Lecture 1 - World of Economic Growth

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

How is economic growth typically measured

GDP

Why study GDP growth

GDP captures something that humans care about

consumption + investment

but

GDP ignores important things that also matter

e.,g., leisure, health & goods produced in underground economy

GDP positively correlated with other things

life satisfaction, health, human rights

Measurement problems - how to incorporate quality improvements

Why study economic growth?

doesnt happen automatically

matters - more consumption, better health etc

varies massively across time, countries, regions

can be stimulated and hampered by gov policies

How to compare GDP levels

To make meaningful comparisons across time and across countries correct using Purchasing Power Parity (PPP)

What does PPP do

shows relative value of currencies across countries

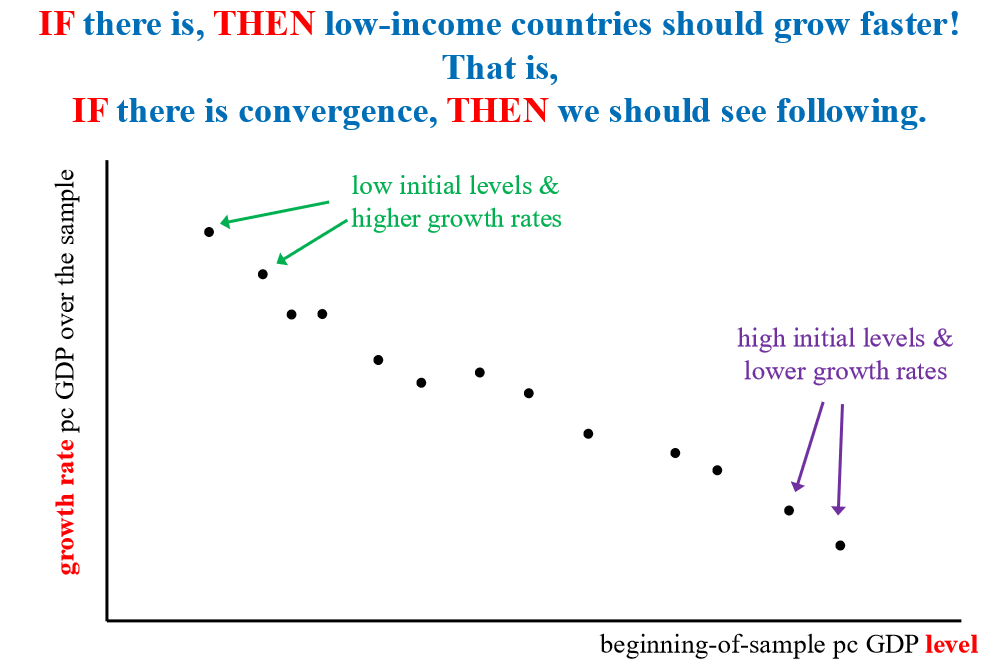

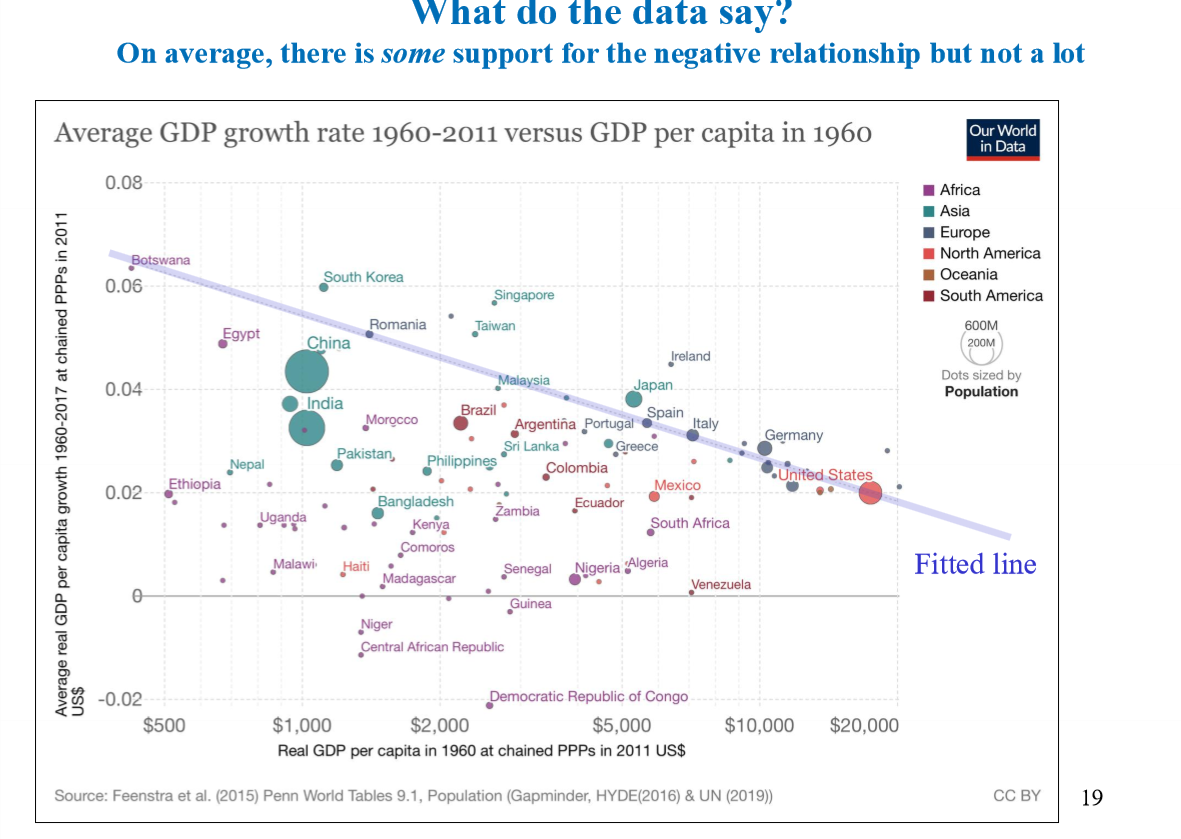

Convergence

idea that low income countries have higher growth rates so they catch up to higher income countries (converge)

The negative relationship and convergence

Is the negative relationship not only neccessary for convergence, but also sufficient?

Unconditional convergence below

Unconditional convergence

No country characteristics conditioned on

Conditional convergence

Much more evidence if countries are ‘similar’

similar technology levels

similar investment rates

similar population growth rates

industrialised countries

part of same unions e.g. EU

Is there convergence?

If low income countries save more - countries can grow by allocating a large share of GDP to investment instead of consumption

What does a log scale show

Growth in percentage change not absolute values

Problem with aggregate GDP

averages hide distributional differences

not everyone equally affected by recession

some people lose jobs others unaffected

GDP down by 2% but some lose 100% of income

Is long-term growth affected by the presence of business cycles? ie what would UK GDP series look like without business cycle fluctuations

Smooth line - same average growth rate

A higher average growth rate (connecting the peaks) - peaks represent potential, however peak may also represent an overheated situation that is not sustainable // higher growth possible in a more stable environment e.g. bc more willingness to invest under certainty

A lower average growth rate as business cycles bring creative destruction //innovative entrepreneurial activity is needed for growth, but a necessary side effect is volatility

Does growth affect the prevalence of recessions?

Growth happens bc entrepreneurs take risk → higher business cycle volatility

More growth → better institutions → lower volatility

Why did ‘Eurasians’ end up doing so much better than the other continents?

Once everybody started as ‘hunter-gatherers’

Eurasians: access to plants/animals useful for farming (e.g. domesticable horses)

Farming → Surplus to support ‘thinkers’ & specialisation

Living with animals → People become immune to germs

Thinkers → Invent guns and steel

Dominate hunter-gatherers on other continents

Interact with those not immune to germs

Dominate hunter-gatherers on other continents

IR time period

1750 - 1820

18th C

Factors behind 1st IR

1) Protection of property rights

2) Atlantic trade

3) Enlightenment

4) Agricultural revolution

5) ‘High’ wages and cheap coal

6) Financial revolution?

Protection of property rights

Credible commitment to not expropriate

Invstmt requires protection of property rights

Earlier, UK kings abused property rights

UK civil war and glorious revolution 1688-89

laws that limit power of kings

Why wasn’t power given to a new elite in the UK

(related to property rights protection)

Landowners (Tories) vs merchants (Whigs)

Two diverse powerful groups with different interests created a delicate power struggle

Atlantic trade

Atlantic trade → resources increased

Atlantic trade and protection of property rights →

Advantages of Atlantic trade not absorbed by aristocratic elite

seen by UK and Netherlands growing, and France, Portugal and Spain less so

Enlightenment

New Revolutionary View:

Mankind can improve upon its fate by scientific inquiry, especially empiricism and reason

Religious dogma was challenged

Importance of Interaction Factors

Many smart people in diff countries before the enlightenment

Came up with brilliant inventions

But often lost

Watershed moment: Invention printing press (1450)

IDeas could be easily preserved and easily disseminated

China had invented a printing press before Gutenberg but progress hampered by lack of alphabet

Following combo helpful

Enlightenment freed up the mind and resulted in having a religion that wasn’t to oppressive

A particular invention to disseminate info

Convenient alphabet

Agricultural Revolution

Stimulated by protection of property rights

Adding turnips allowed for more efficient crop rotation → productivity increased

Cows ate turnips so shared use of lands was problematic

so land had to be enclosed and this pushed poor people to cities releasing manpower and creating labour for factories

Causation between AR and IR

1. Agricultural Revolution released manpower and helped the industrial revolution.

2. Industrial revolution attracted manpower from farming which triggered agricultural revolution.

What type of wage behaviour would distinguish the two stories?

If #1, then wages in industry should ↓ due to inflow of workers from agriculture.

If #2, then wages in industry should ↑ due to increased demand for man power.

Data indicates that #2 is more plausible.

High wages and cheap coal

1) Wages in England were ‘high’ due to economic expansion (rural manufacturing, agricultural productivity increases + growth of cities)

2) Coal was abundant and cheap, so energy costs not a problem for initially very inefficient machines ( and coal had long term advantages as opposed to peat which was used in the Netherlands)

Above → labour saving innovations

‘high’ wages means high enough so that using machines was even cheaper, workers not well off

Role of Finance

UK Financial Revolution (after glorious revolution of 1688)

BOE: Created in 1694 and lender of last resort in 1760

Emergence of a stock market

Financial development known to be important for economic growth during other episodes

But role of finance for 1st Industrial Revolution disputed

Most financing did not come from banks (UK banks didn’t do much long-term lending)

However, Heblich and Trew (2019) using a unique regional data set document that bank access was important for industrialisation and TFP increases.

Was 1st Industrial Revolution a Success Story?

Yes if focus on economic growth narrowly defined

Lots of important aspects ignored:

Working conditions

Living conditions (overcrowding in cities)

Colonial expansion (for imports of raw materials & export finished goods)

Environment