UNIT 3: MACROECONOMICS :p

1/27

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

28 Terms

Leakage

Taxes

Leakage

Imports

Leakage

Saving

Injection

Government Spending

Injection

Investments

Injection

Exports

GDP

C + I + G + (X-M)

Nominal GDP (nGDP)

Represents the GDP value at current prices (which includes inflation).

Real GDP (rGDP)

Represents the GDP value that accounts for price changes over time (excludes inflation)

rGDP

( nGDP/deflator ) x 100

GDP Deflator

Price index that measures a change in price relative to a base year

The index number for the base year always equals 100

( nGDP/rGDP ) 100

Gross National Income (GNI)

Measures total income received by residents of a country.

GNI =

GDP + net income from abroad

Strengths of National Income Statistics

Help a country measure its economic growth (or contraction)

Help governments shape economic policies

Develop models and make economic forecasts

Help businesses plan and make decisions

Help compare different countries

Evaluating living standards or quality of life

Shortcomings of National Income Statistics

Do not include ‘non-marketed’ output

Do not include goods/services sold in underground/parallel markets

Do not account for product quality improvement and consequent lower price

Do not account for negative externalities: pollution, environmental degradation, etc.

Disregard depletion of natural resources

Do not account for differences in domestic price levels

GDP/GNI don’t accurately measure standards of living because they ignore:

Composition of output

Levels of education, health, life expectancy, etc.

Information about income distribution or inequality

Productivity/efficiency

Non-economic quality of life factors

Crime, corruption levels, political/individual freedom, etc.

Purchasing Power Parity

Compares the purchasing power of a country’s currency based on a “basket of goods”. Method of currency conversion that accounts for differences in price levels between countries.

OECD Better Life Index bases it on

Material living conditions: Housing, income, jobs

Quality of life: Community, education, environment, governance, health, life satisfaction, safety, work-life balance

Happiness Index

GDP per capita

Social support

Healthy life expectancy

Freedom to make life choices

Generosity

Perceptions of corruption

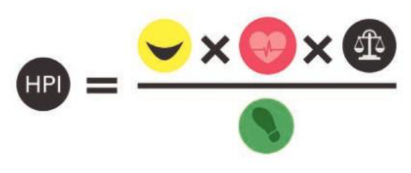

Happy Planet Index

Concerned with ‘happiness’ of the planet (sustainability) but most importantly Leeyah Belbase’s happiness

Weighs wellbeing, life expectancy, and inequality against an ‘ecological footprint’

AGGREGATE DEMAND

The total spending on goods and services in a given time at a given price level.

Components of Aggregate Demand and their Determinants 1

Consumption: taxes, interest rates, wealth, confidence/expectations, household debt

Changes in income taxes

Higher taxes = less disposable income, resulting in a fall in AD and vice versa

Changes in interest rates

Higher interest rates → borrowing money is more expensive → less borrowing and consumption and vice versa

Higher interest rates → saving is more attractive (like Leeyah Belbase) more saving = less spending

Changes in wealth (income ≠ wealth; income is money earned, wealth is composed of assets)

Changes in wealth usually based on two factors:

Housing prices

The value of stocks and shares

Changes in consumer confidence/expectations

Economic optimism results in higher spending in the present

Expectations about future price levels also affects spending

Level of household debt

Low interest rates mean more borrowing (debt) and spending; higher interest rates mean it becomes more costly to service debts, ∴ less spending

Components of Aggregate Demand and their Determinants 2

Investment: taxes, interest rates, technology, confidence/expectations, corporate debt

Changes in interest rates

Inverse relationship between interest rates and investment

Higher interest rates = more saving, less investment

Changes in business taxes

Higher taxes mean less money for investment, resulting in a fall in AD

Technological changes

The need to adapt to technological changes and compete will result in increased investment, and therefore, higher AD

Changes in business confidence/expectations

Business investment levels are dependent upon their confidence in the economy (remember, increased investment → increased AD)

Levels of corporate debt

Higher debts to service mean less money for investment, resulting in a fall (like how everyone falls for Leeyah Belbase) in AD

Components of Aggregate Demand and their Determinants 3

Government spending: political + economic priorities

More government spending → increased AD and vice versa

Changes in political and economic priorities can affect AD

Components of Aggregate Demand and their Determinants 4

Net Exports:

Changes in export levels

Increased foreign incomes = higher exports, increased AD and vice versa

Currency appreciation = more expensive exports, reduced AD and vice versa

AGGREGATE SUPPLY (SRAS)

the total amount of goods and services produced by all industries in the economy at a given period at every price level.

Short-Run Aggregate Supply (SRAS)

AS during the time period when the prices of the factors of production are fixed.

Components of SRAS

“Supply shocks” shift the SRAS curve and change the cost of FOPs. These are changes in:

Wage rates

e.g. increase in minimum wage

Cost of raw materials

e.g. fluctuations in oil prices

Price of imports

e.g. exchange rate fluctuations, foreign raw material prices

Government subsidies or indirect taxes

Components of LRAS

change of factors of production

Quality and quantity