Bank Reconciliations

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

15 Terms

What is a Bank Reconciliation

A report explaining any differences between the checking account balance in the depositor's records and the balance on the bank statement

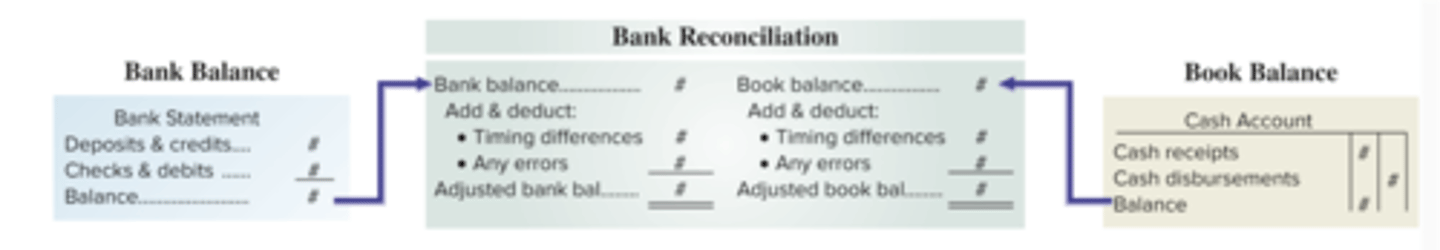

What is the process of a bank reconciliation (image)

What are the various reasons bank statement balances differ from the depositor's book balance?

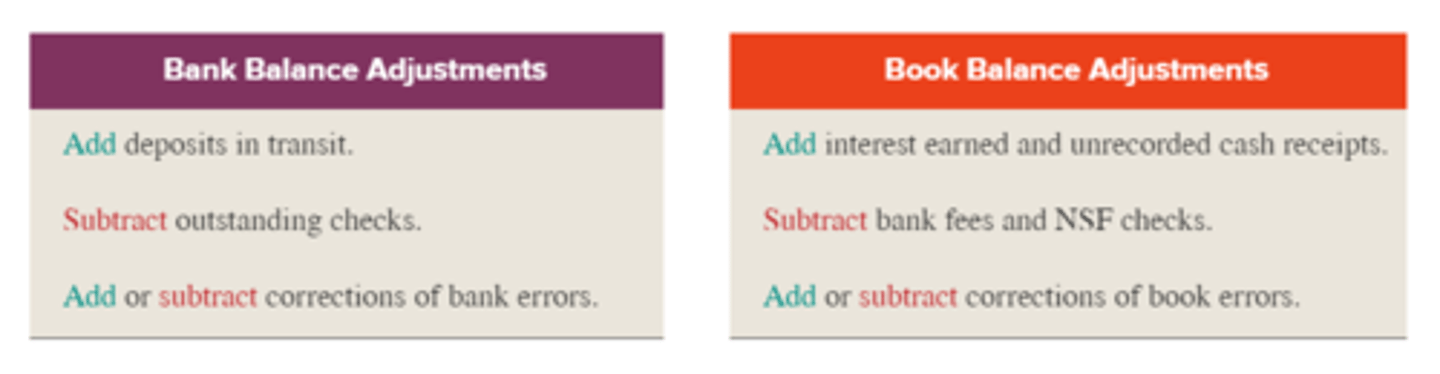

Outstanding Checks (adjust bank balance)

Deposits in Transit/Outstanding Deposits (Adjust bank balance

Deductions for Uncollectible Items and For Services/NSF Checks (Adjust book balance)

Collections or Interest Earned (Adjust book balance)

Error (Adjust either)

Outstanding Checks

Checks written by the depositor, subtracted on the depositor's books, but not yet received by the bank by the bank statement date

Decrease bank balance

Deposits in Transit

Deposits made and recorded on the depositor's books but not yet listed on the bank statement. This happens because deposits can be made after the bank is closed and are marked as being in the following period

Increase bank balance

Deductions for Uncollectible Items/NSF Checks

When companies deposit another party's check that is uncollectible

Decrease book balance

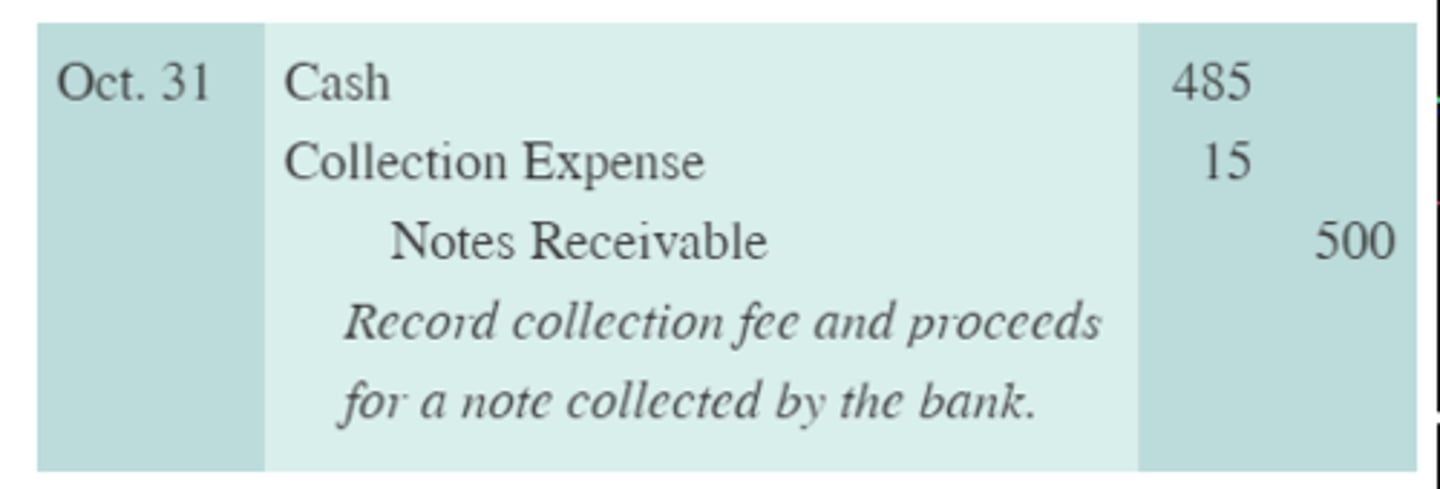

Additions for collections and interest

When a bank collects an item, it is added to the depositor's account, less any service fee. The bank then sends a credit memo to notify the depositor of the transaction

Increase book balance

Errors

How test:

Comparing deposits on the bank statement with deposits in the accounting records

Comparing canceled checks on the bank statement with checks recorded in accounting records

Summary of Additions and Subtractions

Example of Bank Reconciliation

What is the notion for adjustments related to Bank Reconciliations

Only entries which affect the book balance need adjustments

How to adjust for Collection of Notes Receivable

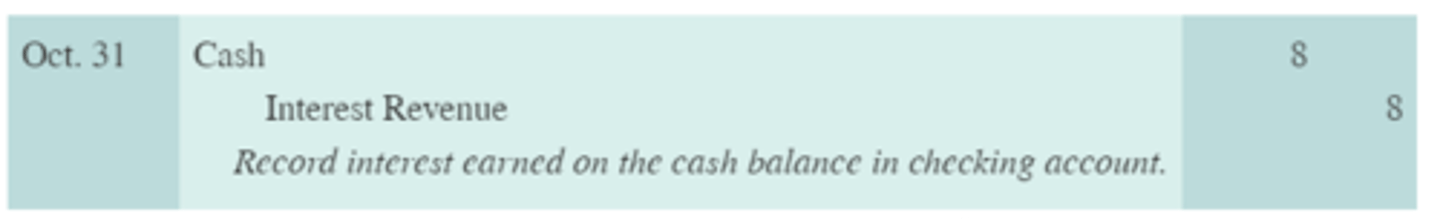

How to adjust for Recording for Interest Earned

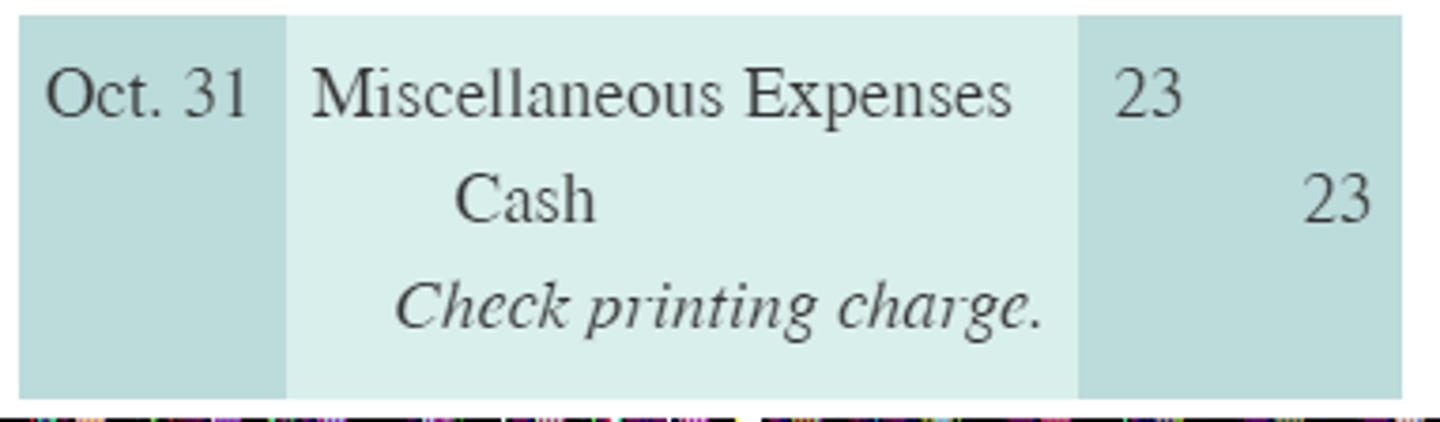

How to adjust for recording expenses for check printing charge

How to adjust for an NSF check that is returned as uncollectible.

Bank charged 10 for handling the NSF check, and deducted 30 total. The check was worth 20.