4.2.4 Financial Markets & Monetary Policy

1/124

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

125 Terms

What are the 4 core functions of money?

a medium of exchange - Money avoids the problems of barter

A store of value

A measure of value/unit of account

Standard for deferred payment

What are the 6 characteristics of money?

Durability: Money must be able to withstand being used repeatedly

Portability: Money must be easily transportable so it can be easily transferred to other individuals,

Divisibility: It is also preferable that money can be divided into smaller units of value,

Acceptability: Money must be widely accepted for it to be usable for different types of transactions,

Scarcity: Money must be in limited supply to ensure its value remains relatively stable,

Security: Money must also be extremely difficult to counterfeit, as if it is easily duplicated it will cease to become a medium of exchange

What is narrow money?

The basic amount of notes and coins and operational deposits/reserve balances at the Bank of England.

–money that can be accessed ‘on demand’.

What is Broad money?

all notes,coins,deposits in savings accounts and other less liquid assets

What does liquidity mean?

How easily an asset can be turned into cash.

Cash is a highly liquid asset, whereas property for example is more illiquid.

What is a stock?

security that represents the ownership of a fraction of the corporation.

Units of stock are called "shares" which entitles the owner to a proportion of the corporation's assets and profits equal to how much stock they own.

When is a bond issued?

by governments and corporations when they want to raise money.

What is a bond yield?

return on the capital invested by an investor.

Formula for Yield

Yield formula = coupon/market price x100

What are the 3 types of financial market?

Money market

Capital market

Foreign exchange market

What is the money market?

provides short term , typically 24 hrs to 12 months, finance to individuals, firms and governments

includes interbank lending

What is the capital market?

provides medium to long- term finance to firms and governments

includes companies issuing shares or corporate bonds, or governments issuing bonds to finance their borrowing requirements

What’s the difference between the primary capital market and the secondary capital market?

The primary capital market is where newly issued securities are sold by companies or governments

The secondary capital market is where previously issued shares or bonds are traded e.g. The London Stock Exchange is an example of a secondary capital market

What is the foreign exchange market?

different currencies are bought and sold

What’s the difference between the spot market and the future market?

The spot market involves the immediate exchange of foreign currency

The forward market involves the exchange of foreign currency at some specified time in the future.

What’s the difference between the money and capital market?

Money market - where commercial banks provide short term loans to each other

Capital market - businesses obtain funds to finance long-term growth

What’s the role of financial markets in the wider economy?

To facilitate saving by businesses & households

To lend to businesses and individuals

To facilitate the exchange of goods and services

To provide forward markets in currencies and commodities

To provide a market for equities

How do financial markets in the wider economy lend to businesses and individuals?

Mortgages for home-buyers

Loans / credit for small and medium sized enterprises

How does the financial market in the wider economy provide forward markets in currencies and commodities?

allows companies & individuals to hedge against uncertainty for example by buying their currencies & commodities months in advance

How does the financial market in the wider economy provide a market for equities?

Allows businesses to fresh equity capital e.g. to fund their expansion

Equity markets provide a market for capital control, a market discipline on listed businesses

What is a financial market?

any exchange that facilitates the trading of financial instruments, eg stocks, bonds, commodities

What is debt?

Amount owed by the borrower to the lender

What is equity?

Amount of money a company’s owner has put into

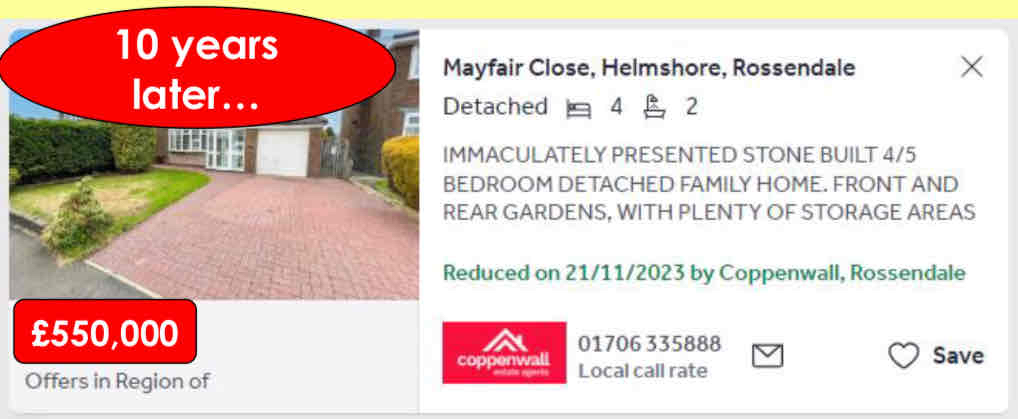

Lets say you purchased this house for £400,000 10 years ago.

You sell the house for £540,000.

What are commercial banks?

high street/retail banks e.g. Barclays, HSBC & NatWest

provide services to customers e.g: foreign exchange, insurance and brokerage services

How do Commercial banks make money?

By offering interest on savings, and lending out this money to other people at a higher interest

savers deposit money into their chosen bank, receiving interest in return

borrowers receive money in the form of loans/mortgages paying interest

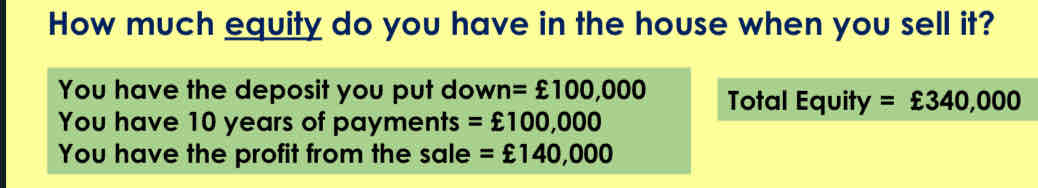

What are the main roles/function of Commercial banks?

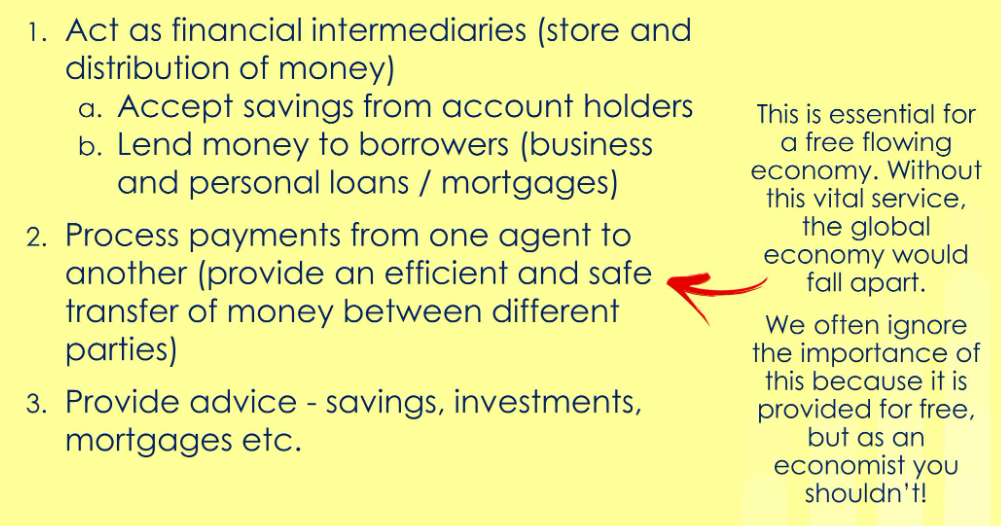

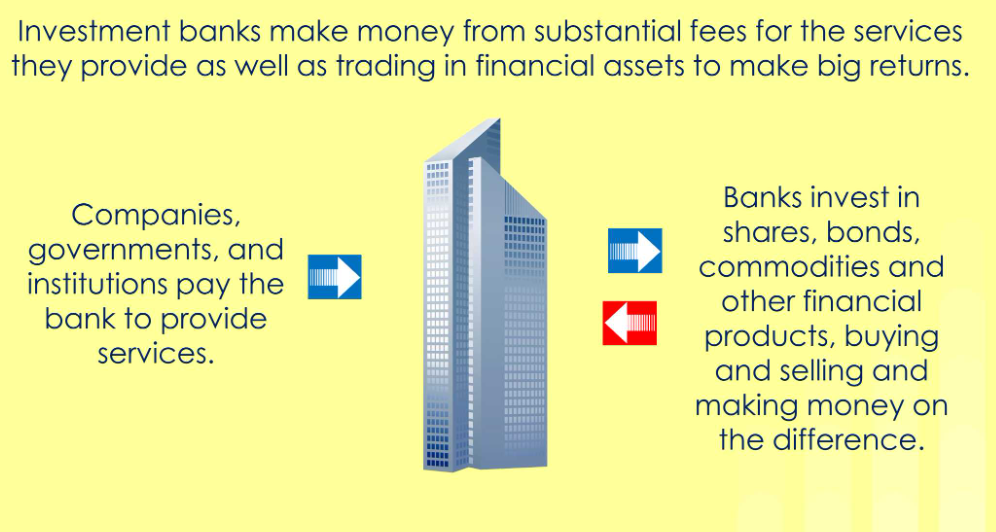

What’s the key function of investment banks?

help companies/government raise finance by giving advice

arranging new issues of shares/corporate bonds

helping them to manage the risk in doing so

How do IBs make money?

How do banks create credit?

extending loans to businesses and households

do not need to attract deposits from savers to do this

When a bank makes a loan, it credits their bank account with a bank deposit of the size of the loan/mortgage.

new money is created.

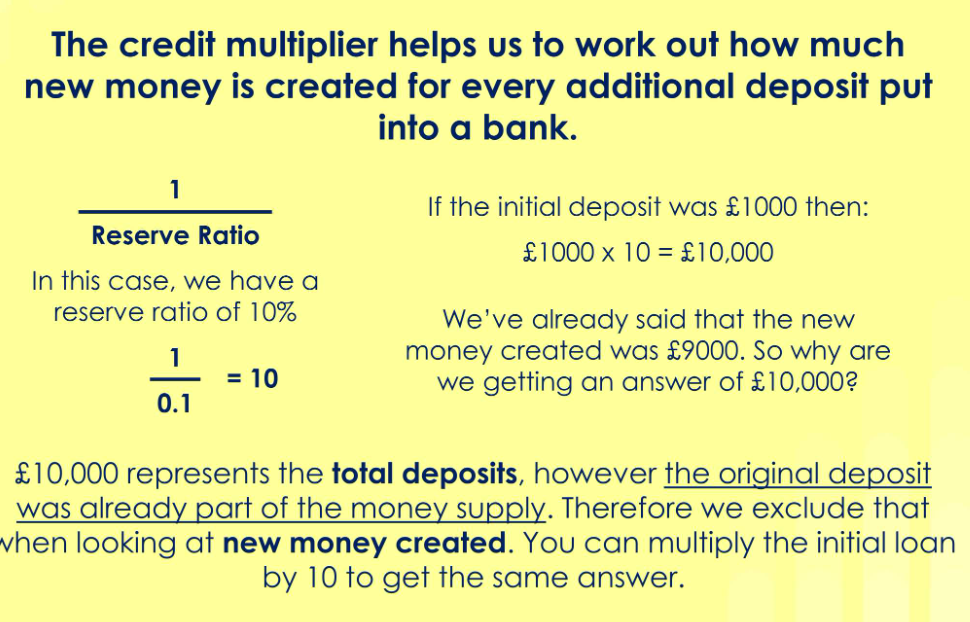

What is the Credit Multiplier? Give the formula.

What is QE?

creation of new money electronically to buy bonds in the financial market with the aim to stimulate AD

Inflation is an effect of QE, what can the BOE do?

Reduce money supply by selling their assets

Reduces spending in the economy

Describe the process of QE

bank buys gov bonds using money they have created

Then used to buy bonds from investors = increases the amount of cash flowing in the financial system

Encourages more lending to firms and individuals = cost of borrowing lower

Encourages more investment, spending = leading to more EG —> also lead to inflation (money supply increasing)

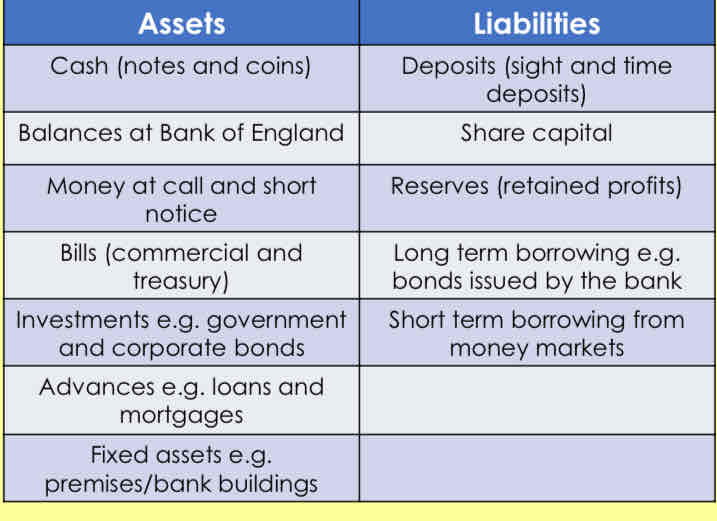

What are balance sheets?

comprised of assets & liabilities

total assets must equal total liabilities

For a commercial bank

What are assets?

What are liabilities?

➢an asset is any claim that the bank has against others

➢a liability is any claim that others have on the bank

What does a commercial banks balance sheet look like?

What happens if commercial banks balance sheets are not liquid enough?

loss of confidence amongst consumers in the ability of the bank to meet its liabilities

For a commercial bank to succeed, why it is important that a large portion of these assets are as liquid as possible?

the bank will struggle to meet its liabilities as and when they fall

liquid assets do not tend to be very profitable but less liquid assets carry a greater burden of risk.

What are commercial banks 3 core objectives?

1. Profitability- commercial banks have a requirement to ensure investors receive a return on their investment through dividends. Banks with weak profitability will likely see their share price fall and find new investment harder to attract.

2. Liquidity- Commercial banks must ensure that they have enough liquidity to meet the demands of their depositors, who can withdraw their money at any time.

3. Security - Commercial banks seek to ensure that their assets are as secure as possible. An example of a secured loan is a mortgage.

An unsecured loan, such as a credit card, is riskier for the bank as there’s no underlying asset acting as security, the balance between the different types of asset is important in determining the banks overall stability.

What types of loans can you get from a bank/lender?

business

Overdraft

Credit card

Mortgage

Personal loan

Payday loan

What does the central bank take action to do?

influence the manipulation of IR, ER, supply of money and credit

What are the functions of a Central Bank?

manages the currency, money supply & IR

Issue physical cash securely & use methods to prevent fraud

How does a reduction in IR affect AD?

C = reduce OC of saving, households with variable mortgage rates benefit through low repayments ( increases disposable income)

I = cheaper for firms to borrow from commercial banks, use these to form R&D/innovation

G = gov debt repayments lower, gov can issue more bonds to contribute to higher levels of gov spending

X-M = reduces flow of note money into econ (rate of return is lower than other countries) = weakens ER as it increases supply of £ on forex markets

What is the BOE considered to be?

lender of last resort = if there is no other method to increase the supply of liquidity when it’s low

If institution is close to collapsing bank might lend to them

Banks will avoid borrowing from the BOE = suggest that bank is experiencing financial difficulties

What are some responsibilities of the BoE?

promote safety of financial firms

protect & enhance the resilience of the financial system = prevent future financial crises

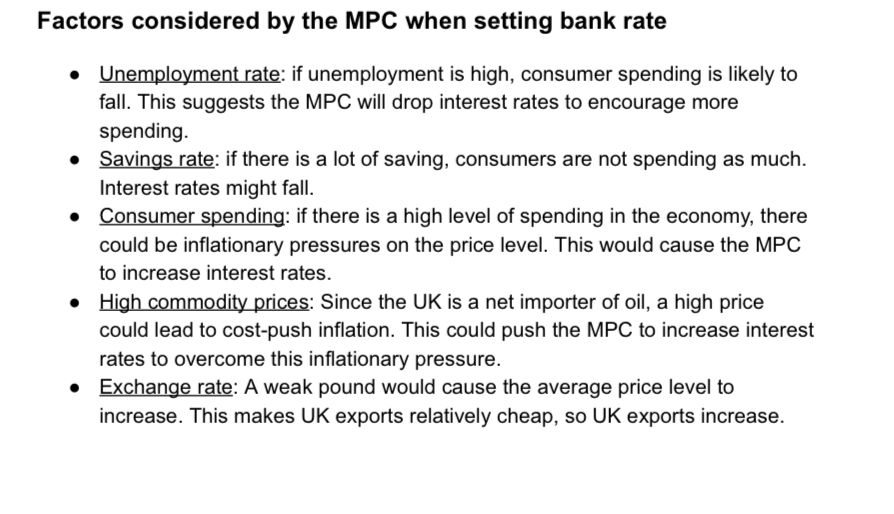

What factors do the MPC consider when setting the bank rate?

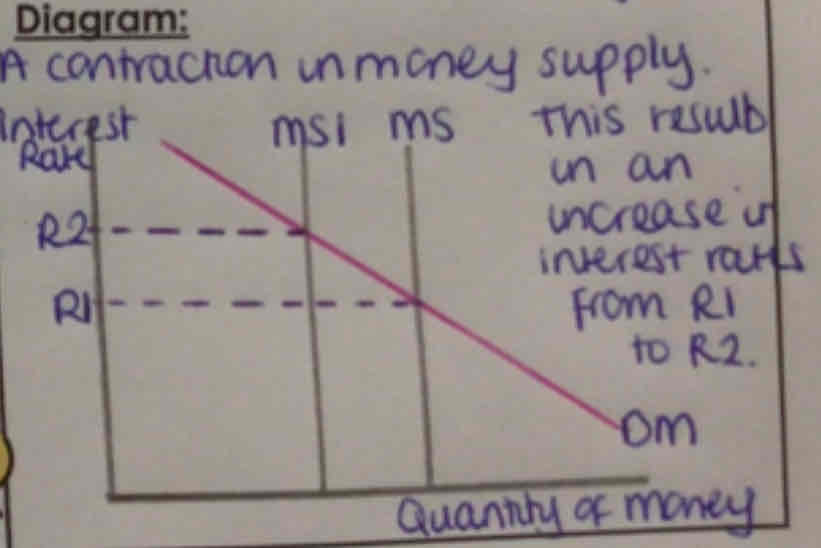

Draw a diagram to show a contraction in the money supply

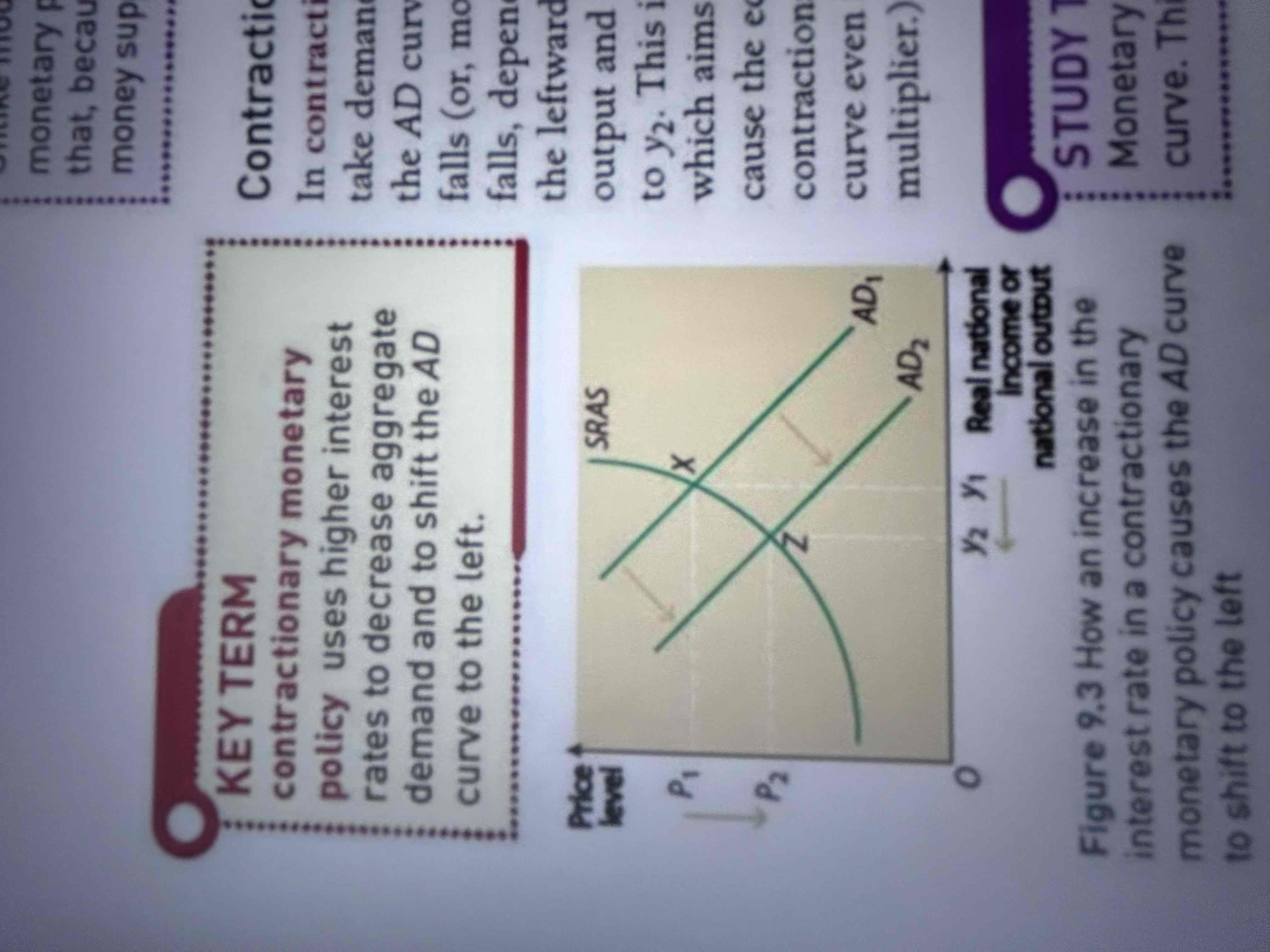

What is contractionary monetary policy?

uses higher interest rates to decrease AD and shift AD curve inwards to left.

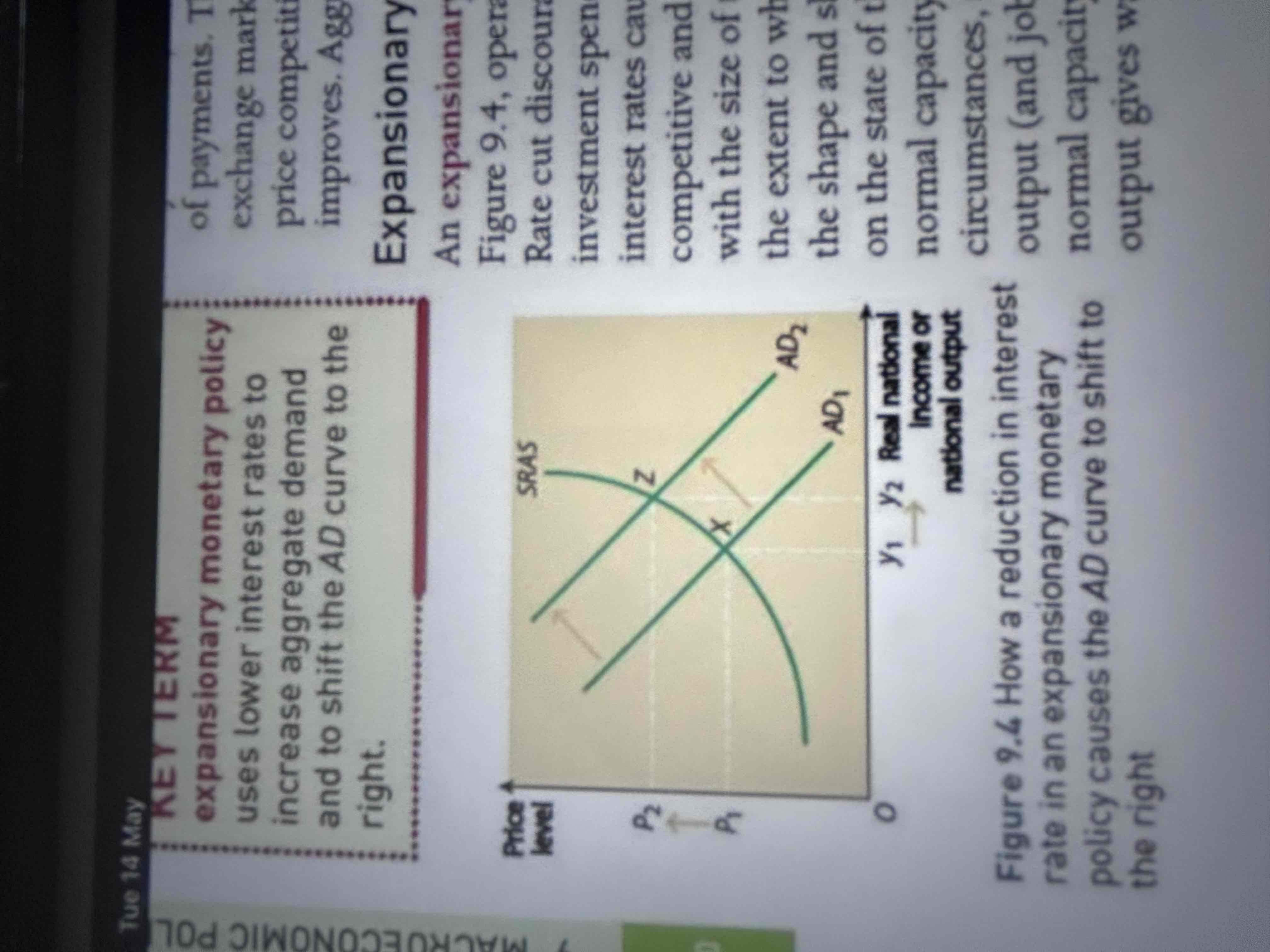

What is expansionary monetary policy?

uses lower interest rates to increase AD and to shift AD curve to right

What is fiscal policy?

involves the use of taxation, public spending and the government’s budget to achieve the gov’s policy objectives

What is the budget deficit?

government spending exceeds government revenue

Represents a net injection of demand into the circular flow of income and a budget deficit is expansionary

What is a budget surplus?

when G<R

Represents a net withdrawal from the circular flow and hence a BS is contractionary

What are the three macroeconomic policies?

monetary policy - includes interest rates, tax, debt

Fiscal policy - gov spending, money supply

Supply side - productivity

How do the government receive money?

through taxes and borrowing money if in debt

Where does the government spend its money?

healthcare

Education

National defence

Councils

Welfare benefits

Social protection

Debt interest

Police

Transport

What are the main taxes?

corporation tax

National income tax

Inheritance tax

VAT road tax

NICs

Council

How does fiscal policy affect AD?

expansive fiscal policy can be created through increasing GS or decreasing Income tax

Causes AD to increase

Increased consumption

GDP increases

How does fiscal policy affect AD?

expansionary fiscal policy increases AD

Gov will increase spending and cut taxes

Lower taxes will increase consumers spending because they have more disposable income

Worsens gov budget deficit

So expansive fiscal increases AD

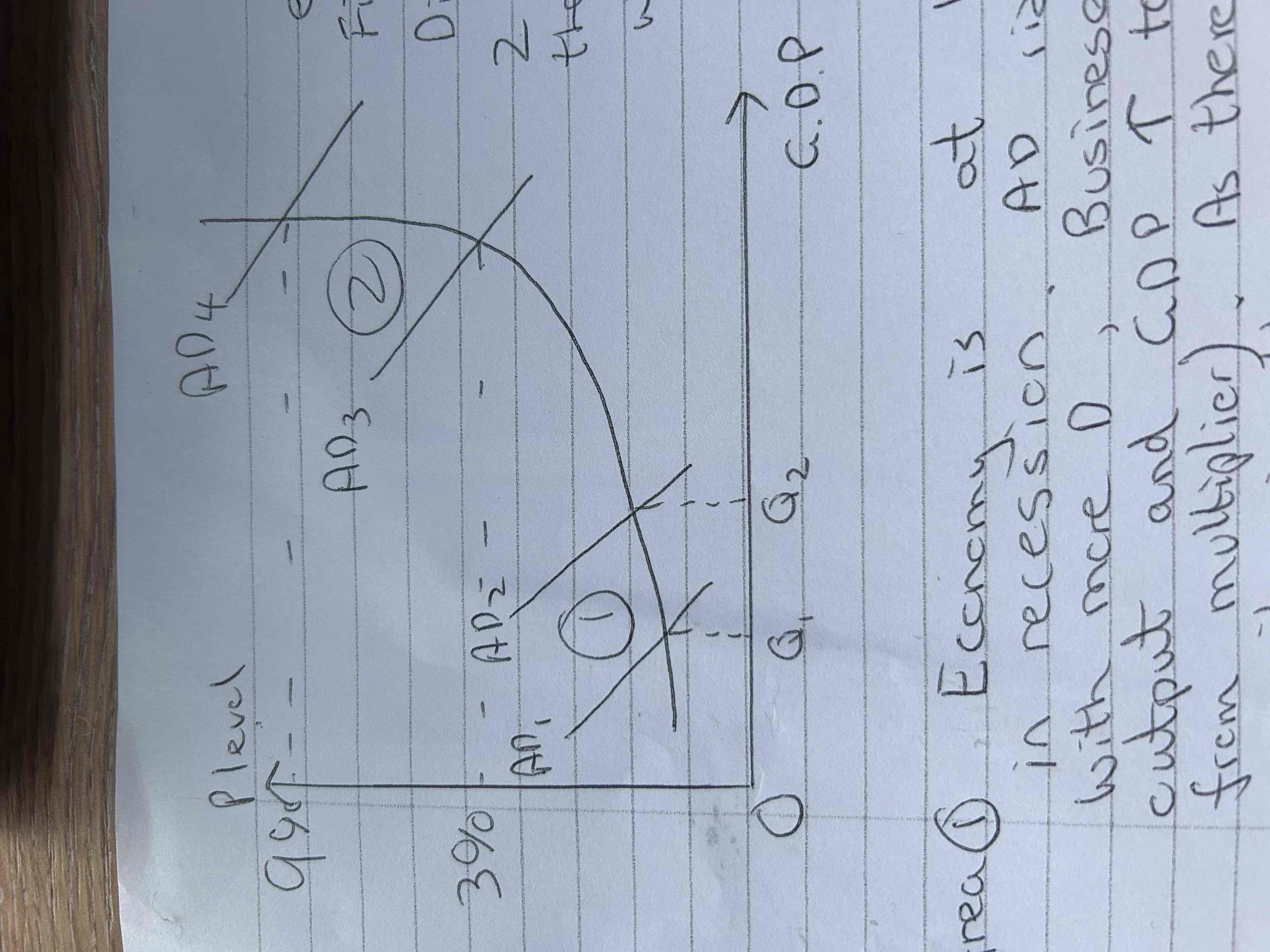

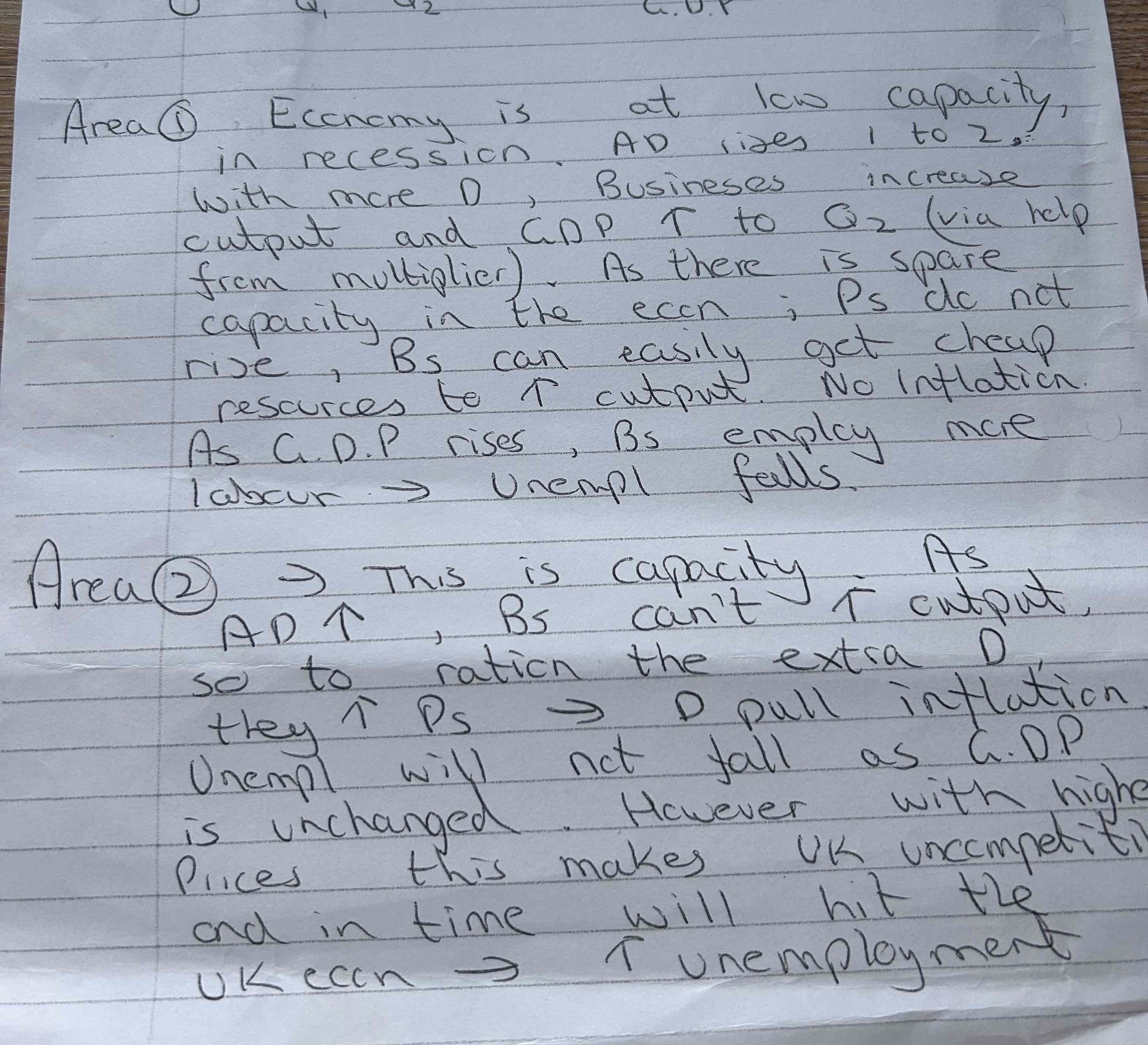

Diagram shows 2 areas on the AS curve when AD could rise

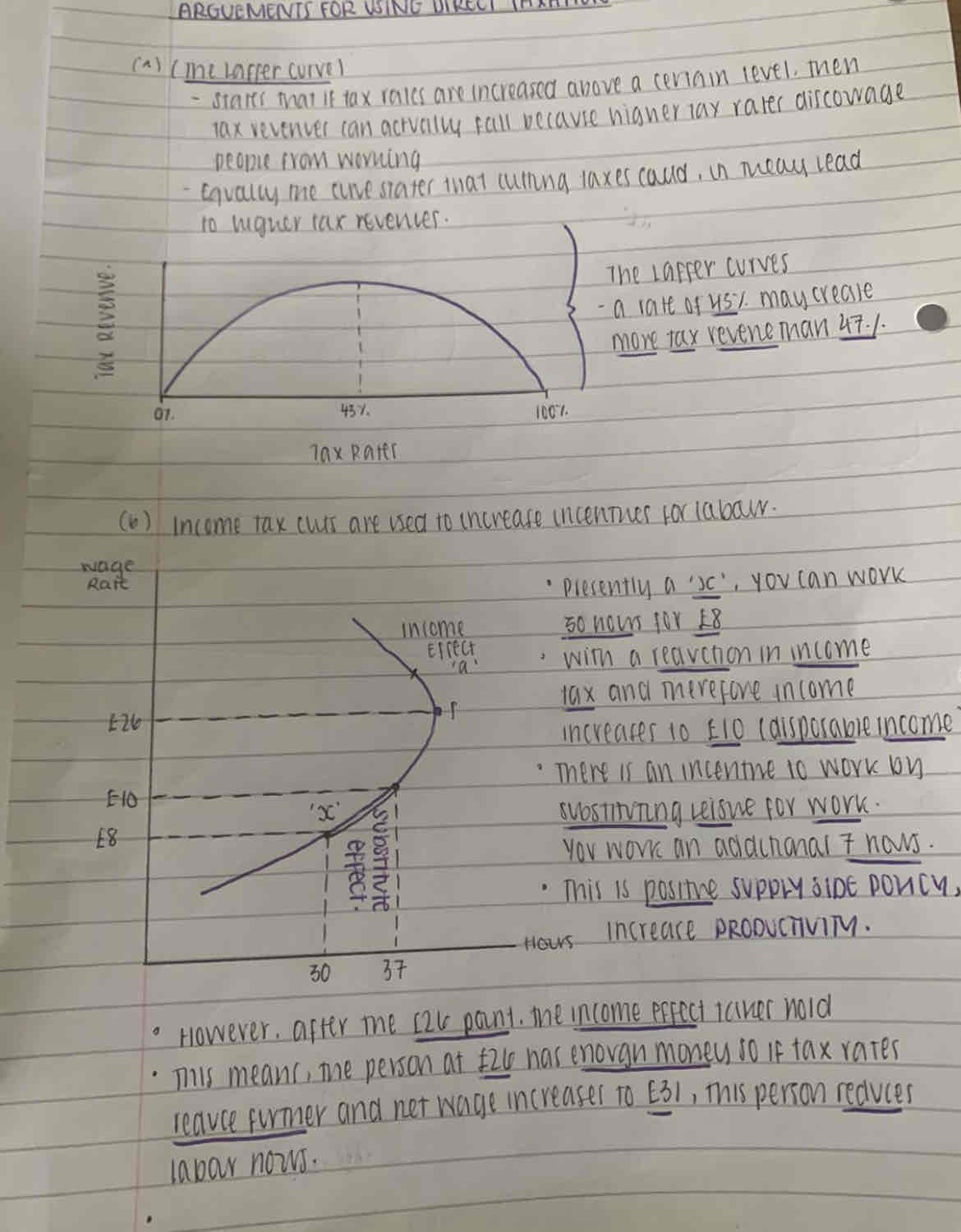

How can fiscal policy affect supply?

Changes in income tax rates and can have a significant effect on work incentives in the labour market. Consider 40% or say 15% tax???

Higher government spending on education & training, can increase human capital / productivity to lift the long-term trend rate of growth.

Changes in corporation tax changes profits and investment

if Y tax / corp tax falls may help S side as efficiency rises. (incentives to work / more Bus investment)

What’s the criticism of all policies, what’s another criticism of fiscal policy?

The government may have poor information about the state of the economy.

Time lags. To change econ it could take several months.

Crowding out. (fiscal only) Higher government spending will crowd out the private sector. This is because the government have to borrow from the private sector who will then have lower funds for businesses

What are the main objectives of the UK tax system?

Raise money

Lower Y tax helps incentives to work.

Tax de merits ALTER D FOR SOME GOODS

Redistribute Y / Wealth with benefits. Help poor Y end

Manage econ to alter AD via Y tax changes

What are the two types of tax?

Direct taxes – are directly on your circumstance– usually through “pay as you earn” (y tax). Also corporation tax.

Indirect taxes – include VAT and a range of excise duties on oil, tobacco, alcohol. The burden of an indirect tax can be passed on by the supplier to the final customer

What are the types of direct tax?

Income Tax = Biggest rev earner, Progressive tax system

Corporation Tax

Capital gains tax - sell an asset for greater than purchase Price pay tax on gain

Inheritance tax

National insurance

What is the purpose of indirect tax?

1. Generate tax revenue for a government.

2. Discourage consumption of ‘harmful’ products

The burden of an indirect tax can be passed on by the supplier to the final customer

What’s an example of an indirect tax?

A unit tax (specific ) is a set amount of tax per unit sold, such as a 10p tax on packets of cigarettes.

VAT

The percentage of VAT is 20%, on most goods except,,what?

no/low VAT:

newspapers

Children’s clothes

Food and drink (chocolate covered biscuits,ice cream, crisps)

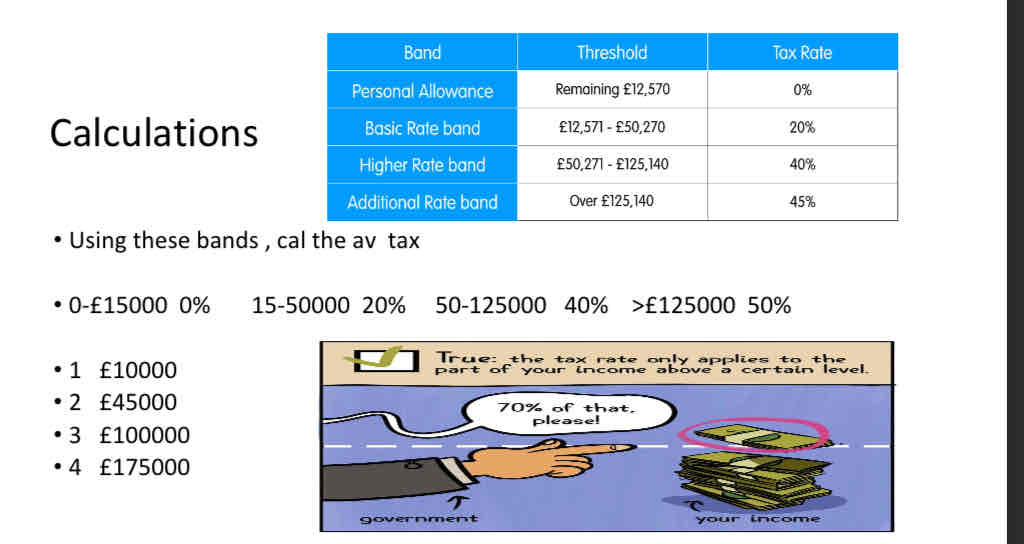

What is progressive tax?

involves a tax rate that increases as taxable income increases.

It imposes a lower tax rate on low-Y earners and a higher tax rate on higher earners

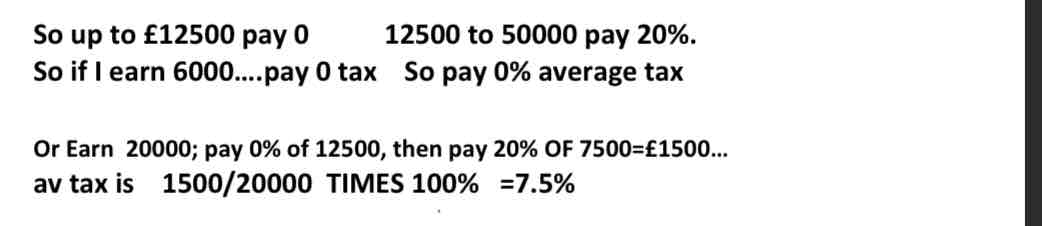

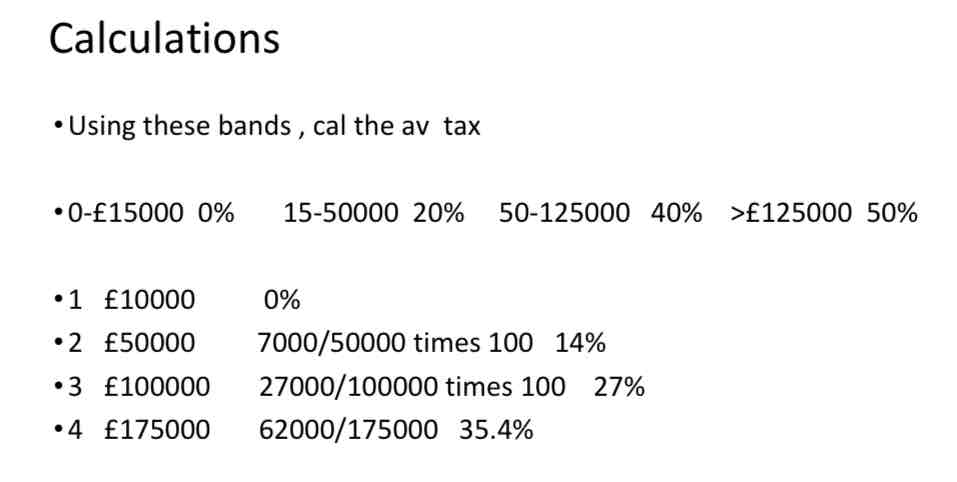

Formula for average tax

Average tax = tax paid/ income X 100

What happens for regressive taxes?

the average rate of tax is greatest for those on lower incomes.

• VAT

• The tax on national lottery tickets (12%)

• Exercise duties on smoking and alcohol and betting and gaming duties • Higher fuel duties

On 10000 spend all so pay 20%

vat av tax 2000/10000 20%

If on say £500000 spend say 200000 pa vat is £40000

Av tax 40000/500000 times 100 = 8%

So as Y rises vat as proportion of vat falls.....regressive

What does the pattern of consumption in the economy refer to?

refers to trends or predictable which consumers purchase goods or services over time

How does fiscal policy influence the pattern of consumption on an economy?

exercises duties- taxes of cigarettes, decreases consumption

Govt spending via subsidies- spend on merit goods such as the NHS

Fall in income tax, changes rate of consumption

Fall in corporation tax, increase in price changed the budget spending power

Tax of demerit goods (e.g alcohol)

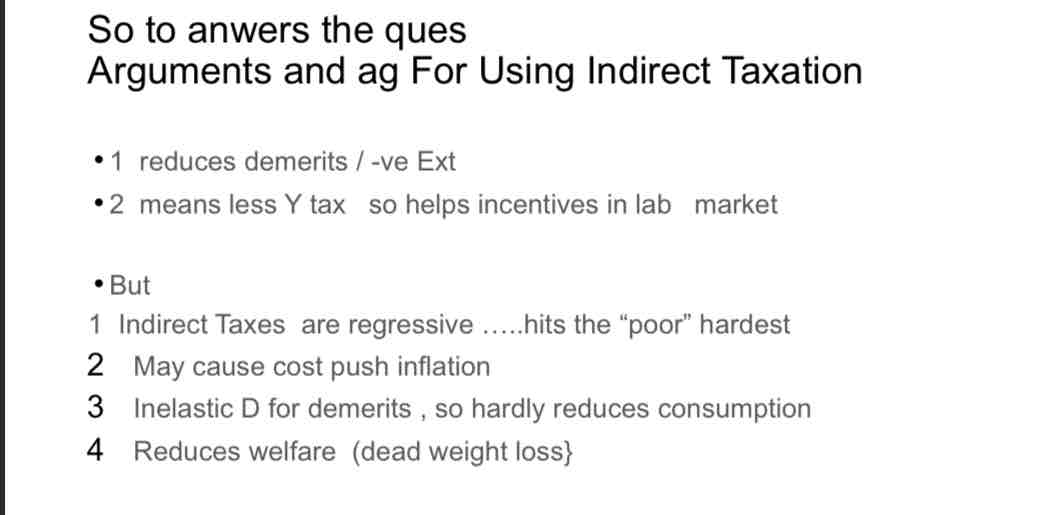

What are the pros and cons of indirect taxes?

Pros:

raises a lot of money for infrastructure, to pay welfare benefits, NHS, education, public/merit goods

Used to change the pattern of consumption

Reduces demand for petrol via positive ext.

Cons:

Indirect taxes are regressive meaning low income people are hit the hardest

Many cause cost-push inflation causing VAT to increase the prices causing costs to increase

Petrol/cigarette taxes have no effect on their demand

Why do some indirect taxes have no effect on their demand, like the taxes on cigarettes and alcohol?

raises a lot of money

IDR taxes less likely to distort choices that people have between work and leisure, have less of a negative effect on work incentives

Higher IDR taxes allows a decrease in direct tax rates, lower income tax rates so people work harder

What are arguments against using indirect taxation?

IDR taxes are regressive

May cause cost push inflation

Does the cig/petrol tax work?

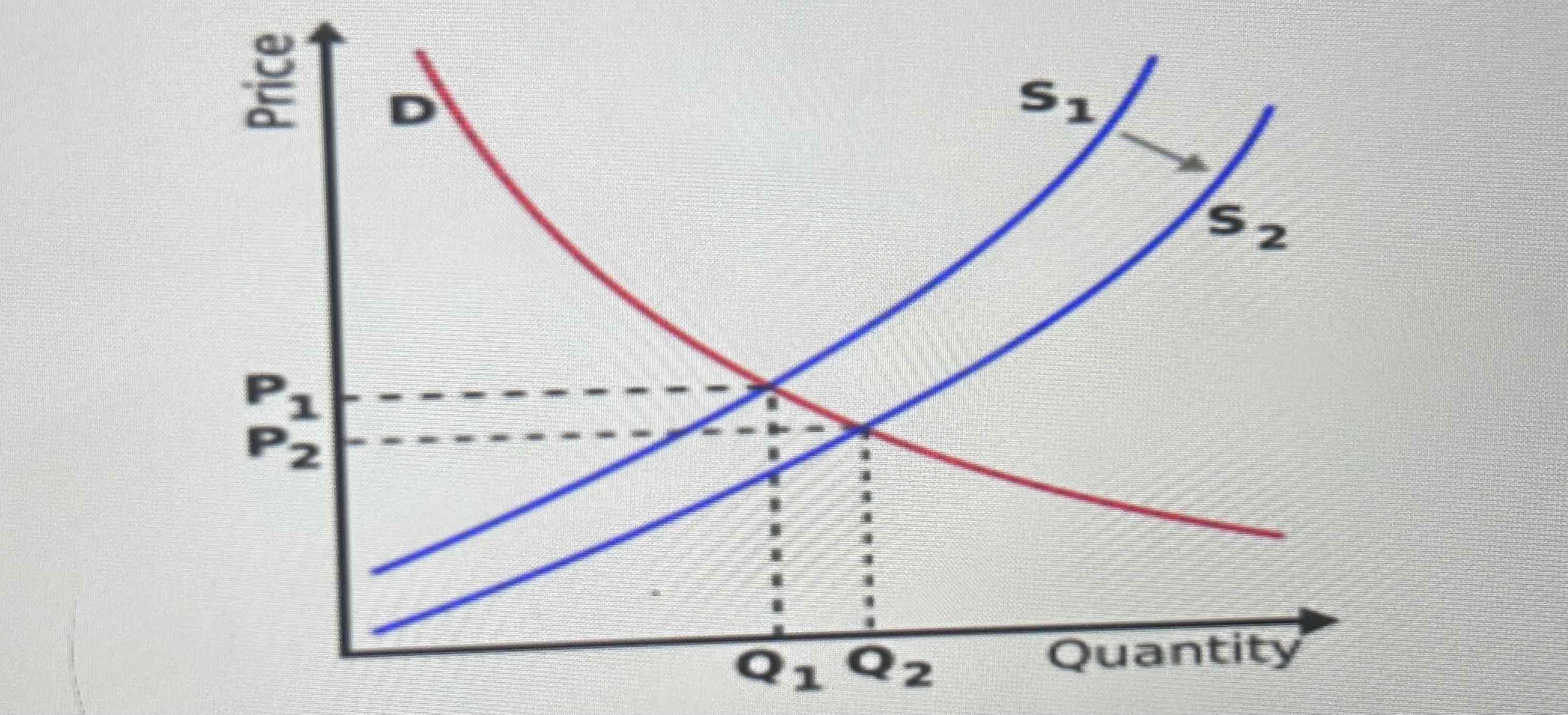

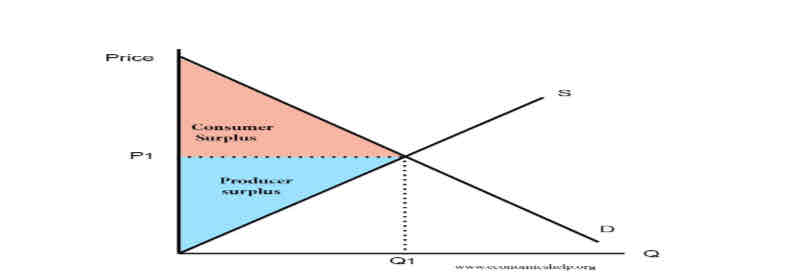

Draw a D/S diagram showing IDR taxation causing a deadweight loss of welfare to society:

What is consumer surplus?

difference between the price that consumers pay and the price that they are willing to pay.ie consumers save money that can be spent elsewhere to increase their welfare

What is producer surplus?

difference between the price that producers get and the price that they are willing to supplly at.. Eg P is £9 but could S at £5 PS is £4 EXTRA PROFIT, so their welfare rises due to PS

Arguments for and against using indirect taxation

Arguments for direct taxation

What is regulation?

a rule or directive made and maintained by an authority.

the action or process of regulating or being regulated, "the regulation of financial markets"

Why do banks need regulating?

to protect consumers, ensure the stability of the financial system, and prevent financial crime.

Why Regulate?

Moral hazard

Systemic risk

run the risk of more financial crashes like 2008 and ‘the lost decade’ in terms of real income growth—> impacts economy

What can regulators do?

aims are to reduce the risk of moral hazards

can raise, or impose, a minimum level of assets that banks need to maintain in order to meet their liabilities.

This mitigates against the risk of a liquidity crisis (bank run) or insolvency (losses are too big).

Which 3 measurements help assess the risks?

➔ Liquidity Ratios (Reduces risk of liquidity crisis)

➔ Capital Ratios (Reduces risk of liquidity crisis)

➔ Leverage ratios (Reduces risk of insolvency )

Who helps with financial regulation?

The Bank of England

Prudential Regulation Authority (PRA)

Financial Policy Committee (FPC)

Financial Conduct Authority (FCA).

Who is the UK banking industry regulated by, what do they do?

FCA = regulates financial firms to ensure they’re being honest to consumers and they seek to protect consumer interests, aims to promote competitions in the interests of consumers

PRA = promotes safety & stability of banks, building societies, investment firms

What do the FPC do?

regulates risk in banking & ensures the financial system is stable

Clamps down on unregulated parts & loose credit

Monitors overall risks to the financial system as well as individual groups being regulated

“Too big to fail”

What does this refer to?

a theory in banking and finance that asserts that certain corporations are so large and so interconnected that their failure would be disastrous to the greater economic system, and therefore should be supported by government when they face potential failure

What is moral hazard?

any situation in which one person makes the decision about how much risk to take, while someone else bears the cost if things go badly.

Conditions necessary for moral hazard

Information asymmetry.

Where one party holds more information than another. The bank knows their own accounts better than outsiders.

A contract affects the behaviour of two different agents.

E.g. If you are insured, then you may have less incentive to take care against risks. With large banks, they felt the government would have to bail them out if things went wrong.

What is an asset?

economic resources owned by a company likely to generate future benefits or cash flows.

What is a liability?

refer to things that you owe or have borrowed.

A liquidity ratio refers to

the number of liquid assets to overall assets.

Use of liquidity ratio:

require banks to hold enough liquid assets to pay any unexpected short term demand in liabilities.

Central banks and regulators might require anywhere from 60-100%.

Formula for liquidity ratio

Current Assets/Current Liabilities