aggregate demand & supply

1/43

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

44 Terms

real wealth effect

price rises, dollars buy fewer goods and services, people feel poorer, spending decreases. TLDR; increase in P, causes fall in C & decrease in # of goods and services demanded

interest-rate effect

price rises, takes more dollars to buy g&s, people sell assets for money driving up interest rates.

TLDR; increase in P causes increase in I, smaller # of g&s demanded

what happens to the AD curve when a ten year old investment credit tax expires?

I decreases, shift to the left

what happens to the AD curve when there is a fall in prices that increases the real value of consumers’ wealth?

shift down along AD curve (wealth-effect)

what happens to the AD curve when state governments eliminate sales tax?

C increases, shift to the right

why is the the LRAS vertical?

the natural rate of output/potential output/full-employment output is not influenced by price, and is influenced only by labor, capital, and level of technology

example scenarios of shifts in LRAS

baby boom generation retires, long-term supply decreases, LRAS shifts left

new government policies reduce the natural rate of employment, the % of the labor force employed increases, LRAS shifts right

LRAS shifts from human/physical capital

investment in factories or equipment, capital rises, LRAS shifts right

more people get degrees, capital rises, LRAS shifts right

natural disasters destroy factories, capital decreases, lRAS shifts left

LRAS shifts from changes in natural resources & technology

change in weather patterns makes farming more difficult, LRAS shifts left

discovery of new minerals, LRAS shifts right

reduction in supply of imported resources such as oil, LRAS shifts right

technological advances that allow more output to be produced from given inputs, LRAS shifts right

SRAS

(over a period of 1-2 years), increase in P causes increase in g&s supplied

sticky wage theory

wages take time to change

if price level > price expected, firms increase output and employment

higher price causes higher output

SRAS curve slopes upward

increase in price level causes decrease in unemployment (more employment)

decrease in price level causes increase in unemployment (less employment)

LRAS vs SRAS

if AS is vertical, changes in AD don’t cause changes in output and employment (LRAS)

if AS slopes up, changes in AD cause changes in output and employment (SRAS)

consumer spending (AD curve)

positive outlook (shift right) negative outlook (shift left), tax increase (shift left), income increase (shift right)

investment spending (ad curve)

positive expectations (shift right), negative expectations (shift left), lower interest rates (shift right), higher interest rates (shift left)

government spending (ad curve)

increase in spending (shift right), decrease in spending (shift left)

net exports (ad curve)

increase in exports from weakened domestic currency (shift to right), decrease in exports from strengthened domestic currency (shift to left)

monetary policy (ad curve)

increase in money supply (lowers interest, shift to right), decrease in money supply (increases interest, shift to left)

factors that increase AD (shift to right)

higher consumer/business confidence

increased government spending

higher exports/lower imports

increased money supply (reduced interest rates)

factors that decrease AD (shift to left)

lower consumer confidence

lower disposable income

decreased government spending

lower exports/higher imports

decreased money supply (higher interest rates)

factors that increase AS (shift to right)

decreased input prices

increase in productivity

positive supply shocks

lower cost expectations

decrease in taxes

reduced government regulation

factors that decrease SRAS

increased input prices

decrease in producivity

negative supply shocks

expectations of higher costs

increase in taxes

increase in government regulation

when SRAS shifts to the right…

price level 👇, real gdp 👆

when SRAS shifts to the left…

price level 👆, real gdp 👇

when AD shifts to the right…

price level 👆, real gdp 👆

when AD shifts to the left…

price level 👇, real gdp 👇

when LRAS shifts right…

price level stays the same, real gdp up👆

when LRAS shifts left…

price level👆, real gdp 👇

multiplier effect

1/1-MPC

example: if the MPC is 80%, then the multiplier would be 1/1-0.8, = 1/0.2=5

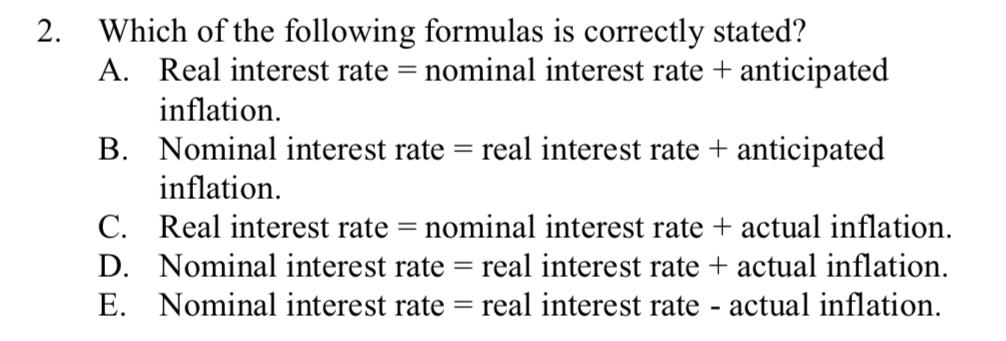

which of the following formulas is correctly stated?

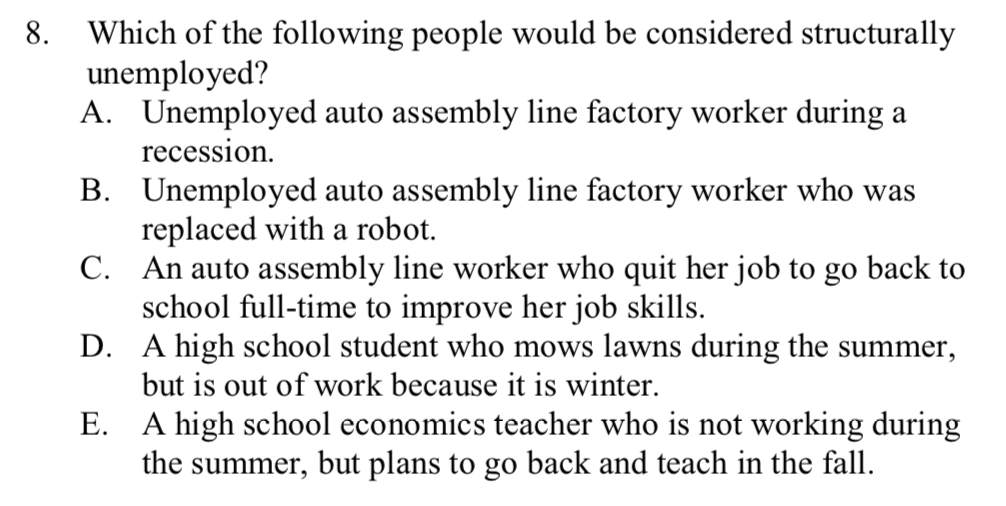

which of the following people would be considered structurally unemployed?

which of the following describes the components of aggregate demand?

C + I + G + (exports-imports)

formula for nominal interest rate

real interest rate + anticipated inflation rate

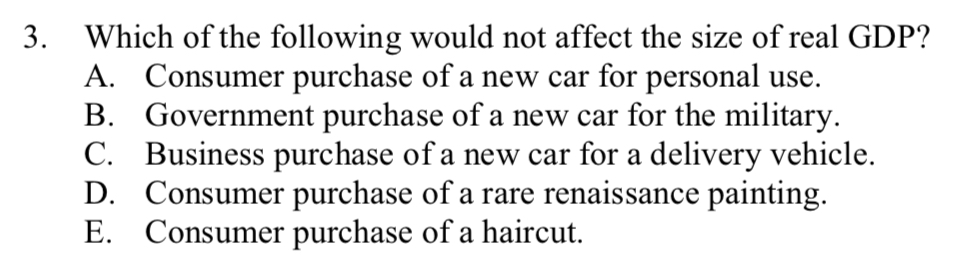

which of the following would not affect the size of real gdp?

D, consumer purchase of a rare painting

why: not newly produced (read CAREFULLY)

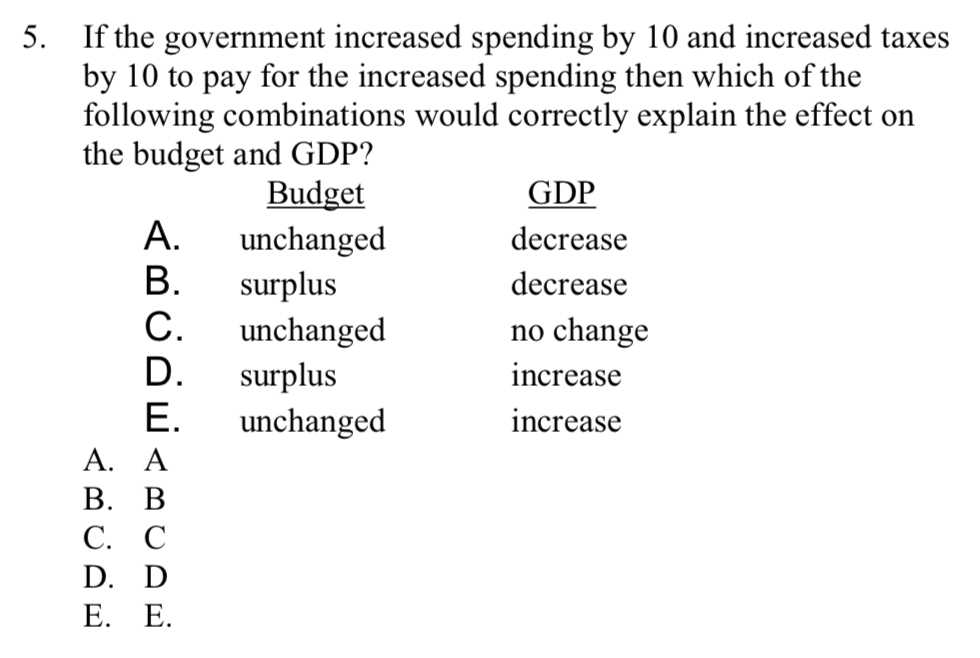

if the government increased spending by 10 and increased taxes by 10 to pay for the increased spending then which of the following combinations would correctly explain the effect on the budget and GDP?

E, budget unchanged, real gdp increases

why: government spending directly increases demand

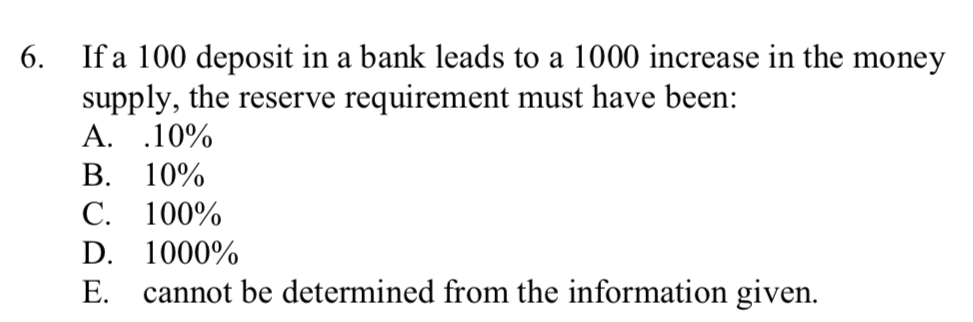

if a 100 dollar increase leads to a 1000 dollar increase in the money supply, the reserve requirement must have been

B, 10%

why:

multiplier = 1/reserve requirement

money creation = initial deposit x multiplier

reserve requirement = 1/multiplier

10=1/rr

rr=1/10=0.10=10%

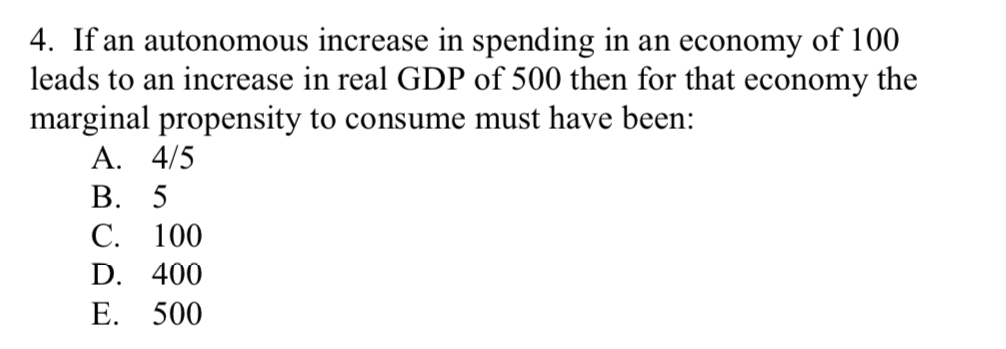

if an autonomous increase in spending in an economy of 100 leads to an increase in real GDP of 500 then the marginal propensity to consume must have been…

A, 4/5 or 0.8

multiplier = 1/1-mpc

multiplier= change in gdp/change in spending, 500/100=5

5=1/1-mpc

1=5(1-mpc)

mpc = 4/5

fiscal policy

who controls it: congress and president

what: managing taxes and government spending

expansionary fiscal policy (boosts economy)

lowering taxes: people have more disposable income to spend

increased government spending: direct increases why in demand, more jobs

contractionary fiscal policy (fights inflation)

raising taxes: people spend less

decreased government spending: less money circulating, aggregate demand directly decreases

monetary policy

who controls it: the federal reserve

what: buying/selling bonds, reserve requirements (how much banks must hold), discount rate (interest rate for banks)

expansionary monetary policy (boosts economy)

lowering interest rates: borrowing is cheaper, more investments and consumer spending

buying government bonds: increases money supply for more spending

contractionary monetary policy (fights inflation)

raise interest rates: people invest and spend less

selling government bonds: banks have less money, higher interest rates, less money supply

phillips curve

high inflation = lower unemployment

lower inflation = higher unemployment