Chapter 34: Financial Economics

Financial investment - Either buying an asset or building an asset in the expectation of financial gain

- Studying investments that individuals and firms make in the wide variety of assets available to them in our modern economy

- Economic investment - Either to paying for new additions to the capital stock or new replacements for capital stock that has worn out

Present value - The present-day value, or worth, of returns or costs that are expected to arrive in the future

- The proper current price for any risk-free investment is the present value of its expected future returns

- Example: If an investor receives $1,000 today and can earn a rate of return of 5% per year, the $1,000 today is worth more than receiving $1,000 five years from now

Compound interest - How quickly an investment increases in value when interest is paid, or compounded, not only on the original amount invested but also on all interest payments that have been previously made

- Allow us to measure the time-value of money

Present value model

- Makes it easier to transform future amounts of money into present amounts of money

- An asset’s owner obtains the right to receive one or more future payments

- If an investor is considering buying an asset, her problem is to try to determine how much she should pay today to buy the asset and receive those future payments

Popular investments

- All investments share 3 features:

- Require that investors pay some price to acquire them

- Give owners the chance to receive future payments

- Future payments are typically risky

- Popular investments are stocks, bonds, and mutual funds

Stocks - Ownership shares in a corporation

- Bankrupt - Unable to make timely payments on their debts

- The maximum amount of money that shareholders can lose is what they pay for their shares

- Limited liability rule - Limits the risks involved in investing in corporations and encourages investors to invest in stocks by capping their potential losses at the amount that they paid for their shares

- Capital gains - Investors sell their shares in the corporation for more money than they paid for them

- Dividends - Equal shares of the corporation’s profits

Bonds - Debt contracts that are issued most frequently by governments and corporations

- Default - The corporation or government that issued the bond will fail to make the bond’s promised payments

- Bonds are much more predictable than stocks

- Generate lower average rates of return than stocks

Mutual fund - A company that maintains a professionally managed portfolio

- Portfolio - A collection of either stocks or bonds

- Index funds - Portfolios are selected to exactly match a stock or bond index

- Indexes follow the performance of a particular group of stocks or bonds in order to gauge how well a particular category of investments is doing

- Actively managed funds - Have portfolio managers who constantly buy and sell assets in an attempt to generate high returns

- Passively managed funds - Assets in their portfolios are chosen to exactly match whatever stocks or bonds are contained in their respective underlying indexes

An investment’s rate of return is inversely related to its price

- The higher the price, the lower the rate of return

- Percentage rate of return - The percentage gain or loss (relative to the buying price) over a given period of time, typically a year

Arbitrage - When investors try to take advantage and profit from situations where two identical or nearly identical assets have different rates of return

- Simultaneously selling the asset with the lower rate of return and buying the asset with the higher rate of return

- This arbitrage process will continue—with the rate of return on the higher-return company falling and the rate of return on the lower-return company rising—until both companies have the same rate of return

Risk - The fact that investors never know with total certainty what those future payments will turn out to be

- An outcome (good or bad) lacks certainty

Diversification - The strategy of investing in a large number of investments in order to reduce the overall risk to the entire portfolio

- “Don’t put all your eggs in one basket.”

- Diversifiable risk - The risk that is specific to a given investment and that can be eliminated by diversification

- Non-diversifiable risk - Pushes all investments in the same direction at the same time so that there is no possibility of using good effects to offset bad effects

- For investors who have created diversified portfolios, all diversifiable risks will be eliminated, so that the only remaining source of risk will be non-diversifiable risk

Comparing risky investments

- Average expected rate of return - The probability weighted average of the investment’s possible future rates of return

- Probability weighted average - Each of the possible future rates of return is multiplied by its probability expressed as a decimal (so that a 50 percent probability is .5 and a 23 percent probability is .23) before being added together to obtain the average

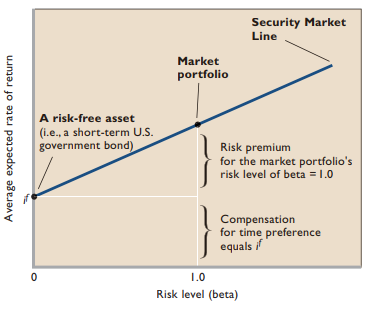

- Beta - Measures how the non-diversifiable risk of a given asset or portfolio of assets compares with that of the market portfolio

- Market portfolio - The name given to a portfolio that contains every asset available in the financial markets

Risk-free rate of return

- Positive relationship between risk and returns, with higher returns serving to compensate investors for higher levels of risk

- Time preference - Because people tend to be impatient, they typically prefer to consume things in the present rather than in the future

- Risk-free interest rate - The rate of return that they generate is not in any way a compensation for risk

Security Market Line - Any investment’s average expected rate of return has to be the sum of two parts—one that compensates for time preference and another that compensates for risk

- Risk premium - The rate that compensates for risk

- Security Market Line defines the relationship between average expected rates of return and risk levels that must hold for all assets and all portfolios trading in the financial markets