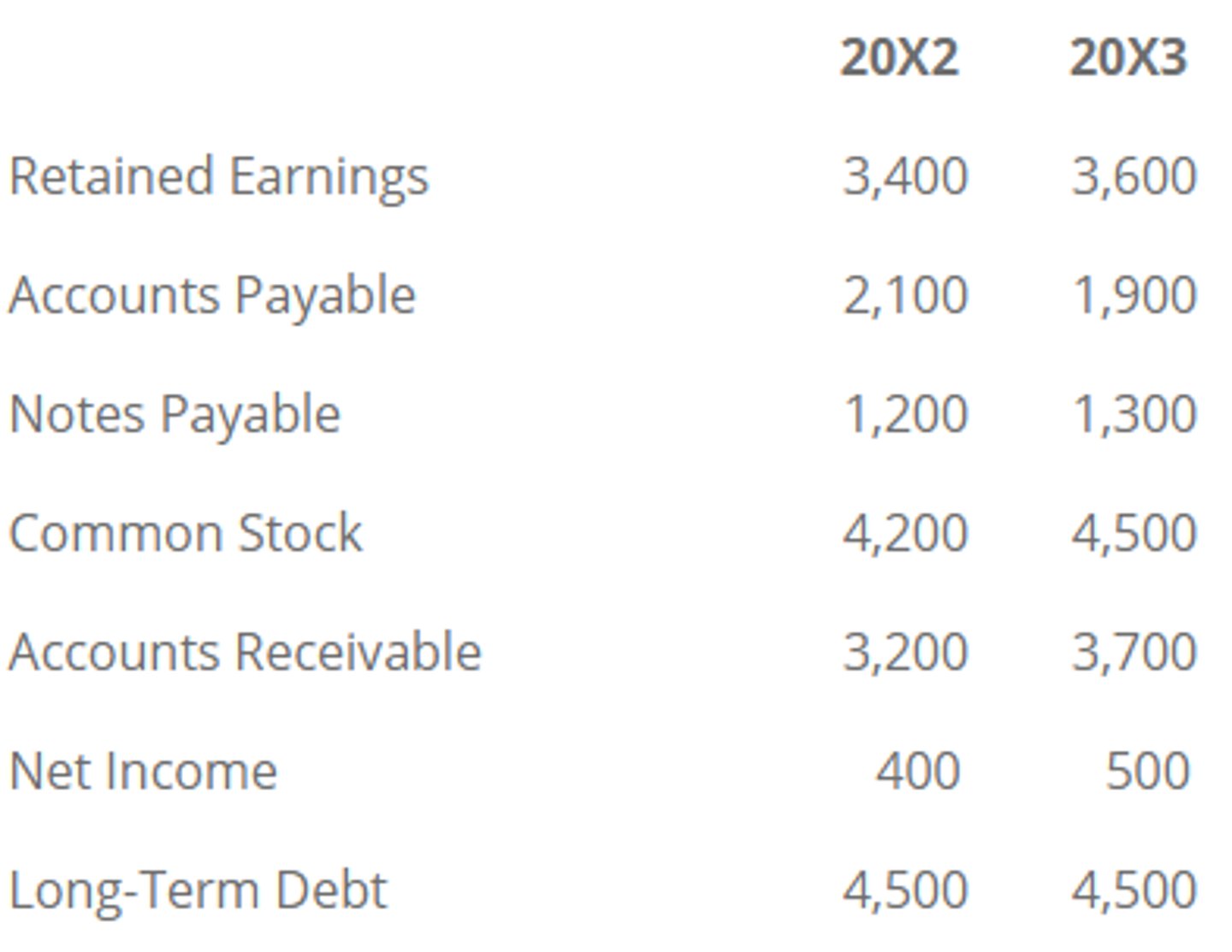

Given the following data, calculate CFF for 20X3.

$100

3 multiple choice options

The calculation of FCFF uses NOPAT instead of Net Income because FCFF is the cash available to both debt holders and equity holders.

True

1 multiple choice option

Company A reported the following for 20X4:

Net income: $100,000

Depreciation: $20,000

Change in A/R: $10,000

What is the cash flow from operating activities?

$110,000

3 multiple choice options

Company B reported the following for 20X4:

Gross equipment (1/1/20X4): $50,000

Gross equipment (12/31/20X4): $65,000

Net income: $100,000

Depreciation: $20,000

What is the cash flow from investing activities for 20X4?

$(15,000)

3 multiple choice options

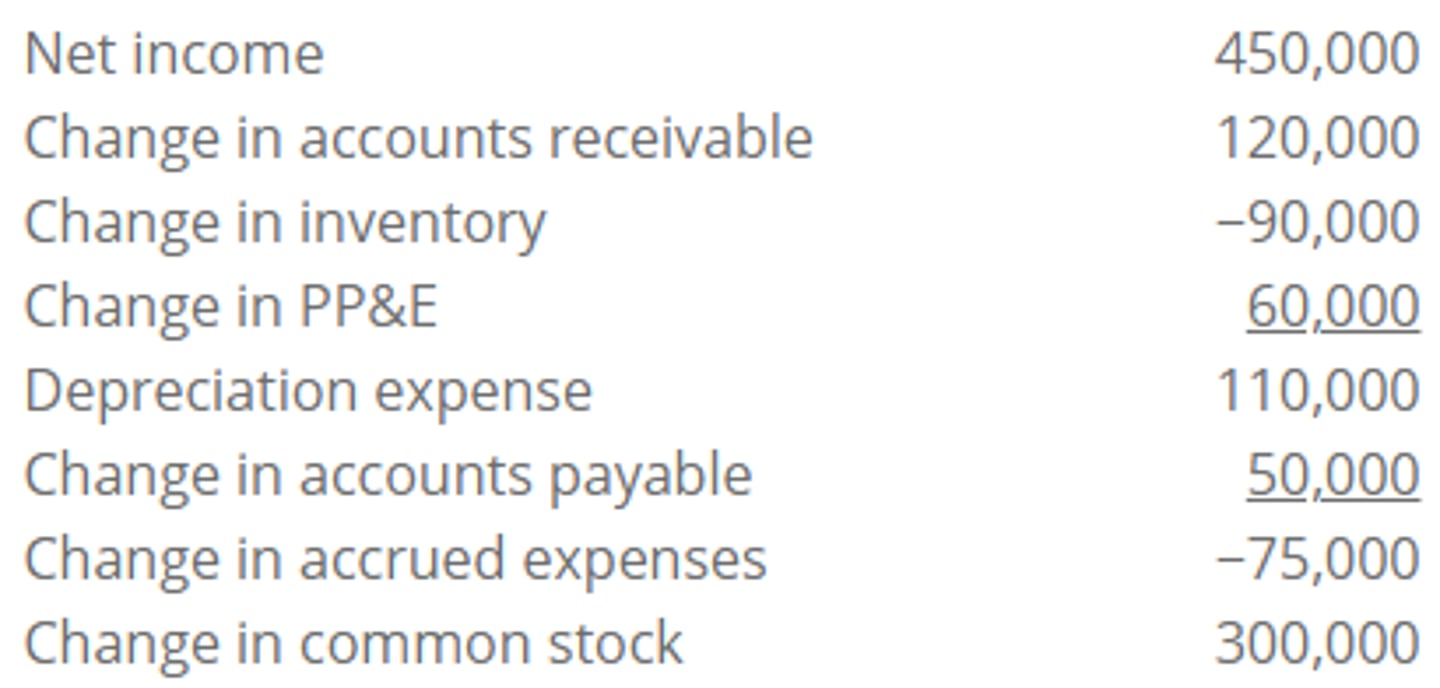

Given the following information, what is the cash flow from operations?

$505,000

3 multiple choice options

Given the following information, what is the cash flow from investing?

Increase in gross PP&E 125,000

Beginning net PP&E 750,000

Ending net PP&E 850,000

Depreciation expense 25,000

$(125,000)

3 multiple choice options

Given the following information, what is the cash flow from financing?

Accounts payable 100,000

Accrued expenses 50,000

Increase in mortgage payable 300,000

Decrease in bonds payable 75,000

Dividends paid 80,000

$145,000

3 multiple choice options

When fixed assets increase, what happens to cash?

Cash decreases.

3 multiple choice options

Last year, a firm recorded net PP&E of $4,600, while this year the same firm recorded net PP&E of $4,500. If the depreciation expense for last year and this year are $500 and $800, respectively, what is the CFI of the company? (Assume no asset disposals.)

$700 outflow

3 multiple choice options

What is the purpose of the statement of cash flows?

C. It explains the change in cash balance for one period of time.

3 multiple choice options

Financial data for Company C is given below for 20X4:

EBIT: 1,000,000

Depreciation: 30,000

Change in working capital: (10,000)

Net capital expenditures: 15,000

Tax rate: 40%

Compute the free cash flow for 20X4.

$625,000

3 multiple choice options