Unit 4: The Global Economy

1/159

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

160 Terms

international trade

the transnational exchange of goods and services which involves the sale of exports and purchase of imports

factor endowment

the quantity and quality of FOPs available in a country

benefit of trade - increased competition

domestic firms find greater competition as overseas firms can produce goods and services of higher quality and quantity at lower prices

local firms are forced to become more efficient and innovative which brings benefits to the consumer

benefit of trade - lower prices

more competition, efficiency, economies of scale due to the market being larger → lower average cost of production

domestic producers can buy FOPs from overseas which can be cheaper reducing the cost of production thus the final price

benefit of trade - greater choice

trade makes the market bigger, more goods and services from more firms are available

benefit of trade - acquisition of resources

different factor endowments mean different countries have resources suited to different FOPs

international trade can allow countries access to more natural and/or capital resources which would otherwise not be available thus bettering their production processes

benefit of trade - foreign exchange earnings

export earnings in the form of foreign currencies

exporting country can purchase goods and services from other countries (this is import expenditure)

benefit of trade - access to larger markets

greater quantity of consumers increases the quantity supplied which enables economies of scale

integration of economies through trading blocs further enables this

benefit of trade - economies of scale

increase in output lowers average costs of production

cost savings can be passed on to consumers in the form of lower prices

larger scale enables domestic businesses to utilise division of labour and specialisation, invest in capital machinery

benefit of trade - efficient resource allocation

international trade encourages an efficient allocation of scarce resources globally

relatively free international trade makes domestic firms increase the quality of their output due to overseas competition which improves resource allocation in the domestic economy

benefit of trade - efficient production

domestic and foreign firms engage in price and non-price competition

domestic consumers can access a greater quantity of goods and services at lower prices

inefficient and unproductive firms become uncompetitive so when competition increases they are forced to become more efficient in their production process

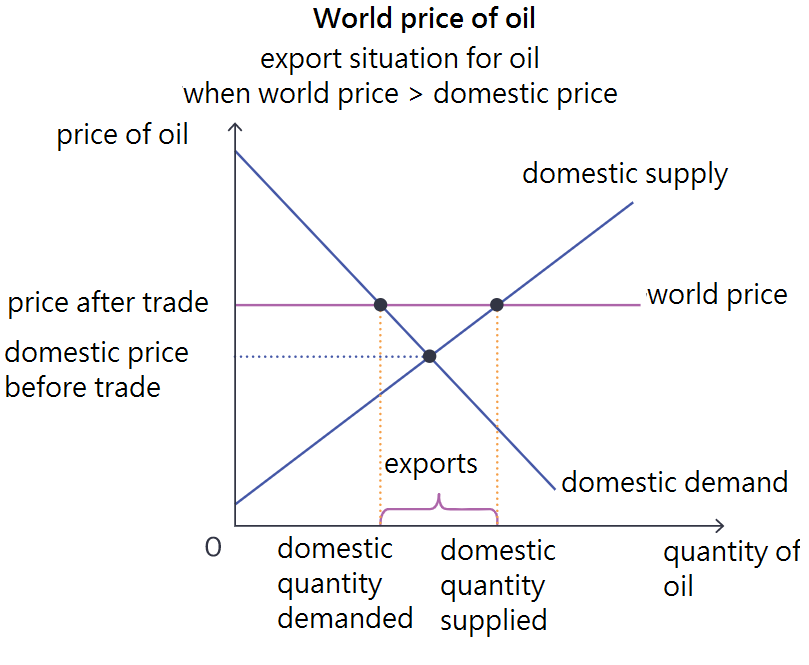

export situation diagram

when the world price is greater than the domestic equilibrium before trade occurs, producers benefit from free trade as they can export goods for higher prices and thus make more revenue and profits

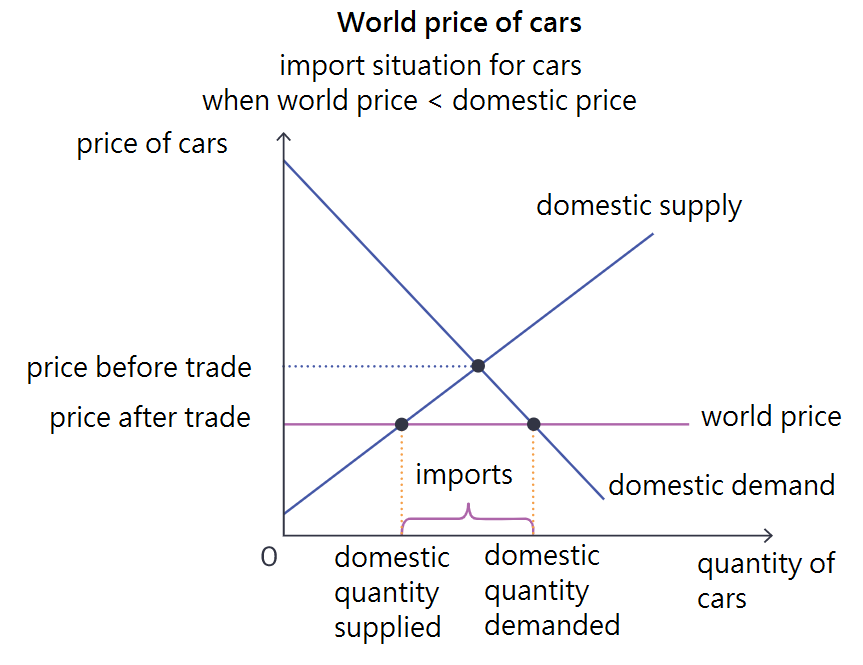

import situation diagram

when the world price is less than the domestic equilibrium before trade occurs, consumers benefit from free trade as lower priced goods are imported and thus reduce the domestic equilibrium price

the world price

the world price is horizontal meaning that the world will supply/demand any quantity of the good at one price

it assumes that the country has no influence over the world price — is a price taker

the World Trade Organisation

only global organisation dealing with rules of trade between nations

help producers and importers conduct their business

representatives from 150 nations

formed in 1995

positive = globalising the economy, allowing more trade to happen more smoothly

negative = developed countries increasing trade with developing countries without considerations for labour and environmental practices

protectionism

the use of barriers to trade to safeguard an economy from excessive international trade and foreign competition

barriers to trade

obstacles to international trade imposed by a government to safeguard national interests by reducing the competitiveness of foreign firms

comparative advantage

economies should specialise in the goods and services which they have a relatively low opportunity cost for when producing

increases efficiency and expands production capacity

tariffs

specific tax on imported goods and services

implemented unilaterally or as part of a trading bloc

increase the costs of production for foreign firms which raises the price of imported goods, so makes domestic products relatively cheaper

most common form of trade protection

quotas

quotas = quantitative limits on the importation of a good into a country

implemented unilaterally or as part of a trading bloc

restrict supply at the expense of foreign firms

quota creates more scarcity so increases the price

domestic supply shifts with the quota, additional amount is is the imported quantity

export subsidies

form of financial assistance to domestic firms which lowers their costs of production to help them compete against foreign firms

production subsidies = help reduce costs of production, most common

export subsidies = targeted at protecting specific export orientated firms

consumers pay Pw but producers receive Ps

reduces the quantity imported as the shortage in the domestic market is mitigated

administrative barriers

the application of bureaucratic standards and regulations imposed on foreign firms in order to protect domestic firms and consumers

examples include strict rules for food safety, environmental standards, product quality

compliance increases costs for foreign firms

barriers can increase the time it takes for imports to enter the domestic market, allowing domestic firms to fill a gap first

regulations can be easier for domestic firms to meet due for social/economic/cultural reasons so give them a competitive advantage

embargoes

a form of administrative barrier that involves the use of bans on trade with a certain country

often due to political and/or economic disputes (sanctions)

can be made for health and safety reasons too

exchange controls

a form of administrative barrier involving restrictions on the quantity of foreign exchange that can be bought or sold by domestic residents

restricts the volume of foreign trade as money has to be exchanged for trade to occur

includes daily limits on the amount of money that can be exchanged by tourists and investors

globalisation

ongoing integration of national economies into global rather than national markets

a natural outcome of increasing trade

large companies end up controlling free markets, they operate in numerous countries which sets up global supply chains, these can take advantage of developing countries — labour and environmental standards are not the standard they would be in a developed country, other problems occupy governments in these countries

country with absolute advantage

most efficient producer for a particular good

if countries trade based on absolute advantage prices and opportunity cost are low

idea that countries should specialise in what they are good at making — they will be more efficient so can sell at the most competitive (lowest) price

minimal waste of resources as this is caused by inefficient production

limitations of comparative advantage

assumes comparative advantage is constant — capabilities and resources of countries can change for various reasons

assumes no barriers to international trade — arguments for protectionism, use of tariffs and quotas in the real world

transportation costs are not considered — it takes time and money to move goods between countries, a great distance can detract from or eliminate a comparative advantage

assumes perfect occupational mobility of resources — ideas that FOPs cab be switched between industries without any loss of efficiency, assumption of the PPC model

assumes perfect knowledge of pricing information for consumers and producers — complications from exchange rate fluctuations and relative inflation rates don’t allow for this

exchange rate

the value of one currency expressed in terms of another currency

floating exchange rate

the value of a currency is determined by the demand for and supply of the currency in the foreign exchange market

appreciation

a sustained increase in the value of one currency in terms of another under a floating exchange system

only happens when an increase in demand is not matched by a factor increasing the supply of that same currency or vice versa

depreciation

a sustained decrease in the value of one currency in terms of another under a floating exchange rate system

domestic demand for imports and impact on the exchange rate

when a good is imported into the domestic economy the supply of that country’s currency increases and demand for the overseas currency decreases

suppliers of domestic goods are paid in the domestic currency throughout the supply chain so

higher demand for imports = increase in supply of domestic currency = depreciation

foreign currency appreciates

foreign direct investment (FDI)

spending by multinational corporations (MNCs) in the domestic economy

inward FDI and impact on the domestic currency

foreign MNCs expanding their operations in the domestic economy

higher demand for domestic currency → appreciation

outward FDI and impact on the domestic currency

MNCs from the domestic economy expanding their operations in overseas markets

higher supply of domestic currency —> depreciation

portfolio investment

purchase of financial investments abroad such as the purchase of stocks, shared and bonds of overseas firms and governments

domestic investors have to purchase foreign currency to buy such financial investments

inward portfolio investment and impact on the currencies

spending in the domestic economy by foreign investors

higher demand for domestic currency —> appreciation of domestic currency

depreciation of foreign currency

outward portfolio investment and impact on the currencies

domestic investors investing in overseas markets

increase in domestic currency’s supply

increase in demand for overseas currency

depreciation of domestic currency

appreciation of foreign currency

remittances and impact on the currencies

movement of money when nationals working abroad send money back to their home country

money sent to family or own bank account

expats supply the foreign currency (they are being paid in it) and demand their home currency

depreciation of foreign currency

demand increases → appreciation of home currency

speculation

happens when a financial asset is purchased in the hope or anticipation that the resale value will be higher

investing in currencies

impacts the exchange rate when done a large scale

if the value of a currency is expected to rise demand for it will increase leading to appreciation

relative inflation rates

higher inflation → less demand for currency → depreciation

speculators will sell currency when it is subject to high inflation, this increases supply of the currency causing further depreciation

relative interest rates

investors may save in a currency with higher interest rates so they receive higher returns, increase in supply of original currency and increase in demand of foreign currency

reduced interest rates will lead investors to sell their investments in that currency leading to depreciation

relative growth rates

higher growth is indicative of higher AD

inflation may increase, interest rates increase

demand for that currency increases causing appreciation

economic growth → higher interest rates → appreciation

When a currency appreciates or when it is overvalued, domestic currency is more expensive compared to the trading partners’ currencies, so:

exports are more expensive for them—they buy less as per the law of demand

export (receipts) decrease—worsening the balance of trade, slowing aggregate demand (AD) (assuming PED > 1)

this could lead to a declines in export industries, thus less employment and less gross domestic product (GDP).

When the currency appreciates, trading partners’ products become less expensive, so:

imports are less expensive—they buy more as per the law of demand

import payments increase—worsening the balance of trade, slowing AD (assuming PED > 1)

this also makes domestic producers less competitive, thus less employment and less GDP.

positive impacts of currency appreciation

lower AD means inflation is lower

imported inputs/raw materials are less expensive for those industries that depend upon them

imported consumer goods are less expensive.

fixed exchange rate

government pegs one country’s value to another country’s value

managed exchange rates

a system where the government or central monetary authority intervenes periodically in the foreign exchange market to influence the exchange rate, when deemed necessary to maintain certainty and confidence in the economy

devaluation

deliberate attempt by the government to make their currency depreciate (shift the exchange rate down)

evaluation (revaluing a currency)

deliberate attempt by the government to make their currency appreciate (shift the exchange rate up)

crawling peg system

a form of fixed exchange rate system in which a currency is permitted to fluctuate within predetermined bands of exchange rates

consequences of an overvalued currency

currency overvalued → government wants ER to reduce → sells overvalued currency → supply increases → ER reduces

consequences of an undervalued currency

undervalued currency → government wants ER to increase → purchases undervalued currency → demand increases → ER increases

overvalued currencies

overvalued currency = the value of a currency is above its equilibrium value in the long run

shouldn’t happen in a free floating system due to the price mechanism

consequences are that imports become cheaper and exports become more expensive, downward pressure on inflation, domestic efficiency must increase to compete with foreign firms

undervalued currencies

undervalued currency = the value of a currency is below its equilibrium value in the long run

exports become relatively cheaper → economic growth and increased employment in export industries

imports become more expensive for domestic buyers → more domestic goods are bought → fewer leakages from the economy

How the reserve bank can revalue the currency

buy (demand) more of its currency on the forex by selling foreign reserves

increase interest rates.

How the reserve bank can devalue the currency

sell (supply) more of its currency on the forex by buying foreign reserves

decrease interest rates.

reasons to fix the exchange rate

eliminates uncertainty in international transactions

avoids inflation due to currency depreciation

avoids a loss of international competitiveness

imposes greater accountability on the government

consequences of currency appreciation

exported goods are more expensive for other countries to buy → less money comes in from exports → AD slows if PED>1 and domestic industries may decline

easier to buy imports → more money is spent on imports → AD slows if PED>1 and domestic producers are less competitive

imported raw materials are cheaper → cost of production decreases → SRAS increases → GDP and employment increase, inflation decreases

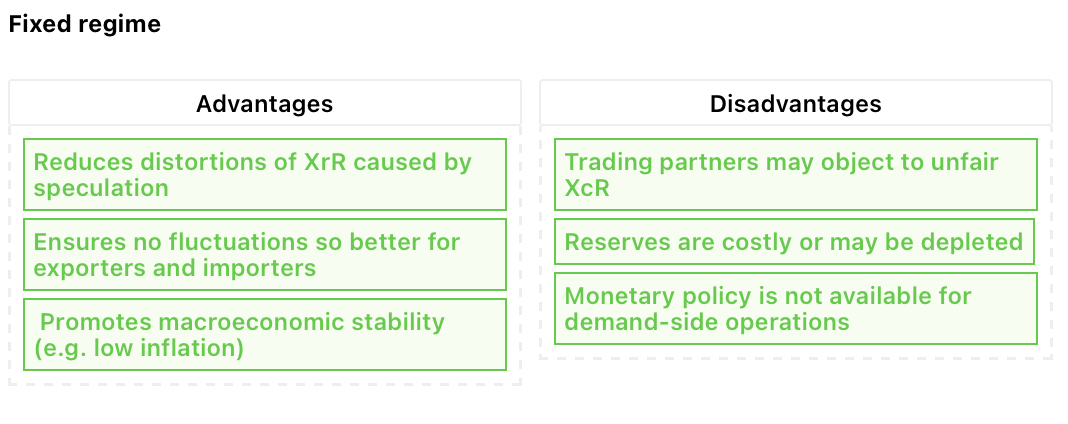

advantages and disadvantages of a fixed exchange rate

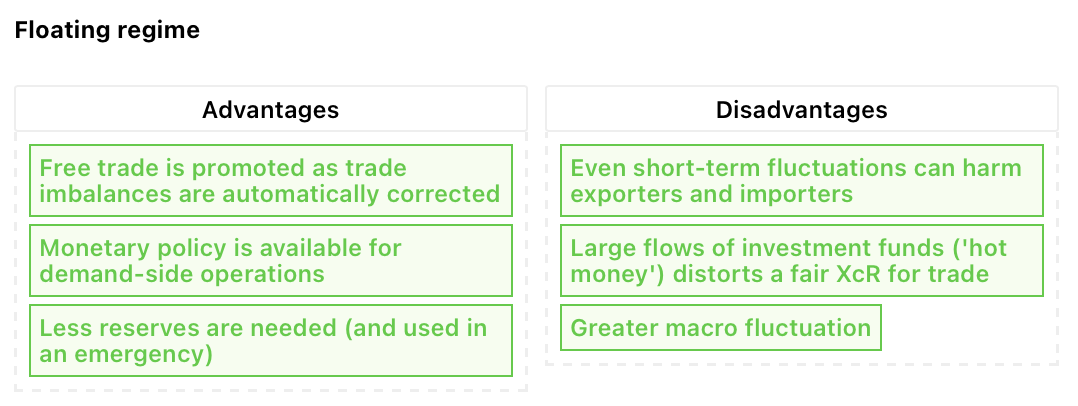

advantages and disadvantages of a floating exchange rate

the current account

records the flow of money for buying goods and services between a country and its trading partners

current account deficit

more money spent on imports than earned from exports

current account surplus

more money earned from exports than spent on imports

financial account

records the purchase of real and financial assets between a country and all other nations

financial account deficit

a country owns more assets overseas than foreigners own of that country’s assets

financial account surplus

more foreigners have domestic assets than the country has of foreign assets

balance of payments

a financial record of a country’s transactions, including exports and imports, with the rest of the world, usually over one year

components of the current account

can be remembered as GIST (goods, income, services, transfers)

current transfers

inflows and outflows of money that are not made in exchange for trade or any corresponding output of goods or services

includes: foreign aid, government grants, concessionary loans, donations and net remittances

net current transfers = current transfers from abroad minus current transfers sent abroad

income in the current account

inflows earned from foreign investments minus the outflows of factor incomes paid to foreign investors

sum of wages, interest, rent and profit (WIRP)

eg residents who earn income from foreign assets

the capital account

records the different forms of capital inflows and outflows of a country during a given time period, namely capital transfers and transactions in non-produced, non-financial assets

includes for example foreign currency flows, debt forgiveness, debt relief and transactions in non-produced, non-financial assets

capital transfers

different forms of capital inflows and outflows of a country

transactions in non-produced, non-financial assets

legal property rights to natural resources and intellectual property rights to intangible assets

capital account balance

net capital transfers + transactions in non-produced, non-financial assets

components of the financial account

transactions recorded relate to cross-border investment

comprised of four sections: foreign direct investment (FDI), portfolio investment, reserve assets, official borrowing

FDI = spending by multinational corporations (MNCs) in countries they are not headquartered in

portfolio investment = stock of investment assets

reserve assets = sticks of foreign currencies and liquid assets held by central banks

official borrowing = government borrowing

how the balance of payments works

overall BOP must always balance because in the long-term a country can only spend what it earns

possible to run a deficit in one component as it can be offset by a surplus in another

so theoretically:

overall BOP has a balance of zero

credit items are matched by debit items

deficits are matched by surpluses

for the BOP to balance: current account = capital account + financial account + errors and omissions

Marshal Lerner condition

states that a currency depreciation will only rectify a current account deficit if: PED(exports) + PED(imports) > 1

what happens when the MLC is not met (sum of PED is less than 1)

when PED exports = inelastic

currency depreciates → export price falls → TR falls

when PED imports = inelastic

currency depreciates → import price rises → TE (expenditure) rises

NX decreases (further into the negatives) worsening the current account deficit

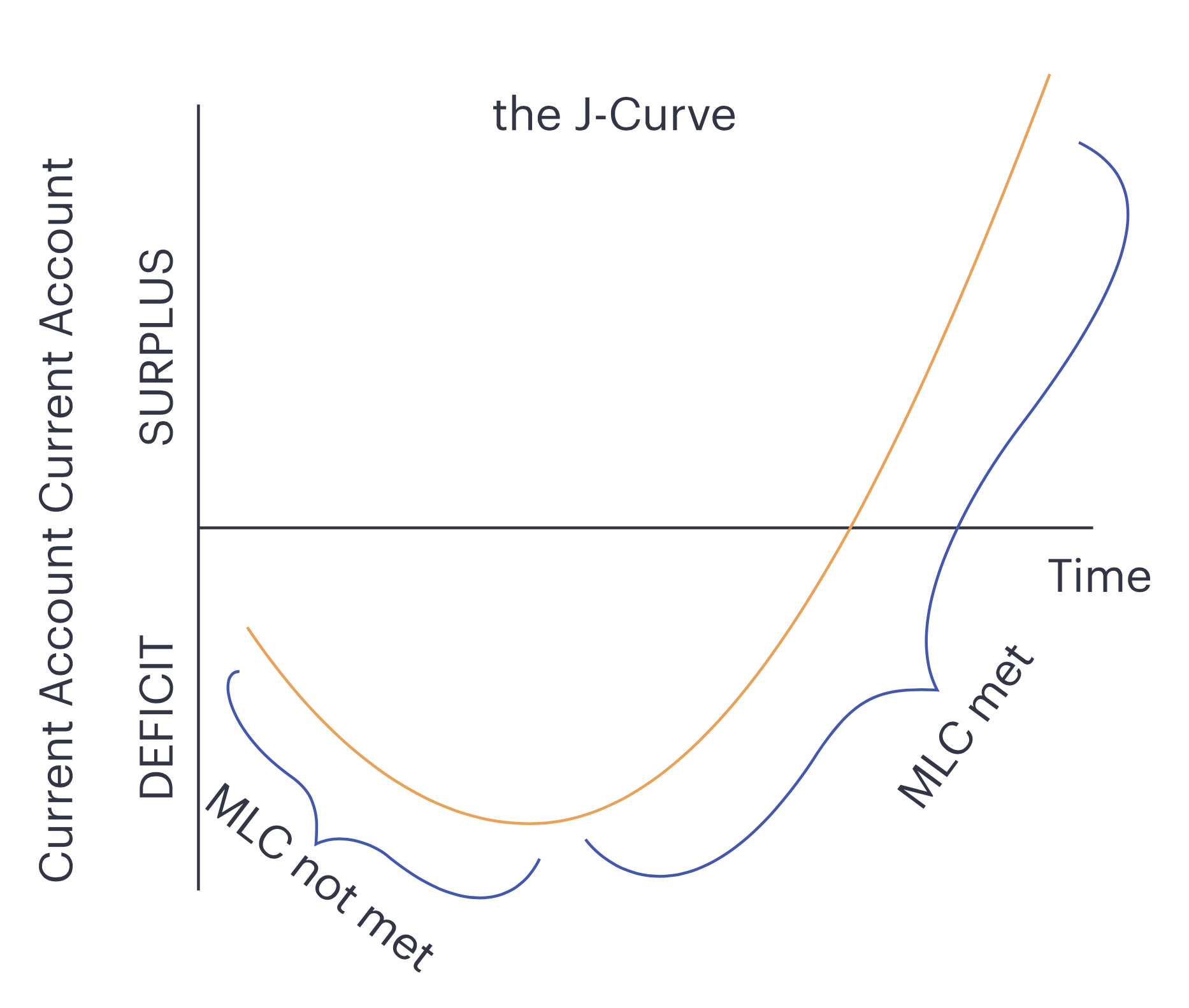

the J-Curve effect

in the short term demand tends to be inelastic for imports and exports

producers and consumers take time to adjust to new prices (caused by exchange rate fluctuations)

y axis is current account in the appropriate currency and x axis is time

when a current depreciated the current account deficit worsens before it improves (after economic agents have adjusted)

economic integration

process of countries becoming more interdependent and economically unified

intensifies competitiveness among producers in a trading bloc → increased efficiency → lower prices + better goods for consumers

preferential trade agreement

a trade treaty between two or more countries, giving special or favourable terms and conditions of trade to member countries

reduction or removal of tariffs and other trade barriers

bilateral agreements, regional trade agreements, multilateral agreements

can be through the WTO

bilateral trade agreement

a preferential trade agreement between two countries, usually by mutual agreement to reduce or remove barriers to trade

2004 CEPA between China and Hong Kong

legally binding

are not bound by WTO rules as their scope can go beyond trade

regional trade agreement

a reciprocal trade agreement between two or more countries usually belonging to the same geographical region

examples: EU, APEC, CAFTA-DR, Mercosur

includes internal rules for member states to follow and external rules for dealing with non-member states

multilateral trade agreement

a legally binding preferential trade agreement between more than two countries and/or trade blocs, under the guidelines of the WTO

agreement and intention to reduce or remove international trade barriers between member countries

includes RTAs which follow the rules and regulations of the WTO

trading bloc

a group of countries that agree to economic integration and freer international trade by reducing or removing trade barriers with each other

free trade agreement

a type of trading bloc between member states that agree to trade freely with each other but can impose separate trade restrictions on non-member countries

least economically integrated type of trading bloc

examples are USMCA (US, Mexico, Canada), EFTA and SAFTA

customs union

a trading bloc whereby member countries engage in free trade with each other but impose a common external tariff when trading with non-member states

reduces administrative burdens

negotiate collectively with non-member states

revenue from tariffs is combined

biggest is the EU

common market

a customs union that allows the free movement of factors of production between member countries

most integrated type of trading bloc

has a common external tariff (CET)

improves allocation of resources within and between member states

largest common market is the European Economic Area (EEA) includes all EU countries and EFTA countries

advantages of trading blocs - trade creation

when trade shifts from higher-cost producers outside of a trading bloc to lower-cost producers within the bloc due to the removal of trade barriers

customs union → external tariffs → goods from non-member states become more expensive → quantity demanded for such goods decreases → space in the market for producers within the trading bloc

advantages of trading blocs - access to larger markets and the potential for economies of scale

membership of a trading bloc → MNCs can easily expand operations within the bloc → larger market + larger scale → economies of scale → lower prices + higher quality for consumers

advantages of trading blocs - greater employment opportunities

economic integration → economic growth + freedom of movement of labour

advantages of trading blocs - stronger bargaining power in multilateral negotiations

low income countries have access to the expertise and support of larger, more developed countries

CAFTA-DR gives the member states more power when negotiating with the US

advantages of trading blocs - greater political stability and cooperation

more interdependence requires harmonious relations between countries

more growth and employment within a country contributes to stability domestically

disadvantages of trading blocs - trade diversion

trade shifts from lower-cost producers outside of a trading bloc to higher-cost producers within the bloc, under the terms and conditions of the trade bloc agreements

mainly occurs in customs unions

production happens in countries with higher opportunity costs and less comparative advantage

efficiency decreases and prices increase

can lead to increases unemployment in the short-term

disadvantages of trading blocs - loss of sovereignty

mainly applies to common markets and monetary unions

economic independence decreases when countries join trading blocs as more rules and regulations must be followed

disadvantages of trading blocs - challenges to multilateral trading negotiations

agreements are complex and inflexible especially when a lot of countries are involved and there are regional/language/cultural differences

monetary union

the monetary system in a common market that requires the convergence of monetary policy that is governed by a common central bank

exchange rates are permanently fixed (essentially making one currency) or a common currency is used (for a full monetary union)

example of the ‘eurozone’ where the Euro is the currency overseen by the European Central Bank (ECB)

advantages of monetary unions

exchange rate certainty — as a common currency is used, eliminates risks of trade associated with ER fluctuations

increased cross-border investments — more FDI due to a common currency, more investment within the union leads to more growth and employment

increased trade — between members of the union due to the preferential trade agreements and common currency

lower transactions costs — common currency means money doesn’t need to be exchanged for trade

price transparency — comparisons are easier with a common currency

disadvantages of monetary unions

loss of economic sovereignty — member countries give up freedom to adjust their monetary policy

loss of exchange rate flexibility — member states cannot appreciate or depreciate its currency to gain a competitive advantage

asymmetric impacts on member states — common central bank’s actions will not affect all member states equally, policy could have much worse effects for some member states

changeover costs — costs associated with converging currencies and running the common central bank