IntAcc Ch2 Bank Reconciliation

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

3 kinds of bank deposits

Demand deposit

Savings deposit

Time deposit

Demand deposits

Current/Checking account or commercial deposit

Deposit slips

Withdrawable on demand

Noninterest bearing

Saving deposit

passbook

Withdrawal anytime or with notice

Interest bearing

Time deposit

interest bearing

Formal agreement by certificate of deposits

Withdrawn on demand after a certain time

Bank reconciliation

only for demand deposit or checking account

Credited

Increase in depositors account

Debited

Decrease in depositors account

Cancelled checks

Issued by depositors and paid by bank

Book reconciling items

Credit memos

Debit memos

Errors

CDE

Bank reconciling items

deposits in transit

Outstanding checks

Errors

DITOCE

Credit memos

Credited by bank, not recorded by depositor

Book reconciling item

Increase book balance

Credit memos include

Notes receivables collected by bank for depositor

Proceeds of back loan

Matured time deposits

Debit memos

Checks paid by Bank for the depositor using company's bank account.

Book reconciling item

Decreases book balance

Debit memos include

Non sufficient funds

Bank service charges

Defective checks

Reduction of matured loan

Deposit in transit

Collections recorded by depositor not by Bank

Bank reconciling item

Increase bank balance

DIT includes

Collections in transit

Undeposited collections (COH awaiting delivery)

Outstanding checks

Checks recorded by depositor but not reflected on bank

Bank reconciling item

decreases bank balance

Outstanding checks include

checks drawn and given to payee but not presented for payment

Certified checks

Deducted from OC since it's accepted by bank hence no longer outstanding

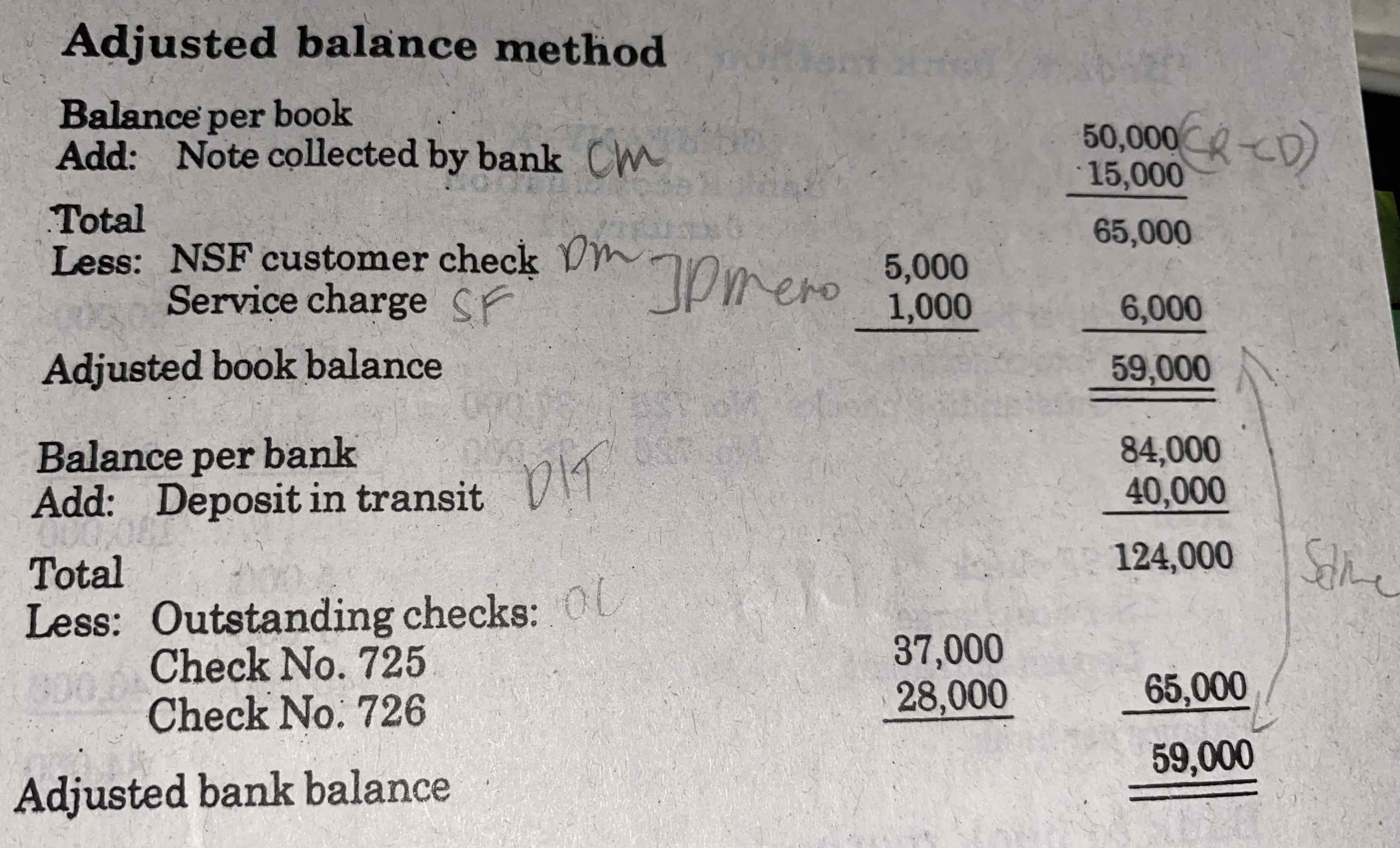

Adjusted balance method format

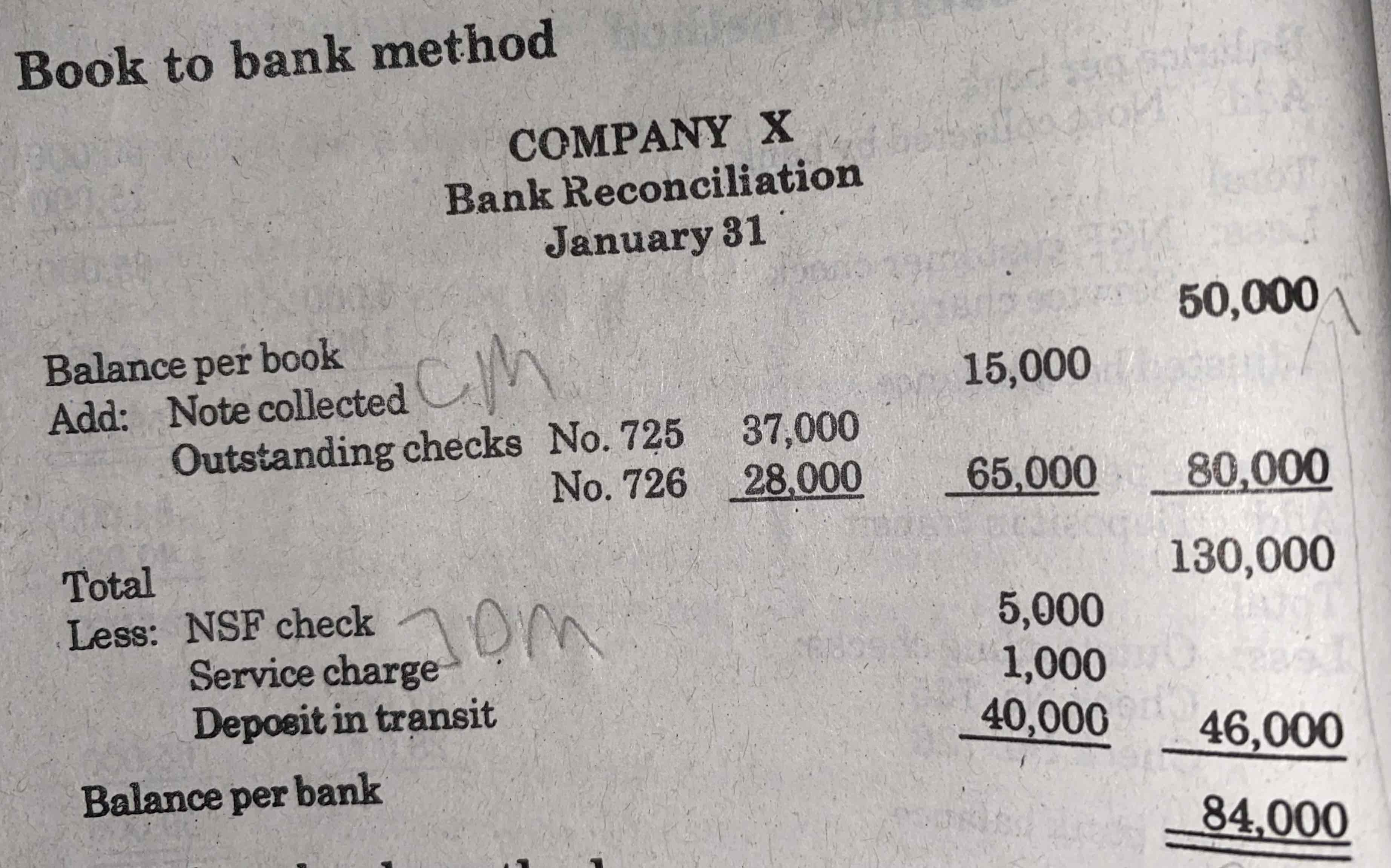

Book to bank method