Macroeconomic Equilibrium

1/10

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

11 Terms

What is real national output equilibrium?

When AD intersects with SRAS

What will cause new short run equilibriums?

Any changes in the components of AD will shift the curve left or right

Any changes to the non price determinants of SRAS will shift the curve left or right

What do Classical economists believe in the long run equilibrium?

The economy will always return to its full potential level of output and all that will change in the long run is the average price level

What is the Classical Adjustment Process (self correcting)?

Classical economists believe that the economy will self correct itself back to full potential output in the long run

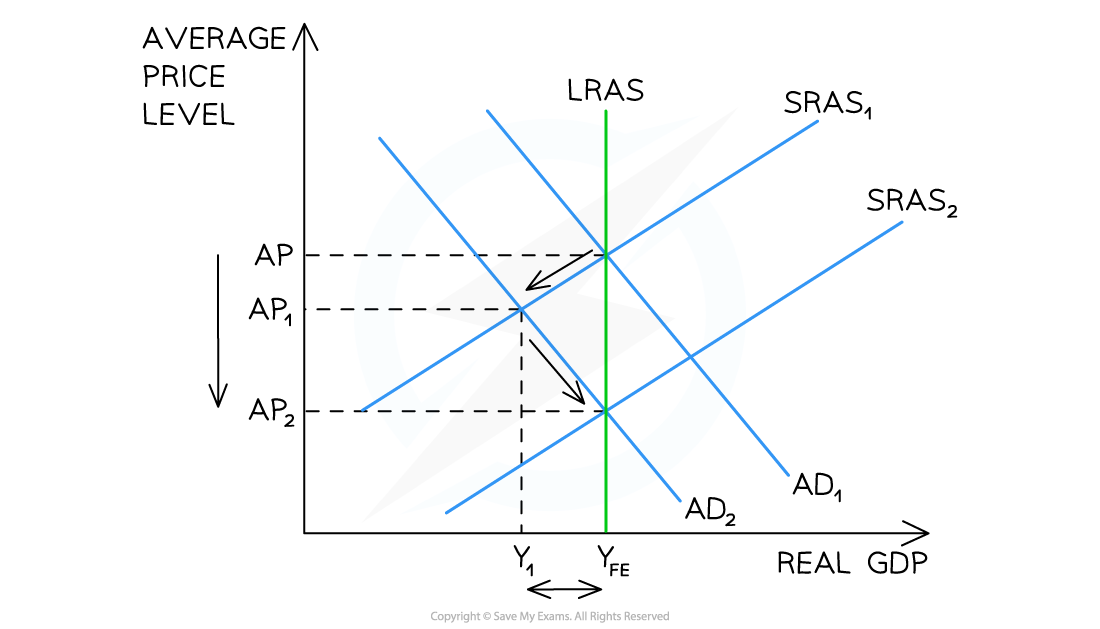

How does self correcting adjust from a deflationary output gap?

Economy is in recession/deflationary gap

Fall in output = lay off workers

Unemployed workers now willing and able to work for lower wages → reduces costs of production → SRAS curve shifts to the right

New long run equilibrium created

Economy back at full employment but at a lower average price

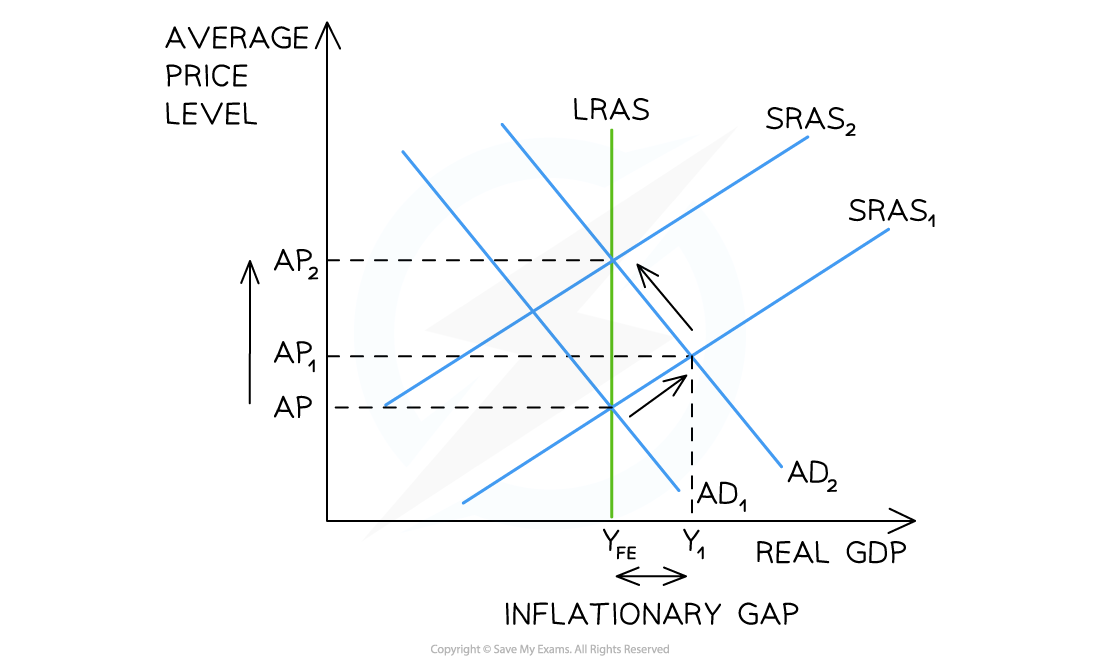

How does self correcting work in a inflationary output gap?

Economy is producing more output than potential

Output rises = prices rices

Increase in average prices (inflation) → workers demand higher wages

Higher wages increase costs of production → shifts SRAS curve to the left

New long run equilibrium formed

Economy is back at full employment but at a higher average price

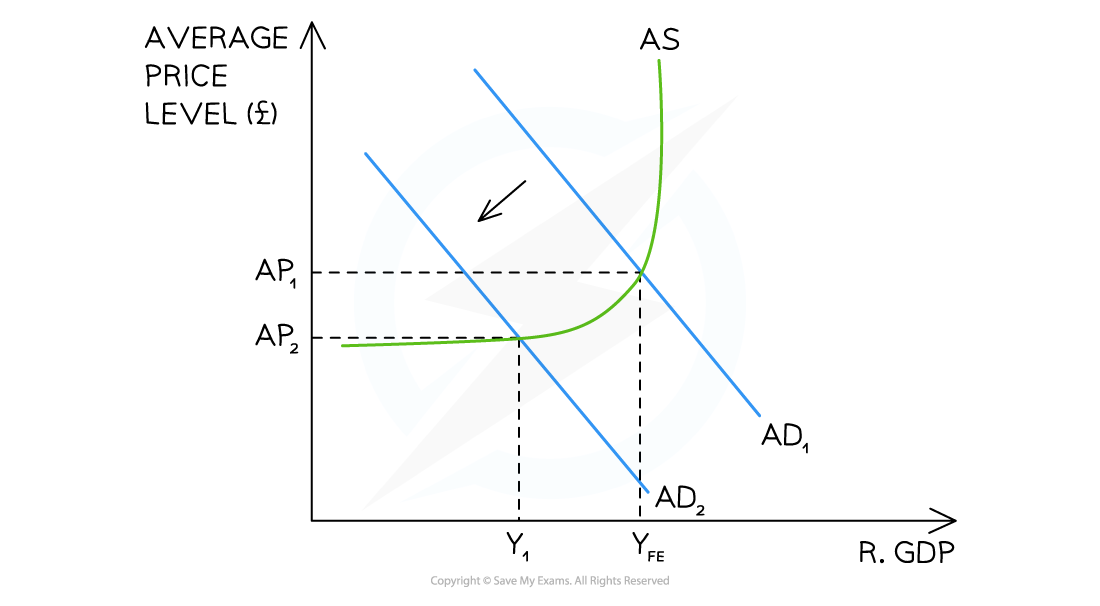

What is the Keynesian view of long run equilibrium?

Believe that the economy can be in long run equilibrium at any level of output

Economy will not always self correct and return to full employment

Can get stuck at equilibrium below the full employment level

Role of the government to increase its expenditure to shift AD to change the ‘animal spirits’ in the economy and prevent hgih employment, low output and low confidence

What are the assumptions and implications of Classical thinking?

Wages are flexible → markets can self correct in the long run due to flexible wages to change costs of production. This self correction is based on automatic short run supply side changes, hence no need for government intervention

Any deviation from Yfe is temporary → there may be periods of unemployment went recessionary gaps occur, however markets will return to Yfe which corresponds to the natural rate of unemployment of an economy

Demand side policies are less effective than supply side policies in generation economic growth → Economic growth is generated by increasing the productive capacity of the economy → Says’ Law → government intervention should focus on increasing the supply side of the economy

What are the assumptions and implications of Keynesian thinking?

“In the long run we are all dead” → idea of self correcting markets in the long run was flawed and that it could take a long time, resulting in severe recessionary gaps and rise unemployment, lasting for generations

Wages can be inflexible ‘sticky’ downwards → markets will reach a point where self correction as a result of falling wages is no longer viable. Workers will reach a point where they are no longer willing to accept lower wages, and wage decreases cannot occur due to wage blockages (eg minimum wage laws)

Governments have to intervene to break the negative ‘animal spirits’ → human emotions driven by financial decisions and uncertainty/volatility of market → if the emotions are gloomy about the economic outlook, then gloominess will continue → Great Depression → government spending can help boost the economy and build business and consumer confidence

Real world deflationary example of macroeconomic equilibrium

Japan 1990s

Cause: Asset bubble burst caused demand collapse and deflation.

Policy: Public infrastructure investment, labor reforms, R&D incentives, and quantitative easing.

Outcome: Gradual recovery as deflation eased and the economy moved toward equilibrium.

Real world inflationary example of macroeconomic equilibrium

USA Post Covid

Cause: Excessive stimulus and demand recovery outpaced LRAS.

Policy: Infrastructure spending, labor market reforms, R&D incentives, and monetary tightening.

Outcome: Inflation moderated, and the economy returned to equilibrium by 2023.