Doblas HW7 review

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

When the government imposes a tax on labor income, what happens to the production function and potential GDP?

_______ the production function occurs and potential GDP _______.

A leftward movement along; decreases

An accounting system that measures the lifetime tax burden and benefits of each generation is called _______.

generational accounting

What is the lag that identifies the time it takes Congress to pass the laws needed to change taxes or spending?

The _______ lag is the time it takes Congress to pass the laws needed to change taxes or spending.

law-making

How do tax revenues change during a recession? How does needs-tested spending change during an expansion?

Tax revenues _______ during a recession. Needs-tested spending _______ during an expansion.

decrease; decreases

Which of the following is not an objective of fiscal policy?

Fiscal policy attempts to achieve all of the following objectives except _______.

a stable money supply

What is an increase in the income tax rate is an example of?

An increase in the income tax rate is an example of _______.

discretionary fiscal policy

One of the four alternative fiscal policy changes that could be made to help the federal government meet its Social Security obligations are:

________ income taxes

Raise

One of the four alternative fiscal policy changes that could be made to help the federal government meet its Social Security obligations are:

_______ Social Security taxes

Raise

One of the four alternative fiscal policy changes that could be made to help the federal government meet its Social Security obligations are:

_______ Social Security benefits

Cut

One of the four alternative fiscal policy changes that could be made to help the federal government meet its Social Security obligations are:

_______ Federal Government Discretionary Spending

Cut

If a structural surplus exists but the government's budget is balanced, what is happening in the economy?

If a structural surplus exists but the government's budget is balanced, then _______.

real GDP is less than potential GDP

Potential GDP is $10 trillion and actual real GDP is $8 trillion.

The economy has a structural deficit of $1.5 trillion and an actual deficit of $2 trillion.

Calculate the cyclical deficit.

The cyclical deficit is _______.

$0.5 trillion

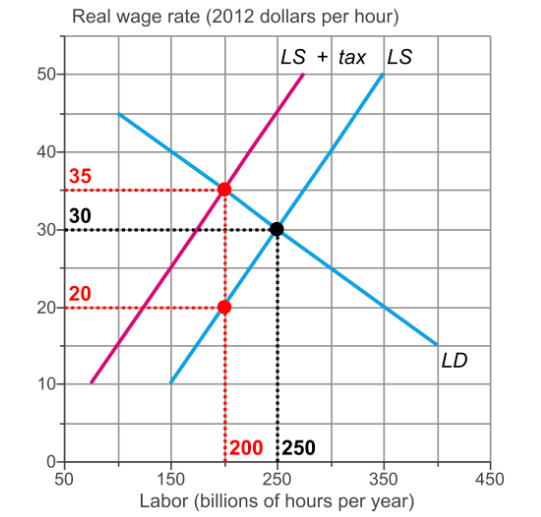

The figure shows the labor market when an income tax is imposed.

What is the tax wedge?

The tax wedge is _______.

$15 an hour

What does the Laffer curve tell us about tax rates?

A cut in the tax rate can increase tax revenue.