Ch 8

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

managers are “_____” of shareholders,

agents

method of valuing common stock (2)

free cash flow model

dividend growth model

what is free cash flow

cash flow available for investors

what is wacc

rate of return required by investors

PV of expected cash flow

sources of value (2)

value of operations

nonoperating assets

order of claim

bondholders

preferred stockholders

common stockholders

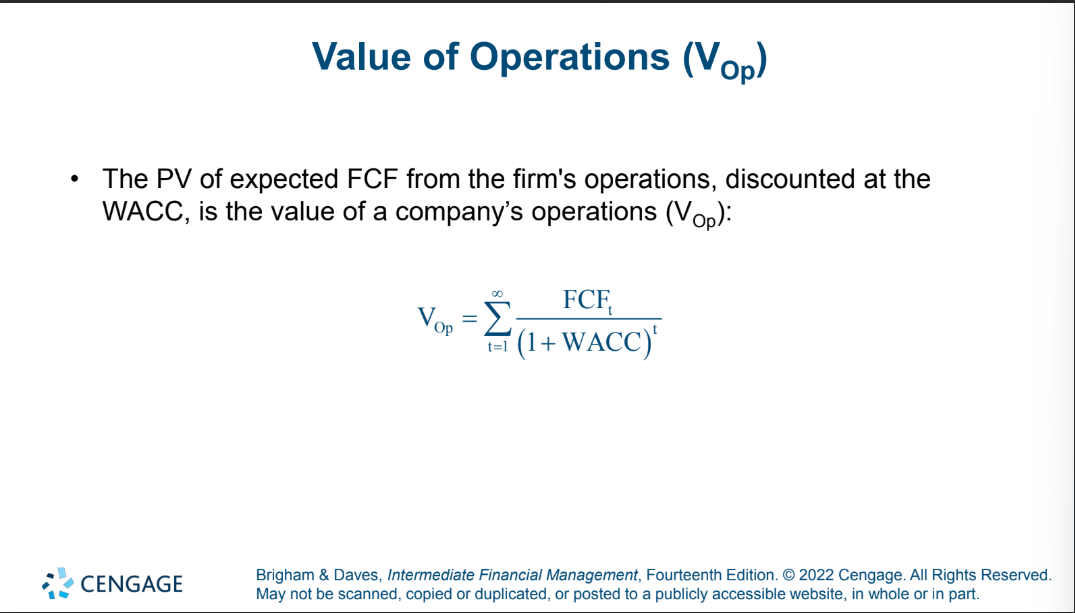

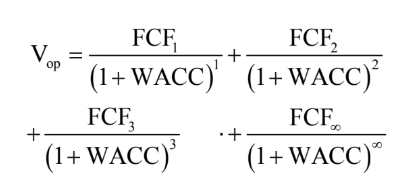

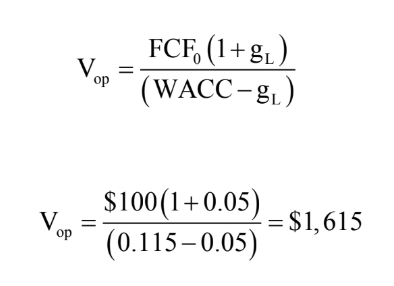

value of operations = PV of FCF Discounted at WACC

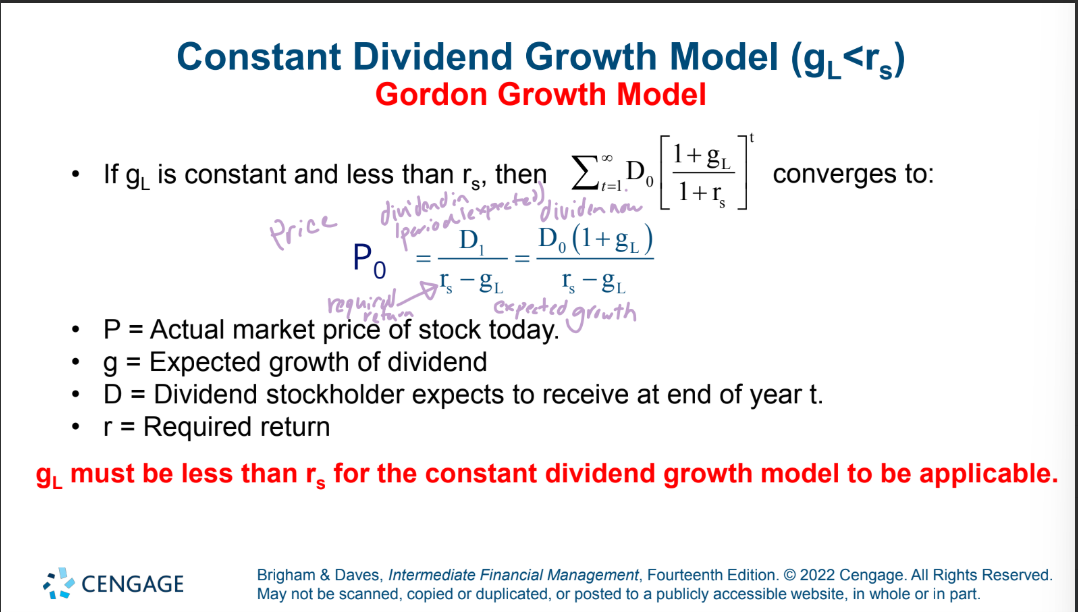

constant growth formula

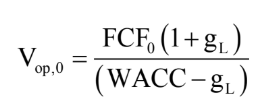

Find value of operations

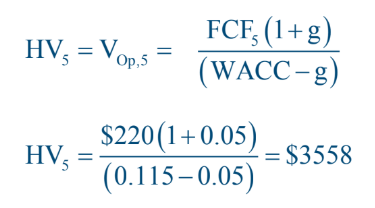

what is horizon value

value of alll fcf discounted back to horizon

horizon value is also called

terminal value

continuing value

Part 1

Find Horizon Value

FCF = $220

WACC = 11.5%

GL = 5%

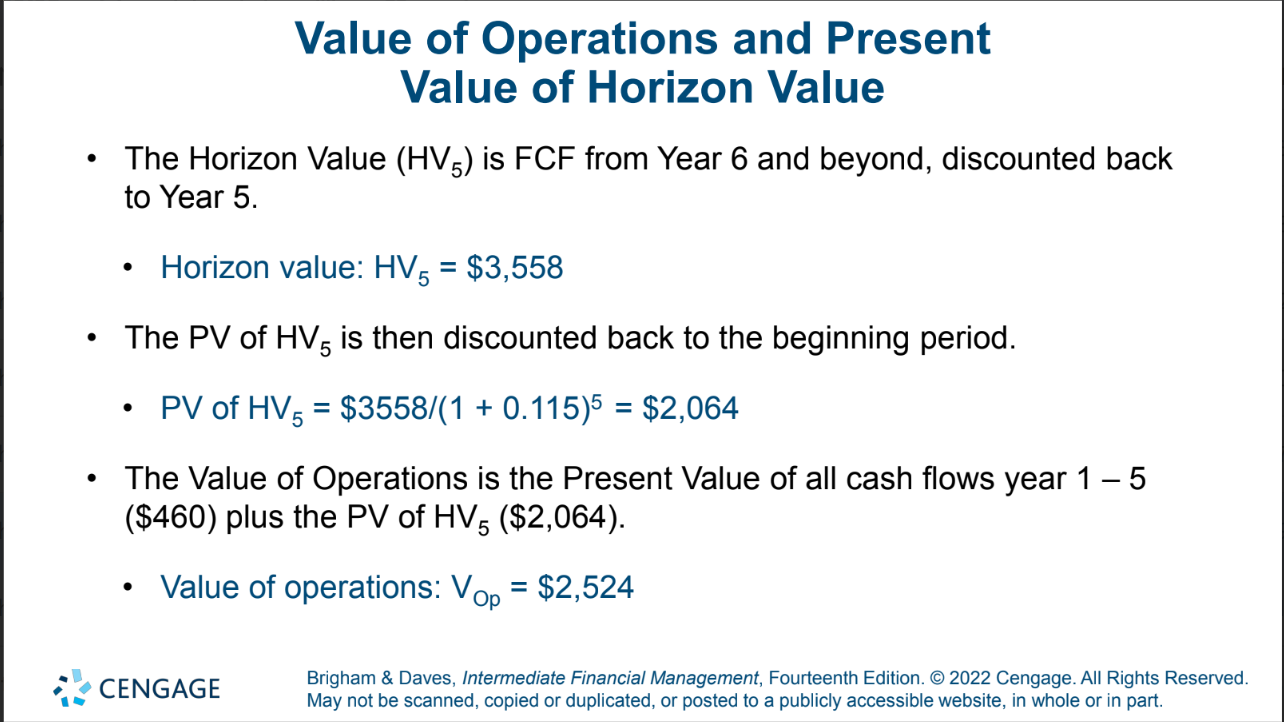

Part 2

FCF = $220

WACC = 11.5%

GL = 5%

The Horizon Value (HV5) is FCF from Year 6 and beyond, discounted back to Year 5.

The PV of HV5 is then discounted back to the beginning period.

The Value of Operations is the Present Value of all cash flows year 1 – 5

($460) plus the PV of HV5 ($2,064).

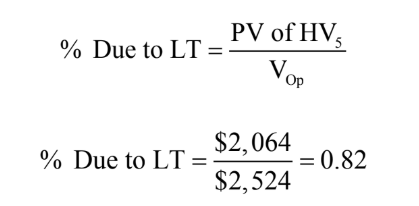

Part 3

Percent of Value Due to Long-term Cash Flows

why do public companies focus on quarterly earnings?

change in quarterly earnings can signal changes in future cash flow

managers bonuses

what does ROIC mean

return on invested capital

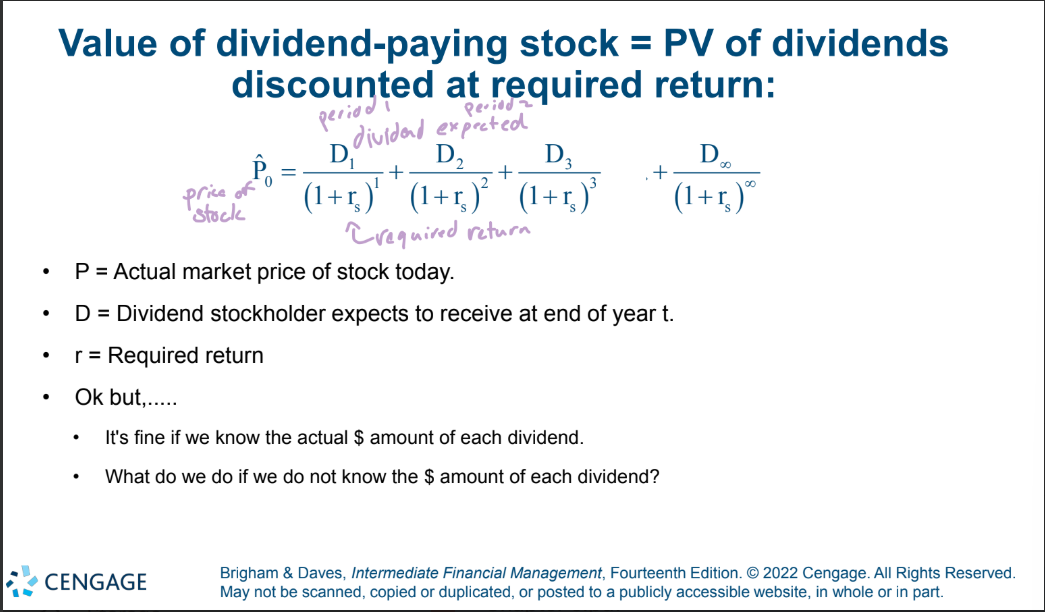

PV of dividend

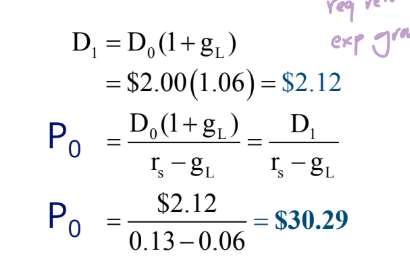

find estimated stock value

D0 = $2.00

rs = 13%,

gL = 6%

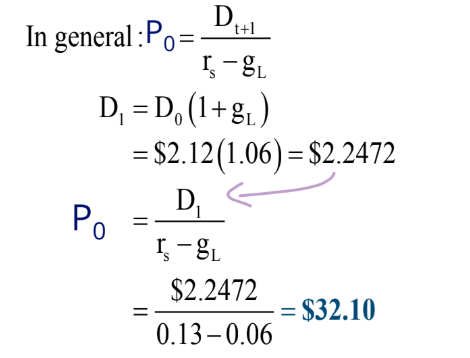

find Expected Stock Price 1 Year Later

D0 = $2.00

rs = 13%,

gL = 6%

dividend yield formula Total return = dividend yield + capital gains yield.

dividend yield = dividend/price

capital gain yield formula

capital gain yield = new price - old price / old price

total return formula

Total return = dividend yield + capital gains yield.

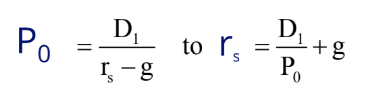

rate of return formula

FCF model vs Dividend Growth Model

FCF

more situations

require forecasted f/s

Dividend Growth Model

constant growth rate

less than required return