Chapter 19: The Phillips Curve and Inflation

1/70

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

71 Terms

Three causes of inflation

1. Inflation expectations

2. Demand-pull inflation

3. Supply shocks and cost-push inflation

the rate at which average prices are anticipated to rise next year

inflation expectations

If they expect inflation to be 2% next year, then it’s likely the prices of their key inputs will also rise by 2%

Thus, they’ll raise next year’s prices by 2% to keep up

Inflation expectations

inflation resulting from excess demand

demand-pull inflation

When demand outstrips a business’ productive capacity, it raises prices

demand-pull inflation

When business is booming, it can take over an hour to get a table. In the long run

open new restaurants

When business is booming, it can take over an hour to get a table. In the short run

raise prices

When demand exceeds the economy’s productive capacity, prices rise

scaling up

widespread price increases create

demand-pull inflation

inflation that results from an unexpected rise in production costs

cost-push inflation

The original catalyst for cost-push inflation is a

supply shock

Demand-pull inflation increases the

output gap

Inflation =

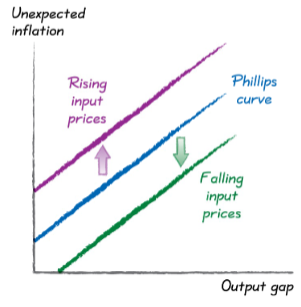

expected inflation + Demand-pull inflation + cost-push inflation

Two key factors for setting prices

marginal costs and competitor’s prices

If people expect high inflation, they’ll get

high inflation

If people expect low inflation, they’ll get

low inflation

Inflation expectations lead and actual inflation

follows

The goal of monetary policy is to try to shape

inflation expectations

suggests what investors expect inflation to be over the next 10 years

10-year break-even rate

ongoing survey of professional economists regarding their inflation forecasts

economists’ forecasts

Three ways to track inflation expectations

surveys, economists’ forecasts, financial markets

people who expect recent levels of inflation to continue

adaptive expectations

people who believe the Fed will deliver on its promise to ensure inflation stays around 2%

anchored expectations

people who use all available data to come up with the most accurate forecast possible

rational expectations

people who revisit their views on inflation only irregularly, so they stick with their previous view

sticky expectations

when the quantity demanded at the prevailing price exceeds the quantity supplied

excess demand

can also pull inflation below inflation expectations when demand is unexpectedly weak

demand-pull inflation

when the quantity demanded at the prevailing price is below what’s supplied

insufficient demand

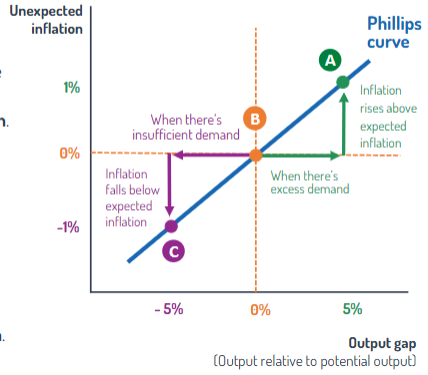

When demand matches the economy’s productive capacity, there’s no

demand-pull inflation, inflation = inflation expectations

Demand-pull inflation is driven by the

output gap

When there’s a positive output gap, there’s

excess demand

When there’s a negative output gap, there’s

insufficient demand

Unexpected inflation =

inflation - inflation expectations

Draw Phillips Curve

y

Higher output relative to potential leads to greater

inflationary pressure

predicts how far inflation will diverge from expected inflation

phillips curve

If unexpected inflation is (BLANK) actual inflation equals expected inflation

zero

If unexpected inflation is (BLANK) actual inflation will be less than expected inflation

negative

Negative on the Phillips curve does not mean that actual inflation is

negative

If unexpected inflation is (BLANK) actual inflation will be greater than expected inflation

positive

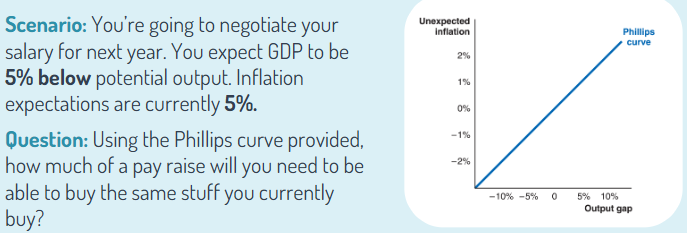

4%

high unemployment means

below potential, low unexpected inflation

low unemployment means

above potential, high unexpected inflation

equilibrium unemployment rate means

at potential, zero unexpected inflation

Draw labor market Phillips curve

y

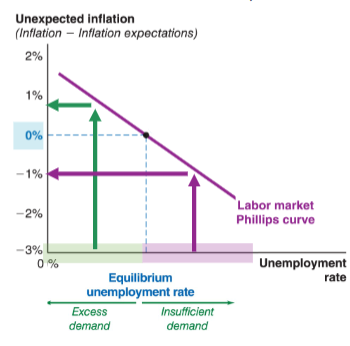

When an unexpected boost to production costs pushes sellers to raise their prices

cost-push inflation

Any factor that leads to an unexpected rise in production costs will cause the Phillips curve to

shift upward

Any change in production costs that leads suppliers to change the prices they charge at any given level of output

supply shocks

supply shocks shift the

Phillips curve

Three causes of supply shocks that shift the Phillips curve

input prices, productivity, exchange rates

input prices, productivity, and exchange rates all focus on

unexpected changes

Draw rising and falling input prices on the Phillips curve

y

If the prices of your inputs rise it

increases inflation and shifts Phillips curve up

If the prices of your inputs fall it

decreases inflation and shifts Phillips curve down

Important input prices that can spark cost-push inflation

oil and commodity prices, rising wages

a cycle where higher prices lead to higher nominal wages, which leads to higher prices

wage-price spiral

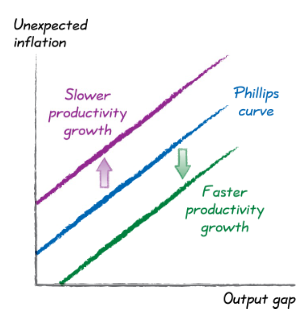

Faster-than-expected productivity growth lowers your

marginal costs

Faster productivity growth causes the Phillips curve to

shift down

Slower productivity growth causes the Phillips curve to

shift up

Draw faster and slower productivity growth on the Phillips curve

y

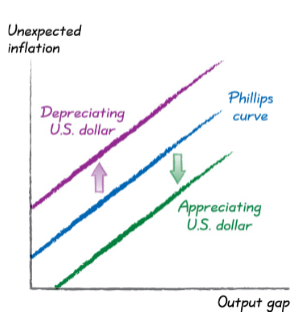

A depreciating U.S. dollar causes the Phillips curve to

shift up

An appreciating U.S. dollar causes the Phillips curve to

shift down

When the the U.S. dollar depreciates, it means the U.S. dollar becomes (BLANK) for foreigners to buy

cheaper

Draw depreciating and appreciating U.S. dollar on Phillips curve

y

When the U.S. dollar depreciates, foreign goods are more expensive for people in the United States

direct effect

More expensive foreign goods lead to higher prices on domestic goods

indirect effect

Demand-pull inflation leads to (BLANK) the Phillips curve

movement along

Cost-push inflation leads to a (BLANK) in the Phillips curve

shift

(BLANK) neither shift nor cause movement along the Phillips curve

inflation expectations

Inflation expectations are a key (BLANK) factor in determining overall inflation

long-run

Phillips curve focuses on the

short run