The Behavior of Interest Rates (Chapter 5)

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Relationship between quantity demanded of an asset and wealth

positive

Relationship between quantity demanded of an asset and expected return

Positive

Relationship between quantity demanded of an asset and risk

Negative

Relationship between quantity demanded of an asset and liquidity

Positive

Shifts in the demand for bonds: wealth

increase in wealth shifts demand for bonds RIGHT

Shifts in the demand for bonds: expected interest rate

increase in expected future interest rate shifts demand for bonds LEFT

Shifts in the demand for bonds: inflation

increase in expected rate of inflation shifts bond demand LEFT

Shifts in the demand for bonds: risk

increase in riskiness of bonds causes bond demand to shift LEFT

Shifts in the demand for bonds: liquidity

increase in liquidity of bonds shifts the demand curve RIGHT

Shifts in the supply of bonds: investment opportunities

higher profitability of investment opportunities shifts supply curve RIGHT

Shifts in the supply of bonds: expected inflation

increase in expected inflation shifts supply curve RIGHT

Shifts in the supply of bonds: government deficit

increased budget deficit shifts the supply curve RIGHT

Fisher Equation

nominal interest = real interest + inflation

Real world application of fisher’s equation

Central bank policy decisions

Inflation-adjusted returns

loan pricing

Forecasting inflation using machine learning

Employ NLP models to extract inflation expectations

Combine with data to improve inflation forecasting

Better inflation prediction → more accurate interest rate setting

Liquidity Preference Theory

All other things being equal, investors prefer cash or other highly liquid holdings

Bs - Bd = Md - Ms

If the bond market is in equilibrium, then the money market must be in equilibrium

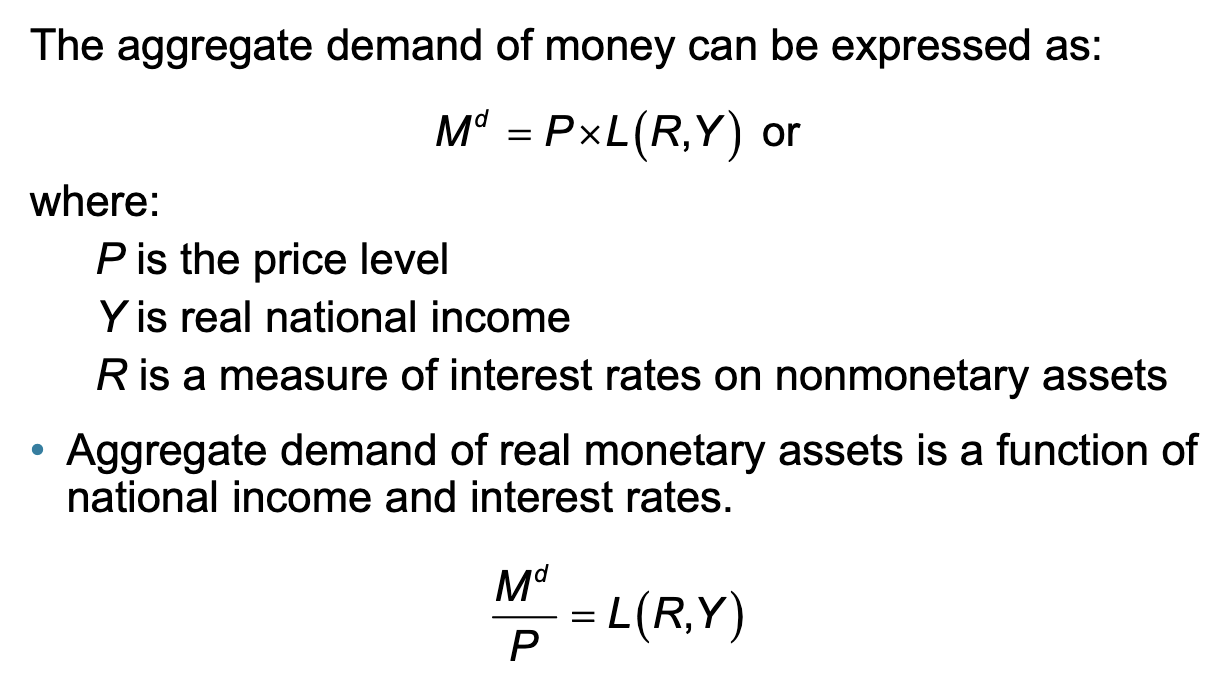

Model of Aggregate Money Demand

Income Effect on money demand

Increase in income causes the demand curve for money to shift RIGHT

Price level effect on money demand

Rise in the price level causes the demand curve for money to shift RIGHT

Income effect on interest rates

increase in income → increase in money supply → rise in interest rates

Price level effect on interest rates

increase in price level → increase in money supply → increase in interest rates

Expected inflation effect on interest rates

increase in expected inflation → increase in money supply → increase in interest rates

Liquidity effect on interest rates

increase in money supply → lower interest rates