Internal Controls and Cash Management in Financial Accounting

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

What are the two main reasons for incorrect financial statements?

Errors (unintentional) and fraud (intentional)

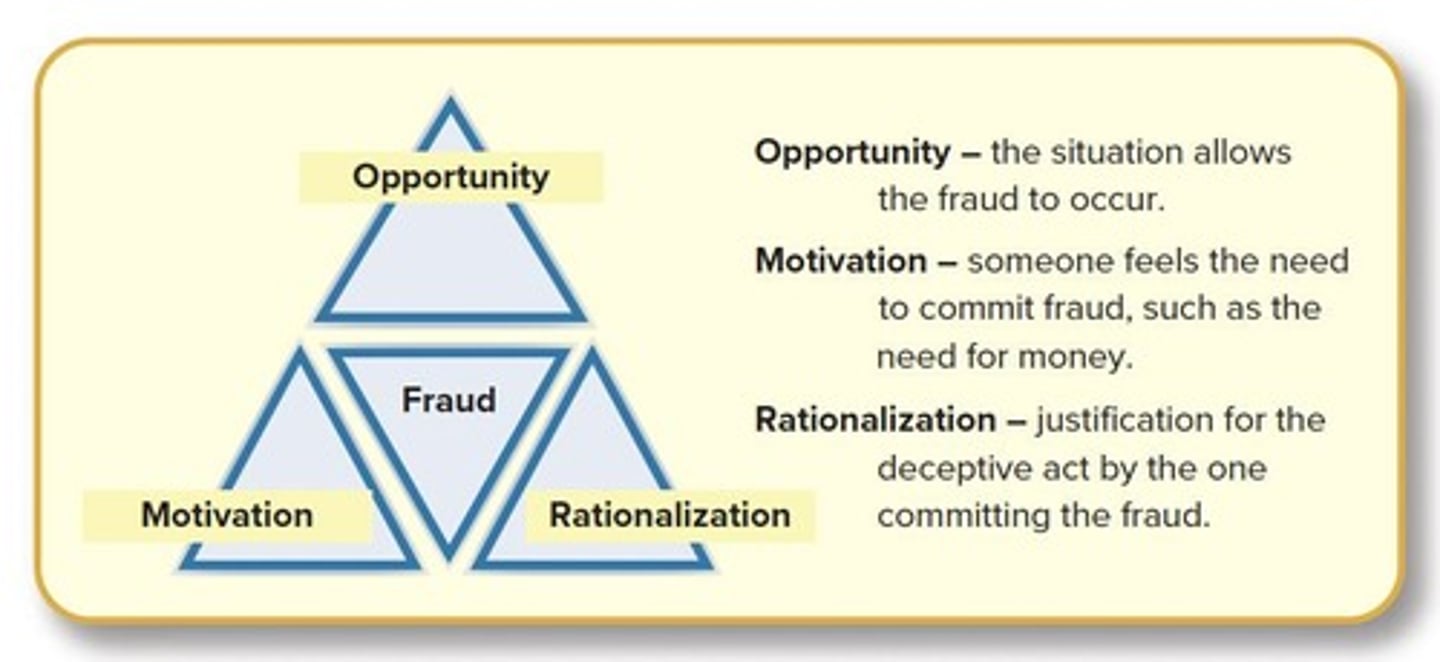

What does the Fraud Triangle represent?

The three elements that lead to fraud: opportunity, pressure, and rationalization.

What is the primary purpose of internal controls?

To eliminate the opportunity element of fraud and safeguard company assets.

What are the key guidelines established by the Sarbanes-Oxley Act of 2002?

Internal control procedures and auditor-client relations.

Who is ultimately responsible for the effectiveness of internal controls in a company?

Top executives.

What are the components of internal control?

Methods for collecting relevant information and timely communication.

What are preventative controls in internal control activities?

Separation of duties, physical controls, proper authorization, employee management, and e-commerce controls.

What is the purpose of separation of duties?

To prevent fraud by ensuring that no single employee has control over all aspects of a transaction.

What are detective controls in internal control activities?

Reconciliations, performance reviews, and audits.

What limitation of internal control involves collusion?

Collusion occurs when two or more people coordinate to circumvent internal controls.

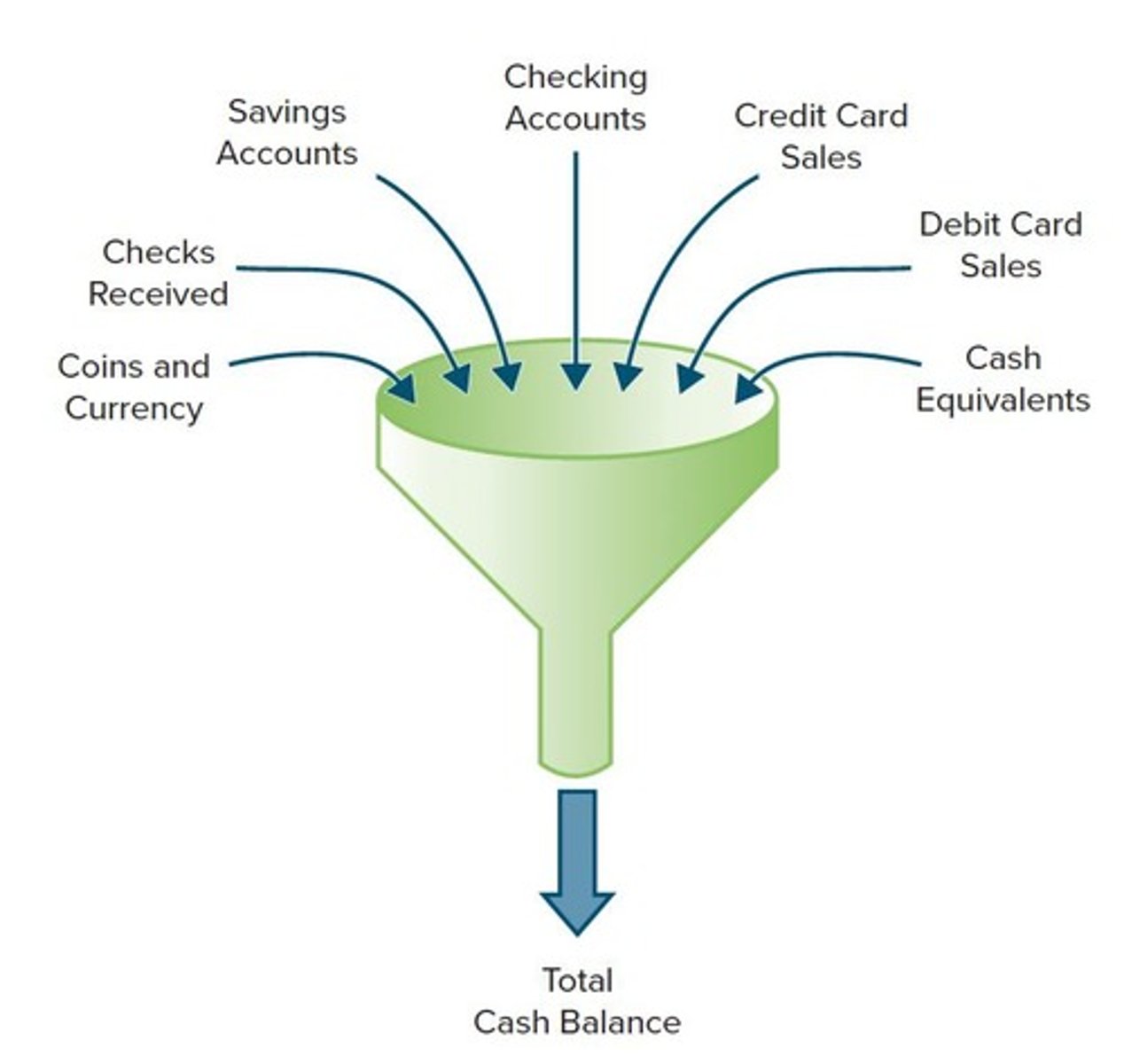

What types of cash are included in the total cash balance?

Coins, currency, checks, savings and checking account balances, credit and debit card sales.

What are cash equivalents?

Short-term, highly liquid investments that mature within three months.

What is restricted cash?

Cash not available for current operations, classified as current or long-term asset based on expected use.

What controls are important over cash receipts?

Separation of duties and independent verification of cash receipts.

What are the types of collections of payments from customers?

Cash, checks, credit cards, mobile payments, electronic funds transfers, prepaid cards, and cryptocurrencies.

What should be done with cash and checks received?

Open mail daily, list amounts and payers, and designate an employee for deposits.

How does accepting credit and debit cards help with internal controls?

It reduces the need for employees to handle cash directly.

What is a key control for cash disbursements?

Make disbursements by check, debit card, or credit card to maintain a permanent record.

What should be done before authorizing expenditures?

Verify the accuracy of the purchase and ensure proper authorization.

What are some controls for verifying debit and credit card statements?

Compare amounts with purchase receipts and ensure separation of duties.

What is the importance of proper authorization in cash disbursements?

To prevent unauthorized use of company funds.

What is the purpose of reconciliations in internal controls?

To ensure that physical assets agree with accounting records.

What is an example of a physical control over cash?

Ensuring that cash and accounting records are kept safe.

What should be done periodically to maintain effective internal controls?

Conduct audits and performance reviews.

What is the role of employee management in internal controls?

To provide employees with the knowledge necessary to perform their job duties effectively.

What is a common issue that can affect the effectiveness of internal controls?

Human error, such as carelessness or fatigue.

What is an example of a control for cash disbursements?

Require two signatures for larger checks.