Theme 3C - Market failure ARGH

1/14

Earn XP

Description and Tags

Government intervention to grants and vouchers

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

Define government intervention and the reasons for it

Definition : Is any action carried out by the government that affects the market with the objective of changing the free market equilibrium/outcome

Reasons :

Encourage, discourage or even prohibit the production or consumption of a good to maximise social welfare

Raise tax revenue for government and/or producers revenue

Make certain goods more affordable

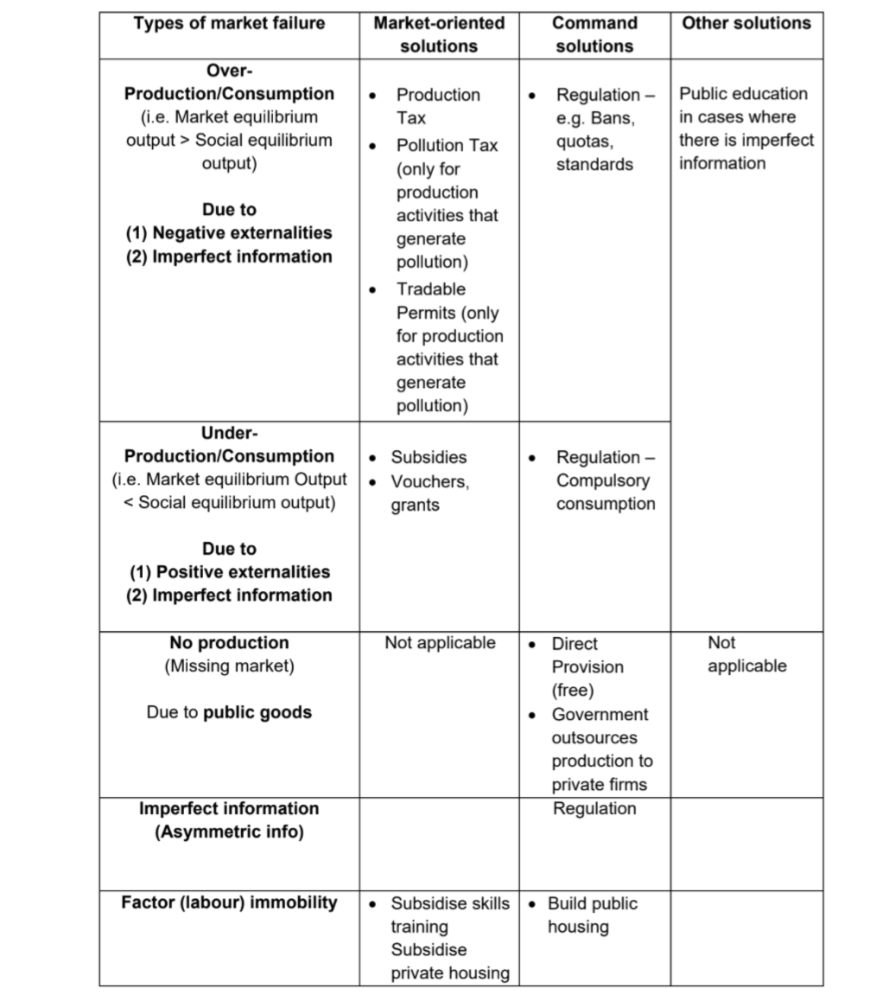

Give the summary of GI (causes of market failure → solutions)

Compare market-oriented and command policies

Market-oriented policies | Command policies |

Measures that involve influencing consumer/producer behaviour through the market/price mechanism by tweaking price incentives/disincentives) -> market continues to work according to market forces | Measures that involve direct government intervention and are prescriptive |

Work through changing economic agents’ benefits or costs, which changes the consumption and production decisions of consumers and firms | Government making the consumption / production decision instead of private consumers or firms |

|

Others:

|

Define indirect tax and why it is imposed

Definition : An indirect tax usually refers to a tax on expenditure on goods and services but is not paid directly by the consumers to the government but indirectly via the producer of the good (Eg. GST)

Producer or retailer has the legal responsibility to pay the tax to the government

Tax passed on to consumers through a higher price

Why :

Governments impose IT on goods and services that they deem undesirable and want to discourage consumption (Eg. cigarettes)

Producers factor these taxes into costs of production -> supply to fall -> fall in equilibrium quantity, ceteris paribus, reducing the equilibrium quantity produced and consumed

In order to increase government revenue to support government’s expenditure in markets and in the economy

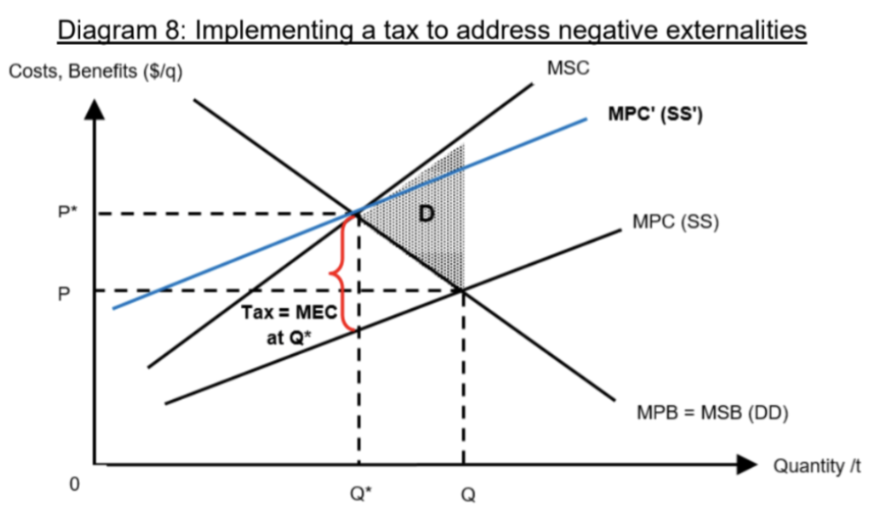

Describe production tax and how it removes negative externalities

Used to reduce the consumption / production levels of a particular good

Correct negative externalities

To correct the problem of negative externalities due to air pollution in the production of petrochemicals, the government can levy a tax on output (production tax) to reduce the consumption / production levels to the socially optimal level

The government could impose a per unit output tax = MEC at the socially optimal output Q*, forcing firms to internalise the external costs when making production decisions.

The output tax raises the producers’ marginal private costs of production (MPC), causing supply to fall.

SS curve (MPC) will shift vertically upwards to SS’ (MPC’) by the amount of MEC at Q*

Assuming the government has perfect information and is able to estimate the MEC accurately, the tax results in a fall in market equilibrium output from Q to Q* (new equilibrium output)

Fall in supply due to the indirect tax would lead to a shortage, which creates upward pressure on price

MAP -> At the new market equilibrium output (where SS’ = DD coincides with socially optimal output Q* (where MSB = MSC), the welfare loss of area D will be eliminated, and allocative efficiency is restored

Draw the graph of production tax

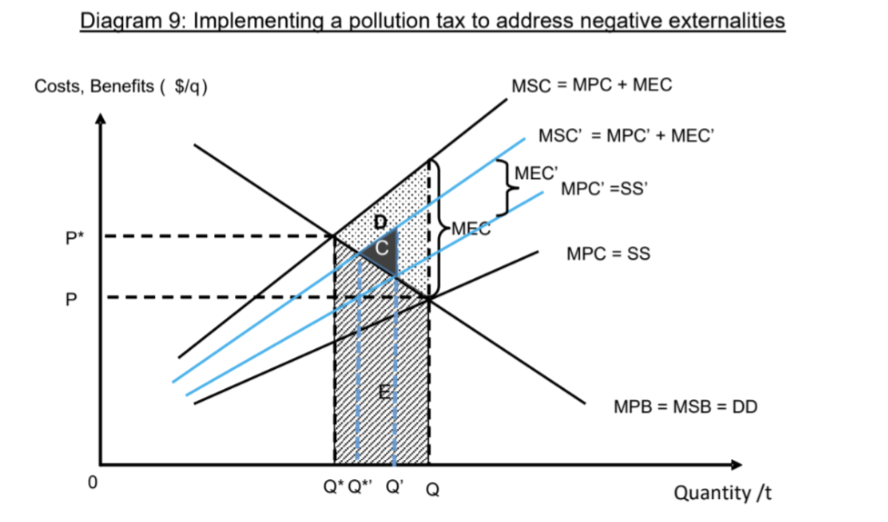

Describe pollution tax and how it reduces negative externalities

Is a compulsory levy imposed on producers, where firms have to pay the government a fixed fee per unit of pollution generated

Rational firms will either:

Switch over to greener methods of production and lower pollution

If the marginal private benefit of lowering pollution (avoiding having to pay the pollution tax) outweighs the marginal private costs of lowering pollution (cost of installing equipment to reduce carbon emissions)

With the reduction of pollution emitted, the extent of the negative impact on third parties is reduced from MEC to MEC’, shown by a downward shift of the MSC curve from MSC to MSC’ -> lesson welfare loss from D to C -> more allocative efficient outcome

Continue their ‘more pollutive’ methods of production and pay the tax

Marginal cost of production will rise and they will end up cutting back production shown by a fall in supply from SS to SS’

A pollution tax would result in a reduction in welfare loss to society from area D to area C, resulting in a less allocative inefficient outcome

Draw the graph of pollution tax

Define subsidies and its aim

Definition : payment made by the government to producers to encourage the production of certain goods or services, but it is not made in exchange for any goods or services

Change signals and incentives prices convey -> change in consumption / production of goods

Aim :

Increase the consumption or production of a good of service -> increases the equilibrium quantity

Make a good more affordable for the poor (when producers pass on the cost savings they receive from these subsidies to consumers) -> improving equity

Explain how subsidies address positive externalities and factor immobility

Reduces marginal cost of production -> supply increase -> Increases production and consumption of foods -> equilibrium quantity increase

Usually implemented on goods that the government deems desirable to have higher consumption of (healthcare, education)

To address:

Positive externalities

The government could pay firms a per unit output subsidy equal to MEB at the socially optimal output Q*

Producer internalize MEB -> lower the producers’ MPC, causing an increase in supply -> SS curve (MPC) will shift vertically downwards to SS1 (MPC’) by the amount of MEB at Q*, which leads to a fall in the price of the good/service from P to P1

Assuming the government has perfect information and is able to estimate the MEB at Q* accurately, the subsidy results in a rise in output from Q to Q*

The new market equilibrium output (where SS’ = DD) coincides with socially optimal output Q* (where MSB = MSC), causing the welfare loss of area A to be eliminated and allocative efficiency is restored

Factor immobility

Subsidise the provision of training by private firms to encourage existing workers whose skill sets have become redundant to continuously upgrade their skills

Increase in quantity demanded -> more workers can move more easily into industries that are in demand -> reducing occupational immobility

Describe tradable permits

Permits to pollute that can be traded (bought and sold) in a market

Implemented specifically to deal with negative externalities in the form of air pollution

Only firms that manage to emit carbon dioxide below its permitted limit can sell their excess rights in the carbon market

If all firms are already polluting at the permitted maximum level, no firm will be able to sell their rights to other firms

Government decides on optimal level of pollution that is allowable

Government auction the corresponding number of permits to pollute directly to firms or distribute to firms for free

Firms are free to buy or sell the permits with each other, with price of permits being determined in the market by demand and supply forces

Firms who obtain the permits acquire the right to emit the given quantity of pollution

However, firms do not have the same costs of production

Firms with high clean-up costs would wish to pollute above the quota and would have to buy more permits from other firms in order to continue production

Their MPC would increase from MPC1 to MPC2

Firms with low clean-up costs rather pollute less than the quota given so they are incentivised to earn additional profits from the sale of their tradeable permits to other firms who find it more expensive to cut emissions

This will reduce the MEC and hence MSC

New socially optimal level is Qs’ where MSC2=MSB and this is also new private optimal output Qp’ where MPC2 = MPB

Describe outcome of tradable permits

Certainty in outcome (total pollution level) as government decides total allowable pollution and permits

Tradable permits that gives a long term incentive for firms to pollution abate

Targets root cause -> incentivise firms to switch to cleaner methods of production

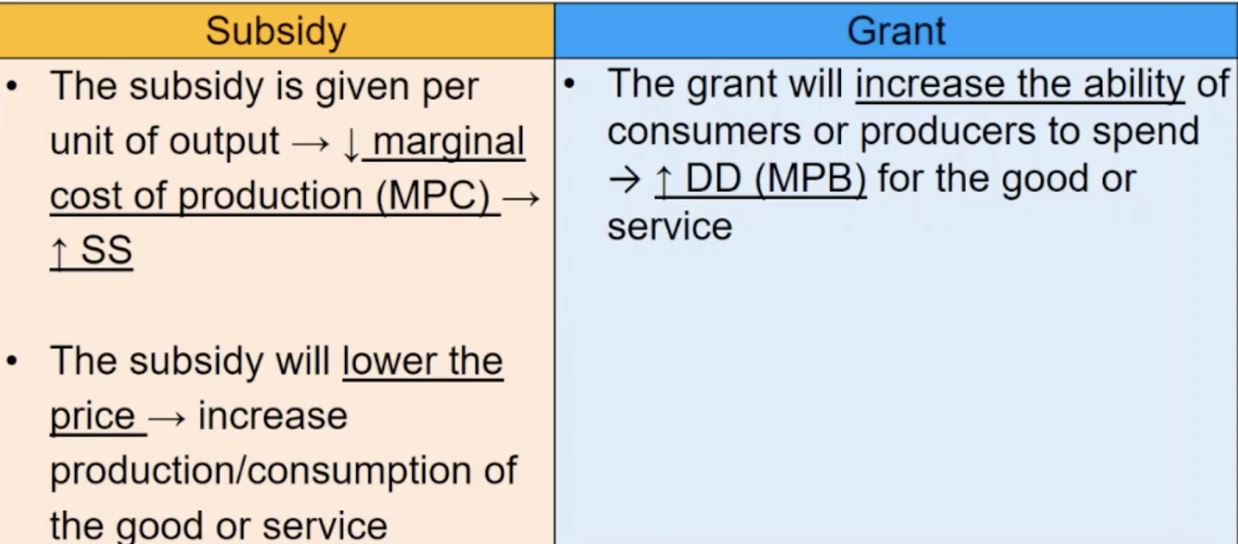

Describe grants and vouchers

Increase consumers’ ability to spend on the good or service -> increasing their demand for and consumption of the good or service to the socially optimal quantity, restoring allocative efficiency

Increase firms ability to produce more of the good or service to improve allocative efficiency

Eg. Edusave grants, research grants -> innovation, SkillsFuture grants -> reducing occupational immobility, grants to workers in parts of country with shortage of labour + housing grants to reduce cost of relocation -> reduce geographical immobility

Compare subsidy and grant

Describe limitation of tradable permits

Trade off with inequity

Increase cost of production -> SS falls -> increase in price -> since good is essential, takes up larger proportion of low-income households

This creates a trade-off between the government’s two microeconomic objectives

To decrease limitation: government can slowly decrease the quantity of tradable permits as they are doing to give firms more time to find more carbon efficient alternatives to nitrogen fertilisers -> so more firms can maintain production levels while reducing MEC