3.4.5 Monopoly

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

Define a pure monoply

There is only one firm in a market, owns 100% of market share

Define a legal monopoly and give an example.

A firm with over 25% market share

For example, Tesco has 29% of market share in the supermarket industry

What are the 4 assumptions of a monopoly model?

Single seller of a good

There are no substitutes

High barriers to entry and exit

Short run profit maximisers

What are the two causes of monopoly power? Explain them.

Legal causes. For example the government gave the BBC permission to be the only operator for TV ( initially) Gov may grant a patent

Growth and Takeovers. Outcompete rivals by taking over them, occurs in a competitve monopoly

What are the 5 barriers to entry and why do firms utilise them?

Firms erect high barriers to entry to protect business from competitiors and enjoy supernormal profits

Legal barriers

Sunk costs

Economies of scale

Brand loyalty

Anti-competitve policies

Explain legal barriers and provide an example.

Legal barriers are any patents, copyright, trademarks to prevent new firms using ideas of an incumbent firm.

e.g, Microsoft filed patents on all of its technology.

Dyson filed a patent on its bagless vacuum and was able to sue a new firm for £4 million

Explain sunk costs.

Sunk costs are costs that cannot be recovered if a firm leaves the market

For example specialist machinery and advertisement. High sunk costs increase the cost of failure which deter new firms from entering due to greater risk of loss

Explain economies of scale and provide an example.

Larger firms benefit from 6 internal economies of scale. Risk bearing, Managerial, Financial, Purchasing, Technical and Marketing. New firms cannot compete with this.

e.g Intel owns 87% of market share, use technical economies to use high tech machinery, lower costs, increase efficiency, smaller firms cannot compete

Explain anti-competitive practices.

Anything a firm may do to reduce or restrict competition.

Vertical integration is an anti-competitive practice as large firms take control of scarce resources and can refuse others from using them. Prevents other firms from entering the market

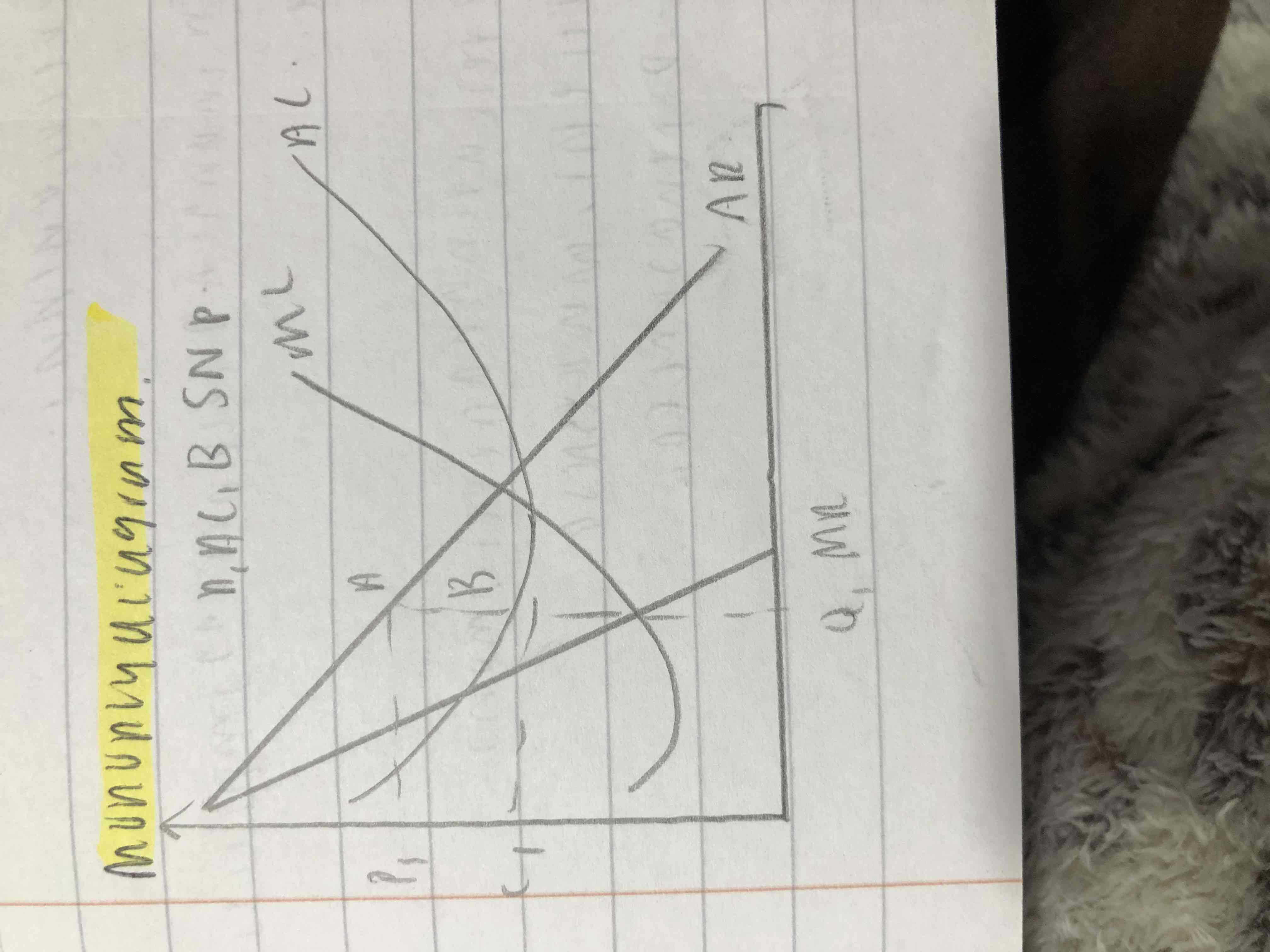

Illustrate the monopoly diagram.

Is a monopoly productively efficient?

No

Productive efficiency occurs at AC=MC. Monopoly does not operate at the minimum efficiency scale as it intentionally restrict output

Is a monopoly allocatively efficient?

No

Firms do not allocate at where MC=AR

Are monopolies dynamically efficient?

Potentially.

As monopolies are profit maximisers they can invest in research and development and become more innovative

However, as they dominate the market, little competition, high SNP, little incentive to invest

Are monopolies X-efficient?

No

Lack of competitive pressure leads to organisational slack

Are these features of consumer welfare met by monopolies?

Low prices

High quality

High levels of choice

Low prices are NOT met, market powet to exploit

High quality is NOT met as their is no incentive to improve

High levels of choice is NOT met as there is only 1 firm in the industry

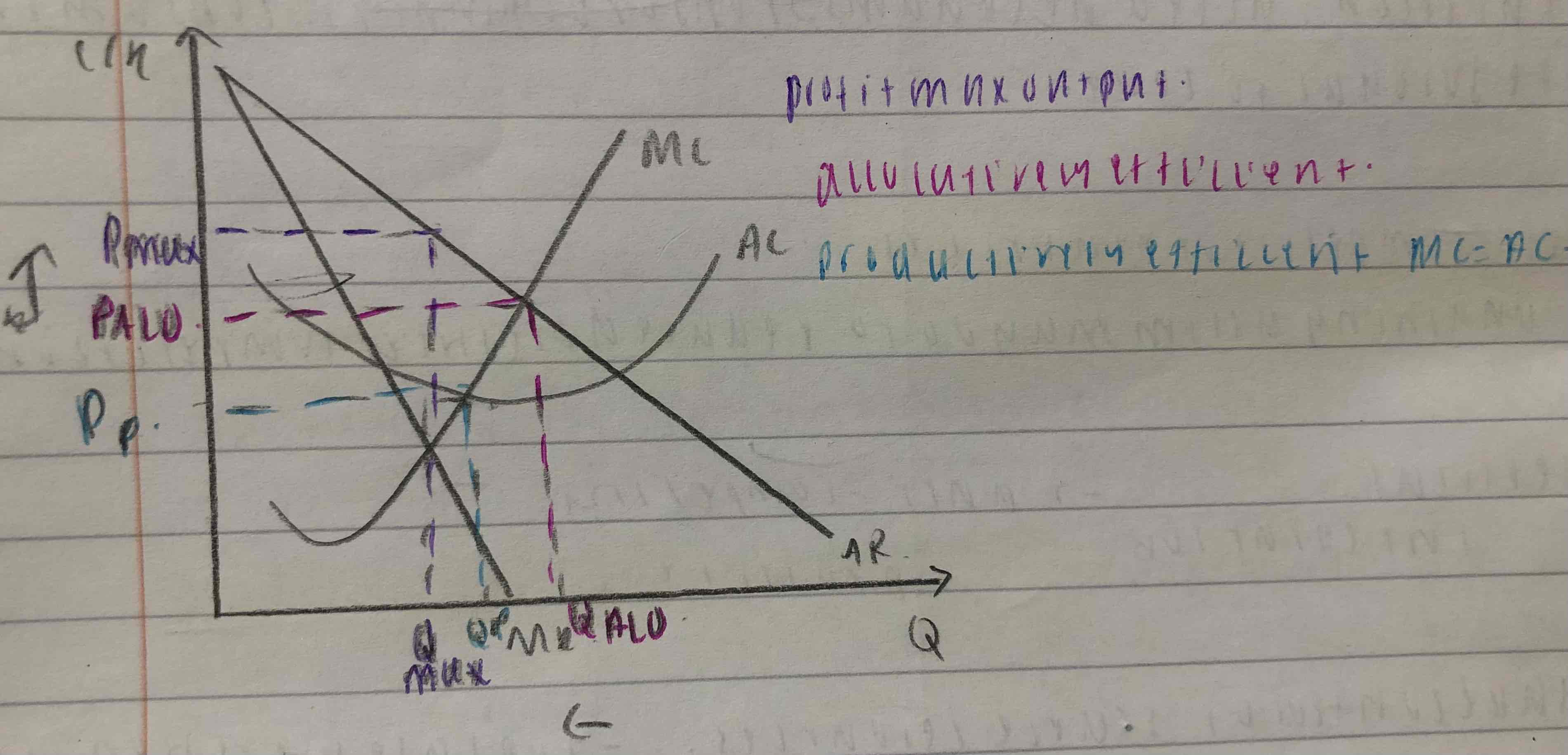

Demonstrate profit max, allocative efficiency and productive efficiency on the monopoly diagram.

Define a natural monopoly and provide 2 examples.

A natural monopoly is an industry with substantial economies of scale that only one firm is viable.

e.g the NHS owns 90% of the healthcare market

Transport for London owns 100% of transport in London

What are 2 features of a Natural Monopoly and provide explanations using TFL as an example.

High sunk costs. E.G. training drivers, technology behind oysters, railway tracks is estimated at £129 billion. It would be inefficient for another firm to open up and do the same

Huge internal economies if scale. Able to reduce long run average costs extremely low. E.G TFL can use technical or purchasing economies of scale to buy fuel in bulk or invest in specialist tech like oyster

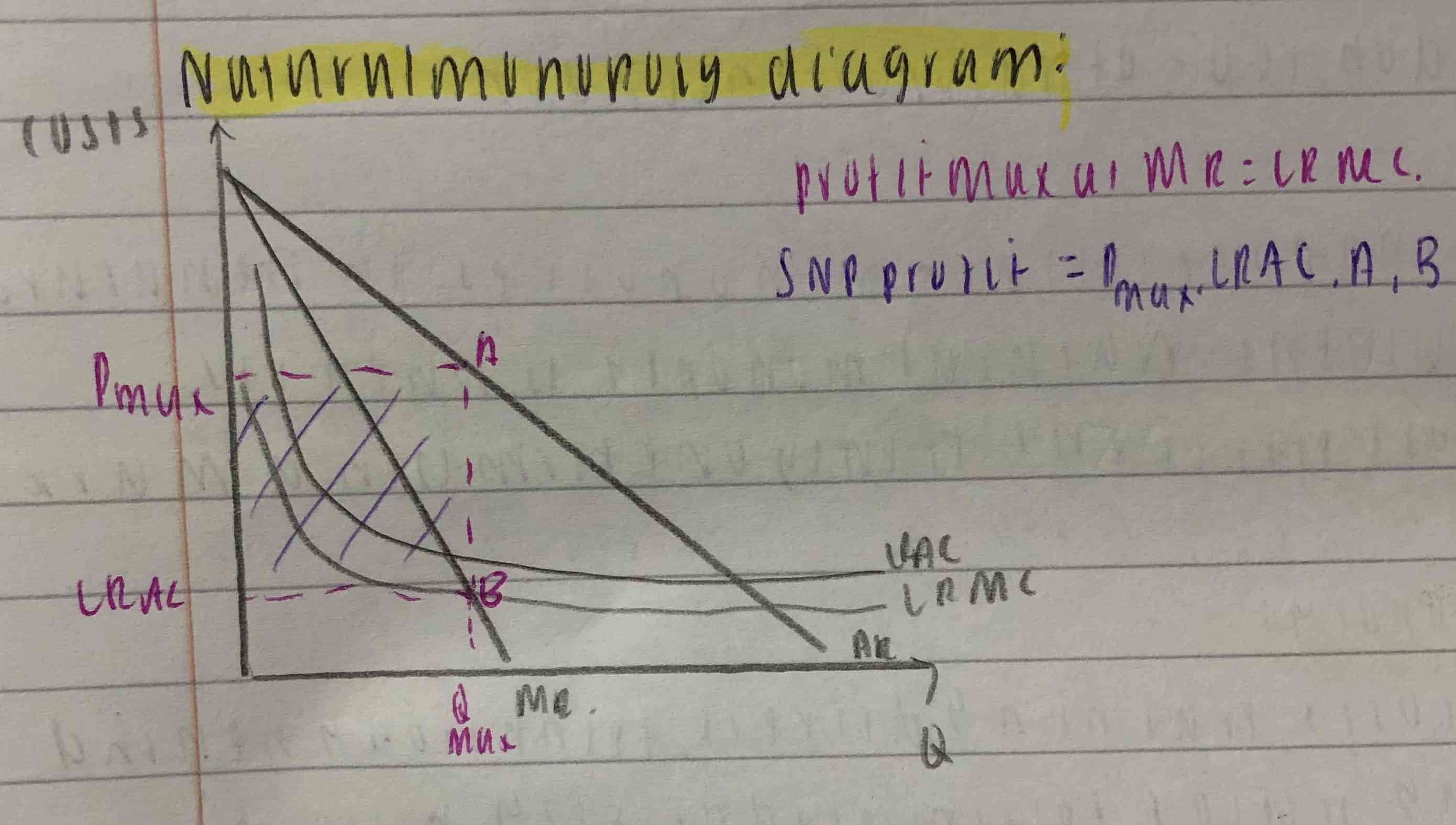

Illustrate the natural monopoly diagram.

Is a natural monopoly productively and allocatively efficient?

Is not productively efficient. AC and MC dont even intersect, have incentive to restrict output to create SNP

Not allocatively efficient as charge price above allocatively efficient level

Why are natural monopolies sometimes nationalised? +eval

They are of essential goods/services and so cannot be left to the free market where firms will use their market power to exploit consumers. The MC curve is below AC curve means its impossible for a firm to charge an allocatively efficient price without making a loss meaning some intervention in the market is required to ensure there is sufficient investment in this service

The problem with nationalisation is the lack of profit incentive may create X- inefficient results

Explain the 3 advantages and disadvantages of a natural monopoly.

1) Avoids the wasteful duplication of resources leading to lower costs and ultimately most likely lower prices for consumers.

A profit max firm will still be incentivised to restrict output meaning there is significant allocative inefficiency and consumers will be charged with high prices. Problem in natural monopoly as it provides essential goods and services to consumer.

2) Nationalisng the industry means economies of scale can be enjoyed without consumers being exploited as the firm no longer behaves as a profit maximiser

However, X-inefficiency is likely to occur when there is no profit incentive

3) Regulation can help achieve allocative efficiency in the natural monopoly case by setting a pricing rule and subsiding the difference between average cost and average revenue

However, Governments need sufficient information to know where to set the price rule in order to regulate efficiency. Even if regulation takes place there will still be ineffiency as a refulated firm lacks incentive to keep costs down due to limited profits.

What is price discrimination and provide an example.

Price discrimination is when a firm chargers different groups of consumers different prices but for the same good

E.G Amazon changes its prices over 2 million times per day

What are the 3 conditions required for price discrimination to occur?

1) Firm must have market power. This is so that they can charge anything other than the market price.

2) Firm must have information. E.G Amazon uses age gender to figure out elasticity

3) Consumers must have limited ability to re-sell the product. If they can resell the product price discrimination would not work.

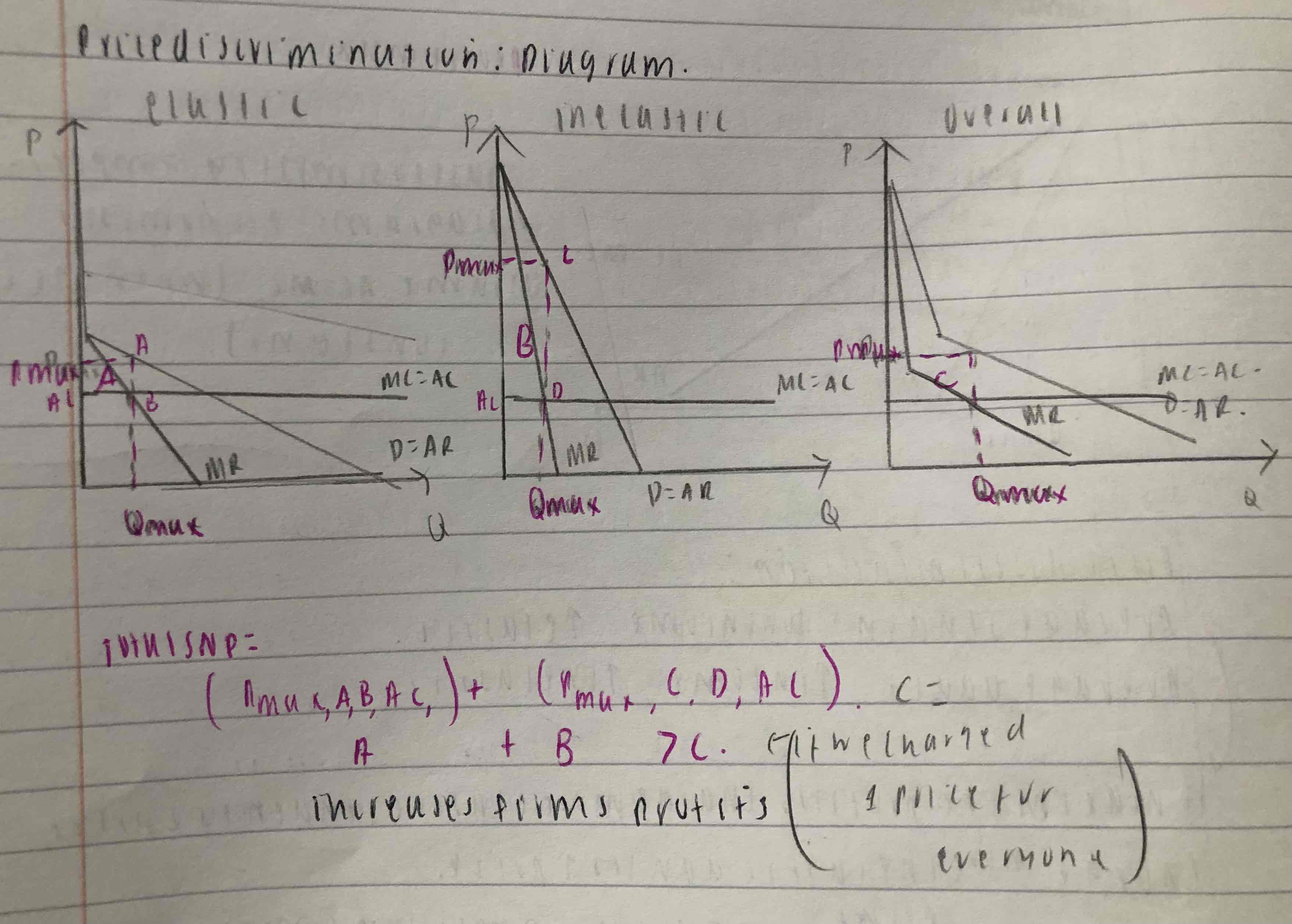

Illustrate the price discrimination diagram.

state 2 advantages and disadvantages of price discrimination on consumers.

One advantage is increased consumer welfare/equality due to lower prices for more elastic consumers like students or low income. disadvantage, price discrimination in monopoly lead to exploitation of inelastic consumers

one advantage is increased quality. Price discrimination allows firms to match prices with consumers' willingness to pay. In theory, this can lead to a more efficient allocation of resources, as more people may be able to purchase the product (especially those who otherwise wouldn’t have bought it at the higher price). This can lead to higher output and an increase in total welfare. however, little incentive to invest and innovate if little competition, profit max firms

Increased supernormal proft area a+b>c, increased dynamic efficiency increased investment quality of a good or service more consumers etc

Increase brand loyalty due to firms using targeted pricing strategies, leading to better service or product offerings for those consumers.

Evaluate the advantages and disadvantages of monopoly power. [1]

(there are 6)

1) Firms are likely to use their power to exploirt consumers by charging high prices and operating productively and allocatively inefficienctly (use standard monopoly diagram)

However, firms will still benefit from economies of scale in a monopoly and will therefore be more productively efficient. Even if they do exploit consumers they could still use their greater productive efficiency to charge lower prices than in perfect competition at least be dynamically efficient and produce better quality products

Evaluate the advantages and disadvantages of monopoly power. [2]

Monopolies make supernormal profits which can be used to be dynamically efficient

However, if monopolies have complete market power they will not do this they wull simply enjoy greater profits and not re invest them due to little incentive

Evaluate the advantages and disadvantages of a monopoly. [3]

If firms can price discriminate there is no deadweight loss to society simply a reallocation of welfare from consumers to producers

However, perfect price discrimination is unlikely. A deadweight loss is likely to result from a monopoly

Evaluate the advantages and disadvantages of a monopoly [4]

The government can use competition policy to refulate monopoly firms limiting their power by forcing them to operate at the allocatively efficieny level. Increase in consumer surplus.

If the monopolist knowns the government will step in and regulate when they make a supernormal profit there is little incentive to be efficient in the first place and X inefficiency is likely to result

What are the advantages of a monopoly on consumers?

Higher quality of goods

Lower prices

What are the advantages of monopolies for firms?

Price makers

Drive out competitors through dynamic efficiency