Theme 1 Edexcel A-Level Economics (A)

1/102

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

103 Terms

What is a Positive Economic Statement?

Objective, can be proved or disproved by factual evidence

Basic Economic Problem

Society has finite resources (Factors of Production), but infinite wants, causing scarcity and the need to allocate resources.

Renewable vs Non-Renewable Energy Sources

Renewable naturally replenished in a reasonable time frame, non-renewable are finite and used up faster then replenished

Opportunity Cost

The benefit forgone of the next best alternative when allocating resources

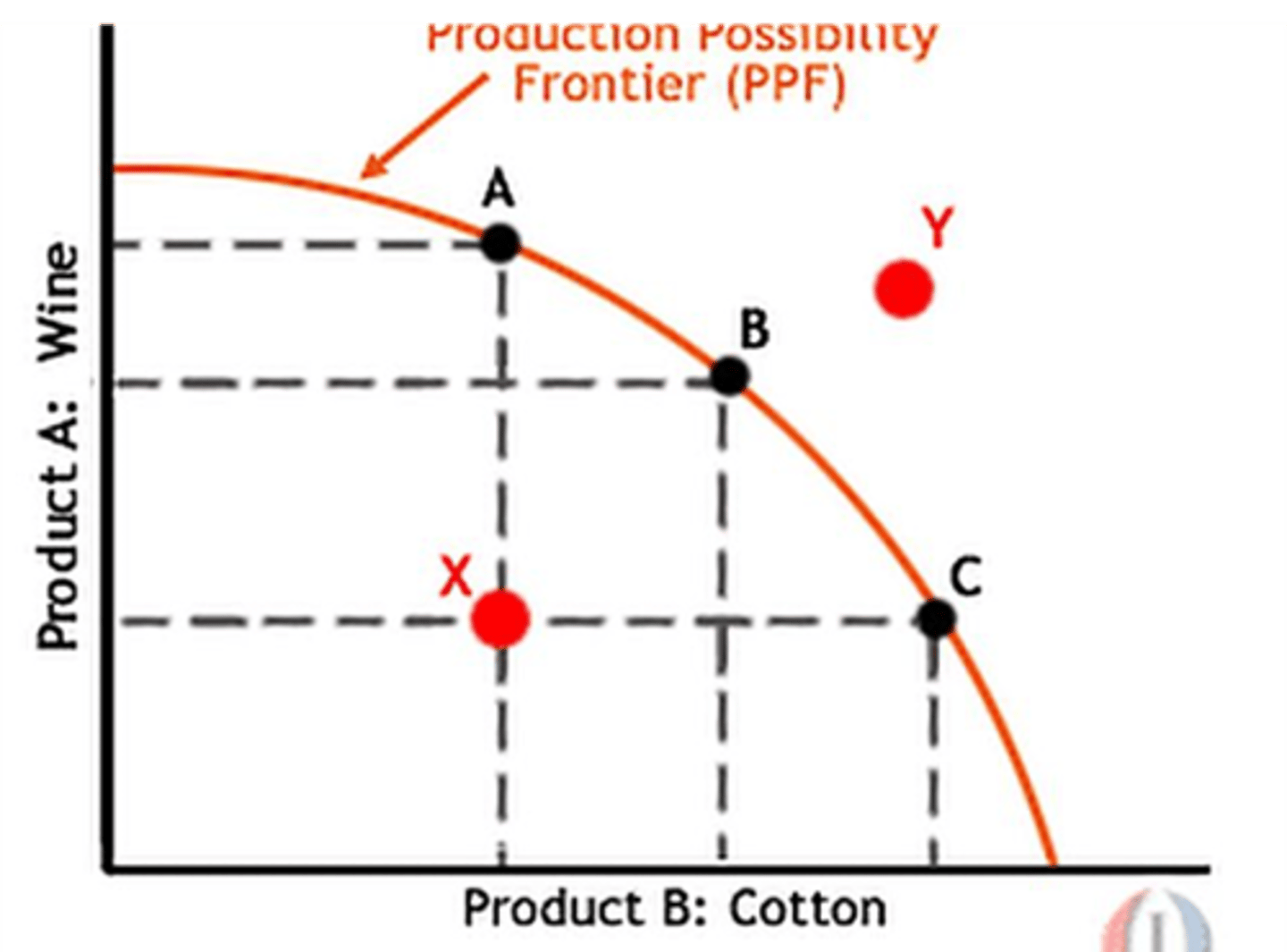

What does a PPF Show?

Maximum possible output combinations of two goods or services in an economy. The PPF is where all resources are fully employed.

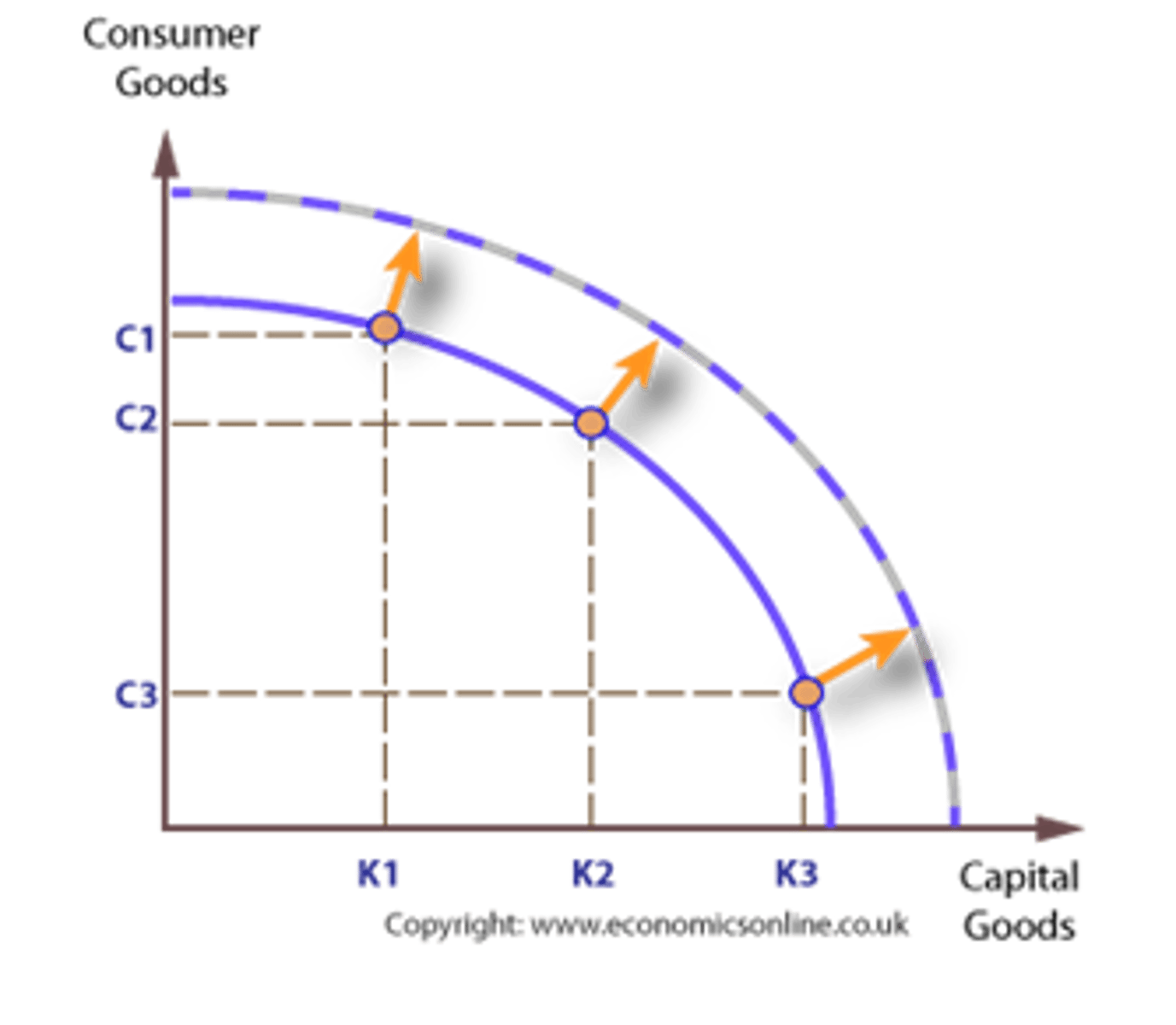

What does an outward shift in the PPF show?

Increased productive capacity in an economy (Increase in LRAS)

What is Factor Mobility of a PPF?

If there is a curve, factors are not perfectly mobile between production. This means that opportunity cost varies through each change of the curve.

Capital Good

An intermediate good used for the process of producing something else.

Consumer Good

A good intended for use by individuals, with no economic use after consumption

What is Division of Labour? (2)

From the Wealth Of Nations (A.S.)

Where a task is broken into smaller tasks or processes that workers can specialise in to increase productivity and/or efficiency.

Productivity Definition

Output per unit of input in terms of Factors of Production

Efficiency

How well resources are being utilised within a process to avoid wastage

Define Specialisation

When workers, businesses or individuals in a household concentrate resources on the completion of a single task (as part of a bigger operation).

Advantages of Specialisation

Increases Productivity - lower CPU, firms decrease, if elastic demand increases, higher revenue, increased output further

Recruitment and Training Costs Lower

Theory of Comparative Advantage - countries can limit their opportunity cost by specialising in the product/service they can produce most efficiently and productively. Leads to boosted global output.

Disadvantages of Specialisation

Occupationally Immobile Workforce - increased vulnerability to economic shocks, structural unemployment can occur

Inverse Effects of Monotony (Boredom) - bored workers work less efficiently, or leave businesses (low staff retainment)

Overextraction of Raw Materials - countries specialise in a particular product, and exhaust the land

Barter Definition

Where one good is traded for another - alternative to money

Advantages of Free Market (4)

- Consumer sovereignty as they have free choice

- Businesses will want to innovate, increase quality and be efficient (reduced resource consumption, optimising allocation of resources)

- Workers will work hard to facilitate their wants and needs (especially those in poverty)

- Survival of the Fittest (SMITH) will mean competition seeks better products and lower prices for consumers

Disadvantages of Free Market (6)

- Consumers may demand illegal markets (drugs, weapons, people)

- Keeping costs low may mean making redundancies

- Maximising utility often involves unsustainable practices that make it harder for future generations (environmental degradation)

- Monopolies are a risk of free markets

- Inequality, as governments are not redistributing or providing benefits

- Karl Marx argues that inequality is inevitable due to the wealth reaping income

Advantages of a Command Economy (4)

- More equality is possible as state allocates resources

- Government can respond more effectively to wars/crises

- Stability of economy

- Safety net for those unable to work

Disadvantages of a Command Economy (3)

- Planning is more difficult due to lack of market mechanism

- Lack of political freedom (in most cases) and Authoritarianism

- Lack of incentive for businesses to innovate

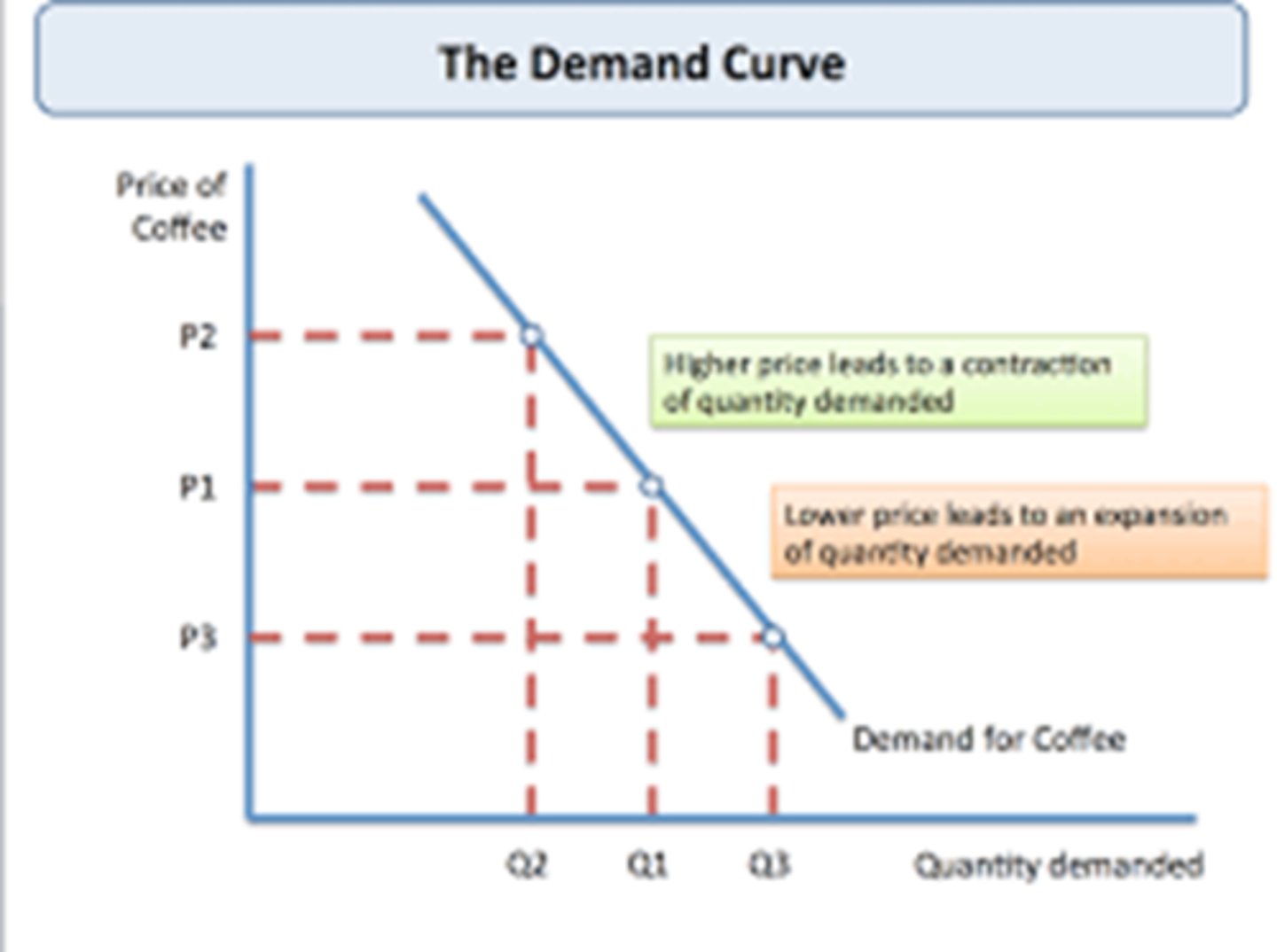

Demand Definition

The quantity of goods purchased at a given price, ceterus paribus

What does the law of demand describe?

An inverse relationship between the quantity demanded and the price

What causes the Law of Demand?

The Law of DMU - As consumption increases, the marginal utility decreases

The Income Effect - If income is fixed while prices increase, peoples real income decreases, so quantity demanded is lower as prices rise

The Substitution Effect - As prices increase, alternatives become more attractive so demand of good X falls.

What causes a shift of the demand curve?

Population

Legislation

Advertisement

Substitutes

Trends/Fashion

Incomes

Compliments

What is PEd and why is it important?

Measures the responsiveness of quantity demanded to a change in price.

Always Q before P

Used to adjust prices and forecast revenues (governments and firms)

Inelastic increase prices to increase revenue

Elastic increase quantity to increase revenue

What factors affect PEd?

Brand Loyalty

Availability of Substitutes

Time period (long term everything elastic)

Proportion of income spent

Addictiveness

Necessity or Luxury

What is YEd, what effects it and why is it important?

Responsiveness in the quantity demanded due to change in income.

Affected by whether is is luxury or necessity. Inferior goods will have a negative YEd.

Firms can diversify to have products with variable responsiveness to YEd

What is XEd, and what do values mean?

Cross Elasticity of Demand measures responsiveness of quant. demanded of one good due to change in price of another.

XEd<0, goods are compliments

XEd>0, goods are substitutes

Supply Definition

Quantity of a good or service that all firms plan to sell at a given price, ceterus paribus

What is the Law of Supply?

A positive relationship between price and quantity supplied. Suppliers are willing to provide more to the market at higher prices.

What causes a shift of the supply curve?

Productivity increases

Technological advancements

Stockpiling of goods

Costs of production

Other firms change price

What is PEs, and why is it important?

The responsiveness of firms producing a good in relation to changes in market price

Shows how easily a firm can respond to changes in demand

If demand at every price level increases (rightward shift) inelastic demand will have a large rise in price

What factors affect PEs?

Some sellers take flexible positions...

Spare Capacity

Stock Levels

Time period

Factor substitution

Production time

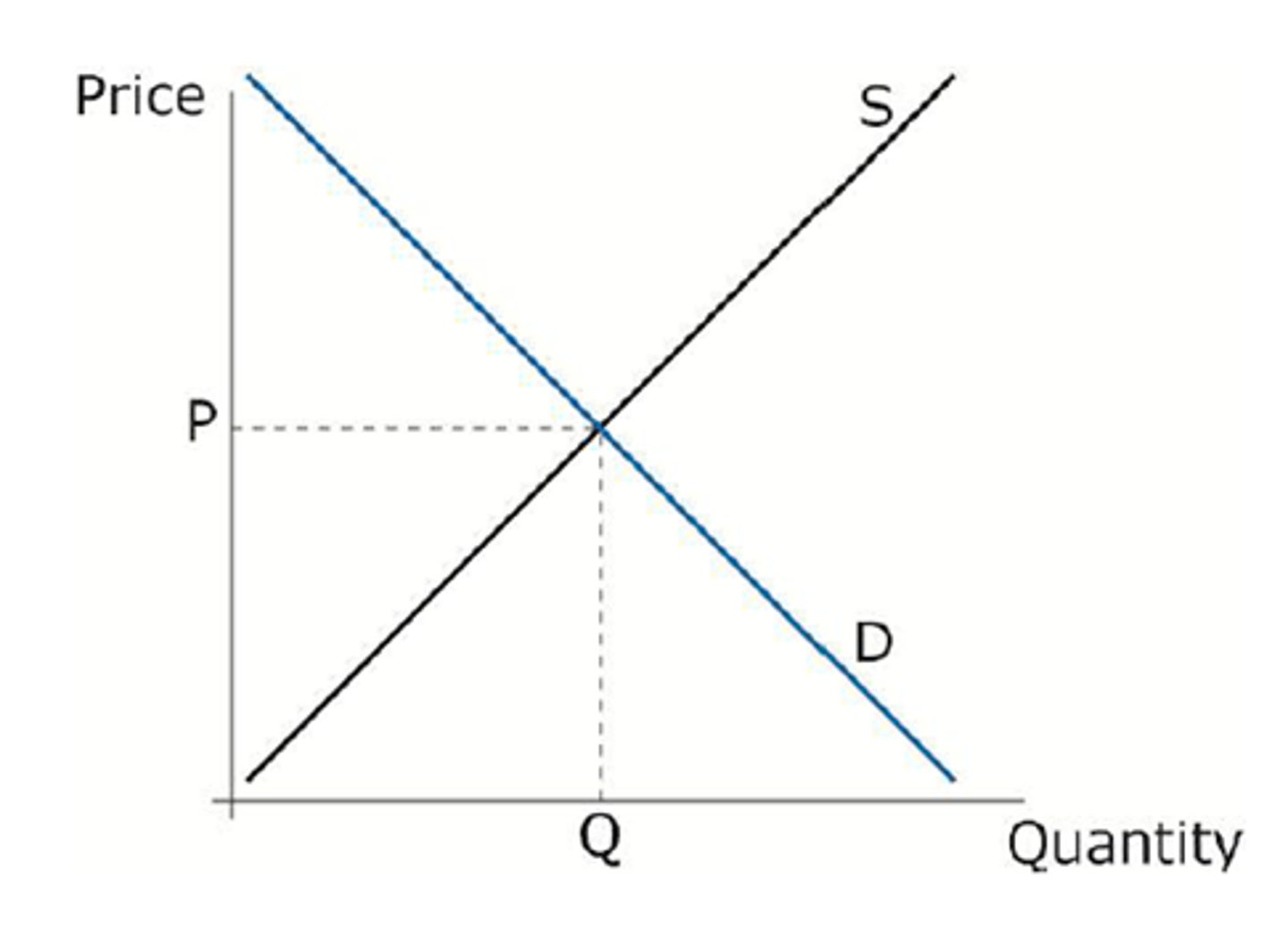

What is the market clearing price, and how is it determined?

The point where demand and supply intersect. This is where suppliers and consumers supply and demand equal amount of the good, and there will be ne excess demand or supply. The price is that of this equilibrium.

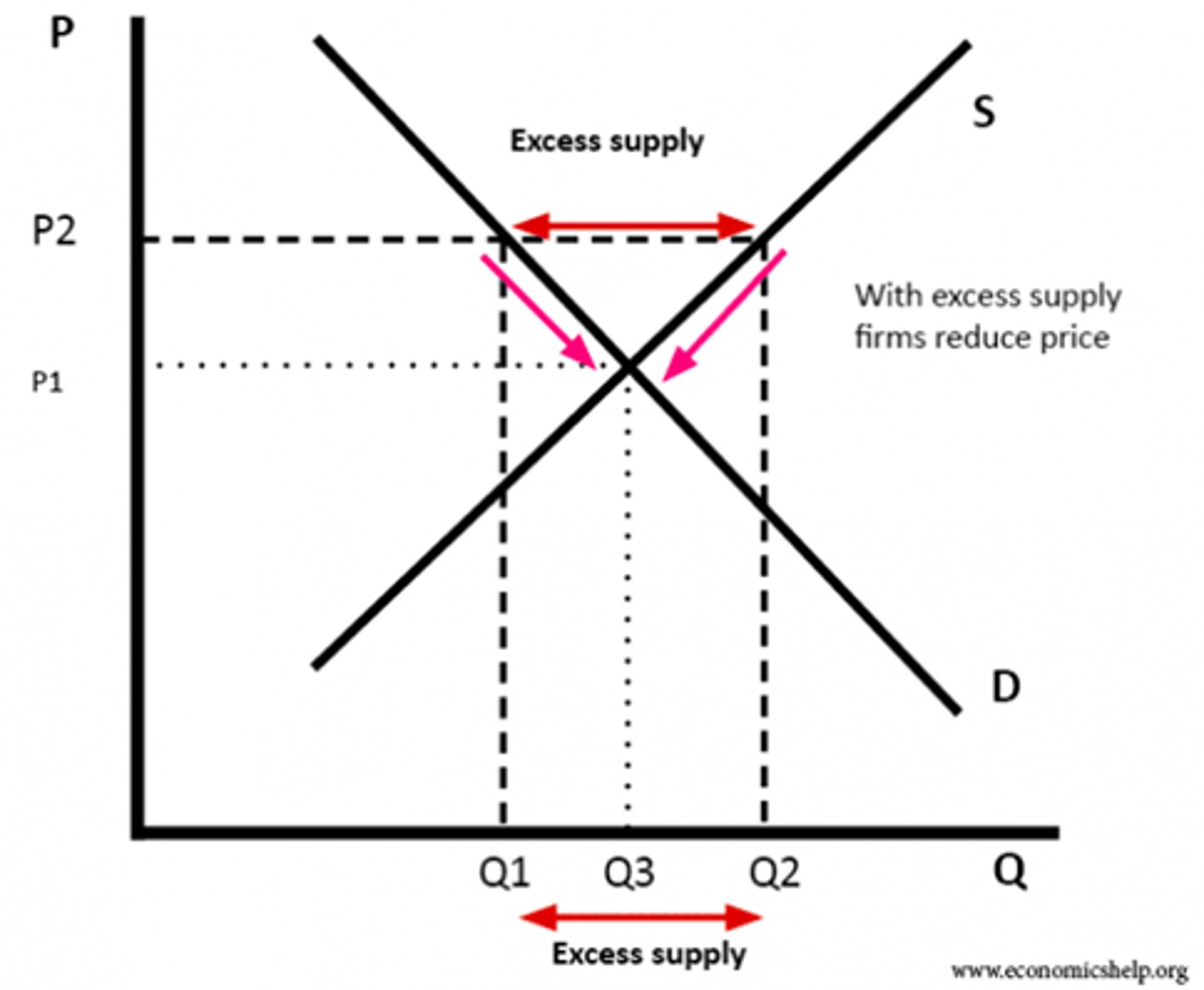

What is excess Supply?

Where the market price is above the equilibrium (P2), so supply exceeds demand (Q2>Q1), causing a downwards pressure on price to drop (P1), restoring equilibrium (P1Q3)

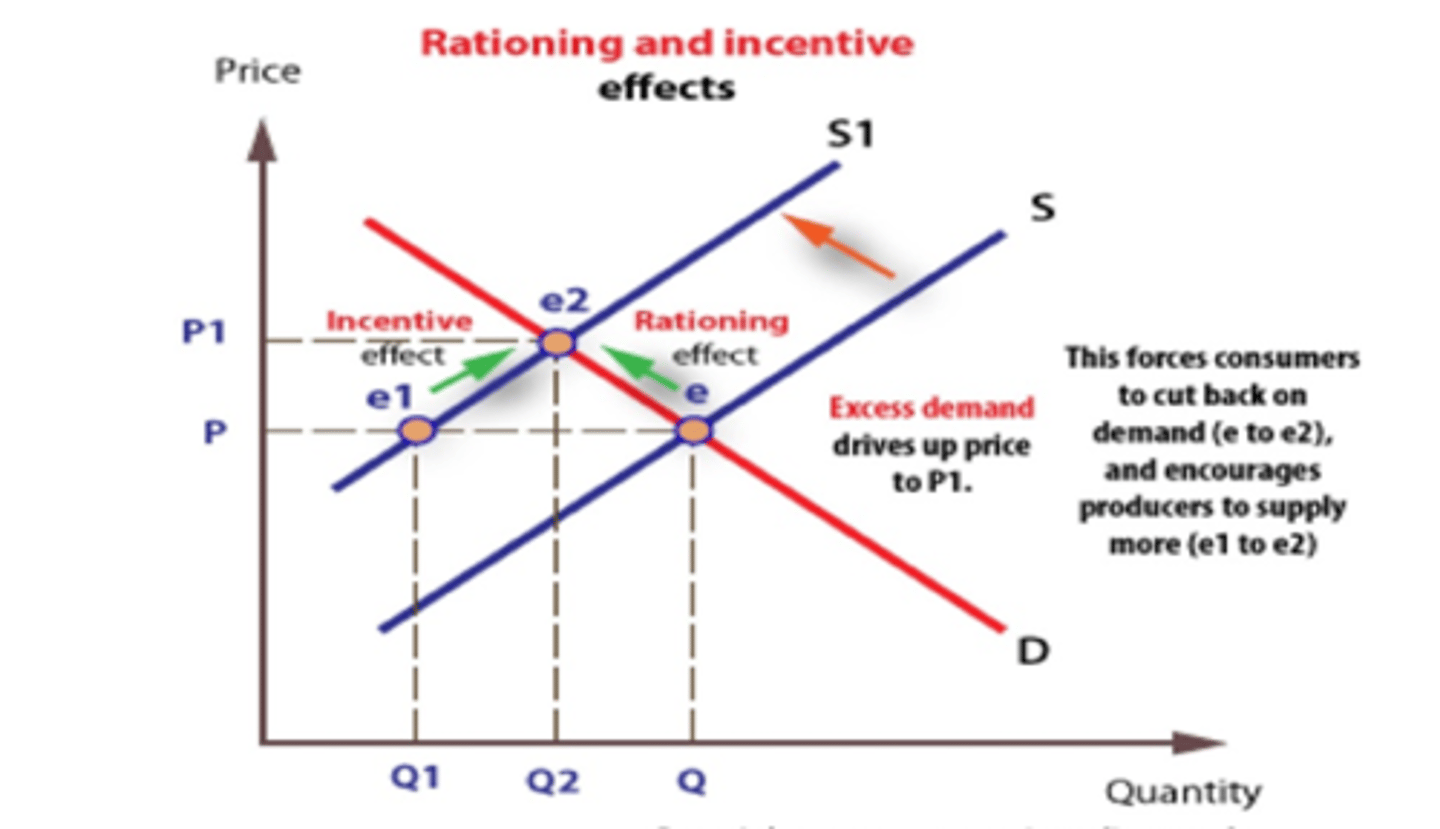

What are the functions of the Price Mechanism?

Signalling Function

Rationing Function

Incentive Function

Signalling Function

When demand or supply shifts, then there will be excess demand or supply. This acts as a signal for prices to change. When prices are higher than the new equilibrium, consumers are signalled to leave, and producers are signalled to enter.

Rationing Function

Prices increase to ration scarce resources where demand outstrips supply

Incentive Function

Higher prices incentivise producers to supply more and enter the market or produce more.

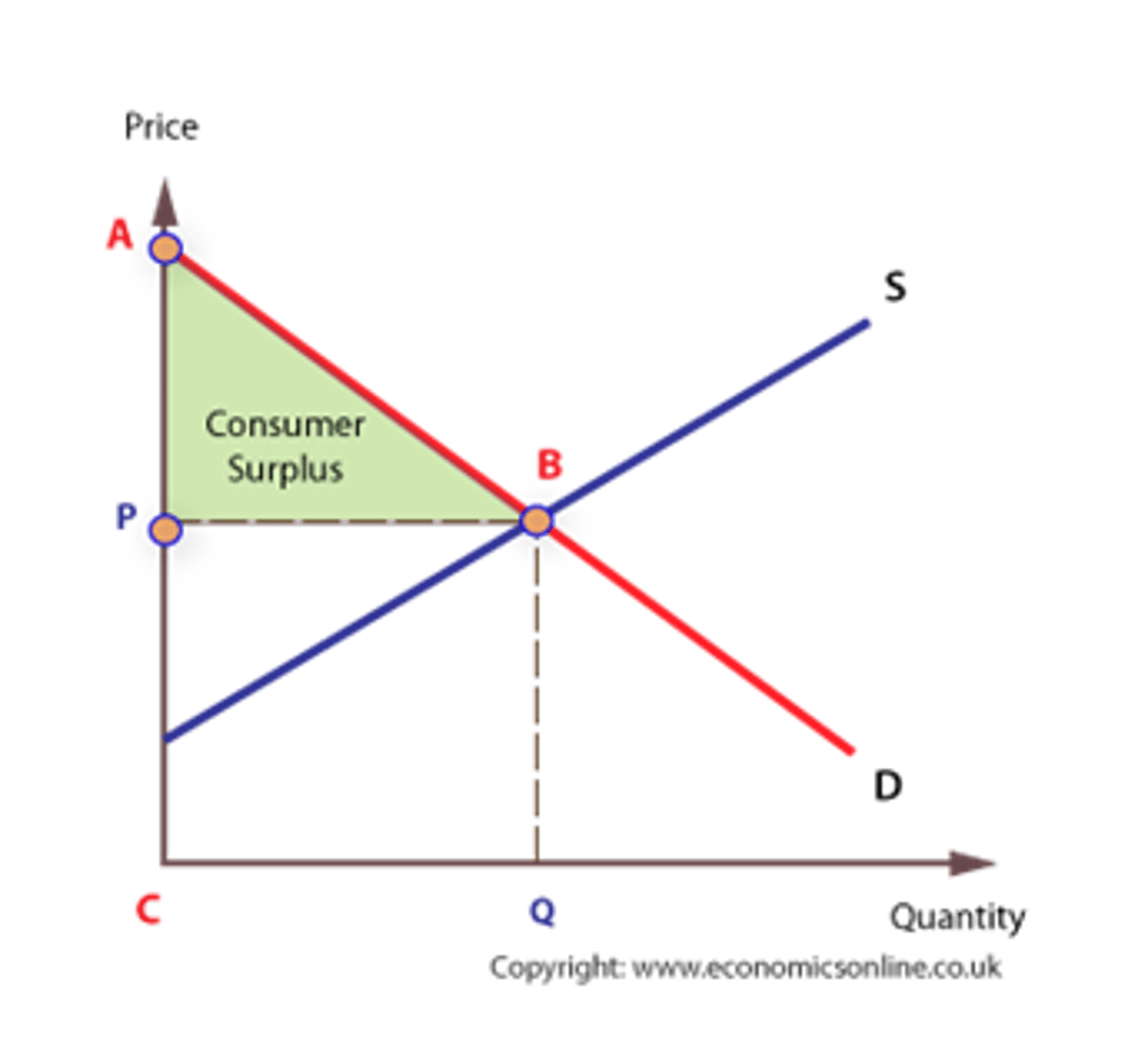

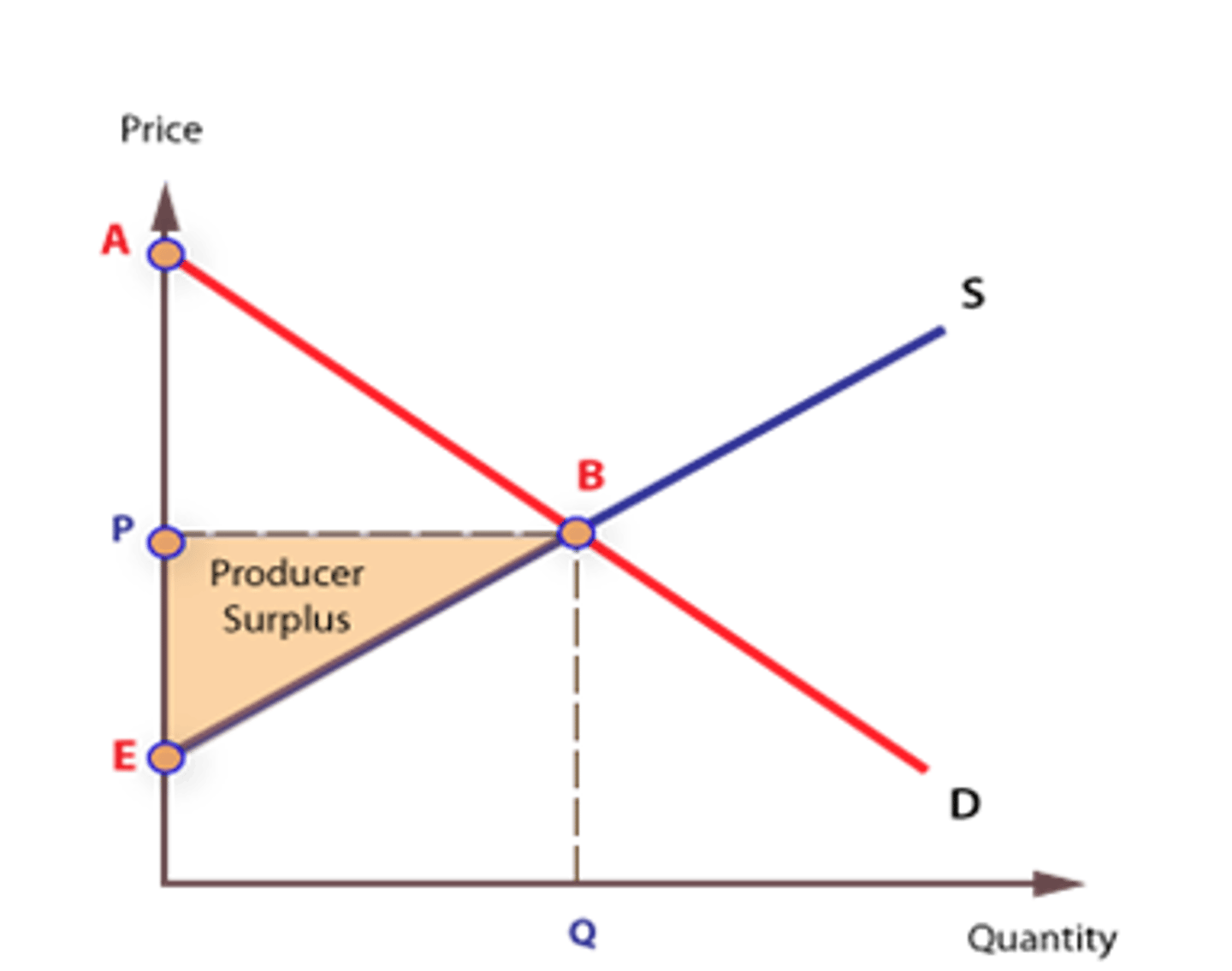

What is Consumer Surplus?

The difference between how much buyers are willing and able to pay compared to what they actually pay. The added benefit of the good not reflected by price.#

Necessity goods like water have the highest consumer surplus.

What is Producer Surplus?

The difference between the price producers are willing to sell a good for compared to what they actually receive. Added benefit of increased prices.

What are Taxes and what types?

Taxes are a compulsory charge that contributes to state revenue.

Direct Taxes are charged directly on the income or profit of an entity

Indirect Taxes are charged through sales of a product

Examples of Indirect Taxes

Specific and Ad-Valorem

15p on Confectionary

20% VAT on most Goods and Services

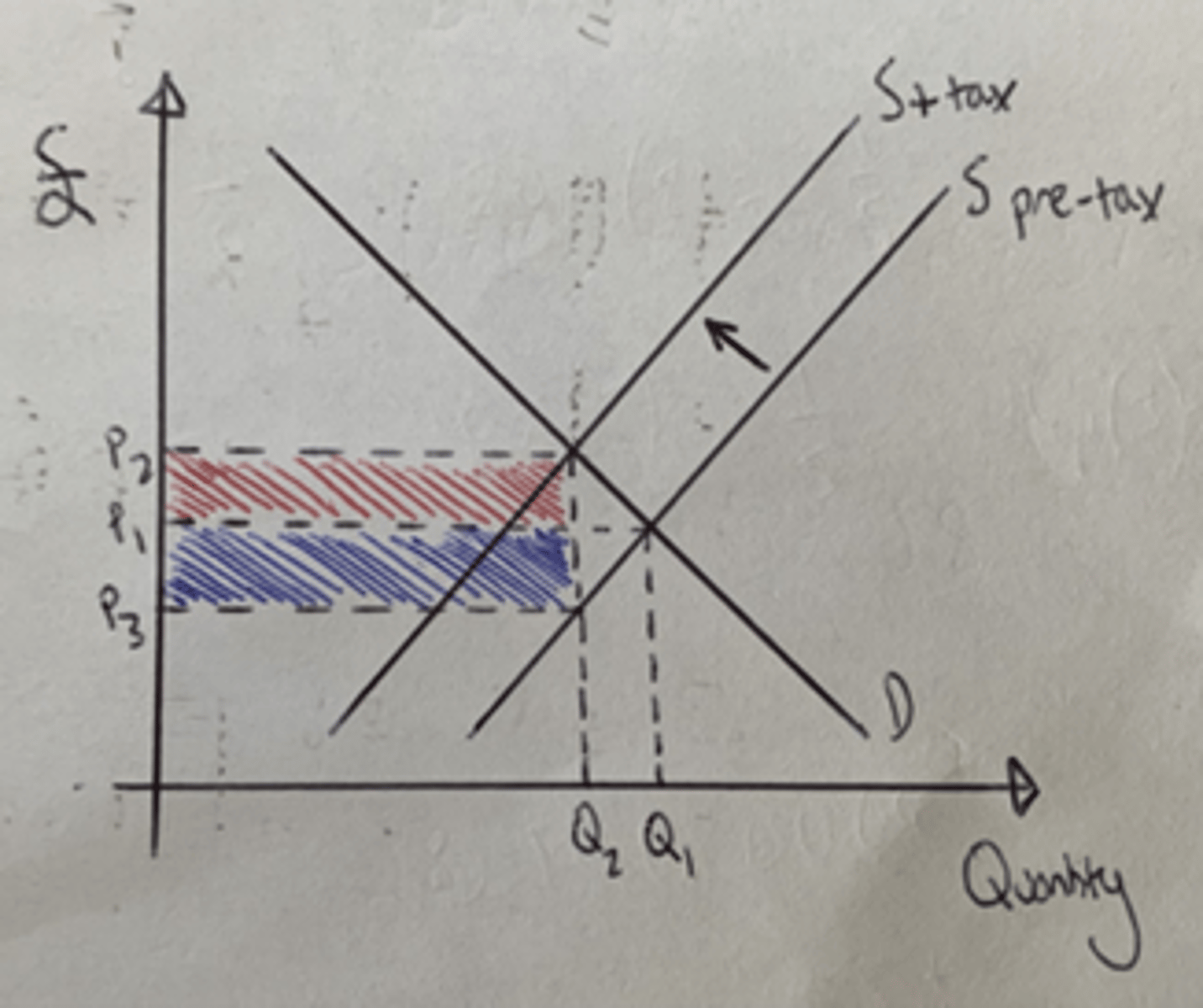

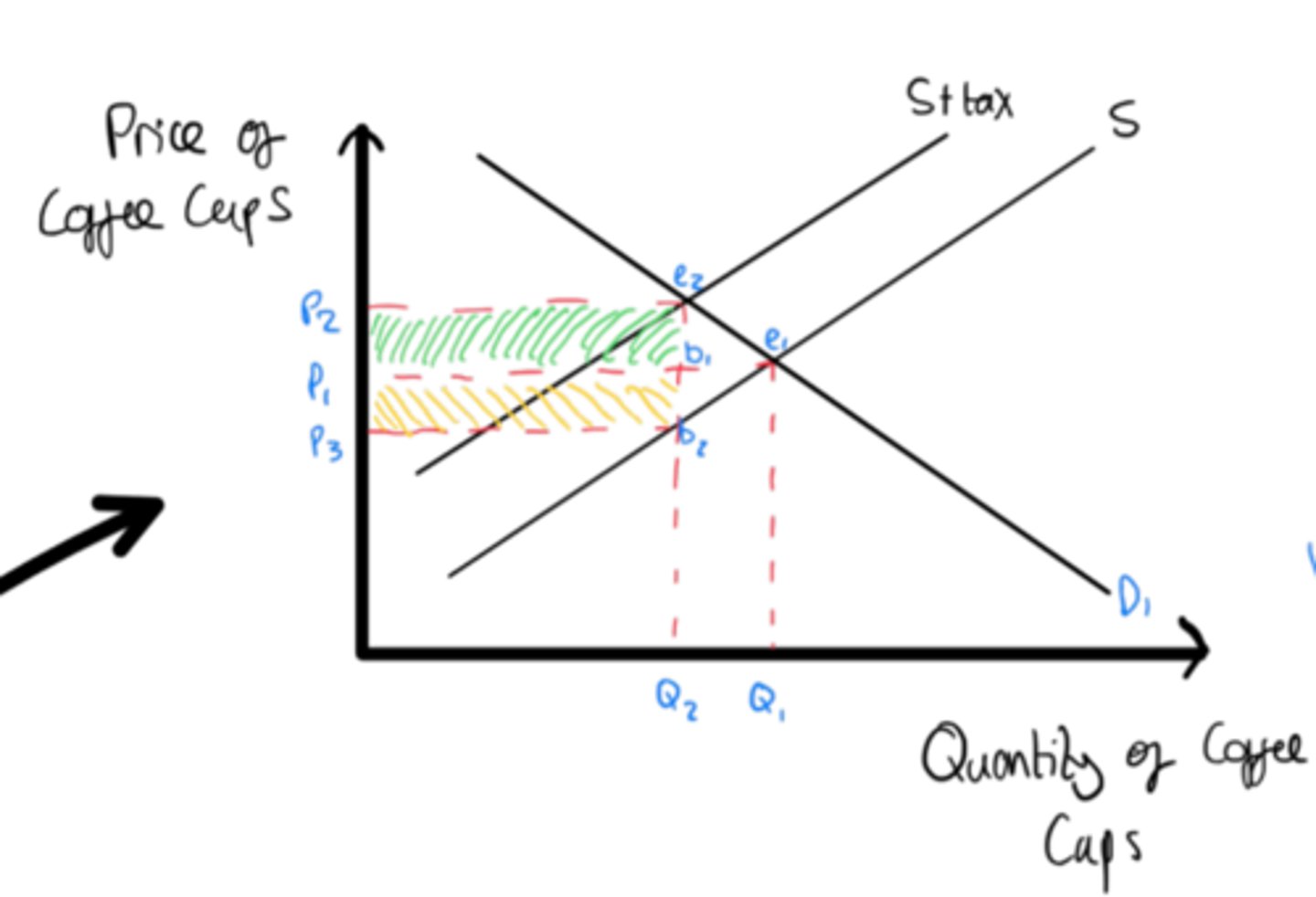

Specific Taxes Diagram and Definition w elasticity effects

A charge on the sale of a product of a fixed amount (15p)

The tax burden is different based on consumers and producers

More inelastic demand, higher burden of tax

More inelastic supply, higher burden of tax

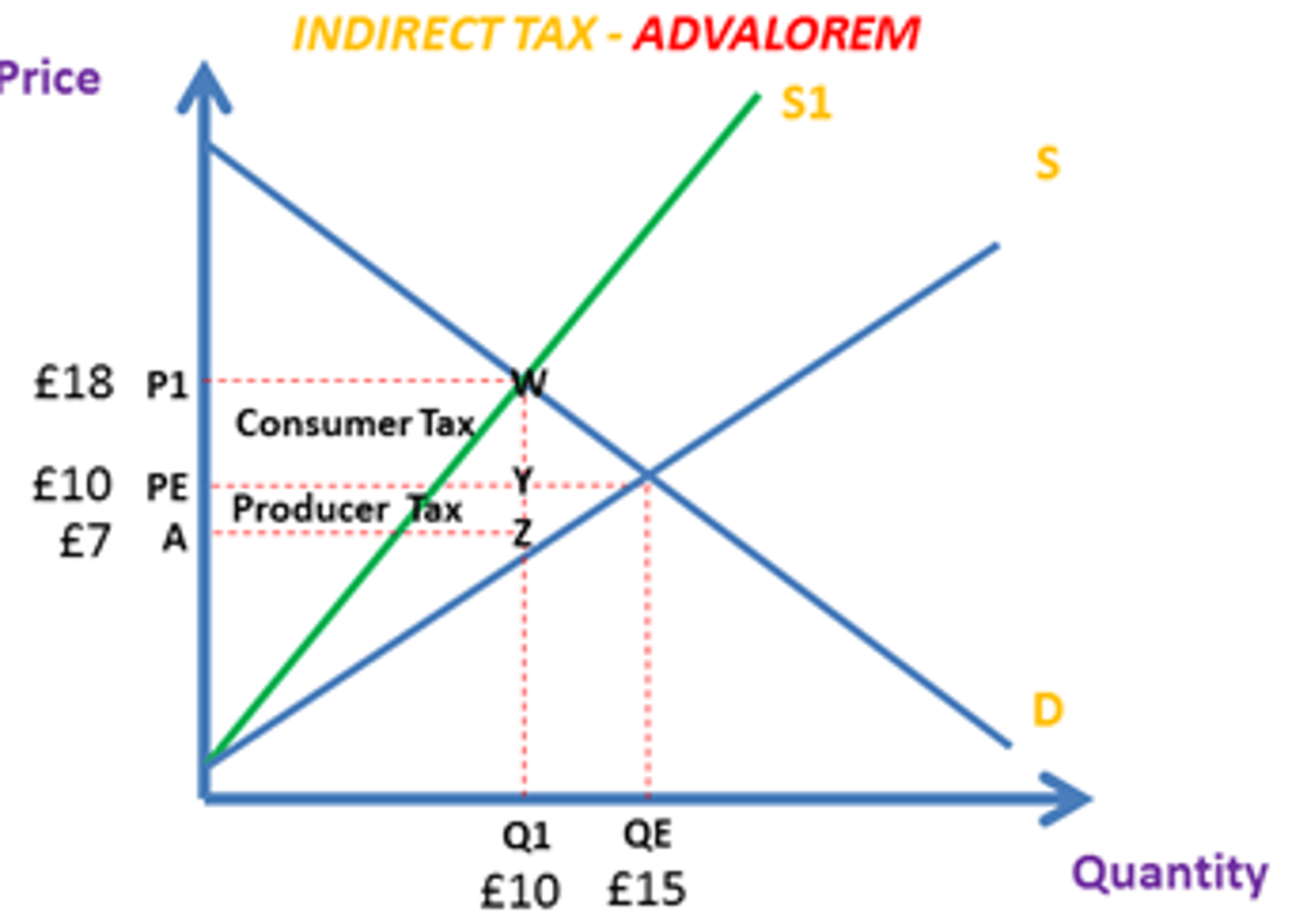

Ad-Valorem Tax Diagram and Definition

A charge on the sale of a product as a %

Higher the price of the product, the greater the cost of tax

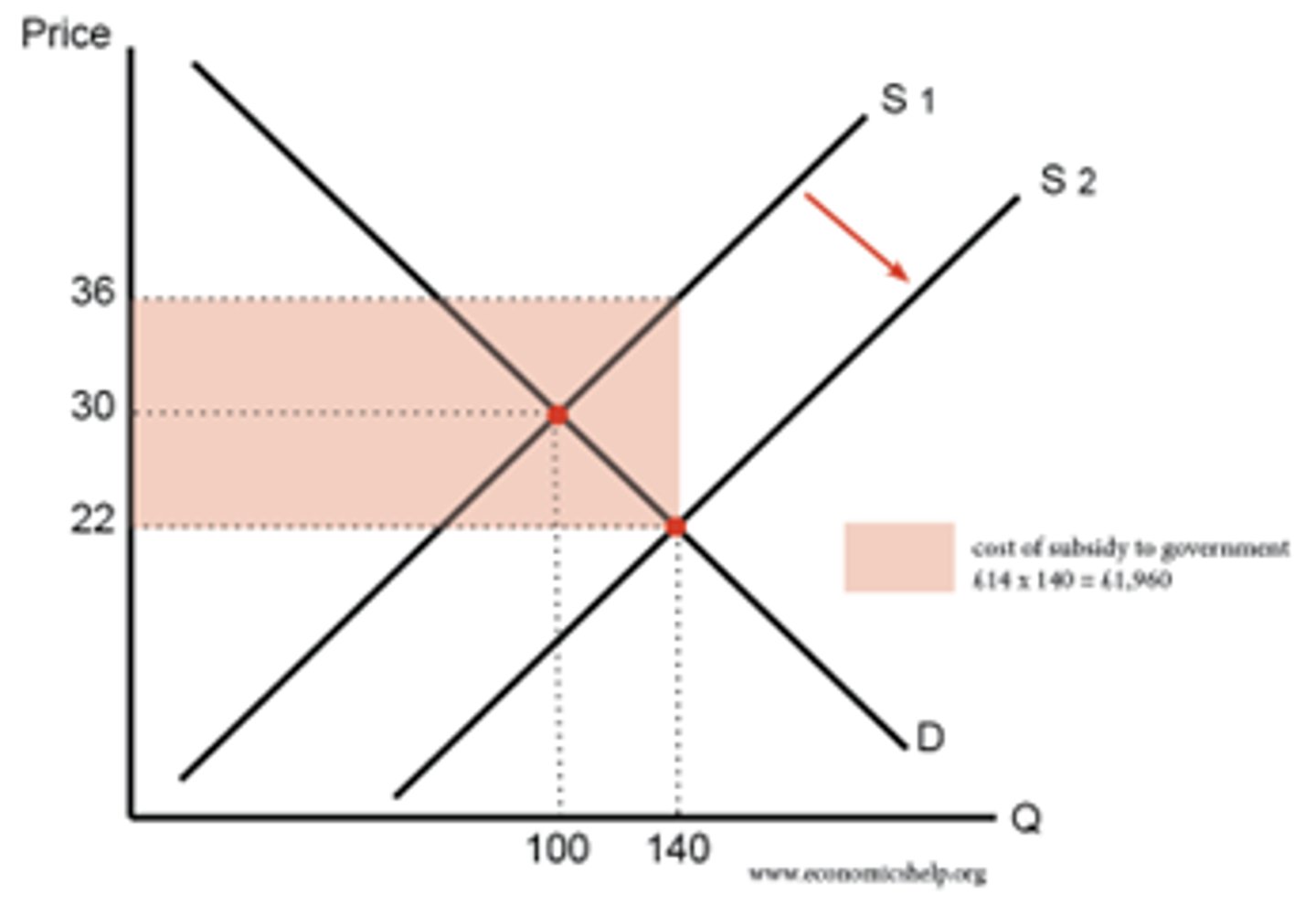

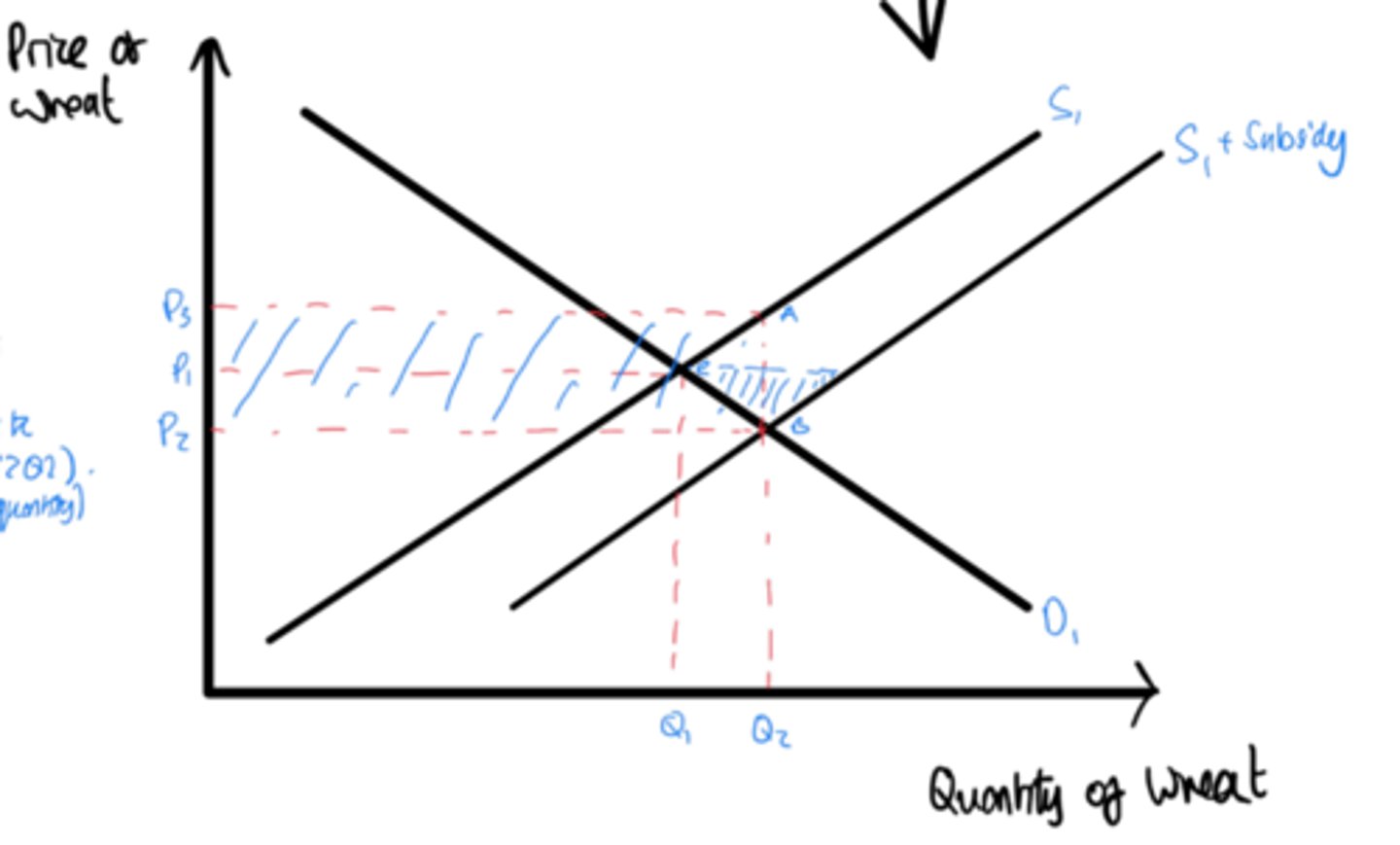

What is a Subsidy, its diagram and cost to the government?

A payment made to producers to encourage production

What is Bounded Rationality? (4)

The idea that the cognitive decision-making capacity of humans cannot be fully rational due to constraints such as:

- Imperfect Information

- Time limits on decision making

- Emotional decision-making

- Human cognitive limits on processing information

What are Heuristics?

Rules of thumb or mental shortcuts that affect decision-making

What are Maximisers and Satisficers?

We do not follow the neo-classical economic idea of a 'rational consumer'. We recognise our time as precious, and so do not analyse all information to evaluate the cost-benefit of decisions. We rely on Heuristics to make decisions.

We are therefore considered satisficers not utility maximisers.

Main reasons consumers do not act rationally? (6)

Herd Behaviour - we make choices based on other people in our social groups

Social Norms - we follow social norms outside the law to feel part of community, but doesn't necessarily maximise utility

Habitual Behaviour - the 'status quo' bias is just sticking with current situation rather than seeking better alternatives. Insurance and banking is a good example of this.

Computational Weakness - we find it hard to compute future probabilities and how we may feel

Priming - recent experiences influence our thoughts, feelings and behaviour. Small things that subconsciously change the way we act.

Addiction - underestimate the future problem, overestimate immunity and availability bias

Examples of Priming

Framing - information is presented by firms or governments to highlight a particular element to attract us or deter is to/from it

Anchoring - consumers anchor themselves on the first piece of information they get, even if its irrelevant

Market Failure Definition

When the price mechanism does not bring about efficient allocation of resources.

What are the 3 types of Market Failure?

Positive and Negative Externalities

Public Goods

Information Gaps

Negative Externalities

The costs of a transaction not paid by producers or consumers, but instead by a third party. External Costs.

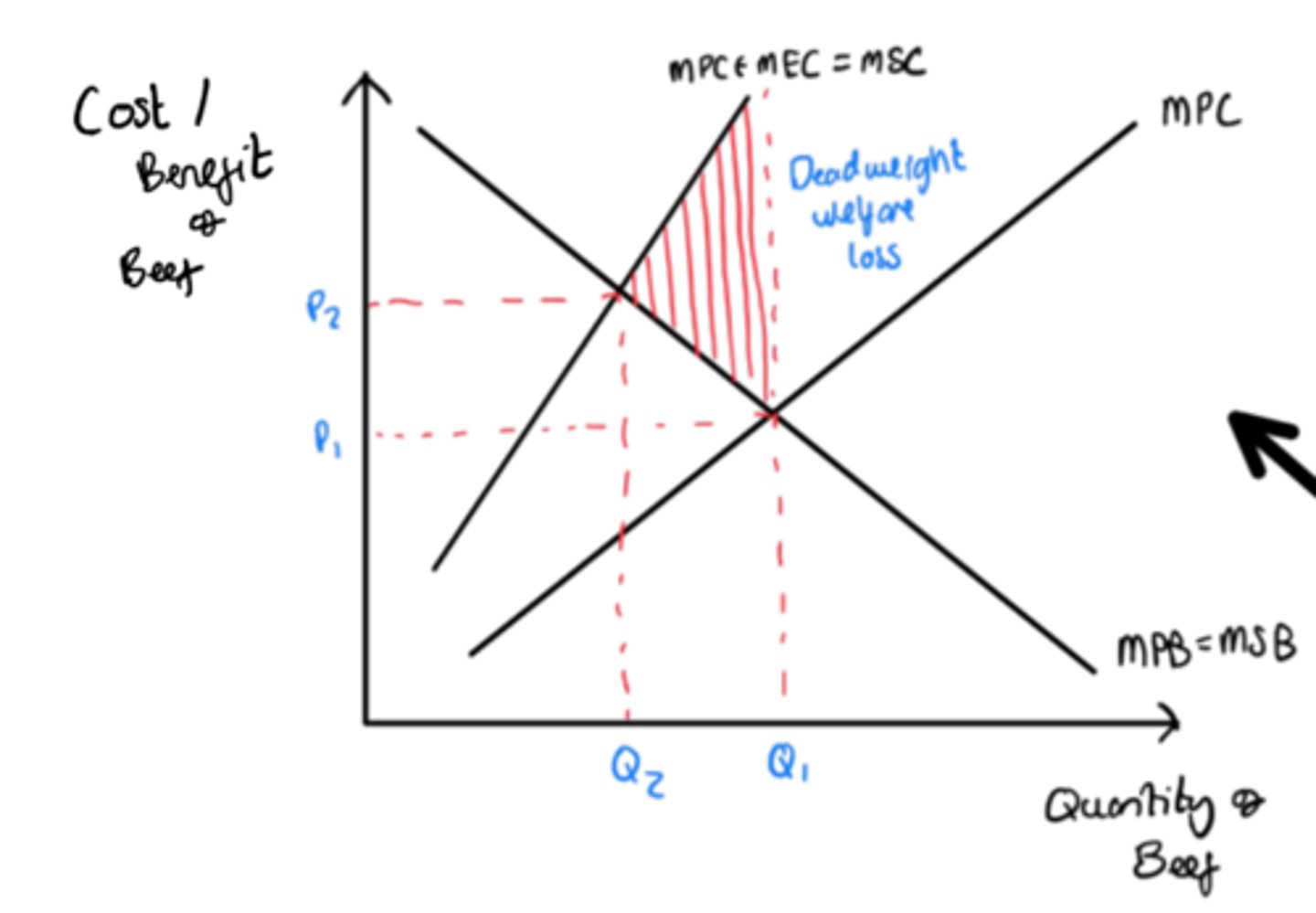

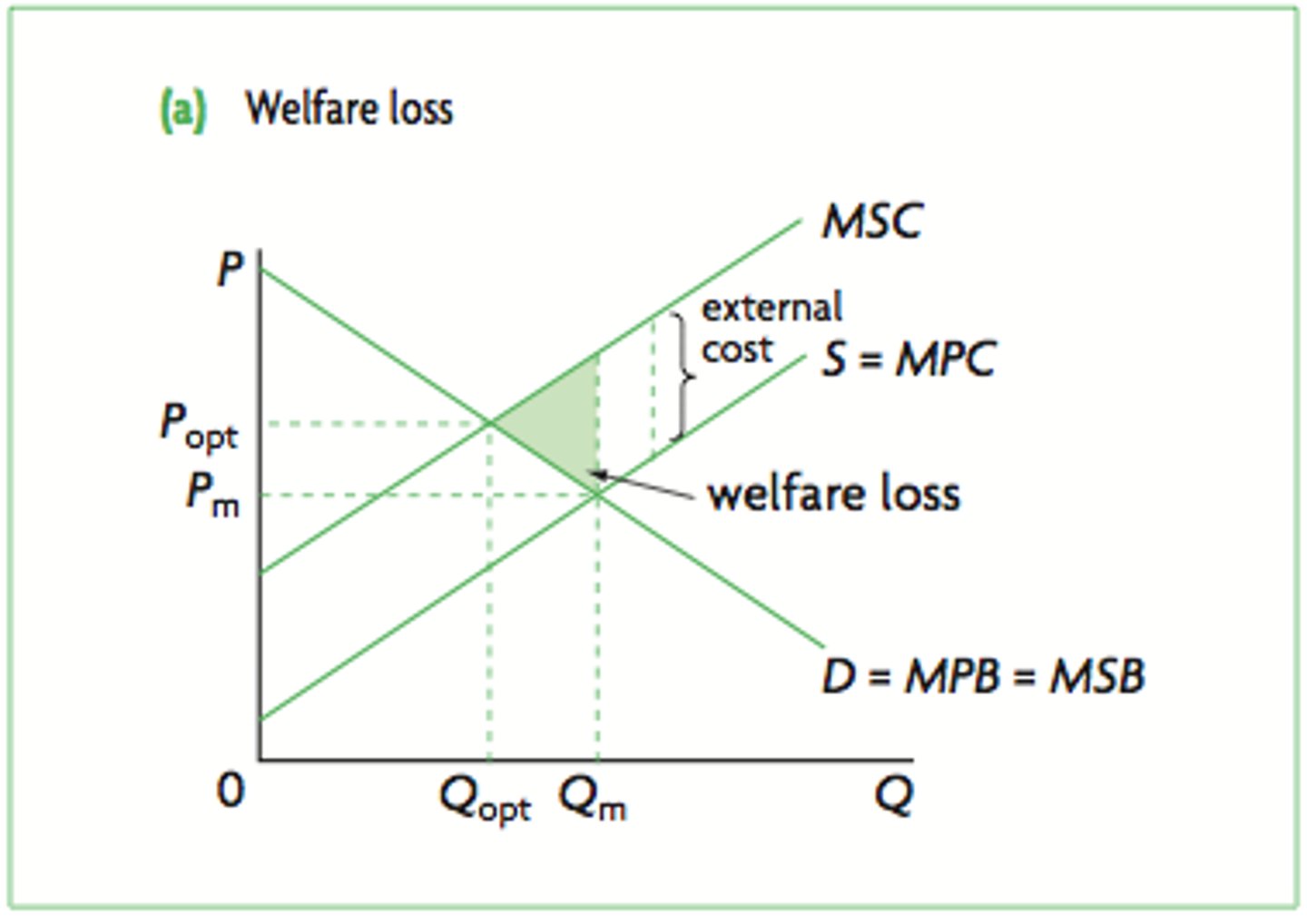

Negative Externalities diagram explanation

- Production causes private costs such as...

- Also causes external costs like...

- In the free market, Q is produced since MPB=MPC

- External costs mean MSC>MPC as shown in diagram

- Socially optimum level of production accounts for all costs and benefits

- This occurs at Q* where MSC=MSB

- In a free market, overproduction occurs, and causes the welfare lost in the area shaded.

Positive Externalities

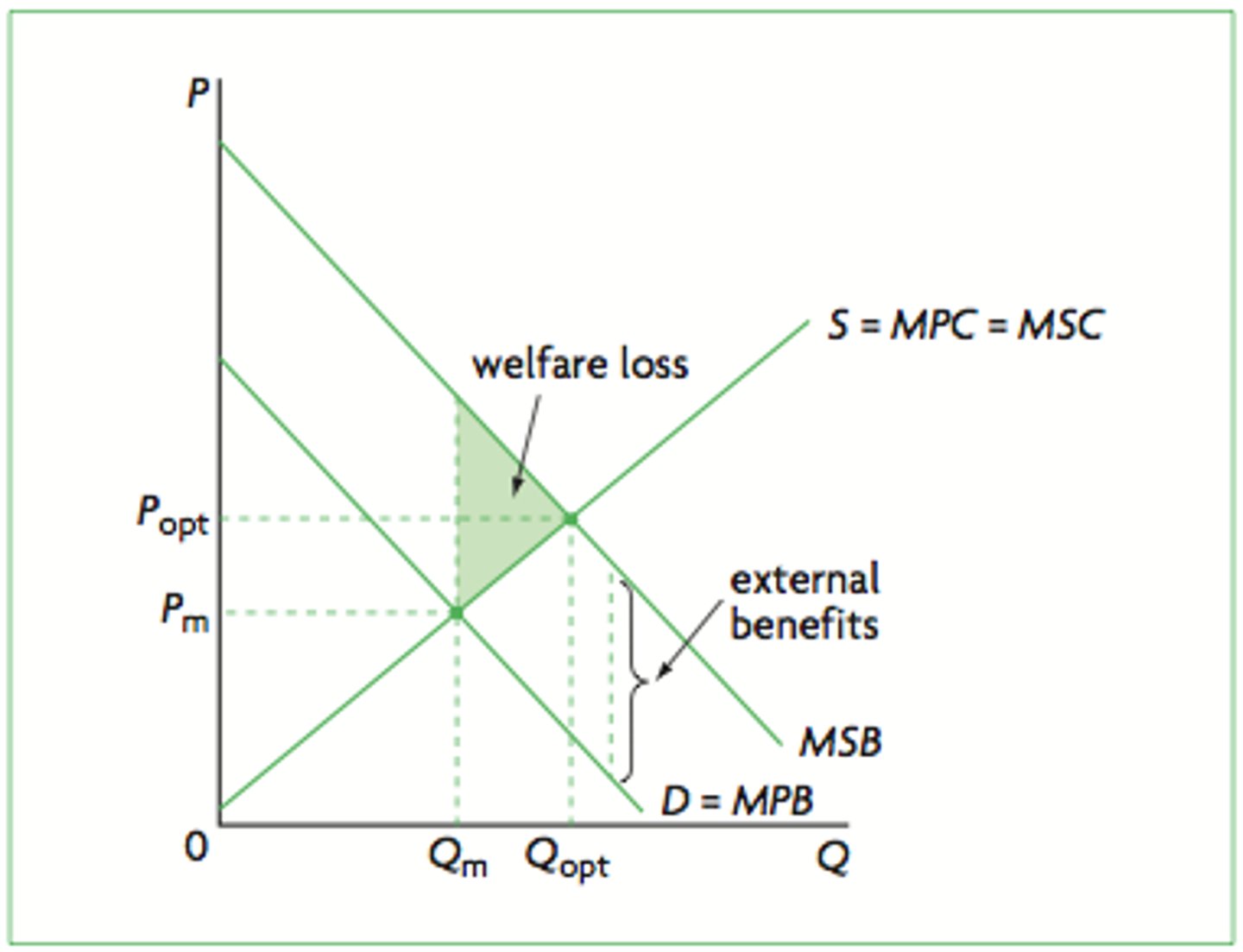

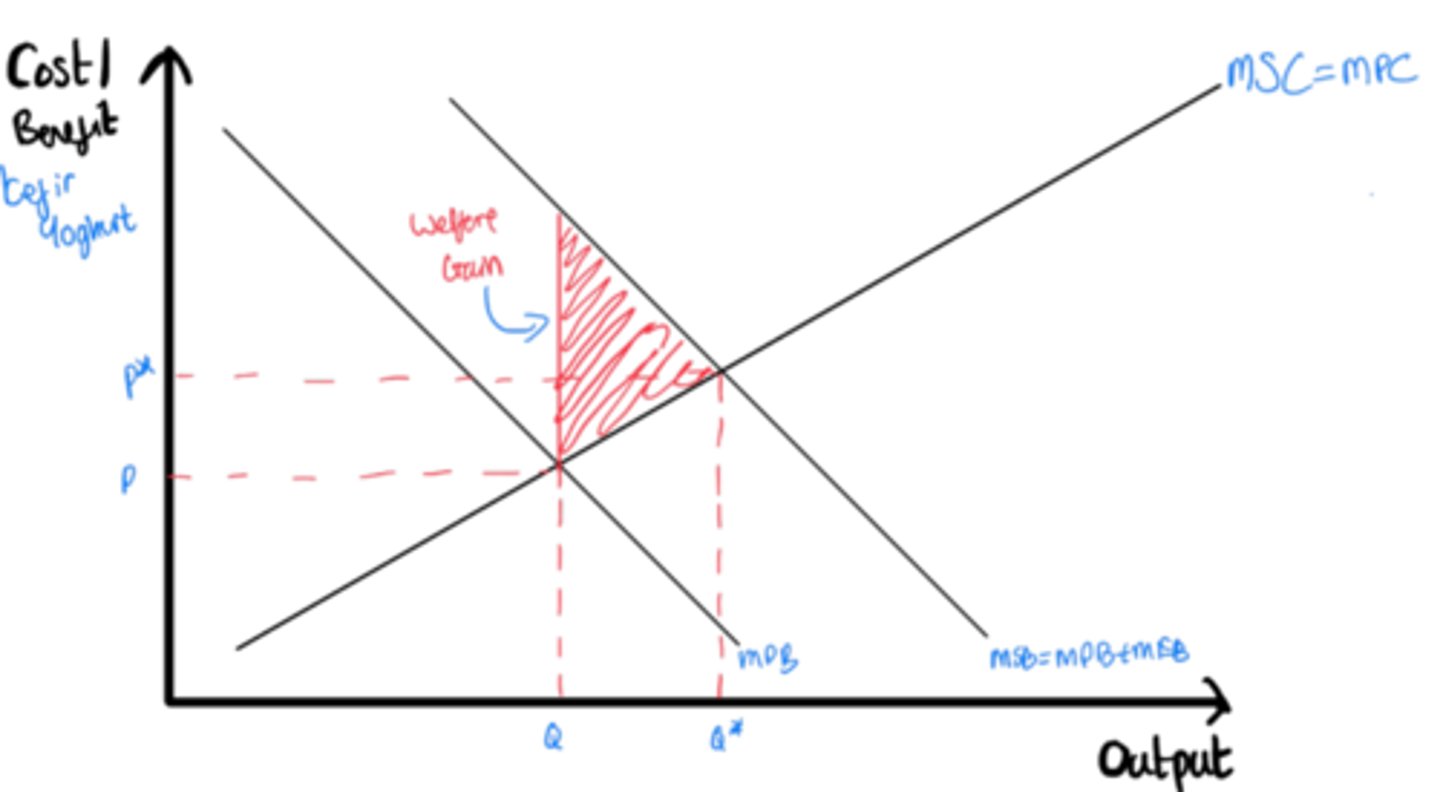

The benefits of a transaction not incurred by the consumer but instead by third party. External Benefits.

Positive Externalities diagram explanation

- Consumption causes private benefits such as...

- Also causes external benefits such as... for... who are not directly involved.

- In the free market, Q is consumed since MPB=MPC

- External benefits mean that MSB>MPB as in diagram

- Socially optimum level of output includes all costs and benefits

- This occurs at Q* where MSB=MSC

- The free market causes underconsumption and welfare loss shown in the area shaded.

What are Public Goods?

Public Goods are goods that are both non-rivalry and non-excludable.

Non-rivalry = the consumption by one person does not reduce the availability/quality for another consumer

Non-excludable = the benefits of the good cannot be confined to only those who have paid

Quasi-Public Goods are those that are either non-rival or non-excludable to some extent, but not both.

How do public goods cause market failure?

Rational consumers have no incentive to pay for the good, as they can receive the utility without paying. This is the free rider problem. Private companies will therefore not provide the good - governments will have to.

What are Information Gaps?

When a group of people (consumers, firms or governments) have incorrect or incomplete information so make potentially poor choices.

There can also be asymmetric information, where buyers and sellers have differing access to information so make poor decisions.

Examples of Information Gaps

Pension schemes - hard to know which is the best option due to complexity

Vaping - long-term consequences hard to gauge due to the novelty of the technology

How do Information Gaps cause market failure?

Producers may supply, or consumers demand, more of a good than if the had perfect information, resulting in welfare loss. Unaware of consequences of producing/consuming a good, leading to welfare loss.

What is Pareto efficiency?

When you can't make someone better off without making someone else worse off.

What is Government Intervention?

Where Market Failure creates justification for a government to act in order to maximise welfare and allocate resources efficiently.

What are the methods of Government Intervention?

- Taxation

- Subsidisation

- Minimum Prices

- Maximum prices

- Regulation/legislation

- Information Provision

- Tradeable Permits

Think about:

Government effects

Consumer Effects

Producer Effects

Social Effects

Whether or not there is intervention - Free Market Equilibrium?

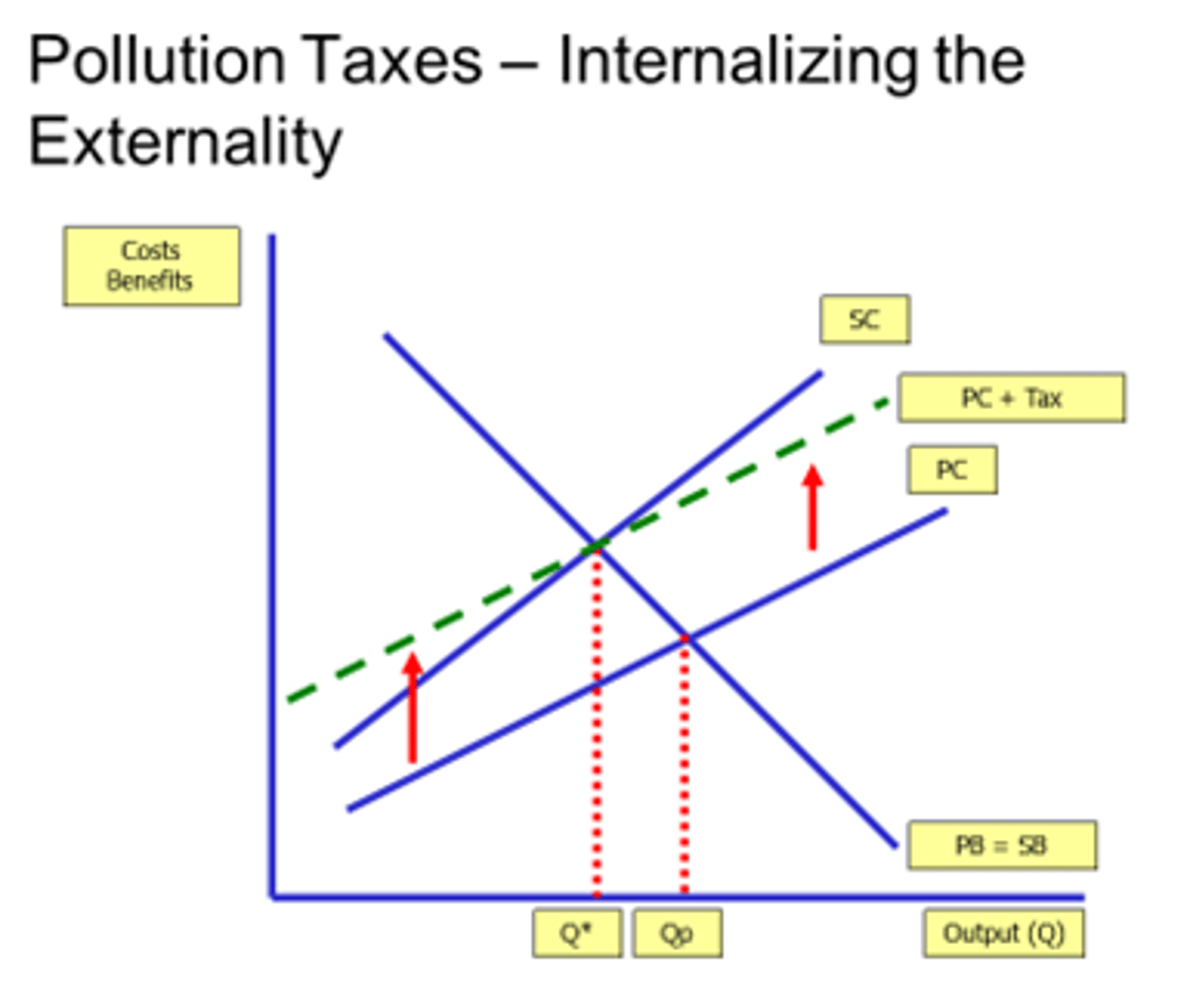

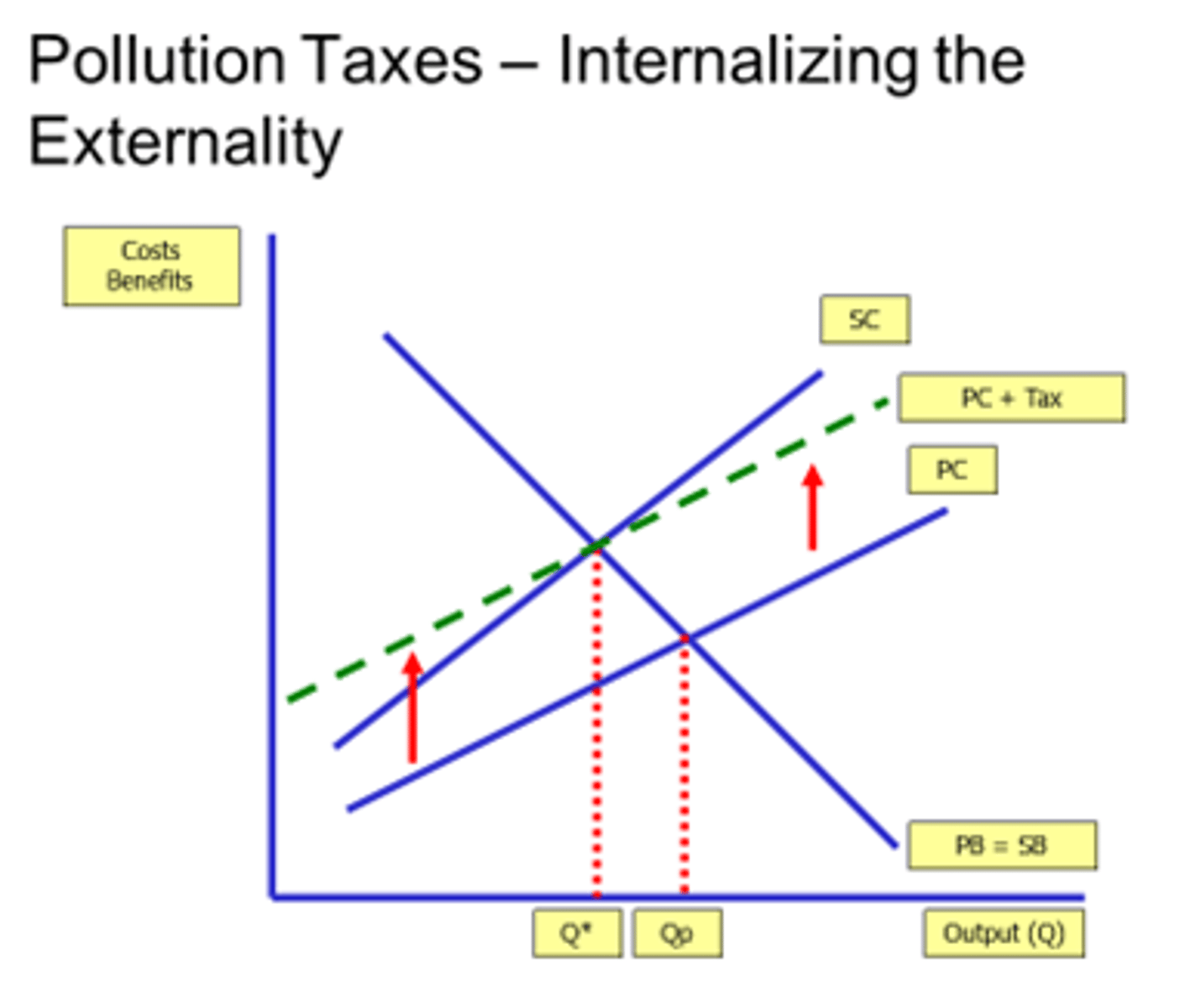

What does a taxation intervention look like, and what is it?

- Taxes placed on products with negative externalities

- To reduce overproduction/overconsumption by raising the price

- Brings the equilibrium closer to social optimum.

- Effectiveness depends on PEd

Advantages of Taxation as a method of intervention (5)

- Pigou's 'Polluter Pays' principle (internalises externality)

- The revenue generated is paid towards reducing the externality

- Increases producer costs, prices raised as supply decreases, also reduces demand

- Taxes can be changed easily

- Encourages innovation

Disadvantages of Taxation as a method of intervention (5)

- Relies on shadow pricing externalities, which is often subjective

- Inelastic demand (addictive products) will be less affected, - a high proportion of goods with negative externalities are inelastic (cigarettes, fossil fuels)

- Tax can be regressive, which increases the burden on poorer people

- Still the risk of tax evasion

- Increases supply costs can lead to cost-push inflation

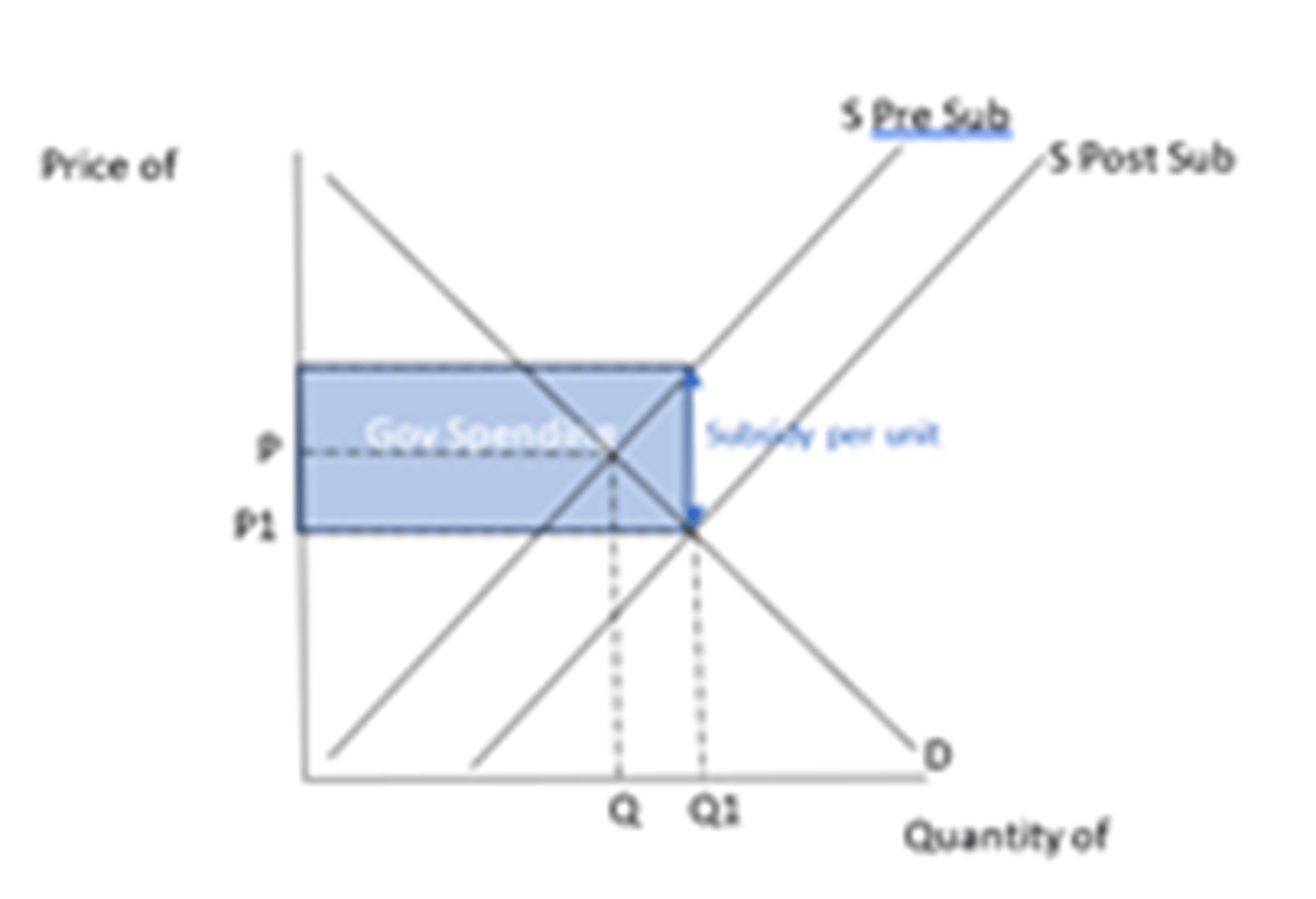

What does a subsidy intervention look like, and what is it?

- Government gives grants to producers to reduce costs of supply, or to consumers to reduce price

- Always paid directly to producers

- Quantity bought and sold increases, reducing the welfare loss from underconsumption caused by the positive externality, moving the equilibrium closer to social optimum at Q*

- Effectiveness depends on PEd

Advantages of Subsidisation as a method of intervention (5)

- Consumers get lower prices

- Producers get higher revenues

- Consumer and producer surplus increase

- Net positive as they are merit goods

- Increases LRAS

Disadvantages of Subsidisation as a method of intervention (5)

- Cost to the government represents an opportunity cost

- May require raised taxes

- Reduces incentive to innovate

- Less effective for inelastic goods

- Hard to calculate

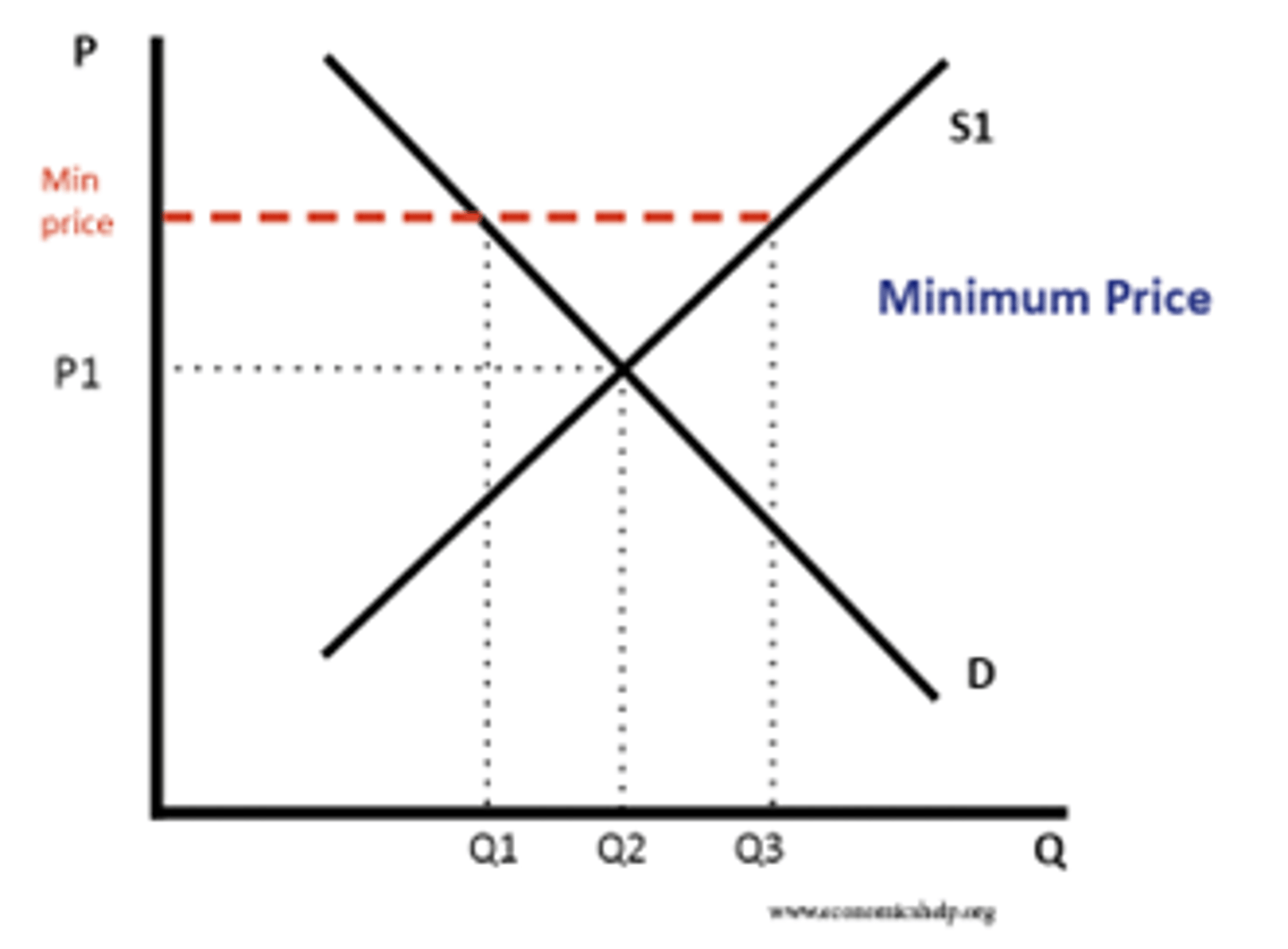

What does a Minimum Price intervention look like, and what is it?

- Set above the market equilibrium

- Used to limit how cheaply a good can be purchased

- Used to protect consumers or producers

Minimum wage or alcohol duty to reduce consumption

Advantages of Minimum Price as a method of intervention (4)

- Price stability (prevents fluctuations)

- Reduced consumption of demerit goods

- Prevent poor quality goods from being produced

- Bring the level of production/consumption closer too the socially optimum level

Disadvantages of Minimum Price as a method of intervention (2)

- Leads to excess supply, either wasted resources, sold to government (OC) or illegal markets

- Reduces consumer and producer surplus

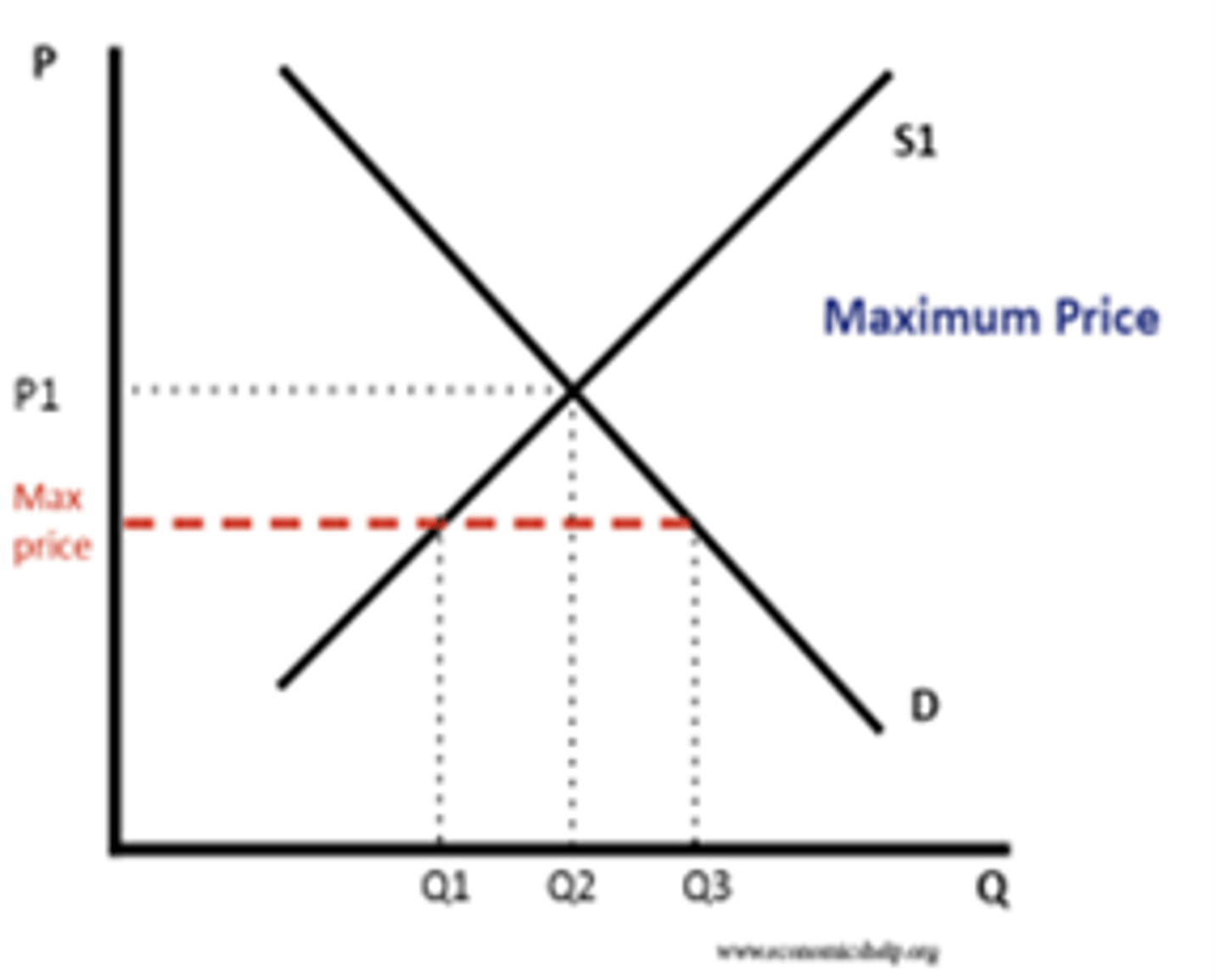

What does a Maximum Price intervention look like, and what is it?

- Price set below the free market equilibrium

- Holds the price of goods down to make more accessible

- Alternative to subsidy

- Causes excess demand (shortage)

Advantages of Maximum Price as a method of intervention (4)

- No cost to government

- Makes merit goods more accessible to consumers

- Increases consumer surplus

- Reduces inflation

Disadvantages of Maximum Price as a method of intervention (4)

- Shortage means people will go without

- Suppliers may reduce quality

- Suppliers may leave the market

- Can lead to recession as firms are less profitable

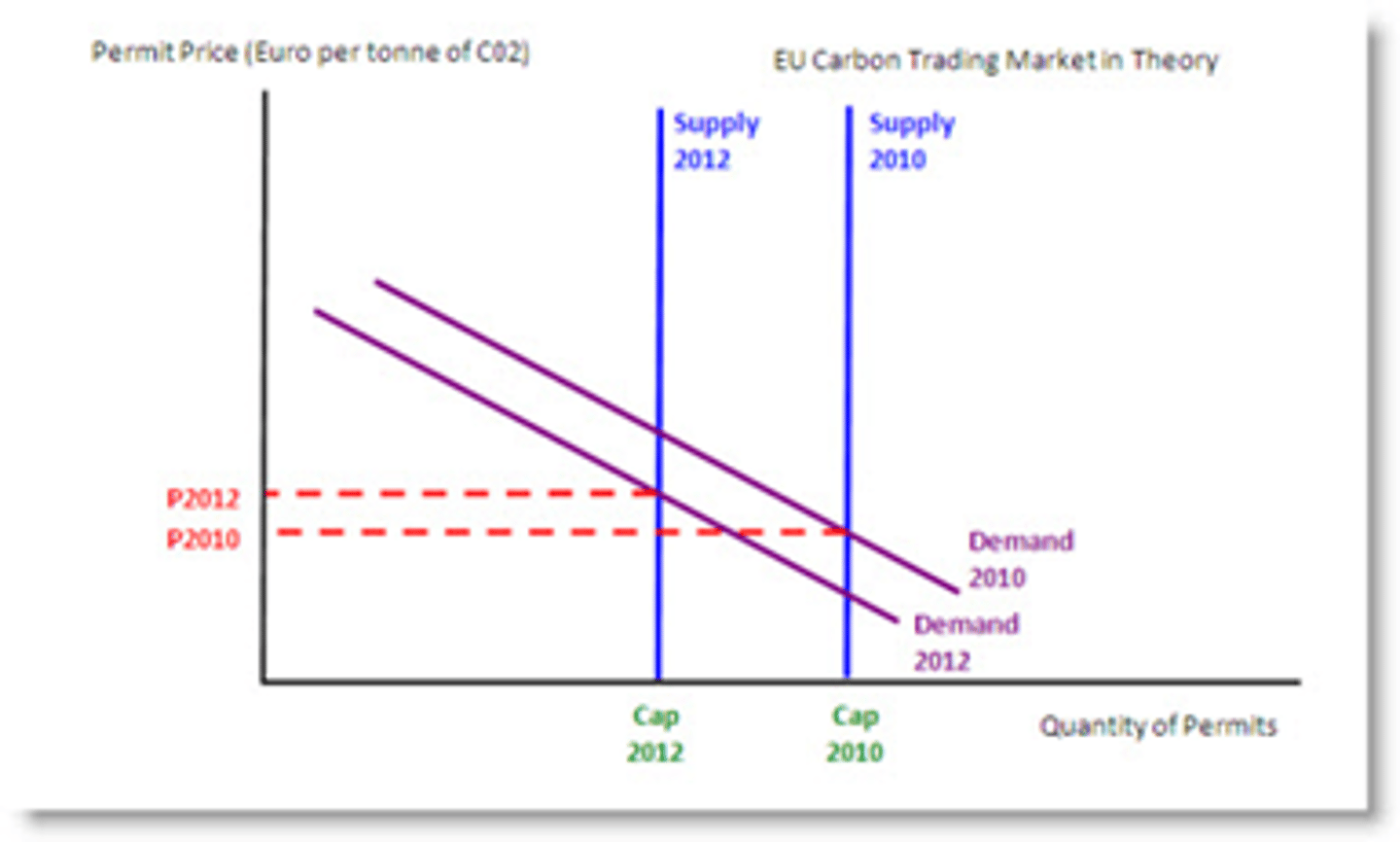

What are Tradeable Permits and how do they work?

Permits are the right to do something, and there is a market for this right. Pollution is the most common example in the EU and UK. Permits can be bought and sold, and their quantity is reduced over time. The price of these permits is what motivates businesses to innovate.

As the number of permits fall, they becomes more valuable so price increases.

Over time, the amount of pollution per year will be reduced as permit numbers fall to 0.

Advantages of Tradeable Permits (3)

- Gives firms flexibility to pay or innovate

- Government source of revenue to cover effects of externality

- Creates a market, where the prices can be determined by 'the invisible hand' (market mechanism)

Disadvantages of Tradeable Permits (4)

- Prices can fall too low, where the cost of buying permits can be cheaper than paying fines

- Morally questionable to associate a simple price against a negative externlaity

- Difficult to regulate the amount of pollution or other measurable characteristic, so expensive and hard to enforce

- Prices are volatile, which harms business planning

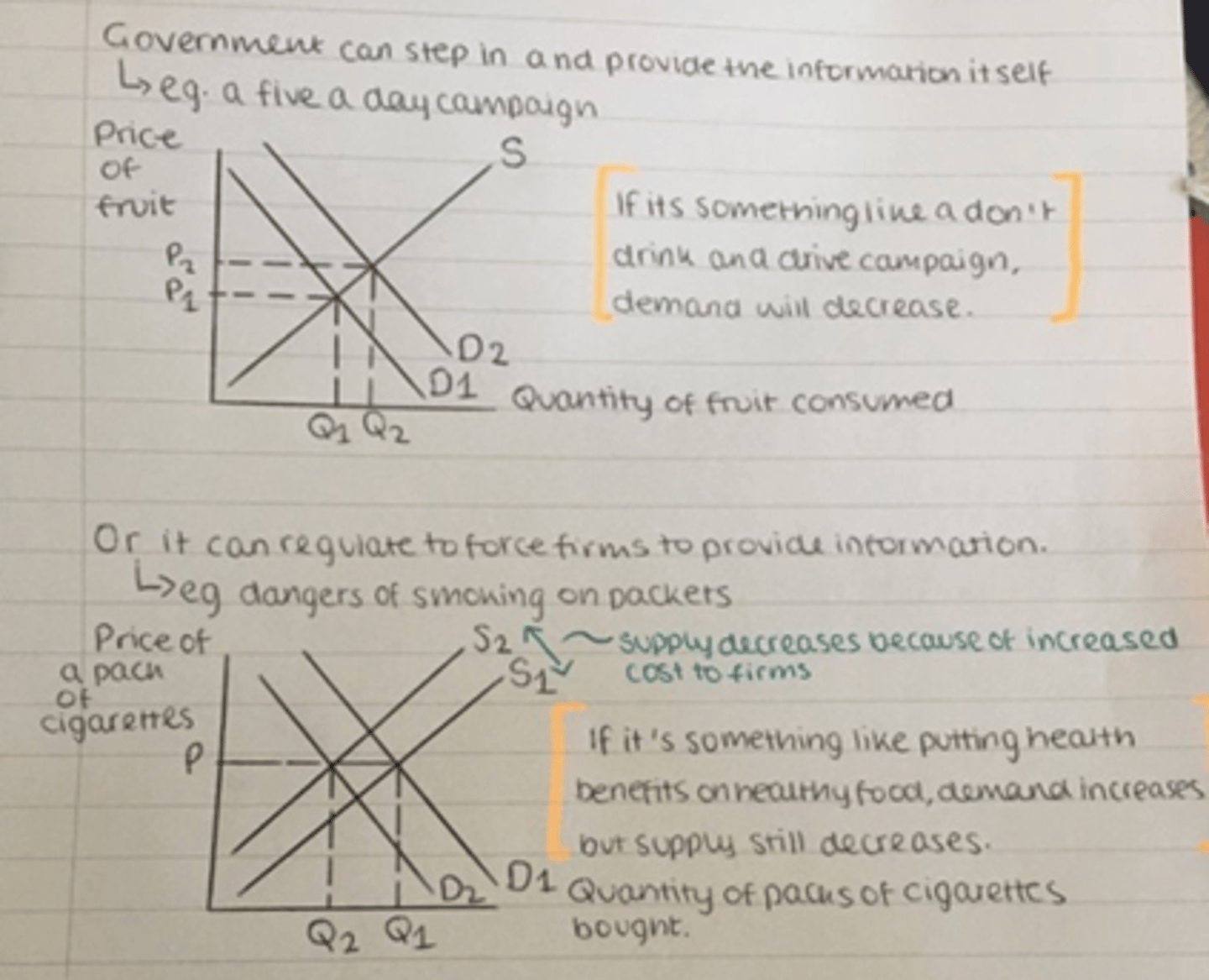

Information Provision explanation as a method of G.I.

Government seeks to overcome market failures (especially from asymmetric of information failures) through providing information on the harmful or positive effects of a good being consumed/produced. Seeks to influence demand.

Advantages of Information Provision (2)

- Reduces asymmetric information

- Corrects market failure

Disadvantages of Information Provision (3)

- Information campaigns can be expensive

- No guarantee that they will have any effect

- Time lag of information to action

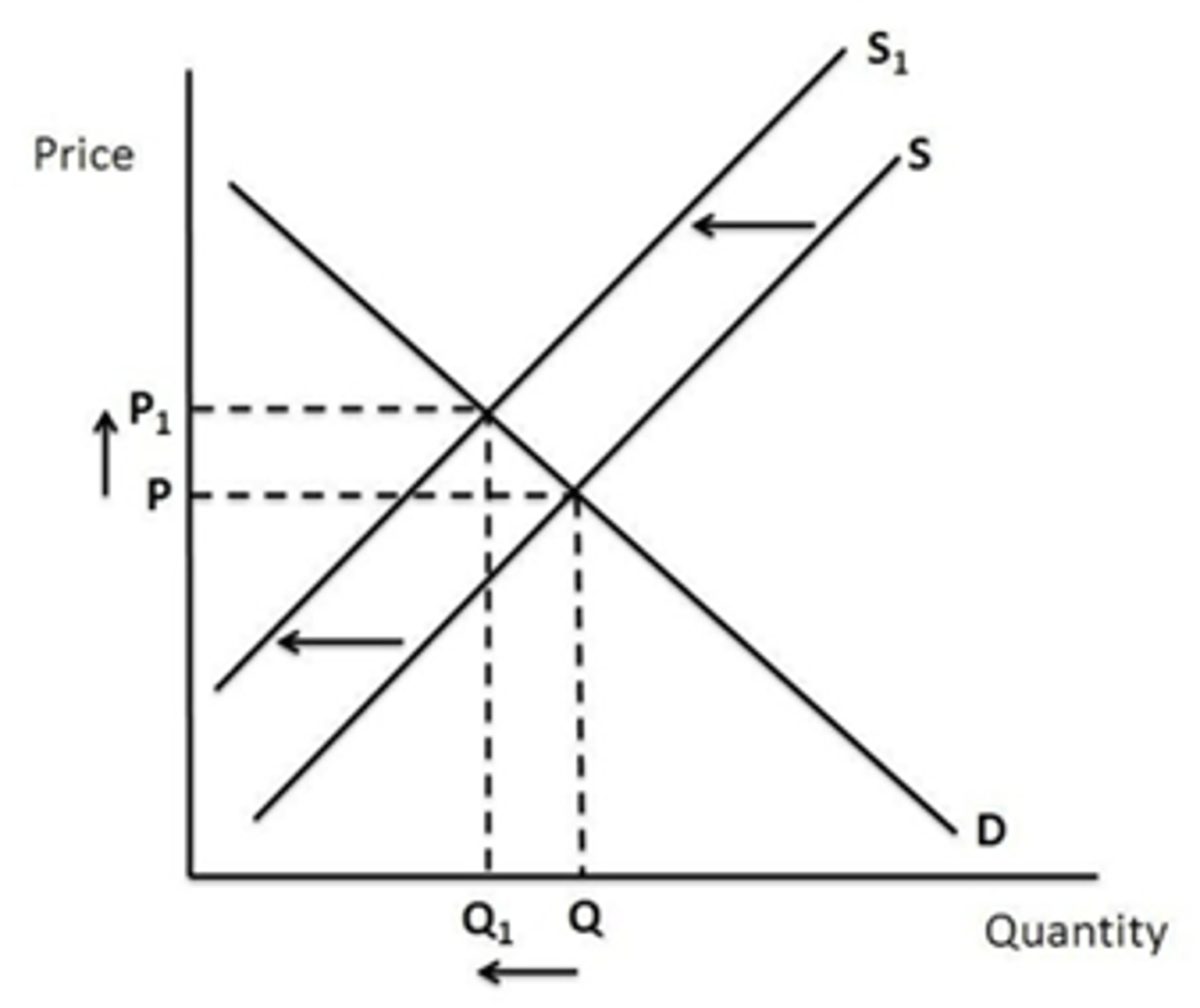

What is Regulation as an intervention method?

Government rules to influence the behaviour of consumers and producers. Usually leads to supply decreases.

Advantages of Regulation (3)

- Stops illegal activity and can close down businesses

- Easy to understand

- Fines act as a deterrent

Disadvantages of Regulation (3)

- Expensive to monitor

- Overregulation causes its own market failure

- Less competitive in global markets

What are the causes of Government Failure? (8)

- Political Self-Interest

- Policy myopia

- Regulatory capture

- Information failures

- Disincentive effects

- High enforcement costs

- Conflicting policy objectives

- Unintended consequences

What is political self-interest as a G.F. ?

Pursuit of self interest leads to decisions favouring personal goals

What is policy myopia as a G.F. ?

Short sightedness of policy decisions that seek quick fixes rather than structural economic problems

What is regulatory capture as a G.F. ?

When the producers have 'captured' the ideals of policymakers, so policy favours producers rather than consumers

What is information failure as a G.F. ?

Where imperfect government information leads to poor policy- and decision-making

What are disincentive effects as a G.F. ?

Attempts to reduce inequality in wealth and income, leads to a lack of motivation and productivity

What are high enforcement costs as a G.F. ?

When the administration costs of an intervention from policy exceed the social benefit accrued. Opportunity costs > returns.

What are conflicting policy objectives as a G.F. ?

Where two or more policies conflict with each other so are ineffective

What are unintended consequences as a G.F. ?

Policies lead to unintended effects that reduce welfare or have high financial costs to undo

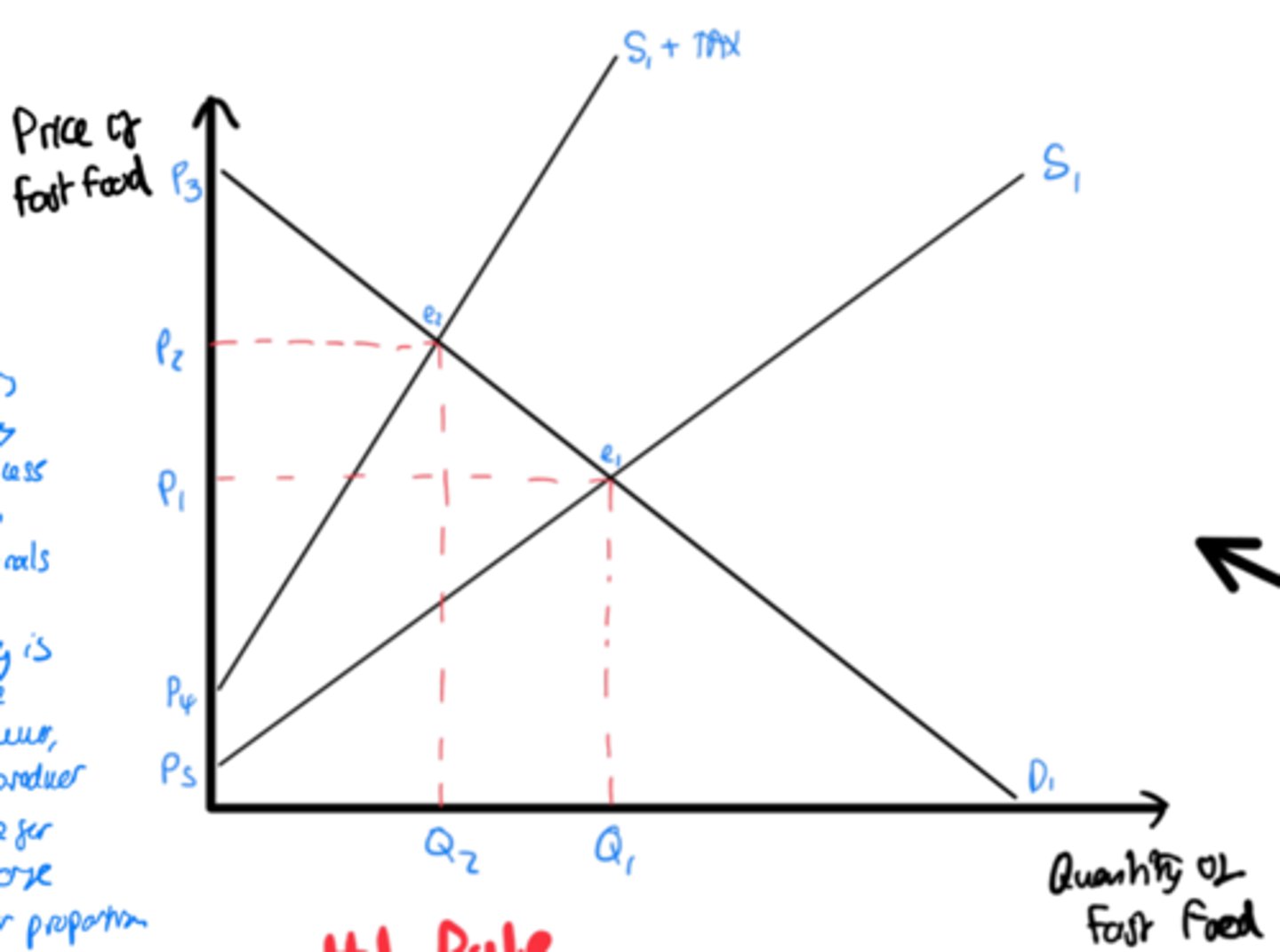

Ad-valorem tax diagram explanation

- An indirect tax is imposed by the government on producers/consumers

- This is because... (demerit/externality)

- Increases the businesses costs to supply

- Supply decreases so shifts left (S1 - S1+tax)

- The new supply is more inelastic, due to it being a percentage of product price

- There is excess demand at the original price

- There is therefore pressure for price to rise due to rationing function (P1 - P2)

- Demand contracts and equilibrium moves from Q1P1 to Q2P2

- The government revenue generated is ...

- Moves closer to social optimum level of production

- Consumer and producer surplus fall, but consumer falls by a greater amount

- Producer burden is... consumer burden is...

Specific tax diagram explanation

- Tax is introduced to cover negative externalities of production/consumption

- This causes business prices to rise per unit by a fixed amount

- This shifts supply left (decrease) linearly from S1 - S+Tax

- This leaves excess demand at the original price

- Results in the rationing function, causes demand to contract and price to rise P1 - P2

- New equilibrium at Q2P2

- Tax burden is...

- Producer/Consumer surplus is...

- Government Revenue is...

Government subsidy diagram explanation

- Government provides subsidy to a business to encourage production of a good underproduced by free market

- Reduces supply costs, so cost per unit goes down

- They are able to increase supply from S1 - S2

- This increase in supply leads to excess supply at the original price

- This causes demand to expand, and the price to fall P1 - P2

- The quantity demanded increases from Q1 - Q2, so new equilibrium forms at Q2P2

- There is a cost to the government shown by P3ABP2

- This government expenditure represents an opportunity cost...

- Consumer and producer surplus increase...

Negative externality of production diagram explanation

- Production of goods and services causes private costs

- Negative externalities of production occur when there is an external cost associated with the making of a good or service

- This means, that in the free market, goods are often overproduced by firms who are seeking profit as shown by Q1 Q2

- This overproduction is represented by MPC, which reflects the marginal private costs of producing units

- However, the socially optimum level of consumption (MSC) accounts for external costs, such as air pollution, noise pollution and industrial waste, and the costs associated with internalising it

- This is where MSC = MEB (Marginal external benefits)

- The welfare loss for not internalising the externality can be shown by area shaded on the diagram

- Socially optimum level of production and consumption is Q*P*