Chapter 11 - Monetary Policy

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

monetary policy

macroeconomic policy that involves action by RBA, on behalf of gov to influence the cost and availability of money and credit in the economy

conducted by RBA

RBA 3 objectives when setting M.P

1) stability of currency

2) maintainence of full employment

3) economic prosperity and welfare

when will RBA implement contractionary M.P?

when inflation is exceeding target

what happens when inflation exceed target?

1) consumer purchasing power falls

price rising faster than their income

2) internatiinal competitiveness falls

worker wage expectation may increase, thus business COP increase, leading to cost push inflation

3) real value on return on investment falls

although ‘number’ same, return on investment can buy less things due to inflation

when will RBA implement expansionary MP?

when inflation lower than target

what happens when inflation lower than target?

1) consumer delay purchases when they expect price to fall

2) downward pressure on price

consumers spend less and business receive less revenue, thus reduce wages

usually, businesses will let wages follow trend of inflation but if inflation already too low, they cant reduce wages anymore, so they lay off workers

conventional MP

action by RBA to influence cash rate through DMO process

cash rate

interest rate set by RBA that banks pay or charge to borrow funds from other banks in overnight market

DMO(domestic market operation) process

when RBA buy/sell bonds to financial insituitions to inject/withdraw cash from financial systems to influence cash rate

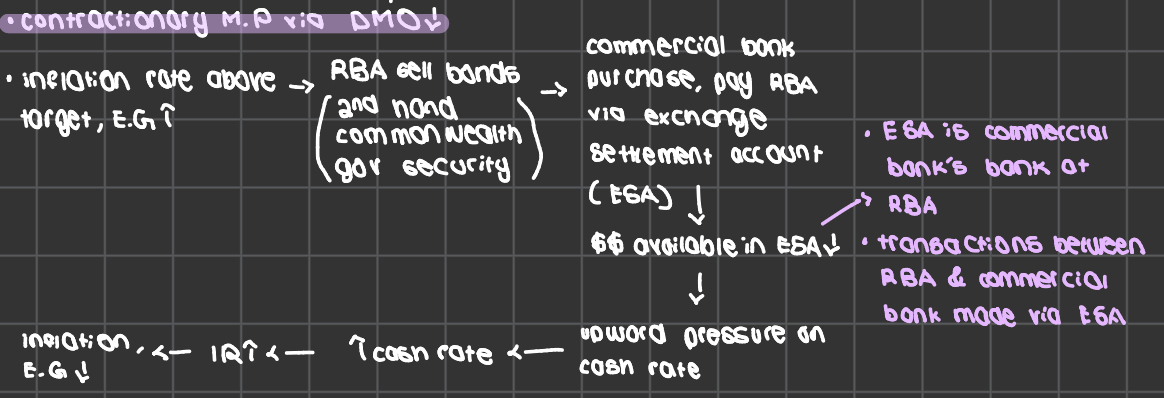

contractionary DMO

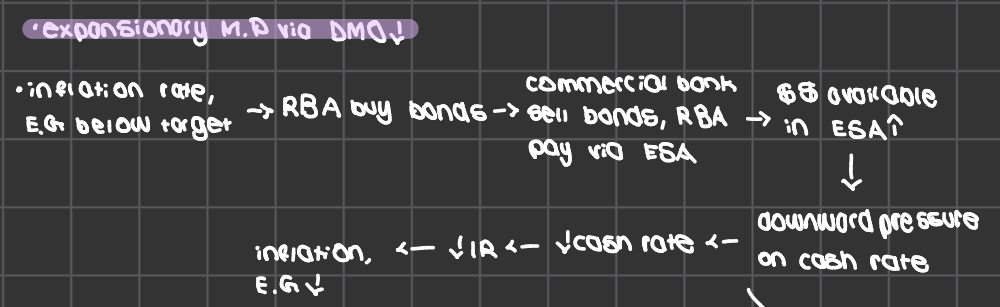

expansionary DMO

unconventional monetary policy

using tools that dont change interest rate to influence economy

unconventional monetary policy types

forward guidance

asset purchase

term funding facilities

adjustment to market operations

negative interest rate

forward guidance

central bank communicate stance of MP

time based guidance - bank commit to certain MP stance until specific time

stance based guidance - bank commit to a certain MP stance until specific economic condition met

asset purchase

outright purchase of assets by central bank from private sector

injects money into economy, encourage lending and investment

term funding facilities

allow bank to borrow from RBA at lower cost IF bank lower lower IR for borrowers too

adjustment to market operations

provide larger amounts of liquidity to financial system(give banks money)

expand range of accepted collateral

increase range of eligible counterparties they allow to engage in DMO

negative interest rate

people get charged to deposit money into bank