105 Lesson 1: The Functions of the Financial System, Assets, Contracts, Financial Intermediaries, and Positions

1/79

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

80 Terms

What are the three main functions of the financial system?

To help people achieve their purposes in using the financial system.

To find the rate of return where aggregated saving = aggregated borrowings.

Allocate capital where is most efficient.

How does the financial system supports the saving process?

The financial system creates investment vehicles (bank deposits, notes, stocks, etc.) for investors to by or sell and it minimizes transaction costs.

How does the financial system supports borrowing?

A well-functioning financial system reduces transaction costs (arranging, monitoring and recovering of loans) which improves borrowing efficiency.

How does the financial system help companies in raising equity capital?

The financial system is responsible of the valuation of securities that company’s sell. They ensure that the financial information is accurate, disclose and promote transparency and liquidity in investors participation.

What is the objective of risk-hedging contracts?

These contracts address different types of risks like for example: default, exchange rate, and interest rate risks.

How does the financial system facilitates exchange of assets?

The financial system reduces transaction costs for traders and creates liquidity in sport markets (inmmediate delivery)

What does information-base trading generate?

Information-base trading is promoted by the financial system and achieves liquid markets with low transaction costs because of good practice of accounting standards and regulatory requirements.

What is the main objective of savers and borrowers in regards of transferring money

The savers main objective is to transfer money from present to future while borrowers aim to transfer money from future to present.

What encourages savers and borrowers?

Savers are encouraged by high expected returns on saving and they respond by reducing current consumption while borrowers get discouraged by the high cost of borrowing.

Where does the equilibrium interest rate happen?

This happens where demand for funds (borrowing) equals supply for funds (savings) → The equilibrium interest rate is crucial for the financial system.

What determines the required rate of return of securities?

Required rates of return for securities depend on:

Risk characteristics.

Terms.

Liquidity.

Define allocative efficiency

Allocative efficiency is achieved when scarce capital is used most productively

What is the asset classification in the financial system

There is two types of assets:

Financial assets include securities, currencies, and contracts.

Physical assets encompass commodities and real assets.

Explain the three types of market classification on the financial system

Based on timing of delivery:

Spot markets: Immediate delivery.

Forward, futures, and options markets: Delivery at a future point.

Based on seller:

Primary markets: Securities sold by issuers (funds from purchaser to issuer).

Secondary markets: Securities sold by investors (funds flow between traders).

Based on maturity:

Money markets: Trade short-term debt instruments (≤ 1 year).

Capital markets: Trade longer-maturity instruments.

What are the two types of investment markets?

We have two types of investment markets:

Traditional investment markets: Publicly traded debt, equities, and shares in pooled investment vehicles.

Alternative investment markets: Hedge funds, private equity, commodities, real estate securities and properties, and securitized debt.

What instruments encompass securities?

Bonds, notes, commercial papers, mortgages, common stocks, preferred stocks, warrats, mutual fund shares, unit trusts and depository receipts.

What are the two types of classification of securities?

Public securities: Traded in public markets (e.g., exchanges) with strict regulatory compliance.

Private securities: Typically limited to qualified investors, relatively illiquid.

What are fixed-income securities?

They are promises to repay borrowed money with payments including interest and principal.

What are the different types of fixed-income securities?

Notes: Maturities ≤ 10 years.

Bonds: Maturities > 10 years.

Bills: Issued by governments, maturities ≤ 1 year.

Certificates of deposit: Issued by banks, typically mature within a year.

Commercial paper: Issued by corporations, usually matures within a year.

Repurchase agreements: Short-term lending instruments.

Money market instruments: Traded in money market, maturities ≤ 1 year.

What are the different types of equity instruments and what is the equity owners main characteristic?

Types of equity securities:

Common shares: Participate in decision-making, entitled to dividends, have claim on assets after other claims in case of bankruptcy.

Preferred shares: Higher priority in dividend claims, fixed dividends.

Warrants: Right to purchase common stock at a predetermined price before expiration.

Equity owners have ownership rights in a company

What are pooled investments?

Pooled investment vehicles: (e.g., mutual funds, depositories, and hedge funds) issue securities representing shared ownership in their held assets.

Investors seek investment management expertise and portfolio diversification.

What are asset-backed securities?

They are pools of loans or receivables used as underlying assets → they transfer interest and principal payments from underlying assets to holders monthly.

What are currencies?

They are issued by national monetary authorities and primarily trade in the foreign currency market.

What are contracts?

Contracts are agreements for future actions. Their value depends on the underlying asset (commodity, security, index, interest rate, or another contract).

How can we classify contracts?

Classification based on:

Nature of the underlying asset:

Physical contract: Underlying asset is physical.

Financial contract: Underlying asset is financial.

Timing of delivery:

Spot contract: Immediate delivery (≤ 3 days), trades in spot market.

Forward, futures, swap, or options contract: Delivery in the future (≥ 3 days).

What are forward contracts?

Forward contracts involve two parties:

One has the obligation to buy the underlying asset at a specified price on a future date. → the long position.

The other part has the obligation to sell and underlying asset at a fixed future date price → the short position.

What are forward contracts usually used for?

They are often used to hedge preexisting risk

What are future contracts?

Similar to forward contracts, but with significant differences:

Standardized and trade on organized exchanges. Predetermined contract sizes, expiration dates, and terms.

Highly regulated with Clearinghouse used to ensure contract performance.

Clearinghouses: financial institution or organization that facilitates the trading of financial derivatives, such as futures and options contracts.

What are swap contracts?

They are agreements between two parties to exchange cash flows at periodic settlement dates over a certain period → can be viewed as a series of forward contracts.

What are option contracts?

Contracts that give holders the right but not the obligation, to buy (call option) or sell (put option) securities at a predetermined price (exercise price) in the future.

They are used for hedging, speculation and risk management.

What is a call option?

A call option provides the holder with the right to buy the underlying asset at the exercise price if they choose to do so.

Call options are often used by investors who anticipate that the price of the underlying asset will rise. If the asset's price exceeds the exercise price, the call option can be profitable.

What is a put option?

A put option grants the holder the right to sell the underlying asset at the exercise price.

Put options are commonly used as insurance against a decline in the value of the underlying asset. If the asset's price falls below the exercise price, the put option can be profitable.

What is the difference between european and american options

European Options: European options can only be exercised at expiration, which means the right to buy or sell the underlying asset can only be exercised on the expiration date itself.

American Options: American options, on the other hand, can be exercised at any time between the purchase of the option and the expiration date. This flexibility can be advantageous to option holders, allowing them to capture profits or manage risks earlier.

What are insurance contracts?

Contracts designed to protect individuals or entities from unexpected financial losses.

They are established between two parties:

The insurer (insurance company).

The insured (person or entity seeking protection).

What are Credit Default Swaps (CDSs)?

Credit default swaps are a type of financial derivative that operates as a form of insurance against the default of a debt issuer, such as a corporation or government entity.

CDSs are often used by investors and financial institutions to protect against credit risk or to speculate on the creditworthiness of an entity. They pay the principal if a company defaults on its bonds.

What are commodities? Give some examples

Commodities are raw materials or primary agricultural products that can be bought and sold, such as precious metals, energy products, industrial metals, agricultural products, and carbon credits.

Where are commodities traded?

Spot Market: where commodities are traded for immediate delivery and settlement. Transactions typically settled within a few business days.

Forward or Futures Market: In contrast, the forward and futures markets involve contracts for the future delivery of commodities. These contracts specify the quantity and quality of the commodity, as well as the price and date of delivery.

Who are the primary traders in the sport and forward or future markets of commodities?

Spot Market: This market is vital for producers, consumers, and traders who need to obtain or deliver the actual commodities quickly.

Forward or Futures Market: Participants in these markets may include investment managers and information-motivated traders (hedgers) → investment managers seek to achieve diversification and manage risk within their investment portfolios while information-motivated traders often include speculators who seek to generate profits from their trading activities.

Why do investment managers and information-motivated traders prefer the future market?

Because futures markets are known for their relatively high liquidity compared to other financial markets.

What is real estate and who can own them?

Real assets are tangible properties, such as real estate, aircraft, machinery, and natural resources like lumber stands.

Real assets can be owned by operating companies or institutional investors, either directly or indirectly.

Why are real estate assets attractive?

Diversification: Real assets are attractive to investors because they often have low correlations with traditional financial assets. This makes them valuable for portfolio diversification and risk management.

Income and Tax Benefits: Many real assets offer the potential for regular income in the form of rent, lease payments, or resource revenues. Additionally, they may provide tax benefits, such as deductions and tax deferrals, which can be advantageous for investors

Why is valuation of real estate difficult?

Valuing real assets can be challenging due to their heterogeneous (differing in nature) and unique nature. Each property or asset may have distinct characteristics, making it difficult to apply uniform valuation methods.

Also, Real assets tend to be relatively illiquid compared to financial assets like stocks and bonds. Selling real assets can take time and may involve high transaction costs. Additionally, managing and maintaining real assets often requires ongoing expenses, such as property management or maintenance costs.

How can investors gain real assets indirectly?

Investors can gain exposure to real assets indirectly through investment vehicles like real estate investment trusts (REITs) and master limited partnerships (MLPs). These entities pool funds from investors and invest in various real assets. Investors can trade shares in REITs and MLPs on liquid markets, making these investments more easily divisible and tradable compared to direct ownership of real assets.

What are brokers and what are their main objectives?

Brokers are intermediaries who act as agents to execute client orders in financial markets

They help reduce trading costs by finding counterparties for buyers and sellers.

What are block traders?

Block brokers specialize in serving large traders, and large orders may execute at a premium (buy) or discount (sell) to market prices to attract counterparties.

What are investment banks?

Investment banks provide a range of financial services to corporations and governments, including arranging security offerings, issuing securities, and advising on mergers and acquisitions.

What are exchanges?

Exchanges are trading platforms where buyers and sellers come together to trade various financial instruments, including stocks, bonds, and derivatives.

Many exchanges use electronic order matching systems to facilitate trading.

What are Alternative Trading Systems (ATSs)?

ATSs are trading venues similar to traditional exchanges but do not exercise regulatory authority over their members.

Why are ATSs know as “dark pools?

Some ATSs are known as "dark pools" because they do not display orders publicly, making them attractive to traders seeking anonymity.

What are dealers and what is the main difference with brokers?

Dealers act as counterparties in fulfilling orders, creating liquidity in the market by connecting traders who arrive at different times.

Dealers may also serve as brokers, and they are sometimes referred to as broker-dealers.

There can be a potential conflict of interest in filling orders: brokers aim to secure the best price for their clients, while dealers seek to maximize their own profits.

What is securitization?

Securitization is a process in which assets are purchased, pooled, and then used as collateral to issue securities representing ownership of those assets.

Who are securitizers, and what is their role?

Securitizers are financial intermediaries responsible for creating and selling securitized instruments. They facilitate the securitization process, which involves converting different types of debt into tradable securities.

What types of financial entities fall under depository institutions, and what services do they provide?

Depository institutions include commercial banks, savings and loan banks, and credit unions. They gather funds from depositors and provide services such as lending those funds to borrowers, paying interest to depositors, and offering transaction services.

What role do brokers, like prime brokers, play in the financial industry?

Brokers, including prime brokers, act as intermediaries between clients seeking to borrow funds and those willing to lend. They lend funds deposited by clients to other clients for securities margin purchases.

What do insurance companies do, and how do they benefit both buyers and investors?

Insurance companies create and sell insurance contracts to protect buyers from specific risks. They act as intermediaries connecting insurance buyers with investors, creditors, and reinsurers willing to assume the risks associated with insured events.

What challenges are involved in managing insurance contracts?

Managing insurance contracts involves addressing challenges like fraud (fake loss claims), moral hazard (reduced vigilance due to insurance coverage), and adverse selection (riskier individuals being more likely to buy insurance).

What is the "Law of one price," and how do arbitrageurs relate to it?

The "Law of one price" states that securities with identical future cash flows should have the same price today. Arbitrageurs actively seek violations of this law, looking for instances where identical securities are priced differently. They engage in arbitrage, buying and selling the same security in different markets at varying prices to profit from mispricings.

What role do arbitrageurs play in financial markets?

Arbitrageurs act as financial intermediaries, connecting sellers in one market with buyers in another, contributing to the efficient pricing of assets, and adding liquidity to markets by correcting mispricings.

What is the role of clearinghouses in financial markets, and what services do banks and broker-dealers offer?

Clearinghouses arrange the final settlement of trades and act as performance guarantors, especially in futures markets.

Banks and broker-dealers offer custodial services to hold securities on behalf of clients, safeguarding them against loss due to fraud or oversight.

What are long and short positions in the context of financial assets or contracts?

A long position indicates ownership of an asset or contract and benefits from an increase in the asset's or contract's price.

A short position involves selling an asset that is not owned (short selling) or writing/selling a contract and profits from a decrease in the asset's or contract's price.

Why might someone take a short position in an asset or contract?

Short positions are often taken by information-motivated traders who anticipate a price decrease or by hedgers who use short positions to mitigate preexisting risk, such as protecting against a fall in gold prices with short gold futures contracts.

What is a long position in forwards and futures, and what does it involve?

A long position in forwards and futures contracts involves an obligation to take physical delivery at contract expiration and benefits from an increase in the asset's price.

What is a short position in forwards and futures, and what does it involve?

A short position in these contracts entails the obligation to make physical delivery and benefits from a decrease in the asset's price.

Explain the difference between a long and a short position in options.

For options, a long position holds the right to exercise the option, while a short position (the writer) is obligated to fulfill the contract.

In a long call option, the holder benefits when the underlying asset's price rises, whereas in a short call option, the writer benefits when the price falls.

In a long put option, the holder benefits when the price of the underlying asset falls, and in a short put option, the writer benefits when the price rises.

How are long and short positions determined in swap contracts?

Swap contracts involve two parties agreeing to exchange cash flows, and it's often challenging to determine the long and short sides. Typically, the party benefiting from a price increase is referred to as the long side.

What is involved in a long or short position in currency contracts, and what should be specified?

In currency contracts, one party purchases one currency while simultaneously selling another. When referring to a long or short position in a currency contract, it's essential to specify the other currency involved (e.g., long on the dollar against the yen).

What are the characteristics and risks associated with short positions in financial instruments and securities?

Short Positions in Contracts: Short positions involve selling financial contracts that the short seller doesn't own. The short seller essentially becomes the issuer of the contract. They will need to fulfill the contract's obligations when it matures, which can result in potential losses if the contract moves against them.

Short Positions in Securities: In the context of securities, short positions entail selling borrowed securities, with the intention of repurchasing the same securities from the market at a later date. The short seller returns these borrowed securities. The short seller's profit or loss depends on the price difference between selling the borrowed securities and repurchasing them from the market.

Maximum Profit and Loss for Long and Short Positions:

For the holder of a long position, the maximum profit is theoretically unlimited. They can benefit from an asset's price increase without an upper price limit. However, their losses are typically limited to the amount they paid to acquire the asset.

In contrast, for the short seller, the maximum profit is limited to the price at which they initially sold the asset (or received for the contract). Their profit is capped because the asset's price cannot fall below zero. However, their losses are potentially unlimited because the asset's price can increase significantly, resulting in substantial losses.

What is a leveraged position in financial markets, and how does it relate to borrowing?

A leveraged position involves investors borrowing funds to purchase securities, which amplifies both potential gains and potential losses.

What is the interest rate charged on margin loans, and what is it commonly called?

The interest rate on margin loans is commonly known as the "call money rate."

What are minimum margin requirements, and what is the initial margin requirement?

Minimum margin requirements are rules imposed to control the level of borrowing. The initial margin requirement represents the proportion of the total cost of assets that the investor must contribute using their own equity (unborrowed funds).

How is the leverage ratio calculated, and what does it measure?

The leverage ratio is calculated by dividing the value of the position (total investment, including both borrowed and equity funds) by the value of the equity investment. It measures the extent of leverage.

How is the maximum leverage ratio determined, and what does it represent?

The maximum leverage ratio is determined by taking the reciprocal of the minimum margin requirement. It represents the highest leverage level allowed under the margin requirement rules.

Why are leveraged positions important for investors using margin financing, and what do they amplify?

Leveraged positions can significantly amplify the potential for both profits and losses, making them a key consideration for investors using margin financing.

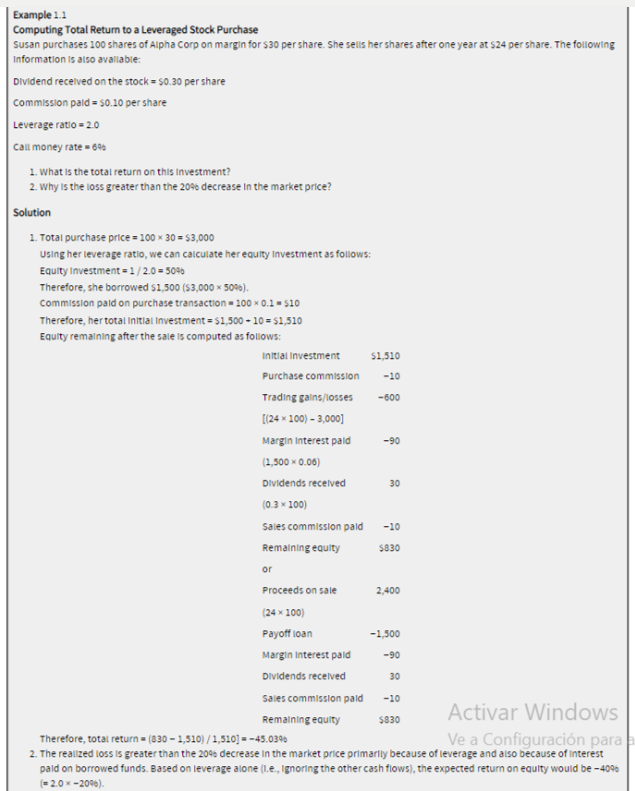

Give an example of computing total return

What are maintenance margin requirements, and how do they relate to margin trading?

Maintenance margin requirements are additional margin requirements imposed on top of the initial margin requirement for traders who engage in margin trading. They serve as a safety net to ensure that the trader maintains a minimum level of equity as the market value of the securities fluctuates.

How do price changes in purchased stocks or securities affect collateral value in margin trading?

As the price of the purchased stock or securities changes, it affects the collateral value that secures the margin loan. Collateral value is the value of the securities, adjusted for price fluctuations.

What is a margin call, and why is it issued to investors in margin trading?

A margin call is a demand from the broker for the investor to deposit additional funds into their margin account if the value of the security, adjusted for price changes, falls below the maintenance margin requirement. It serves as a warning that the trader's equity has fallen below an acceptable threshold.

How can an investor meet the maintenance margin requirement when issued a margin call?

To meet the maintenance margin requirement, the investor must deposit sufficient funds into their margin account. This can be done by adding more cash or securities to the account to increase the equity portion.

What are the potential consequences of failing to meet the maintenance margin requirement in margin trading?

Failure to meet the maintenance margin requirement can lead to margin liquidation or margin call sale, where the broker may sell the stock or securities in the investor's account to pay off the margin loan, preventing further losses and ensuring the loan is covered.

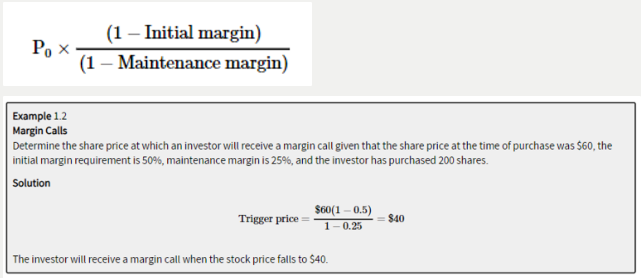

State the formula for a margin call