ACCY 202 Exam 1 & 2

1/103

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

104 Terms

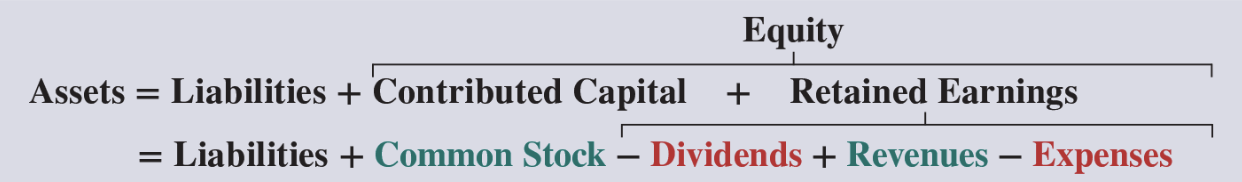

Accounting Equation

Accrual Basis: Revenue Recognition Principle

Revenue is recognized when good or service is provided to the customer and at the expected amount to be paid by the customer, regardless of when the cash is received (performance obligation is met)

Accrual Basis: Expense Recognition Principle (Matching Principle)

Expense is recognized in the same accounting period as the revenues that those expenses helped generate

Cash Basis Accounting

Revenue is recognized when cash is received and expenses are recognized when cash is paid

Return on Assets

NI/Average total assets

Net Income (Income Statement)

Revenue - Expenses

Ending Retained Earnings (Statement of RE)

Beg. RE + NI - Dividends

Balance Sheet

Assets = L + E

Debt Ratio

Total Liabilities/Total Assets

Normal Debit Balance

Dividends, Equity, Assets

Normal Credit Balance

Liabilities, Equity, Revenue

Operating Activities

Reflect cash generated by or consumed by a company’s day-to-day operations; relate to Income Statement and current assets/liabilities on the balance sheet

Financing Activities

Reflect the cash flow between a company and its owners (stockholders) and creditors (lenders) and how a company raises and repays capital; relate to changes in long-term debt and equity on balance sheet

Investing Activities

Reflect cash spent on or received from the purchase or sale of long-term assets (non-current) and other investments that affect long-term resources and growth; relate to PPE and long-term investments on balance sheet

Cash received from customers for sales of goods or services. |

Cash received from interest on loans (from a customer). |

Cash received from dividends (from an investment). |

Operating Inflows

Cash paid to suppliers for inventory. |

Cash paid to employees for wages and salaries. |

Cash paid to the government for taxes. |

Cash paid for operating expenses (rent, utilities, insurance). |

Cash paid for interest on debt/loan |

Operating Outflows

Cash received from selling equipment, buildings, or land. |

Cash received from selling investments in the stock or bonds of other companies. |

Cash collected on loans made to other parties. |

Investing Inflows

Cash paid to purchase new equipment, buildings, or land (Capital Expenditures, or CapEx). |

Cash paid to purchase investments in the stock or bonds of other companies. |

Cash paid to make loans to other parties. |

Investing Outflows

Cash received from issuing (selling) new stock. |

Cash received from issuing new bonds or taking out new long-term loans. |

Financing Inflows

Cash paid to shareholders as dividends. |

Cash paid to repay the principal amount of loans or redeem bonds. |

Cash paid to repurchase the company's own stock (Treasury Stock). |

Financing Outflows

Cash Basis Income

Cash receipts - cash payments

Deferred/Unearned Revenue

Cash paid in advance for goods and services provided in the future; debit as a liability, credit revenue when good/service is provided

Accrued Liabilities/Revenues

Costs that are incurred or revenues earned in a period that are both unpaid or not yet received in cash/assets and unrecorded

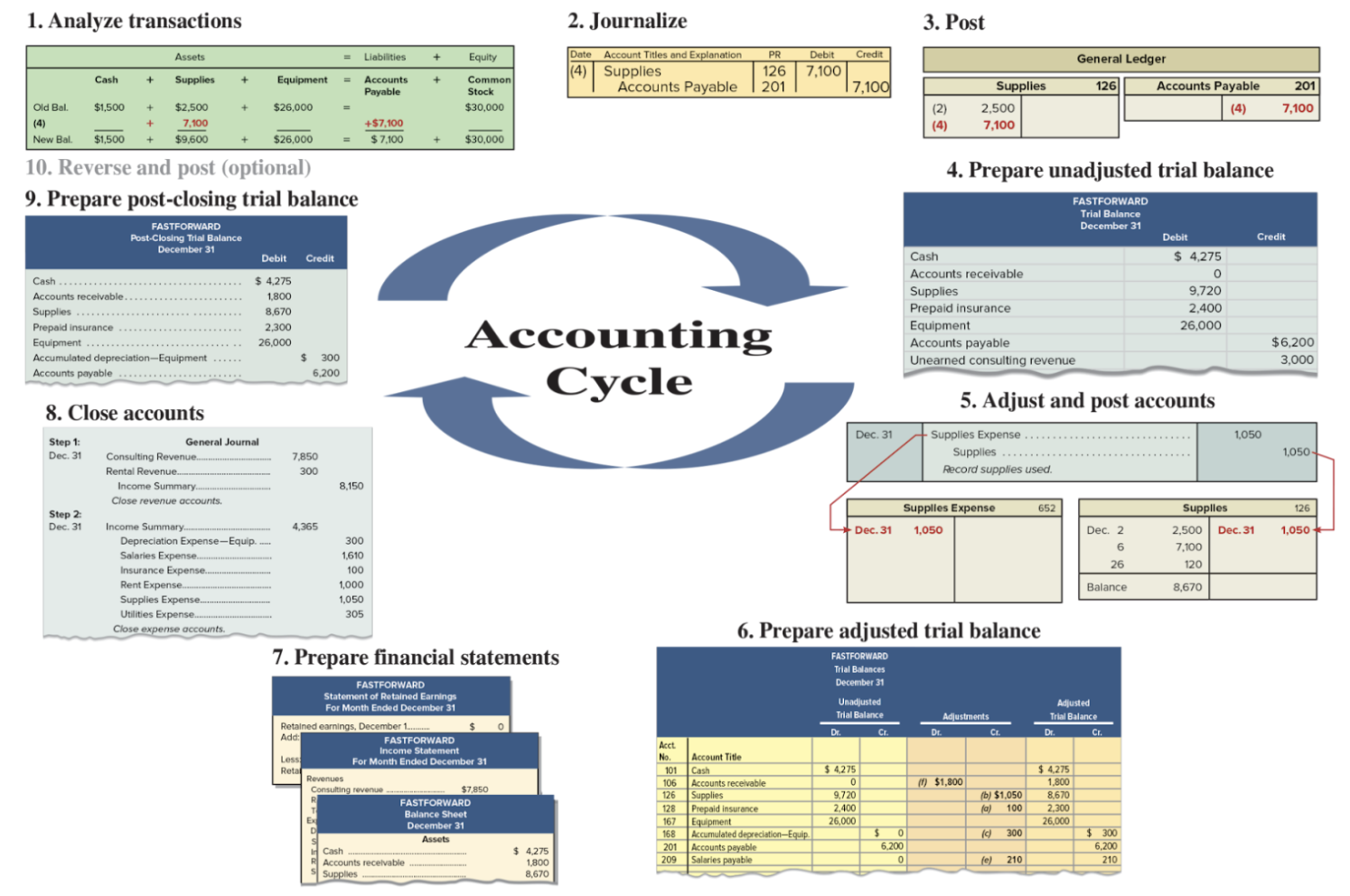

Accounting Cycle

Straight-Line Method of Depreciation

Changes the same amount to each period of the asset’s useful life

Depreciable Cost of Asset

Cost - Salvage Value /

Useful Life in Periods

Net Book Value

Asset’s total cost - accumulated depreciation

Straight-Line Depreciation Alternative Equation

100%/number of periods in the asset’s useful life

Accumulated depreciation

Contra Asset; normal credit balance

Units of Production Method of Depreciation

1. Depreciation Per unit = Cost - salvage value / total units of production

2. Depreciation Expense = Depreciation per unit x Units produced in period

Accured Interest Expense Equation

Principal amount owed x Annual interest rate x Fraction of year since last payment

Change in Estimates/Revised SL Depreciation

Book Value - Revised Salvage Value /

Revised remaining useful life

If Sale Price = Book Value

No gain or loss

Sale price > book value

Gain

Sale price < book value

Loss

Total Asset Turnover

Net Sales/Average total assets

Add deposits in transit

1st Ex: Bank Balance Adjustment

Subtract outstanding checks

2nd Ex: Bank Balance Adjustments

Add or Subtract Bank Error Corrections

3rd Ex: Bank Balance Adjustments

Add interest earned and unrecorded cash receipts

1st Ex: Book Balance Adjustments

Subtract bank fees and NSF checks

2nd Ex: Book Balance Adjustments

Add or Subtract Book Error Corrections

3rd Ex: Book Balance Adjustments

Overstated Cash Balance (Book); ex. recorded a check for $800 instead of $80

Subtract

Understated Cash Balance (Book); ex. recorded a deposit for $100 instead of $1,000

Add

Overstated your Bank Balance; ex. the bank incorrectly added money to your account

Subtract

Understated your Bank Balance; ex. the bank incorrectly removed money from your account

Add

Net Change in Cash

Cash from Operating Activities + Cash from Investing Activities + Cash from Financing Activities

Ending Cash Balance

Beginning Cash Balance + Net Cash Provided by Operating Activities + Net Cash Provided by Investing Activities + Net Cash Provided by Financing Activities

Net cash flow

Cash inflow - Cash outflow

Investing & Financing

Identical for both Direct and Indirect Methods

In direct method for operating activities…

Convert Accrual Basis in Income Statement to Cash Basis for Statement of Cash Flows (ex. Wages Expense —> Cash paid to Employees)

Operating Cash Flow (Direct Method): Cash Received from Customers

Sales Revenue

+ Decrease in Accounts Receivable (cash inflow)

- Increase in Accounts Receivable (cash outflow)

Cash Paid to Suppliers

COGS + Change in Inventory - Change in Accounts Payable

(if A/P decreased, cash outflow —> + decrease in A/P)

Cash Paid for Rent

Rent Expense + Change in Prepaid Rent

(If Prepaid Rent increased, cash outflow —> +)

Cash Paid for Insurance

Insurance Expense + Change in Prepaid Insurance

Cash Paid of Utilities

Utilities Expense + Change in Utilities Payable

Cash Paid for Interest

No adjustment

Cash Paid

+ a decrease in payable or increase in prepaid

- an increase in payable or decrease in prepaid

Depreciation Per unit

Cost - salvage value / total units of production

Depreciation Expense

Depreciation per unit x Units produced in period

Retained Earnings

Rev - Exp - Div

Cash Balance per Bank Statement

Adjusted Cash Balance - Total Bank Adjustment

Credit Memoranda (CM)

Banks use CM to indicate an increase in the customer’s account balance

Debit Memoranda (DM)

Banks use DM to indicate an decrease in the customer’s account balance

Adjusted NI

NI - Depreciation Expense +/- Gain or Loss on Disposal

Total Cash Paid (interest)

Cash paid for Principal + Cash paid for Interest

Net Income for Merchandiser

Gross Profit - Expenses

Gross Profit

Net Sales - COGS

Net Sales

Sales - Discounts - Returns/Allowances

Gross Profit/Margin Ratio

Gross Margin / Net Sales

Merchandise Inventory

Current Asset not on company’s balance sheet and a product owned by company intended to be sold

Inventory Costs

Costs to buy goods, ship them, and make them ready for sale

Perpetual Inventory System

Records Costs of Goods Sold at the time of Each Sale

Merchandiser’s Operating Cycle

Purchases

Merchandise Inventory

Credit Sales

Accounts Receivable

Cash Collection

COGS (1)

GAFS - Ending Inventory

GAFS

Beg Inventory + Net Purchases

How to Read Credit Terms (ex. 2/10, n/60)

2% discount if paid within 10 days, otherwise entire amount is due within 60 days

Cash Discount for Sellers

Sales Discount

Cash Discount for Buyers

Purchases Discount

Payment within Discount Period

Debit Accounts Payable

Credit Merchandise Inventory and Cash

FOB Shipping Point (3 Parts)

Buyer accepts ownership when the goods depart the seller’s place of business

Buyer pays shipping costs, risk of loss in transit

Goods are part of the buyer’s inventory when they are in transit

FOB Destination

Ownership of goods transfers to the buyer when the goods arrive at the buyer’s place of business

Seller pays for shipping

Revenue is not recorded until goods arrive at the destination

Debits to Merchandise Inventory

Purchases

Transportation-In

Credits to Merchandise Inventory

1.Purchases Discounts

Returns

Allowances

Purchases allowances

Seller granting a price reduction (allowance) to a buyer of defective or unacceptable merchandise

Two Required Entires for Perpetual Accounting System

Revenue Recorded (and asset increased) from the customer

COGS incurred (and asset decreased) to the customer

Sales Discounts & Sales Returns and Allowances

Contra Revenue Account w/normal debit balance

Selling Expenses

Costs to market and distribute products and services

Selling Expenses Examples

Advertising, store supplies, rent, and delivery of goods to customers

G&A Expense

Costs to administer a company’s overall operations

G&A Expense Examples

Office salaries, office equipment, and office supplies

Consignment Goods (3 Parts)

Goods sent by the owner (consignor)

The consignor owns the consigned goods and reports them in its inventory

Consignee never reports consigned goods in inventory

Net Realizable Value (damaged or obsolete goods, always a loss if occurred)

Sales price - Cost of making the sale

FIFO

Assumes costs flow in the order incurred

LIFO

Assumes costs flow in the reverse order incurred

Weighted Average

assumes costs flow at an average of costs available

Rising Costs FIFO

Reports lowest COGS, yielding highest gross profit and net income

Rising Costs LIFO

Reports highest COGS, yielding lowest gross profit and net income

Rising and Falling Costs Weighted Average

Yields results between FIFO and LIFO

Falling Costs FIFO

(Opp of Rising) Reports highest COGS, yielding lowest gross profit and net income